Finance

What Is A Good Free Cash Flow Margin

Modified: December 29, 2023

Discover what a good free cash flow margin is in the field of finance and how it can impact your financial decisions. Gain insights on optimizing cash flow for better financial management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

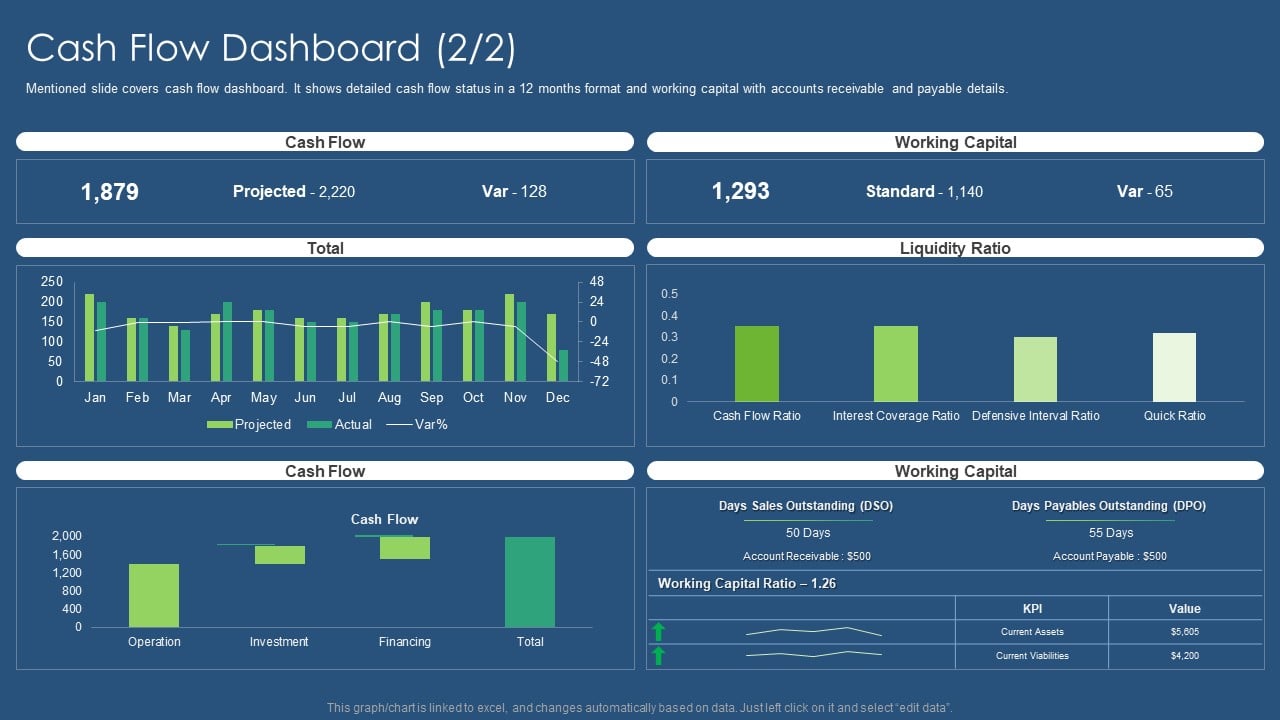

When it comes to evaluating the financial health and performance of a company, there are various metrics that investors and analysts rely on. One such important metric is the Free Cash Flow Margin. Free cash flow margin provides insights into the company’s ability to generate cash from its operations after accounting for the necessary capital expenditures. It is a key indicator of financial stability and profitability.

In simple terms, free cash flow margin measures the percentage of revenue that a company can convert into free cash flow. Free cash flow is the amount of cash left over after deducting operating expenses, taxes, and capital expenditures. It represents the cash that a company has available to invest in growth, distribute to shareholders, or pay off debt.

