Home>Finance>In Which Two Financial Statements Does Net Income Appear?

Finance

In Which Two Financial Statements Does Net Income Appear?

Modified: December 30, 2023

Discover where net income appears in the two key financial statements in the field of finance. Uncover the role of net income in financial reporting and analysis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where numbers tell the story of businesses and their performance. In the realm of financial statements, net income takes center stage, serving as a fundamental indicator of a company’s profitability. Understanding where net income appears within the financial statements is crucial for investors, analysts, and anyone interested in evaluating the financial health of a business.

Net income, also known as net profit or the bottom line, represents the amount of money left over after deducting expenses from revenue. It provides insight into how effectively a company generates profit from its operations and is a key metric for assessing the financial performance and sustainability of a business.

In this article, we’ll delve into the two primary financial statements where net income appears – the income statement and the balance sheet. We’ll explore these statements in detail and discuss the significance of net income within each.

Whether you’re a finance professional or just someone interested in the inner workings of businesses, this article will provide you with valuable insights on where to find net income in the financial statements and why it matters.

Definition of Net Income

Net income is a key financial metric that measures the profitability of a company. It represents the amount of money remaining after deducting all expenses, including operating costs, interest, taxes, and other relevant factors, from the revenue generated by the business during a specific period.

To calculate net income, a company begins with its total revenue, which includes all the income generated from its core operations, such as sales of products or services. From this revenue, various expenses are subtracted, including the cost of goods sold, operating expenses, and administrative costs.

After deducting these expenses, interest expenses, and taxes, the resulting figure is the net income. This ultimately represents the profit that the company has earned after accounting for all its costs.

Net income is an essential metric as it provides a clear measure of a company’s profitability, helping to evaluate its financial health and performance. It allows investors, creditors, and analysts to assess the company’s ability to generate sufficient profit to cover its expenses, repay debts, and provide returns to shareholders.

A positive net income indicates that the company is making a profit, while a negative net income, known as a net loss, indicates that the company is operating at a loss. It is important to note that net income is typically reported on an annual, quarterly, or monthly basis, depending on the financial reporting period.

Net income is also significant as it serves as a starting point for various financial ratios and analysis. It is used to calculate key metrics such as earnings per share (EPS), return on investment (ROI), and price-to-earnings (P/E) ratios, which are important indicators for investors and analysts in making informed decisions about investing in the company’s stock or assessing its overall financial performance.

In summary, net income represents the final measure of a company’s profitability after deducting all expenses from its total revenue. It is a vital metric for assessing financial performance, evaluating the ability to generate profit, and facilitating comparison with other companies within the same industry.

Importance of Net Income

Net income plays a crucial role in evaluating the financial performance and sustainability of a business. It provides valuable insights into the profitability of a company and serves as a key indicator for investors, creditors, and analysts. Here are a few reasons why net income is important:

- Profitability Assessment: Net income allows stakeholders to assess how effectively a company generates profit from its operations. By analyzing net income over time, investors can evaluate the trend of a company’s profitability and make informed decisions about financial investments.

- Financial Health Evaluation: A positive net income is an indication that a company is generating more revenue than its expenses, showcasing its ability to sustain operations and potentially grow in the future. On the other hand, a negative net income or net loss suggests that the company is incurring more expenses than its revenue, indicating potential financial challenges.

- Investment Decision-Making: Investors often rely on net income to assess the value and attractiveness of a company’s stock. Positive net income can signal a healthy and profitable business, making the company an attractive investment opportunity. Conversely, negative net income may deter investors, as it suggests financial instability or a struggling business.

- Metric for Comparisons: Net income provides a standardized metric to compare the financial performance of different companies within an industry. By evaluating the net income of various competitors, investors and analysts can gain insights into which companies are more profitable and potentially better positioned for success.

- Financial Reporting Compliance: Net income is a vital component in financial reporting, as it must be accurately recorded and reported in accordance with accounting standards. It ensures transparency and integrity in financial statements, providing stakeholders with reliable information for decision-making.

Overall, net income is a fundamental measure that helps stakeholders assess a company’s financial performance, profitability, and potential for growth. It provides a snapshot of a company’s ability to generate profit and helps guide investment decisions, lending decisions, and strategic planning.

