Finance

What Is Investment Banking Analyst

Modified: December 30, 2023

Learn about the role of an investment banking analyst in finance and gain insights into their responsibilities, skills, and career opportunities.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Investment Banking Analyst

- Roles and Responsibilities of an Investment Banking Analyst

- Required Skills and Qualifications

- Education and Training

- Career Path and Advancement Opportunities

- Compensation and Benefits

- Challenges and Rewards of Being an Investment Banking Analyst

- Conclusion

Introduction

Investment banking is a dynamic and fascinating field that plays a crucial role in the global financial industry. At the heart of this industry are investment banking analysts, essential players who are key to the success of investment banking firms.

An investment banking analyst is an entry-level position within an investment bank, responsible for assisting senior professionals in various financial transactions. These transactions may include mergers and acquisitions, initial public offerings (IPOs), debt and equity offerings, and providing strategic advice to clients.

Investment banking analysts are known for their analytical prowess, attention to detail, and ability to thrive in high-pressure environments. They possess a deep understanding of financial markets, investment strategies, and industry trends. Through their analysis and insights, investment banking analysts help facilitate deals and provide valuable recommendations to senior bankers and clients.

As the financial landscape continues to evolve, investment banking analysts are adapting to the demands of a rapidly changing industry. They utilize innovative technologies and tools to analyze data, generate financial models, and evaluate investment opportunities. This enables them to provide informed advice and support to their teams and clients.

Becoming an investment banking analyst requires a strong educational foundation, exceptional analytical skills, and the ability to work collaboratively in a fast-paced environment. It is a challenging yet rewarding profession that offers opportunities for professional growth and job satisfaction.

In this article, we will explore the roles and responsibilities of an investment banking analyst, the requisite skills and qualifications, as well as the education and training needed to enter the field. We will also delve into the career path and advancement opportunities, the compensation and benefits, as well as the challenges and rewards associated with being an investment banking analyst. Let’s embark on this journey into the world of investment banking analysts.

Definition of Investment Banking Analyst

An investment banking analyst is a crucial role within an investment bank that focuses on financial analysis, deal execution, and client relationship management. They act as a bridge between clients and senior bankers, providing key insights and support throughout the deal-making process.

The primary responsibility of an investment banking analyst is to perform extensive financial analysis, including conducting research, building financial models, and preparing presentations for clients. They use their quantitative and qualitative analysis skills to assess the financial health of companies, evaluate potential investment opportunities, and provide recommendations to senior bankers and clients.

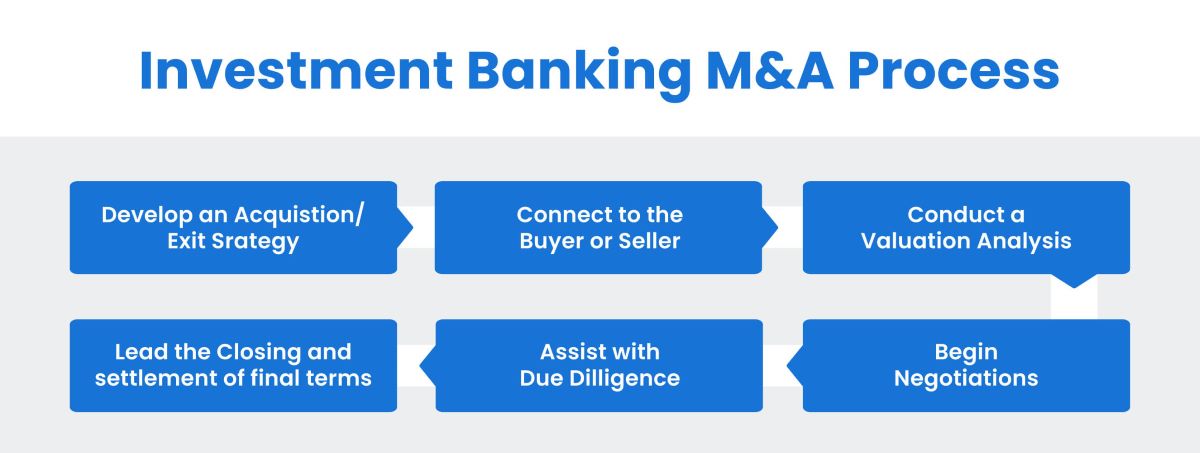

An investment banking analyst also plays a vital role in deal execution. They collaborate with senior bankers, legal teams, and other stakeholders to ensure smooth transaction processes. They assist in drafting offering documents, managing due diligence, coordinating with external parties, and monitoring the progress of deals.

