Finance

How To Manage Business Cash Flow

Published: December 21, 2023

Learn effective strategies to manage your business cash flow and improve your financial stability. Explore expert advice and tips on finance management for small businesses.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Importance of Managing Business Cash Flow

- Understanding Cash Flow

- Steps to Manage Business Cash Flow

- Create a Cash Flow Forecast

- Monitor and Track Cash Flow

- Improve Cash Inflow

- Optimize Cash Outflow

- Set Up an Emergency Fund

- Consider Financing Options

- Build Strong Customer Relationships

- Review and Adjust Strategies Regularly

- Conclusion

Introduction

Welcome to the world of business, where success and profitability go hand in hand with proper financial management. One of the key pillars of financial management is effectively managing business cash flow. Whether you are a start-up or an established business, maintaining a healthy cash flow is crucial for the smooth operation and growth of your enterprise.

In simple terms, cash flow refers to the movement of money in and out of your business. It encompasses the inflow of revenue from sales, as well as the outflow of expenses such as salaries, rent, and supplier payments. Managing cash flow requires careful planning, monitoring, and execution to ensure that your business has enough liquidity to meet daily operational needs and seize growth opportunities.

Effective cash flow management is vital for several reasons. Firstly, it allows you to have a clear picture of your business’s financial health and its ability to cover operating expenses. Secondly, it helps you anticipate and prepare for potential cash shortages or surpluses. Thirdly, it enables you to make informed decisions regarding investments, expansions, and financial commitments.

Without proper cash flow management, businesses may face a myriad of challenges, including delayed payments to suppliers, missed payroll, or even bankruptcy. On the other hand, businesses that successfully manage their cash flow position themselves for long-term success, stability, and growth.

In this article, we will delve into the importance of managing business cash flow and provide you with practical steps to effectively manage your cash flow. By implementing these strategies, you can ensure that your business remains financially robust and resilient in today’s competitive marketplace.

Importance of Managing Business Cash Flow

Managing cash flow is a critical aspect of running a successful business. It directly impacts your company’s financial stability, profitability, and overall growth. Let’s explore the key reasons why managing business cash flow is of utmost importance:

- Sustaining Operations: Cash flow management ensures that you have enough funds to cover your day-to-day expenses, such as payroll, rent, utilities, and inventory. By staying on top of your cash flow, you can avoid disruptions in your operations, maintain supplier relationships, and fulfill customer orders promptly.

- Meeting Financial Obligations: As a business owner, you have various financial obligations to fulfill, including paying vendors, suppliers, and lenders. Effective cash flow management enables you to meet these obligations on time and maintain a good credit rating. Timely payments not only strengthen your business relationships but also help negotiate better terms with suppliers.

- Expanding and Investing: Positive cash flow provides you with the necessary resources to invest in growth opportunities, such as expanding your product line, opening new locations, or investing in marketing campaigns. By managing your cash flow effectively, you can seize these growth opportunities and position your business for long-term success.

- Weathering Economic Challenges: Economic downturns, market fluctuations, and unexpected events can impact your business’s financial health. By effectively managing your cash flow, you can build a financial cushion that helps you navigate through challenging times and maintain business continuity.

- Gaining Investor Confidence: Investors and lenders often evaluate a company’s cash flow statements to assess its financial health and potential for growth. By demonstrating strong cash flow management, you enhance your credibility and attract potential investors who are more likely to provide funding for your business initiatives.

Overall, managing business cash flow is essential for maintaining smooth operations, meeting financial obligations, seizing growth opportunities, weathering economic challenges, and gaining the confidence of investors and lenders. It is a proactive approach that ensures the financial stability and long-term success of your business.

Understanding Cash Flow

Before diving into the strategies for managing business cash flow, it’s important to have a clear understanding of how cash flow works. Cash flow refers to the movement of money in and out of your business over a specific period of time, typically on a monthly or quarterly basis. It is categorized into three main components: cash inflow, cash outflow, and net cash flow.

Cash Inflow: Cash inflow represents the money coming into your business from various sources. The primary source of cash inflow is revenue generated from sales of products or services. Other sources of cash inflow may include loans, investments, grants, or any other form of capital infusion into your business.

