Finance

How To Buy Credit Default Swaps

Published: January 14, 2024

Learn how to buy credit default swaps and navigate the world of finance with expert tips and insights.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to investing, there are numerous options available. One investment instrument that has gained popularity in recent years is credit default swaps (CDS). While CDS may sound complex and intimidating, they can actually be a valuable tool for investors looking to mitigate risk or speculate on the creditworthiness of certain entities.

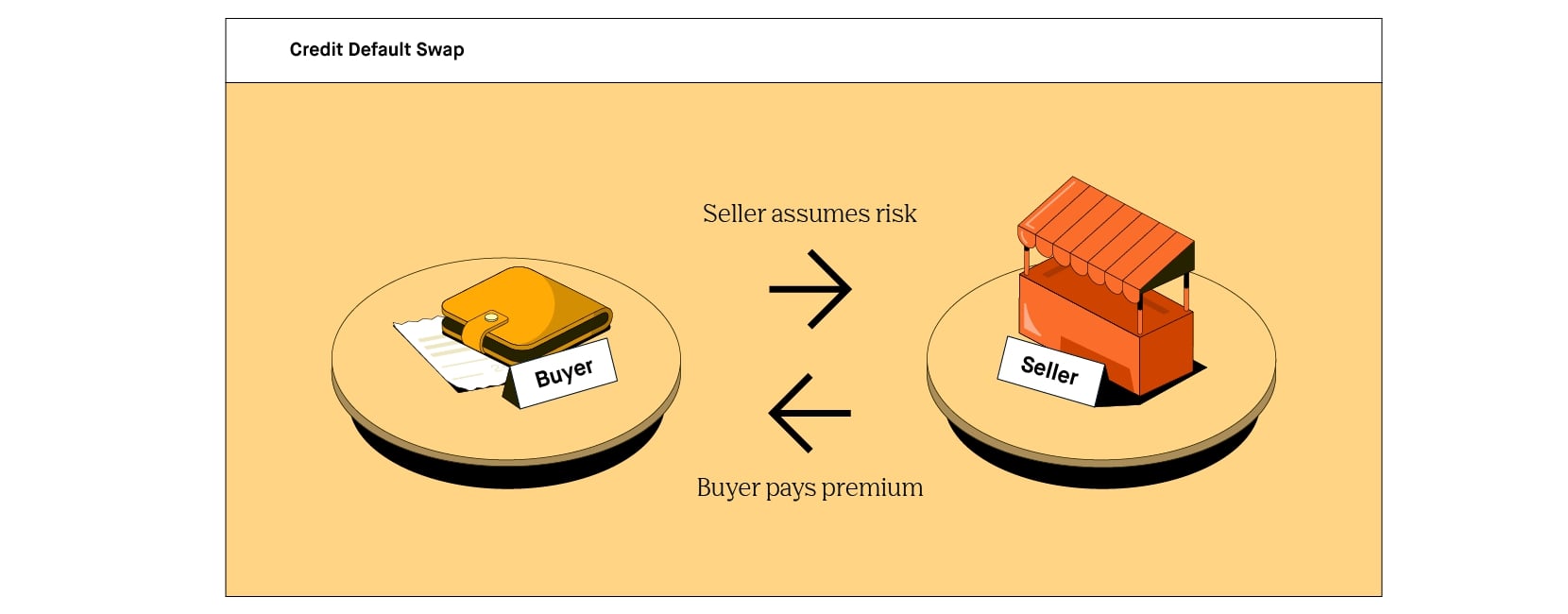

So, what exactly are credit default swaps? In simple terms, a credit default swap is a financial contract between two parties, commonly referred to as the buyer and the seller. The buyer pays periodic premiums to the seller in exchange for protection against the default of a specific reference entity, such as a company or a country. In the event of a default, the seller compensates the buyer for the losses incurred.

The credit default swap market started gaining attention in the early 2000s and became widely known during the global financial crisis of 2008. It is now a multi-trillion-dollar market, with participants ranging from banks and hedge funds to institutional investors and speculators.

