Finance

What Is A Bake Off In Investment Banking?

Modified: December 30, 2023

Discover the concept of a bake off in investment banking and its significance in the world of finance. Gain insights into the competitive process and its role in making informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of investment banking, competition is fierce. Banking firms are constantly vying for lucrative deals, and the process of winning clients can be highly competitive. One strategy that investment banks employ to secure business is a “bake off.” While the term “bake off” might typically bring to mind a cooking competition, in the context of investment banking, it takes on a different meaning.

A bake off in investment banking refers to a competitive bidding process where multiple banks pitch their services to a prospective client. It is a way for organizations seeking financial advisory services, such as mergers and acquisitions, equity offerings, or debt issuances, to evaluate different investment banks and select the one that best meets their needs.

The purpose of a bake off is to allow clients to assess the capabilities, expertise, and financial solutions offered by various investment banks. It is an opportunity for banks to showcase their skills, industry knowledge, and track record, in the hopes of being chosen to manage a high-profile transaction. The result of a bake off can significantly impact the reputation and revenue of the winning bank, making it a critical process in the investment banking industry.

During a bake off, investment banks compete against each other by presenting their proposed strategies, financial models, and pricing structures. They typically prepare detailed presentations, outlining their understanding of the client’s needs, industry research, and tailored recommendations. These pitches can often involve multiple rounds of presentations, meetings, and negotiations with the client.

The client, on the other hand, evaluates the banks based on various factors, including their industry expertise, ability to execute transactions, track record, reputation, and pricing. Through this evaluation process, the client aims to identify the bank that not only offers the best financial solution but also aligns with their organization’s culture and values.

Definition of a Bake Off

In the context of investment banking, a bake off is a competitive process where multiple banks present proposals to win a financial advisory or transactional mandate from a client. It is an opportunity for banks to demonstrate their expertise, capabilities, and understanding of the client’s needs in order to secure the business.

During a bake off, each participating bank prepares a detailed presentation that outlines their proposed strategy, financial models, and pricing structure. The presentations are often accompanied by supporting documentation, industry research, and case studies showcasing the bank’s past successes in similar transactions.

The term “bake off” refers to the idea that banks are essentially “baking” their proposals or pitches to create an enticing offer for the client. They are expected to come up with innovative solutions, demonstrate a deep understanding of the client’s industry, and articulate the value they can bring to the transaction.

The bake off process can vary in duration, complexity, and level of involvement from both the client and the banks. It typically involves multiple rounds of presentations, meetings, and negotiations. The client may request additional information or clarification on certain aspects of the proposals, leading to further discussions and refinement of the offers.

At the end of the bake off, the client evaluates the proposals from each bank based on various criteria, such as the bank’s expertise, transaction execution capabilities, track record, reputation, and pricing structure. The client may also consider intangible factors like cultural fit and the bank’s ability to understand and align with their business goals.

The winning bank is chosen based on the client’s evaluation and selection process. This decision often has a significant impact on the bank’s reputation, revenue, and overall business prospects. Therefore, participating banks put in their best efforts to differentiate themselves and convince the client that they are the most suitable partner for the proposed transaction.

It is important to note that a bake off is not solely based on the financial aspect of the proposal. While pricing is a consideration, the client also values the expertise, strategic thinking, and relationship-building abilities of the participating banks. The bake off serves as a platform for the client to assess the overall value proposition of each bank before making a final decision.

Purpose of a Bake Off in Investment Banking

The purpose of a bake off in investment banking is to enable clients to evaluate and compare the capabilities, expertise, and value propositions of different banks before selecting the most suitable partner for a financial transaction. It serves as a competitive process that allows clients to make informed decisions based on their specific needs and priorities.

One key purpose of a bake off is to assess the banks’ industry knowledge and understanding of the client’s business. Clients want to work with banks that have a deep understanding of their industry dynamics, trends, and challenges. By evaluating the banks’ ability to provide tailored solutions and insights, clients can gauge the quality and relevance of their advice.

In addition, a bake off provides an opportunity for clients to evaluate a bank’s track record and reputation. Clients are interested in partnering with banks that have a strong history of successfully executing similar transactions. The bake off process allows clients to assess the banks’ past performance and their ability to deliver results in a timely and efficient manner.

