Finance

How To Enter PNC Merchant Fee Into QuickBooks

Published: February 23, 2024

Learn how to seamlessly enter PNC merchant fees into QuickBooks to keep your finance records accurate and up to date. Simplify your accounting process with these easy steps.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance and accounting, where every transaction tells a story and every dollar has a purpose. In this article, we will delve into the intricacies of entering PNC Merchant fees into QuickBooks, a vital task for businesses that utilize PNC's merchant services and rely on QuickBooks for their accounting needs.

Managing financial transactions is a critical aspect of running a successful business, and the ability to accurately record merchant fees is paramount to maintaining transparent and insightful financial records. By understanding the process of entering PNC Merchant fees into QuickBooks, businesses can ensure that their financial statements accurately reflect the costs associated with processing payments.

Navigating the intersection of merchant services and accounting software may seem daunting at first, but with the right knowledge and tools at your disposal, you can streamline this process and gain a clearer understanding of your business's financial health. Throughout this article, we will explore the nuances of PNC Merchant fees, demystify the process of entering these fees into QuickBooks, and equip you with the knowledge to confidently manage this aspect of your financial record-keeping.

So, whether you're a small business owner striving for financial clarity or an accounting professional seeking to optimize your clients' financial systems, join us on this journey as we unravel the intricacies of managing PNC Merchant fees in QuickBooks. Let's embark on this enlightening exploration of finance and accounting, where every entry tells a story of financial prudence and business acumen.

Understanding PNC Merchant Fee

Before delving into the technicalities of entering PNC Merchant fees into QuickBooks, it’s essential to grasp the nature and significance of these fees. When businesses accept credit card payments, they often partner with a merchant services provider like PNC to facilitate these transactions securely and efficiently. In exchange for this service, the business incurs merchant fees, which are the costs associated with processing credit and debit card payments.

PNC Merchant fees encompass various components, including interchange fees, assessment fees, and the provider’s markup. Interchange fees are set by the card networks (Visa, Mastercard, etc.) and are paid to the card-issuing banks. Assessment fees, on the other hand, are collected by the card networks themselves. Additionally, the provider’s markup represents the profit margin for the merchant services provider, such as PNC.

Understanding the breakdown of PNC Merchant fees is crucial for businesses aiming to comprehend the true cost of processing card payments. By gaining insight into these fees, businesses can make informed decisions regarding their pricing strategies, cost management, and overall financial health.

Moreover, comprehending PNC Merchant fees fosters transparency and accountability in financial record-keeping. When accurately recorded in accounting software like QuickBooks, these fees contribute to a comprehensive view of the business’s expenses, enabling informed financial analysis and strategic planning.

As we navigate the landscape of PNC Merchant fees, it’s important to recognize the integral role they play in the broader financial ecosystem of businesses. By unraveling the intricacies of these fees, businesses can cultivate a deeper understanding of their financial dynamics and leverage this knowledge to drive sustainable growth and profitability.

Entering PNC Merchant Fee into QuickBooks

Now that we’ve gained a comprehensive understanding of PNC Merchant fees, let’s explore the process of accurately recording these fees in QuickBooks. This pivotal task ensures that businesses maintain precise financial records, enabling them to monitor expenses, analyze profitability, and make informed financial decisions.