Another crucial aspect of an investment banking analyst’s role is client relationship management. They work closely with clients to understand their financial goals, industry dynamics, and unique needs. By maintaining strong relationships, investment banking analysts build trust and credibility, ensuring the satisfaction of their clients and the generation of new business opportunities.

Furthermore, investment banking analysts participate in internal and external meetings, contributing their insights and analysis to the decision-making process. They stay updated with market trends, industry news, and regulatory changes to provide informed advice to clients and contribute to the firm’s strategic planning.

In summary, an investment banking analyst is a finance professional who combines analytical skills, financial acumen, and client relationship management to support the deals and transactions of an investment bank. They are instrumental in performing financial analysis, executing deals, and building strong client relationships. Their role is crucial in facilitating successful transactions and driving the growth and profitability of investment banking firms.

Roles and Responsibilities of an Investment Banking Analyst

Investment banking analysts play a vital role in the day-to-day operations of an investment bank. They are responsible for a wide range of tasks and responsibilities that contribute to the success of financial transactions and client relationships. Here are some key roles and responsibilities of an investment banking analyst:

- Financial Analysis: Investment banking analysts are responsible for conducting in-depth financial analysis. This involves researching and analyzing financial statements, company valuations, market data, and industry trends. They use this information to build financial models and provide recommendations for strategic decision-making.

- Deal Execution: Investment banking analysts are involved in the execution of deals, working closely with senior bankers and other stakeholders. They help in drafting offering documents, conducting due diligence, and coordinating with legal and regulatory teams. They also assist in managing the deal timeline, ensuring compliance with all legal and regulatory requirements.

- Client Relationship Management: Investment banking analysts maintain strong relationships with clients, serving as a key point of contact. They work closely with clients to understand their financial needs and provide tailored solutions. They assist in preparing pitch presentations, answering client inquiries, and providing ongoing support throughout the transaction process.

- Market Research: Investment banking analysts stay up-to-date with market trends, industry news, and regulatory changes. They conduct thorough market research to identify potential investment opportunities and evaluate market conditions that may impact client decisions. This research contributes to the development of investment strategies and recommendations.

- Communication and Presentation: Investment banking analysts prepare presentations, reports, and financial models for both internal and external stakeholders. They communicate complex financial concepts and analysis in a clear and concise manner. They participate in meetings, contributing their insights and analysis to discussions and decision-making processes.

- Collaboration: Investment banking analysts work collaboratively within their teams and across departments. They collaborate with senior bankers, legal teams, compliance officers, and other professionals to ensure seamless execution of deals. They actively contribute to team discussions and leverage their skills and knowledge to support overall team objectives.

These are just a few of the many roles and responsibilities that investment banking analysts undertake. Their work is critical in facilitating financial transactions, providing strategic advice, and building strong client relationships. Investment banking analysts are essential assets to investment banks, contributing to the success and growth of the firm.

Required Skills and Qualifications

Being an investment banking analyst requires a diverse set of skills and qualifications to excel in this demanding role. Here are some of the essential skills and qualifications for aspiring investment banking analysts:

- Strong Analytical Skills: Investment banking analysts must possess excellent analytical skills to interpret complex financial data, conduct financial modeling, and perform in-depth financial analysis. They need to have a keen eye for detail and the ability to identify key patterns, trends, and insights from large sets of data.

- Financial Acumen: A solid understanding of financial concepts and proficiency in financial statement analysis are crucial for investment banking analysts. They should be well-versed in financial markets, valuation techniques, capital markets, and investment strategies.

- Quantitative Skills: Investment banking analysts must have a strong foundation in mathematics and statistics. They should be proficient in quantitative analysis, able to perform calculations, and work with complex financial models. Proficiency in Excel and financial modeling software is essential.

- Communication Skills: Effective communication is vital for investment banking analysts. They need to be able to clearly and concisely convey complex financial concepts to both technical and non-technical audiences. Strong written and verbal communication skills are necessary for preparing reports, presentations, and client interactions.

- Time Management: Investment banking analysts often work on multiple projects under tight deadlines. They must have excellent time management skills to prioritize tasks, meet deadlines, and handle high-pressure situations with efficiency and accuracy.