Another purpose of a bake off is to compare the proposed financial solutions and strategies offered by each bank. Banks are expected to present innovative approaches and creative ideas that address the client’s specific needs. Clients can assess the feasibility, risks, and potential rewards of each bank’s proposal, helping them make an informed decision that aligns with their strategic objectives.

Furthermore, the bake off process enables clients to evaluate the cultural fit and working relationship with potential banking partners. The client’s decision is not solely driven by financial considerations; they want to work with a bank that understands their organizational culture, values, and long-term goals.

Overall, the purpose of a bake off is twofold: firstly, it allows clients to assess and compare the capabilities, expertise, and solutions offered by different banks; and secondly, it enables banks to showcase their strengths, industry knowledge, and ability to deliver value. By conducting a bake off, clients can make a well-informed decision and select the bank that best meets their needs, while banks have an opportunity to differentiate themselves and secure valuable business opportunities.

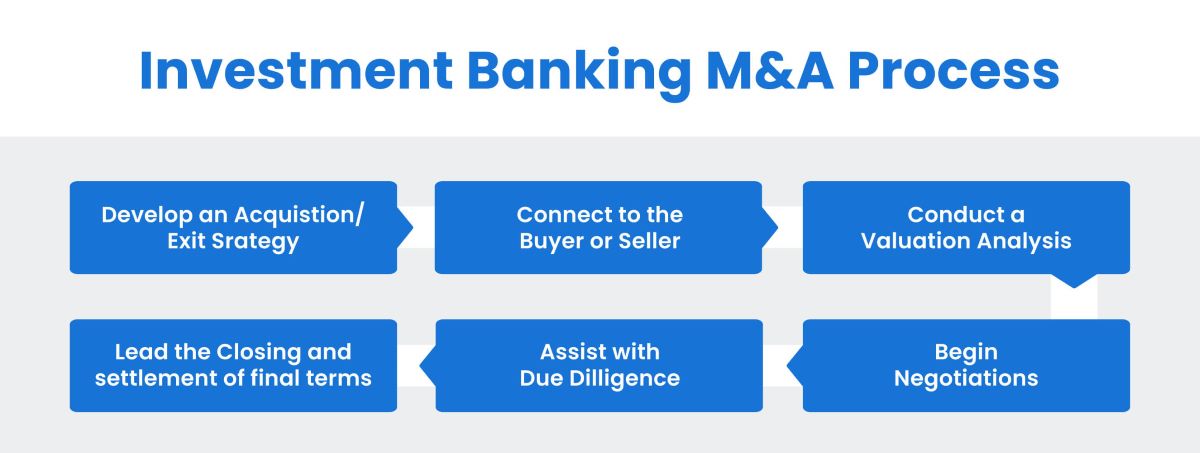

Process of a Bake Off

The process of a bake off in investment banking typically involves several stages and can vary in duration and complexity. While the specific steps may vary depending on the transaction and client requirements, the following is a general overview of the process:

- Preliminary Evaluation: The client identifies the need for financial advisory services or a transaction and decides to initiate a bake off process. They may create a shortlist of potential banks based on their reputation, expertise, and past experience in similar transactions.

- Request for Proposals (RFP): The client shares a detailed RFP with the shortlisted banks. The RFP outlines the client’s needs, transaction details, and evaluation criteria. Banks are typically given a timeframe to submit their proposals.

- Proposal Preparation: Each participating bank thoroughly analyzes the RFP and begins preparing their proposal. This involves conducting comprehensive research, developing financial models, and formulating a customized strategy that aligns with the client’s objectives.

- Presentation Rounds: The banks present their proposals to the client through multiple rounds of presentations. These presentations allow banks to showcase their expertise, industry knowledge, and ability to provide innovative solutions. The client may ask questions and seek clarifications during these sessions.

- Negotiations and Refinement: After the initial presentations, the client may request additional information or enter into negotiations with the banks. This can include discussing pricing, terms, and any specific requirements that the client may have. The banks work to refine their proposals and address any concerns or feedback from the client.

- Final Evaluation and Selection: Once the presentations and negotiations are complete, the client evaluates each bank’s proposal using predefined criteria. This evaluation process may involve considerations such as the bank’s expertise, execution capabilities, track record, reputation, cultural fit, and pricing structure. Based on this evaluation, the client selects the bank they believe is the best fit for their needs.

