Finance

Trailing Free Cash Flow (FCF) Definition

Published: February 10, 2024

Learn the definition of trailing free cash flow (FCF) in finance and its importance in analyzing financial performance. Enhance your understanding of finance concepts.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Trailing Free Cash Flow (FCF) in Finance

Welcome to the finance corner of our blog! Today, we are diving into the world of Trailing Free Cash Flow (FCF) and demystifying its definition. If you’ve ever wondered what Trailing FCF is and how it can impact your financial decisions, you’re in the right place. Let’s explore this concept together!

Key Takeaways:

- Trailing Free Cash Flow (FCF) is the measure of a company’s operating cash flow that is available after accounting for expenses and investments.

- It is a key indicator of a company’s financial health and can help investors evaluate its ability to generate additional cash in the future.

What is Trailing Free Cash Flow (FCF)?

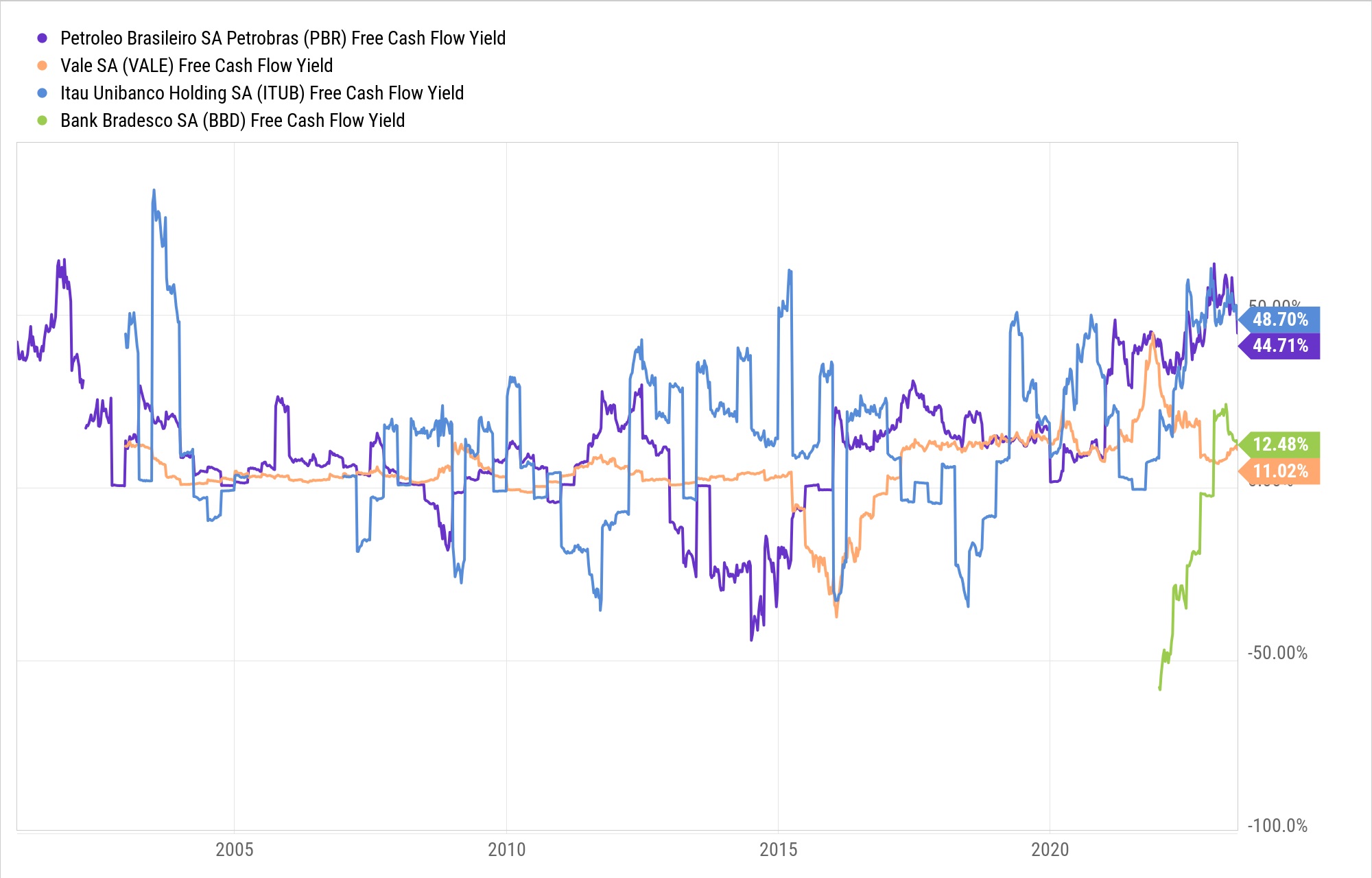

Trailing Free Cash Flow (FCF) refers to the amount of cash generated by a company’s operations after deducting capital expenditures and other investments made during a specific period. It is a financial metric used by investors and analysts to assess the financial performance and potential of a company.

In simple terms, Trailing FCF represents the cash a company has left over after meeting all its financial obligations and reinvesting in its growth. This cash can be used for various purposes such as paying off debts, returning value to shareholders through dividends or share buybacks, reinvesting in the business, or pursuing new opportunities.

Trailing FCF is calculated by subtracting capital expenditures, mandatory interest payments, and taxes from a company’s operating cash flow for a specific period. By analyzing a company’s historical Trailing FCF, investors can gain insights into its ability to generate consistent cash flows over time. This information can be invaluable in assessing the company’s financial stability and predicting its future financial performance.

Why is Trailing Free Cash Flow (FCF) Important?

Trailing Free Cash Flow is an essential metric for investors as it provides a snapshot of a company’s financial health and its ability to generate excess cash. Here are a few reasons why Trailing FCF holds significance:

- Financial Stability: Trailing FCF demonstrates a company’s ability to generate positive cash flow, indicating its financial stability. A strong FCF suggests that the company can meet its ongoing financial commitments and potentially weather financial downturns more effectively.

- Investment Potential: Trailing FCF allows investors to evaluate a company’s potential for future growth, as excess cash can be reinvested in expanding operations, funding research and development, or acquiring new assets.

- Dividend Payments and Shareholder Value: Positive Trailing FCF can enable a company to return value to its shareholders through dividend payments or share buybacks, thereby enhancing shareholder value.

- Ability to Manage Debt: Trailing FCF provides insights into a company’s ability to generate enough cash to meet debt obligations and interest payments, making it easier to assess its creditworthiness and risk profile.

In summary, Trailing Free Cash Flow is an essential financial metric that offers meaningful insights into a company’s financial stability and growth potential. Investors and analysts often rely on Trailing FCF to make informed investment decisions and understand the financial health of the companies they are interested in.

By understanding the definition and significance of Trailing Free Cash Flow, you can gain a clearer perspective on the financial performance of a company and make more informed decisions when it comes to your investments.

Thank you for joining us in this journey through the world of finance. Stay tuned for more insightful articles on various financial topics!