Finance

What Is A Limitation Of Online Banking

Published: November 27, 2023

Discover the limitation of online banking for finance. Learn how it impacts personal finances and find alternative solutions to manage your money effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

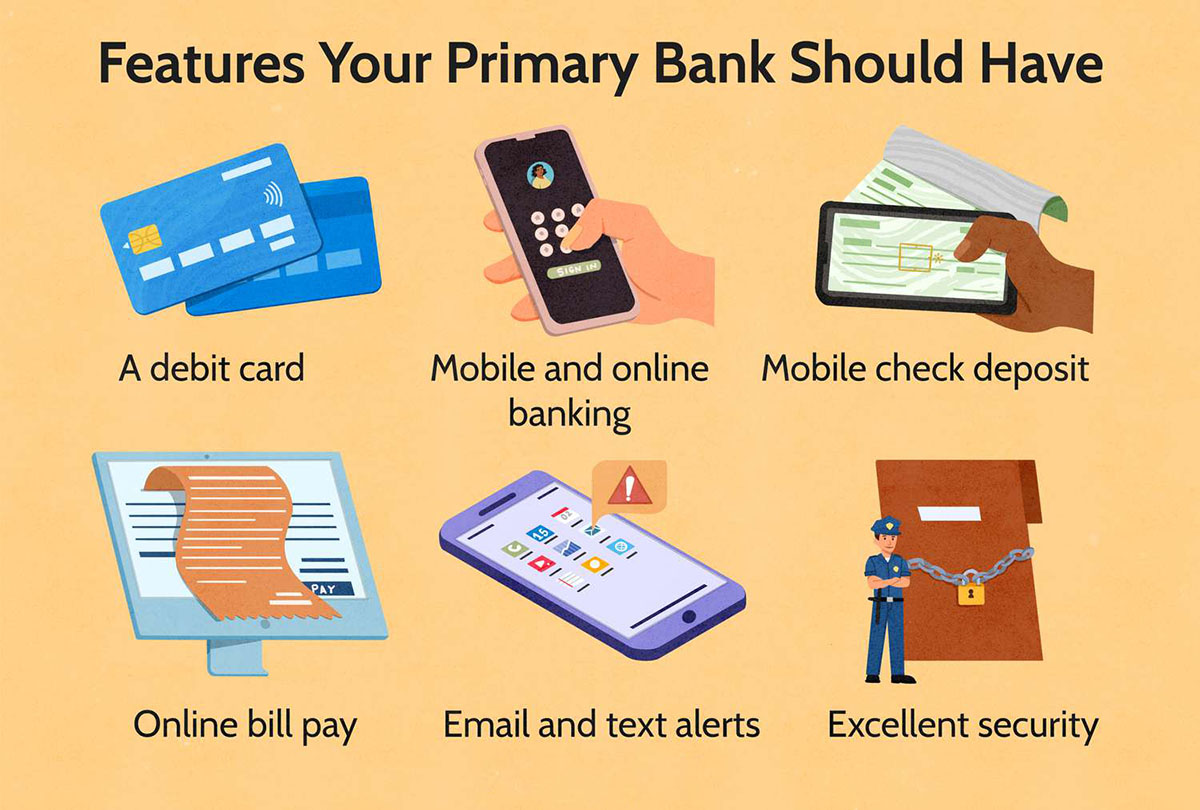

With the rapid advancement of technology, online banking has become an integral part of our lives. It offers convenience, accessibility, and time-saving benefits that were unfathomable just a few decades ago. Online banking allows us to manage our finances, make transactions, and access banking services anytime, anywhere, with just a few clicks.

However, like any other technological innovation, online banking also has its limitations. It is important to understand and be aware of these limitations before fully embracing this digital banking experience. This article will delve into the various limitations of online banking and shed light on some of the challenges that users may face.

While online banking provides numerous advantages, such as real-time balance updates, electronic statements, and quick funds transfer, it is essential to acknowledge its limitations. By doing so, users can make informed decisions and take necessary precautions to mitigate any associated risks.

The following sections will explore the limitations of online banking, including the lack of face-to-face interaction, security concerns, limited access to cash, technical issues and downtime, dependence on internet connection, lack of personalized support, potential for fraud and scams, limited banking hours, and unsuitability for certain transactions. It is important to note that these limitations are not meant to discourage the use of online banking, but rather to highlight areas where caution and understanding are necessary.