The free cash flow margin metric is widely used by investors, analysts, and financial institutions to assess a company’s financial strength, operational efficiency, and sustainability in generating cash. A high free cash flow margin indicates that a company is effectively managing its cash flow and has the potential for future growth and investment opportunities.

On the other hand, a low or negative free cash flow margin can be a cause for concern. It suggests that a company is struggling to generate sufficient cash from its operations and may have difficulty covering its expenses or pursuing growth initiatives. This could indicate underlying issues such as inefficiencies in operations, high debt levels, or an inability to adapt to changing market conditions.

Understanding the free cash flow margin of a company is crucial for investors as it provides a deeper insight into its financial position, profitability, and ability to weather economic downturns. It helps investors determine if a company is generating sustainable cash flows and has the potential for long-term viability.

Throughout this article, we will delve into the definition of free cash flow margin, its importance, how to calculate it, factors that affect it, and examples of companies with good free cash flow margins. Additionally, we will discuss the limitations of this metric to provide a comprehensive understanding of its significance in financial analysis.

Definition of Free Cash Flow Margin

Free cash flow margin is a financial metric that measures the percentage of revenue a company generates as free cash flow. Free cash flow is the cash remaining after deducting operating expenses, taxes, and capital expenditures necessary to maintain and expand the company’s operations. It is a key indicator of a company’s ability to generate cash from its core business activities.

