Finance

What Is An IRS Consent Form 4506-C?

Published: October 31, 2023

Learn what an IRS Consent Form 4506-C is and how it relates to finance. Discover its purpose and how to use it for financial purposes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to financial matters, transparency and verification of information are of utmost importance. This is especially true in the world of lending, where lenders need to thoroughly assess the financial history and creditworthiness of borrowers. To facilitate this process, the Internal Revenue Service (IRS) has developed various forms, one of which is the IRS Consent Form 4506-C.

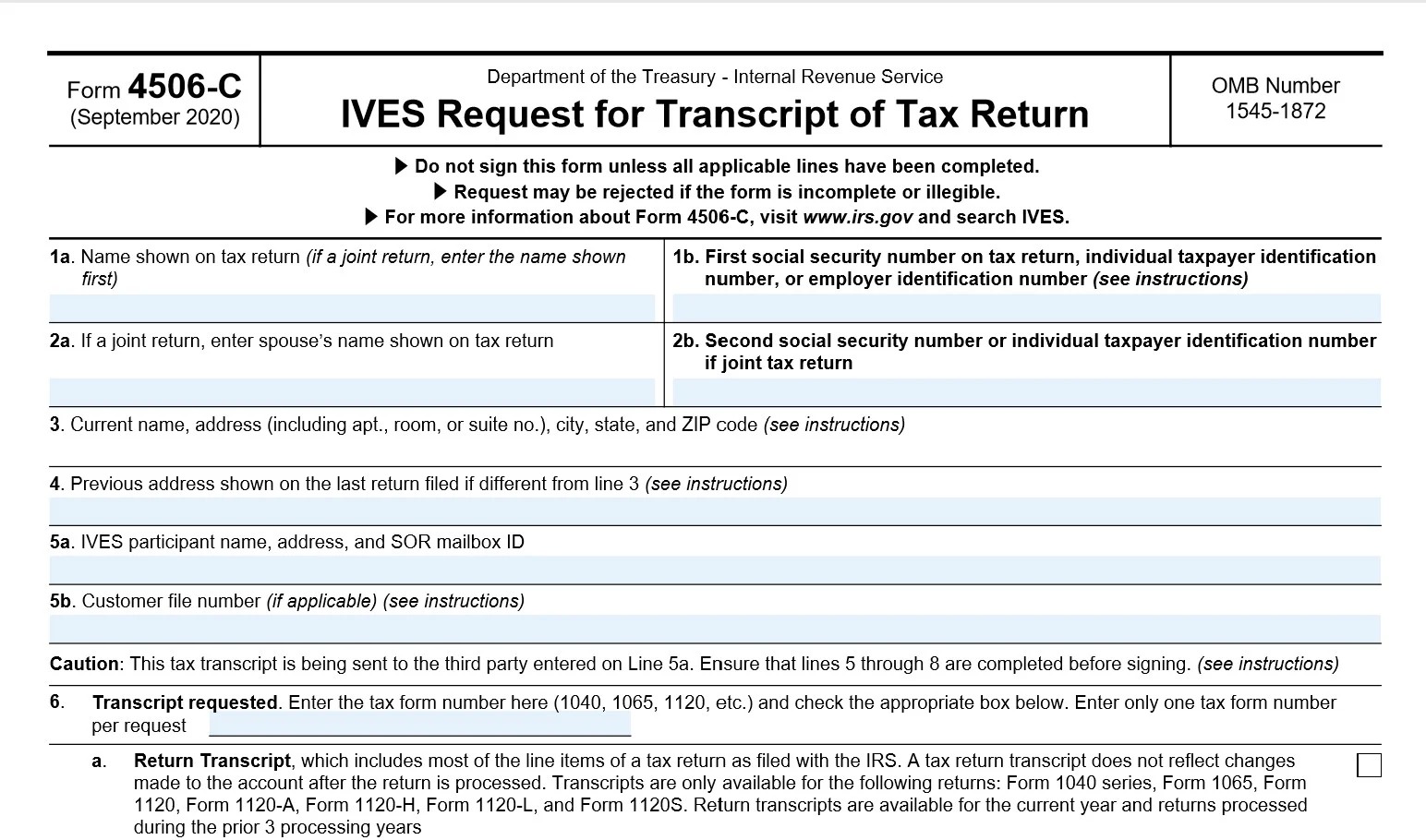

The Form 4506-C, also known as the Consent for Release of Information, is a document that authorizes the IRS to release an individual or a business entity’s tax return information to a third party. This form serves as a crucial tool for lenders, mortgage service providers, government agencies, and other authorized entities to verify the accuracy of the tax information provided by individuals or businesses.