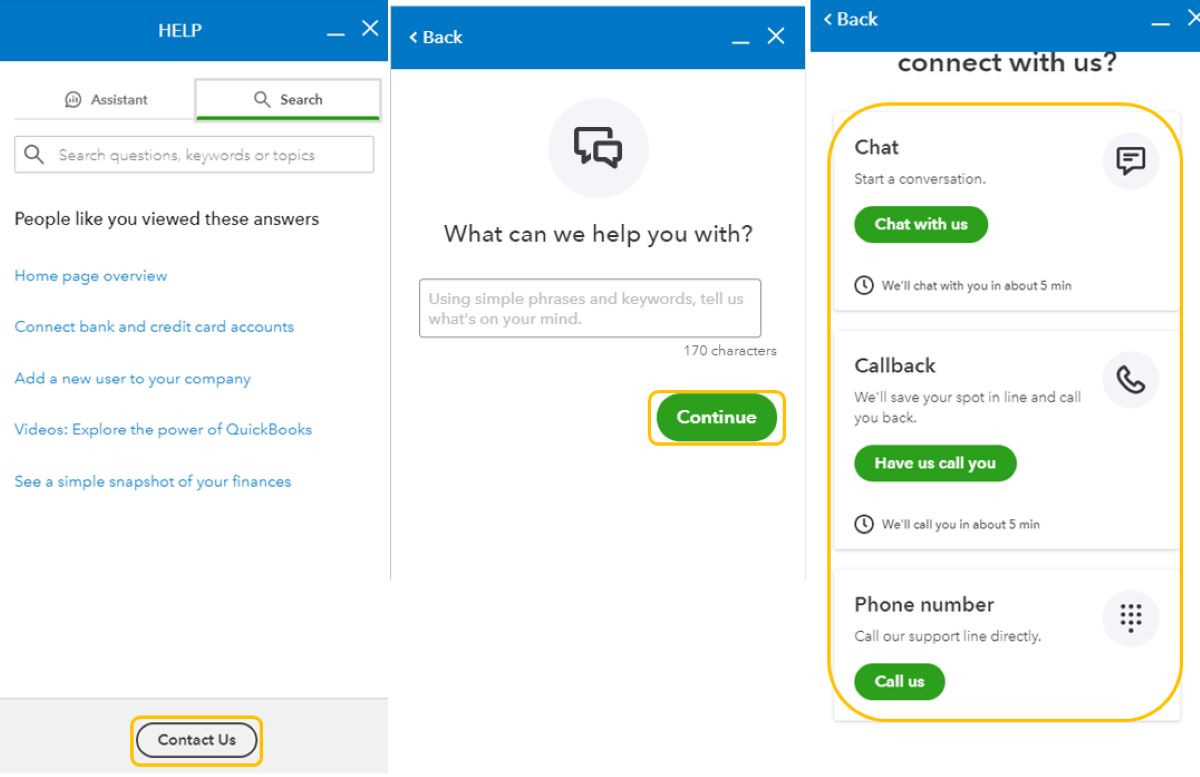

1. Create a Vendor Profile: In QuickBooks, start by creating a vendor profile for PNC Merchant Services. This allows you to attribute the merchant fees to the appropriate vendor, facilitating organized expense tracking.