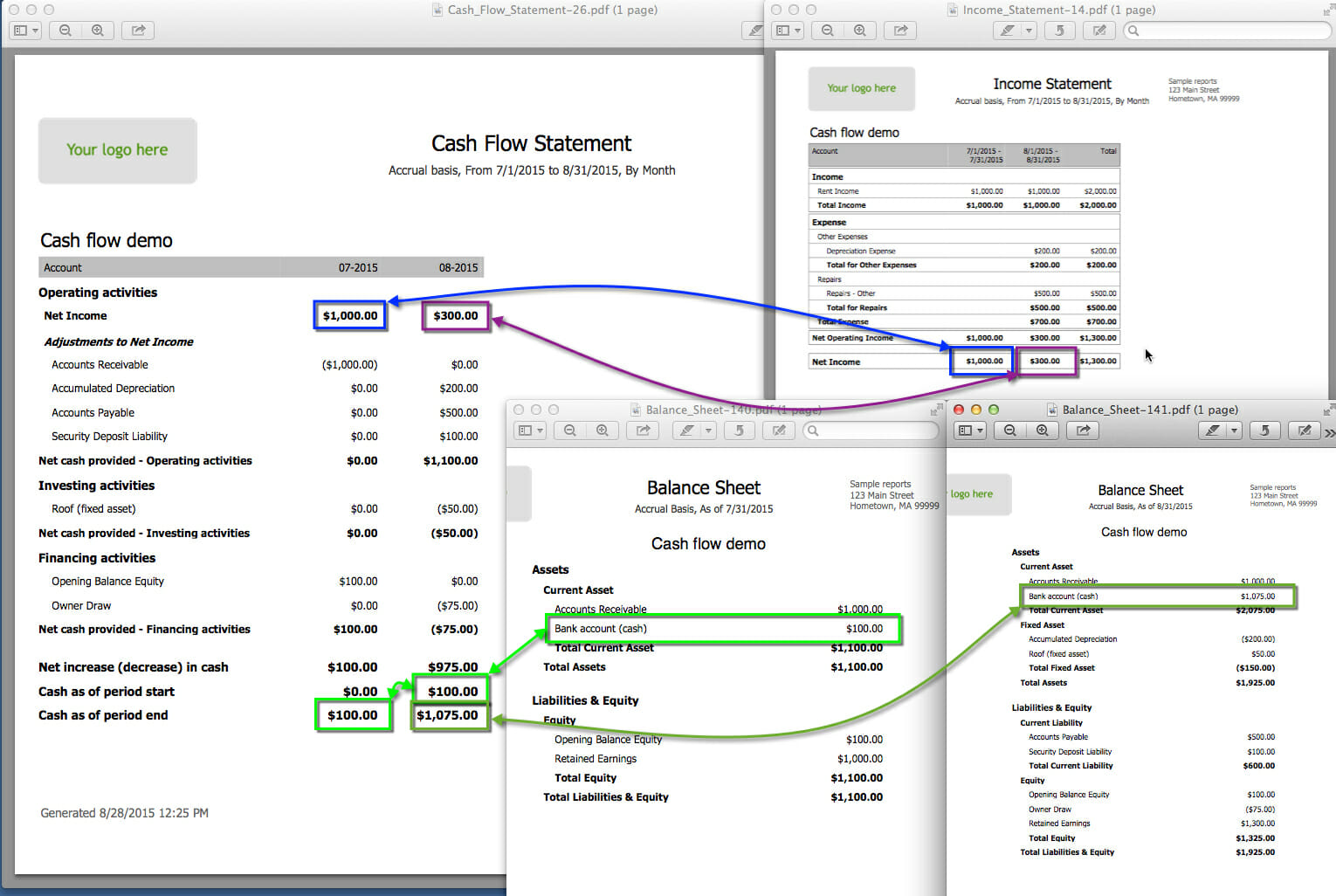

To calculate the free cash flow margin, the formula is as follows:

Free Cash Flow Margin = (Free Cash Flow / Revenue) x 100

The numerator, free cash flow, represents the cash available to the company after deducting expenses necessary for daily operations and capital investments. It is calculated as:

Free Cash Flow = Operating Cash Flow – Capital Expenditures

The denominator, revenue, represents the total sales or income generated by the company within a specific period. By dividing the free cash flow by the revenue and multiplying the result by 100, we get the free cash flow margin as a percentage.

The primary purpose of calculating the free cash flow margin is to evaluate the financial health and profitability of a company. It provides insights into how efficiently a company converts its revenue into cash that can be reinvested or distributed to shareholders. A higher free cash flow margin indicates better financial performance, as it signifies that the company generates more cash per unit of revenue.

For example, if a company has a free cash flow margin of 10%, it means that for every dollar of revenue, 10 cents are converted into free cash flow. This indicates that the company has a strong ability to generate cash and manage its operational expenses.

Comparing the free cash flow margins of different companies within the same industry or sector can also help investors and analysts identify the most financially efficient businesses. It allows for better benchmarking and assessment of a company’s competitive position in terms of cash generation and financial management.

Overall, the free cash flow margin provides meaningful insights into a company’s ability to generate cash, fund growth, pay dividends, and repay debts. It serves as a valuable tool for investors and stakeholders to assess a company’s financial performance and make informed investment decisions.

Importance of Free Cash Flow Margin

The free cash flow margin is a crucial financial metric that holds significant importance for investors, analysts, and stakeholders. It provides valuable insights into a company’s financial health, operational efficiency, and long-term sustainability. Here are some key reasons why the free cash flow margin is important:

1. Financial Stability: The free cash flow margin reflects a company’s ability to generate cash from its core operations. A high free cash flow margin indicates that the company has enough cash to cover its expenses, invest in growth opportunities, and weather economic downturns. It provides a measure of financial stability and resilience against unforeseen challenges.

2. Profitability: The free cash flow margin is closely linked to a company’s profitability. Companies with higher margins have the potential to generate more free cash flow, which can be used for various purposes like research and development, strategic acquisitions, or returning value to shareholders through dividends or share buybacks.

3. Efficient Cash Management: By examining the free cash flow margin, investors and analysts can assess a company’s ability to efficiently manage its cash flow. A higher margin suggests that the company is converting a larger proportion of its revenue into cash, indicating effective cash management processes and control over expenses.

4. Investment and Growth Opportunities: Companies with a healthy free cash flow margin are often better positioned to invest in growth initiatives. The availability of excess cash allows them to fund research and development, expand into new markets, upgrade technology and equipment, or make strategic acquisitions. This, in turn, can lead to increased market share, revenue growth, and enhanced shareholder value.

