Finance

What Is A Lock-In Letter From The IRS?

Published: October 31, 2023

Discover what a lock-in letter from the IRS entails and how it impacts your financial situation. Gain insights into the implications and steps to navigate this crucial aspect of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

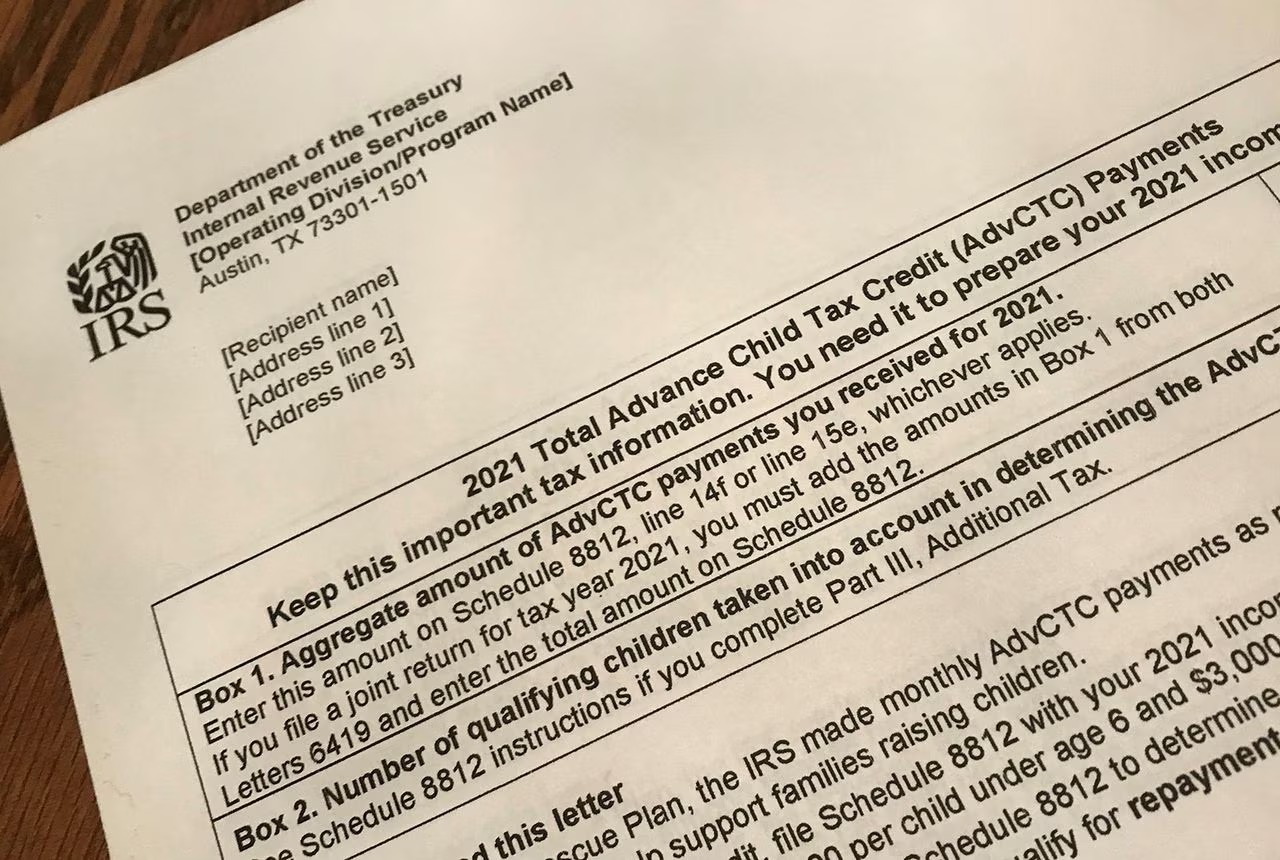

Understanding the intricacies of tax regulations can be a daunting task, especially when dealing with the Internal Revenue Service (IRS). One aspect of IRS communication that taxpayers may encounter is a Lock-In Letter. This official document can have significant implications for both individuals and businesses. In this article, we will explore what a Lock-In Letter is, its purpose, reasons for receiving one, its contents, the consequences of ignoring it, and how to respond if you find yourself in this situation.

A Lock-In Letter from the IRS serves as a notice to taxpayers that their withholding allowances have been adjusted. This adjustment is done by the IRS itself, superseding any previous allowances claimed by the taxpayer. Essentially, the Lock-In Letter enforces a specific withholding tax rate for the taxpayer’s income, thereby “locking in” the amount of taxes that will be withheld from their paychecks or other sources of income.

