Home>Finance>What Does It Mean When My Credit Card Balance Is Negative

Finance

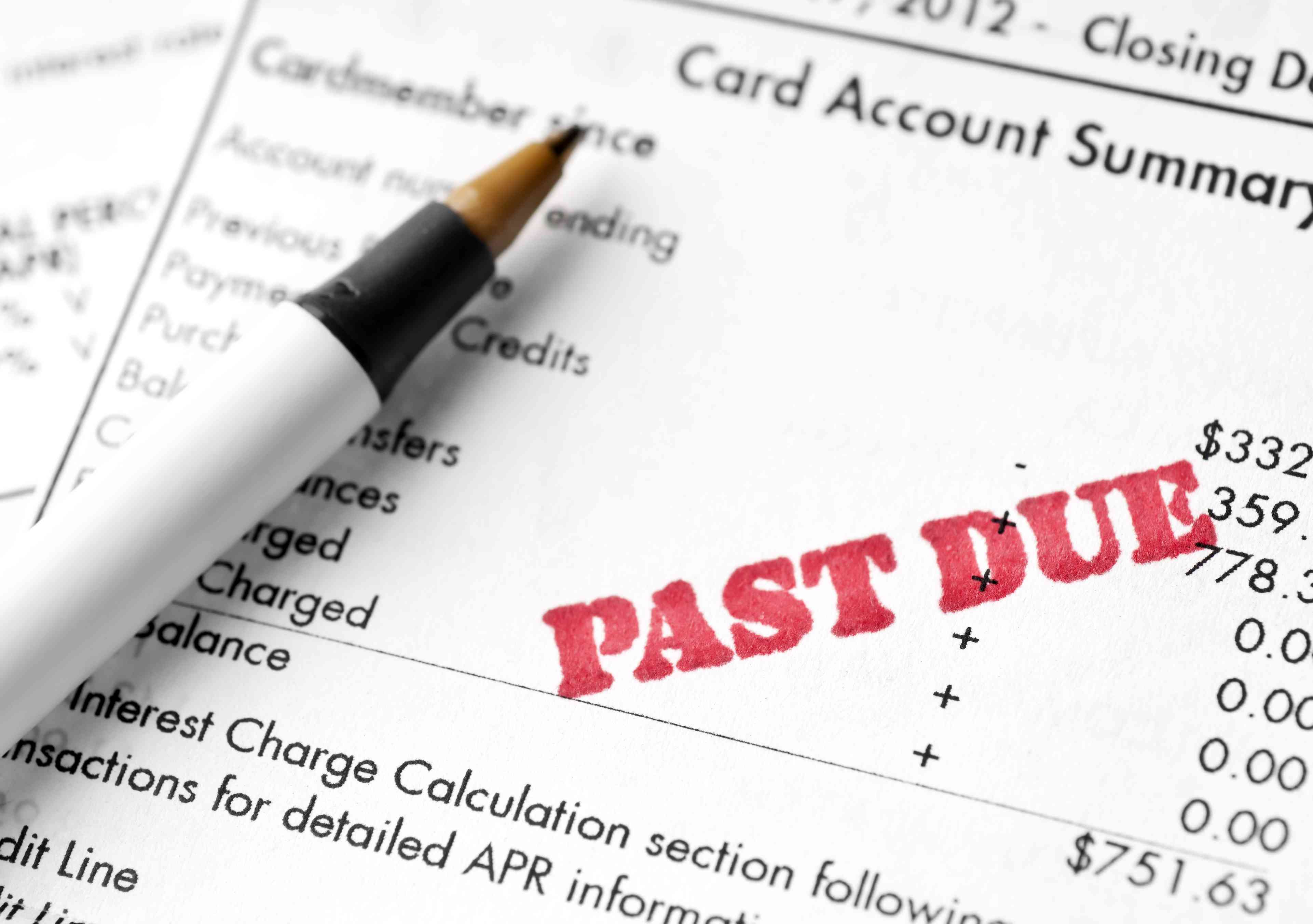

What Does It Mean When My Credit Card Balance Is Negative

Modified: February 21, 2024

Learn about the impact of a negative credit card balance and what it means for your finances. Explore ways to manage and address this situation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Credit cards have become an essential financial tool for many people around the world. They offer convenience, flexibility, and the ability to make purchases or access funds when needed. However, understanding credit card balances can sometimes be confusing, especially when you come across a negative balance. You might wonder what it means and how it impacts your financial situation. In this article, we will explore the concept of negative credit card balances and shed light on what they signify.

