Finance

What Are Patronage Dividends

Published: January 3, 2024

Discover how patronage dividends are used in finance to reward customers and investors. Explore how these dividends can positively impact your financial returns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Patronage Dividends

- History of Patronage Dividends

- Purpose of Patronage Dividends

- Benefits of Patronage Dividends

- Disadvantages of Patronage Dividends

- Examples of Companies Offering Patronage Dividends

- Factors Affecting the Amount of Patronage Dividends

- How to Receive Patronage Dividends

- Conclusion

Introduction

When it comes to investing, earning a return on your investment is often the primary goal. This return typically comes in the form of interest, dividends, or capital gains. However, there is another unique way for investors, particularly those in certain types of cooperatives, to earn a share of the profits generated by the company they invest in. This is known as patronage dividends.

Patronage dividends are a form of profit-sharing that is commonly provided by cooperatives to their members. Unlike traditional dividends, which are typically distributed to shareholders of publicly-traded companies, patronage dividends are distributed to the members of the cooperative based on their participation or patronage of the cooperative’s products or services.

In this article, we will explore the concept of patronage dividends in more detail, including their definition, history, purpose, benefits, and disadvantages. We will also look at some examples of companies that offer patronage dividends, the factors that can affect the amount of patronage dividends, and how investors can receive them.

Understanding patronage dividends and their potential impact can be valuable for both individual investors and those considering investing in cooperative enterprises. So, let’s dig deeper into the world of patronage dividends and explore how they work in practice.

Definition of Patronage Dividends

Patronage dividends refer to the distribution of a portion of a cooperative’s profits to its eligible members based on their patronage or participation in the cooperative. Unlike traditional dividends, which are typically paid to shareholders of publicly-traded companies, patronage dividends are only paid to members of the cooperative.

Cooperatives are member-owned and member-controlled organizations that aim to provide goods or services to their members. These could be agricultural cooperatives, credit unions, consumer cooperatives, or worker-owned cooperatives. The purpose of a cooperative is not solely to maximize profits but to serve the needs and interests of its members.

Patronage dividends are a way for cooperatives to share the profits generated by their operations with their members. The amount of patronage dividends received by each member is generally determined by their level of participation or patronage in the cooperative. This can be based on the volume of business conducted with the cooperative, such as the amount of products purchased, services rendered, or work performed.

Patronage dividends are often calculated as a percentage of the member’s patronage-related activity. For example, if a member’s purchases with the cooperative accounted for 10% of the total purchases made by all members during a specific period, they would be eligible to receive 10% of the patronage dividends distributed by the cooperative.

It is important to note that patronage dividends are usually not paid in the form of cash. Instead, they are typically issued as equity shares, membership equity, or equity credits that represent the member’s share of the cooperative’s profits. These can be redeemed by the member at a future date or used to reduce the cost of future purchases from the cooperative.

Overall, patronage dividends are a unique feature of cooperatives that allow members to share in the financial success of the cooperative based on their level of participation or patronage. By doing so, cooperatives promote a sense of ownership and incentivize members to continue supporting and engaging with the cooperative’s activities.

History of Patronage Dividends

The concept of patronage dividends has a rich history dating back to the early cooperative movement of the 19th century. The primary objective of cooperatives during this time was to address the economic challenges faced by individuals and communities, particularly in agriculture and trade.

The Rochdale Society of Equitable Pioneers, established in England in 1844, is widely recognized as the birthplace of the modern cooperative movement. This pioneering group of weavers and other tradespeople aimed to improve their economic conditions by pooling resources and forming a cooperative grocery store. As part of their cooperative principles, they introduced the concept of distributing surplus profits to their members based on their purchases from the store.

The idea of sharing the profits with the members was seen as a way to incentivize loyalty and promote sustainable economic growth. The Rochdale Pioneers believed that by returning a portion of the profits to the members, they would be more inclined to continue supporting the cooperative, thus ensuring its long-term viability.

Over time, the practice of providing patronage dividends spread beyond the realm of consumer cooperatives. Agricultural cooperatives, credit unions, and other types of cooperatives began adopting the concept as a way to reward and involve their members.