Investing in credit default swaps offers several advantages. Firstly, they provide a way to hedge against the risk of default. For example, if an investor holds bonds issued by a company but is concerned about the company’s financial health, they can purchase a credit default swap to protect themselves from potential default and associated losses. Secondly, credit default swaps can be used for speculation. Investors who believe that a particular entity’s creditworthiness will deteriorate can buy credit default swaps without owning the underlying bonds and potentially profit if their prediction proves correct.

However, it’s important to note that credit default swaps also come with risks. The value of credit default swaps can fluctuate significantly based on changes in market perceptions of credit risk. Additionally, credit default swaps are not regulated like traditional securities, which can expose investors to counterparty risk. If the seller of a credit default swap is unable to fulfill their obligations in the event of a default, the buyer may suffer losses.

Before diving into the world of credit default swaps, there are a few factors to consider. Firstly, investors must have a good understanding of the underlying reference entity’s creditworthiness and the factors that can impact it. Conducting thorough research and analysis is crucial to making informed investment decisions. Secondly, investors should consider their risk appetite and investment goals. Credit default swaps can be complex and volatile, so it’s important to assess whether they align with your investment strategy.

In the next sections, we will explore the steps involved in buying credit default swaps and delve deeper into the intricacies of this investment instrument. As with any investment, it’s essential to approach credit default swaps with caution and seek advice from financial professionals to ensure they align with your risk tolerance and investment objectives.

What are Credit Default Swaps?

Credit default swaps (CDS) are a specialized type of derivative contract that allows investors to hedge against or speculate on the creditworthiness of a specific reference entity, such as a company or a country. In essence, they are insurance-like contracts in which the buyer pays periodic premiums to the seller in exchange for protection against the default of the reference entity.

When an investor buys a credit default swap, they are essentially agreeing to make premium payments to the seller over a specified period of time. In return, the seller agrees to compensate the buyer for any losses incurred if the reference entity experiences a credit event, such as defaulting on its debt obligations. The compensation typically takes the form of a cash payment or the delivery of physical assets.

The key concept behind credit default swaps is the transfer of credit risk. By purchasing a CDS, the buyer essentially shifts the risk of default from themselves to the seller. This can be particularly useful for investors who hold bonds or other debt instruments issued by the reference entity and want to protect themselves against the possibility of default.

Credit default swaps can also be used for speculative purposes. Investors who believe that the creditworthiness of a particular reference entity will deteriorate in the future can buy credit default swaps without holding any underlying debt instruments. If their prediction proves correct, they can sell the CDS at a higher price and profit from the difference.

It’s important to understand that credit default swaps are highly customizable contracts. The terms and conditions can vary depending on the specific agreement between the buyer and the seller. Common variables that can be negotiated include the size of the contract, the premium payments, the maturity date, and the documentation of what constitutes a credit event.

Despite their potential benefits, credit default swaps have also faced criticism and controversy. During the 2008 global financial crisis, CDS were under scrutiny due to their role in the downfall of several major financial institutions. Critics argue that the unregulated nature of the CDS market, combined with the potential for speculative trading, can contribute to excessive risk-taking and market instability.

In summary, credit default swaps are financial instruments that allow investors to transfer or assume credit risk related to a specific reference entity. They can be used for hedging purposes to protect against default or for speculative trading based on anticipated changes in creditworthiness. However, it’s important to approach credit default swaps with caution and carefully assess the associated risks before participating in this complex market.

Understanding Credit Default Swap Market

The credit default swap (CDS) market is a global and decentralized over-the-counter (OTC) market where participants can buy and sell credit default swaps. This market allows investors to manage credit risk and speculate on the creditworthiness of a specific reference entity.

Participants in the credit default swap market include banks, institutional investors, hedge funds, and other financial institutions. These market participants trade CDS contracts among themselves, either bilaterally or through a central clearing party. The market is characterized by its flexibility and ability to customize contract terms to meet the specific needs of the parties involved.