When it comes to credit cards, the terms “balance” and “negative balance” refer to the amount of money you owe to the credit card company or the amount they owe you, respectively. Typically, when you make purchases or take out cash advances on your credit card, your balance increases. On the other hand, when you make payments towards your credit card debt, your balance decreases.

However, situations may arise where your credit card balance becomes negative. This occurrence is not as rare as you might think, and it can happen due to various reasons. Understanding what a negative credit card balance indicates is crucial for managing your finances effectively and maintaining a healthy credit profile. In the following sections, we will delve deeper into the meaning of a negative credit card balance and explore some common reasons behind it.

Understanding Credit Card Balances

Before we delve into the concept of a negative credit card balance, it’s important to have a clear understanding of how credit card balances work.

Your credit card balance is the total amount of money you owe to your credit card company at any given time. It includes both purchases you have made with your card and any fees or interest charges that have been accrued.

When you make a purchase using your credit card, the amount is added to your balance. For example, if you buy a new pair of shoes for $100, your credit card balance will increase by $100.

On the other hand, when you make a payment towards your credit card debt, the amount is subtracted from your balance. For instance, if you pay $50 towards your credit card bill, your balance will decrease by $50.

It’s important to note that credit cards usually have a grace period, during which you can repay the full balance without incurring any interest charges. However, if you carry a balance beyond the grace period, interest charges will be applied to the remaining amount.

In addition to purchases and payments, credit card balances can also be affected by other factors such as cash advances, balance transfers, and fees. Understanding these factors is essential for managing your credit card balance effectively and avoiding any surprises.

Now that we have a clear understanding of how credit card balances work, let’s explore what it means when your credit card balance becomes negative and how it can impact your financial situation.

What Does a Negative Credit Card Balance Mean?

A negative credit card balance occurs when the amount of credit card payments or credits exceeds the outstanding balance. In simple terms, it means that you have overpaid your credit card bill or received a refund or credit that exceeds the amount you owe.

Having a negative credit card balance may seem unusual, but it can happen for various reasons. It could be due to a returned purchase, a credit card dispute resolution, or even a credit card issuer error.

When you have a negative credit card balance, it’s important to understand how it affects your financial situation. On the surface, it may seem like a positive outcome since you don’t owe any money, but there are a few things to consider:

- No interest charges: When you have a negative balance, you won’t be charged any interest on that amount since you don’t owe anything. This can be a relief, especially if you typically carry a balance and accrue interest charges.

- No payment required: With a negative balance, you are not required to make any payment towards your credit card debt. You’ve essentially pre-paid for future purchases or reduced the outstanding balance to zero.

- Potential limitations: While a negative balance technically means you have a credit with your credit card issuer, it’s important to note that there may be limitations on how you can use that credit. Some issuers may restrict certain transactions or impose time limits for using the credit.

It’s worth mentioning that a negative balance does not mean you have extra spending power. It simply signifies that you have overpaid or received a credit on your account. It’s important to keep track of your credit card balances and monitor any negative balances to ensure accurate accounting and avoid potential issues.

In the next section, we will explore some common reasons behind a negative credit card balance.

Common Reasons for Negative Credit Card Balances

While a negative credit card balance may seem unusual, there are several common reasons that can lead to this situation. Let’s explore some of the most common causes:

- Returns and refunds: One of the primary reasons for a negative credit card balance is returning a purchase. When you return an item to the merchant, they may issue a refund back to your credit card. If the refund amount exceeds your outstanding balance, it will result in a negative balance.

- Credit card disputes: If you successfully dispute a charge on your credit card and the issuer sides with you, they may credit your account with the disputed amount. This credit can lead to a negative balance if it exceeds your outstanding debt.

- Overpayments: Sometimes, you may accidentally make a payment that exceeds your outstanding balance. This can happen if you mistype the payment amount or if you make multiple payments for the same bill without realizing it. These overpayments result in a negative credit card balance.