Lack of Face-to-Face Interaction

One of the primary limitations of online banking is the lack of face-to-face interaction with bank representatives. Traditional banking allows customers to visit their local branch and speak with a teller or a customer service representative in person. This personal interaction not only provides a sense of security and trust but also enables customers to ask questions, seek clarifications, and receive immediate assistance with their banking needs.

With online banking, however, this personal touch is missing. While customers can communicate with bank representatives through phone or online messaging, it may not offer the same level of comfort or reassurance as face-to-face interaction. This can pose a challenge when dealing with complex transactions, requesting specialized services, or resolving issues that require detailed explanations or in-depth discussions.

Additionally, the lack of face-to-face interaction in online banking may make certain tasks more challenging. For instance, the process of opening a new account or applying for a loan typically involves paperwork and the need to physically provide documents. With online banking, customers may need to scan and upload documents, which can be time-consuming and less convenient compared to bringing them to a branch in person.

Despite these limitations, online banking platforms strive to provide alternatives to face-to-face interaction. Many banks offer extensive customer support services, including online chat, email support, and dedicated helplines. They also provide detailed FAQs and online tutorials to assist customers in navigating the various features and services available.

Despite the convenience of online banking, some individuals may still prefer the personal touch offered by traditional brick-and-mortar banks. They value the ability to form relationships with bank personnel and receive personalized assistance, particularly for more complex financial matters. However, for those who prioritize convenience and efficiency, online banking remains an attractive option, despite the lack of face-to-face interaction.

