Home>Finance>Operating Cash Flow (OCF): Definition, Cash Flow Statements

Finance

Operating Cash Flow (OCF): Definition, Cash Flow Statements

Published: January 3, 2024

Understand the definition of Operating Cash Flow (OCF) and its importance in finance. Learn how to analyze cash flow statements for a comprehensive financial assessment.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Basics of Operating Cash Flow (OCF): Definition, Cash Flow Statements

Finance is a crucial aspect of our lives. Whether it’s managing personal finances or running a business, understanding financial concepts is essential to achieving success. One such concept that every individual and business owner should be familiar with is Operating Cash Flow (OCF). In this blog post, we will dive deep into the definition of OCF and how it relates to cash flow statements.

Key Takeaways:

- Operating Cash Flow (OCF) is a measure of the amount of cash generated or consumed by a company’s daily operations.

- OCF is a vital metric for analyzing a company’s ability to generate cash from its core business activities.

So, what exactly is Operating Cash Flow? In simple terms, OCF is the cash generated or consumed by a company’s daily operations. It gives an insight into how much cash is generated from selling products or services and covers items like sales revenue, operating expenses, and taxes. OCF is an important indicator of a company’s financial health, as it shows whether the business can generate enough cash from its core operations to cover expenses and invest in growth.

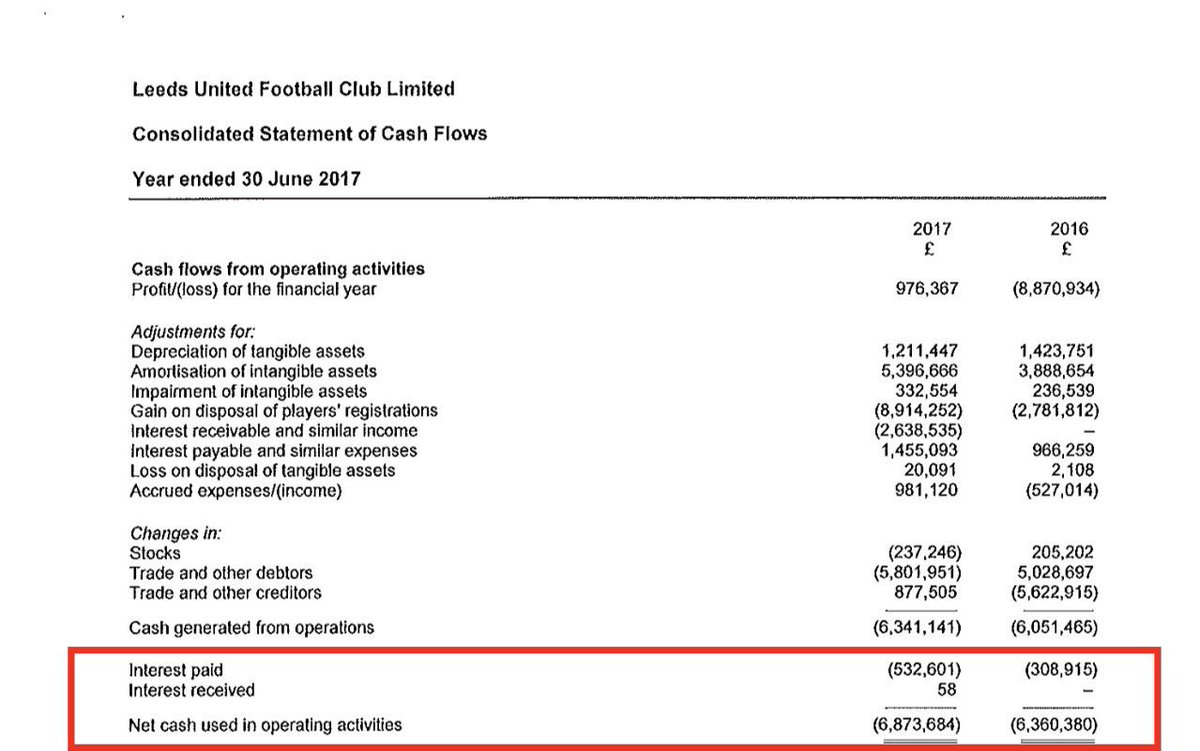

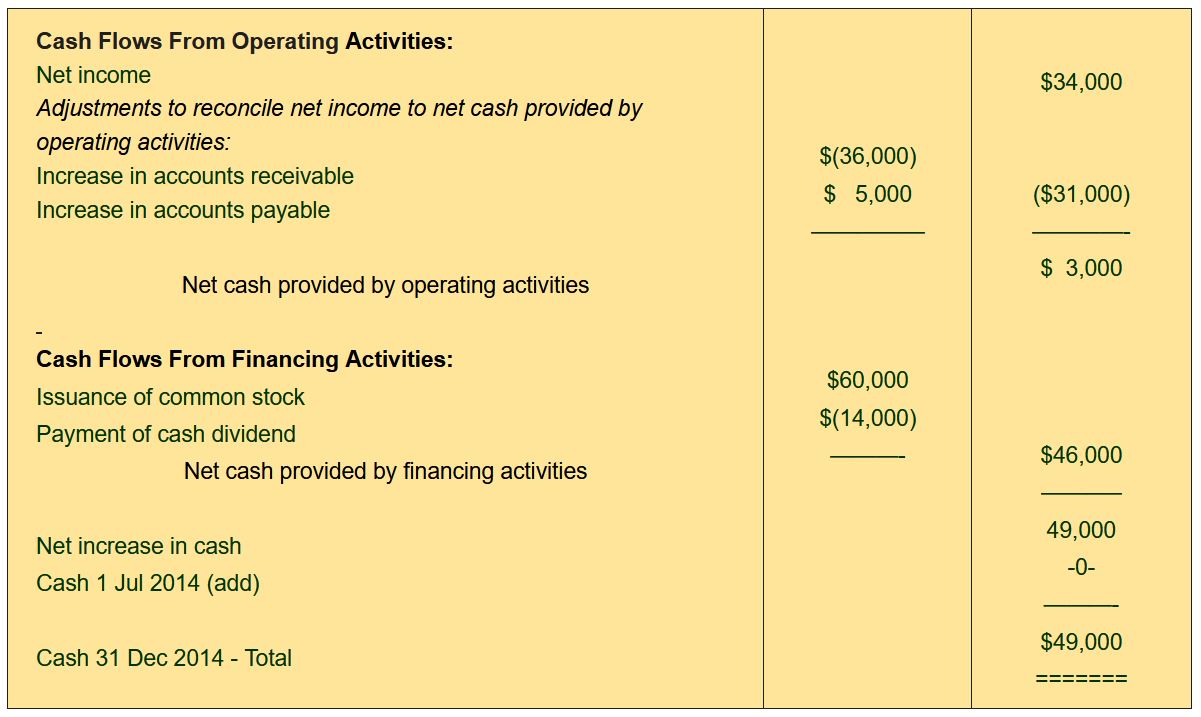

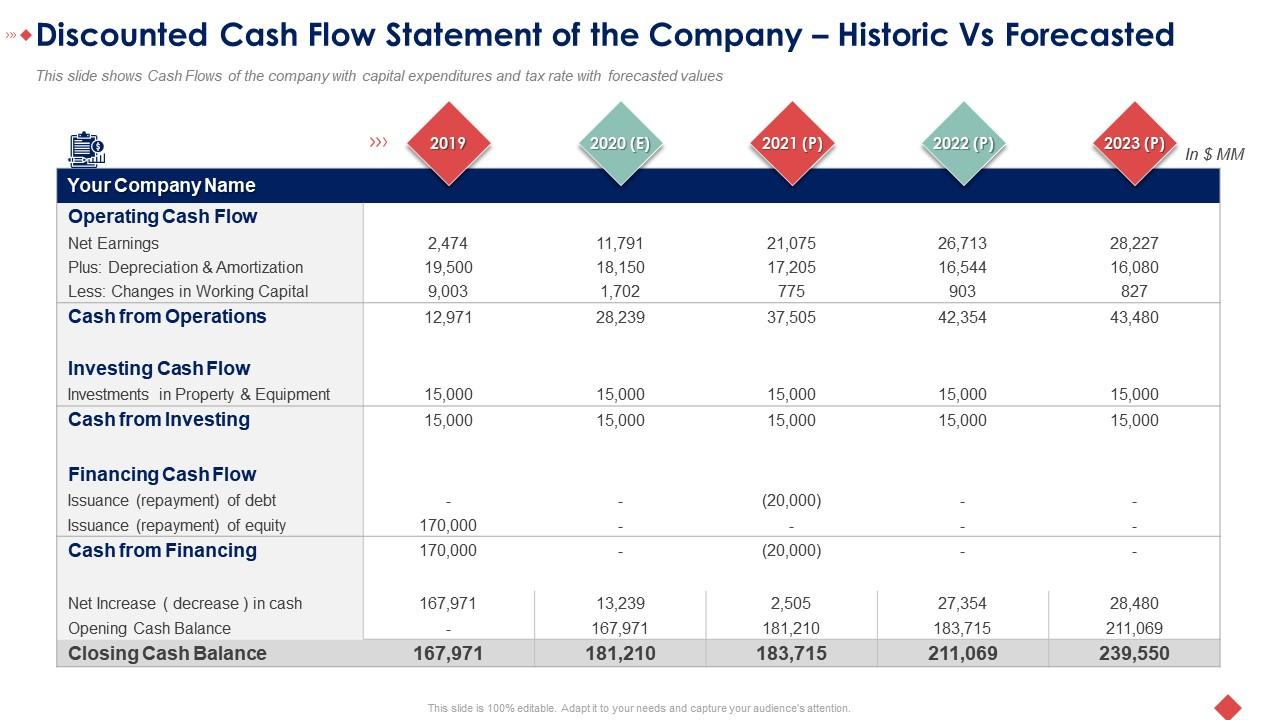