- Credit card promotional offers: Certain credit card issuers may offer promotional incentives, such as cashback rewards or statement credits. If you receive these rewards, they can reduce your outstanding balance and potentially create a negative balance.

- Credit card issuer errors: In rare cases, errors made by the credit card issuer can lead to a negative balance. For example, if they mistakenly apply a double payment or miscalculate your balance, it can result in a negative credit card balance.

It’s important to note that while these are common reasons for negative credit card balances, it’s always a good practice to review your credit card statements regularly and keep track of your transactions to identify any discrepancies or errors.

Now that we’ve explored the common reasons behind a negative credit card balance, let’s discuss how it can affect you and your financial situation.

How Does a Negative Credit Card Balance Affect You?

Having a negative credit card balance can have both positive and negative implications for your financial situation. Let’s examine how it can affect you:

- No interest charges: When you have a negative balance, you don’t owe any money to the credit card company. As a result, you won’t be charged any interest on that amount. This can be particularly beneficial if you typically carry a balance and accrue interest charges on your credit card debt.

- No immediate payment required: With a negative credit card balance, you have essentially pre-paid for future purchases or reduced your outstanding balance to zero. This means you don’t have an immediate payment obligation towards your credit card debt.

- Potential limitations: While a negative balance signifies that you have a credit with your credit card issuer, it’s important to note that there may be limitations on how you can use that credit. Some issuers may restrict certain transactions or impose time limits for using the credit.

- Reduced credit utilization: Credit utilization, which is the percentage of available credit you’re using, is an important factor in determining your credit score. If you have a negative credit card balance, it can significantly lower your credit utilization ratio. This can have a positive impact on your credit score, as lower credit utilization is generally seen as responsible credit management.

- Credit card issuer policies: Every credit card issuer may have different policies and procedures regarding negative credit card balances. It’s important to familiarize yourself with your credit card issuer’s policies to understand how they handle negative balances and any associated fees or restrictions.

While a negative credit card balance may seem like a favourable situation, it’s essential to manage it responsibly. Here are a few tips to help you navigate a negative credit card balance effectively:

- Monitor your balance: Keep an eye on your credit card statements and regularly check your balance to ensure accuracy. Mistakes can happen, so it’s important to catch any errors or discrepancies.

- Understand credit card policies: Familiarize yourself with your credit card issuer’s policies regarding negative balances, including any time limits or restrictions for using the credit.

- Contact your credit card issuer: If you have any questions or concerns about your negative balance, don’t hesitate to reach out to your credit card issuer’s customer service. They can provide clarification and guidance on how to best manage the situation.

- Consider requesting a refund: If you have a significant negative balance and don’t anticipate using the credit soon, you may consider contacting your credit card issuer and requesting a refund of the excess amount.

Overall, a negative credit card balance can provide temporary relief from interest charges and payment obligations. However, it’s important to stay informed, manage the balance responsibly, and maintain regular communication with your credit card issuer.

In the next section, we will discuss some tips for avoiding a negative credit card balance in the first place.

How to Manage a Negative Credit Card Balance

If you find yourself with a negative credit card balance, it’s important to manage it effectively. Consider the following strategies to navigate this situation:

- Review your transactions: Take the time to review your credit card statements carefully. Ensure that the negative balance is accurate and matches any returns, refunds, or credits you have received. If you notice any discrepancies, contact your credit card issuer as soon as possible to address the issue.

- Understand usage restrictions: Some credit card issuers may impose restrictions on how you can use the negative balance. Read the terms and conditions of your credit card agreement or contact customer service to understand any limitations or expiration dates associated with the credit. Understanding these restrictions will help you make informed decisions about how to utilize the credit.

- Consider future purchases: If you have a negative balance and plan to continue using the credit card, you can apply the credit towards future purchases. This can help offset any upcoming charges and ensure that you use the credit before it expires. Remember to keep track of your balance to avoid overspending.

- Request a refund: If you have a significant negative balance and don’t anticipate using the credit in the near future, you might consider contacting your credit card issuer and requesting a refund of the excess amount. Some issuers may be willing to issue a refund via check or direct deposit, depending on their policies.