Cash Outflow: Cash outflow encompasses all the expenses your business incurs during the same period. This includes operating expenses such as salaries, rent, utilities, and raw materials. It also includes payments for loans, taxes, and any other financial obligations your business has to fulfill.

Net Cash Flow: Net cash flow is the difference between cash inflow and cash outflow. A positive net cash flow indicates that your business is generating more cash than it is spending, while a negative net cash flow indicates that your business is spending more cash than it is earning.

It’s important to note that positive cash flow does not necessarily mean profitability, as it does not take into account non-cash expenses such as depreciation. However, positive cash flow is essential for the sustainability and growth of your business.

In addition to understanding the components of cash flow, it’s crucial to be familiar with two key terms:

- Operating Cash Flow (OCF): Operating Cash Flow measures the cash generated from the core operations of your business. It reflects the cash generated or used by your business activities, excluding any financing or investing activities.

- Free Cash Flow (FCF): Free Cash Flow represents the cash available to your business after deducting capital expenditures required to maintain or expand your operations. It is a measure of the surplus cash that can be used for reinvestment, debt repayment, or distribution to shareholders.

By understanding the components of cash flow and the related terms, you can gain valuable insights into the financial health of your business and make informed decisions to ensure its long-term sustainability.

Steps to Manage Business Cash Flow

Managing business cash flow requires a proactive and strategic approach. By following these steps, you can effectively monitor and control your cash flow to ensure the financial stability and growth of your business:

- Create a Cash Flow Forecast: Start by developing a cash flow forecast that outlines the expected inflows and outflows of cash for a specific period, such as a month or a quarter. This forecast will serve as a roadmap for managing your cash flow and help you anticipate any potential shortfalls or surpluses.

- Monitor and Track Cash Flow: Regularly monitor and track your actual cash inflows and outflows against your forecast. This will allow you to identify any deviations or discrepancies and take timely corrective actions. Utilize accounting software or cash flow management tools to streamline this process.

- Improve Cash Inflow: Explore ways to accelerate cash inflow into your business. Offer discounts for early payment, incentivize customers to pay invoices more promptly, or consider implementing a recurring billing system. You can also explore additional revenue streams or diversify your product offerings to generate more cash inflow.

- Optimize Cash Outflow: Review your expenses and identify areas where you can optimize cash outflow. Negotiate better terms with suppliers, streamline your inventory management, and eliminate unnecessary expenses. Focus on reducing discretionary spending and prioritize essential operational costs.

- Set Up an Emergency Fund: Establish an emergency fund to prepare for unexpected events or cash flow gaps. Having a financial buffer will protect your business during lean periods and help you avoid cash flow crises.

- Consider Financing Options: Explore financing options that can provide additional cash flow during times of growth or when facing cash flow challenges. This can include lines of credit, business loans, or alternative financing methods. However, carefully assess the terms and interest rates to ensure they align with your business’s cash flow capabilities.

- Build Strong Customer Relationships: Foster strong relationships with your customers to encourage timely payments and reduce payment delays. Implement clear payment terms and follow up on overdue invoices promptly. Offer exceptional customer service to strengthen loyalty and encourage repeat business.

- Review and Adjust Strategies Regularly: Cash flow management is not a one-time task. Continuously review and adjust your cash flow strategies based on market conditions, business performance, and industry trends. Regularly update your cash flow forecast and adapt your plans to ensure they remain aligned with your business goals.

By following these steps and consistently monitoring your cash flow, you can significantly improve the financial health and stability of your business. Remember, cash flow management is a continuous process that requires careful attention and proactive decision-making to ensure sustained success.

