Finance

What IRS Number To Call To Verify Identity

Published: November 1, 2023

Need to verify your identity with the IRS? Find out which number to call for financial verification and prevent identity theft.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Need for Identity Verification

- Overview of IRS Identity Verification Process

- Common IRS Identity Verification Methods

- Importance of Calling the Right IRS Number

- How to Determine the Correct IRS Number to Call

- Steps to Verify Your Identity with the IRS

- Frequently Asked Questions (FAQs)

- Conclusion

Introduction

When it comes to managing our finances, it’s crucial to protect our identities and safeguard our personal information. This is especially true when dealing with government institutions like the Internal Revenue Service (IRS). The IRS often requires identity verification as part of their processes, and understanding the importance of this step is essential.

In this article, we will delve into the topic of IRS identity verification and provide valuable insights on how to navigate this process effectively. We’ll explore the various methods the IRS utilizes to verify identities, the significance of calling the right IRS number, and step-by-step instructions on how to verify your identity. So, whether you’re a taxpayer who is filing taxes, seeking assistance, or resolving an issue with the IRS, this guide will serve as a valuable resource to help you successfully verify your identity.

By familiarizing yourself with the necessary steps and resources, you can ensure a smooth and secure experience when interacting with the IRS. So let’s dive in and gain a deeper understanding of the IRS identity verification process.

Understanding the Need for Identity Verification

Identity verification is a critical step in any financial transaction or interaction, and the IRS is no exception. With the increasing prevalence of identity theft and fraud, it is crucial for the IRS to confirm the identity of taxpayers before proceeding with any requests or providing sensitive information. By implementing robust identity verification processes, the IRS aims to protect taxpayers’ personal data and prevent unauthorized access to tax records.

The primary purpose of identity verification is to ensure that the person contacting or corresponding with the IRS is indeed the taxpayer they claim to be. This allows the IRS to verify the validity of tax returns, process refund claims, and provide accurate information regarding tax matters. Identity verification helps to prevent potential fraudulent activities such as filing false tax returns, attempting to claim fraudulent refunds, or accessing sensitive taxpayer information.

Moreover, identity verification is crucial when communicating with the IRS over the phone or through written correspondence. Verifying your identity helps the IRS authenticate your identity and provides an additional layer of security for both parties involved. It helps minimize the risk of unauthorized individuals gaining access to your tax information and ensures that you are the only authorized person receiving confidential information or making decisions regarding your tax obligations.

Additionally, when interacting with the IRS, you may need to verify your identity for various reasons, such as resolving tax issues, updating your personal information, responding to notices, or seeking assistance regarding your tax account. Without proper identity verification, the IRS would not be able to provide personalized assistance or take appropriate actions to address your specific tax-related concerns.

Understanding the need for identity verification when dealing with the IRS is crucial to not only protect your own personal information but also to ensure that the IRS maintains the integrity and security of its operations. By complying with the identity verification requirements, you contribute to creating a safer and more efficient tax system.

Overview of IRS Identity Verification Process

The IRS has implemented a comprehensive identity verification process to protect taxpayers and ensure the accuracy of tax-related activities. This process involves confirming the identity of individuals who interact with the IRS, whether it be through tax return filings, phone calls, or written correspondence.

When you file your tax return electronically, the IRS uses sophisticated algorithms and filters to detect potential identity theft or fraudulent activities. If your tax return raises any red flags, you may be asked to go through an identity verification process before your return can be processed. This is done to ensure that the tax return is legitimate and you are the rightful taxpayer.

The identity verification process may also be triggered if you contact the IRS by phone or by mail regarding your tax account. In such cases, you may be required to verify your identity before the IRS can provide any sensitive information or take action on your request.

During the identity verification process, you may be asked to provide certain information and documentation to verify your identity. The specific requirements vary depending on the situation and the method of verification being used. Commonly requested documents include your Social Security number, date of birth, address, and personal identification numbers.

In some instances, the IRS may also request additional documentation to establish your identity, such as a copy of your driver’s license or passport. It is essential to provide accurate and up-to-date information during the verification process to avoid delays and ensure a successful outcome.