5. Debt Management: The free cash flow margin helps evaluate a company’s ability to manage its debt obligations. A positive free cash flow margin indicates that the company has sufficient cash flow to service its debt, reducing the risk of default and improving creditworthiness.

6. Stock Valuation: The free cash flow margin is a vital component in valuing stocks. Investors often analyze the free cash flow margin alongside other key financial ratios to determine a company’s intrinsic value and its potential for generating future cash flows. Stocks of companies with strong free cash flow margins are generally more attractive to investors seeking stable and profitable investments.

7. Key Performance Indicator: The free cash flow margin serves as an essential Key Performance Indicator (KPI) to assess a company’s financial performance. It provides a clear picture of the company’s ability to generate cash and its overall financial strength. Monitoring the free cash flow margin over time helps track the company’s progress, identify trends, and make informed decisions regarding investment strategies.

Overall, the free cash flow margin plays a vital role in evaluating a company’s financial health, efficiency, profitability, and growth potential. It provides valuable insights for investors and analysts to make informed investment decisions, assess risk, and measure a company’s long-term sustainability in the market.

Calculation of Free Cash Flow Margin

The calculation of the free cash flow margin involves deriving the ratio of free cash flow to revenue. This metric provides insights into the company’s ability to convert its revenue into cash flow that can be reinvested or distributed to shareholders. Let’s break down the steps to calculate the free cash flow margin:

Step 1: Calculate Free Cash Flow (FCF)

The first step is to calculate the free cash flow, which represents the cash generated by a company after deducting operating expenses, taxes, and capital expenditures. The formula for calculating free cash flow is:

Free Cash Flow = Operating Cash Flow – Capital Expenditures

The operating cash flow is the cash generated from the core operations of the business, while the capital expenditures represent the investments made in assets or infrastructure required to maintain and expand the company’s operations.

Step 2: Calculate Free Cash Flow Margin

Once the free cash flow is determined, the next step is to calculate the free cash flow margin by relating it to the company’s revenue. The formula for calculating the free cash flow margin is:

Free Cash Flow Margin = (Free Cash Flow / Revenue) x 100

This formula gives the free cash flow margin as a percentage. It indicates the proportion of revenue that is converted into free cash flow.

For example, if a company generates $1 million in free cash flow and has $10 million in revenue, the free cash flow margin would be (1,000,000 / 10,000,000) x 100 = 10%. This means that the company can convert 10% of its revenue into free cash flow.

The free cash flow margin calculation allows investors and analysts to compare the cash-generating abilities of different companies within the same industry or sector. It helps in assessing the efficiency and profitability of businesses in converting their revenues into cash flow.

It is important to note that the calculation of free cash flow can vary depending on the specific financial metrics used by different analysts or financial institutions. However, the basic formula remains consistent, focusing on the operating cash flow and capital expenditures.

By calculating the free cash flow margin, investors and analysts can gain insights into a company’s cash-generating potential, financial performance, and its ability to reinvest in the business or return value to shareholders.

How to Interpret Free Cash Flow Margin

The free cash flow margin is a key financial metric that provides insights into a company’s efficiency in generating cash flow from its operations. Interpreting the free cash flow margin correctly is crucial for investors and analysts to understand a company’s financial health and operational performance. Here are some key points to consider when interpreting the free cash flow margin:

1. Higher is Better: A higher free cash flow margin indicates that the company is generating a larger proportion of free cash flow relative to its revenue. It suggests that the company is efficient in managing its operational expenses and capital investments, resulting in a stronger ability to generate cash. A high free cash flow margin is generally seen as a positive sign, indicating financial strength and profitability.