- Engagement and Contracting: The selected bank and the client move forward with the engagement process, which includes finalizing the terms and conditions of the engagement, negotiating fees, and signing a contract. This marks the official start of the working relationship between the client and the successful bank.

The duration of a bake off process can vary, ranging from a few weeks to several months, depending on the complexity and scale of the transaction. It requires significant effort and coordination from both the client and the participating banks to ensure a thorough evaluation and selection process.

It is worth noting that while a bake off primarily focuses on evaluating the proposals, the process also allows for relationship building and assessing cultural fit. This ensures that not only is the bank capable of delivering the desired financial solutions but also that they are aligned with the client’s values and long-term objectives.

Selection Criteria for a Bake Off

When conducting a bake off in investment banking, clients evaluate participating banks based on a set of predetermined selection criteria. These criteria allow clients to compare and assess the capabilities, expertise, and suitability of each bank. While specific criteria may vary depending on the transaction and client requirements, the following are common factors considered during the selection process:

- Industry Expertise: Clients look for banks that have a deep understanding of their industry and the specific dynamics of the transaction. The bank’s knowledge of industry trends, regulations, and competitive landscape is crucial in developing tailored strategies and providing valuable insights to the client.

- Transaction Execution Capability: Clients assess the bank’s ability to successfully execute the proposed transaction. They consider factors such as the bank’s track record in similar deals, the scale of transactions they have handled, and their experience in dealing with complex financial structures.

- Reputation and Track Record: The reputation and track record of a bank play a significant role in the selection process. Clients often consider the bank’s history of delivering results, the quality of their advice, and their ability to handle sensitive and confidential information. Positive client testimonials and independent rankings can also influence the client’s decision.

- Value Proposition: Clients evaluate the bank’s proposed financial solutions and related services. They consider the bank’s innovative ideas, strategic thinking, and the extent to which their proposals align with the client’s objectives. The ability to provide customized and creative solutions that go beyond standard offerings can set a bank apart.

- Pricing Structure: While not the sole determinant, the pricing structure is an important consideration. Clients compare the banks’ fee structures, costs, and value for money. Banks that can provide competitive pricing while delivering high-quality services are often favored.

- Cultural Fit and Relationship Building: Clients assess the cultural fit between the bank and their organization, considering factors such as the bank’s approach to client relationships, their ability to collaborate, and their understanding of the client’s corporate culture. The bank’s willingness to build strong, long-term relationships and act as a trusted advisor is highly valued.

Depending on the specific transaction and client requirements, additional criteria related to risk management, financial stability, geographic presence, and technological capabilities may also be considered.

It is important to note that the selection criteria are not mutually exclusive, and different clients may prioritize different factors based on their specific needs and preferences. The ultimate goal is to select the bank that offers the best combination of industry expertise, execution capabilities, reputation, value proposition, pricing, and cultural fit, ensuring a successful and mutually beneficial partnership.

Benefits of a Bake Off

A bake off in investment banking offers several benefits to both clients and participating banks. This competitive process provides valuable insights, fosters innovation, and ultimately leads to the selection of the most suitable banking partner for a financial transaction. The following are key benefits of a bake off:

- Enhanced Evaluation: A bake off allows clients to thoroughly evaluate multiple banks before making a decision. They can compare the expertise, track records, and proposed financial solutions of each bank, empowering them to select the bank that best aligns with their specific needs and objectives.

- Access to Specialized Expertise: The bake off process ensures that clients have access to a diverse range of specialized expertise. Each participating bank brings unique insights and experiences, allowing the client to tap into a wealth of knowledge and industry-specific insights to develop the most effective financial strategy.

- Market Insights and Innovation: Through the bake off process, clients gain access to market insights and innovative ideas proposed by the participating banks. Banks strive to differentiate themselves by presenting creative approaches and solutions to the client’s needs, driving innovation in the industry and potentially uncovering new opportunities.

- Price Competition: The competitive nature of a bake off can lead to price competition among the participating banks. Banks are motivated to offer competitive pricing structures and fee arrangements to secure the business. This can result in cost savings for the client and the opportunity to obtain high-quality financial services at a competitive price.