In the United States, patronage dividends became popular among agricultural cooperatives during the early 20th century. As farmers faced increasing economic challenges and market fluctuations, they found strength and stability by joining together in cooperative associations. These associations, such as grain elevators, dairy cooperatives, and farm supply cooperatives, not only provided essential services but also shared the profits generated by their operations through patronage dividends.

Today, patronage dividends remain an integral part of the cooperative business model, with countless cooperatives across various industries continuing the tradition. They are seen as a way to align the interests of the cooperative and its members, as well as foster a sense of community and shared success.

It is worth noting that the specific regulations and tax treatment of patronage dividends may vary between countries and regions. In some jurisdictions, there are specific laws and requirements governing the distribution of patronage dividends to ensure fairness and accountability.

The rich history of patronage dividends reflects the principles and values of the cooperative movement, emphasizing democratic control, member participation, and sustainable economic development. As cooperatives continue to evolve and adapt to the changing needs of their members, patronage dividends remain a core element of their commitment to shared prosperity and community-building.

Purpose of Patronage Dividends

Patronage dividends serve several important purposes within cooperative organizations. Understanding these purposes can provide valuable insights into why cooperatives choose to distribute a portion of their profits to their members in the form of patronage dividends.

1. Rewarding Member Loyalty and Participation: One of the primary purposes of patronage dividends is to reward and incentivize member loyalty and active participation. By returning a portion of the profits to the members based on their patronage, cooperatives encourage members to continue doing business with the cooperative, thus fostering a sense of ownership and commitment.

2. Equalizing Income Distribution: Cooperatives often have a mission to promote economic equality and address income disparities. By distributing patronage dividends to members based on their level of participation, cooperatives can help bridge economic gaps and ensure that the benefits of the cooperative’s success are shared among the members.

3. Reinforcing Cooperative Values: Patronage dividends align with the core cooperative values of cooperation, self-help, and self-responsibility. By sharing profits with members, cooperatives demonstrate their commitment to putting people before profits and prioritize the economic well-being of their members over external shareholders.

4. Encouraging Member Engagement: Patronage dividends are a powerful tool for encouraging member engagement and active involvement in the cooperative’s activities. When members receive a direct financial benefit from their patronage, they are more likely to participate in decision-making processes, attend meetings, and contribute to the cooperative’s success.

5. Investing in the Local Community: Cooperatives are often deeply rooted in their local communities and committed to their social and economic development. By distributing patronage dividends to members, cooperatives ensure that the financial benefits generated by their operations circulate within the community, supporting local economies and contributing to the overall well-being of the region.

6. Financial Stability and Long-Term Viability: Patronage dividends can also contribute to the financial stability and long-term viability of cooperatives. By providing members with an additional source of income or a reduction in future costs, cooperatives can attract and retain members, build financial reserves, and invest in growth and innovation.

Overall, the purpose of patronage dividends is multi-faceted, encompassing member rewards, economic equality, cooperative values, member engagement, community development, and long-term sustainability. By fulfilling these purposes, patronage dividends play a crucial role in the success and impact of cooperatives around the world.

Benefits of Patronage Dividends

Patronage dividends offer several benefits to both cooperative members and the cooperative itself. These benefits contribute to the overall success, sustainability, and sense of community within the cooperative organization.

1. Financial Rewards: One of the immediate benefits of patronage dividends is the financial reward to members. By receiving a share of the cooperative’s profits based on their patronage, members can enjoy an additional income stream or a reduction in future costs, providing tangible financial benefits.

2. Incentive for Loyalty: Patronage dividends serve as an incentive for members to remain loyal to the cooperative. Knowing that they can earn a financial reward based on their participation encourages members to continue supporting and engaging with the cooperative’s activities, leading to a more stable customer base for the cooperative.

3. Shared Ownership and Participation: Patronage dividends reinforce the cooperative principle of shared ownership. By distributing profits directly to members, cooperatives promote a sense of ownership and involvement, fostering a stronger sense of community and collective decision-making.

4. Economic Equality: Through patronage dividends, cooperatives strive to address income disparities within their membership. By distributing profits based on patronage rather than the amount of shares held, cooperatives help level the playing field and promote economic equality among members.

