Home>Finance>What Is Considered Liquid Assets On A Balance Sheet

Finance

What Is Considered Liquid Assets On A Balance Sheet

Modified: February 23, 2024

Learn about liquid assets on a balance sheet and their importance in finance. Discover what qualifies as liquid assets and how they impact a company's financial stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When assessing the financial health of a company, one crucial aspect to consider is its liquidity. Liquidity refers to the ability of a company to convert its assets into cash quickly and without significant loss in value. A vital component of a company’s liquidity is its liquid assets, which play a pivotal role in determining its short-term financial viability.

Liquid assets on a balance sheet refer to the assets that can be easily converted into cash within a short period, usually within one year. These assets are essential because they provide a readily available source of funds to meet immediate financial obligations or take advantage of investment opportunities. Understanding liquid assets is crucial for investors, creditors, and analysts, as they help in evaluating a company’s ability to navigate financial uncertainties.

Ensuring an adequate level of liquid assets is vital for a company’s survival and stability. Insufficient liquid assets can lead to cash flow issues, which can result in missed payments to creditors, inability to meet operating expenses, or missed investment opportunities. On the other hand, if a company holds too many liquid assets, it may indicate an inefficient use of resources, as these assets may not be generating optimal returns.

In this article, we will delve deeper into the concept of liquid assets on a balance sheet. We will explore the definition of liquid assets, their importance in assessing a company’s financial health, examples of liquid assets, the difference between liquid and non-liquid assets, various types of liquid assets, methods of determining their value, and how they are reported on a balance sheet.

Understanding the role and significance of liquid assets is vital not only for companies but also for individual investors who want to evaluate the financial soundness and stability of any investment opportunity. Let’s dive into the world of liquid assets and explore their significance in financial analysis.

Definition of Liquid Assets

Liquid assets, also known as current assets, are resources that can be easily converted into cash within a short period of time, typically within one year. These assets are readily available to meet a company’s short-term financial obligations or investment needs. They are considered the most liquid form of assets as they can be quickly converted into cash without significant loss in value.

The key characteristic of a liquid asset is its ability to maintain its value or convertibility in a short period of time. This makes them highly preferable in situations where immediate access to cash is necessary. Liquidity is an important factor to consider because it provides the ability to respond to unexpected expenses, take advantage of investment opportunities, or sustain financial stability during economic downturns.

Examples of liquid assets include cash, cash equivalents, marketable securities, accounts receivable, and inventory. Cash refers to the physical currency and funds held in checking accounts or petty cash. Cash equivalents are highly liquid investments that can be quickly converted into cash, such as short-term treasury bills or highly rated commercial paper. Marketable securities are investment instruments, such as stocks and bonds, that can be easily bought or sold in the financial markets.

Accounts receivable represent the outstanding payments that a company is expecting to receive from its customers. These can be converted into cash by collecting payments from customers. However, it is crucial to consider the creditworthiness of the customers and the likelihood of timely payment. Inventory, while not as easily convertible as cash or securities, can still be considered a liquid asset as it can be sold to generate cash quickly when needed.

It is important to note that while liquid assets have a high degree of convertibility into cash, they may not necessarily maintain their full value. For example, selling marketable securities during a period of market downturn may result in a loss due to a decrease in their market value. Nonetheless, the ability to quickly convert these assets into cash still deems them highly valuable for addressing short-term financial needs.

In summary, liquid assets are assets that can be readily converted into cash within a short period of time without significant loss in value. These assets play a crucial role in maintaining financial stability, meeting short-term obligations, and capitalizing on investment opportunities.

Importance of Liquid Assets on a Balance Sheet

Liquid assets are of paramount importance when analyzing a company’s financial health and stability. They provide a clear indication of a company’s ability to meet short-term financial obligations and operate smoothly. The presence of sufficient liquid assets on a balance sheet is crucial for several reasons:

1. Meeting Short-Term Obligations: Having an adequate amount of liquid assets ensures that a company can readily meet its short-term financial obligations, such as paying off creditors, suppliers, and employees. This helps maintain the company’s reputation, credibility, and continued operations.

2. Managing Cash Flow: Liquid assets serve as a buffer to manage cash flow fluctuations. They provide a cushion to cover unexpected expenses, fluctuations in revenue, or delays in receivables. A healthy level of liquid assets ensures that a company can navigate financial uncertainties without experiencing liquidity issues.