The primary purpose of a Lock-In Letter is to ensure accurate and adequate tax withholding from the taxpayer’s income. The IRS may issue this letter if they believe that the individual or business in question has been under-withholding taxes, potentially leading to a significant tax debt at the end of the year. By adjusting the withholding rate, the IRS aims to prevent this situation and guarantee that the correct amount of income tax is paid throughout the year.

There are several reasons why an individual or business might receive a Lock-In Letter from the IRS. One common scenario is when a taxpayer consistently owes a significant amount of taxes at the end of the year. This may indicate that they are not withholding enough from their income. The IRS may also issue a Lock-In Letter if there are discrepancies and inconsistencies in the taxpayer’s previous tax returns or if they failed to file tax returns altogether.

When a taxpayer receives a Lock-In Letter, it typically contains essential information related to their tax withholding. The letter will specify the appropriate tax withholding rate, the effective date of the new withholding rate, and any additional instructions or actions required by the recipient. It is crucial to review the contents of the Lock-In Letter thoroughly to understand the IRS’s expectations and comply with the new withholding requirements.

Definition of a Lock-In Letter from the IRS

A Lock-In Letter from the IRS is an official document that instructs taxpayers to withhold taxes from their income at a specific rate. The IRS issues these letters when they determine that the taxpayer’s current withholding allowances are inadequate or inaccurate. The purpose of a Lock-In Letter is to ensure that individuals or businesses pay the correct amount of taxes throughout the year, avoiding a large tax debt or potential penalties.

When the IRS sends a Lock-In Letter, it includes a new withholding rate that supersedes any previous allowances claimed by the taxpayer. This means that the recipient must adjust their tax withholding according to the specified rate, referred to as the “locked-in” rate. This rate remains in effect until the IRS approves a change or adjustment.

The Lock-In Letter serves as a way for the IRS to enforce proper tax compliance and prevent under-withholding. Under-withholding occurs when a taxpayer does not have enough taxes withheld from their income, which can result in a significant tax liability when filing a tax return. The IRS uses the Lock-In Letter as a proactive measure to ensure that taxpayers are meeting their tax obligations throughout the year.

It’s important to note that a Lock-In Letter is a legally binding document. Taxpayers are obligated to adhere to the new withholding rate specified in the letter. Failing to comply with the instructions outlined in the Lock-In Letter can lead to penalties and further scrutiny from the IRS.

The IRS issues Lock-In Letters based on their evaluation of a taxpayer’s historical compliance and financial situation. If the IRS determines that the individual or business is not withholding enough taxes or has been inconsistent in their previous tax filings, they may issue a Lock-In Letter to rectify the situation. The goal is to ensure that taxpayers withhold the correct amount of taxes, preventing any potential financial hardships at the end of the tax year.

Purpose of a Lock-In Letter

The purpose of a Lock-In Letter from the IRS is to ensure accurate and adequate tax withholding from a taxpayer’s income. By issuing this letter, the IRS aims to rectify situations where the taxpayer’s current withholding allowances are insufficient, potentially leading to a significant tax debt at the end of the year.

One of the primary purposes of a Lock-In Letter is to address cases where taxpayers consistently owe a substantial amount of taxes when filing their annual tax returns. This situation often indicates that the individual or business is not withholding enough taxes from their income throughout the year. The IRS uses the Lock-In Letter as a proactive measure to enforce a specific tax withholding rate that will prevent the accumulation of a large tax debt.

The purpose of the Lock-In Letter is also to promote tax compliance. If the IRS identifies discrepancies or inconsistencies in a taxpayer’s previous tax returns or if the taxpayer has failed to file tax returns altogether, they may issue a Lock-In Letter. This serves as a mechanism to ensure that the taxpayer is meeting their tax responsibilities and providing accurate information to the IRS.

Another purpose of the Lock-In Letter is to provide a clear and enforceable directive to the taxpayer. With the specified withholding rate outlined in the letter, the IRS aims to eliminate any ambiguity regarding the appropriate amount of taxes to be withheld. By providing a specific and “locked-in” rate, the IRS ensures that the taxpayer follows the instructions and withholds taxes accordingly.

Furthermore, the purpose of issuing a Lock-In Letter is to alleviate any potential financial burdens for the taxpayer at the end of the year. By adjusting the withholding rate, the IRS ensures that the taxpayer incrementally pays their tax liability throughout the year, rather than facing a substantial lump sum payment when filing their tax return.