- Quality Control: A bake off ensures that the selected bank meets the client’s standards of quality and expertise. The rigorous evaluation process helps to filter out banks that may not have the necessary capabilities or may not align with the client’s long-term goals. This enhances the chances of a successful transaction and minimizes the risk of potential issues down the line.

- Relationship Building: The bake off process provides an opportunity for clients to build relationships with potential banking partners. Through presentations, meetings, and negotiations, clients can assess the banks’ communication skills, cultural fit, and willingness to collaborate. This enables the client to establish a strong, long-term relationship with the selected bank based on mutual trust and understanding.

Overall, a bake off promotes transparency, competition, and excellence in the investment banking industry. It ensures that clients have access to a wide array of options, enabling them to make informed decisions and select the bank that offers the best combination of expertise, innovation, and value proposition. Additionally, participating banks are incentivized to continuously enhance their services and offerings to stand out in a highly competitive landscape, ultimately benefiting both clients and the industry as a whole.

Limitations of a Bake Off

While a bake off in investment banking can provide valuable insights and help clients select the most suitable banking partner, it also comes with certain limitations. It is important to be aware of these limitations when engaging in the bake off process. The following are some common limitations:

- Time and Resource Intensive: The bake off process can be time-consuming and resource-intensive for both clients and participating banks. Preparing detailed proposals, conducting presentations, and engaging in negotiations requires significant effort and coordination. The process can potentially delay the commencement of the transaction or divert resources from other business activities.

- Subjectivity in Evaluation: Despite the predefined selection criteria, there can be an element of subjectivity in the evaluation process. The client’s assessment of factors such as cultural fit or innovative ideas may vary, leading to different interpretations and preferences. This subjectivity can make the final decision less objective and more reliant on personal judgments and preferences.

- Limited Depth of Understanding: The bake off process provides a snapshot of each bank’s capabilities and proposed solutions. However, it may not always allow for a thorough understanding of the bank’s operational processes, risk management practices, and long-term commitment. Clients may need to conduct further due diligence before finalizing the bank selection.

- Non-Disclosure of Sensitive Information: Participating banks may not have access to all the confidential information necessary to fully understand the intricacies and nuances of the client’s business. This lack of complete information can limit the banks’ ability to provide the most accurate and relevant advice, potentially impacting the quality of their proposals.

- Focus on Immediate Transaction: The bake off process tends to focus on the specific transaction at hand, sometimes at the expense of considering the long-term strategic alignment between the client and the selected bank. Clients should carefully evaluate whether the selected bank’s capabilities and values align with their broader business objectives beyond the immediate transaction.

Despite these limitations, a bake off remains a widely used and effective method for selecting banking partners in the investment banking industry. By being aware of these limitations, clients can better manage their expectations and ensure they conduct thorough due diligence before making a final decision.

Key Players in a Bake Off

A bake off in investment banking involves several key players who have distinct roles and responsibilities throughout the process. These players work together to ensure a successful and informed decision regarding the selection of a banking partner. The following are the key players involved in a bake off:

- Clients: Clients are the organizations seeking financial advisory services or undertaking a transaction. They initiate the bake off process and define the requirements, evaluation criteria, and timeline. Clients play a crucial role in evaluating proposals, conducting negotiations, and ultimately selecting the most suitable banking partner.

- Investment Banks: The participating investment banks are the main contenders in the bake off. These banks showcase their expertise, present proposals, and compete for the client’s business. Investment banks assign teams of experienced professionals who develop tailored strategies, financial models, and pricing structures. Their goal is to highlight their capabilities and differentiate themselves from their competitors in the industry.

- Advisory Committees: In some cases, clients may form an advisory committee comprising internal stakeholders, board members, or subject matter experts. These committees provide guidance and insights throughout the bake off process. They review proposals, assess the banks’ capabilities, and offer expertise in evaluating the potential impact of the transaction on the client’s business.

- Legal and Financial Advisors: Clients often engage legal and financial advisors to assist them in the bake off process. These advisors provide expertise and guidance in matters related to legal, regulatory, and financial aspects of the transaction. They help assess the financial viability of the proposals, review the proposed terms and conditions, and provide legal advice during negotiations.

- Independent Consultants and Analysts: Independent consultants and analysts may be enlisted by clients to provide objective insights and analysis during the bake off process. These professionals can conduct third-party assessments of the proposals, offer industry perspectives, and provide an unbiased evaluation of the participating banks.

