Finance

Uncovered Interest Arbitrage Definition

Published: February 12, 2024

Discover the meaning of Uncovered Interest Arbitrage in the world of finance and how it impacts investment strategies. Expand your financial knowledge today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Uncovered Interest Arbitrage Definition: Understanding the Financial Strategy

Welcome to the world of finance! Today, we will dive into the fascinating concept of Uncovered Interest Arbitrage and dissect its definition, importance, and implications. If you’ve ever wondered how investors take advantage of interest rate differentials across countries, you’ve come to the right place. So, let’s uncover the concept of Uncovered Interest Arbitrage and explore its significance in the financial world.

Key Takeaways:

- Uncovered Interest Arbitrage involves exploiting interest rate differences between countries to make profitable investments.

- Foreign exchange rates play a crucial role in determining the success of Uncovered Interest Arbitrage.

What is Uncovered Interest Arbitrage?

Uncovered Interest Arbitrage is a financial strategy where investors capitalize on the difference in interest rates among various countries. This strategy involves borrowing funds in a country with lower interest rates and investing them in a country with higher interest rates. The goal is to generate profits by taking advantage of the interest rate differentials.

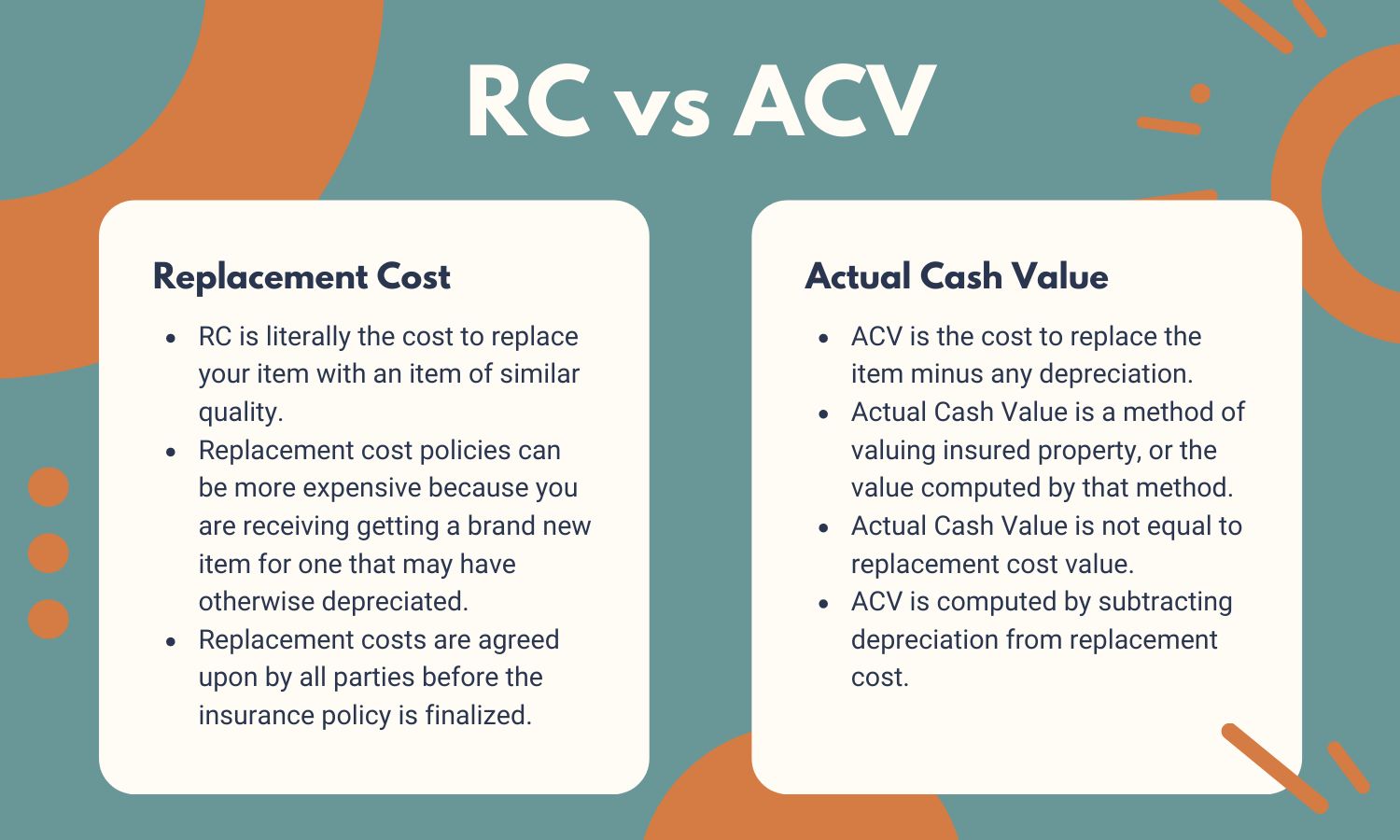

Unlike Covered Interest Arbitrage, which uses forward contracts to protect against exchange rate fluctuations, Uncovered Interest Arbitrage does not involve hedging currency risk. Instead, it relies on the assumption that exchange rates will remain stable over the investment period. Therefore, the interest rate differential alone is expected to generate profits.

How Does Uncovered Interest Arbitrage Work?

Let’s say Country A has a lower interest rate compared to Country B. An investor might borrow money in Country A and convert it into the currency of Country B. The investor would then invest this money in Country B, where they can earn a higher interest rate. At the end of the investment period, the investor converts the funds back into the currency of Country A, repays the borrowed amount, and retains the profits generated from the interest rate differential.

The success of Uncovered Interest Arbitrage relies on the stability of foreign exchange rates. If the exchange rates fluctuate unfavorably, the investor may lose or gain less than anticipated. Therefore, it is crucial for investors to assess exchange rate risks and make informed decisions while executing this strategy.

Why is Uncovered Interest Arbitrage Important?

Uncovered Interest Arbitrage is important because it allows investors to take advantage of interest rate differentials and potentially earn higher returns on their investments. This strategy benefits from the free flow of capital and can contribute to the efficiency of financial markets.

By engaging in Uncovered Interest Arbitrage, investors help to equalize interest rates between countries. This, in turn, can promote economic stability and reduce interest rate disparities across borders. Additionally, Uncovered Interest Arbitrage can exploit market inefficiencies, which can have a positive impact on overall market efficiency.

The Bottom Line

Uncovered Interest Arbitrage is a financial strategy that enables investors to leverage interest rate differentials between countries. By borrowing funds in a country with lower interest rates and investing them in a country with higher interest rates, investors have the potential to earn profits. However, this strategy is not without risks, as exchange rate fluctuations can impact the expected returns. Therefore, it is important for investors to thoroughly analyze exchange rate risks and make informed decisions when implementing Uncovered Interest Arbitrage.

We hope this article has shed light on the concept of Uncovered Interest Arbitrage and its significance in the world of finance. Remember, knowledge and understanding of financial concepts are powerful tools for making informed investment decisions. Stay tuned for more fascinating topics from our Finance category! If you have any questions or would like to learn about any other concept, feel free to reach out to us.