3. Seizing Opportunities: In business, opportunities arise that require immediate action, such as investing in new projects, acquiring competing businesses, or making strategic partnerships. Having sufficient liquid assets allows a company to capitalize on these opportunities without seeking external funding or incurring high-interest debt.

4. Cushion during Economic Downturns: During economic downturns or recessions, companies often face reduced revenue, tightened credit markets, and decreased consumer spending. Having ample liquid assets provides a safety net, enabling a company to sustain operations, pay bills, and survive until conditions improve.

5. Confidence for Investors and Creditors: Investors and creditors closely scrutinize a company’s balance sheet to evaluate its financial position and creditworthiness. A healthy level of liquid assets reflects a company’s ability to honor its financial commitments, inspiring confidence in potential investors and creditors.

6. Financial Flexibility: Liquid assets offer financial flexibility by providing a company with the ability to adjust its operations, respond to market changes, and adapt to unforeseen circumstances. It allows management to make strategic decisions without being constrained by immediate liquidity concerns.

It is important to note that the importance of liquid assets may vary across different industries and companies. Industries that operate in highly cyclical markets or are subject to unpredictable revenue streams may require a larger cash cushion to navigate through uncertain periods. Conversely, industries with stable cash flows and minimal short-term financial obligations may have a lower need for liquid assets.

Ultimately, the presence of adequate liquid assets on a balance sheet demonstrates financial prudence and a company’s ability to weather unexpected challenges while capitalizing on growth opportunities. It serves as a fundamental indicator of a company’s short-term financial viability and stability, providing insight into its overall financial health.

Examples of Liquid Assets

Liquid assets are an essential component of a company’s financial profile. They provide readily available sources of cash that can be used to meet short-term obligations and take advantage of investment opportunities. Here are some common examples of liquid assets found on a balance sheet:

- Cash: Cash is the most basic and liquid asset. It includes physical currency, as well as funds held in checking accounts, savings accounts, and petty cash. Cash provides immediate access to funds and is crucial for daily operational needs and urgent expenses.

- Cash Equivalents: Cash equivalents are highly liquid investments that can be quickly converted into cash without significant risk of loss. Examples include short-term treasury bills, certificates of deposit (CDs), money market funds, and highly rated commercial paper. These investments offer a higher yield than traditional savings accounts while maintaining a high degree of safety and liquidity.

- Marketable Securities: Marketable securities refer to financial instruments that are easily bought and sold in the financial markets. Examples include stocks, bonds, and mutual funds. While their liquidity can vary depending on market conditions, they are generally considered liquid assets as they can be converted into cash relatively quickly.

- Accounts Receivable: Accounts receivable represent funds owed to a company from customers or clients for goods or services provided on credit. While they are not immediately in cash form, they are considered liquid assets as they can be converted into cash by collecting payments from customers. The liquidity of accounts receivable depends on the creditworthiness of the customers and the effectiveness of the company’s collection efforts.

- Inventory: Inventory, although not as easily convertible as cash or securities, is still considered a liquid asset. It represents the goods or products that a company has in stock and intends to sell. Inventory can be quickly converted into cash by selling the products. However, it is important to consider the potential obsolescence or devaluation of inventory when evaluating its liquidity.

- Short-Term Investments: Short-term investments are financial instruments that have a maturity period of less than one year. These can include government-issued treasury securities, corporate bonds, and money market funds. While the liquidity of these investments may vary, their short-term nature allows for relatively easy conversion into cash.

It’s important to note that the composition of liquid assets can vary among companies and industries. Service-based businesses may have a higher proportion of accounts receivable as their primary liquid asset, while manufacturing or retail businesses may have a significant portion of their liquid assets tied up in inventory.

Understanding and monitoring the composition of liquid assets is crucial for assessing a company’s ability to address short-term financial obligations, manage cash flow, and seize investment opportunities. It helps give a comprehensive view of the company’s liquidity and financial flexibility.

Non-Liquid Assets vs Liquid Assets

When analyzing a company’s balance sheet, it is important to distinguish between non-liquid assets and liquid assets. While both types of assets contribute to a company’s overall value, their level of liquidity and ease of conversion into cash differ significantly.

Liquid Assets: Liquid assets, as discussed earlier, are assets that can be easily converted into cash within a short period, typically within one year. They provide readily available sources of funding to meet short-term financial obligations or take advantage of investment opportunities. Examples of liquid assets include cash, cash equivalents, marketable securities, accounts receivable, and inventory.