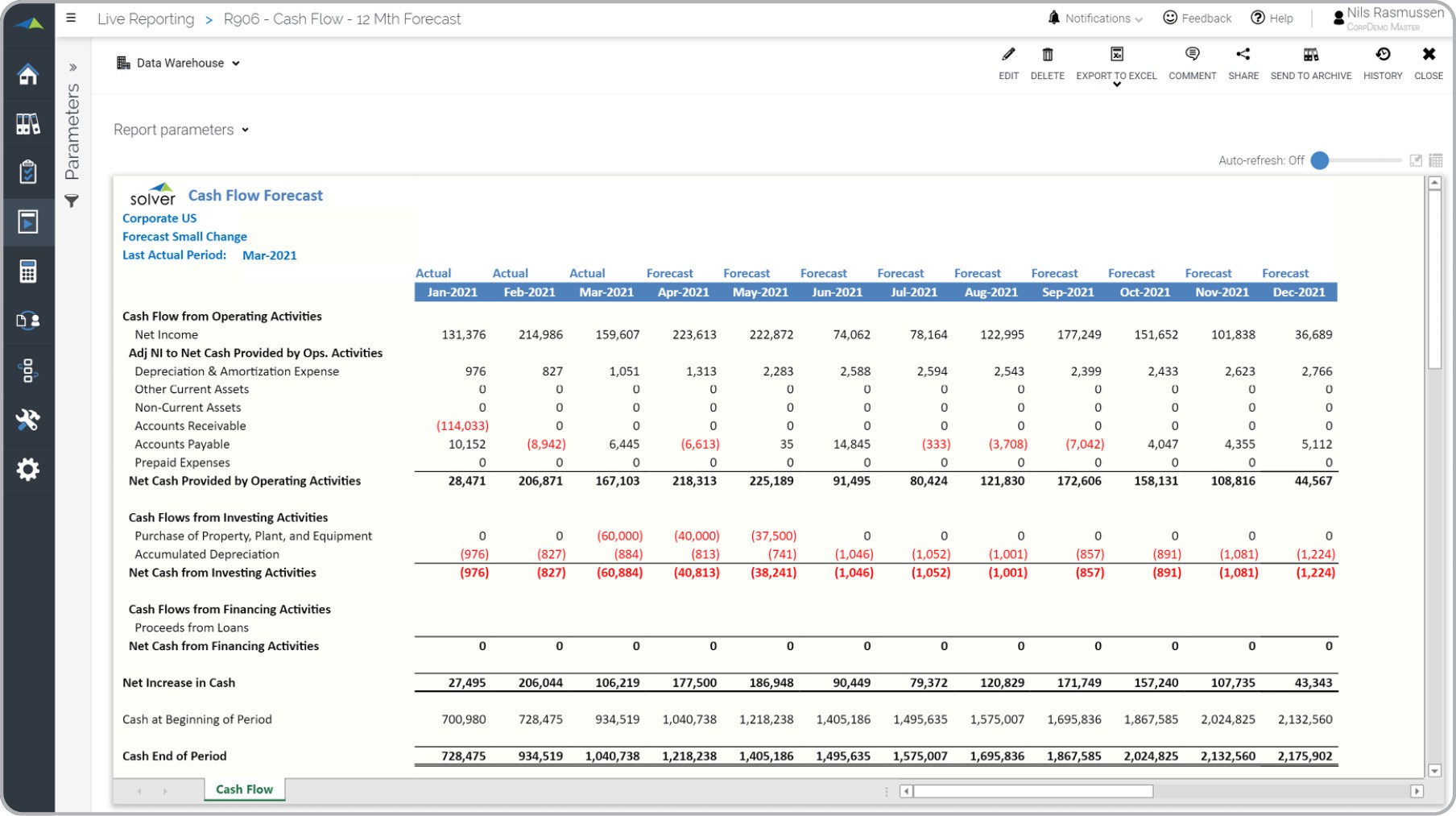

Create a Cash Flow Forecast

Creating a cash flow forecast is the first and crucial step in managing business cash flow effectively. A cash flow forecast provides a clear projection of the anticipated inflows and outflows of cash over a specific period, usually on a monthly or quarterly basis. It serves as a roadmap for monitoring and controlling your cash flow, allowing you to anticipate potential cash shortfalls or surpluses.

To create a cash flow forecast, follow these steps:

- Start with Historical Data: Begin by analyzing your past cash flow statements to understand historical trends and patterns. This will provide valuable insights into the typical inflows and outflows of cash for different periods. Identify any seasonal fluctuations or trends that may impact your cash flow.