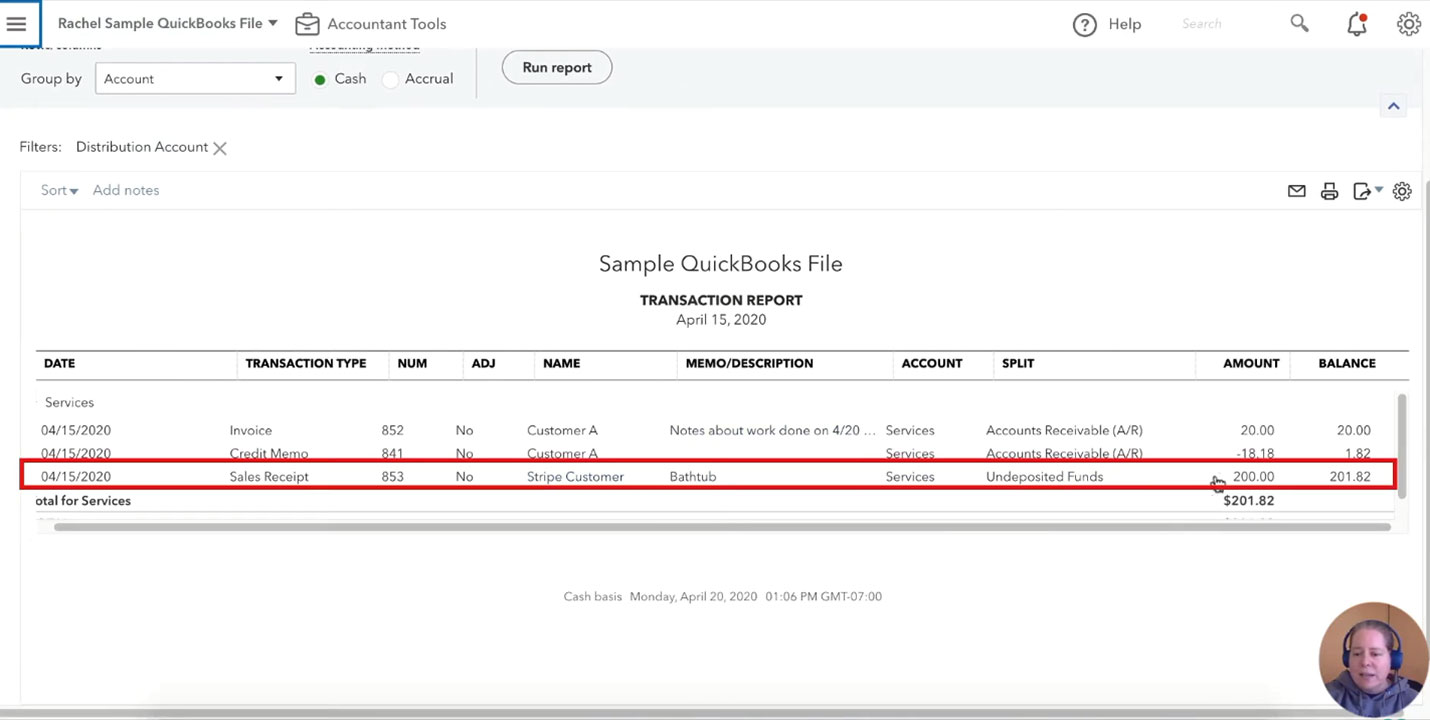

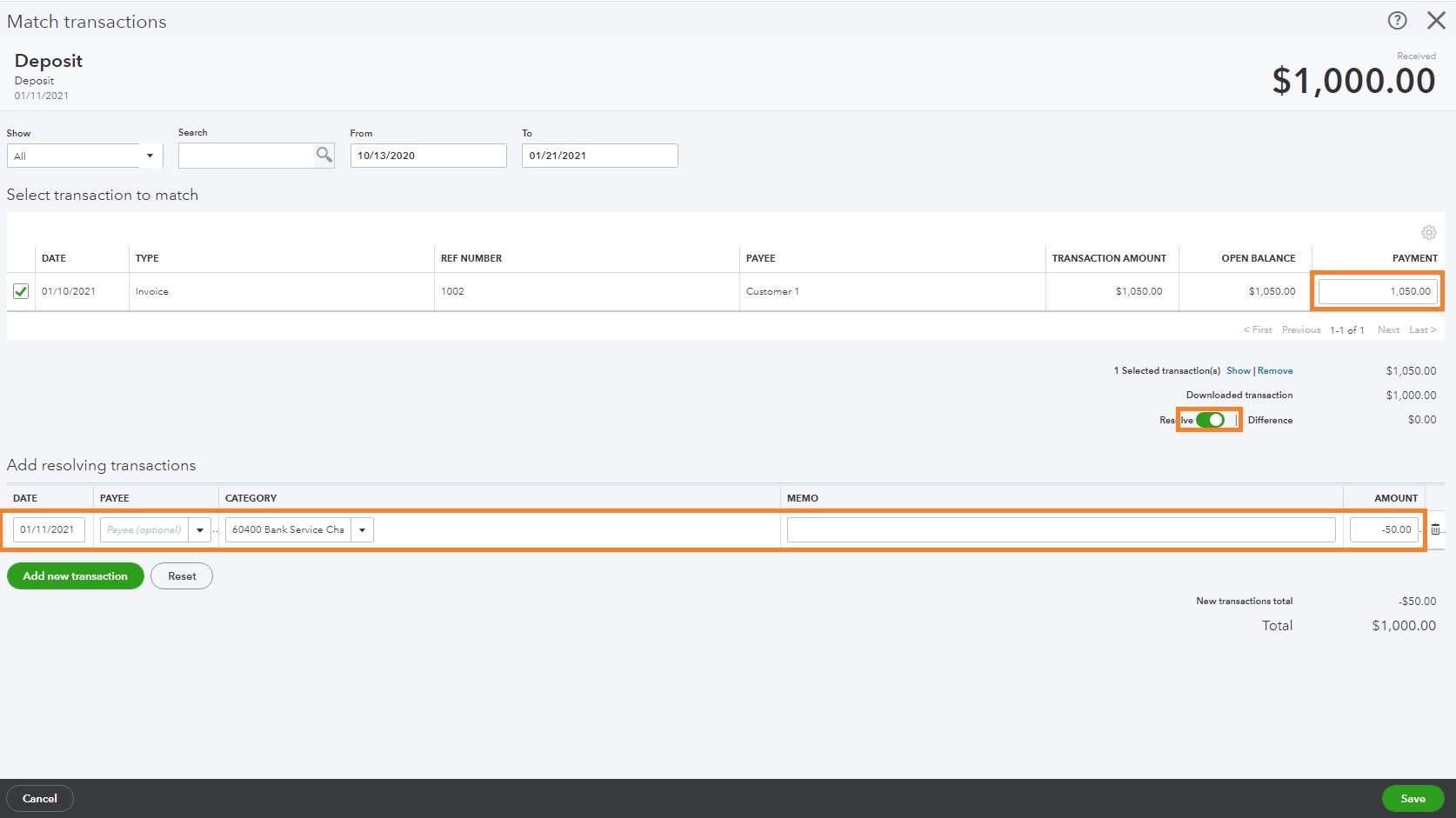

2. Record the Expense: When the PNC Merchant fee is incurred, record it as an expense in QuickBooks. Specify the amount, date, and relevant details to ensure accurate documentation of the transaction.