Financial Statements

To understand where net income appears, it is essential to have a basic understanding of the two primary financial statements – the income statement and the balance sheet. These statements provide crucial information about a company’s financial performance and position:

- Income Statement: The income statement, also known as the profit and loss statement, is a financial statement that reports a company’s revenues, expenses, and net income over a specific period, such as a year or a quarter. It starts with the company’s total revenue and deducts various expenses to arrive at the net income. The income statement provides a snapshot of a company’s profitability and helps stakeholders evaluate the effectiveness of its operations.

- Balance Sheet: The balance sheet is a financial statement that reports a company’s assets, liabilities, and shareholders’ equity at a specific point in time. While the income statement focuses on a period’s performance, the balance sheet provides a snapshot of the company’s overall financial health. Net income from the income statement flows into the balance sheet and contributes to the retained earnings within the shareholders’ equity section. It represents the portion of a company’s profits that are retained within the business rather than distributed as dividends to shareholders.

These two financial statements work in conjunction with each other, providing a comprehensive view of a company’s financial performance, position, and potential for growth. The income statement shows how effectively a company generates profit, while the balance sheet illustrates its assets, liabilities, and ownership structure.

Both statements are crucial for decision-making purposes. Investors and analysts examine the income statement to assess a company’s profitability and financial trends over time. The balance sheet provides a snapshot of a company’s financial position and its ability to fund its operations and investments.

Now that we have a high-level understanding of the financial statements, let’s explore where net income specifically appears within these statements.

Income Statement

The income statement, also known as the profit and loss statement, reveals a company’s financial performance by reporting its revenues, expenses, and ultimately, its net income. Within the income statement, net income is a significant component that showcases the profitability of the business.

The structure of the income statement typically follows a formulaic approach, with the following key components:

- Revenue: At the top of the income statement, you will find the total revenue or sales generated by the company during the specified period. This includes income from sales of products or services, as well as any other sources of revenue, such as interest or licensing fees.

- Cost of Goods Sold (COGS): After revenue, the income statement deducts the cost of goods sold, which represents the direct costs associated with producing or acquiring the products or services sold. This includes materials, labor, and any other costs directly tied to the production process.

- Gross Profit: The difference between revenue and the cost of goods sold represents the gross profit. It reflects the profitability of the company’s core operations before considering other operating expenses.

- Operating Expenses: Following the gross profit, the income statement deducts operating expenses, including salaries, rent, utilities, marketing expenses, and other costs associated with running the day-to-day operations of the business.

- Interest and Taxes: After operating expenses, any interest expenses related to loans or debts are deducted. The income statement also accounts for income taxes based on the applicable tax rates for the company.

- Net Income: Finally, after deducting all expenses, including interest and taxes, from the gross profit, the income statement arrives at the net income or net profit. This represents the amount of money left over after all costs and expenses have been accounted for. It is a key indicator of the company’s profitability during the specified period.

Net income is typically presented at the bottom of the income statement, hence its name “the bottom line.” It reflects the overall financial performance of the company, indicating whether it generated profit or incurred a loss during that period.

The income statement is vital in evaluating the profitability and financial health of a business. It allows investors, creditors, and analysts to assess the company’s ability to generate profit, control expenses, and manage its operations effectively.

Next, let’s explore the other financial statement where net income also plays a crucial role – the balance sheet.

Balance Sheet

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It presents a summary of a company’s assets, liabilities, and shareholders’ equity. Within the balance sheet, net income also plays a significant role, contributing to the retained earnings of the business.

The structure of the balance sheet is divided into three main components:

- Assets: Assets represent the economic resources owned by the company. They can include cash, accounts receivable, inventory, property, plant, and equipment, investments, and intangible assets. Assets are categorized as current assets, which are expected to be converted into cash within one year, and non-current assets, which have a longer life span.

- Liabilities: Liabilities represent the company’s obligations or debts, including accounts payable, loans, accrued expenses, and long-term debt. Like assets, liabilities are categorized as current liabilities, which are due within one year, and non-current liabilities, which have a longer maturity period.