- Estimate Cash Inflows: Estimate your expected cash inflows based on your sales forecast. Consider factors such as payment terms, customer payment behavior, and market conditions. Break down your projected inflows by different revenue streams or customer segments to get a more accurate picture.

- Project Cash Outflows: Identify and list all your business expenses, including fixed costs (e.g., rent, utilities, salaries) and variable costs (e.g., supplies, marketing expenses). Account for upcoming one-time expenses, such as equipment purchases or lease renewals. Use historical data and current market rates to estimate these costs.

- Factor in Timing: Consider the timing of your cash inflows and outflows. Be aware of any delays in customer payments or early vendor payment requirements. Factor in the typical payment terms for your industry to accurately predict the timing of cash flows.

- Account for Seasonality: If your business experiences seasonal fluctuations, adjust your cash flow forecast accordingly. Identify the months when cash flow is typically higher or lower, and plan for any necessary adjustments during those periods.

- Account for Non-Cash Items: While cash flow focuses on actual cash movements, consider any non-cash items that may impact your business’s financial health. These can include depreciation, amortization, and non-cash expenses. While they do not directly affect cash flow, they can impact profitability and future cash flow projections.

- Review and Refine: Regularly review and refine your cash flow forecast as new information becomes available or circumstances change. Update it with the most accurate and up-to-date data to ensure its reliability.

By creating a comprehensive cash flow forecast, you gain visibility into your business’s financial health and future cash flow expectations. It enables you to detect potential cash flow gaps in advance and implement strategies to manage them effectively. Use the cash flow forecast as a tool for decision-making and as a benchmark to track your actual cash flow against projected figures.

Monitor and Track Cash Flow

Once you have created a cash flow forecast, it’s essential to regularly monitor and track your actual cash flow against your projections. Monitoring and tracking your cash flow allows you to gain real-time visibility into the movement of money in and out of your business. It helps you identify any discrepancies, potential cash flow issues, or areas of improvement.

Here are some steps to effectively monitor and track your cash flow:

- Record all Cash Transactions: Keep a record of all cash inflows and outflows on a daily basis. This includes sales revenue, customer payments, vendor payments, operating expenses, and any other cash transactions relevant to your business.

- Organize and Categorize Transactions: Categorize your cash transactions into different categories, such as sales revenue, operating expenses, loan repayments, and capital investments. This allows you to analyze and understand the sources and uses of your cash flow more effectively.

- Utilize Cash Flow Management Tools: Consider using cash flow management tools, accounting software, or spreadsheets to streamline the tracking process. These tools can automate calculations, provide real-time cash flow reports, and make it easier to identify trends or anomalies in your cash flow.

- Compare Actuals with Forecast: Regularly compare your actual cash flow with your forecasted cash flow. Identify any variances and investigate the reasons behind them. This will help you understand if your projections are accurate and make adjustments as needed.

- Pay Attention to Cash Flow Patterns: Look for patterns or trends in your cash flow. Identify months or seasons when cash flow is typically high or low. This information can help you anticipate and plan for potential cash flow fluctuations in the future.

- Identify Cash Flow Bottlenecks: Analyze your cash flow data to identify any areas of bottlenecks or inefficiencies. Determine if there are specific factors affecting cash inflow or outflow, such as late-paying customers or high-cost suppliers. Addressing these bottlenecks can improve your overall cash flow management.

- Take Prompt Action: If you identify any cash flow issues, take immediate action to address them. This may involve implementing strategies to improve collections, negotiating more favorable payment terms with suppliers, or adjusting your expenses to align with your cash flow capabilities.

- Regularly Review Cash Flow Reports: Schedule regular reviews of your cash flow reports to assess the financial health of your business. Look for positive indicators, such as consistent positive cash flow or an increasing cash balance. Conversely, be alert to negative trends and take corrective actions to avoid cash flow crises.

By monitoring and tracking your cash flow regularly, you can proactively manage your business’s financial health. It enables you to stay informed about your cash position, make timely decisions, and take necessary actions to ensure a smooth cash flow operation.