5. Community Development: As cooperatives are often deeply connected to their local communities, patronage dividends contribute to community development. By circulating profits back into the community, cooperatives support local economies, create job opportunities, and invest in initiatives that benefit the community as a whole.

6. Financial Stability: Patronage dividends can enhance the financial stability of the cooperative. By attracting and retaining members through the promise of financial rewards, cooperatives can secure a stable customer base, strengthen their financial position, and reinvest in growth and innovation.

7. Cooperative Values: Distributing patronage dividends reflects the values of cooperation and mutual benefit that are at the core of cooperatives. Sharing profits with members demonstrates a commitment to putting people before profits and prioritizing member well-being over external shareholders.

8. Increased Engagement and Participation: Patronage dividends encourage members to actively engage in the cooperative’s activities, processes, and decision-making. Members who receive financial rewards are more likely to attend meetings, participate in discussion, and contribute their ideas and expertise, leading to a more vibrant and successful cooperative community.

Overall, the benefits of patronage dividends extend beyond the financial rewards, fostering a sense of ownership, participation, equality, and community. By aligning the interests of the cooperative and its members, patronage dividends contribute to the overall success and impact of the cooperative organization.

Disadvantages of Patronage Dividends

While patronage dividends offer various benefits to cooperative members, there are also potential disadvantages that should be considered. It’s important to have a balanced understanding of the potential drawbacks in order to make informed decisions regarding the distribution of patronage dividends.

1. Variability of Dividend Amounts: The amount of patronage dividends that each member receives can vary from year to year and may be influenced by factors such as the cooperative’s financial performance, member patronage levels, and overall profitability. This variability can make it difficult for members to rely on patronage dividends as a consistent source of income.

2. Lack of Immediate Liquidity: Patronage dividends are typically issued as equity shares or credits, rather than cash. While this promotes member ownership and ongoing support for the cooperative, it means that members may have limited access to immediate liquidity. They cannot easily convert the patronage dividends into cash unless the cooperative provides a redemption mechanism or there is a secondary market for the equity shares.