The primary purpose of Form 4506-C is to reduce instances of fraud and protect lenders from potential losses. By requesting and reviewing a borrower’s tax return transcripts, lenders can validate the income stated on loan applications and ensure that the borrower has not misrepresented their financial situation.

In the following sections, we will delve deeper into the purpose, process, and significance of Form 4506-C, covering everything you need to know about this essential document.

Purpose of Form 4506-C

The Form 4506-C serves a crucial purpose in the lending and financial industry. Its primary function is to provide lenders and other authorized entities with access to an individual or business entity’s tax return information. By obtaining this information, lenders can verify the accuracy of income stated on loan applications, detect potential fraud, and make informed decisions regarding loan approvals.

Here are the main purposes of Form 4506-C:

- Income Verification: Lenders rely on accurate income information to assess a borrower’s ability to repay a loan. By requesting tax return transcripts through Form 4506-C, lenders can compare the income reported on the loan application with the income reported to the IRS. This helps ensure that borrowers are not inflating their income or misrepresenting their financial situation.

- Fraud Detection: Fraudulent loan applications are a significant concern in the lending industry. Through Form 4506-C, lenders can detect potential fraud by verifying the authenticity of tax return information. If the tax return transcripts do not align with the borrower’s reported income, it may indicate fraudulent activity.

- Compliance: Financial institutions must comply with various regulations and guidelines to ensure transparency and prevent illegal activities such as money laundering. Form 4506-C helps lenders meet these compliance requirements by providing a reliable source of verified tax information for loan applicants.

- Accurate Loan Underwriting: Lenders need accurate financial information to make informed decisions about loan approvals. By accessing tax return transcripts through Form 4506-C, lenders can ensure the accuracy and completeness of financial records, minimizing the risk of defaults and improving the overall quality of their loan portfolios.

Overall, the purpose of Form 4506-C is to enhance the integrity and trustworthiness of the loan application process. By requesting tax return transcripts, lenders can protect themselves from fraudulent applications, accurately assess borrowers’ income, and make well-informed lending decisions.

How to Request Form 4506-C

Requesting Form 4506-C is a straightforward process that can be done either online or through mail. Here are the steps to request this important document:

- Online Request: The IRS offers an online platform called the IRS Get Transcript service, where individuals and businesses can request tax return transcripts, including Form 4506-C. To request online, you will need to create an account on the IRS website and provide the necessary information, such as your Social Security Number or Employer Identification Number (EIN). Once your request is submitted and verified, you will be able to view and download the tax return transcripts.

- Mail Request: If you prefer a traditional approach, you can request Form 4506-C by mail. To initiate the request, you can download and fill out Form 4506-C from the IRS website. The form requires you to provide the requested tax return years, your taxpayer identification number, and other relevant information. After completing the form, mail it to the address indicated on the IRS website, specific to your location or tax situation. It’s important to ensure that all the required information is accurately provided to avoid delays in processing.

- Third-Party Vendors: In some cases, individuals or businesses may choose to use third-party vendors who specialize in requesting and processing tax return transcripts. These vendors can assist with the preparation and submission of Form 4506-C on your behalf. While using a third-party vendor can expedite the process, it’s essential to research and choose a reputable vendor to ensure the security and confidentiality of your tax information.

Once your request for Form 4506-C is submitted, the IRS will process it and provide you with the requested tax return transcripts. It’s important to note that the processing time may vary depending on the method of request and the current workload of the IRS. Therefore, it’s advisable to submit your request well in advance of any deadlines or time-sensitive situations to allow ample time for processing.

By following these steps, you can easily request Form 4506-C and gain access to the necessary tax return information required by lenders and other authorized entities.

Required Information on Form 4506-C

When completing Form 4506-C, it’s important to provide accurate and detailed information to ensure the proper processing of your request. Here are the key pieces of information that are typically required on Form 4506-C:

- Entity Name and Address: If you are requesting the form on behalf of a business entity, you will need to provide the full legal name and address of the entity. This information helps the IRS identify the specific business for which the tax return information is being requested.

