Home>Finance>What Are The Advantages Of Having A Checking Account

Finance

What Are The Advantages Of Having A Checking Account

Published: October 28, 2023

Discover the benefits of having a checking account for your finances. Enjoy convenient transactions, easy bill payments, and secure financial management. Open a checking account today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Having a checking account is an essential tool for managing personal finances. It offers a range of benefits that can significantly simplify daily financial transactions and provide peace of mind. Whether you’re receiving your salary, paying bills, or making everyday purchases, a checking account can streamline these processes and help you stay on top of your financial responsibilities.

In this article, we will explore the advantages of having a checking account and how it can positively impact your financial well-being. From the convenience of easy access to funds to the security of online and mobile banking, a checking account offers a myriad of benefits that make it an indispensable financial tool.

With the rise of technology and the increasing digitization of financial transactions, having a checking account has become more important than ever. It enables you to seamlessly navigate the digital landscape, allowing you to make online purchases, set up direct deposits, and manage your finances with ease.

Moreover, by having a checking account, you can take advantage of various financial services that can help build your credit history, improve your financial management skills, and simplify your bill payment processes.

So, whether you’re considering opening a checking account or already have one but want to understand its benefits better, let’s delve into the advantages of having a checking account and how it can empower you to take control of your financial life.

Convenience

One of the primary advantages of having a checking account is the convenience it offers in managing your day-to-day financial transactions. With a checking account, you have a dedicated account for your regular expenses, making it easier to track your spending and maintain a clear financial record.

By having a checking account, you no longer need to carry around large amounts of cash or worry about finding an ATM when you need to make a purchase. Simply swipe your debit card or write a check, and the funds will be transferred from your account to the merchant. This convenience is particularly useful for online shopping, where you can securely make purchases without the need for physical currency.

Additionally, many checking accounts offer features like overdraft protection, which can save you from the hassle and embarrassment of declined transactions. With overdraft protection, if you accidentally exceed the available funds in your account, the bank will cover the transaction, preventing any disruption in your financial activities.

Moreover, most checking accounts provide access to a wide network of ATMs, allowing you to withdraw cash whenever you need it. This convenience is especially beneficial when traveling or in situations where cash is necessary, such as in certain retail establishments or for small transactions.

Furthermore, many banks now offer mobile banking apps that allow you to manage your checking account on-the-go. These apps enable you to check your account balance, transfer funds, pay bills, and even deposit checks using your smartphone’s camera. The convenience of mobile banking eliminates the need to visit a physical bank branch and provides you with immediate access to your finances.

In summary, the convenience of a checking account lies in its ability to simplify your financial transactions. From using a debit card or writing a check to accessing cash through ATMs and managing your account through mobile banking apps, a checking account offers unparalleled convenience in handling your day-to-day finances.

Easy Access to Funds

Having a checking account provides you with easy access to your funds whenever you need them. Unlike a savings account, which often has limitations on the number of withdrawals you can make, a checking account allows for frequent transactions and immediate access to your money.

With a checking account, you can withdraw cash from an ATM, write a check, or use your debit card to make purchases. These options offer flexibility and convenience, ensuring that your funds are readily available for your everyday needs.

Furthermore, most banks provide online and mobile banking platforms that allow you to transfer money between accounts instantly. This means you can easily move funds from your checking account to other accounts, such as savings or investment accounts, to maximize your financial planning and goals.

A checking account also provides you with the ability to make electronic payments and digital transfers. Whether you need to send money to a friend or family member, pay your utility bills, or make online purchases, having a checking account simplifies these transactions and eliminates the need for cumbersome cash or paper-based methods.

Additionally, some checking accounts offer the option of overdraft protection, which allows you to access extra funds in case of emergencies or unexpected expenses. This feature provides a safety net to cover short-term financial gaps, ensuring that you have access to funds even if your account balance is low.

In summary, a checking account offers easy access to your funds, whether you need cash, want to make a purchase, or need to transfer money digitally. Its flexibility and convenience make managing your finances and accessing your money a seamless and efficient process.