2. Consistency and Trends: It is important to analyze the free cash flow margin over multiple periods to identify consistency or any trends. Consistently high or improving margins indicate a stable and healthy cash-generating ability. Conversely, decreasing margins over time may indicate potential issues in the company’s operations, such as rising costs or declining revenue. Examining trends in the free cash flow margin provides insights into the company’s ability to sustain its cash flow generation.

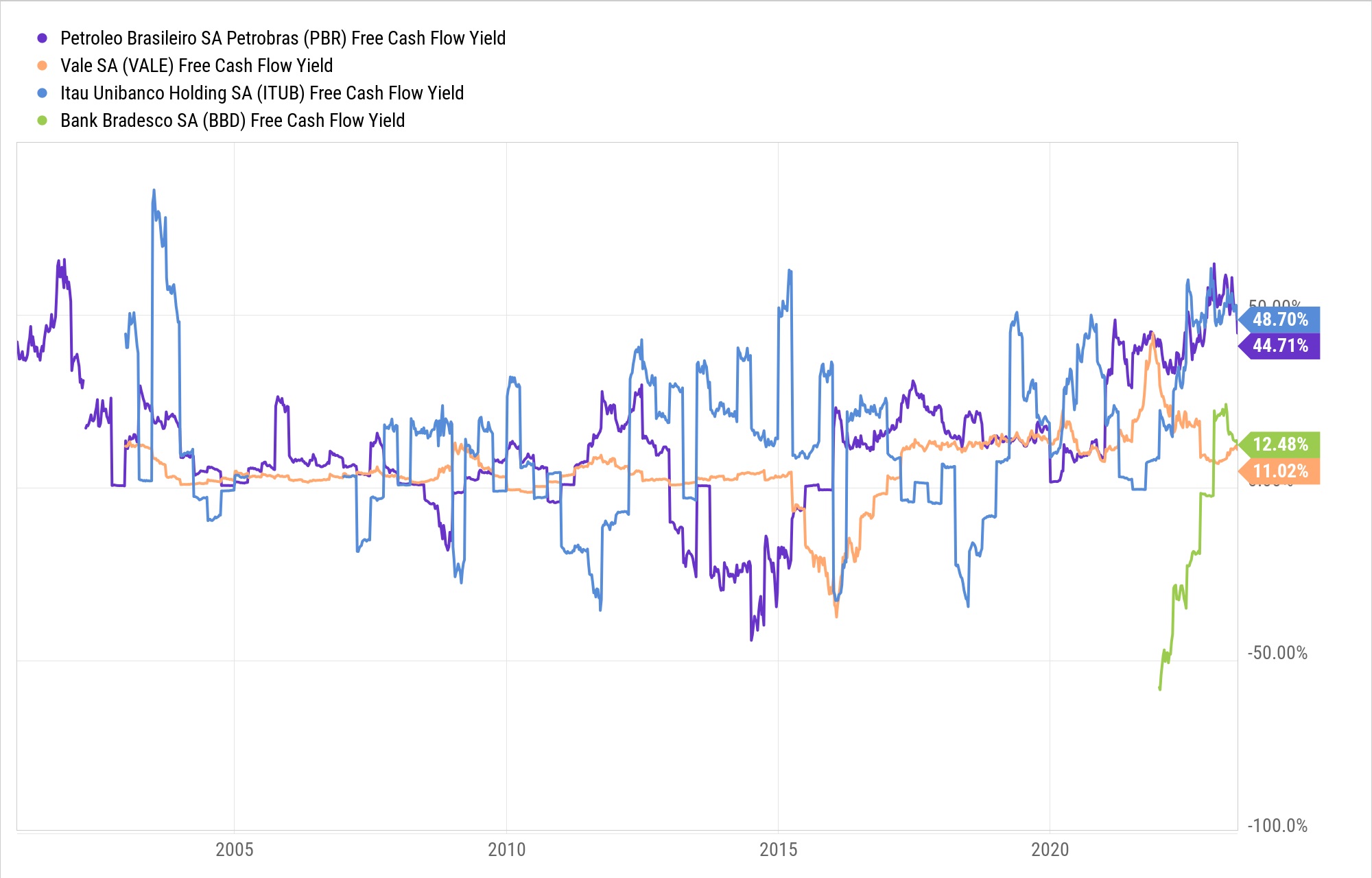

3. Industry and Sector Comparisons: Comparing the free cash flow margin of a company to its peers within the same industry or sector is essential for a meaningful analysis. Industries with high capital requirements, such as manufacturing or telecommunications, may have lower free cash flow margins compared to industries with lower capital requirements, such as software or services. Understanding the industry norms and comparing a company’s margin to its competitors helps in identifying its position in the market.

4. Historical Comparisons: Analyzing the free cash flow margin of a company in relation to its historical performance is valuable. Comparing current margins to past periods allows investors to identify changes in the company’s cash generation abilities and evaluate the impact of operational or strategic changes. It provides insights into the company’s ability to adapt to industry fluctuations and management’s effectiveness in improving financial performance.

5. Company’s Strategy and Growth: Interpreting the free cash flow margin should be done in the context of the company’s strategy and growth plans. A company aiming for aggressive expansion or investing heavily in research and development may have temporarily lower margins due to higher capital expenditures. However, if the company’s investments yield positive results in terms of revenue growth and market share, it may be interpreted as an effective use of cash flow for long-term value creation.

6. Comparing Free Cash Flow Margin with Net Profit Margin: Comparing the free cash flow margin with the net profit margin provides further insights into a company’s financial performance. If the free cash flow margin is significantly higher than the net profit margin, it suggests that the company has effective management of its working capital and strong cash flow generation capabilities. However, if the free cash flow margin is consistently lower than the net profit margin, it may indicate potential issues with cash flow management and the quality of earnings.