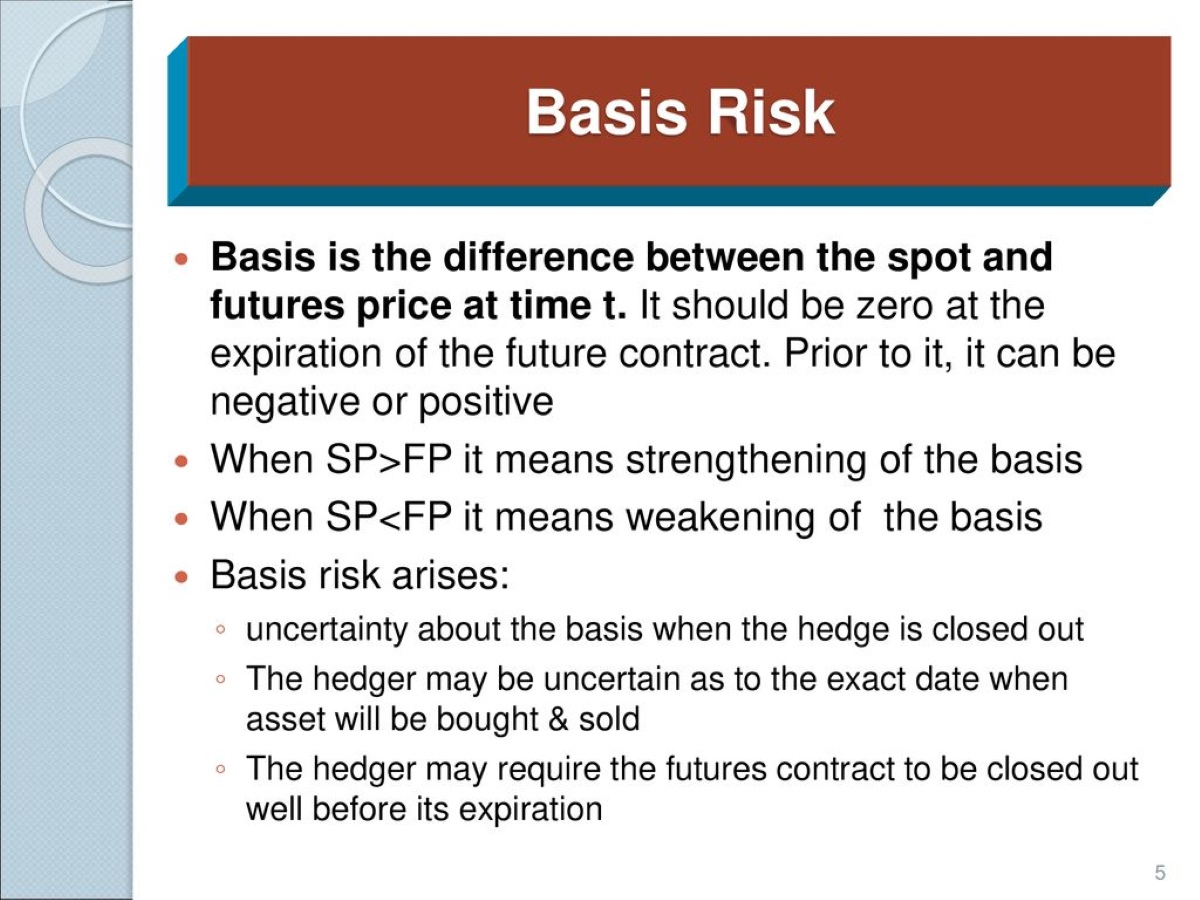

Security Concerns

While online banking offers convenience, it also raises concerns about security. The digital nature of online banking means that sensitive financial information is transmitted and stored electronically, which can be vulnerable to cyberattacks and unauthorized access.

One of the primary security concerns with online banking is the risk of phishing scams. Phishing scams involve fraudulent individuals or organizations attempting to obtain personal and financial information by impersonating legitimate banks or other trusted entities. These scammers often send convincing emails or create fake websites that mimic the appearance of legitimate banking platforms, tricking unsuspecting users into providing their login credentials and other sensitive details.

Another security concern is the potential for data breaches. Even with robust security measures in place, there is always a risk that hackers may find vulnerabilities and gain unauthorized access to a bank’s database. This could result in the exposure of customers’ personal and financial information, which can lead to identity theft and financial losses.

To address these concerns, banks invest in advanced encryption technologies and multi-factor authentication methods to protect customer information. Encryption ensures that data transmitted between the user’s device and the bank’s servers is secure and cannot be easily intercepted. Multi-factor authentication adds an extra layer of security by requiring users to provide additional verification beyond their login credentials, such as a one-time password sent to their mobile device.

Furthermore, banks educate their customers about potential security risks and provide guidance on how to safeguard their online banking accounts. This includes practices such as creating strong and unique passwords, regularly updating antivirus software, avoiding public Wi-Fi networks when accessing banking services, and being cautious of suspicious emails or messages.

Although online banking security has significantly improved over the years, it is essential for users to remain vigilant and proactive in protecting their personal information. By following recommended security practices and staying informed about the latest security threats, customers can minimize their risk and confidently engage in online banking activities.

Limited Access to Cash

While online banking offers convenience and flexibility, one of its limitations is the limited access to physical cash. Unlike traditional brick-and-mortar banks, where customers can directly withdraw cash from tellers or ATMs, online banking relies heavily on electronic transactions and digital funds.

This limitation becomes evident in situations where individuals require immediate access to cash. For example, if someone needs cash for an emergency or to make a purchase at a business that only accepts cash payments, online banking may not be sufficient. In such cases, individuals may need to visit a physical bank branch or locate an ATM to withdraw the required funds.

Moreover, certain transactions, particularly those involving large cash deposits or withdrawals, may not be feasible through online banking. Banks may have restrictions on the amount of cash that can be withdrawn through ATMs or may require prior notice for larger transactions. This can be inconveniencing for individuals who prefer or need to handle cash transactions.

However, it is important to note that online banking platforms often provide alternatives to physical cash, such as electronic fund transfers, mobile payment apps, and online payment services. These options allow users to make digital payments and transfer funds seamlessly, eliminating the need for cash in many day-to-day transactions.

Additionally, some online banks have established partnerships with traditional financial institutions, allowing their customers to use the affiliated bank’s ATMs for cash withdrawal. This helps bridge the gap and provides a degree of flexibility for those who still rely on physical cash for certain transactions.

In summary, while online banking offers numerous benefits, it may fall short when it comes to providing immediate access to physical cash. Users must be aware of this limitation and plan accordingly, especially in situations where cash transactions are necessary. Exploring alternative payment options and understanding the available withdrawal options can help individuals manage their finances effectively in the digital era.

Technical Issues and Downtime

A significant limitation of online banking is the occurrence of technical issues and downtime. As with any digital platform, online banking systems are susceptible to technical glitches, software updates, and maintenance requirements. These factors can sometimes result in service interruptions and temporary unavailability of banking services.