- Contact Information: Your contact information, including your name, phone number, and email address, is required on the form. This allows the IRS to communicate with you if there are any questions or issues related to your request.

- Taxpayer Identification Number (TIN): Whether you are requesting the form for an individual or a business entity, you will need to provide the corresponding Taxpayer Identification Number (TIN). For individuals, this is typically the Social Security Number (SSN), while business entities use an Employer Identification Number (EIN).

- Authorization to Release Information: The form requires you to grant authorization to release your tax return information to the designated recipient. The authorization ensures that the third party receiving the information is authorized to do so and has a legitimate need for it.

- Requested Tax Return Years: You will need to specify the tax return years for which you are requesting transcripts. It’s important to be precise and provide accurate years to ensure that you receive the desired tax return information.

It’s crucial to review the information provided on Form 4506-C before submitting it to the IRS. Any inaccuracies or missing information could lead to delays in processing or the rejection of your request. It’s advisable to double-check all the required fields and ensure that the information is legible and correctly entered.

By providing the necessary information on Form 4506-C, you enable the IRS to accurately process your request and release the tax return information to the authorized recipient.

Consent and Authorization

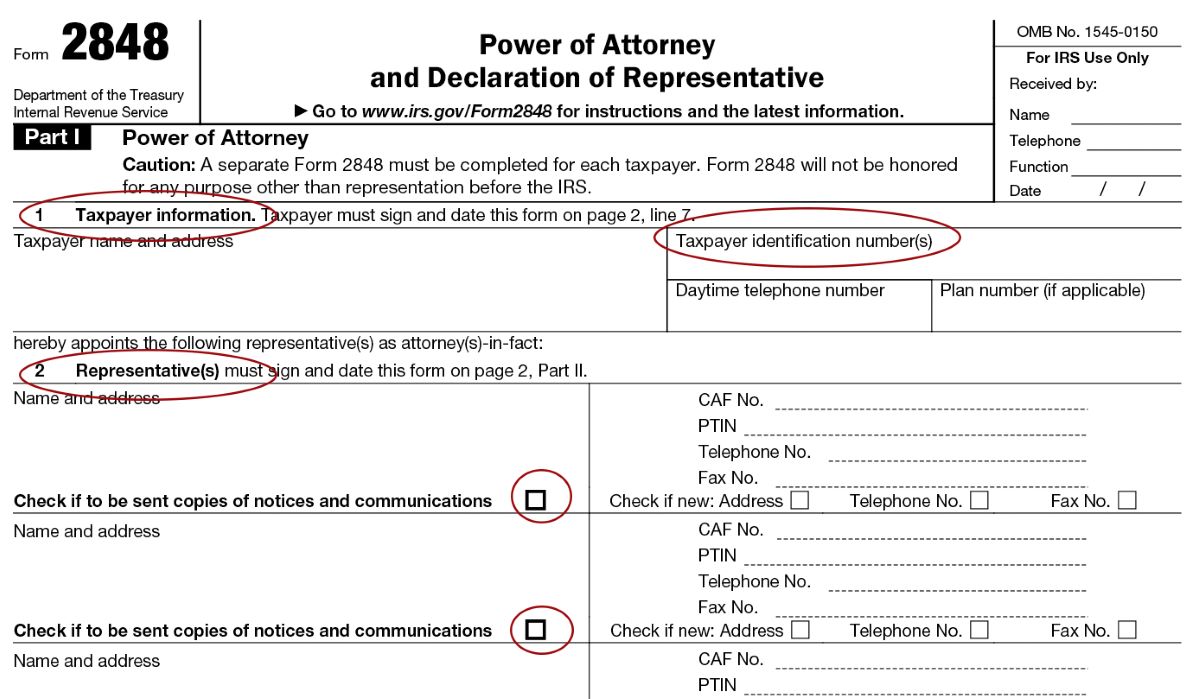

Consent and authorization are essential components of Form 4506-C. By signing the form, you grant permission for the IRS to release your tax return information to the designated recipient. This consent ensures that the recipient is authorized to access and use the information for the specified purpose.

Here are the key points to understand about consent and authorization on Form 4506-C:

- Voluntary Consent: Providing consent on Form 4506-C is voluntary. It is up to you to decide whether to authorize the release of your tax return information. However, it’s important to note that some lenders and government agencies may require tax return information as part of their evaluation or verification process.