Ultimately, the purpose of a Lock-In Letter is to establish a consistent and accurate method of tax withholding for the taxpayer’s income. By enforcing a specific withholding rate, the IRS aims to prevent under-withholding and promote tax compliance, ensuring that taxpayers meet their obligations and avoid penalties or other consequences associated with insufficient tax payments.

Reasons for Receiving a Lock-In Letter

There are several reasons why an individual or business may receive a Lock-In Letter from the IRS. This official document is typically issued when the IRS determines that the taxpayer’s current withholding allowances are inadequate or inaccurate. Let’s explore some common scenarios that can lead to receiving a Lock-In Letter:

1. Consistent tax debts: If a taxpayer consistently owes a significant amount of taxes when filing their annual tax return, it may trigger the issuance of a Lock-In Letter. This indicates that the individual or business is under-withholding taxes throughout the year, resulting in a large tax liability. The IRS uses the Lock-In Letter to enforce a specific withholding rate that ensures the taxpayer pays the appropriate amount of taxes each pay period.

2. Inaccurate previous tax returns: Discrepancies or inconsistencies in a taxpayer’s previous tax returns can also prompt the IRS to issue a Lock-In Letter. The IRS may identify errors, omissions, or discrepancies that raise concerns regarding the accuracy of the taxpayer’s reported income or deductions. In such cases, the Lock-In Letter aims to rectify any inaccuracies and ensure the taxpayer provides accurate information for future tax filings.

3. Failure to file tax returns: If an individual or business fails to file tax returns or has a history of non-compliance, the IRS may issue a Lock-In Letter. This serves as a way to both address the non-compliance issue and ensure that the taxpayer meets their tax obligations moving forward. The Lock-In Letter provides a directive on the appropriate withholding rate to ensure timely and accurate tax payments.

4. Significant changes in income: Major changes in income, such as a substantial increase or decrease in earnings, can also trigger the issuance of a Lock-In Letter. The IRS may examine the taxpayer’s financial situation and determine that their current withholding allowances are no longer adequate. Adjusting the withholding rate through the Lock-In Letter helps align the tax withholding with the taxpayer’s new income level.

5. Under-reporting of income: If the IRS suspects that a taxpayer is under-reporting their income, it may result in the issuance of a Lock-In Letter. This often occurs when there are discrepancies between the income reported on tax returns and income information obtained from other sources, such as employers or financial institutions. The Lock-In Letter is used to establish a withholding rate that reflects the actual income earned by the taxpayer.

Receiving a Lock-In Letter can be an indication that the IRS has identified potential issues with a taxpayer’s withholding or tax compliance. It is important to address the concerns raised in the letter promptly and take steps to comply with the new withholding requirements outlined by the IRS.

Content of a Lock-In Letter

A Lock-In Letter from the IRS contains important information related to a taxpayer’s tax withholding. The letter includes specific details and instructions that the recipient must follow to ensure compliance with the IRS’s requirements. Here are the key components typically found in a Lock-In Letter:

1. Withholding rate: The Lock-In Letter specifies the new withholding rate that supersedes any previous withholding allowances claimed by the taxpayer. This rate is “locked-in,” meaning it must be applied to the taxpayer’s income until the IRS approves a change or adjustment. The withholding rate determines the percentage of taxes to be withheld from the individual or business’s income.

2. Effective date: The letter indicates the date when the new withholding rate goes into effect. It is crucial to note this date to ensure that the appropriate withholding adjustments are made timely. Failing to comply with the effective date can have consequences such as incorrect tax withholding and potential penalties.

3. Instructions: The Lock-In Letter provides specific instructions on how the taxpayer should implement the new withholding rate. This may involve adjusting payroll systems, informing employers, or making changes to other sources of income. It is essential to carefully read and understand these instructions to ensure compliance with the IRS’s requirements.

4. Contact information: The letter includes contact information for the IRS representative who issued the Lock-In Letter. This allows the taxpayer to seek clarification or address any questions or concerns they may have regarding the letter’s content or requirements. It is advisable to keep this information readily available for future reference.

5. Consequences of non-compliance: The Lock-In Letter may outline the potential consequences of failing to comply with the new withholding rate and instructions. These consequences can include penalties, additional taxes owed, or increased IRS scrutiny. It is crucial to understand the ramifications of non-compliance and take appropriate action to avoid any further complications.

6. Request for additional information: In some cases, the Lock-In Letter may request additional information to support the taxpayer’s compliance and help the IRS assess their tax situation accurately. This may involve providing documentation, such as updated financial information or relevant tax records. Responding promptly and providing the requested information can help ensure a smoother resolution.