Non-Liquid Assets: Non-liquid assets, on the other hand, are assets that cannot be readily converted into cash or require substantial time and effort to convert. These assets are typically more long-term in nature and include items such as property, plant, and equipment (PP&E), long-term investments, and intangible assets like patents and copyrights. While valuable, these assets may have limited marketability or may take longer to sell or liquidate.

The main difference between non-liquid and liquid assets lies in their convertibility and time horizon. Liquid assets can be quickly converted into cash without significant loss in value, often within days or weeks. They provide the necessary flexibility to address short-term financial needs and take advantage of immediate opportunities.

Non-liquid assets, on the other hand, may take longer to convert into cash. Selling property or equipment, for instance, may require finding a willing buyer, negotiating a price, and completing legal processes, which can often take several months or even years. Long-term investments, such as bonds or shares in other companies, may also require waiting until maturity or finding a buyer on the secondary market.

It is important to note that the distinction between liquid and non-liquid assets is not always clear-cut. Some assets, like accounts receivable, fall on the borderline between the two categories. While accounts receivable are considered liquid assets, their liquidity depends on the creditworthiness of the customers and the effectiveness of the company’s collection efforts.

Investors, creditors, and analysts pay close attention to both liquid and non-liquid assets when evaluating a company’s financial health and stability. Liquid assets provide insight into a company’s short-term liquidity and cash flow management, while non-liquid assets reflect the company’s long-term value and potential for future growth.

It is crucial to strike a balance between liquid and non-liquid assets. While having sufficient liquid assets ensures the ability to address short-term financial obligations, non-liquid assets contribute to a company’s long-term value and potential for capital appreciation.

Overall, understanding the distinction between liquid and non-liquid assets is essential for assessing a company’s liquidity, financial flexibility, and the ability to weather both short-term challenges and long-term growth.

Types of Liquid Assets

Liquid assets encompass a variety of resources that can be easily converted into cash within a short time frame. These assets provide a company with the flexibility to meet short-term financial obligations and seize immediate investment opportunities. Here are some common types of liquid assets:

- Cash: Cash is the most fundamental and readily available form of liquid asset. It includes physical currency as well as the funds held in checking accounts, petty cash, and cash equivalents. Cash provides immediate liquidity and can be used for daily operational needs, paying bills, and meeting unforeseen expenses.

- Cash Equivalents: Cash equivalents are highly liquid investments that can be quickly converted into cash without significant risk of loss. Examples include short-term treasury bills, certificates of deposit (CDs), money market funds, and highly rated commercial paper. These investments offer attractive returns while still maintaining a high degree of liquidity and stability.

- Marketable Securities: Marketable securities are investments that are easily bought and sold in the financial markets, facilitating their quick conversion into cash. This category includes publicly traded stocks, bonds, and mutual funds. While their liquidity can vary depending on market conditions and trading volumes, they are considered liquid assets due to their marketability.

- Accounts Receivable: Accounts receivable represent the payments owed to a company by its customers or clients for goods or services provided on credit. Although not in cash form, accounts receivable are considered liquid assets because they can be converted into cash by collecting payments from customers. The liquidity of accounts receivable depends on factors such as the creditworthiness of the customers and the efficiency of the collection process.

- Inventory: Inventory is a liquid asset that represents the goods or products a company has in stock and intends to sell. While not as easily convertible as cash or securities, inventory can be sold to generate cash quickly when needed. Managing inventory effectively is crucial to ensure that it remains a liquid asset, as excessively high levels or obsolete inventory can hinder liquidity.

- Short-Term Investments: Short-term investments are financial instruments with maturity periods of less than one year. These investments can include government-issued treasury securities, corporate bonds, and money market funds. While their liquidity may vary based on the specific instrument and market conditions, their short-term nature ensures relative ease of conversion into cash.

It is important to note that the types and composition of liquid assets may vary depending on the industry and nature of the business. For example, service-based companies may have a higher proportion of accounts receivable, while manufacturing companies may have significant inventory holdings.

Monitoring the types of liquid assets within a company is essential for assessing its short-term financial health, liquidity position, and ability to meet immediate obligations. It helps ensure that the company maintains the necessary financial flexibility to navigate unexpected events and capitalize on potential opportunities.

Understanding the different types of liquid assets allows investors, creditors, and analysts to evaluate a company’s liquidity risks, cash flow management, and overall financial stability.