- Teamwork and Collaboration: Investment banking analysts work in collaborative environments, interacting with various teams and stakeholders. They should be able to contribute effectively in a team, communicate ideas, and actively engage in discussions.

- Attention to Detail: Precision is crucial in the investment banking industry. Investment banking analysts must have a meticulous approach, paying attention to every detail, and ensuring accuracy in financial models, reports, and presentations.

- Adaptability and Resilience: Investment banking analysts operate in a fast-paced and ever-changing environment. They need to be adaptable, flexible, and resilient in dealing with new challenges, unexpected situations, and demanding workloads.

In addition to these skills, a strong educational background is essential for investment banking analysts. Most investment banks prefer candidates with a bachelor’s degree, preferably in finance, economics, business, or a related field. Some larger firms may seek candidates with a master’s degree in finance or business administration.

Furthermore, internships or previous work experience in finance or investment banking can provide a competitive edge when pursuing a career as an investment banking analyst.

By possessing these skills and qualifications, aspiring investment banking analysts can position themselves for success and excel in this challenging yet rewarding field.

Education and Training

Education and training play a critical role in preparing individuals for a career as an investment banking analyst. While specific requirements may vary among firms, here is an overview of the typical educational background and training needed for this role:

Educational Requirements: Most investment banks prefer candidates with a bachelor’s degree in finance, economics, business, or a related field. A strong foundation in financial concepts, accounting principles, and quantitative analysis is essential. Some larger firms may also seek candidates with a master’s degree in finance or business administration, which can provide a deeper understanding of advanced financial concepts and enhance career prospects.

Relevant Coursework: Aspiring investment banking analysts should focus on courses that develop their financial analysis skills, including financial statement analysis, corporate finance, investment management, and valuation techniques. Courses in mathematics, statistics, and economics are also beneficial, as they provide a strong analytical foundation.

Internships and Work Experience: Gaining practical experience through internships or entry-level positions in finance or investment banking can significantly enhance a candidate’s profile. Internships offer an opportunity to learn the intricacies of financial analysis, deal execution, and client relationship management. They provide valuable hands-on experience and industry exposure, increasing the chances of securing a full-time position as an investment banking analyst.

Training Programs: Many investment banks offer comprehensive training programs for newly hired investment banking analysts. These programs typically last several weeks to several months and aim to equip analysts with the necessary skills and knowledge to excel in their roles. Training covers topics such as financial modeling, industry research, client communication, and deal execution. These programs also provide networking opportunities and allow analysts to build relationships with colleagues and mentors within the firm.

Professional Certifications: Although not required, earning relevant professional certifications can demonstrate a candidate’s commitment to the field and enhance their credentials. The Chartered Financial Analyst (CFA) designation, for example, is highly regarded in the finance industry and can provide a competitive advantage. Other certifications such as the Financial Modeling and Valuation Analyst (FMVA) or Certified Investment Banking Professional (CIBP) may also be beneficial in enhancing expertise and credibility.

Continuing Education: Investment banking analysts should embrace the importance of lifelong learning and stay updated with industry trends, regulatory changes, and technological advancements. Continuing education through seminars, workshops, and online courses can help sharpen skills, broaden knowledge, and stay competitive in the ever-evolving field of investment banking.

Ultimately, a combination of formal education, practical experience, and ongoing learning is essential to excel as an investment banking analyst. Building a solid educational foundation, gaining relevant work experience, and continuously staying abreast of industry developments will pave the way for a successful and rewarding career.

Career Path and Advancement Opportunities

The role of an investment banking analyst serves as a launching pad for a rewarding career in the finance industry, providing valuable experience and a strong foundation for future advancement. Here is an overview of the career path and advancement opportunities for investment banking analysts:

Analyst Level: Upon joining an investment bank, individuals typically start at the analyst level. As analysts, they gain exposure to various areas within investment banking, working on financial analysis, conducting due diligence, and supporting senior bankers. This level provides valuable experience, allowing analysts to develop a solid skill set and knowledge base.

Associate Level: After two to three years as an analyst, high-performing individuals may have the opportunity to advance to the associate level. Associates take on more responsibility, including managing projects, leading deal execution, and interacting directly with clients. They work closely with senior bankers and play a crucial role in client relationship management and business development.

Vice President Level: The next step in the career progression is the vice president level. At this level, individuals assume greater leadership and management responsibilities. Vice presidents oversee deal teams, mentor junior colleagues, and play a significant role in driving business growth. They are heavily involved in client relationships, deal origination, and strategic decision-making.