It is vital to thoroughly review the content of the Lock-In Letter and understand the IRS’s expectations. Failure to comply with the instructions outlined in the letter can lead to significant financial and legal consequences. If there are any uncertainties or concerns, reaching out to the designated IRS representative for clarification is recommended.

Consequences of Ignoring a Lock-In Letter

Ignoring a Lock-In Letter from the IRS can have serious consequences for taxpayers. It is essential to understand the implications of disregarding or failing to comply with the instructions outlined in the letter. Here are some potential consequences of ignoring a Lock-In Letter:

1. Penalties and interest: Ignoring a Lock-In Letter can result in penalties and interest accruing on any underpaid taxes. The IRS may assess penalties for under-withholding, late or non-payment of taxes, and failure to comply with tax regulations. The longer the non-compliance continues, the more the penalties and interest can accumulate, further exacerbating the taxpayer’s financial burden.

2. Increased tax liability: Ignoring a Lock-In Letter typically means that the taxpayer continues to withhold taxes based on their previous allowances, which may not align with the IRS’s requirements. As a result, the taxpayer may end up underpaying their taxes and accumulating a higher tax liability at the end of the year. This can lead to financial strain and difficulties in settling the outstanding tax debt.

3. IRS enforcement actions: Non-compliance with a Lock-In Letter can trigger more severe enforcement actions by the IRS. This can include wage garnishment, bank levies, or the filing of a federal tax lien on the taxpayer’s property or assets. These enforcement actions can have a significant impact on the taxpayer’s financial stability and creditworthiness.

4. Audit or increased scrutiny: Ignoring a Lock-In Letter may raise red flags with the IRS, potentially subjecting the taxpayer to increased scrutiny or even an audit. This can result in a deeper examination of the individual or business’s financial records, tax returns, and overall tax compliance. An audit can be time-consuming, stressful, and may uncover additional tax liabilities or discrepancies.

5. Damaged reputation: Non-compliance with IRS directives, including ignoring a Lock-In Letter, can damage a taxpayer’s reputation. This can have consequences in various aspects of life, including professional reputation and credibility. Businesses may also face reputational damage, affecting customer trust and relationships.

6. Legal consequences: Continued non-compliance with IRS instructions can lead to legal consequences, such as civil or criminal penalties. Willful non-compliance or intentional tax evasion can result in criminal charges, fines, and even imprisonment. It is crucial to take IRS communications seriously and promptly address any concerns or issues raised.

It is highly recommended to carefully review and comply with the instructions outlined in a Lock-In Letter to avoid these significant consequences. If there are legitimate concerns or challenges in meeting the requirements, seeking professional advice or contacting the IRS representative assigned to the case can help find a resolution and prevent further complications.

Responding to a Lock-In Letter

When receiving a Lock-In Letter from the IRS, it is essential to respond promptly and appropriately to ensure compliance with the new tax withholding requirements. Here are the steps to consider when responding to a Lock-In Letter:

1. Review the letter: Thoroughly read and understand the content of the Lock-In Letter. Pay attention to the specified withholding rate, effective date, and any additional instructions or requirements. Understanding the IRS’s expectations is crucial for taking the appropriate actions.

2. Evaluate the accuracy: Verify the information provided in the Lock-In Letter against your records. Ensure that the IRS’s determination is based on accurate and up-to-date information. If there are any discrepancies or inaccuracies, gather supporting documentation to present your case to the IRS.

3. Assess your financial situation: Evaluate your financial situation to ensure that you can comply with the new withholding requirements. Review your income, expenses, and cash flow to determine how the adjusted withholding rate will impact your overall financial well-being. If necessary, consult with a tax professional or financial advisor for guidance.

4. Contact the IRS representative: If you have questions or require clarification regarding the Lock-In Letter, reach out to the IRS representative whose contact information is provided in the letter. Communicating with the IRS representative can help address any concerns or issues you may have and ensure a clear understanding of the requirements.

5. Make the necessary adjustments: Adjust your tax withholding according to the instructions outlined in the Lock-In Letter. Update your payroll system or inform your employer of the new withholding rate if applicable. Ensure that the withholding adjustments align with the effective date specified in the letter to avoid any compliance issues.

6. Keep records: Maintain thorough records of your correspondence with the IRS and the adjustments made in response to the Lock-In Letter. Keep copies of any supporting documentation, such as updated financial information or communication with the IRS representative. These records will be essential in case of any future inquiries or audits.