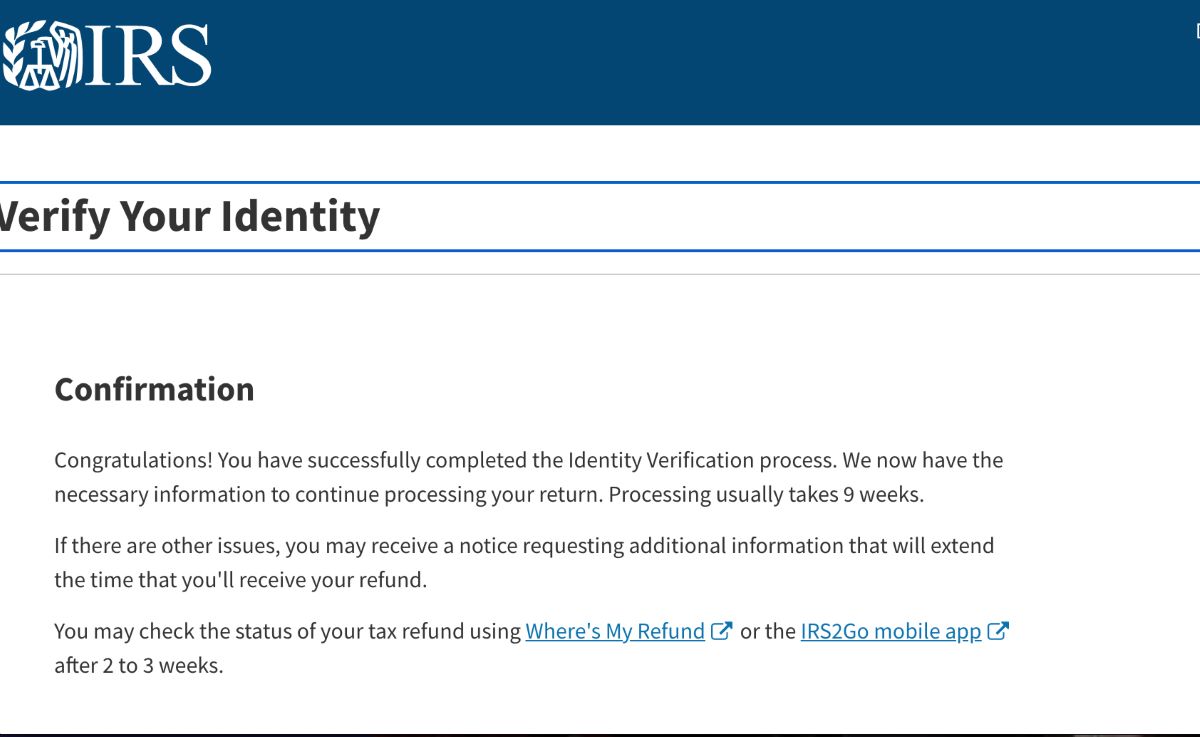

Once your identity is verified, the IRS will proceed with processing your tax return, providing necessary assistance, or taking appropriate actions based on your request. If, however, your identity cannot be verified, the IRS may delay processing your tax return or request additional information until the verification is complete.

It is important to note that the IRS takes identity verification seriously and continuously enhances its security measures to combat identity theft and fraudulent activities. By understanding the overview of the IRS identity verification process, you can prepare yourself to navigate this important step whenever necessary.

Common IRS Identity Verification Methods

The IRS employs several methods to verify the identities of individuals interacting with their system. These methods are designed to confirm that the person contacting the IRS is indeed the authorized taxpayer. Here are some of the common identity verification methods used by the IRS:

- Knowledge-Based Authentication (KBA): This method involves asking individuals a series of questions based on their personal and financial history. The questions can range from specific details about past addresses, loan amounts, or other information that only the authorized taxpayer would know. The accuracy of the responses helps establish the identity of the individual.

- Financial Verification: In some cases, the IRS may request financial information to verify an individual’s identity. This can include providing details about specific transactions, income amounts, or tax-related information. By comparing the information provided with their records, the IRS can confirm the identity of the taxpayer.

- Form 4506-T: The IRS may require individuals to complete Form 4506-T, which allows the IRS to verify the accuracy of the information provided on a tax return. By obtaining a copy of the individual’s tax transcript directly from the IRS, they can confirm the legitimacy of the tax return and verify the identity of the taxpayer.

