Home>Finance>What Is Physical Delivery? Definition And How It Works In Trading

Finance

What Is Physical Delivery? Definition And How It Works In Trading

Published: January 8, 2024

Learn the definition and process of physical delivery in finance, and how it contributes to trading activities. Discover how physical delivery works in various financial markets.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Physical Delivery in Trading

Welcome to the fascinating world of trading! Whether you are a seasoned investor or just starting your journey, it is essential to understand key concepts and terminology. One such concept is physical delivery, which plays a crucial role in certain types of trading transactions. In this article, we will delve into the definition of physical delivery and explore how it works in the world of trading.

Key Takeaways

- Physical delivery is the process of actually delivering the underlying asset of a trading contract upon its expiration.

- During physical delivery, the buyer receives the physical asset as specified in the contract, and the seller hands it over.

Definition of Physical Delivery

In simple terms, physical delivery refers to the process of actually delivering the underlying asset of a trading contract upon the contract’s expiration. It is typically associated with trading commodities, futures contracts, or certain derivatives. Physical delivery signifies the completion of the trade, where the buyer receives the physical asset, and the seller hands it over.

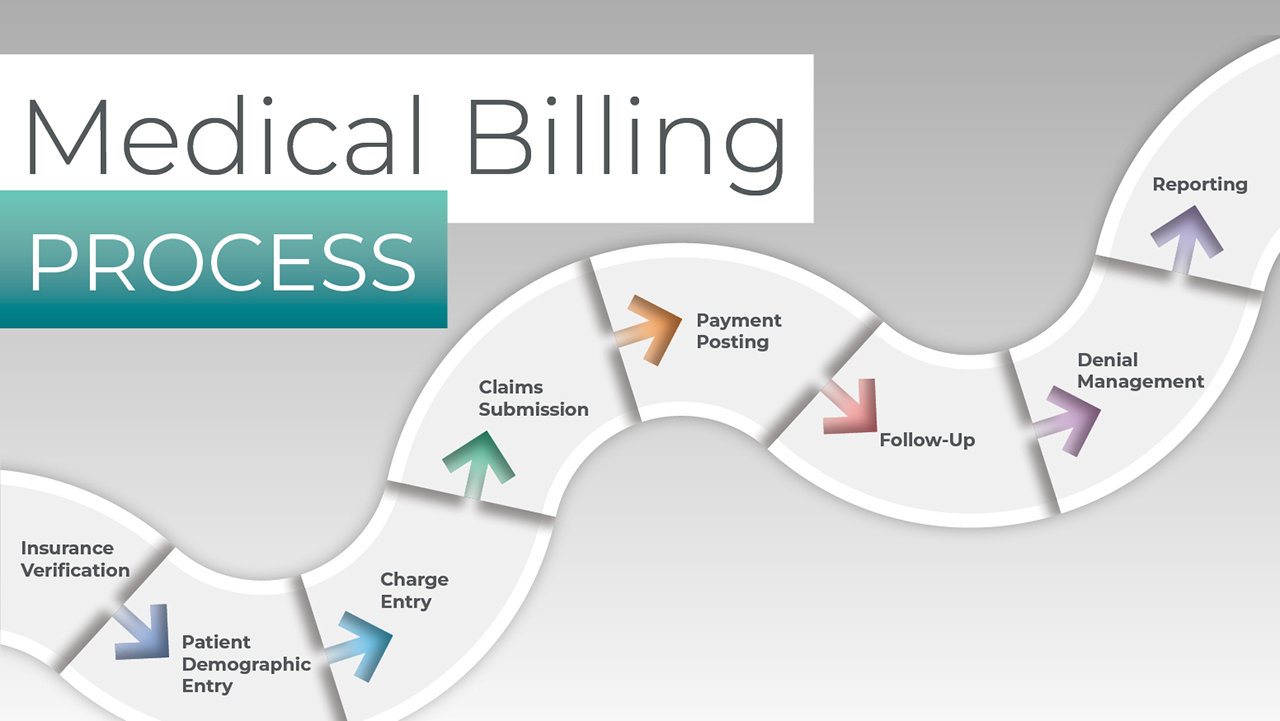

How Does Physical Delivery Work in Trading?

Now that we understand the basic definition of physical delivery, let’s take a closer look at how it works in trading:

- Contract Specification: When entering into a trading contract, the parties involved agree upon the specification of the asset to be delivered. This includes details such as quality, quantity, delivery location, and the timeline for delivery.

- Expiration of the Contract: At the expiration of the trading contract, the buyer and seller are obligated to fulfill their respective roles. The buyer must take delivery of the physical asset, while the seller must deliver the asset as specified in the contract.

It’s important to note that not all trading contracts result in physical delivery. In some cases, traders may opt to close out their positions before the contract expires, offsetting their obligations and avoiding physical delivery. This is particularly common in futures trading, where most contracts are settled in cash.

Understanding physical delivery is crucial for traders who engage in markets where physical assets are traded. By comprehending how physical delivery works, traders can navigate the various intricacies of the trading process with confidence and make informed decisions. So whether you are interested in commodities, futures contracts, or other derivative products, keep this concept in mind as you explore the exciting world of trading!