Home>Finance>What Are The Disadvantages Of Hedging With Currency Futures

Finance

What Are The Disadvantages Of Hedging With Currency Futures

Published: January 15, 2024

Explore the potential drawbacks of hedging with currency futures in the field of finance. Better understand the risks associated with this popular financial strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing foreign exchange risk, currency hedging is a commonly utilized strategy. Hedging involves taking positions in the financial markets to offset potential losses from adverse currency movements. It is particularly relevant for businesses involved in international trade, as fluctuations in currency values can significantly impact their profitability.

In the realm of currency hedging, one popular avenue is hedging with currency futures. Currency futures are derivative contracts that allow traders to buy or sell a particular currency at a predetermined price and future date. While currency futures offer several advantages in mitigating currency risk, it is crucial to acknowledge and understand the potential disadvantages that may arise from using this hedging method.

In this article, we will explore the disadvantages of hedging with currency futures, providing insights into the challenges businesses may face when adopting this strategy. By being aware of these drawbacks, businesses can make informed decisions regarding their hedging strategies and consider alternative approaches if necessary.

Definition of Currency Hedging

Currency hedging refers to the practice of taking measures to protect against potential losses that may arise from fluctuations in foreign exchange rates. It involves the use of financial instruments, such as currency futures, options, forwards, or swaps, to offset the impact of adverse currency movements on financial positions or transactions.

When businesses engage in international trade, they are exposed to currency risk. This risk arises due to the fluctuating values of different currencies in relation to each other. For example, if a company imports goods from another country and the value of the importing country’s currency depreciates against the exporting country’s currency, the importer will need to pay a higher amount in their local currency to purchase the goods.

To mitigate this risk, businesses can adopt currency hedging strategies. Currency futures, in particular, are widely used instruments for hedging purposes. A currency futures contract is an agreement to buy or sell a specific currency at a predetermined price and future date. By entering into such contracts, businesses can lock in a specified exchange rate and protect themselves against potential losses resulting from adverse currency movements.

Hedging allows businesses to have more certainty in their financial planning and budgeting, as they can better anticipate their future cash flows and expenses. It provides a level of protection against unpredictable currency fluctuations and helps to stabilize financial performance, especially for multinational corporations with significant exposure to multiple currencies.

Despite the advantages offered by currency hedging, it is essential to be aware of the potential disadvantages that may arise when using currency futures as a hedging tool. These drawbacks include counterparty risk, lack of flexibility, potential losses, complexity, expertise required, and costs and margins. Understanding these disadvantages will help businesses make informed decisions about their hedging strategies and assess alternative options that align with their risk appetite and financial goals.

Advantages of Hedging with Currency Futures

When it comes to managing foreign exchange risk, hedging with currency futures offers several advantages. These advantages make it a popular choice among businesses looking to protect themselves against adverse currency movements while engaging in international trade. Here are some key advantages of hedging with currency futures:

- Price Certainty: Hedging with currency futures allows businesses to lock in a specific exchange rate for a future date. This provides price certainty and protects businesses from potential losses resulting from unfavorable currency movements. It allows them to plan and budget effectively, reducing uncertainty in their cash flows and financial performance.

- Liquidity: Currency futures have a high level of liquidity, as they are traded on major financial exchanges. This means that businesses can easily enter into and exit positions, providing flexibility and efficiency in managing their hedging strategies.

- Transparency: Currency futures markets are highly regulated and transparent. This transparency ensures fair pricing and allows businesses to access real-time market information, enabling them to make informed hedging decisions.

- Standardized Contracts: Currency futures contracts are standardized, with fixed contract sizes and expiry dates. This standardization simplifies the hedging process and makes it easier for businesses to execute their hedging strategies.

- Margin Requirements: When hedging with currency futures, businesses are only required to deposit a small percentage of the contract value as margin. This allows them to control a larger amount of currency exposure with a smaller upfront investment.

- Market Access: Currency futures provide businesses with access to a wide range of currencies. This allows them to hedge against various currency pairs, reducing their overall currency risk and providing flexibility in managing their global operations.

By taking advantage of these benefits, businesses can effectively manage their foreign exchange risk and protect themselves against potential losses. Hedging with currency futures provides a structured and transparent approach to currency risk management, allowing businesses to focus on their core operations and financial objectives.