Safety and Security

One of the key advantages of having a checking account is the safety and security it provides for your funds. Keeping large amounts of cash at home can be risky, as it is susceptible to theft or loss. By depositing your funds into a checking account, you ensure that your money is protected and backed by the security measures implemented by your bank.

When you open a checking account, your funds are typically insured by the Federal Deposit Insurance Corporation (FDIC) in the United States, or by other similar government agencies in other countries. This means that even if your bank were to fail, your deposits would be protected up to a certain amount, providing you with peace of mind regarding the safety of your money.

Furthermore, with a checking account, you can monitor your transactions and account activity regularly. Banks provide account statements that detail your deposits, withdrawals, and payments, which you can review to ensure that there are no unauthorized transactions. In case of any discrepancies or fraudulent activity, you can quickly report it to your bank for investigation and resolution.

Credit and debit cards associated with checking accounts often come with additional security features, such as magnetic stripe or chip technology, which help protect against fraudulent use. Many banks also offer real-time transaction alerts, notifying you via email or text message each time your card is used. These alerts enable you to identify and report any unauthorized transactions promptly.

In addition, online and mobile banking platforms provided by most banks employ robust security measures, including encryption and multi-factor authentication, to protect your account and personal information. These measures ensure that your financial data is secure and inaccessible to unauthorized individuals.

Overall, a checking account offers a secure and protected environment for managing your funds. From the FDIC insurance coverage to the monitoring of transactions, the safety and security of your money is a vital benefit of having a checking account.

Online and Mobile Banking

The advent of technology has revolutionized the way we manage our finances, and one of the significant advantages of having a checking account is the access to online and mobile banking services. These platforms offer a range of features that enhance convenience, accessibility, and efficiency in handling your finances.

With online banking, you can access your checking account through your bank’s website, allowing you to view your account balance, transaction history, and even download statements. Online banking provides you with a comprehensive overview of your financial activity, giving you better control and visibility over your funds.