Improve Cash Inflow

Improving cash inflow is crucial for maintaining a healthy cash flow and ensuring the sustainability of your business. By implementing strategies to boost cash inflow, you can increase the amount and speed of money coming into your business. Here are some effective ways to improve cash inflow:

- Offer Incentives for Early Payment: Encourage your customers to pay their invoices early by offering discounts, such as a percentage off their total bill or free shipping on their next order. This can incentivize prompt payments and improve cash inflow.

- Implement Clear and Timely Invoicing: Invoice your customers promptly and clearly communicate payment terms and due dates. Make sure to follow up on any overdue invoices promptly to avoid delays in cash collection.

- Use Online Payment Methods: Provide convenient and diverse payment options, such as online payments, credit cards, and digital wallets. Offering multiple payment channels increases the likelihood of timely payments and improves cash inflow.

- Manage Receivables Effectively: Keep a close eye on your accounts receivable and actively manage any outstanding balances. Follow up with customers on overdue payments and establish a system for regular communication to ensure timely collection.

- Implement Revenue-Boosting Strategies: Explore ways to diversify and grow your revenue streams. This could involve launching new products or services, expanding into new markets, or increasing marketing efforts to attract more customers and generate higher sales.

- Consider Offering Prepaid or Subscription Services: If applicable to your business model, consider offering prepaid or subscription-based services. This ensures that you receive payment in advance, providing a steady stream of cash flow.

- Negotiate Favorable Payment Terms: When establishing relationships with vendors and suppliers, negotiate favorable payment terms. This may include extended payment periods or discounts for early payments, which can help improve your cash flow by allowing more time for cash to be generated.

- Optimize Inventory Management: Excess inventory ties up valuable cash. Regularly review your inventory levels and adjust accordingly to ensure that you are holding an optimal amount. This helps prevent cash from being tied up in slow-moving or obsolete inventory.

- Enhance Customer Relationships: Build strong customer relationships by providing exceptional customer service. Satisfied customers are more likely to be repeat buyers and pay on time, thus improving cash inflow.

- Explore Financing Options: In certain situations, securing financing can improve your cash inflow. For example, obtaining a line of credit or business loan can provide a cash cushion during slower periods or fund expansion plans.

Improving cash inflow requires a proactive approach and strategic implementation of these strategies. Regular monitoring and analysis of your cash inflow will allow you to identify areas for improvement and take appropriate actions to optimize cash inflow, ensuring a steady stream of revenue for your business.

Optimize Cash Outflow

Optimizing cash outflow is an essential component of effective cash flow management. By minimizing unnecessary expenses and optimizing your cash outflow, you can maximize the financial resources available to your business. Here are several strategies to help you optimize cash outflow:

- Review and Prioritize Expenses: Regularly review your business expenses and identify areas where you can reduce costs. Prioritize essential expenses while assessing discretionary spending that can be minimized or eliminated.

- Negotiate with Suppliers: Negotiate favorable terms with your suppliers to reduce costs. This may include requesting discounts for bulk purchases, negotiating longer payment terms, or exploring alternative suppliers that offer better pricing.

- Improve Inventory Management: Efficient inventory management helps prevent excess inventory and associated carrying costs. Regularly evaluate your inventory levels to optimize stock levels, minimize storage costs, and avoid inventory obsolescence.

- Implement Cost-saving Measures: Identify cost-saving opportunities within your operations. This could involve energy-saving practices, streamlining processes, outsourcing non-core tasks, or leveraging technology to automate manual processes.

- Control Overhead Expenses: Assess and control overhead expenses, including rent, utilities, and insurance. Shop around for competitive rates and consider downsizing or relocating to a more cost-effective space, if applicable.

- Monitor and Analyze Cash Flow: Continuously monitor your cash flow and track your cash outflow against your forecast. Regular analysis will help you identify any areas of excessive spending or cash flow leaks that can be addressed and rectified.

- Take Advantage of Payment Terms: Strategically utilize payment terms offered by vendors and suppliers. Pay invoices on time to avoid late fees, but don’t pay too early unless offered an attractive discount. Maximize the cash float by utilizing available credit terms to manage your cash flow more effectively.

- Consider Outsourcing: Evaluate tasks within your business that can be outsourced to external service providers. Outsourcing certain functions, such as accounting or IT support, can often be more cost-effective than hiring full-time employees.

