Finance

What Is A Vendor Credit

Published: January 11, 2024

Discover what a vendor credit is and how it can impact your finances. Learn how to optimize these credits to gain financial advantage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When conducting business transactions, it’s not uncommon for vendors and suppliers to offer special incentives to their customers. One such incentive is a vendor credit, which can be a valuable asset for both businesses and individuals alike. In this article, we will explore the concept of vendor credits, how they work, their benefits and drawbacks, and provide examples of how they can be utilized.

A vendor credit, also known as a supplier credit or a vendor rebate, is essentially a form of payment or compensation that a vendor offers to a customer as an incentive. Unlike traditional discounts that are applied at the time of purchase, vendor credits are typically issued after the transaction has taken place. This allows the vendor to reward customers for their loyalty or encourage future business.

Vendor credits can take various forms, such as cash refunds, account credits, or credits towards future purchases. The specific terms and conditions of the vendor credit will vary depending on the vendor’s policies and the nature of the transaction. It’s important to understand that vendor credits are not a guaranteed benefit, but rather a promotional tool that vendors use to incentivize their customers.

Now that we have a basic understanding of what vendor credits are, let’s delve deeper into how they work and the benefits they can offer to businesses and individuals.

Definition of Vendor Credit

A vendor credit refers to a payment or compensation issued by a vendor or supplier to a customer as an incentive or reward. It is a form of credit that is often given to customers after they have made a purchase or fulfilled certain conditions set by the vendor. This credit can come in various forms, including cash refunds, account credits, or credits towards future purchases.

Vendor credits are different from discounts or price reductions because they are typically issued after the transaction has taken place. While discounts are usually applied at the time of purchase, vendor credits serve as a post-purchase incentive to encourage customer loyalty or future business. Vendors may offer these credits as a way to express gratitude to their loyal customers or to promote certain products or services.

The specific terms and conditions of a vendor credit can vary widely depending on the vendor’s policies and the nature of the transaction. Some vendors may offer a percentage of the purchase amount as a credit, while others may have a specified amount or a predetermined formula to calculate the credit. It is important for customers to carefully review the terms and conditions associated with vendor credits to fully understand how and when they can be utilized.

It is worth noting that vendor credits are not guaranteed benefits and are at the discretion of the vendor. Not all vendors offer vendor credits, and even if they do, they may have specific requirements or restrictions in place. Customers should be aware of any time limitations or limitations on how the credit can be used, as there may be expiry dates or restrictions on eligible products or services.

In the next section, we will explore how vendor credits actually work and the various benefits they can offer to businesses and individuals.