Disadvantages of Hedging with Currency Futures

While hedging with currency futures provides several benefits in managing foreign exchange risk, it is important to consider the potential disadvantages that come with this hedging strategy. These drawbacks may impact businesses in different ways, and understanding them is crucial for making informed hedging decisions. Here are some disadvantages of hedging with currency futures:

- Counterparty Risk: Hedging with currency futures involves entering into a contract with a counterparty, typically a futures exchange or a financial institution. There is always a risk of the counterparty defaulting on their obligations, which may lead to financial losses for the hedger.

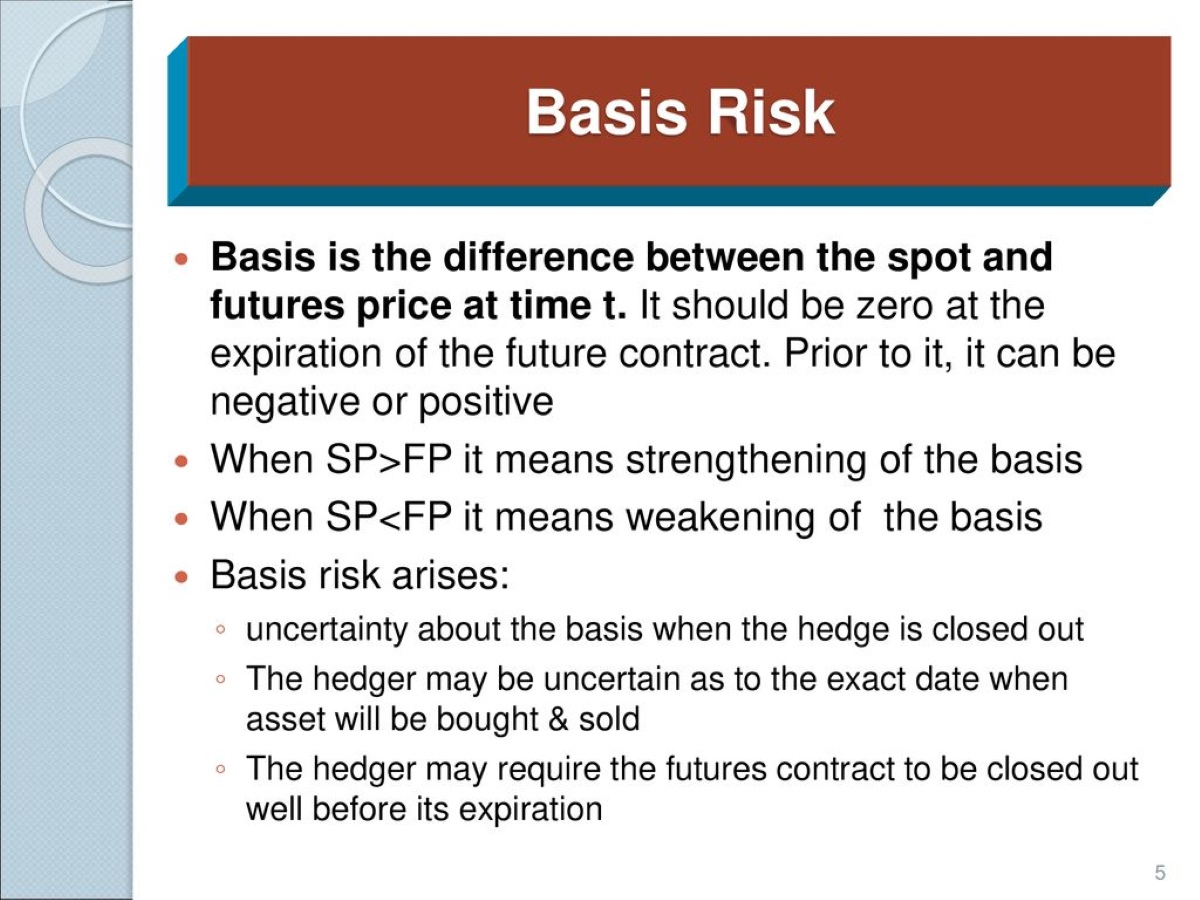

- Lack of Flexibility: Currency futures contracts have fixed expiration dates and contract sizes. This lack of flexibility may limit the hedger’s ability to adjust their positions as market conditions change, potentially exposing them to additional risks.

- Potential Losses: While hedging aims to mitigate losses, it does not eliminate the possibility of losses entirely. If the currency moves in a favorable direction for the hedger, they may miss out on potential gains. Additionally, if the hedging strategy is not well-executed or if market conditions are unfavorable, there is a risk of incurring losses.