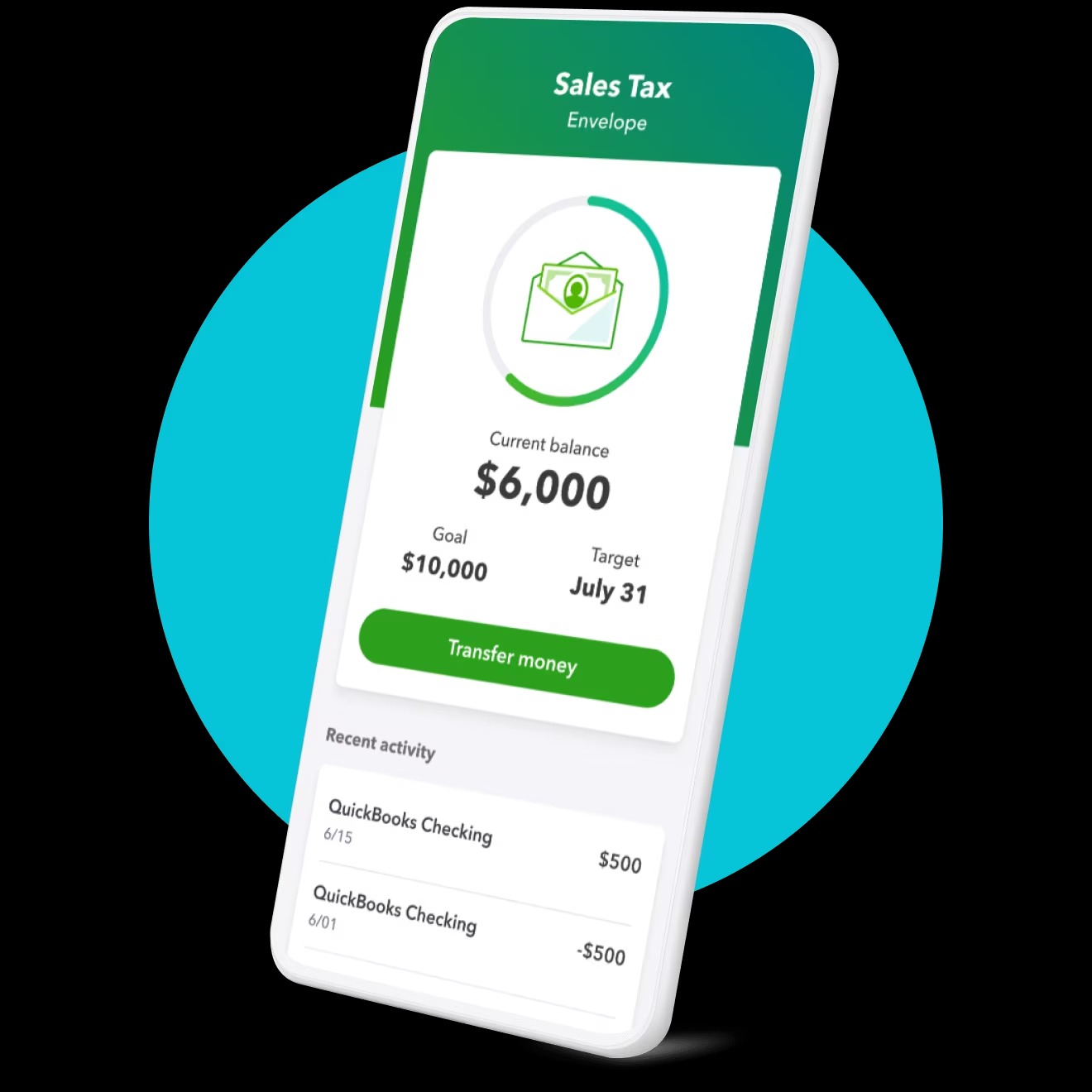

Mobile banking takes convenience a step further by providing access to your checking account through a dedicated mobile app on your smartphone or tablet. These apps offer a user-friendly interface and allow you to perform various financial tasks on the go, such as transferring funds, paying bills, and even depositing checks using your device’s camera.

Online and mobile banking not only provide convenience but also enhance security. With features like two-factor authentication and biometric login options, such as fingerprint or facial recognition, the risk of unauthorized access to your account is significantly reduced. You can also set up real-time alerts for specific transactions or balance thresholds, keeping you informed about any account activity in real-time.

Another significant advantage of online and mobile banking is the ability to conduct banking transactions 24/7. Whether it’s transferring money to another account, making bill payments, or setting up automatic recurring payments, you have the flexibility to manage your finances at any time, from anywhere, as long as you have an internet connection.

Furthermore, online and mobile banking offer features like budgeting tools and spending analysis, giving you insights into your spending habits and helping you make informed financial decisions. These tools can track your expenses, categorize them, and provide personalized recommendations to help you achieve your financial goals.

In summary, online and mobile banking services provided with a checking account offer unparalleled convenience, accessibility, and security. They empower you to have complete control over your finances, simplify day-to-day transactions, and make informed financial decisions with ease.

Bill Payment Options

One of the significant advantages of having a checking account is the convenience of various bill payment options. Whether it’s paying monthly bills or managing recurring expenses, a checking account offers a range of methods that simplify the process and ensure timely payments.

The most common bill payment option associated with a checking account is writing checks. With a checking account, you can easily write a check to pay your rent, utility bills, credit card payments, or any other bills that require a physical payment method. Writing a check provides a paper trail and allows for record-keeping, making it a reliable and traditional means of bill payment.

However, the popularity of electronic payments has grown significantly, and most banks now offer online bill payment services. With online bill payment, you can set up one-time or recurring payments directly from your checking account to pay your bills electronically. This eliminates the need for writing and mailing checks, saving you time, effort, and postage costs.