Director/Managing Director Level: Directors and managing directors are senior-level professionals who have extensive experience and a proven track record in investment banking. They are responsible for managing and overseeing a portfolio of clients, leading high-value transactions, and contributing to the overall strategic direction of the investment bank. Directors and managing directors often have significant industry expertise and play leadership roles within the firm.

Opportunities Beyond Investment Banking: Investment banking analysts also have the potential to transition to other areas within finance or business. Some may choose to pursue positions in private equity, venture capital, corporate development, or consulting. The transferrable skills gained as an investment banking analyst, such as financial analysis, deal execution, and client relationship management, make these transitions feasible and attractive.

MBA and Graduate School: Another common path for investment banking analysts is to pursue an MBA or graduate school. This advanced degree can further enhance one’s knowledge, broaden their network, and open doors to higher-level positions within the finance industry. Many investment banks actively support and encourage analysts to pursue advanced degrees, providing sponsorships or internships during their graduate studies.

Entrepreneurship and Startups: Some investment banking analysts may choose to leverage their skills and experience to start their own businesses or join early-stage startups. The financial expertise, strategic thinking, and network developed as an investment banking analyst can be invaluable in entrepreneurial pursuits.

Advancement in the investment banking industry requires a combination of strong performance, networking, continuous learning, and seizing opportunities. Building strong relationships, acquiring new industry knowledge, and embracing challenges are key to advancing one’s career beyond the analyst level.

It is important to note that the career path in investment banking is highly competitive and demanding. However, it also offers immense rewards, including professional growth, financial success, and the opportunity to work on prominent deals and with high-profile clients.

Compensation and Benefits

Investment banking analysts are highly sought after for their expertise and play a crucial role in the success of investment banks. As such, they are often rewarded with competitive compensation packages and attractive benefits. Here are some key aspects of compensation and benefits for investment banking analysts:

Base Salary: Investment banking analysts are typically offered a competitive base salary, which can vary depending on factors such as the firm’s location, size, and reputation. Generally, the base salaries for investment banking analysts are higher than those in many other industries, reflecting the demanding nature of the work and the need to attract top talent.

Bonuses: Investment banking analysts are eligible for performance-based bonuses, which are a significant part of their overall compensation. These bonuses are typically awarded annually and are based on individual and team performance, transaction volume, and the overall financial success of the firm. Exceptional performance can lead to substantial bonuses, providing a significant boost to an analyst’s earnings.

Signing Bonuses: Investment banks often provide signing bonuses to attract top talent. These bonuses are one-time payments given to analysts upon joining the firm and are intended to offset relocation expenses and recognize the competitive nature of the industry.

401(k) and Retirement Plans: Investment banking firms often offer retirement savings plans, such as a 401(k) plan, to help analysts save for their future. These plans typically include a company match, where the firm contributes a certain percentage of the analyst’s salary to the retirement account.

Health and Insurance Benefits: Investment banking analysts generally receive comprehensive health and insurance benefits, including medical, dental, and vision coverage. Additionally, they may have access to life insurance, disability insurance, and other forms of coverage to protect their well-being.

Vacation and Time Off: Although investment banking analysts are known for their demanding hours, firms typically offer vacation and time off policies to provide work-life balance. This may include a certain number of annual paid vacation days, sick leave, and personal days to recharge and rejuvenate.

Professional Development Opportunities: Investment banking firms often provide opportunities for professional growth and development. Analysts may have access to training programs, workshops, and conferences to enhance their skills and knowledge. Additionally, firms may sponsor advanced degrees, such as an MBA, to further support career progression.

Work Perks and Amenities: Investment banking firms often offer various work perks and amenities to create a positive work environment. These may include access to fitness facilities, catered meals, employee discounts, transportation reimbursements, and other benefits that contribute to the overall well-being and convenience of analysts.

It is important to note that compensation and benefits can vary based on factors such as the analyst’s location, experience level, industry conditions, and the specific investment banking firm. It is advisable for individuals to thoroughly research and understand the compensation and benefits package offered by prospective employers to make informed decisions about their career paths.

Overall, the compensation and benefits provided to investment banking analysts reflect the demanding nature of the job, the level of skill and expertise required, and the crucial role they play in the success of investment banks.