7. Monitor future correspondence: After responding to the Lock-In Letter, continue to monitor your correspondence from the IRS. Ensure that there are no additional requests for information or further actions required. Compliance with the IRS’s instructions and any ongoing communication will be essential to avoid any potential penalties or enforcement actions.

Responding promptly and effectively to a Lock-In Letter is crucial for tax compliance and to avoid any negative consequences. It is advisable to seek professional advice, such as consulting with a tax professional or accountant, if you have specific concerns or challenges with complying with the requirements outlined in the Lock-In Letter.

Appealing a Lock-In Letter Decision

If you disagree with the decision outlined in a Lock-In Letter from the IRS, you have the option to appeal the decision. The appeal process allows you to present your case and provide additional information to challenge the IRS’s determination. Here are the steps to consider when appealing a Lock-In Letter decision:

1. Familiarize yourself with the appeal process: Review the IRS’s guidelines and procedures for appealing a decision. Understand the specific steps involved, the deadline for filing an appeal, and the required forms or documentation.

2. Gather supporting documentation: Collect any relevant documentation that supports your case and challenges the IRS’s determination. This can include past tax returns, financial records, and any additional information that provides clarity or justification for your position.

3. Complete the necessary forms: Fill out the appropriate forms required for the appeal process. This may include Form 9423, Collection Appeal Request, or other specific forms related to the lock-in decision. Ensure that you fill out the forms accurately and include all necessary supporting documentation.

4. Submit the appeal: Submit the completed forms and supporting documentation to the IRS within the designated timeframe. It is crucial to meet the deadline for filing the appeal to ensure that your case is considered. Keep copies of all documents submitted for your records.

5. Await response and engage in communication: After submitting the appeal, the IRS will review your case and provide a response. It is important to remain diligent and responsive during this process. Communicate promptly with the IRS representative assigned to your case and provide any additional information they may request.

6. Seek professional advice if necessary: If you require assistance or encounter difficulties during the appeal process, consider seeking professional advice from a tax attorney, certified public accountant (CPA), or enrolled agent. They can provide guidance, advocate on your behalf, and ensure that your appeal is effectively presented.

7. Review the decision and next steps: Once the IRS responds to your appeal, carefully review their decision. If the appeal is successful, the Lock-In Letter decision may be modified or overturned. However, if the appeal is denied, you may need to consider other options, such as working out a payment plan or exploring further legal remedies.

8. Comply with the new decision: If the appeal results in a modified or overturned decision, comply with the updated instructions or requirements provided by the IRS. Adjust your tax withholding accordingly and ensure that you meet your tax obligations based on the new determination.

Remember to keep detailed records of your correspondence, appeal documents, and any ongoing communication with the IRS throughout the process. These records will be essential for future reference and potential audits or inquiries.

Appealing a Lock-In Letter decision requires careful preparation, adherence to deadlines, and effective communication with the IRS. Seeking professional advice can help navigate the complex appeal process and maximize your chances of a favorable outcome.

Conclusion

A Lock-In Letter from the IRS can have significant implications for individuals and businesses when it comes to tax withholding. Understanding what a Lock-In Letter is, its purpose, and the consequences of non-compliance is crucial in navigating this situation effectively.

A Lock-In Letter serves to ensure accurate and adequate tax withholding, addressing situations where taxpayers consistently owe significant taxes or have been inconsistent in their previous tax filings. It provides a specific withholding rate that supersedes any previous allowances claimed by the taxpayer, preventing under-withholding and potential tax debt.

Ignoring a Lock-In Letter can lead to a range of consequences, including penalties, increased tax liability, IRS enforcement actions, audit scrutiny, and damage to one’s reputation. It is essential to respond promptly to the letter, evaluate its accuracy, and assess your financial situation to comply with the new withholding requirements.

If you disagree with the Lock-In Letter decision, you have the right to appeal. Going through the appeal process involves gathering supporting documentation, submitting the necessary forms, and engaging in communication with the IRS representative assigned to your case.

In conclusion, it is crucial to take a Lock-In Letter from the IRS seriously and respond appropriately. Complying with the instructions outlined in the letter or appealing the decision can help ensure tax compliance, minimize penalties, and maintain a good standing with the IRS. Seeking professional advice from a tax professional can further assist in navigating the process and maximizing the chances of a favorable outcome.

Remember, taking proactive steps and staying informed can help individuals and businesses navigate the complexities of tax withholding and maintain a strong relationship with the IRS.