- Authorized Recipient: The form allows you to specify the recipient to whom the tax return information will be released. The recipient could be a lender, mortgage service provider, government agency, or any other authorized entity that has a legitimate need for the information. It is crucial to ensure that you provide the correct and complete information of the recipient.

- Purpose of Use: Form 4506-C requires you to provide the purpose for which the tax return information will be used. Common purposes include loan underwriting, verification of income, compliance with regulatory requirements, and fraud detection. Being clear and specific about the purpose helps the IRS determine the legitimacy of the request and ensures that the information is used appropriately.

- Duration of Consent: Some versions of Form 4506-C include a section where you can specify the length of time for which the consent is valid. For example, you may choose to grant consent for a specific loan application or for a limited period. It’s important to consider the timeframe that aligns with your specific needs and requirements.

By providing consent and authorization on Form 4506-C, you are allowing the IRS to release your tax return information to the designated recipient. It’s crucial to read and understand the consent section of the form before signing to ensure that you are fully aware of the information being disclosed and the purposes for which it will be used.

Remember, your consent is an important part of the process, and it helps maintain the privacy and security of your tax return information while facilitating accurate and reliable verification processes in the lending and financial industry.

Timelines for Processing Form 4506-C

The timeline for processing Form 4506-C can vary depending on various factors, including the method of request, the current workload of the IRS, and the complexity of the tax return information being requested. While the IRS strives to process requests as efficiently as possible, it’s important to be aware of the general timelines that could be involved in the process.

Here are some key points to consider regarding the timelines for processing Form 4506-C:

- Online Request: If you choose to request Form 4506-C online through the IRS Get Transcript service, the processing time is typically faster compared to mailing a physical request. In most cases, once your request is submitted and verified, you can access and download the tax return transcripts immediately. However, there may still be some wait time for the verification process, especially during peak filing seasons or high-demand periods.

- Mail Request: Processing times for Form 4506-C submitted by mail can vary. The IRS advises that it may take up to 60 days to process mailed requests. However, it’s important to note that during busier periods or when the IRS has a significant backlog, the processing time may be longer. It’s advisable to plan ahead and submit your request well in advance to account for any potential delays.

- Complex Requests: In some cases, the tax return information being requested may be more complex or require additional verification. For example, if you are requesting older tax return transcripts or specific forms, the processing time may be slightly longer as the IRS may need to retrieve older records or review the request more thoroughly. It’s important to factor in the potential time required for these types of requests.

While these timelines provide a general guideline, it’s important to note that they can vary depending on the individual circumstances and workload of the IRS. It’s always a good practice to submit your request as early as possible to allow ample time for processing. You should also take into account any specific deadlines or time-sensitive situations that may require the timely receipt of the tax return transcripts.

Additionally, it’s important to follow up on your request if you haven’t received a response within the expected timeframe. This can be done by contacting the IRS directly or through the online support systems available on their website.

By understanding the potential processing timelines for Form 4506-C, you can plan accordingly and ensure the timely receipt of the tax return transcripts needed for your specific purposes.

Uses of Form 4506-C

Form 4506-C serves various purposes and is utilized by different entities in the lending and financial industry. Here are some of the key uses of Form 4506-C:

- Income Verification for Lenders: Lenders rely on accurate income information to evaluate loan applications and determine an individual or business entity’s creditworthiness. By requesting and reviewing tax return transcripts through Form 4506-C, lenders can verify the income reported by borrowers, ensuring that it aligns with the information provided on loan applications. This helps lenders make more informed lending decisions and reduces the risk of fraudulent or inaccurate income claims.

- Mortgage Underwriting: Mortgage lenders often require tax return information as part of the underwriting process. By requesting Form 4506-C from borrowers, mortgage service providers can verify the accuracy of income stated on loan applications, ensuring that borrowers have the financial capacity to repay the mortgage. This helps reduce the risk of default and strengthens the integrity of the mortgage lending process.

- Government Agencies: Government agencies, such as the Small Business Administration (SBA) or the Department of Housing and Urban Development (HUD), may require tax return information when individuals or businesses apply for government-backed loans or assistance programs. Form 4506-C is used to obtain tax return transcripts that verify income and ensure compliance with eligibility criteria. This helps maintain transparency and prevents fraudulent claims in government funding programs.