Technical issues can range from minor inconveniences, such as slow website loading or difficulty logging in, to more severe disruptions, like system crashes or transaction errors. When faced with such issues, customers may experience frustration and inconvenience, especially if they rely heavily on online banking for their financial activities.

Downtime, where the online banking system is completely inaccessible, can be particularly problematic. It can occur unexpectedly due to technical failures or scheduled maintenance work. During these periods, customers are unable to access their accounts, make transactions, or perform other banking activities. This can be especially challenging when time-sensitive financial matters or transactions are at stake.

Banks strive to minimize technical issues and downtime by investing in robust IT infrastructure, regular maintenance, and prompt issue resolution. However, it is impossible to completely eliminate the risk of technical problems. Therefore, it is important for users to have alternative ways to manage their finances, like keeping some cash on hand or having a backup credit card, in case online banking services are temporarily unavailable.

In the event of technical issues or downtime, it is crucial for banks to provide clear and timely communication to keep customers informed. This includes notifying users in advance about planned maintenance or system upgrades, and promptly addressing any unexpected disruptions. Clear communication helps to build trust and assures customers that their banking provider is actively working to resolve any issues.

Despite the potential for technical issues and downtime, online banking remains a widely adopted and convenient option for managing finances. The benefits of easy access, time efficiency, and convenience often outweigh the occasional inconveniences caused by technical problems. However, it is important for users to have contingency plans in place and maintain awareness of any scheduled maintenance or service disruptions to mitigate the impact of these limitations.

Dependence on Internet Connection

One significant limitation of online banking is its dependence on a stable internet connection. Without a reliable internet connection, customers may face difficulties accessing their online banking platforms, making transactions, or performing other banking activities.

In today’s digital age, where most people have access to the internet, this may not seem like a major concern. However, there are instances where individuals may experience internet outages, network disruptions, or limited connectivity due to various reasons such as technical issues or natural disasters. These disruptions can hinder the ability to access online banking services and conduct financial transactions.

Another consideration is the reliance on mobile data. While mobile banking applications offer convenience and accessibility, they require a reliable mobile data connection. In areas with poor mobile network coverage or high data costs, online banking may not be as accessible or feasible.

To address this limitation, banks often provide alternative methods for customers to access their accounts and carry out transactions. This includes telephone banking, where customers can perform basic banking functions over the phone by speaking with a bank representative. Additionally, banks may offer offline modes or mobile apps that allow users to view past transaction history or access limited features even without an internet connection. However, it is important to note that offline modes may have restricted functionality and cannot support real-time transactions.

While the dependence on internet connectivity is a recognized limitation of online banking, it is important to consider the broader context. In today’s interconnected world, reliable internet access is becoming more widespread, and advancements in technology continue to improve connectivity. Moreover, online banking offers numerous benefits that outweigh this limitation, such as the ability to access account information 24/7, easily transfer funds between accounts, and view real-time transaction updates.

Overall, the dependence on internet connection remains a limitation of online banking. Users must be aware of this and have contingency plans in place, such as maintaining alternative banking methods or preparing for possible internet disruptions. By doing so, individuals can continue to enjoy the convenience and efficiency provided by online banking while being prepared for any potential challenges related to internet connectivity.

Lack of Personalized Support

One of the limitations of online banking is the lack of personalized support that customers may experience compared to traditional banking. In a physical bank branch, customers have the opportunity to interact face-to-face with bank representatives who can provide personalized assistance, answer questions, and offer tailored financial advice.

Online banking, on the other hand, relies primarily on digital interactions and self-service tools. While many online banking platforms provide extensive resources such as FAQs, online chat support, and email assistance, some individuals may still prefer the personalized guidance and support that comes with in-person interactions.

This lack of personalized support can be noticeable in situations where customers require assistance with complex financial matters, such as investment strategies, retirement planning, or loan applications. Without the guidance of a dedicated bank representative, individuals may need to rely on their own research or consider seeking advice from outside sources.

However, it is important to note that technological advancements have led to the emergence of online financial advisory services and robo-advisors. These platforms leverage algorithms and data analysis to provide personalized investment advice and financial planning services. While not the same as face-to-face interaction, these digital solutions offer a level of personalization that can help bridge the gap between traditional banking support and online banking convenience.