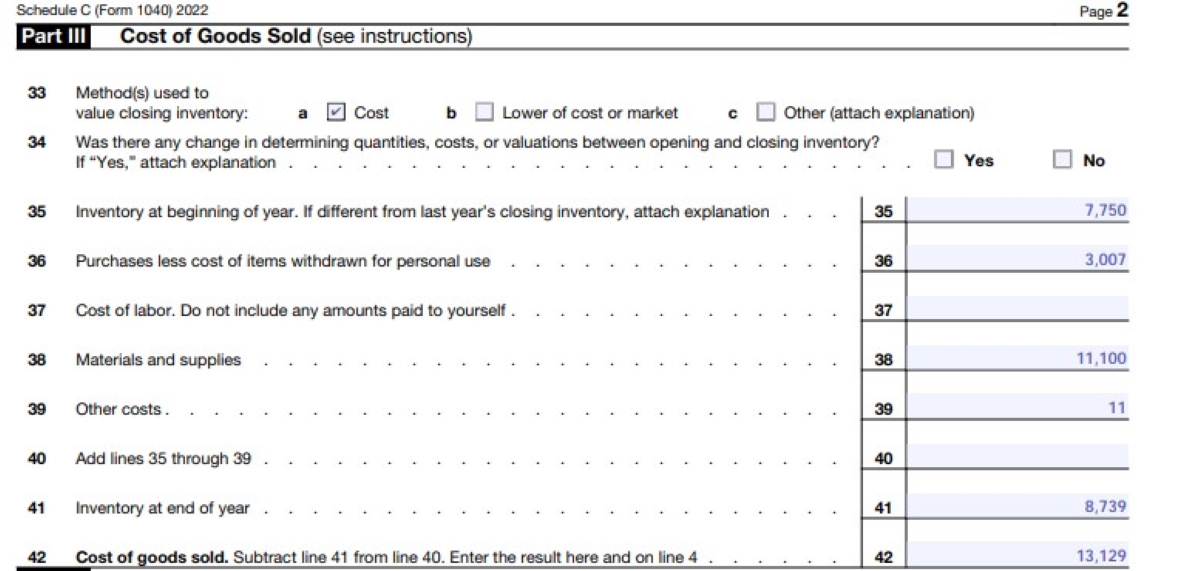

3. Categorize the Expense: Assign the PNC Merchant fee to the appropriate expense category, such as “Merchant Fees” or “Credit Card Processing Fees.” This categorization streamlines expense management and provides clarity in financial reporting.