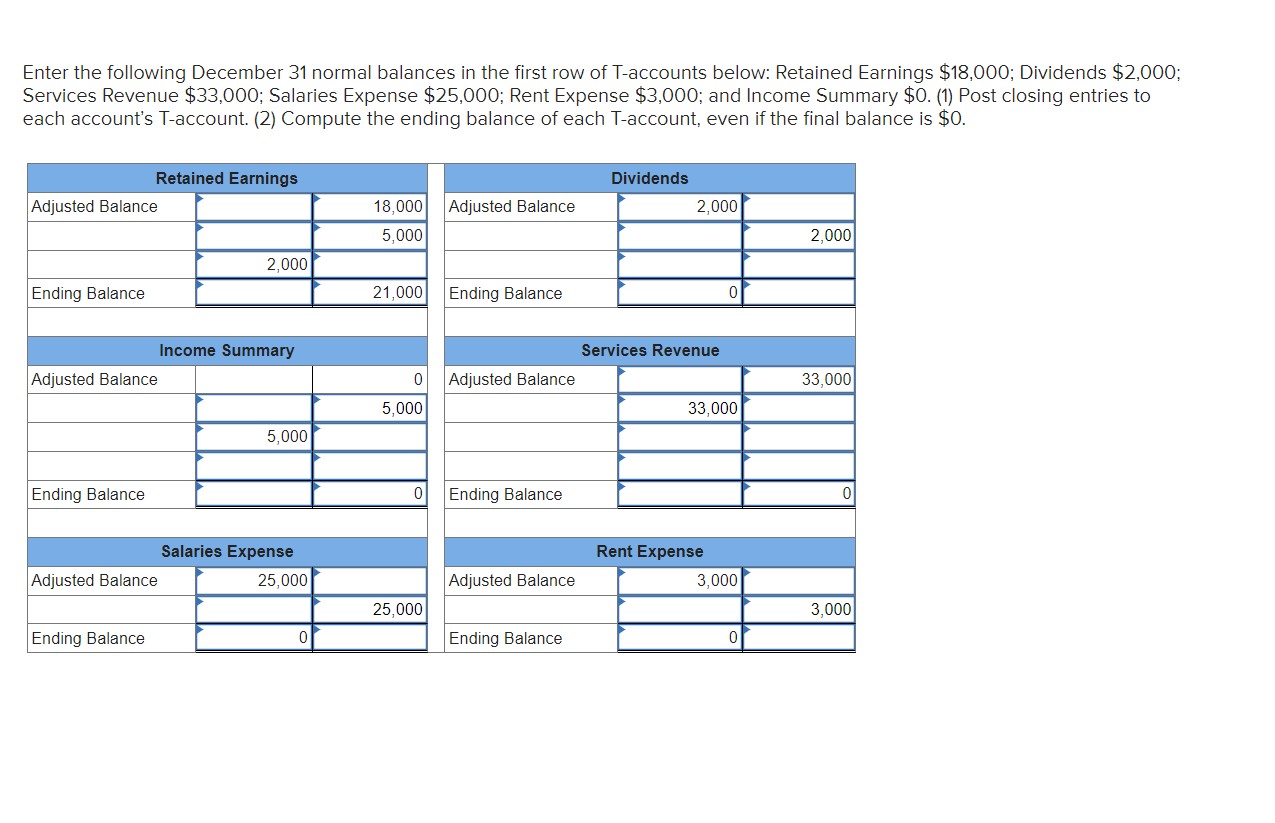

3. Tax Considerations: The taxation of patronage dividends can vary based on local laws and regulations. In some jurisdictions, patronage dividends may be treated as taxable income, requiring members to include them in their annual tax filings. This adds a layer of complexity and potential tax implications for members, which they need to account for in their financial planning.

4. Potential for Inequality: While patronage dividends aim to promote economic equality among cooperative members, there is still the possibility of inequality. Members who have a higher level of patronage or greater purchasing power with the cooperative may receive a larger share of the dividends. This could create disparities among members, which may conflict with the principle of cooperative equality.

5. Impact on Cooperative Finances: Distributing a portion of the cooperative’s profits as patronage dividends reduces the amount of retained earnings that can be reinvested in the cooperative’s operations, growth, or reserves. This can have an impact on the cooperative’s financial stability and ability to fund future projects or respond to economic challenges.

6. Potential for Financial Dependency: In some cases, members may become overly reliant on patronage dividends as a source of income. This can create a sense of dependency on the cooperative’s financial performance, which may not always be consistent or guaranteed. It’s important for members to consider diversifying their sources of income to mitigate the potential risk of relying solely on patronage dividends.

7. Administrative Complexity: Calculating and distributing patronage dividends requires administrative efforts and record-keeping within the cooperative. This can be a time-consuming process for the cooperative to execute, especially for larger cooperatives with a high number of members and complex patronage calculations. The administrative overhead can impact the efficiency and resources of the cooperative.

While these disadvantages should be taken into account, they should not overshadow the many benefits that patronage dividends can offer to cooperative members. Cooperatives and their members must carefully consider the trade-offs and potential drawbacks in light of their specific circumstances and goals.

Examples of Companies Offering Patronage Dividends

Many cooperatives around the world have embraced the concept of patronage dividends and offer them to their eligible members. Let’s take a look at a few examples of companies from different industries that provide patronage dividends:

1. Land O’Lakes: Land O’Lakes is a well-known agricultural cooperative based in the United States. As a farmer-owned cooperative, Land O’Lakes distributes patronage dividends to its members based on their purchases of agricultural inputs, such as feed, seed, and fertilizer. The cooperative aims to reward member loyalty, support farmers’ financial success, and ensure the stability of the agricultural community.

2. REI (Recreational Equipment Inc.): REI is a consumer cooperative that specializes in outdoor recreational gear and apparel. As a cooperative, it shares its profits with members through patronage dividends. REI’s patronage program, known as the “Member Dividend,” is based on members’ qualifying purchases throughout the year. Members receive a portion of their annual purchases back in the form of a dividend, which can be used towards future purchases at REI.

