Finance

What Is Outstanding Balance In Credit Card

Modified: February 21, 2024

Learn what an outstanding balance is in credit cards and how it affects your finances. Understand the importance of managing your credit card balance to maintain a healthy financial state.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit cards, where convenience and flexibility meet financial obligations. As you embark on your credit card journey, understanding various terms and concepts becomes crucial, one of which is the outstanding balance. This article aims to demystify the concept of outstanding balance and shed light on its importance in managing your credit card finances effectively.

When you use a credit card, you are essentially borrowing money from the card issuer to make purchases. The outstanding balance refers to the amount of money you owe to the credit card company at any given point in time.

Whether you are a credit card beginner or have been using credit cards for a while, it is essential to grasp the concept of outstanding balance. By gaining a clear understanding of this term, you can make informed decisions, avoid unnecessary fees, and maintain a healthy credit score.

Next, we will delve into the definition of outstanding balance and how it is calculated to provide a comprehensive understanding of this critical aspect of credit card management.

Definition of Outstanding Balance

The outstanding balance on your credit card is the total amount of money you owe to the credit card company. It includes the purchases you have made, any fees or interest charges, and any outstanding balances from previous billing cycles. In simple terms, it is the sum of all unpaid obligations on your credit card account.

When you use your credit card to make purchases, the card issuer extends credit to you. They pay the merchant on your behalf, and you are obligated to repay the amount to the credit card company. If you don’t pay your credit card bill in full by the due date, the remaining balance carries over to the next billing cycle and becomes part of the outstanding balance.

It’s important to note that while some credit cards offer an interest-free grace period, where you can avoid interest charges by paying the full balance by the due date, others may charge interest from the date of purchase. In such cases, even if you make the minimum payment, the remaining balance accrues interest, which increases your outstanding balance.

It’s crucial to regularly check your credit card statement to keep track of your outstanding balance. The statement will provide a breakdown of your charges, payments, and accumulated fees or interest. By being aware of this information, you can effectively manage and control your credit card debt.

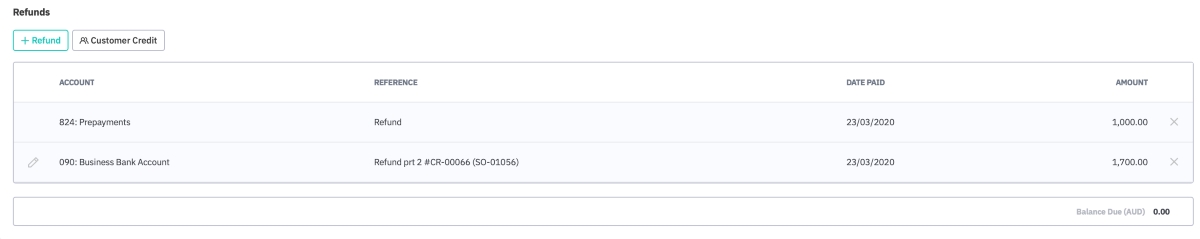

How Outstanding Balance is Calculated

Calculating your outstanding balance on a credit card involves considering various factors such as purchases, payments, fees, and interest charges. Understanding the calculation method will help you stay informed about your financial obligations and make informed decisions regarding your credit card usage.

Here are the key components that contribute to the calculation process:

- Purchases: Your outstanding balance increases with each purchase you make on your credit card. These can include everyday expenses like groceries, dining out, or online shopping. The total amount of your purchases adds to the outstanding balance.

- Payments: When you make a payment towards your credit card bill, it reduces the outstanding balance. If your payment is equal to or greater than the total outstanding balance, you can eliminate the debt completely. However, if your payment is lower than the total outstanding balance, the remaining amount will carry over to the next billing cycle.

- Fees and Charges: Credit cards often come with various fees and charges, such as annual fees, late payment fees, or cash advance fees. These fees, if applicable, are added to the outstanding balance.

- Interest Charges: If you carry a balance on your credit card after the grace period, interest charges come into play. The interest rate, also known as the annual percentage rate (APR), is applied to the remaining balance, increasing the outstanding balance. It’s important to note that if you pay your balance in full each month by the due date, you can avoid interest charges.

To calculate your outstanding balance accurately, you need to subtract your payments from your total purchases, while taking into account any fees and interest charges. By regularly reviewing your credit card statement and understanding the calculation process, you can be mindful of your financial obligations and make strategic decisions to manage your outstanding balance effectively.