Furthermore, many banks strive to provide a balance between self-service digital platforms and personalized support. They may offer dedicated helplines staffed by knowledgeable customer service representatives who can assist with more complex inquiries or guide customers through specific processes. Banks may also organize online webinars or educational resources to help users navigate the intricacies of financial management and banking operations.

It is also worth mentioning that some customers may feel more comfortable utilizing both online banking and traditional banking. They may choose to engage in online transactions and utilize digital services for day-to-day banking activities, while reserving visits to physical branches for more complex or personalized banking needs.

In summary, while online banking does lack the personal touch of face-to-face interactions, banks are increasingly implementing measures to provide a level of personalized support through alternative means. Customers should consider their individual preferences and requirements when deciding which banking approach best suits their needs.

Potential for Fraud and Scams

One of the significant concerns associated with online banking is the potential for fraud and scams. The digital nature of transactions and the use of personal information online can make customers vulnerable to various fraudulent activities if proper precautions are not taken.

Phishing scams, mentioned earlier in the article, pose a particularly significant threat. Phishing scams involve fraudulent individuals or organizations attempting to obtain personal and financial information by masquerading as legitimate entities. These scammers often use emails, text messages, or phone calls to deceive users into providing sensitive details such as usernames, passwords, or credit card numbers. Falling victim to phishing scams can result in identity theft, financial fraud, and unauthorized access to accounts.

In addition to phishing, online banking users need to remain cautious about other types of scams, such as fake websites, malware, and social engineering techniques. Fake websites may be designed to mimic legitimate banking platforms, tricking users into unsuspectingly providing their login credentials. Malware, including viruses and spyware, can compromise personal information stored on devices and enable unauthorized access to online bank accounts. Social engineering involves manipulating individuals to divulge sensitive information willingly through tactics like impersonating bank employees or claiming urgent financial matters.

Banks are well aware of the prevalence of fraud and scams in the online banking space and take numerous measures to protect their customers. They invest in advanced security systems, encryption technologies, and fraud detection algorithms to safeguard against unauthorized access and fraudulent activities. Banks also educate their customers about common fraud techniques and provide guidelines on how to protect themselves.

Customers, too, play a crucial role in mitigating the risk of fraud and scams. It is essential to remain vigilant and maintain good security practices, such as regularly updating passwords, avoiding clicking on suspicious links or opening suspicious attachments, and not sharing personal or financial information with unverified sources. Utilizing secure networks, enabling two-factor authentication, and regularly monitoring account activity are also effective steps to enhance security.

In case of suspected fraudulent activity, banks typically have dedicated fraud reporting mechanisms in place. Users can report any suspicious transactions, unauthorized access, or potential scams to the bank for investigation and resolution.

While the potential for fraud and scams is indeed a limitation of online banking, it should not discourage users from utilizing this convenient and efficient banking method. By maintaining awareness, adopting best security practices, and staying informed about the latest fraud trends, customers can mitigate the risk and confidently enjoy the benefits of online banking.

Limited Banking Hours

One of the limitations of online banking is the lack of 24/7 availability compared to traditional branch banking. Online banking platforms may have limited customer service hours or specific timeframes during which certain transactions can be completed.

With traditional banks, customers can visit their local branch during specified operating hours to speak with a bank representative, resolve issues, or perform transactions in person. These branches typically have set hours, including evenings and weekends, to accommodate customers’ schedules.

Online banking, on the other hand, operates primarily through digital platforms, which are subject to specific timeframes and may not offer round-the-clock access. While individuals can view their account balances or perform certain transactions at any time, there may be limitations for certain services or customer support. This can be challenging for individuals who need assistance outside of regular business hours or face urgent banking matters that cannot wait until the next working day.

However, it is important to note that online banking still provides a degree of flexibility compared to traditional banking hours. Online platforms allow users to access their account information, make transfers, and pay bills outside of branch operating hours. Additionally, many banks offer automated services, including 24/7 telephone banking and online chat support, which can address basic inquiries and perform routine transactions.

Furthermore, the limited banking hours can be mitigated by the ability to schedule future transactions in advance. Users can set up automated payments, schedule fund transfers, and initiate other transactions during their preferred time, even if it falls outside of regular banking hours. This feature allows for flexibility and convenience, as long as users plan ahead.