- In-Person Verification: In certain situations, the IRS may require an individual to visit a local IRS office to verify their identity in person. This method is typically used when other verification methods cannot be completed or if there are additional concerns regarding the individual’s identity.

These are just a few examples of the common identity verification methods employed by the IRS. The specific method used may depend on the nature of the interaction, the level of risk associated with the transaction, and other factors determined by the IRS. It is important to provide accurate and truthful information during the verification process to ensure a smooth and successful outcome.

Importance of Calling the Right IRS Number

When it comes to verifying your identity with the IRS, calling the right IRS number is of utmost importance. The IRS has various phone lines dedicated to specific purposes, and choosing the correct number ensures that you receive the appropriate assistance and guidance for your specific needs.

Calling the right IRS number ensures that you reach the department or division that is equipped to handle identity verification inquiries. The IRS has specialized units trained to address identity verification concerns, and connecting with the appropriate unit will streamline the process and avoid unnecessary delays or confusion.

Using the correct IRS number also minimizes the risk of falling victim to scams or fraudulent schemes. Identity thieves and scammers often pose as IRS representatives and try to extract personal information or money from unsuspecting individuals. By calling the officially designated IRS number, you can confirm the legitimacy of the contact and protect yourself from becoming a victim of fraud.

Furthermore, when you call the right IRS number, you have access to professionals who are well-versed in the policies and procedures related to identity verification. They can provide accurate and up-to-date information, answer your questions, and guide you through the process to ensure that your identity is verified promptly and accurately.

Calling the correct IRS number also allows you to take advantage of electronic services and online resources provided by the IRS. Many identity verification processes can be completed digitally, saving you time and reducing the need for in-person visits or paper documentation. By reaching out to the appropriate IRS number, you can gain access to these convenient and efficient options.

Overall, calling the right IRS number is essential to ensure a smooth and secure identity verification process. It allows you to connect with the appropriate department, protect yourself from scams, receive accurate information, and access electronic services. By doing so, you can effectively verify your identity and resolve any tax-related concerns you may have.

How to Determine the Correct IRS Number to Call

Determining the correct IRS number to call is crucial to ensure you reach the appropriate department and receive the assistance you need. Here are some steps to help you determine the correct IRS number to call:

- Visit the Official IRS Website: The IRS official website, www.irs.gov, is a reliable source of information. Start by visiting their website and search for the specific purpose you are calling about. The IRS provides dedicated pages for various topics, including identity verification, tax returns, refunds, and more. These pages often include specific phone numbers to call for assistance.

- Review IRS Correspondence: If you have received a notice or letter from the IRS, it typically contains contact information specific to your situation. Be sure to read the correspondence carefully, as it may provide an IRS phone number or a unique reference number to use when contacting them.

- Check IRS Publications: The IRS publishes numerous documents and publications that may include contact information for specific inquiries. Look for publications related to your topic of interest and explore the contact information provided within those publications.

- Call the General IRS Customer Service Number: If you are unsure of the specific number to call, you can start by contacting the IRS general customer service line at 1-800-829-1040. The representatives there can guide you in the right direction and provide the appropriate contact information based on your inquiry.

- Consult a Tax Professional: If you are still unsure which IRS number to call, consider seeking advice from a tax professional. They have experience in navigating IRS processes and can provide guidance on the correct number to contact for your specific situation.

Remember to exercise caution when searching for IRS contact information online. Scammers may create fake websites or phone numbers that appear to be from the IRS but are designed to steal your personal information. Always verify the authenticity of the information by checking the official IRS website or consulting reliable sources.

By following these steps and taking the necessary precautions, you can determine the correct IRS number to call and ensure you reach the appropriate department for your identity verification needs.

Steps to Verify Your Identity with the IRS

If you find yourself in a situation where you need to verify your identity with the IRS, following the correct steps is crucial. Here is a general guide on how to verify your identity with the IRS:

- Gather Required Documentation: Start by gathering the necessary documentation based on the specific method of identity verification being used. Common documents include your Social Security number, date of birth, address, and personal identification numbers. Be prepared to provide accurate and up-to-date information during the verification process.