- Control Debt: Manage your business debt responsibly by keeping track of repayment obligations and prioritizing payments. Avoid unnecessary borrowing and optimize debt payments to minimize interest charges and fees.

- Implement Expense Approval Process: Introduce an expense approval process to ensure that all expenses are reviewed and approved before they are incurred. This helps prevent unnecessary or unauthorized spending.

By implementing these strategies and actively managing your cash outflow, you can improve your business’s cash flow position and increase your available working capital. Regularly reviewing and optimizing your expenses will help you maintain financial stability and allow for more efficient allocation of resources.

Set Up an Emergency Fund

Setting up an emergency fund is a crucial step in managing business cash flow effectively. An emergency fund serves as a financial safety net, providing a buffer to help your business navigate unexpected events or cash flow challenges. Having a reserve of funds can prevent disruptions to your operations and give you peace of mind in times of uncertainty. Here’s how to set up an emergency fund:

- Establish a Target Amount: Determine an ideal target amount for your emergency fund based on your business’s specific needs. Ideally, it should cover several months of operating expenses to provide adequate protection during downturns or unforeseen circumstances.

- Designate a Separate Account: Open a separate bank account specifically for your emergency fund. Keeping it separate from your regular business accounts helps ensure that the funds are reserved for emergencies only and not accidentally used for other purposes.

- Allocate Regular Contributions: Commit to making regular contributions to your emergency fund. Set a schedule and allocate a fixed amount or a percentage of your business’s revenue or profits to build up the fund over time.

- Automate Contributions: Consider setting up automatic transfers from your business account to your emergency fund account. Automating the process ensures consistent contributions and removes the temptation to divert funds for other purposes.

- Control Access to the Fund: Limit access to the emergency fund to key decision-makers within your business. Implement processes and procedures that require approval and documentation before withdrawing funds.

- Replenish the Fund: If you need to tap into your emergency fund, make it a priority to replenish the withdrawn amount as soon as possible. Rebuilding the fund helps maintain its effectiveness for future unforeseen events.

- Regularly Reevaluate the Target Amount: Periodically reassess your emergency fund’s target amount to ensure it aligns with your business’s evolving needs. Adjust the target based on changes in operating expenses, industry trends, and overall business growth.

- Consider Supplemental Insurance: Evaluate the need for supplemental insurance coverage to protect your business against specific risks. This could include business interruption insurance, disability insurance, or liability insurance, depending on your industry and circumstances.

Building and maintaining an emergency fund demonstrates prudent financial management and provides a safety net for your business. It allows you to weather financial challenges without relying on external financing or experiencing disruptions to your operations. By consistently contributing to your emergency fund and managing it responsibly, you can ensure the long-term stability and resilience of your business.

Consider Financing Options

When managing business cash flow, it’s essential to explore various financing options that can provide additional liquidity during periods of growth or cash flow challenges. Financing options allow you to access funds to meet short-term obligations, invest in business expansion, or bridge temporary cash flow gaps. Here are several financing options to consider:

- Line of Credit: A line of credit provides you with access to a predetermined amount of funds that you can borrow as needed. This flexible financing option allows you to withdraw funds when necessary, repay them, and borrow again within the predetermined limit.

- Business Loans: Business loans provide a lump sum of money that is repaid, with interest, over a specified period. They can be used for various purposes, such as purchasing equipment, financing inventory, or investing in business expansion.

- Invoice Financing: Invoice financing allows you to borrow against outstanding customer invoices. This type of financing provides immediate cash flow by advancing a portion of the invoice amount, typically a percentage, before the customer pays the full amount.

- Merchant Cash Advances: If your business accepts credit card payments, you may be eligible for a merchant cash advance. This type of financing provides a lump sum upfront in exchange for a percentage of future credit card sales.

- Equipment Financing: If you need to purchase or upgrade equipment, equipment financing allows you to secure a loan specifically for that purpose. The equipment itself serves as collateral, and repayments are made over a predetermined period.

- Government Grants and Programs: Investigate government grants and programs that may be available for small businesses. These can provide financial assistance, tax incentives, or favorable loan terms to support your business’s growth and cash flow needs.