3. Navy Federal Credit Union: Navy Federal Credit Union is the largest credit union in the United States, serving members of the military and their families. As a member-owned financial institution, Navy Federal Credit Union offers patronage dividends to its eligible members in the form of bonus dividends. These dividends are distributed based on members’ participation in the credit union’s services, including savings, loans, and credit card usage.

4. The Co-operative Group (UK): The Co-operative Group is a British consumer cooperative that operates across various sectors, including food, funeral care, insurance, and banking. The group distributes patronage dividends to its members based on their purchases from its retail stores, with members receiving points on qualifying purchases which can be converted into vouchers to be spent in Co-operative stores.

5. Organic Valley: Organic Valley is an agricultural cooperative focused on organic farming and sustainable agriculture. The cooperative distributes patronage dividends to its farmer-members based on their production and the cooperative’s financial performance. The goal is to support organic farmers financially, promote rural vitality, and incentivize sustainable agricultural practices.

These examples illustrate the diversity of industries and types of cooperatives that offer patronage dividends to their members. From agriculture to retail, financial services to outdoor gear, cooperative organizations recognize the importance of sharing their profits with the individuals who support their business

Factors Affecting the Amount of Patronage Dividends

The amount of patronage dividends that cooperative members receive can vary based on several factors. Understanding these factors can provide insight into how the distribution of patronage dividends is determined within a cooperative. Here are some key factors that can influence the amount of patronage dividends:

1. Level of Participation or Patronage: The primary factor that determines the amount of patronage dividends is the level of participation or patronage by individual members within the cooperative. This can include factors such as the volume of purchases made by the member, the amount of business conducted with the cooperative, or the extent of services utilized. The more active and engaged a member is, the higher their patronage and the greater share of the dividends they are likely to receive.

2. Cooperative’s Financial Performance: The financial performance of the cooperative can play a significant role in determining the size of patronage dividends. If the cooperative generates higher profits, there is a greater potential for distributing larger dividends to its members. Conversely, if the cooperative faces financial challenges or lower profitability, the amount of patronage dividends may be reduced or even eliminated.

3. Cooperative’s Profit Allocation Policy: Each cooperative can have its own profit allocation policy that dictates how patronage dividends are calculated and distributed. The policy may consider factors such as the ratio of patronage-related revenue to total revenue, the allocation percentage set by the board of directors, or other criteria defined by the cooperative’s bylaws. The specific policy determines the formula or method used to calculate each member’s share of the patronage dividends.

4. Regulatory and Legal Requirements: Depending on the jurisdiction and the legal framework surrounding cooperatives, there may be specific regulations or legal requirements that influence the distribution of patronage dividends. These can include guidelines on the proportion of profits that must be allocated to patronage dividends, restrictions on the types of businesses eligible for patronage dividends, or limitations on the treatment of patronage dividends for tax purposes. Cooperatives must comply with these requirements while determining the amount and distribution of their patronage dividends.

5. Cooperative’s Reserves and Retained Earnings: The financial health and stability of the cooperative, as reflected in its reserves and retained earnings, can impact the amount of patronage dividends. Cooperatives may choose to retain a portion of their profits to reinvest in the business, build financial reserves, or ensure long-term sustainability. The portion of profits allocated to patronage dividends will depend on the cooperative’s financial goals and risk management strategies.

6. Board of Directors’ Decisions: Ultimately, the board of directors of the cooperative plays a critical role in determining the amount of patronage dividends. They are responsible for setting the dividend policy, considering the cooperative’s financial performance and member interests, and making decisions on the allocation and distribution of patronage dividends. The board ensures that the distribution is fair, transparent, and aligned with the cooperative’s mission and goals.

Cooperatives must take into account these factors and strike a balance between rewarding member participation and ensuring the long-term financial stability and viability of the cooperative. By doing so, they can distribute patronage dividends that appropriately reflect the cooperative’s financial performance and engage members in its ongoing success.