Interpreting the free cash flow margin requires a holistic understanding of the company’s financials, industry dynamics, and strategic direction. It is important to consider various factors and indicators in conjunction with the free cash flow margin to make informed investment decisions and assess a company’s overall financial health and operational efficiency.

Factors Affecting Free Cash Flow Margin

Several factors can influence a company’s free cash flow margin, which is a key indicator of its financial health and operational efficiency. Understanding these factors is crucial for investors and analysts to evaluate a company’s ability to generate cash flow. Here are some of the key factors that can affect the free cash flow margin:

1. Revenue Growth: Revenue growth directly impacts the free cash flow margin. Higher revenue allows companies to generate more cash flow, assuming other operational factors remain constant. Increasing sales can lead to economies of scale and improved operating efficiency, resulting in a higher free cash flow margin.

2. Cost Management: Effective cost management is essential for improving the free cash flow margin. Controlling operating expenses, such as raw material costs, labor costs, and overhead expenses, can enhance profitability and increase cash flow. Efficient supply chain management and strategic sourcing initiatives can help reduce costs and improve the free cash flow margin.

3. Capital Expenditures: The level and timing of capital expenditures can significantly impact the free cash flow margin. Capital investments in infrastructure, equipment, or research and development are necessary for business growth and competitiveness. However, excessive capital expenditures can strain cash flow, leading to a lower free cash flow margin. Proper capital expenditure planning is vital to maintain a balance between investment needs and available cash flow.

4. Working Capital Management: Efficient management of working capital, including inventory, accounts receivable, and accounts payable, is crucial for maintaining a healthy cash flow. Companies with streamlined and effective working capital management can improve their free cash flow margin. Strategies such as optimizing inventory levels, speeding up collections from customers, and negotiating favorable payment terms with suppliers can enhance cash flow and increase the free cash flow margin.

5. Debt Servicing: The presence of debt can impact a company’s free cash flow margin. High levels of debt and interest payments can restrict cash flow, reducing the free cash flow margin. Servicing debt obligations can consume a significant portion of cash flow, limiting the amount available for reinvestment or distribution to shareholders. Companies with lower levels of debt or efficient debt management strategies can maintain a higher free cash flow margin.