- External Rating Agencies: In some cases, clients may consider external rating agencies’ opinions and rankings as part of their evaluation process. These agencies assess the reputation, financial stability, and capabilities of investment banks and provide independent ratings that can aid the client’s decision-making process.

The interactions and collaboration among these key players drive the bake off process. Clients rely on the expertise, proposals, and negotiations of the investment banks, while also seeking advice from advisory committees, legal and financial advisors, independent consultants, and rating agencies to make an informed decision.

The collective efforts of these key players ensure a comprehensive evaluation process that considers various perspectives and factors, ultimately leading to the selection of the most suitable banking partner for the client’s specific needs.

Case Study: Successful Bake Off Examples

Examining successful bake off examples can provide valuable insights into how clients have effectively utilized the bake off process to select the most suitable investment banking partner. Here are two notable case studies:

Case Study 1: Tech Company IPO

A leading technology company was preparing for its Initial Public Offering (IPO), and they decided to conduct a bake off to select an investment bank to lead the offering. Four prominent investment banks were invited to participate.

During the bake off process, each bank presented their expertise in technology IPOs, demonstrated their understanding of the company’s business model, and proposed strategies to maximize the valuation and success of the IPO. The proposals included comprehensive financial models, a deep analysis of the market landscape, and tailored recommendations for the company’s IPO journey.

The client evaluated the proposals based on a set of criteria, including industry expertise, track record in technology IPOs, understanding of the company’s unique value proposition, and the ability to provide ancillary services such as research coverage and investor outreach.

After several rounds of presentations and negotiations, the client selected a bank that demonstrated not only a strong track record in technology IPOs but also a keen understanding of the company’s vision and growth potential. The engagement resulted in a highly successful IPO, exceeding market expectations and establishing the client as a public company in a highly competitive sector.

Case Study 2: Cross-Border Merger and Acquisition

A multinational corporation was pursuing a cross-border merger and acquisition deal and conducted a bake off to select the investment bank that best suited their strategic objectives. Five global investment banks were invited to participate.

In the bake off process, each bank presented their expertise in cross-border M&A, outlined their understanding of the industry and competitive landscape, and proposed strategies that aligned with the client’s objectives. The banks showcased their cross-border deal experience, highlighting successful transactions in similar markets and industries.

The client evaluated the proposals based on factors such as transaction execution capability, integration planning, access to potential acquirers or targets, industry insights, and cultural compatibility. They also inquired about the proposed deal team’s expertise, availability, and ability to navigate complex regulatory environments.

After careful consideration, the client selected a bank that demonstrated a deep understanding of the target market, had a strong track record in executing similar cross-border deals, and offered a dedicated deal team with senior-level involvement. The engagement resulted in a successful merger, creating significant value for the client through increased market share and new growth opportunities.

These case studies highlight how the bake off process allowed clients to evaluate investment banks based on specific criteria relevant to their unique transactions and strategic objectives. By carefully assessing the expertise, track record, and alignment with their goals, the clients were able to make informed decisions and achieve successful outcomes in their respective deals.

Conclusion

A bake off in investment banking is a competitive process that allows clients to evaluate and select the most suitable banking partner for their financial transaction. It serves as a platform for investment banks to showcase their expertise, propose tailored financial solutions, and differentiate themselves from competitors.

Throughout the bake off process, clients carefully assess participating banks based on a set of selection criteria. Factors such as industry expertise, transaction execution capability, reputation, value proposition, pricing structure, and cultural fit play a vital role in the decision-making process.

While the bake off process offers several benefits, such as enhanced evaluation, access to specialized expertise, and price competition, it is not without its limitations. The process can be time-consuming, subjective to some extent, and may lack a deep understanding of the bank’s overall operations.

The key players in a bake off, including clients, investment banks, advisory committees, legal and financial advisors, independent consultants, and rating agencies, work together to ensure a comprehensive evaluation and selection process.

Case studies of successful bake off examples demonstrate how the process has been effectively utilized to select the most suitable banking partner, leading to successful IPOs, mergers, and acquisitions.

In conclusion, a bake off in investment banking is a valuable process that allows clients to assess the expertise, capabilities, and value propositions of investment banks. By conducting a thorough evaluation and selection process, clients can make informed decisions and establish strong partnerships that contribute to their financial success.