How to Receive Patronage Dividends

Receiving patronage dividends as a member of a cooperative involves several steps. The exact process may vary depending on the cooperative’s specific policies and procedures. Here is a general outline of how members can receive patronage dividends:

1. Membership in a Cooperative: To be eligible to receive patronage dividends, individuals must become members of a cooperative. The process of becoming a member typically involves meeting certain criteria, such as paying an initial membership fee, agreeing to abide by the cooperative’s rules and regulations, and potentially meeting additional requirements specific to the cooperative’s industry or purpose.

2. Active Participation with the Cooperative: Active participation with the cooperative is key to earning patronage dividends. Members must engage with the cooperative by making purchases, utilizing services, or otherwise participating in the cooperative’s activities. The extent of participation and the specific criteria used to determine the level of patronage may vary depending on the cooperative.

3. Calculation of Patronage Dividends: The cooperative calculates the patronage dividends based on the member’s level of participation or patronage. This calculation takes into account factors such as the volume of purchases, services utilized, work performed, or other applicable criteria defined by the cooperative’s policies. The specific formula or method used for calculating patronage dividends is usually determined by the cooperative’s board of directors and stated in their bylaws.

4. Distribution of Patronage Dividends: Once the patronage dividends are calculated, the cooperative distributes them to its eligible members. This can be done in various ways, such as issuing equity shares, membership equity, or equity credits. The form of the patronage dividend may depend on the cooperative’s policies and the regulatory requirements in the jurisdiction where the cooperative operates.

5. Redemption or Use of Patronage Dividends: Members typically have options for redeeming or using their patronage dividends, as determined by the cooperative. This could involve redeeming equity shares for cash, using membership equity credits as a discount on future purchases from the cooperative, or reinvesting equity shares back into the cooperative. The specific options and procedures for redemption or use of patronage dividends are communicated to members by the cooperative.

6. Communication and Reporting: The cooperative should maintain clear and transparent communication with its members regarding the calculation, distribution, and redemption/use of patronage dividends. Members should receive periodic updates on the cooperative’s financial performance, the amount of patronage dividends received, and any changes to the policies or procedures related to the patronage dividend program.

7. Compliance with Tax Requirements: Members should also be aware of any applicable tax obligations related to patronage dividends. Depending on the tax regulations in the jurisdiction, members may need to include their patronage dividends as taxable income in their annual tax filings. Cooperatives should provide the necessary documentation and guidance to members to ensure compliance with tax requirements.

It’s important for members to review the cooperative’s bylaws, participate actively, and stay informed about the patronage dividend program to ensure they receive their rightful share of the cooperative’s profits. If members have any questions or need assistance, they should reach out to the cooperative’s management or designated representative for clarification.

Conclusion

Patronage dividends are a unique feature of cooperatives that allow members to share in the profits generated by the cooperative based on their level of participation or patronage. Throughout this article, we have explored the definition, history, purpose, benefits, and disadvantages of patronage dividends.

Cooperatives around the world, spanning various industries and sectors, have embraced the concept of patronage dividends as a means to reward member loyalty, promote economic equality, and foster a sense of shared ownership. Companies like Land O’Lakes, REI, Navy Federal Credit Union, The Co-operative Group, and Organic Valley are examples of organizations that provide patronage dividends to their eligible members.

While patronage dividends offer financial rewards and incentives for members, there are also potential disadvantages to consider. These include variability in dividends, lack of immediate liquidity, tax considerations, potential for inequality, impact on cooperative finances, potential financial dependency, and administrative complexity.

Factors influencing the amount of patronage dividends include the level of member participation, financial performance, profit allocation policy, regulatory requirements, cooperative reserves, and decisions made by the board of directors. Members must actively participate in the cooperative, understand the calculation and distribution processes, and comply with tax obligations to receive their patronage dividends.

In conclusion, patronage dividends play a crucial role in promoting member engagement, economic equality, and shared community success within cooperatives. By rewarding members for their patronage, cooperatives reinforce their principles of cooperation, mutual benefit, and sustainable development.

As you consider investing in a cooperative or becoming a member of an existing cooperative, understanding the world of patronage dividends can provide valuable insights into the potential financial benefits, responsibilities, and opportunities for community engagement. Embracing the cooperative model and participating actively in the cooperative’s activities can not only bring financial rewards but also contribute to a more equitable and sustainable economic system.