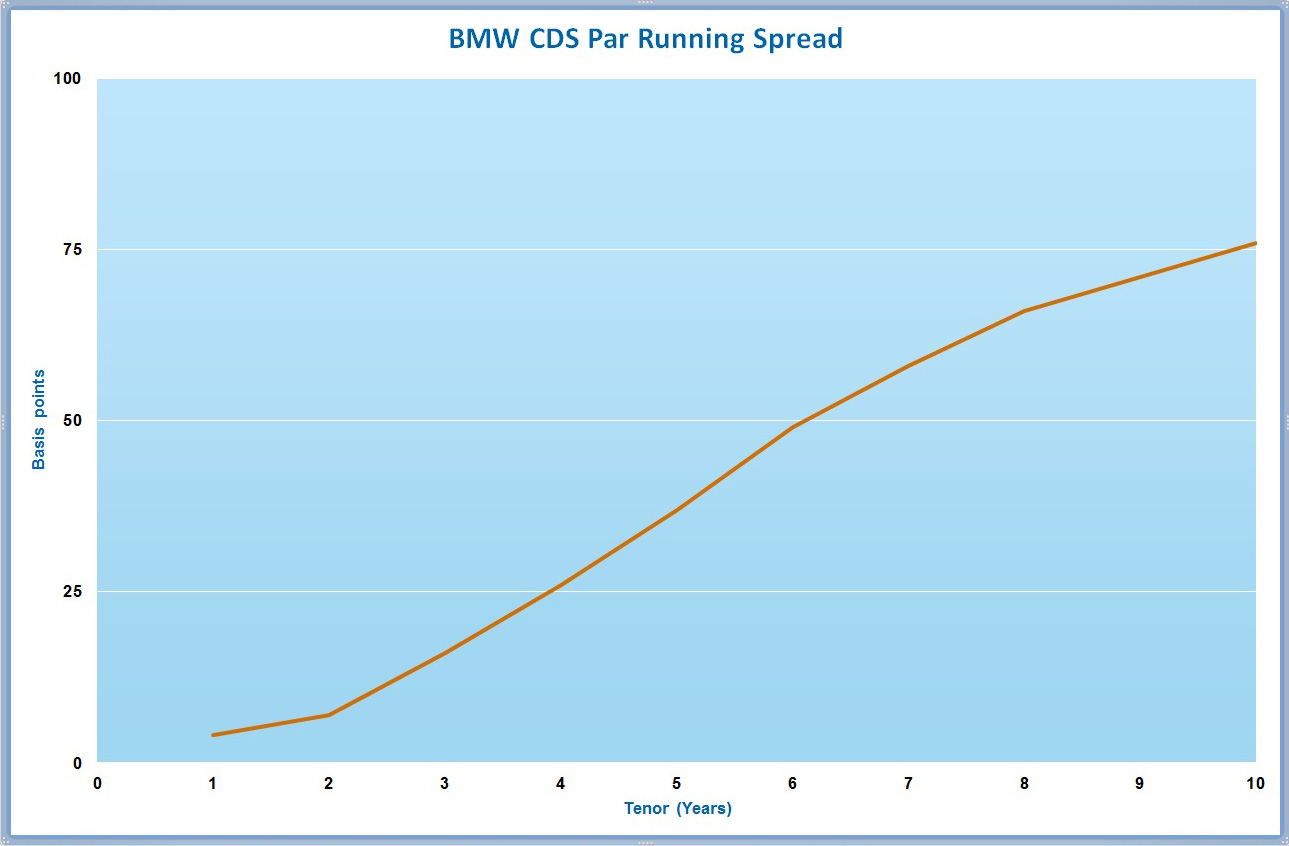

The value of a credit default swap is determined by the market’s perception of credit risk associated with the reference entity. This perception is influenced by various factors, including the financial health of the issuer, economic conditions, industry trends, and market sentiment.

In the credit default swap market, there are two types of market participants: buyers and sellers. Buyers, also known as protection buyers, purchase credit default swaps to protect themselves against the risk of default. They pay periodic premiums to the sellers in exchange for the promise of compensation in the event of a credit event. Sellers, also known as protection sellers, assume the risk of default by receiving the premiums from the buyers. If a credit event occurs, sellers must fulfill their obligations to compensate the buyers.