- Complexity and Expertise Required: Hedging with currency futures requires a certain level of knowledge and expertise in understanding market dynamics, analyzing currency trends, and executing trades effectively. Businesses without the necessary expertise may face challenges in implementing successful hedging strategies.

- Costs and Margins: Hedging with currency futures involves transaction costs, including brokerage fees and exchange fees. Additionally, businesses are required to maintain margins to cover potential losses. These costs and margin requirements can impact the overall profitability of the hedging strategy.

It is important for businesses to carefully assess these disadvantages and evaluate whether hedging with currency futures aligns with their risk tolerance and financial objectives. In some cases, businesses may find alternative hedging instruments or strategies that better suit their needs and limitations.

Ultimately, businesses should seek professional advice and conduct thorough risk assessments before committing to any hedging strategy. By weighing the advantages against the potential disadvantages, businesses can make informed decisions and implement effective risk management practices in their international operations.

Counterparty Risk

One of the primary disadvantages of hedging with currency futures is the presence of counterparty risk. When engaging in currency futures contracts, businesses enter into an agreement with a counterparty, typically a futures exchange or a financial institution. There is always a risk that the counterparty may default on their obligations, leading to potential financial losses for the hedger.

Counterparty risk can arise due to various factors, such as the financial instability of the counterparty or systemic issues within the financial markets. If the counterparty fails to fulfill their obligations, the hedger may be unable to realize the expected benefits of the hedging strategy, leaving them exposed to adverse currency movements.

To mitigate counterparty risk, it is important for businesses to carefully select reputable and reliable counterparties. Conducting due diligence and assessing the financial strength and credibility of the counterparty can help minimize the potential for default. Additionally, businesses can consider utilizing clearinghouses or regulated exchanges, which act as intermediaries and provide clearing services, reducing counterparty risk.

It is crucial for businesses to regularly monitor the creditworthiness and financial stability of their counterparties to ensure ongoing risk mitigation. By being proactive and vigilant in managing counterparty risk, businesses can safeguard themselves against potential losses and maintain the effectiveness of their hedging strategies.

Lack of Flexibility

Another disadvantage of hedging with currency futures is the lack of flexibility compared to other hedging instruments. Currency futures contracts have fixed expiration dates and contract sizes, which can limit the hedger’s ability to adjust their positions as market conditions evolve.

Market dynamics and currency trends can change rapidly, and businesses may need to make adjustments to their hedging strategies to effectively manage their currency risk. However, with currency futures, businesses are constrained by the terms of the existing contracts and may not have the flexibility to adapt their positions accordingly.

This lack of flexibility can be particularly challenging for businesses operating in volatile markets or those with unpredictable currency movements. If market conditions change significantly before the expiration of the futures contract, businesses may not be able to capitalize on favorable currency movements or protect themselves from adverse fluctuations.

To overcome the limitation of inflexibility, businesses may consider utilizing other hedging instruments, such as options or forwards, which provide more customization and flexibility. Options contracts, for example, allow businesses to hedge against downside risk while maintaining the potential for upside gains. Forward contracts offer more flexibility in terms of contract size and expiration date, allowing businesses to tailor their hedging strategies to their specific needs.

By considering alternative hedging instruments that offer greater flexibility, businesses can adapt more effectively to dynamic market conditions and optimize their risk management strategies.

Potential Losses

Despite the goal of reducing losses, hedging with currency futures does not eliminate the possibility of incurring losses. There are several factors that can contribute to potential losses when using currency futures as a hedging tool.

Firstly, if the hedging strategy is not executed correctly, businesses may fail to effectively mitigate currency risk. Poor timing or misjudgment of market movements can result in losses for the hedger.

Secondly, hedging with currency futures involves locking in a specific exchange rate for a future date. If the currency moves in a favorable direction for the hedger after entering into the futures contract, they may miss out on potential gains. This opportunity cost can be considered as a form of loss.

Furthermore, market conditions can be unpredictable, and currency movements can be influenced by various economic, political, or global events. If the hedging strategy is not aligned with the market dynamics, it may not effectively mitigate losses or protect against adverse currency movements.

It is crucial for businesses to carefully analyze market trends, monitor economic indicators, and assess risk factors when implementing a currency futures hedging strategy. By staying informed and making informed decisions, businesses can minimize the potential for losses.