- Personal Investments or Loans: Consider utilizing personal investments or loans from friends or family members to inject cash into your business. However, it’s important to approach these options with clear terms and agreements to avoid strained relationships.

- Investor Funding: Investor funding involves seeking external investors, such as angel investors or venture capital firms, who provide financing in exchange for equity or a stake in your business. This option is more suitable for businesses with high-growth potential.

- Crowdfunding: Crowdfunding platforms allow you to raise funds from a large number of people who believe in your business or product. This can be an effective way to raise capital while gaining exposure and building a community around your brand.

- Peer-to-Peer Lending: Peer-to-peer lending platforms connect borrowers directly with individual lenders. This can provide an alternative financing option, particularly for businesses that may not meet traditional lending criteria.

When considering financing options, carefully assess the terms, interest rates, and repayment plans to ensure they align with your business’s cash flow capabilities. It’s important to choose the option that best fits your specific needs and objectives, while also considering the potential impact on your overall financial position and long-term growth plans.

Build Strong Customer Relationships

Building strong customer relationships is a critical aspect of managing business cash flow. Strong customer relationships foster loyalty, trust, and timely payments, which are vital for maintaining a healthy cash flow. By prioritizing customer satisfaction and engagement, you can improve cash inflow and ensure the long-term success of your business. Here are several strategies to build strong customer relationships:

- Provide Excellent Customer Service: Deliver exceptional customer service at every touchpoint. Respond promptly to inquiries, address concerns or issues, and go the extra mile to exceed customer expectations. A positive customer experience fosters customer loyalty and increases the likelihood of repeat business.

- Personalize Interactions: Treat your customers as individuals by personalizing your interactions. Address them by name, remember their preferences, and tailor your communications and offerings to their specific needs. This level of personalization enhances the customer experience and strengthens the relationship.

- Communicate Clear Payment Terms: Establish clear payment terms and communicate them to your customers upfront. Make sure that your customers understand your invoicing and payment processes, including due dates, accepted payment methods, and any applicable penalties for late payments.

- Send Timely and Accurate Invoices: Invoice your customers promptly and provide accurate and detailed invoices. Include all necessary information, such as the product or service description, quantity, price, and any discounts or taxes. Clear and accurate invoicing reduces payment delays and improves cash inflow.

- Follow Up on Overdue Payments: Actively follow up on overdue payments. Send polite reminders or make phone calls to remind customers of their outstanding invoices. Prompt and persistent follow-ups demonstrate your commitment to timely payments and may help expedite the payment process.

- Offer Incentives for Early Payments: Encourage your customers to pay their invoices promptly by offering incentives, such as a small discount or other perks for early payments. This can motivate timely payments and improve cash inflow for your business.

- Establish Long-term Contracts or Subscriptions: Consider offering long-term contracts or subscription-based services to your customers. These arrangements provide predictability in cash flow, as customers commit to regular, recurring payments over an extended period.

- Listen and Act on Customer Feedback: Actively seek feedback from your customers and show that you value their opinions. Implement suggestions for improvement whenever possible, demonstrating your commitment to providing a better customer experience.

- Surprise and Delight: Find ways to surprise and delight your customers. Offer exclusive discounts, early access to new products or services, or personalized rewards to show your appreciation. These gestures not only strengthen the relationship but can also drive repeat business and referrals.

- Resolve Issues Promptly: Address any customer complaints or issues promptly and efficiently. Take ownership of problems, offer solutions, and communicate transparently throughout the resolution process. Resolving issues in a timely manner demonstrates your commitment to customer satisfaction and helps maintain strong relationships.

Building strong customer relationships requires ongoing effort and dedication. Focus on delivering exceptional customer service, maintaining transparent communication, and demonstrating your commitment to meeting their needs. By nurturing these relationships, you can enhance customer loyalty, prompt timely payments, and ultimately optimize your business’s cash flow.