Challenges and Rewards of Being an Investment Banking Analyst

Being an investment banking analyst comes with its own set of challenges and rewards. This demanding and high-pressure role requires dedication, long hours, and a relentless drive for excellence. Here are some of the challenges and rewards of being an investment banking analyst:

Challenges:

- Intense Workload: Investment banking analysts are known for their demanding and unpredictable work hours. The nature of the job often requires long nights, intense periods of work, and tight deadlines. Analysts must be prepared to handle high-pressure situations and manage multiple projects simultaneously.

- Tight Deadlines: Investment banking deals typically have strict deadlines, and analysts are responsible for meeting those deadlines while maintaining accuracy and attention to detail. This can require sacrificing personal time and managing time efficiently to ensure all tasks are completed promptly.

- High Expectations: Investment banking analysts are expected to deliver exceptional work and perform at a high level consistently. The industry demands perfection in financial analysis, presentations, and client interactions. The pressure to meet or exceed expectations can be stressful and challenging.

- Work-Life Balance: Achieving work-life balance can be difficult for investment banking analysts due to the demanding nature of the job. Long work hours and weekend work may take a toll on personal relationships, hobbies, and general well-being. However, firms are increasingly recognizing the importance of work-life balance and are implementing initiatives to address this challenge.

- Steep Learning Curve: The investment banking industry is complex and constantly evolving. Investment banking analysts face a steep learning curve, needing to quickly grasp financial concepts, industry dynamics, and transaction processes. The need to continuously learn and adapt can be challenging, especially for those in their early career stages.

Rewards:

- Professional Growth: Investment banking offers immense opportunities for professional growth and development. As an analyst, individuals gain exposure to a wide range of financial transactions, industry sectors, and experienced professionals. The skills, knowledge, and network gained in this role can open doors to exciting career paths within finance.

- Financial Reward: Investment banking analysts are well-compensated for their work, with competitive base salaries and performance-based bonuses. Exceptional performance can lead to significant financial rewards and advancement opportunities.

- Industry Prestige: Investment banking is renowned for its prestige and status within the finance industry. Being part of an esteemed investment bank and working on high-profile deals can enhance professional reputation and open doors to future opportunities.

- Learning Experience: Investment banking analysts gain valuable skills and knowledge in financial analysis, deal execution, and client interaction. The exposure to complex financial transactions and industry trends provides a unique learning experience that can propel one’s career forward.

- Networking Opportunities: Investment banking analysts have the opportunity to build a strong professional network while working with colleagues, industry experts, and clients. Networking can lead to future career prospects, business opportunities, and mentorship.

While being an investment banking analyst can be challenging, the rewards are significant for those who are dedicated and thrive in a fast-paced, high-pressure environment. The skills and experiences gained as an analyst can serve as a solid foundation for a successful career in finance and open doors to a wide range of future opportunities.

Conclusion

Being an investment banking analyst is both a challenging and rewarding career choice in the finance industry. These professionals play a crucial role in facilitating financial transactions, providing strategic advice, and building strong client relationships. They possess a unique set of skills and qualifications, including strong analytical abilities, financial acumen, and excellent communication skills.

While investment banking analysts face challenges such as demanding work hours, tight deadlines, and high expectations, they are also rewarded with competitive compensation packages, the opportunity for professional growth, and the prestige associated with the industry. The role offers a steep learning curve, providing exposure to diverse financial transactions and industry sectors, allowing analysts to develop a deep understanding of complex financial concepts and gain valuable experiences early in their careers.

The career path for investment banking analysts offers a clear progression from analyst to associate, vice president, and beyond. There are also opportunities to transition to other areas within finance or business, pursue advanced degrees, or explore entrepreneurial ventures. Investment banks recognize the importance of continuous learning and offer training programs and professional development opportunities to help analysts refine their skills and broaden their industry knowledge.

It is important to note that being an investment banking analyst requires a strong commitment and dedication. The pressures of the job can affect work-life balance and personal relationships. However, investment banks are increasingly implementing initiatives to address these challenges, recognizing the importance of the well-being of their employees.

In conclusion, being an investment banking analyst is a rewarding and respected career choice for individuals passionate about finance, with the drive to excel in a fast-paced, dynamic, and ever-evolving environment. With the right skills, qualifications, and mindset, investment banking analysts can have a fulfilling and successful career, making a significant impact in the finance industry as they contribute to the growth and success of investment banks.