Many banks also offer the option of automatic bill payment, where you authorize the creditor to automatically deduct the amount due from your checking account each month. Automatic bill payment ensures that your bills are paid on time, even if you forget or are unable to make a manual payment. It provides convenience and peace of mind, knowing that your bills are taken care of without any additional effort.

Furthermore, with the advent of online and mobile banking, you can now schedule bill payments and manage your payees from the convenience of your device. These platforms allow you to set up reminders for upcoming bill due dates, track your payment history, and receive alerts for bill payment confirmations, ensuring that you stay organized and never miss a payment.

In addition to traditional bill payment methods, some banks offer person-to-person payment options through their online or mobile banking platforms. With these features, you can easily send money to friends or family members to cover shared expenses or repay debts, all directly from your checking account.

Overall, having a checking account provides you with a range of convenient bill payment options, including writing checks, online bill payment, automatic bill payment, and person-to-person payments. These options streamline the bill-paying process, save you time and effort, and ensure that your payments are made accurately and on time.

Building Credit

Having a checking account can contribute to building your credit history, which is essential for establishing a strong financial foundation. While a checking account itself does not directly impact your credit score, it plays a crucial role in demonstrating responsible financial management to potential lenders.

When you open a checking account, you establish a banking relationship and start building a history of responsible account management. This positive relationship can be beneficial when you apply for credit cards, loans, or other forms of credit in the future.

Additionally, having a checking account allows you to set up automatic bill payments and maintain a consistent payment history. Timely payments on bills and utilities, facilitated through your checking account, demonstrate financial responsibility and can positively impact your credit score.

Furthermore, some banks offer the option of overdraft protection, which allows you to access additional funds when your account balance is low. While it is important to use this service responsibly, having overdraft protection and managing it effectively can demonstrate your ability to handle credit responsibly, which can be favorable when applying for loans or other forms of credit.

Moreover, having a checking account may be a prerequisite for certain types of credit, such as secured credit cards. A secured credit card is a credit card that requires a cash deposit as collateral, usually equal to your credit limit. Using a secured credit card responsibly and paying off your monthly balance in full can help you build a positive credit history, and having a checking account is often a requirement to open such a card.

Finally, when it comes to establishing credit, having a checking account can also indicate stability and financial reliability to potential lenders. It shows that you have a stable financial base, as well as the necessary documentation and identification to open and maintain a bank account, which can be viewed favorably by creditors.

While a checking account itself may not directly impact your credit score, it can indirectly contribute to building a robust credit history. By demonstrating responsible account management, setting up automatic bill payments, and fulfilling financial obligations, having a checking account can play a significant role in your journey towards building credit.

Financial Management

Having a checking account promotes effective financial management by providing you with tools and resources to track and control your finances. From budgeting to record-keeping, a checking account can empower you to make informed financial decisions and take charge of your money.

One of the key features of a checking account is the ability to monitor your transactions and account balance. Banks provide regular statements that detail your deposits, withdrawals, and other transactions, allowing you to track your spending and identify areas where you can make adjustments to meet your financial goals.

In addition, many banks offer online and mobile banking platforms that provide real-time access to your checking account. These platforms often include budgeting tools that categorize your expenses and provide insights into your spending habits. By analyzing your expenses, you can identify areas where you may be overspending and make necessary adjustments to stay within your budget.

Furthermore, a checking account simplifies the process of tracking and managing recurring expenses. With features like automatic bill payment and transaction alerts, you can ensure that your bills are paid on time and avoid late fees or penalties. This level of financial control not only saves you time and effort but also helps you maintain a good payment history.

Having a checking account also allows you to build financial discipline and save for the future. You can set up automatic transfers from your checking account to a savings account, allocating a portion of your income towards savings each month. This systematic approach to saving can help you achieve your financial goals, whether it’s building an emergency fund or saving for a major purchase.

In addition, a checking account provides a platform for financial record-keeping. With checks and digital transactions, you have a clear paper trail of your financial activity. This record-keeping can be useful for tax purposes, budgeting, and financial planning. It allows you to review past transactions and identify any discrepancies or fraudulent activity.