How Vendor Credits Work

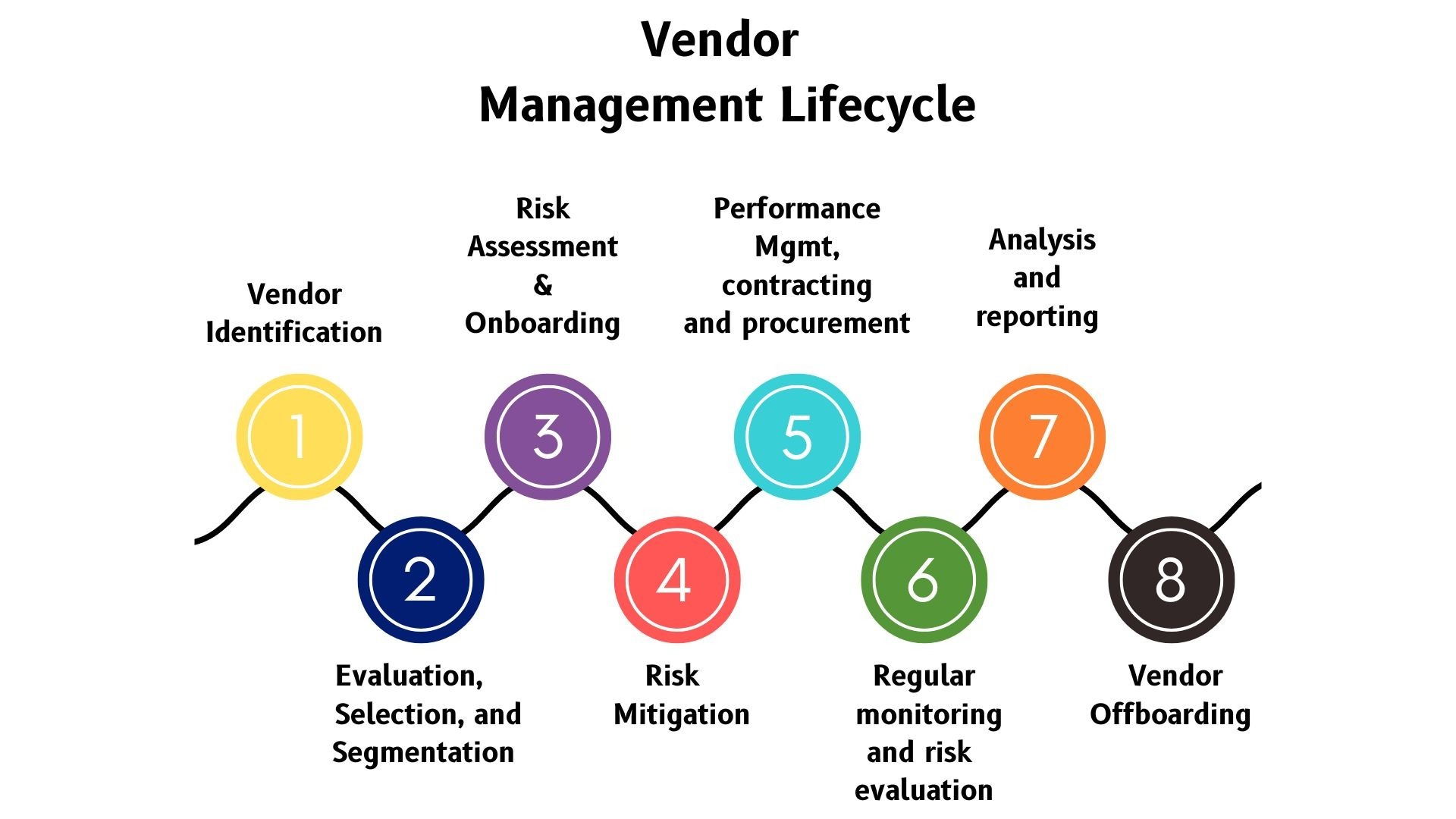

Vendor credits work by providing customers with a form of payment or compensation for their previous purchases or fulfilled conditions set by the vendor. Here is an overview of the typical process of how vendor credits are utilized:

- Purchase or fulfill conditions: Customers make a purchase or fulfill certain conditions specified by the vendor. This could include reaching a minimum spending threshold, purchasing specific products or services, or meeting any other criteria outlined by the vendor.

- Post-purchase verification: Once the transaction is completed, the vendor will review and verify that the customer has indeed met the requirements to be eligible for a vendor credit. The verification process may include validating the purchase receipt, confirming the fulfillment of conditions, or any other necessary checks.

- Issuance of vendor credit: If the customer is deemed eligible, the vendor will issue the vendor credit in the agreed-upon form. This could be in the form of a cash refund, a credit added to the customer’s account, or a credit that can be used towards future purchases.

- Notification to the customer: The vendor will notify the customer about the issuance of the vendor credit. This could be through email, a notification on the customer’s account, or any other communication method specified by the vendor.

- Utilization of vendor credit: Customers can then utilize the vendor credit based on the terms and conditions set by the vendor. This may involve applying the credit towards a future purchase, redeeming it for cash or credit on the customer’s account, or utilizing it in any other manner specified by the vendor.

- Expiration and restrictions: It is important for customers to be aware of any expiration dates or restrictions associated with their vendor credit. Vendor credits may have an expiry period after which they become invalid, and there may be limitations on the products or services that can be purchased using the credit.

It’s crucial for customers to carefully review the terms and conditions associated with vendor credits to understand how they work and how they can be utilized. By understanding the process, customers can effectively take advantage of the benefits of vendor credits while maximizing their value.

In the next section, we will explore the benefits that vendor credits can offer to businesses and individuals alike.

Benefits of Vendor Credits

Vendor credits offer several benefits to both businesses and individuals. Here are some of the key advantages:

- Incentivizes customer loyalty: Vendor credits are an effective way to reward and incentivize customer loyalty. By offering credits to customers for their continued patronage, vendors encourage repeat business and build long-term relationships with their customers.