- Monitor your credit utilization: While a negative credit card balance can temporarily reduce your credit utilization ratio, it’s important to keep an eye on it. If you have other credit cards or loan accounts, make sure your overall credit utilization remains within a healthy range. Maintaining a low credit utilization ratio is beneficial for your credit score.

- Prevent future negative balances: To avoid negative credit card balances in the future, practice good financial habits. Double-check your payments to ensure you are not overpaying. Be mindful of returns and refunds, keeping track of them to ensure they are properly credited. Monitoring your account regularly will help you catch any discrepancies or errors promptly.

Remember, effectively managing a negative credit card balance requires staying informed, understanding your credit card issuer’s policies, and keeping track of your transactions. By taking proactive steps, you can navigate this situation with confidence and maintain control over your finances.

Now that we’ve explored how to manage a negative credit card balance, let’s discuss some tips for avoiding it altogether.

Tips for Avoiding a Negative Credit Card Balance

While a negative credit card balance may not be a significant issue, it’s always better to avoid it if possible. Here are some helpful tips to prevent a negative credit card balance:

- Track your transactions: Stay on top of your credit card activity by regularly reviewing your account statements and monitoring your transactions. This will help you catch any errors or discrepancies early on and ensure that your balance remains accurate.

- Know your available credit: Familiarize yourself with the credit limit on your credit card. This will give you an idea of how much available credit you have and help you manage your spending accordingly. Keeping your balance well below the limit reduces the risk of accidentally overpaying.

- Be mindful of returns/refunds: When returning items purchased with your credit card, make sure to check that the refund is properly applied to your account. Confirm that the refunded amount matches the original charge to avoid any potential negative balance situations.

- Double-check payment amounts: Before making a payment towards your credit card balance, double-check the amount to ensure it matches your outstanding balance. Accidental overpayments can lead to a negative balance. Pay attention to payment confirmation messages or receipts to confirm the accuracy of the payment.

- Communicate with your credit card issuer: If you have any questions or concerns about your credit card balance or transactions, don’t hesitate to reach out to your credit card issuer’s customer service. They can provide clarification and assistance in resolving any issues promptly.

- Automate payments: Consider setting up automatic payments for your credit card bills to ensure you never miss a payment. However, it’s essential to keep track of your account balance and confirm that the automatic payments align with your outstanding balance to avoid any potential negative balance situations.

By implementing these tips, you can maintain control over your credit card balances and minimize the risk of ending up with a negative balance. However, if you do find yourself facing a negative credit card balance, remember that it can be resolved by carefully managing your transactions and communicating with your credit card issuer.

As we conclude, it’s important to maintain a proactive approach to your credit card usage, staying informed, and being mindful of your financial responsibilities. By doing so, you can effectively manage your credit card balances and safeguard your financial well-being.

Conclusion

Understanding credit card balances, including negative balances, is essential for managing your finances effectively and maintaining a healthy credit profile. While a negative credit card balance may seem unusual, it can occur due to reasons such as returns, refunds, disputes, overpayments, or credit card issuer errors.

When you have a negative credit card balance, it means you have overpaid your credit card bill or received a refund or credit that exceeds your outstanding debt. This can have both positive and negative implications for your financial situation.

On the positive side, a negative credit card balance means no interest charges on that amount, no immediate payment required, and potentially reduced credit utilization, which can positively impact your credit score. On the other hand, there may be limitations on how you can use the credit, and it’s important to stay informed about your credit card issuer’s policies.

To manage a negative credit card balance effectively, review your transactions, understand usage restrictions, consider future purchases, and contact your credit card issuer if needed. Staying mindful of your credit card usage, tracking your transactions, and double-checking payment amounts can help you avoid ending up with a negative balance in the first place.

Ultimately, responsible credit card management and proactive monitoring of your credit card balances are key to maintaining a healthy financial position. By implementing the tips provided in this article, you can navigate credit card balances with confidence and ensure that you stay in control of your financial well-being.

Remember, if you have any concerns or questions about your credit card balances or transactions, don’t hesitate to reach out to your credit card issuer’s customer service for assistance. They are there to help you navigate any issues and provide guidance to ensure a positive credit card experience.