It’s important to note that credit default swaps are not standardized contracts like exchange-traded derivatives. Instead, they are customized agreements tailored to the needs of the parties involved. This flexibility allows for a wide range of contract variations, such as the reference entity, notional amount, maturity date, and premium payment schedule.

The credit event is a critical concept in the credit default swap market. It refers to the occurrence of an event that triggers the buyer’s right to receive compensation from the seller. Common credit events include bankruptcy, default on debt payments, restructuring, and failure to meet financial obligations. The occurrence and definition of a credit event are typically stipulated in the contract between the buyer and the seller.

Counterparty risk is also an important consideration in the credit default swap market. Since these contracts are traded over-the-counter, there is a risk that the seller may default on its obligations if a credit event occurs. To mitigate this risk, market participants often enter into agreements with central clearing parties that act as intermediaries and guarantee the performance of the contracts.

Overall, the credit default swap market plays a crucial role in global finance by allowing investors to manage credit risk and speculate on the creditworthiness of entities. However, it is a complex and sometimes controversial market that requires a thorough understanding of its mechanics, risks, and regulations.

Advantages of Investing in Credit Default Swaps

Investing in credit default swaps (CDS) offers several advantages for both hedging and speculative purposes. When used appropriately, CDS can provide investors with opportunities to manage risk and potentially generate profits. Here are some key advantages of investing in credit default swaps:

- Risk Mitigation: One of the primary benefits of CDS is their ability to hedge against credit risk. By purchasing a CDS, investors can protect themselves against the possibility of default by a specific reference entity. This is particularly useful for investors who hold bonds or other debt instruments issued by the reference entity and want to hedge their exposure to potential default.

- Diversification: Credit default swaps allow investors to diversify their portfolio by gaining exposure to different reference entities. This enables them to spread their risk across multiple issuers and industries, reducing the impact of defaults on their overall investment performance.

- Liquidity: The credit default swap market is highly liquid, with a large number of participants buying and selling these contracts. This liquidity provides investors with the opportunity to enter and exit positions easily, allowing for efficient portfolio management and risk adjustment.

- Flexibility: Credit default swaps offer flexibility in terms of contract customization. Investors can tailor the terms and conditions of the CDS contract to suit their specific needs, including the size of the contract, maturity date, and premium payment schedule. This flexibility allows investors to align the CDS with their investment goals and risk appetite.

- Speculative Opportunities: Credit default swaps can be used for speculative purposes, providing investors with the ability to profit from changes in the creditworthiness of a reference entity. If an investor believes that the creditworthiness of a particular entity will deteriorate, they can buy a CDS without holding any underlying debt instruments. If their prediction proves correct, they can sell the CDS at a higher price and profit from the difference.

It is important to note that investing in credit default swaps also carries risks. The value of a CDS can fluctuate based on changes in market perceptions of credit risk, and there is a possibility of loss if the reference entity experiences a credit event. Additionally, the unregulated nature of the CDS market exposes investors to counterparty risk, as the seller may not be able to fulfill their obligations in the event of a default. Therefore, it is crucial for investors to conduct thorough research, assess their risk tolerance, and seek advice from financial professionals before investing in credit default swaps.

Despite the risks involved, credit default swaps provide investors with a valuable tool for managing credit risk and potentially generating profits. By understanding the advantages and conducting diligent analysis, investors can make informed decisions regarding the inclusion of credit default swaps in their investment strategy.

Risks Associated with Credit Default Swaps

While credit default swaps (CDS) offer potential benefits for investors, it’s important to be aware of the risks associated with these financial instruments. Understanding these risks is crucial for making informed investment decisions. Here are some key risks to consider when investing in credit default swaps:

- Credit Risk: The value of a credit default swap is closely tied to the creditworthiness of the reference entity. If the reference entity experiences a credit event, such as defaulting on its debt obligations, the value of the CDS may decrease or even become worthless. As a result, investors may suffer significant losses.