- Increases customer satisfaction: Providing vendor credits can significantly enhance customer satisfaction. Customers appreciate receiving extra value or compensation for their purchases, which can result in a positive perception of the vendor and a higher level of satisfaction with the overall shopping experience.

- Promotes future purchases: Vendor credits can encourage customers to make future purchases. Knowing that they have a credit to utilize can motivate customers to return to the vendor’s store or website to redeem the credit and potentially make additional purchases. This can help drive sales and increase revenue for the vendor.

- Reduces overall costs: For businesses, vendor credits can help reduce overall costs. Instead of offering upfront discounts on products or services, vendors can provide credits that are redeemable towards future purchases. This allows vendors to maintain their profit margins while still providing an attractive incentive to customers.

- Fosters positive vendor-customer relationships: By offering vendor credits, vendors can establish and nurture positive relationships with their customers. Customers feel appreciated and valued when they receive vendor credits, which can lead to stronger loyalty, positive word-of-mouth referrals, and increased customer advocacy.

- Creates a competitive advantage: In competitive markets, offering vendor credits can give businesses a competitive edge. It differentiates them from their competitors and provides an additional benefit that can attract new customers and retain existing ones.

- Flexible utilization: Vendor credits often offer flexibility in how they can be utilized. Customers may have the option to apply the credit towards future purchases, use it for specific products or services, or even redeem it for cash or a credit on their account. This flexibility increases the perceived value of the credit for customers.

Overall, vendor credits not only benefit customers by providing them with additional value, but they also contribute to the success and growth of businesses by incentivizing customer loyalty, fostering positive relationships, and driving future purchases.

In the next section, we will discuss the potential drawbacks or considerations associated with vendor credits.

Drawbacks of Vendor Credits

While vendor credits can offer various advantages, it’s essential to consider the potential drawbacks and limitations. Here are some of the main drawbacks of vendor credits:

- Limited eligibility: Not all customers may be eligible for vendor credits. Vendors often have specific criteria that customers must meet to qualify for credits, such as reaching a minimum spending threshold or purchasing specific products. This limited eligibility can be disappointing for some customers who may not be able to take advantage of the credit.

- Expiration dates: Vendor credits may come with expiration dates, meaning customers must use them within a specified timeframe. If customers fail to redeem their credits before the expiration date, they may lose the opportunity to benefit from them. This can be a disadvantage if customers are unable to make a purchase within the allotted time or are unaware of the expiration date.

- Restrictions on usage: Vendors might impose restrictions on how vendor credits can be used. For example, customers may only be able to apply the credit towards specific products or services, or there may be limitations on the quantity or frequency of credit usage. These restrictions can limit the flexibility and potential benefits for customers.

- Potential for overspending: In certain situations, vendor credits can unintentionally encourage customers to overspend. Customers may feel compelled to make additional purchases to fully utilize the credit, even if they do not necessarily need or want the extra products or services. This can lead to impulsive buying decisions and potentially result in financial strain.

- Difficulty in tracking and managing: For both vendors and customers, tracking and managing vendor credits can be challenging. Vendors need to have systems in place to accurately record and monitor the issuance, redemption, and expiration of credits. Customers may also find it cumbersome to keep track of their credits and remember to utilize them before they expire.

- Reduced profit margin for vendors: While vendor credits can drive sales and customer loyalty, they can also impact the profit margins for vendors. Offering credits means providing additional value to customers without necessarily increasing the revenue generated from the initial purchase. Vendors need to carefully consider the financial implications and ensure that the benefits of offering vendor credits outweigh the potential loss of profit.

By acknowledging and addressing these drawbacks, both vendors and customers can effectively navigate the use of vendor credits and maximize their benefits while mitigating potential challenges or limitations.

In the next section, we will provide examples of how vendor credits can be applied in real-world scenarios.

Examples of Vendor Credit Scenarios

To better understand how vendor credits can be applied in real-world situations, let’s explore a few examples:

- Reward-based vendor credit: An online retailer may offer a vendor credit of 10% of the total purchase amount as a reward for loyal customers. This credit can be applied towards future purchases, encouraging customers to return and shop again.