Understanding cash flow statements is crucial in comprehending OCF. A cash flow statement is one of the financial statements that provides information about the cash generated and used during a specific period. It consists of three sections: operating activities, investing activities, and financing activities. The operating activities section is where the OCF is disclosed.

In the operating activities section of the cash flow statement, you will find information on the cash flows directly related to a company’s core operations. This includes cash received from customers, cash paid to suppliers, and cash paid for operating expenses. The net result of these inflows and outflows determines the OCF.

Why is OCF important? For starters, it gives investors and stakeholders a clear picture of the company’s cash flow situation, which is crucial for making investment decisions. A positive OCF indicates that the company has generated enough cash from its operations to cover expenses and invest in growth. On the other hand, a negative OCF suggests that the company is using more cash than it’s generating, which may raise concerns about its financial sustainability.

Key takeaway: Operating Cash Flow (OCF) is a measure of the amount of cash generated or consumed by a company’s daily operations. It is an important metric for analyzing a company’s ability to generate cash from its core business activities. Cash flow statements provide insights into OCF and other cash flow related information.

In conclusion, operating cash flow (OCF) is a critical financial metric that helps evaluate a company’s financial performance and sustainability. By understanding OCF and its correlation with cash flow statements, investors and business owners can make informed decisions about their investment strategies and financial management. So, next time you come across the term OCF, you’ll know why it matters and how to interpret it.