Finance

Price Per Flowing Barrel Definition

Published: January 11, 2024

Learn the definition of Price Per Flowing Barrel and how it relates to finance

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the Price Per Flowing Barrel

Welcome to the Finance section of our blog! In today’s post, we will delve into the fascinating world of Price Per Flowing Barrel (PFB) and explore its definition, importance, and relevance in the financial sector. So, if you’re curious to learn more about how PFB affects the oil and gas industry, you’ve come to the right place!

Key Takeaways:

- The Price Per Flowing Barrel (PFB) is a financial metric used in the oil and gas industry to evaluate the profitability of an oil production well.

- This metric helps investors and financial analysts determine the value of an oil well and make informed investment decisions.

Before we dive deeper into the definition of PFB, let’s answer an important question: What is the Price Per Flowing Barrel? Simply put, PFB is the price per barrel of oil produced from a specific well. It measures the revenue generated by the oil well, usually on a daily or monthly basis, and compares it to the total number of barrels produced.

PFB is important for both oil and gas companies and investors in several ways. Here are a few key points that highlight its significance:

1. Assessing Profitability

PFB plays a crucial role in evaluating the profitability of an oil well. By comparing the revenue generated to the number of barrels produced, companies can determine how cost-effective and efficient their operations are. This information helps in making informed decisions about optimizing production and identifying potential areas for improvement.

2. Investment Decision-making

For investors, understanding the PFB of oil wells is essential in making sound investment decisions. By analyzing the PFB of different wells, investors can identify profitable opportunities and align their investment strategies accordingly. This metric provides valuable insights into the potential returns on investment and helps investors assess the financial health of oil and gas companies.

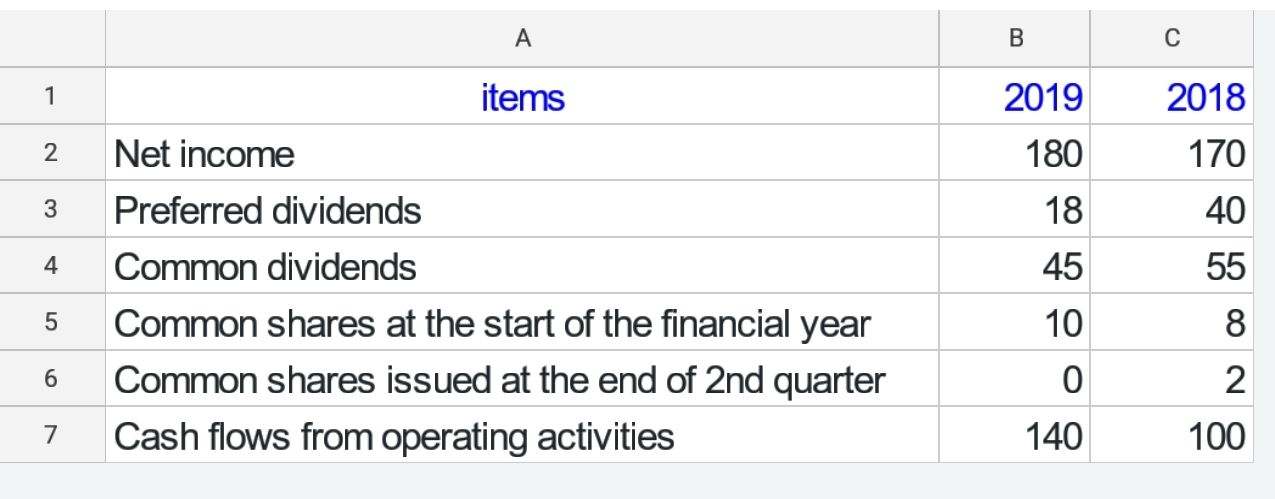

So, how is the Price Per Flowing Barrel calculated? The formula is relatively straightforward:

PFB = Total Revenue / Total Barrels Produced

By dividing the total revenue generated from an oil well by the total number of barrels produced, we can obtain the Price Per Flowing Barrel.

In conclusion, understanding the Price Per Flowing Barrel is vital for companies operating in the oil and gas industry and for investors looking to make informed investment decisions. This metric allows for a comprehensive assessment of profitability and helps in identifying potential investment opportunities. So, whether you’re an industry professional or an investor, keeping an eye on the PFB can certainly be a valuable tool in your financial toolkit!