- Follow IRS Instructions: If you receive a notice or letter from the IRS requesting identity verification, carefully read the instructions provided. The notice will outline the specific steps you need to take and may provide a phone number or online resource to initiate the verification process.

- Contact the IRS: Call the appropriate IRS number based on the purpose of your identity verification. Follow the steps outlined in the previous section to determine the correct number to call. When speaking with an IRS representative, explain that you need to verify your identity and follow their instructions.

- Provide Required Information: During the verification process, you will be asked to provide the necessary information and documentation. This may include answering knowledge-based questions or submitting forms and supporting documents electronically or by mail. Ensure that the information you provide is accurate and consistent with your prior tax filings.

- Follow Up: After submitting the required information, follow any additional instructions provided by the IRS. This may include waiting for a confirmation or resolving any outstanding issues that may have arisen during the verification process. It is important to address any concerns promptly to ensure a successful outcome.

- Keep Documentation: Throughout the identity verification process, it is essential to keep a record of all communication, notices, forms, and supporting documentation. This will help you track your progress and provide evidence of your compliance with the IRS requirements, should any questions or issues arise in the future.

It’s important to note that the specific steps and requirements for verifying your identity with the IRS may vary based on your situation. Always follow the instructions provided by the IRS, as they will guide you through the process and ensure that your identity verification is completed successfully.

By following these steps, you can effectively verify your identity with the IRS and ensure that your tax-related matters are handled accurately and securely.

Frequently Asked Questions (FAQs)

Here are some common questions related to IRS identity verification:

-

What is the purpose of IRS identity verification?

The purpose of IRS identity verification is to ensure that the person contacting or corresponding with the IRS is the authorized taxpayer. It helps prevent identity theft, fraudulent tax filings, and unauthorized access to tax records. -

How does the IRS verify my identity?

The IRS employs various methods to verify identities, such as knowledge-based authentication (KBA), financial verification, requesting specific forms (like Form 4506-T), or in-person verification. -

Why does the IRS ask me to verify my identity?

The IRS requests identity verification to protect both taxpayers and their own operations. By confirming your identity, the IRS ensures the accuracy of tax-related activities, prevents potential fraud, and safeguards confidential taxpayer information. -

What information do I need to provide for identity verification?

The specific information required for identity verification can vary, but common items include your Social Security number, date of birth, address, and personal identification numbers. Additional documentation or forms may be required depending on the verification method used. -

How can I find the correct IRS number to call for identity verification?

To determine the correct IRS number to call, visit the official IRS website, review IRS correspondence, consult relevant IRS publications, or call the general IRS customer service number. These resources can provide you with the appropriate contact information based on your specific needs. -

What happens if my identity cannot be verified with the IRS?

If your identity cannot be verified, the IRS may delay processing your tax return or request additional information until the verification is complete. It is essential to provide accurate and up-to-date information to ensure a smooth verification process.

These are just a few frequently asked questions regarding IRS identity verification. If you have specific concerns or unique circumstances, it is recommended to consult the IRS website or seek guidance from a tax professional to address your specific needs.

Conclusion

Verifying your identity with the IRS is a crucial step in ensuring the integrity and security of your tax-related activities. By understanding the importance of identity verification, familiarizing yourself with the IRS identity verification process, and following the correct steps, you can navigate this process effectively.

Remember the significance of calling the right IRS number to ensure that you connect with the appropriate department and receive accurate information. By providing the necessary documentation and following the instructions provided by the IRS, you can successfully verify your identity and resolve any tax-related concerns you may have.

Identity verification not only protects your personal information but also helps the IRS maintain the security of its operations and prevent fraudulent activities. By complying with the identity verification requirements, you contribute to creating a safer and more efficient tax system.

If you have any doubts or questions about the IRS identity verification process, consult the official IRS website, review IRS correspondence, or seek guidance from a tax professional. By staying informed and proactive, you can ensure a smooth and secure experience when interacting with the IRS.

Remember, verifying your identity with the IRS is an essential step in protecting your financial well-being and maintaining the integrity of the tax system. By following the guidelines provided in this article, you can successfully navigate the IRS identity verification process and safeguard your personal information throughout your tax-related activities.