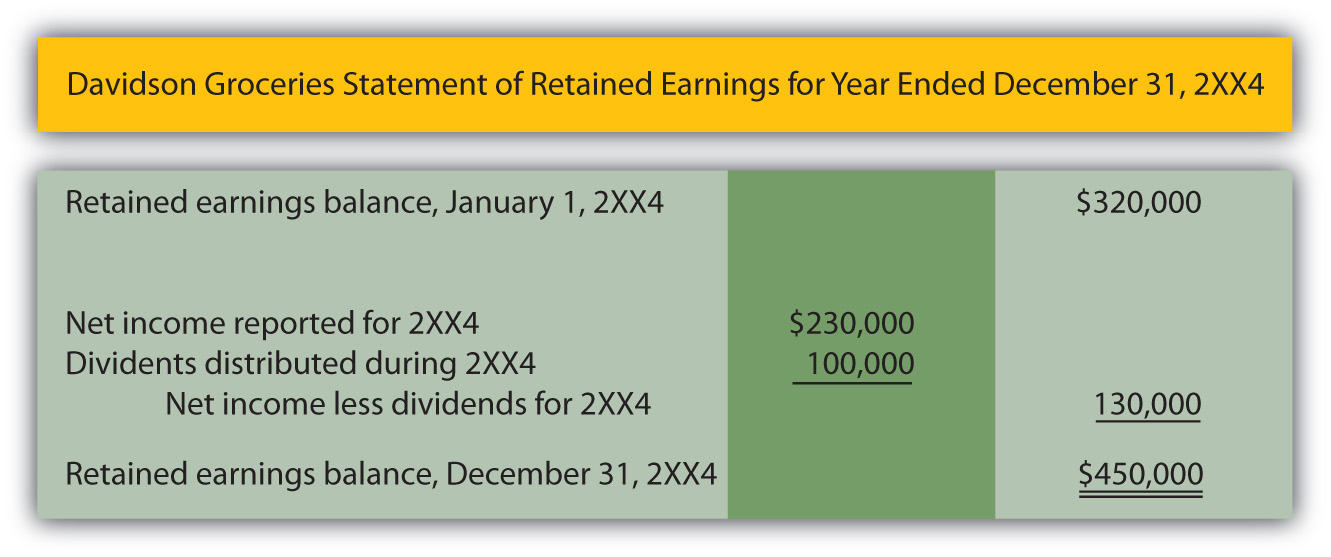

- Shareholders’ Equity: Shareholders’ equity represents the owner’s interest in the business, including the initial investment by shareholders and any additional investments made. It also includes retained earnings, which are the accumulated profits or losses generated by the company over time.