- Market Risk: The prices of credit default swaps can fluctuate significantly based on market perceptions of credit risk. Factors such as economic conditions, industry trends, and market sentiment can all impact the perceived creditworthiness of the reference entity. It’s important to be aware of these market dynamics and the potential for volatility when investing in CDS.

- Counterparty Risk: Credit default swaps are traded over-the-counter, which means they are subject to counterparty risk. If the seller of a CDS is unable to fulfill their obligations in the event of a credit event, the buyer may suffer losses. To mitigate counterparty risk, it’s advisable to work with reputable and well-capitalized counterparties or consider using central clearing parties as intermediaries.

- Liquidity Risk: While the credit default swap market is generally liquid, there may be situations where the availability of buyers or sellers is limited, especially during times of market stress. In such cases, it may be difficult to enter or exit positions at desired prices, potentially leading to increased transaction costs or inability to execute trades promptly.

- Legal and Regulatory Risk: The legal and regulatory framework surrounding credit default swaps can be complex and subject to changes. In some jurisdictions, there may be limited regulation or oversight, which could expose investors to potential risks. It’s crucial to stay informed about the legal and regulatory landscape and consider the potential impacts on investment strategies.

It’s important to assess these risks and carefully consider the potential rewards before investing in credit default swaps. Conducting thorough research on the reference entity’s creditworthiness, incorporating risk management techniques, and seeking advice from financial professionals is essential to mitigate the risks associated with CDS investments.

Furthermore, investors should have a clear understanding of their risk tolerance and investment objectives. Credit default swaps can be complex financial instruments, and it’s crucial to ensure they align with your risk appetite and overall investment strategy. Developing a well-diversified portfolio that includes a variety of asset classes can also help to mitigate the risks associated with investing in credit default swaps.

By being aware of the risks and taking appropriate measures to manage them, investors can make informed decisions and potentially benefit from the opportunities provided by credit default swaps while safeguarding their investment capital.

Factors to Consider Before Buying Credit Default Swaps

Before buying credit default swaps (CDS), it is crucial to consider various factors to ensure that they align with your investment objectives and risk tolerance. While CDS can offer potential benefits, it’s important to carefully assess the following factors:

- Credit Analysis: Conduct a thorough credit analysis of the reference entity. Evaluate its financial health, creditworthiness, and underlying fundamentals. Understanding the issuer’s ability to meet its debt obligations is crucial before entering into a CDS contract.

- Risk Assessment: Assess the risk associated with the specific reference entity you are considering. Evaluate its industry position, market conditions, competitive landscape, and any potential risks that could impact its creditworthiness. This analysis will help you determine the risk/reward potential of the CDS investment.

- Market Conditions: Consider the prevailing market conditions, economic factors, and interest rates that could impact the credit default swap market. Understand how changes in these factors could affect the value and pricing of CDS contracts.

- Counterparty Risk: Evaluate the creditworthiness and financial strength of the counterparty with whom you are entering into the CDS contract. Assess their ability to fulfill their obligations in the event of a credit event. Working with well-capitalized and reputable counterparties can help mitigate counterparty risk.

- Liquidity: Assess the liquidity of the credit default swap market. Consider the availability of buyers and sellers, especially during times of market stress. Adequate liquidity ensures efficient trading and the ability to enter or exit positions when needed.

- Regulatory Factors: Stay informed about the regulatory environment surrounding credit default swaps. Understand any changes in regulations governing the market and the potential impact they may have on your investment strategy. Compliance with regulatory requirements is essential to ensure a transparent and regulated CDS market.

- Risk Appetite: Evaluate your risk tolerance and investment objectives. CDS investments can be complex and carry inherent risks. Determine whether the potential rewards align with your risk appetite and long-term investment goals.

- Professional Advice: Consider seeking the guidance and advice of experienced financial professionals who are well-versed in credit default swaps and the associated risks. Financial advisors with expertise in CDS can provide valuable insights and help you make informed investment decisions.