- Compliance and Audits: Financial institutions and businesses may use Form 4506-C as part of their compliance processes or in response to audits. By requesting tax return information through this form, businesses can demonstrate their compliance with regulations and provide accurate financial records when required. This helps ensure transparency and accountability in financial transactions and strengthens the trust between businesses and regulatory authorities.

These are just a few examples of how Form 4506-C is utilized in the lending and financial industry. The form serves as a valuable tool to verify income, detect fraud, and facilitate accurate underwriting processes. By requesting tax return transcripts through Form 4506-C, lenders and other authorized entities can make informed decisions, mitigate risks, and ensure the integrity of financial transactions.

Limitations and Restrictions

While Form 4506-C is a valuable tool for obtaining tax return information, it’s important to be aware of the limitations and restrictions associated with its use. Here are some key points to consider:

- Authorization Required: Form 4506-C requires the explicit consent and authorization of the individual or business entity whose tax return information is being requested. Without proper authorization, the IRS cannot release the requested information to the designated recipient. This ensures that individuals have control over the disclosure of their tax information and safeguards their privacy.

- Specific Purpose: Form 4506-C allows the requester to specify the purpose for which the tax return information will be used. The IRS expects the information to be used only for the stated purpose and may question requests that appear to be outside the scope of the authorized use. It’s crucial to provide accurate and specific information regarding the purpose to ensure compliance with IRS guidelines.

- Timeframe: The tax return transcripts obtained through Form 4506-C are only valid for a certain period, typically up to 120 days from the date of issuance. After this timeframe, the transcripts may no longer be considered valid or current. It’s important to consider this limitation and ensure that the information is used within the appropriate time frame to maintain accuracy and compliance.

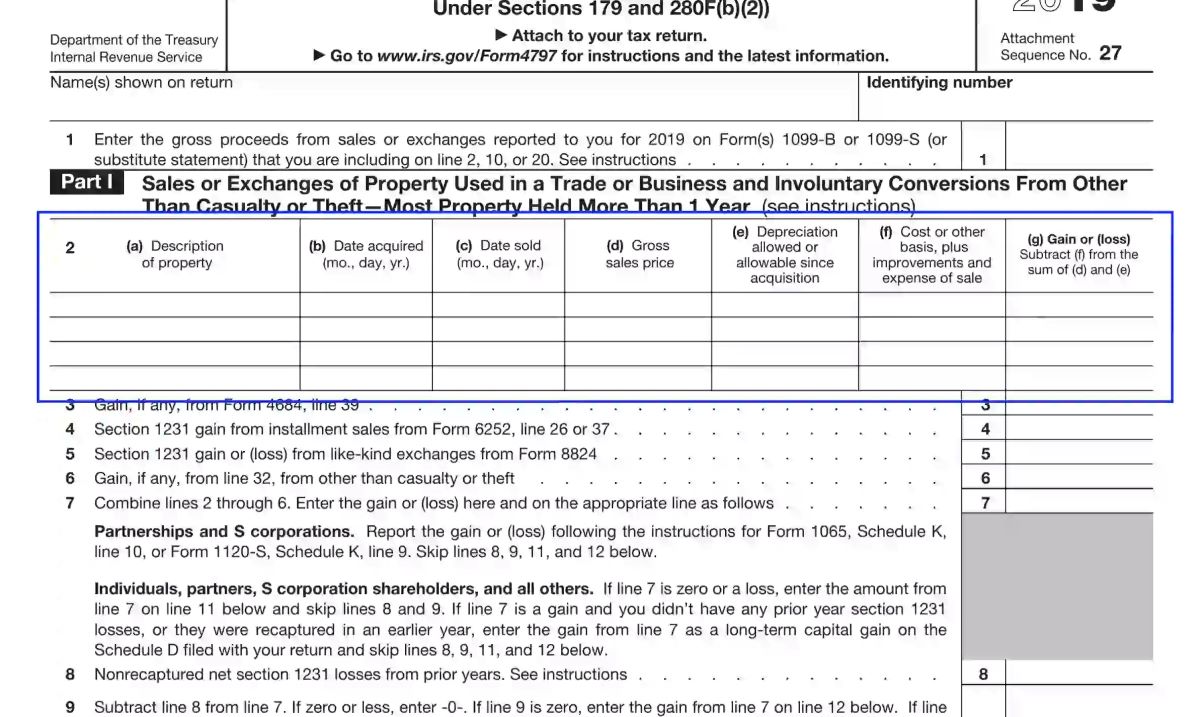

- Availability of Information: While Form 4506-C allows access to tax return information, not all types of tax information may be available. The form provides access to tax return transcripts, which provide summary information from the tax returns. However, specific schedules, attachments, or amendments may not be accessible through this form. It’s important to carefully review the information received and assess if it meets the intended purpose and requirements.