- Seasonal promotion: A clothing store might run a promotion where customers who spend a certain amount during a specific period receive a vendor credit of $20. This credit can be used towards their next purchase within a given time frame, motivating customers to shop more frequently and spend higher amounts.

- Product-specific credit: A technology company may offer a vendor credit of $50 to customers who purchase a specific model of their product. This credit can be redeemed towards accessories or upgrades, encouraging customers to explore additional offerings from the company.

- Referral program credit: A subscription-based service may introduce a referral program, where existing customers receive a vendor credit of one month’s subscription fee for each referred friend who signs up. This credit can be applied towards future subscription payments, incentivizing customers to refer others and promoting customer acquisition.

- Purchase volume credit: A supplier of industrial equipment might offer a vendor credit of 5% on the total spending of a customer over a specific period. This credit can be accumulated and used towards future purchases, providing an ongoing incentive for customers to consistently choose the supplier for their needs.

These examples demonstrate how vendors can use vendor credits strategically to achieve various goals, such as promoting customer loyalty, increasing sales volume, or introducing new products or services. By tailoring vendor credit scenarios to their specific business objectives, vendors can effectively engage customers and foster mutually beneficial relationships.

In the next section, we will discuss the process of applying for vendor credits.

How to Apply for Vendor Credits

The process of applying for vendor credits may vary depending on the vendor and their specific policies. However, here are some general steps that customers can follow to apply for vendor credits:

- Make a qualifying purchase: Customers must first make a qualifying purchase or fulfill the specified conditions set by the vendor. This could involve reaching a minimum spending threshold, purchasing certain products or services, or meeting any other criteria outlined by the vendor.

- Keep track of the purchase details: It is crucial to retain the purchase receipt or any other relevant documentation as proof of the transaction. This will be necessary during the verification process to validate eligibility for the vendor credit.

- Review the terms and conditions: It’s essential to carefully review the terms and conditions associated with the vendor credit. This includes understanding the expiry date (if applicable), any restrictions or limitations on usage, and any other requirements that must be met to receive the credit.

- Contact the vendor if necessary: If there are any questions or clarifications needed, customers should reach out to the vendor’s customer service or support team for guidance. They can provide specific instructions on how to apply for the vendor credit and address any concerns customers may have.

- Follow the redemption process: Based on the vendor’s instructions, customers can proceed with the redemption process. This may involve submitting the necessary information, such as the purchase details, to the vendor via a designated channel (e.g., online form, email, or in-person submission).

- Await verification and issuance: After submitting the application, customers should allow the vendor time to verify their eligibility for the vendor credit. This verification process ensures that the customer has met all the requirements to receive the credit. Once verified, the vendor will issue the credit in the agreed-upon form.

- Confirm the receipt of the vendor credit: Customers should ensure that they receive confirmation from the vendor regarding the issuance of the vendor credit. This confirmation could be in the form of an email, a notification on their account, or any other communication method specified by the vendor.

It’s important to note that the specific steps and requirements may vary between vendors. Therefore, customers should always refer to the vendor’s instructions and guidelines to ensure a smooth application process for the vendor credits.

Once customers have successfully obtained the vendor credit, they can proceed to utilize it based on the vendor’s specified terms and conditions, as discussed in the next section.

How to Use Vendor Credits

Once customers have acquired vendor credits, they can utilize them according to the terms and conditions set by the vendor. Here are the general steps for using vendor credits:

- Review the terms and conditions: Customers should thoroughly read and understand the terms and conditions associated with their vendor credits. This includes any restrictions or limitations on usage, such as eligible products or services, expiration dates, and minimum purchase requirements.

- Determine the available options: Customers should explore the available options for using their vendor credits. This could include applying the credit towards a future purchase, redeeming it for cash or a credit on their account, or any other options specified by the vendor.

- Select the desired items: If the vendor credit can be applied towards a future purchase, customers should choose the items they wish to buy. They should ensure that the selected items meet the eligibility criteria outlined by the vendor.

- Proceed with the checkout process: During the checkout process, customers should indicate that they want to apply their vendor credit. This may involve entering a code or selecting the credit option from the available payment methods, depending on the vendor’s system.