By carefully considering these factors before buying credit default swaps, you can make better-informed investment decisions. Understanding the creditworthiness of the reference entity, assessing market conditions and counterparty risk, and aligning your investment goals with your risk tolerance will help ensure that CDS investments are suitable for your portfolio. Stay informed about regulatory changes and seek expert advice to minimize risks and maximize the potential benefits of investing in credit default swaps.

Steps to Buy Credit Default Swaps

Buying credit default swaps (CDS) involves a series of steps that investors must follow to enter into a contract and gain exposure to a specific reference entity. While the process can vary slightly depending on the specific circumstances and market practices, the following steps provide a general guideline for buying CDS:

- Research and Analysis: Conduct thorough research and analysis on the reference entity you wish to invest in. Evaluate its creditworthiness, financial health, and potential risks. This analysis will enable you to make an informed decision about whether to proceed with purchasing a credit default swap.

- Select a Counterparty: Identify a reputable counterparty to enter into the CDS contract with. This can be either a financial institution, a clearinghouse, or another market participant. Choose a counterparty with a strong credit rating and a sound financial position to mitigate counterparty risk.

- Negotiate Terms: Engage in negotiations with the chosen counterparty to agree on the terms and conditions of the CDS contract. Key variables to negotiate include the notional amount (the total value of the reference entity’s debt), premium payments, maturity date, and credit event definitions. Ensure that the contract terms align with your investment goals and risk tolerance.

- Execute the Trade: Once the contract terms are agreed upon, execute the trade by signing the necessary documentation. This may involve formalizing the agreement through a confirmation process or using electronic trading platforms, depending on the market practices. Ensure that all parties involved have a clear understanding of the terms and obligations.

- Monitor the Investment: After purchasing the credit default swap, monitor the investment regularly. Stay updated on any news or developments related to the reference entity that may impact its creditworthiness. Continuously assess the risks associated with the investment and evaluate whether any adjustments need to be made to your portfolio.

- Close or Hedge the Position: Depending on the market conditions and your investment strategy, you may choose to close or hedge your CDS position. Closing the position involves selling the credit default swap contract, while hedging may involve entering into additional trades to mitigate risks or adjust exposure to the reference entity.

It’s important to note that buying credit default swaps can be complex, and it’s advisable to seek professional advice from financial experts who are familiar with CDS. They can provide guidance on selecting appropriate counterparties, assessing risks, and navigating the intricacies of the credit default swap market.

Additionally, it’s crucial to stay informed about regulatory requirements and compliance obligations when engaging in CDS transactions. Understand and adhere to any reporting or disclosure requirements imposed by the regulatory authorities to ensure compliance.

By following these steps and taking prudent measures, investors can successfully navigate the process of buying credit default swaps and incorporate them effectively into their investment strategies.

Conclusion

Credit default swaps (CDS) can be valuable tools for investors looking to manage credit risk or speculate on the creditworthiness of specific entities. With the ability to hedge against default and potentially profit from changes in creditworthiness, CDS offer unique advantages in the financial markets.

However, it’s important to approach CDS investments with care and consider the associated risks. Credit risk, market risk, counterparty risk, liquidity risk, and regulatory factors must all be evaluated before buying credit default swaps. Thorough research and analysis of the reference entity’s creditworthiness and market conditions are crucial for making informed investment decisions.

When buying credit default swaps, it is essential to choose reputable counterparties and negotiate contract terms that align with your investment goals and risk tolerance. Regular monitoring of the investment and staying updated on market developments will help manage the exposure effectively.

Seeking professional advice from experienced financial experts is highly recommended to navigate the complexities of the credit default swap market and ensure compliance with regulatory requirements.

In concluding, credit default swaps can be powerful instruments for risk management and speculation. By carefully evaluating the advantages, risks, and considerations associated with these financial instruments, investors can make informed decisions and potentially benefit from the opportunities they present while safeguarding their investments.

Overall, credit default swaps require a diligent approach, knowledge of the market, and an understanding of the individual investor’s risk appetite. By incorporating credit default swaps effectively into an investment strategy, investors can enhance their portfolio diversification and potentially improve risk-adjusted returns in the ever-evolving financial landscape.