Additionally, businesses should continually evaluate and review their hedging strategies to ensure their effectiveness. Regularly monitoring and adjusting the hedge positions when necessary can help mitigate losses and maximize the benefits of currency futures hedging.

It is important to note that hedging is not about generating profits; its primary objective is to protect against potential losses. Businesses must weigh the potential losses against the benefits and consider their risk tolerance when deciding to engage in hedging activities.

Complexity and Expertise Required

Hedging with currency futures requires a certain level of knowledge, expertise, and understanding of financial markets. The complexity involved in implementing and managing currency futures hedging strategies can be a significant disadvantage for businesses, especially those without a strong background in finance.

Businesses need to have a solid understanding of how currency markets operate, how futures contracts work, and the factors that influence currency movements. This expertise is crucial for making informed decisions regarding the timing, duration, and size of hedging positions.

An insufficient understanding of market dynamics and the nuances of currency futures can lead to ineffective hedging strategies, potentially resulting in losses or missed opportunities. Without proper expertise, businesses may struggle to analyze and interpret market data, assess risk factors, and execute trades effectively.

Furthermore, managing currency futures positions requires regular monitoring and proactive decision-making. Businesses need to continuously evaluate market conditions, adjust hedge positions when necessary, and reassess their hedging strategies in response to changing circumstances.

For businesses lacking the necessary expertise, it may be prudent to seek the guidance of professionals, such as financial advisors or risk management consultants. These experts can provide valuable insights, help develop effective hedging strategies, and assist in navigating the complexities of currency futures hedging.

By recognizing the complexities involved and investing in the necessary expertise, businesses can enhance their ability to effectively manage currency risk and optimize the outcomes of their hedging activities.

Costs and Margins

One important factor to consider when hedging with currency futures is the associated costs and margin requirements. These costs and margins can have an impact on the overall profitability and feasibility of the hedging strategy for businesses.

Hedging with currency futures involves transaction costs, including brokerage fees and exchange fees. These costs can vary depending on the specific futures contract and the brokerage firm used. It is important for businesses to consider these costs when evaluating the potential benefits of the hedging strategy.

In addition to transaction costs, businesses are required to maintain margins to cover potential losses. Margin refers to the amount of funds that the hedger must deposit with their broker to initiate and maintain the futures position. The margin serves as a form of collateral against potential losses that may occur due to adverse market movements.

The margin requirements mandated by exchanges can vary and may change depending on market conditions. Different currencies and contract sizes also have different margin requirements. Businesses must have the necessary funds available to meet these margin requirements, which can tie up capital and impact liquidity.

It is important for businesses to understand the margin requirements and carefully manage their margin accounts to avoid margin calls or forced liquidation of positions. Failure to meet margin requirements can result in additional costs and potential losses for the hedger.

By considering the costs and margin requirements associated with currency futures hedging, businesses can make informed decisions about the feasibility and affordability of such strategies. It may be necessary to analyze whether the potential benefits outweigh the costs and if alternative hedging instruments or strategies are more suitable for the business’s financial goals and resources.

Working closely with knowledgeable brokers and financial professionals can provide businesses with valuable insights into the costs and margin requirements associated with currency futures hedging. This guidance can help businesses minimize unnecessary costs and ensure proper risk management within their hedging activities.

Conclusion

Hedging with currency futures offers businesses a structured approach to mitigate currency risk and protect against potential losses. However, it is essential to consider the disadvantages that come with this hedging strategy.

Counterparty risk can pose a challenge, as businesses need to carefully select reliable counterparties to minimize the risk of default. The lack of flexibility in currency futures contracts can limit the hedger’s ability to adjust positions according to market dynamics, potentially exposing them to additional risks.

Potential losses are inherent in hedging, and businesses need to carefully analyze market trends, monitor economic indicators, and assess risk factors to mitigate potential losses effectively. Complexity and expertise required can be a disadvantage, especially for businesses lacking a strong financial background.

The costs and margin requirements associated with currency futures hedging can impact profitability and liquidity. It is important for businesses to carefully analyze these costs and manage margin accounts to avoid additional expenses and potential losses.

In conclusion, while hedging with currency futures offers advantages such as price certainty, liquidity, and transparency, businesses must weigh the potential disadvantages against the benefits. By understanding these drawbacks and considering alternative hedging instruments or strategies, businesses can make informed decisions to effectively manage their currency risk and protect their financial interests in the international marketplace.