- Verify the credit deduction: Upon applying the vendor credit, customers should verify that the credit amount has been correctly deducted from the total amount payable. They should carefully review the final payment summary to ensure the credit has been properly applied.

- Confirm the purchase: After confirming the details and payment, customers can proceed with the purchase. The vendor will process the transaction, and customers will receive the purchased items or services as usual.

- Keep track of remaining credit: Customers should keep track of any remaining balance of their vendor credit, especially if it is not fully utilized in a single transaction. This will help them effectively plan future purchases and ensure they make the most of the available credit before it expires.

It’s important for customers to familiarize themselves with the specific instructions and processes provided by the vendor for using their credits. By following these steps, customers can maximize the value of their vendor credits and enjoy the benefits they provide.

In the next section, we will discuss important considerations to keep in mind when dealing with vendor credits.

Considerations for Vendor Credits

While vendor credits can be valuable incentives, there are important considerations to keep in mind when dealing with them. These considerations can help customers make informed decisions and maximize the benefits of their vendor credits:

- Expiration dates: One crucial consideration is the expiration date of vendor credits. Customers should be aware of the timeframe in which they can utilize their credits. Failing to use the credits before they expire may result in the loss of the incentive.

- Restrictions on usage: Vendors may impose certain restrictions on how vendor credits can be used. Customers should carefully review any limitations on eligible products or services, quantity restrictions, or other conditions specified by the vendor. This will ensure they can utilize their credits effectively.

- Balance tracking: Customers should keep track of their remaining vendor credit balance, especially if it is not fully utilized in a single transaction. This allows them to plan future purchases and maximize the value of their credits before they expire.

- Eligibility requirements: Not all customers may be eligible for vendor credits. Customers should thoroughly review the requirements set by the vendor and ensure they meet the necessary criteria to qualify for the credits. This avoids any disappointment or misunderstanding regarding their eligibility.

- Customer service support: If customers encounter any issues or have questions regarding their vendor credits, they should reach out to the vendor’s customer service or support team for assistance. Clear communication with the vendor can help address concerns and resolve any potential issues regarding the credits.

- Financial planning: Customers should incorporate their vendor credits into their financial planning. This includes budgeting for future purchases, estimating the value of their credits, and considering how the credits fit into their overall financial goals and priorities.

- Evaluating the overall value: Customers should assess the overall value of the vendor credit in relation to their specific needs and preferences. It’s important to consider whether the credit aligns with their purchasing habits and whether it provides meaningful savings or benefits.

- Reviewing vendor policies: Familiarizing oneself with the vendor’s policies and terms and conditions is crucial. Customers should thoroughly read and understand the vendor’s guidelines regarding vendor credits to ensure a smooth experience and avoid any surprises or misunderstandings.

By considering these factors, customers can make informed decisions and effectively utilize their vendor credits to their advantage.

Next, let’s conclude our exploration of vendor credits.

Conclusion

Vendor credits are valuable incentives offered by vendors and suppliers to reward customer loyalty and encourage future business. These credits can take various forms, such as cash refunds, account credits, or credits towards future purchases. While vendor credits offer several benefits, it is important to consider the potential drawbacks and keep key considerations in mind.

Vendor credits have numerous benefits, including incentivizing customer loyalty, increasing customer satisfaction, promoting future purchases, reducing overall costs for businesses, fostering positive vendor-customer relationships, and creating a competitive advantage. They also offer flexibility in their utilization, allowing customers to apply them to future purchases or redeem them as cash or account credits.

However, there are considerations to keep in mind when dealing with vendor credits. These include being aware of expiration dates and restrictions on usage, tracking the remaining credit balance, understanding eligibility requirements, seeking customer service support when needed, incorporating vendor credits into financial planning, evaluating the overall value of the credits, and reviewing vendor policies.

By understanding the process of obtaining and using vendor credits, customers can make informed decisions and maximize the benefits they offer. It is crucial to carefully review the terms and conditions associated with vendor credits and proactively manage their utilization to fully capitalize on these incentives.

In conclusion, vendor credits can be valuable tools for both vendors and customers. Vendors can use them to reward customer loyalty, promote sales, and foster strong relationships, while customers can enjoy added value, increased satisfaction, and potential savings. By leveraging vendor credits effectively, businesses and individuals alike can enhance their overall experience and achieve mutual success.