It’s important to adhere to the limitations and restrictions placed on Form 4506-C to ensure compliance and protect the privacy and confidentiality of tax return information. The use of this form should be in line with the authorized purpose, and the information obtained should be used responsibly and in accordance with applicable laws and regulations.

By understanding and respecting these limitations and restrictions, individuals and businesses can effectively utilize Form 4506-C while safeguarding the privacy and integrity of tax return information.

Alternatives to Form 4506-C

While Form 4506-C is a widely used method to obtain tax return information, there are alternative approaches available for verifying income and financial information. Here are a few alternatives to consider:

- Bank Statements: Instead of relying solely on tax return transcripts, lenders may accept bank statements as an alternative proof of income. Bank statements provide an overview of income deposits and can help verify the consistency and source of funds. This can be particularly useful for self-employed individuals or those with non-traditional income sources.

- Pay Stubs and W-2 Forms: For employees, providing recent pay stubs or W-2 forms can be an effective way to verify income. These documents provide detailed information about earnings, deductions, and taxes withheld, giving lenders a clear picture of an individual’s income. This method is commonly used for mortgage applications and other loan types.

- Employer Verification: Some lenders may verify income directly with an applicant’s employer. This involves contacting the employer and requesting confirmation of income and employment details. This approach provides real-time information and can be a reliable source for validating income claims.

- Electronic IRS Income Verification: The IRS offers an electronic income verification service called the Income Verification Express Service (IVES). This service allows authorized third parties to receive income verification directly from the IRS. It provides a quick and secure way to obtain income information and can be a viable alternative to Form 4506-C.

- Credit Reports: Credit reports can provide valuable information about an individual’s financial situation, including payment history, outstanding debts, and credit utilization. While credit reports may not directly verify income, they can give lenders insights into an individual’s overall financial stability and creditworthiness.

It’s important to note that the availability and acceptability of these alternatives may vary depending on the specific requirements of lenders or the purpose of the income verification process. Different lenders may have their own preferences and guidelines for validating income, so it’s essential to communicate with them to determine which alternatives they accept.

While Form 4506-C is a reliable and widely used method, these alternative approaches can provide additional options for verifying income and financial information, offering flexibility and convenience for both borrowers and lenders.

Conclusion

Form 4506-C, the Consent for Release of Information, plays a significant role in the lending and financial industry by providing a secure and authorized means of accessing tax return information. This document allows lenders, mortgage service providers, government agencies, and other authorized entities to verify income, detect fraud, and make informed decisions regarding loan approvals and financial transactions.

Throughout this article, we have explored the purpose, process, and significance of Form 4506-C. We’ve learned that this form is essential for lenders to ensure the accuracy of income stated on loan applications, protect against fraudulent activity, and comply with regulatory requirements. By obtaining tax return transcripts through Form 4506-C, lenders can validate the financial information provided by borrowers, reducing the risk of defaults and strengthening the integrity of the loan underwriting process.

We have also discussed the various steps involved in requesting Form 4506-C, including online and mail options, as well as the required information and the importance of providing accurate details. Additionally, we have highlighted the consent and authorization requirements, emphasizing that the release of tax return information is done with the voluntary consent of individuals or business entities.

Furthermore, we explored the limitations and restrictions associated with Form 4506-C, such as the specific authorized purpose, the timeframe for which the transcripts are valid, and the availability of certain tax information. It is crucial to adhere to these limitations to ensure compliance and protect the privacy of tax return information.

Lastly, we discussed some alternative methods for income verification, including bank statements, pay stubs, employer verification, electronic IRS income verification, and credit reports. These alternatives offer flexibility for borrowers and lenders in verifying income and financial information, depending on specific requirements and preferences.

In conclusion, Form 4506-C serves as a vital tool in maintaining transparency and accuracy in the financial industry. By securing tax return information through this form, lenders can make informed decisions, detect potential fraud, and ensure compliance with regulatory guidelines. Understanding the purpose, process, and limitations of Form 4506-C empowers individuals and businesses to navigate the loan application and verification process with confidence.