6. Seasonality and Business Cycle: Companies that experience seasonality in their operations may see fluctuations in their free cash flow margin. For example, retail businesses often have higher cash flows during the holiday season. Similarly, businesses tied to specific sectors, such as construction or tourism, may experience variations in their cash flow based on economic cycles. Understanding these seasonal and cyclical patterns is essential for analyzing and interpreting the free cash flow margin accurately.

7. Industry and Competitive Factors: The industry and competitive landscape can influence a company’s free cash flow margin. Factors such as pricing pressure, market saturation, technological advancements, and regulatory changes can affect revenue growth, operating costs, and capital investment requirements. Understanding the dynamics of the industry and the company’s competitive position can help in assessing the potential impact on the free cash flow margin.

It is important to note that these factors interplay with each other and can vary in significance across different industries and companies. A comprehensive analysis of these factors is necessary to understand the overall impact on a company’s free cash flow margin and its ability to generate sustainable cash flows.

Examples of Companies with Good Free Cash Flow Margin

There are several companies that have demonstrated strong free cash flow margins, indicating their ability to generate significant cash flow from their operations. These companies have implemented effective strategies in managing their cash flow and achieving financial stability. Here are some examples of companies with good free cash flow margins:

1. Apple Inc.: Apple Inc., the technology giant, has consistently exhibited a strong free cash flow margin. With its diversified product portfolio and strong customer loyalty, Apple generates robust revenue, allowing it to invest in research and development, expand its product offerings, and return value to shareholders through dividends and share repurchases. Its efficient cost management and supply chain practices contribute to a healthy free cash flow margin.

2. Amazon.com Inc.: Amazon.com, the global e-commerce giant, has demonstrated impressive free cash flow margins. The company’s focus on revenue growth, operational scale, and efficient logistical operations has allowed it to generate substantial cash flows. While it reinvests a significant portion of its cash flow into expanding its infrastructure and services, Amazon’s solid revenue streams and cost management contribute to its favorable free cash flow margin.

3. Microsoft Corporation: Microsoft Corporation, a leading technology company, is known for its strong free cash flow generation. The company’s diversified revenue streams, including its software, cloud services, and hardware products, contribute to its consistent revenue growth. Microsoft has effectively managed its costs, while its strategic investments in cloud computing and artificial intelligence have led to increased profitability and a healthy free cash flow margin.

4. Johnson & Johnson: Johnson & Johnson, a multinational pharmaceutical and consumer goods company, has a track record of maintaining a solid free cash flow margin. The company’s broad portfolio of products, including pharmaceuticals, medical devices, and consumer health products, contributes to its steady revenue growth. Johnson & Johnson’s strong financial discipline and efficient working capital management have played a significant role in its ability to generate a healthy free cash flow margin.

5. Visa Inc.: Visa Inc., a global payments technology company, has consistently achieved a strong free cash flow margin. As a leader in the payment industry, Visa benefits from its extensive network and high transaction volumes. The company’s scalable business model, low capital expenditure requirements, and efficient cost management have contributed to its impressive free cash flow margin.

It is important to note that the free cash flow margin can vary across industries, with capital-intensive businesses typically having lower margins due to higher capital expenditures. Additionally, the performance of companies can also be influenced by external factors such as economic conditions, market competition, and regulatory changes. It is crucial to conduct thorough research and analysis to understand the specific factors driving a company’s free cash flow margin.

The examples provided highlight companies that have consistently exhibited strong free cash flow margins, reflecting their ability to generate significant cash flows and manage their financial operations effectively. These companies serve as valuable benchmarks for investors and analysts interested in assessing a company’s financial health and operational efficiency.