Importance of Monitoring Outstanding Balance

Monitoring your outstanding balance on a credit card is crucial for several reasons. By staying aware of the amount you owe and managing it effectively, you can maintain financial stability and make informed decisions about your credit card usage. Here are the key reasons why monitoring your outstanding balance is important:

- Financial Awareness: Keeping track of your outstanding balance helps you understand your financial standing. It provides clarity on the amount of debt you owe and allows you to gauge your overall financial health. This awareness empowers you to make informed decisions about your spending and payment strategies.

- Budgeting and Planning: By monitoring your outstanding balance, you can align your credit card usage with your budget. It allows you to keep tabs on your expenses and make adjustments if necessary. This, in turn, helps in creating a financial plan and setting realistic goals.

- Avoiding Late Payments and Fees: Regularly checking your outstanding balance ensures that you don’t miss any payment deadlines. Late or missed payments can result in hefty late fees and penalties, which can further increase your outstanding balance. Monitoring your balance allows you to stay on top of payment schedules and avoid unnecessary fees.

- Identifying Fraud or Unauthorized Charges: Monitoring your outstanding balance enables you to quickly identify any fraudulent or unauthorized charges on your credit card. By reviewing your statement regularly, you can detect and report any suspicious transactions promptly, protecting your finances and minimizing potential losses.

- Maintaining or Improving Credit Score: Your credit score plays a vital role in your financial well-being. A high outstanding balance compared to your credit limit can negatively impact your credit utilization ratio, which is a key factor in determining your credit score. By monitoring and managing your outstanding balance, you can aim to keep your credit utilization ratio low, potentially improving your credit score.

Monitoring your outstanding balance goes hand in hand with responsible credit card usage. It allows you to stay in control of your finances, avoid unnecessary fees, and maintain a healthy credit profile. By being proactive and vigilant, you can make the most of your credit card benefits while minimizing debt and financial stress.

Tips for Managing Outstanding Balance

Effectively managing your outstanding balance is vital to maintaining a healthy financial life. By implementing the following tips, you can take control of your credit card debt and keep your outstanding balance under control:

- Create a Budget: Start by creating a realistic budget that aligns with your income and expenses. Allocate a specific portion of your budget to credit card payments. This will help you stay within your means and prevent overspending.

- Pay on Time: Make it a priority to pay your credit card bill in full and on time every month. Late payments can result in added fees and increased interest charges, causing your outstanding balance to grow.

- Avoid Minimum Payments: While it may be tempting to make only the minimum payment required, it’s best to pay as much as you can afford each month. By paying more than the minimum, you can reduce your outstanding balance faster and save on interest charges.

- Reduce Unnecessary Spending: Take a close look at your expenses and identify areas where you can cut back. By reducing discretionary spending, you’ll have more funds available to pay down your outstanding balance.

- Avoid Taking on New Debt: It’s advisable to avoid taking on additional debt while you have an outstanding balance on your credit card. Taking on new debt will only increase your financial obligations and make it more challenging to pay off your existing balance.

- Negotiate Lower Interest Rates: If you’re struggling with high interest rates, consider reaching out to your credit card issuer and negotiating a lower rate. A lower interest rate can help reduce the amount of interest charged on your outstanding balance.

- Consider Balance Transfers: If you’re dealing with a substantial outstanding balance and high interest rates, you may explore the option of a balance transfer to a credit card with a lower interest rate. This can help you save on interest charges and make it easier to pay off your debt.

- Regularly Review Your Statements: Stay vigilant by reviewing your credit card statements regularly. Check for any errors, unauthorized charges, or discrepancies in your outstanding balance. Report any issues to your credit card issuer immediately.

By implementing these tips, you can take control of your outstanding balance and work towards becoming debt-free. Remember, responsible credit card management is key to maintaining a healthy financial life.

Impact of Outstanding Balance on Credit Score

Your outstanding balance on a credit card can have a significant impact on your credit score. Your credit score is a numerical representation of your creditworthiness and is used by lenders to determine your eligibility for loans, credit cards, and other financial products. Here’s how your outstanding balance can affect your credit score:

- Credit Utilization Ratio: One of the key factors that influence your credit score is your credit utilization ratio. This ratio compares the amount of credit you are currently using to your total available credit limit. A high outstanding balance compared to your credit limit can indicate a higher credit utilization ratio. Ideally, it’s recommended to keep your credit utilization ratio below 30% to maintain a good credit score.