Review and Adjust Strategies Regularly

Managing business cash flow is an ongoing process that requires continuous monitoring and adjustment. It’s crucial to regularly review your cash flow strategies to ensure they remain effective and aligned with your business goals. By consistently evaluating and adjusting your strategies, you can adapt to changing market conditions and optimize your cash flow management. Here are some key considerations for reviewing and adjusting your cash flow strategies:

- Monitor Cash Flow Performance: Regularly review your cash flow reports and compare them to your projections. Analyze the trends and variances to identify any areas of concern or opportunities for improvement.

- Identify Cash Flow Patterns: Look for recurring patterns and trends in your cash flow. Determine if there are specific months or seasons when cash flow is consistently high or low. Understanding these patterns can help you anticipate and plan for cash flow fluctuations.

- Evaluate Financial and Market Conditions: Stay informed about economic trends, industry changes, and market conditions that may impact your cash flow. Assess how external factors, such as interest rates, inflation, or market demand, can influence your cash flow performance.

- Assess the Effectiveness of Your Strategies: Evaluate the success and effectiveness of your current cash flow management strategies. Determine which strategies are working well and contributing to positive cash flow outcomes. Identify any strategies that may require adjustment or replacement.

- Identify Areas for Improvement: Identify areas within your cash flow management that can be improved. This could include streamlining processes, optimizing revenue streams, negotiating better terms with suppliers, or developing more effective collections strategies.

- Seek External Expertise: Consider consulting with financial experts or seeking advice from business mentors. Their fresh perspective and expertise can provide valuable insights and help you identify areas for improvement that may have been overlooked.

- Stay Up to Date with Technology: Keep abreast of technological advancements and software solutions that can enhance your cash flow management. Explore cash flow management tools, accounting software, or automation solutions that can simplify processes and provide accurate real-time data.

- Adjust Cash Flow Forecasts: Regularly update your cash flow forecasts based on the insights gained from monitoring and evaluating your cash flow performance. Adjust the projections to reflect changes in revenue, expenses, or market dynamics.

- Implement Changes Gradually: When making adjustments to your cash flow management strategies, implement changes gradually and monitor their impact closely. Abrupt changes may have unintended consequences, so it’s important to carefully assess and measure the effectiveness of any adjustments made.

- Seek Continuous Improvement: Aim for continuous improvement in your cash flow management. Regularly reassess, refine, and optimize your strategies to adapt to evolving business needs and maintain a strong financial position.

Remember that cash flow management is an ongoing process that requires attention and adaptation. By regularly reviewing and adjusting your strategies, you can proactively address any cash flow challenges, seize opportunities, and maintain a healthy cash flow that supports the long-term success of your business.

Conclusion

Managing business cash flow is a vital aspect of financial management that directly impacts the success and stability of your business. By effectively managing your cash flow, you can ensure that you have enough liquidity to cover operational expenses, meet financial obligations, and seize growth opportunities. Throughout this article, we have explored the importance of managing business cash flow and provided practical steps to help you do so.

Creating a cash flow forecast allows you to anticipate potential cash shortfalls or surpluses and serves as a roadmap for managing your cash flow effectively. Monitoring and tracking your cash flow on a regular basis helps you gain real-time visibility and enables you to make informed decisions to improve your financial situation.

Improving cash inflow involves implementing strategies such as offering incentives for early payments, optimizing invoicing processes, and diversifying revenue streams. On the other hand, optimizing cash outflow entails reviewing expenses, negotiating with suppliers, and controlling discretionary spending.

Setting up an emergency fund provides a financial safety net for unexpected events or cash flow gaps, allowing your business to navigate through challenging times. Exploring financing options can provide additional liquidity during periods of growth or cash flow challenges, offering flexibility and support for your business’s financial needs.

Building strong customer relationships is crucial for timely payments and customer loyalty. By providing excellent customer service, clear payment terms, and personalized experiences, you can strengthen customer relationships and improve cash inflow.

Finally, reviewing and adjusting your cash flow strategies regularly ensures their effectiveness and alignment with your business goals. By continuously monitoring and refining your strategies, you can adapt to changing market conditions, optimize your cash flow management, and maintain a strong financial position.

Remember, managing business cash flow is an ongoing process that requires attention, proactive decision-making, and adaptability. By implementing the strategies discussed in this article, you can enhance your cash flow management skills and position your business for long-term success and financial stability.