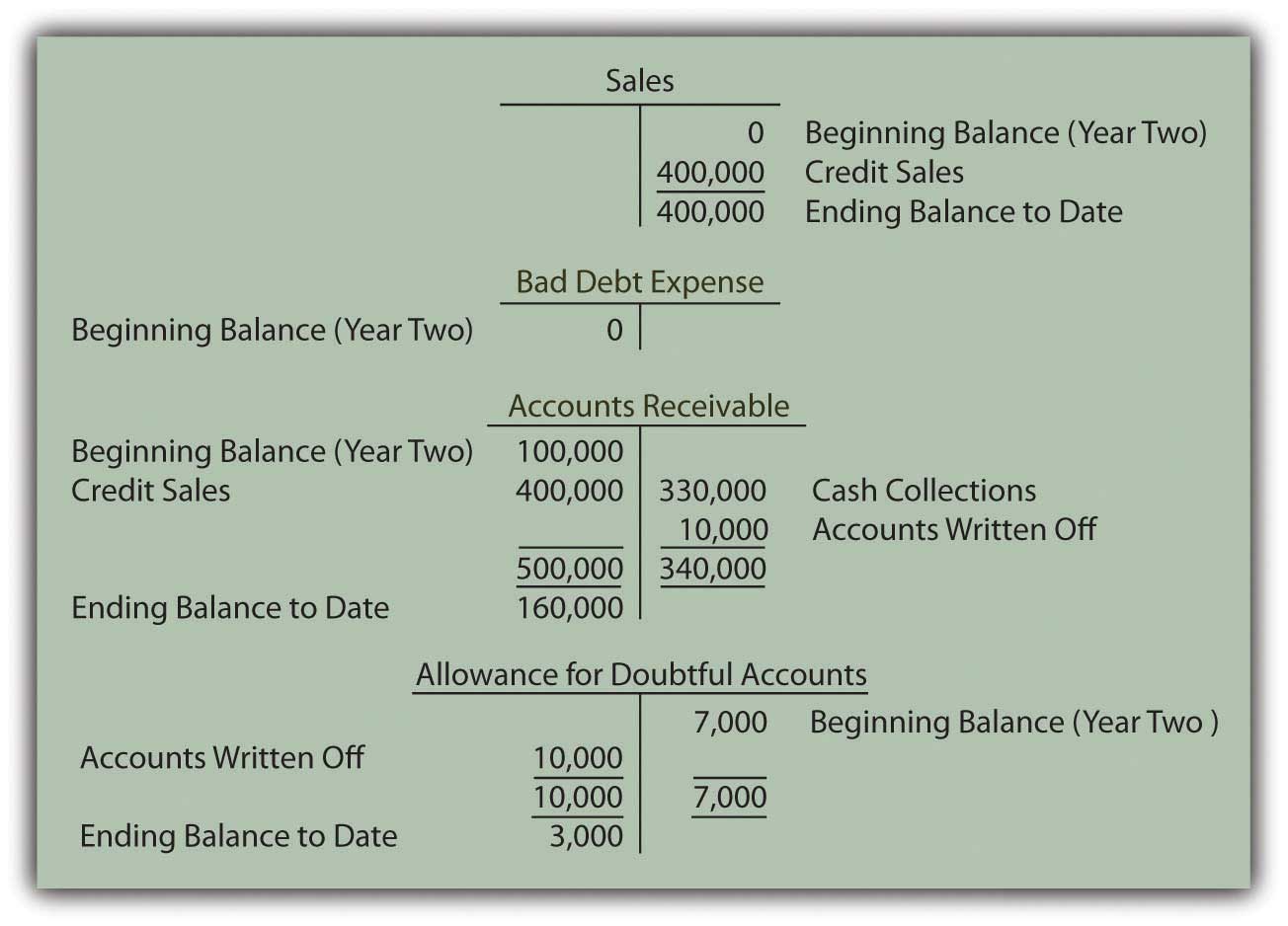

Net income from the income statement flows into the balance sheet and contributes to the retained earnings of the company. Retained earnings reflect the portion of a company’s profits that are not distributed to shareholders as dividends but rather reinvested into the business or held for future use.

Retained earnings serve as an essential component of shareholders’ equity within the balance sheet, providing insights into the company’s long-term financial performance and its ability to generate sustainable profits.

The balance sheet provides a snapshot of a company’s financial position, highlighting its assets, liabilities, and ownership structure. It helps stakeholders assess the company’s liquidity, solvency, and overall financial health. By examining the balance sheet, investors, creditors, and analysts can evaluate the company’s ability to meet its financial obligations and fund future growth.

In summary, the balance sheet complements the income statement by showcasing the company’s financial position at a specific moment in time. Within the balance sheet, net income contributes to the retained earnings, providing insights into the company’s long-term profitability and financial sustainability.

Now that we have explored the income statement and the balance sheet, we can conclude our discussion on where net income appears in these key financial statements.

Conclusion

Net income is a vital component within the financial statements, providing insights into a company’s profitability and financial health. Understanding where net income appears within the income statement and the balance sheet is essential for evaluating the performance and sustainability of a business.

The income statement showcases the revenues, expenses, and ultimately, the net income of a company over a specific period. It reveals the profitability of the business by deducting various costs and expenses from its total revenue. Net income is the bottom line figure on the income statement, representing the final profit or loss generated by the company.

The balance sheet, on the other hand, reflects a company’s financial position at a specific point in time by presenting its assets, liabilities, and shareholders’ equity. Net income from the income statement flows into the balance sheet and contributes to the retained earnings, which reflects the accumulated profits or losses of the business.

Both the income statement and the balance sheet play crucial roles in assessing a company’s financial performance and position. Investors, creditors, and analysts rely on these statements to make informed decisions regarding investment, lending, and strategic planning.

By understanding and analyzing net income within the financial statements, stakeholders can gauge a company’s profitability, evaluate its ability to generate profit, and monitor its financial health over time. Net income serves as a benchmark for comparing the performance of different companies within the same industry and aids in assessing their potential for growth and investment opportunities.

In conclusion, net income is a vital metric within the financial statements, reflecting the profitability of a company. It appears in the income statement as the bottom line figure and contributes to the retained earnings within the balance sheet. By comprehending the significance of net income and its placement in these financial statements, stakeholders can gain valuable insights into the financial performance and position of a company, facilitating informed decision-making and financial analysis.