Home>Finance>Term Sheets: Definition, What’s Included, Examples, And Key Terms

Finance

Term Sheets: Definition, What’s Included, Examples, And Key Terms

Published: February 7, 2024

Learn about finance term sheets, including their definition, what's included, examples, and key terms. Gain a comprehensive understanding of this essential financial document.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Term Sheets: A Guide to Negotiating Financing Deals

Welcome to our finance blog where we discuss various aspects of the financial world. Today, we are diving into an important topic for startups and investors alike – term sheets. If you’ve ever wondered what a term sheet is, what it includes, and why it’s crucial in financing deals, you’ve come to the right place. In this article, we’ll provide a comprehensive overview of term sheets, along with real-life examples and key terms you should know.

Key Takeaways:

- A term sheet is a non-binding document that outlines the terms and conditions of a potential investment deal.

- It serves as a blueprint for negotiating the final investment agreement between the parties involved.

Defining Term Sheets

Before we delve into the specifics, let’s start with the definition. A term sheet can be thought of as a preliminary agreement between a startup seeking capital and potential investors. It outlines the basic terms and conditions that both parties are willing to consider in a future investment deal. It acts as a roadmap for negotiations and sets the foundation for the final investment agreement.

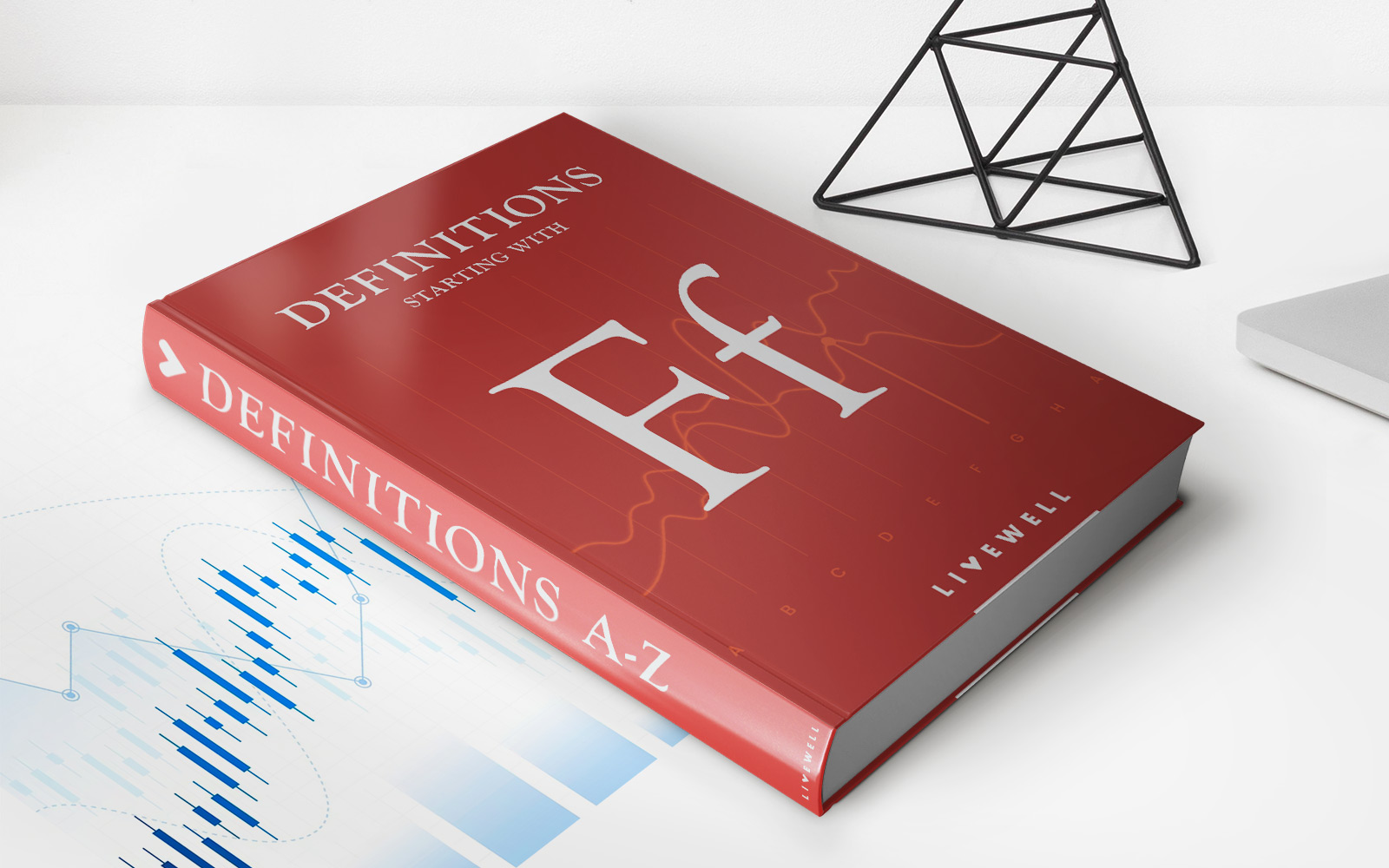

What’s Included in a Term Sheet?

A term sheet typically includes key information and provisions, such as:

- Company Overview: This section provides a brief background of the startup, including its name, industry, and stage of development.

- Investment Amount and Valuation: The term sheet outlines the amount of investment sought by the startup and the valuation of the company at the time of the investment.

- Investor Rights: It specifies the rights that the investors will have in the company, such as board representation or voting rights.

- Use of Funds: This section explains how the funds raised will be utilized by the startup, whether for product development, marketing, or other purposes.

- Exit Strategy: The term sheet may include provisions regarding how the investors can achieve a return on their investment, such as through an IPO or acquisition.

Real-life Examples of Term Sheets

Let’s look at a couple of real-life examples to help illustrate how term sheets work:

Example 1: Startup ABC

- Investment Amount: $2 million

- Valuation: $10 million

- Investor Rights: One board seat

- Use of Funds: Product development and marketing

- Exit Strategy: Acquisition by a major player in the industry

Example 2: Tech Company XYZ

- Investment Amount: $5 million

- Valuation: $20 million

- Investor Rights: Two board seats

- Use of Funds: Expansion into new markets

- Exit Strategy: IPO within 5 years

Key Terms in Term Sheets

Here are some key terms you should be familiar with when negotiating term sheets:

- Drag-Along Rights: These rights allow majority shareholders to force minority shareholders to sell their shares in the event of a sale of the company.

- Vesting: Vesting refers to the schedule according to which shares or stock options granted to employees or founders become fully owned.

- Anti-Dilution Provisions: These provisions protect investors from dilution of their ownership stake in the company in the event of future financing rounds at lower valuations.

- Liquidation Preference: This term determines the order in which investors are paid back in the event of a liquidation or sale of the company.

- Conversion Rights: Conversion rights allow preferred stockholders to convert their shares into common stock under certain circumstances, such as an IPO.

While these are just a few examples, negotiating term sheets requires a nuanced understanding of various terms and their implications. It’s always wise to consult with legal and financial professionals to ensure you fully comprehend the terms involved in a potential deal.

Conclusion

In conclusion, a term sheet is a vital tool in the financing process for startups and investors. It serves as the initial agreement, outlining the terms and conditions of a potential investment deal. By helping both parties align their expectations, it paves the way for further negotiations and the final investment agreement. Understanding the contents of a term sheet and the key terms involved can greatly enhance your ability to navigate the complex world of financing deals.

This concludes our blog article on term sheets. We hope you found it insightful and gained a solid understanding of this critical aspect of the finance world. Remember, when it comes to term sheets, knowledge is power!