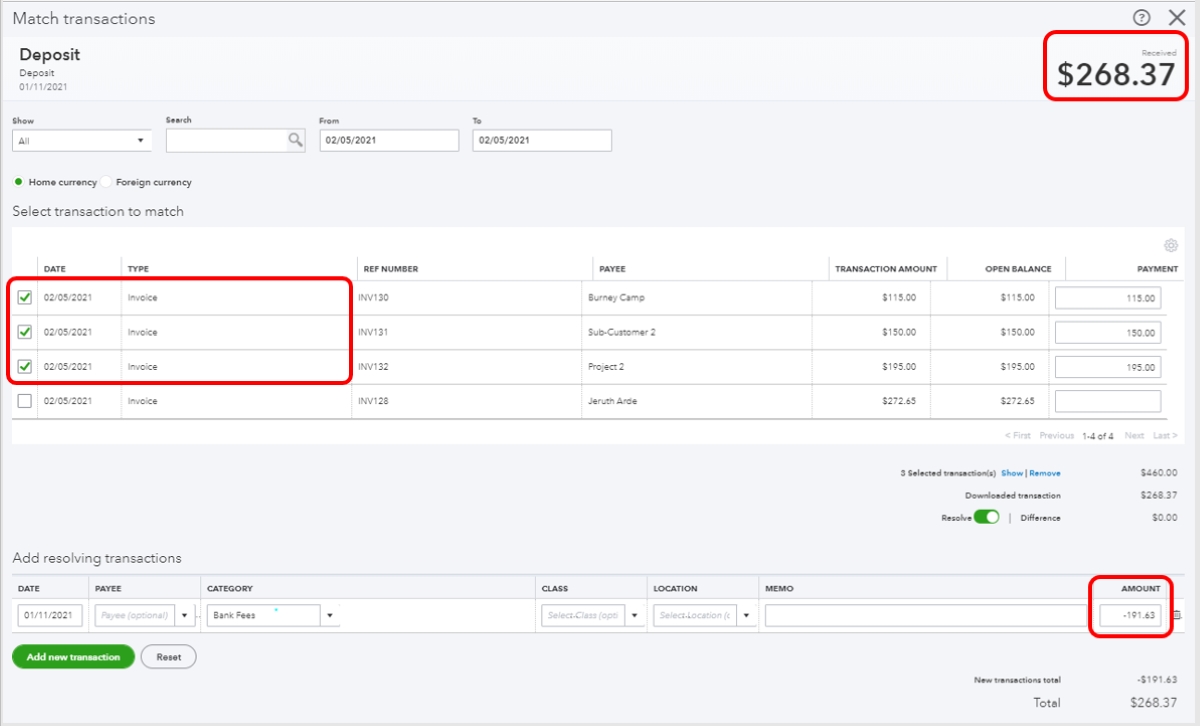

4. Reconcile Accounts: Regularly reconcile your bank and credit card accounts in QuickBooks to ensure that the recorded PNC Merchant fees align with the actual transactions. This practice helps identify discrepancies and maintain financial accuracy.

5. Utilize Class Tracking (if applicable): If your business employs class tracking in QuickBooks to segment transactions by department, location, or other criteria, ensure that PNC Merchant fees are appropriately allocated to the relevant classes for precise cost allocation and performance analysis.

6. Review and Analyze: Periodically review the recorded PNC Merchant fees within QuickBooks to gain insights into your business’s payment processing costs. This analysis can inform pricing strategies, identify cost-saving opportunities, and support informed decision-making.

By meticulously following these steps, businesses can effectively integrate PNC Merchant fees into their financial records within QuickBooks, fostering transparency, accuracy, and strategic financial management.

Entering PNC Merchant fees into QuickBooks is not merely a routine task; it is a fundamental aspect of maintaining financial integrity and harnessing financial data to drive business success. With a clear understanding of the process and its significance, businesses can navigate the realm of merchant fees with confidence, leveraging accurate financial records to propel their growth and prosperity.

Conclusion

As we conclude our exploration of entering PNC Merchant fees into QuickBooks, it’s evident that this process is more than a mere accounting task—it is a strategic imperative for businesses seeking financial clarity and informed decision-making. By comprehending the intricacies of PNC Merchant fees and adeptly integrating them into QuickBooks, businesses can unlock a wealth of benefits that extend far beyond routine expense tracking.

Accurate and transparent financial records serve as the bedrock of sound financial management, empowering businesses to analyze costs, optimize pricing strategies, and make data-driven decisions. Through the meticulous recording of PNC Merchant fees in QuickBooks, businesses gain a comprehensive view of their payment processing expenses, laying the foundation for astute financial analysis and strategic planning.

Furthermore, the integration of PNC Merchant fees into QuickBooks fosters accountability and transparency, enabling businesses to demonstrate financial prudence and operational acumen. This, in turn, enhances stakeholders’ confidence in the business’s financial integrity and management practices.

Moreover, the insights gleaned from accurately recorded PNC Merchant fees can inform critical business decisions, such as evaluating the profitability of different payment methods, identifying cost-saving opportunities, and optimizing overall financial performance.

As businesses navigate the dynamic landscape of commerce, the ability to effectively manage and analyze merchant fees is a hallmark of financial acumen and operational efficiency. By embracing the process of entering PNC Merchant fees into QuickBooks with diligence and insight, businesses can harness the power of financial data to drive sustainable growth and prosperity.

In essence, the task of entering PNC Merchant fees into QuickBooks transcends routine bookkeeping; it is a gateway to financial intelligence and strategic empowerment. With a steadfast commitment to accurate record-keeping and a keen understanding of the nuances of merchant fees, businesses can chart a course towards financial resilience and success in an ever-evolving marketplace.

So, as you embark on this journey of financial stewardship and operational excellence, may the seamless integration of PNC Merchant fees into QuickBooks serve as a beacon illuminating the path to informed decision-making, sustainable growth, and enduring financial vitality.