While online banking’s limited availability may be a concern for some users, it is important to consider the trends in banking services. The shift towards digital banking reflects the changing needs and preferences of customers who value convenience, efficiency, and flexibility. Banks are continuously adapting to meet these needs, investing in improved digital infrastructure and expanding customer service capabilities to offer extended hours and quicker response times.

Overall, while online banking may have limitations in terms of limited banking hours, it still provides a level of convenience and accessibility that traditional banking cannot match. Users who require assistance outside of regular operating hours may need to plan ahead or consider alternative banking channels, such as telephone banking or automated online services, to address their banking needs.

Not Suitable for Certain Transactions

While online banking offers a wide range of services, it may not be suitable for certain types of transactions. There are situations where the physical presence or specialized services of a traditional bank branch are necessary.

One example of transactions that may not be well-suited for online banking is the handling of large amounts of cash. Online banking platforms often have limitations on the amount of cash that can be deposited or withdrawn through ATMs. If individuals need to deposit a significant sum of money or make a large cash withdrawal, it is typically more convenient to visit a physical bank branch where such transactions can be efficiently and securely conducted.

Similarly, complex financial transactions or applications that require detailed discussions or specialized advice may not be ideal for online banking. These could include intricate investment strategies, mortgage applications, or business financing arrangements. In these instances, individuals may benefit from in-person interactions with bank representatives who can provide personalized guidance, address specific concerns, and answer detailed questions.

Furthermore, certain types of banking services, such as obtaining cashier’s checks, certified checks, or bank drafts, may require the physical presence of the account holder at the bank branch. These services often involve the verification of identity and specific documentation, which may not be feasible to complete through online channels.

Additionally, online banking may not be the preferred choice for individuals who prefer the tangible and tactile experience of handling physical money. Some individuals rely on physically depositing or withdrawing money as a way to budget or maintain a better sense of control over their finances.

While online banking may not be suitable for all transactions, it is important to acknowledge that the scope and capabilities of online platforms continue to evolve. Many banks offer extended services through their online channels, including advanced investment options, application submission for loans, and live video chat with banking representatives to address more complex inquiries. These advancements in online banking aim to bridge the gap and provide a wider range of services that cater to a broader range of customer needs.

Ultimately, determining the suitability of online banking for specific transactions depends on the individual’s preferences, requirements, and comfort level. It is crucial to consider the nature of the transaction and evaluate the convenience, efficiency, and level of support offered by both online and traditional banking channels before making a decision.

Conclusion

Online banking has revolutionized the way we manage our finances, offering convenience, accessibility, and time-saving benefits. However, it is important to understand and acknowledge the limitations that come with this digital banking experience. By being aware of these limitations, users can make informed decisions, take necessary precautions, and utilize alternative banking methods when needed.

Some of the limitations of online banking include the lack of face-to-face interaction, security concerns, limited access to physical cash, potential technical issues and downtime, dependence on internet connectivity, limited personalized support, the potential for fraud and scams, limited banking hours, and unsuitability for certain types of transactions.

Despite these limitations, banks continuously strive to improve online banking platforms, enhance security measures, and extend customer support services. They invest in advanced technologies, introduce two-factor authentication, and provide educational resources to help users navigate the digital banking landscape safely.

Users also play a crucial role in mitigating the limitations of online banking by maintaining awareness, following security best practices, and staying informed about potential risks and scams. By remaining vigilant and proactive, customers can minimize their exposure to fraud and ensure the security of their personal and financial information.

While traditional banking offers some advantages, it is clear that online banking has become an integral part of modern financial management. The convenience, flexibility, and efficiency it offers often outweigh the limitations associated with it. For everyday banking needs, such as checking account balances, making payments, and transferring funds, online banking is a convenient and time-saving option.

As technology continues to evolve, online banking will likely become even more advanced, addressing many of the current limitations. However, it is essential for individuals to evaluate their own requirements, preferences, and comfort levels when choosing between online banking and traditional banking. In some cases, a combination of both may be the most suitable approach.

In conclusion, online banking provides numerous benefits, but it is not without its limitations. By understanding these limitations, exercising caution, and staying informed, users can make the most of online banking while safeguarding their financial well-being.