Determining the Value of Liquid Assets

When evaluating a company’s financial health, determining the value of its liquid assets is crucial. Knowing the value of these assets provides insight into a company’s ability to meet short-term obligations and assess its liquidity position. Here are some common methods for determining the value of liquid assets:

- Market Value: Market value is the most straightforward and widely used method for valuing liquid assets. It refers to the current market price at which an asset can be bought or sold. For cash and cash equivalents, their face value is their market value. For marketable securities, their market value is determined by the prevailing market prices, as quoted on stock exchanges or other marketplaces.

- Accounts Receivable Valuation: Valuing accounts receivable requires assessing the creditworthiness of customers and the likelihood of timely payments. It involves analyzing past payment patterns, considering any outstanding issues or disputes, and factoring in the overall economic environment. Typically, companies estimate the collectability of receivables by applying a discount to their face value to account for potential bad debts or delays in payment.

- Inventory Valuation: Valuing inventory can be done using various methods, including the cost method, the lower of cost or market value method, or the net realizable value method. The cost method values inventory at its original cost, while the lower of cost or market value method compares the cost of inventory with its current market value and selects the lower value. The net realizable value method values inventory based on the estimated selling price less any costs of completion, disposal, or transportation.

- Fair Value Assessment: In some cases, companies may need to assess the fair value of their liquid assets. Fair value is the price that would be received to sell an asset in an orderly transaction between willing market participants. It takes into account factors such as market conditions, supply and demand dynamics, and the specific characteristics of the asset. Fair value assessments often rely on third-party appraisals or valuation experts to ensure objectivity and accuracy.

- Financial Statement Analysis: Financial statement analysis involves using various ratios and metrics to interpret a company’s financial position. Liquidity ratios, such as the current ratio and the quick ratio, can provide insights into a company’s ability to cover its short-term obligations using its liquid assets. By comparing these ratios to industry benchmarks or previous periods, analysts can gauge the efficiency and value of a company’s liquid assets.

It is important to note that the methods for determining the value of liquid assets may vary based on the nature of the asset and the specific circumstances surrounding the company. Companies may also be required to adhere to specific accounting standards and regulations that dictate the valuation methods to be used.

Regularly assessing and monitoring the value of liquid assets is crucial in understanding a company’s financial health, making informed investment decisions, and ensuring adequate liquidity to meet short-term obligations. It allows investors, creditors, and analysts to evaluate the efficiency of a company’s asset management and its overall ability to generate cash flow.