Limitations of Free Cash Flow Margin

While the free cash flow margin is a valuable metric for assessing a company’s financial health and operational efficiency, it is important to recognize its limitations. Understanding these limitations helps investors and analysts to conduct a more comprehensive analysis. Here are some key limitations of the free cash flow margin:

1. Timing of Cash Flows: The free cash flow margin provides a snapshot of a company’s cash flow generation for a particular period. It may not capture the timing of cash inflows and outflows accurately. Large one-time cash inflows, such as a sale of assets or an investment infusion, can distort the free cash flow margin and may not be sustainable over time.

2. Capital Intensity: Different industries have varying capital requirements. Companies in capital-intensive industries, such as manufacturing or infrastructure, may have lower free cash flow margins due to significant investments in equipment, facilities, and research and development. Comparing the free cash flow margin of companies across industries may not be a fair comparison without accounting for industry-specific dynamics.

3. Non-Cash Items: The free cash flow margin does not consider non-cash items that can impact a company’s cash flow. Non-cash expenses such as depreciation and amortization are excluded from the calculation, giving an incomplete picture of the company’s overall financial performance. Analysts often use other metrics, such as EBITDA (earnings before interest, taxes, depreciation, and amortization), to supplement the free cash flow margin in their analysis.

4. Working Capital Considerations: The free cash flow margin does not directly account for changes in working capital, such as inventory levels or accounts receivable management. Efficient working capital management plays a vital role in a company’s cash flow generation, and fluctuations in working capital can impact the underlying free cash flow margin.

5. Cash Flow Allocation Decisions: The free cash flow margin does not provide insight into how a company chooses to allocate its cash flow. Companies have different priorities for cash deployment, including reinvestments in the business, debt repayment, acquisitions, dividends, or share buybacks. Understanding a company’s capital allocation strategy is important for a comprehensive assessment of its financial health and future prospects.

6. Company-Specific Factors: It is essential to consider company-specific factors that may influence the free cash flow margin. Factors such as management decisions, business models, competitive advantages, and industry dynamics can impact a company’s cash flow generation. These factors are not reflected solely by the free cash flow margin and require a more in-depth analysis.

7. External Factors: The free cash flow margin does not factor in external factors that can impact a company’s cash flow, such as macroeconomic conditions, industry disruptions, regulatory changes, or geopolitical events. These external variables can influence a company’s cash flow generation and may not be captured by the free cash flow margin alone.

While the free cash flow margin is a useful metric, it is important to use it in conjunction with other financial indicators and conduct a comprehensive analysis of a company’s financial statements, industry dynamics, and competitive landscape to gain a broader understanding of its financial health and operational performance.

Conclusion

The free cash flow margin is a crucial metric for evaluating a company’s financial health, operational efficiency, and ability to generate cash flow. It provides insights into the company’s management of cash flow and its capacity to invest in growth opportunities or return value to shareholders. Understanding the free cash flow margin helps investors and analysts make informed investment decisions and assess a company’s long-term sustainability.

Throughout this article, we have explored the definition of the free cash flow margin, its importance, calculation methodology, interpretation, factors affecting it, examples of companies with good margins, and its limitations. We have seen that a higher free cash flow margin suggests strong cash flow generation and effective financial management, while a lower margin may indicate the need for further analysis and a potential cause for concern.

It is important to note that the free cash flow margin should be analyzed in conjunction with other financial metrics and factors specific to the company and industry. Comparing the margin with industry norms, historical data, and peer companies enables a more comprehensive evaluation of a company’s performance and financial position.

While the free cash flow margin provides valuable insights, it does have limitations. The timing of cash flows, industry dynamics, non-cash items, and working capital considerations are factors that need to be considered when interpreting the margin. Additionally, external factors and company-specific dynamics contribute to a more holistic understanding of a company’s financial health.

In conclusion, the free cash flow margin is a powerful metric that enables investors and analysts to gauge a company’s financial strength, profitability, and potential for growth. By incorporating this metric into their analysis, stakeholders can make more informed decisions and better understand a company’s ability to generate sustainable cash flows and create long-term value.