Overall, a checking account serves as a valuable tool for financial management. By providing tools for budgeting, record-keeping, and automated payments, it enables you to stay organized, make informed financial decisions, and take control of your financial future.

Direct Deposit

Direct deposit is a convenient and efficient feature offered by many checking accounts that allows you to receive your income directly into your account. Instead of receiving a physical paycheck, your employer can deposit your salary or wages electronically into your checking account, eliminating the need for paper checks or manual depositing.

There are several advantages to using direct deposit. First and foremost, it provides unparalleled convenience. With direct deposit, you no longer have to worry about visiting the bank to deposit your paycheck or waiting in line on payday. Your funds are automatically deposited into your account on the designated payday, ensuring prompt access to your money.

Direct deposit also eliminates the risk and inconvenience of lost or stolen checks. With paper checks, there is always a chance of misplacing them or having them stolen, leading to potential delays or even fraudulent use of your funds. Direct deposit minimizes these risks by securely transferring your income directly into your account, reducing the chance of mishaps or unauthorized access.

Additionally, direct deposit allows for faster access to your funds. Unlike paper checks, which may require a waiting period for clearance, direct deposit ensures immediate availability of your funds on the designated payday. This immediate access is particularly beneficial in situations where you depend on your income to cover immediate expenses or financial obligations.

Another advantage of direct deposit is that it can streamline your financial management. With your income automatically deposited into your checking account, you can set up automated bill payments, savings transfers, and other financial arrangements, saving you time and effort in managing your funds. It also provides a clear and easily accessible record of your income, making it easier to track your earnings and expenses.

Direct deposit is not limited to just income from employers. It can also be used to receive other types of payments, such as government benefits, tax refunds, or pension payments. These deposits can be scheduled to align with specific dates, ensuring convenient and timely receipt of funds.

In summary, direct deposit offers a range of benefits, including convenience, security, faster access to funds, and streamlined financial management. By opting for direct deposit, you simplify the process of receiving income, gain immediate access to your funds, and reduce the risk of loss or theft associated with paper checks.

Record Keeping

A checking account provides a reliable and efficient way to keep track of your financial transactions and maintain organized records of your financial activity. Record keeping is essential for various reasons, including budgeting, tax preparation, and financial planning.

With a checking account, each transaction you make, such as deposits, withdrawals, and payments, is recorded and documented. This record of transactions serves as a valuable tool for tracking your spending, analyzing your expenses, and making informed financial decisions.

At regular intervals, usually monthly or quarterly, your bank provides a statement that summarizes your checking account activity. This statement includes details of deposits, withdrawals, checks written, electronic transfers, and any fees or charges associated with your account. These statements offer a comprehensive overview of your financial transactions, making it easier to reconcile your records and identify any discrepancies.

Record keeping becomes particularly crucial during tax season. Having a clear record of your financial activity in your checking account makes it easier to calculate your income, track deductible expenses, and prepare accurate tax returns. You can refer to your bank statements, canceled checks, and transaction history to ensure that you have all the necessary information to complete your taxes correctly.

Furthermore, consistent and accurate record keeping helps you in financial planning. By reviewing your checking account records, you can identify patterns in your spending habits, understand your cash flow, and make informed decisions about budgeting or setting financial goals. This information can guide you in managing your finances effectively, making necessary adjustments, and working towards your long-term financial objectives.

In addition to the records provided by your bank, having a checking account also allows you to maintain your personal financial records. You can keep track of additional information, such as receipts, invoices, and other documents related to your financial transactions. Storing these documents alongside your checking account records ensures that you have a comprehensive and organized financial recordkeeping system.

Overall, a checking account plays a crucial role in record keeping and maintaining organized financial records. Consistently tracking your transactions, reconciling your statements, and storing relevant documents contribute to better financial management, accurate tax preparation, and informed decision making.