- Payment History: Your credit card payment history is another crucial element that affects your credit score. Making timely payments and keeping your outstanding balance low demonstrates responsible credit card usage and a positive payment history. On the other hand, late payments, missed payments, or consistently carrying a high outstanding balance can negatively impact your credit score.

- Creditworthiness: Lenders and creditors evaluate your creditworthiness based on several factors, including your outstanding balance. A high outstanding balance can raise concerns about your ability to manage your finances and repay your debt. This can potentially lower your creditworthiness in the eyes of lenders, making it harder to secure credit or loans in the future.

- Credit Mix: Your credit mix refers to the different types of credit accounts you have, such as credit cards, loans, and mortgages. While credit cards are one component of your credit mix, carrying a high outstanding balance on your credit card can skew your credit mix and potentially impact your credit score.

- Length of Credit History: The length of your credit history also plays a role in your credit score. If you consistently carry a high outstanding balance over an extended period, it can potentially impact the length of your credit history and, consequently, your credit score.

It’s important to note that maintaining a low outstanding balance and making timely payments alone won’t guarantee an excellent credit score. Other factors, such as your overall credit history, the presence of any derogatory marks, and the length of your credit history, also influence your credit score.

By actively managing your outstanding balance, making on-time payments, and keeping your credit utilization ratio low, you can positively impact your credit score. This, in turn, can open doors to better financial opportunities and favorable interest rates in the future.

Common Misconceptions about Outstanding Balance

When it comes to managing credit card finances, there are several misconceptions surrounding the concept of outstanding balance. These misunderstandings can lead to confusion and potentially harmful financial decisions. Let’s debunk some of the most common misconceptions:

- Minimum Payment is Sufficient: One of the biggest misconceptions is that making the minimum payment is enough to manage your outstanding balance. While making the minimum payment can prevent late fees, it can also lead to a growing outstanding balance due to interest charges. It’s best to strive to pay off the full balance each month or as much as you can afford to avoid accruing interest charges.

- Outstanding Balance Doesn’t Affect Credit Score: Some believe that as long as they make their payments on time, their outstanding balance won’t impact their credit score. However, your credit utilization ratio, which reflects your outstanding balance compared to your credit limit, is a key factor in determining your credit score. A high outstanding balance can negatively impact your credit score.

- Carrying a Balance Improves Credit Score: Contrary to popular belief, carrying a balance on your credit card does not improve your credit score. In fact, it can increase your credit utilization ratio and potentially have a negative effect on your credit score. Paying off your outstanding balance in full each month demonstrates responsible credit management and can positively impact your credit score.

- Closing Credit Card Helps Reduce Outstanding Balance: Some people mistakenly think that closing a credit card will automatically reduce their outstanding balance. However, closing a credit card account does not eliminate the existing debt. You are still responsible for paying off the outstanding balance, and closing the account may impact your credit utilization ratio and credit history.

- Outstanding Balance Affects Credit Score Forever: Your outstanding balance does not have a lasting impact on your credit score. It is a dynamic factor that can change month to month based on your credit card usage and payment history. By consistently managing your outstanding balance and making on-time payments, you can improve your credit score and minimize the impact of any previous high balances.

It’s essential to educate yourself about the true nature of outstanding balance and credit card management to avoid falling for common misconceptions. By understanding the facts, you can make informed decisions and effectively manage your credit card debt.

Conclusion

In conclusion, understanding and effectively managing your outstanding balance on a credit card is crucial for maintaining financial stability and a healthy credit profile. The outstanding balance represents the amount of money you owe to the credit card company, and it is influenced by factors such as purchases, payments, fees, and interest charges.

By monitoring your outstanding balance regularly, you can gain financial awareness, budget effectively, and avoid unnecessary fees or penalties. Implementing tips like paying your bill on time, avoiding minimum payments, and reducing unnecessary spending can help you manage your outstanding balance more efficiently.

Keeping your outstanding balance under control is especially important for your credit score. A high outstanding balance can negatively impact your credit utilization ratio, which is a key factor in determining your creditworthiness. By maintaining a low outstanding balance and making timely payments, you can positively influence your credit score and enhance your financial opportunities.

It’s important to dispel common misconceptions surrounding outstanding balances, such as the idea that minimum payments are sufficient or that carrying a balance improves your credit score. Understanding the realities of managing outstanding balances will help you make informed decisions and avoid potential pitfalls.

In summary, by actively monitoring and managing your outstanding balance, you can take control of your credit card debt, maintain a healthy credit profile, and work towards achieving financial well-being.