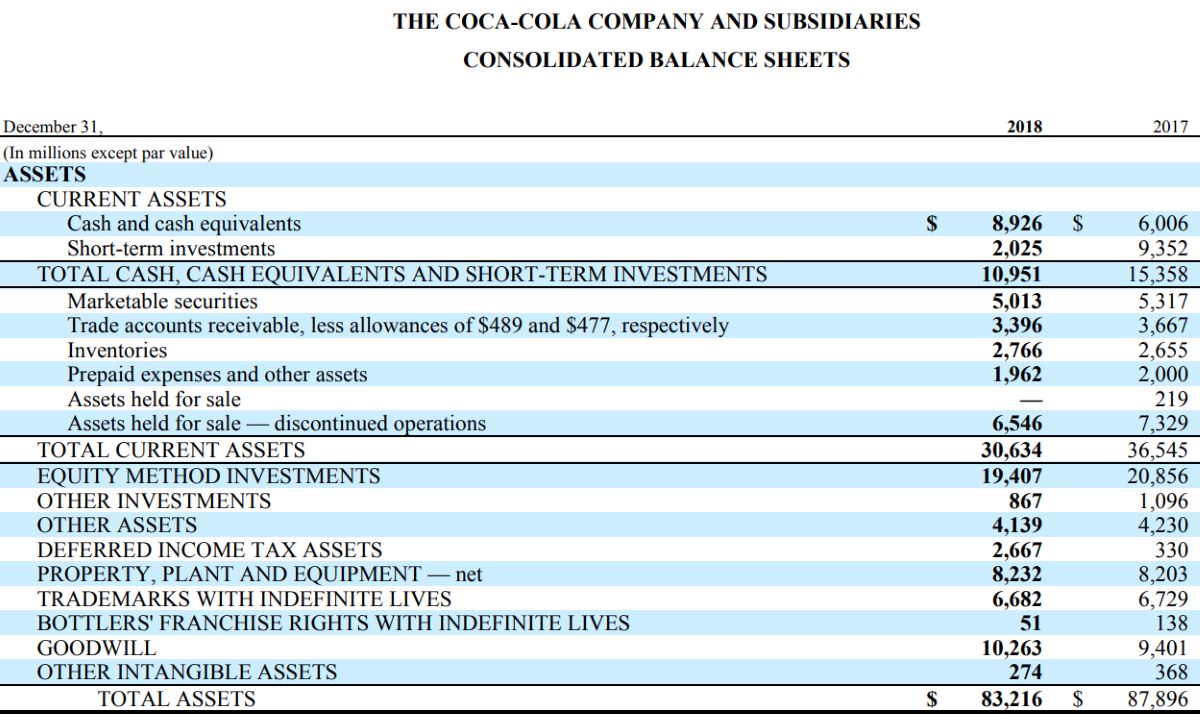

Reporting Liquid Assets on a Balance Sheet

On a balance sheet, liquid assets are reported as current assets. This section of the balance sheet provides a snapshot of a company’s short-term resources that can be readily converted into cash within one year. Reporting liquid assets accurately is essential for investors, creditors, and stakeholders to understand a company’s liquidity position and financial strength.

The specific items that fall under the category of current assets may vary depending on accounting standards and industry practices, but commonly reported liquid assets include:

- Cash: The cash account represents the physical currency and funds held in checking accounts, savings accounts, and petty cash.

- Cash Equivalents: This line item includes highly liquid investments with short maturities, such as short-term treasury bills, money market funds, and commercial paper.

- Marketable Securities: Marketable securities refer to easily tradable financial instruments, such as stocks, bonds, and mutual funds, that can be quickly converted into cash in the financial markets.

- Accounts Receivable: Accounts receivable represents the money owed to the company by its customers for goods or services provided on credit. It is important to consider any doubtful accounts or bad debt allowances in valuing accounts receivable.

- Inventory: Inventory includes the goods or products held by a company for sale or production. It is important to report inventory at its lower of cost or net realizable value to reflect any potential obsolescence or decline in value.

- Short-Term Investments: Short-term investments represent financial assets that are expected to be held for less than one year. These can include marketable securities, certificates of deposits, and other investments with short maturities.

When reporting liquid assets on a balance sheet, they are typically listed in descending order of their liquidity. Cash and cash equivalents are usually reported first, followed by marketable securities, accounts receivable, inventory, and short-term investments.

The balance sheet also provides additional information, such as the value of each liquid asset category and any related allowances or reserves. For example, accounts receivable may be reported at their net realizable value after accounting for any allowances for doubtful accounts. These details provide transparency and enhance the accuracy of the financial statements.

Additionally, it is common to include liquidity ratios, such as the current ratio and quick ratio, alongside the balance sheet. These ratios help analyze the relationship between current assets, including liquid assets, and current liabilities, providing insights into a company’s ability to cover short-term obligations.

Accurate reporting of liquid assets on a balance sheet is crucial for potential investors, creditors, and other stakeholders to assess a company’s liquidity position and short-term financial stability. It allows for a comprehensive understanding of a company’s ability to meet its financial obligations and navigate economic uncertainties.

Conclusion

Liquid assets play a vital role in assessing and understanding a company’s financial health and stability. These assets provide the necessary flexibility and resources to meet short-term obligations, manage cash flow, and seize immediate investment opportunities. By having a clear understanding of liquid assets, investors, creditors, and analysts can make informed decisions and evaluate a company’s ability to withstand financial uncertainties.

Throughout this article, we have explored the definition of liquid assets, their importance on a balance sheet, examples of liquid assets, the distinction between liquid and non-liquid assets, different types of liquid assets, methods for determining their value, and how they are reported on the balance sheet.

It is crucial to maintain a balance in the composition of liquid assets, as excessive holdings can indicate an inefficient use of resources, while inadequate holdings may pose liquidity risks. Companies should regularly monitor their liquid assets and assess their value to ensure they have the necessary financial flexibility and stability.

For investors and creditors, understanding the liquidity position of a company is essential for determining its short-term viability, financial stability, and ability to meet obligations. It provides insights into a company’s ability to weather economic downturns, seize investment opportunities, and sustain operations.

In conclusion, liquid assets form a cornerstone of financial analysis and decision-making. They act as a safety net and a source of immediate financial strength for companies. By effectively managing and leveraging liquid assets, companies can navigate through uncertainties and position themselves for growth. Investors, creditors, and stakeholders who recognize the importance of liquid assets can make well-informed decisions and gain a comprehensive understanding of a company’s overall financial health.