Finance

What Is Quick Ratio In Accounting

Published: October 12, 2023

Learn about the importance of Quick Ratio in accounting and its significance for managing finance effectively. Discover how it helps assess a company's short-term liquidity.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to analyzing the financial health of a company, various metrics and ratios are used. One key ratio in accounting that provides valuable insights into a company’s liquidity position is the quick ratio. This ratio serves as an important indicator of a company’s ability to meet its short-term obligations, and is often used by both investors and creditors to assess its financial stability.

The quick ratio, also known as the acid-test ratio, measures a company’s ability to pay off its current liabilities using its most liquid assets. Unlike the current ratio, which includes all current assets, the quick ratio focuses on only the most readily convertible assets into cash. This provides a more conservative assessment of a company’s short-term liquidity.

Understanding the concept and calculation of the quick ratio is essential for investors, lenders, and financial analysts, as it provides valuable information regarding a company’s financial position and ability to handle its financial commitments. Moreover, it helps stakeholders make informed decisions and identify potential risks associated with the company’s liquidity and financial stability.

In this article, we will delve into the definition, formula, importance, interpretation, and advantages and limitations of the quick ratio in accounting. By the end, you will have a comprehensive understanding of this important financial metric and how it can be used to assess a company’s financial health.

Definition of Quick Ratio

The quick ratio, also known as the acid-test ratio, is a financial metric that measures a company’s ability to pay off its current liabilities using its most liquid assets. Unlike the current ratio, which considers all current assets, the quick ratio focuses on only the most liquid assets, which are assets that can be readily converted into cash within a short period of time.

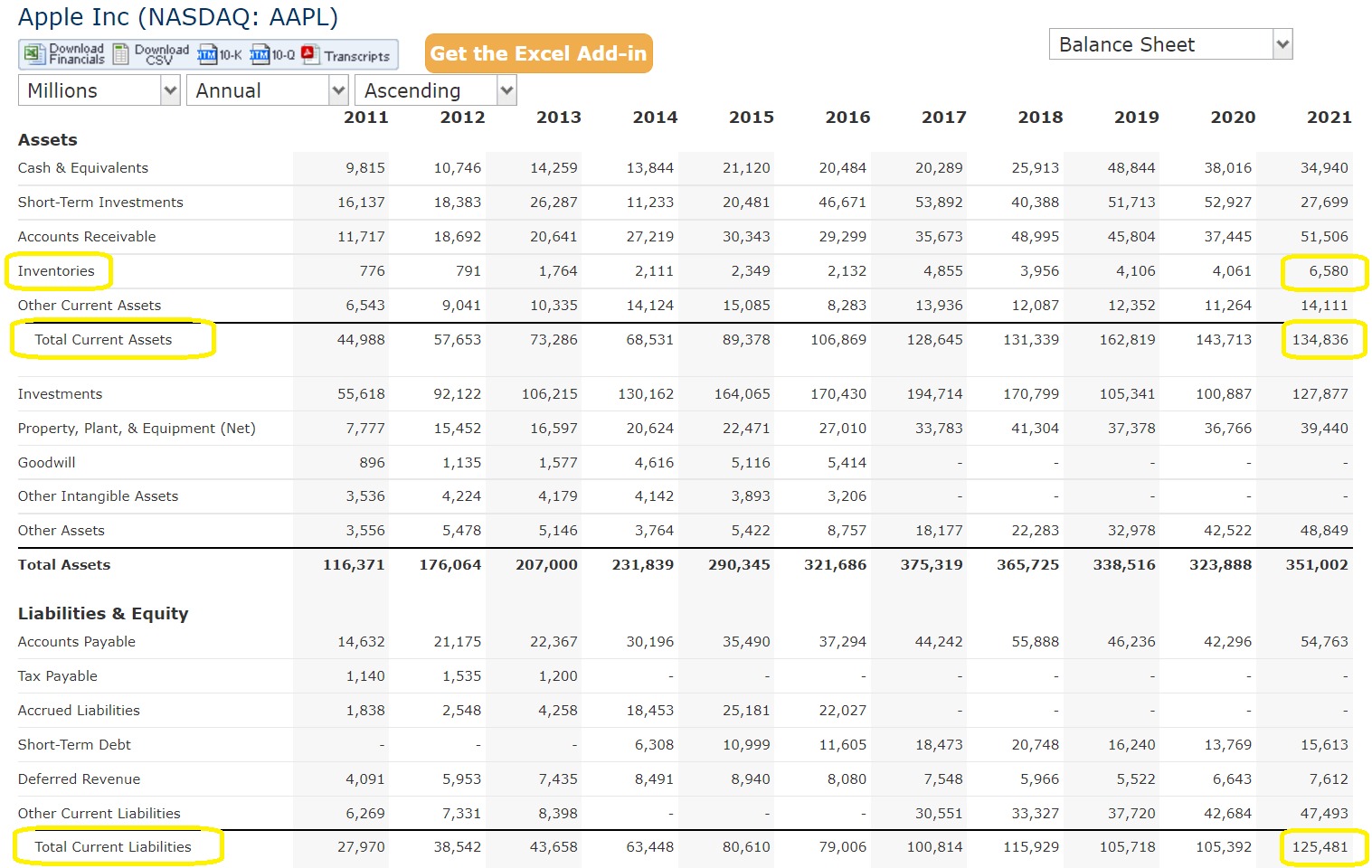

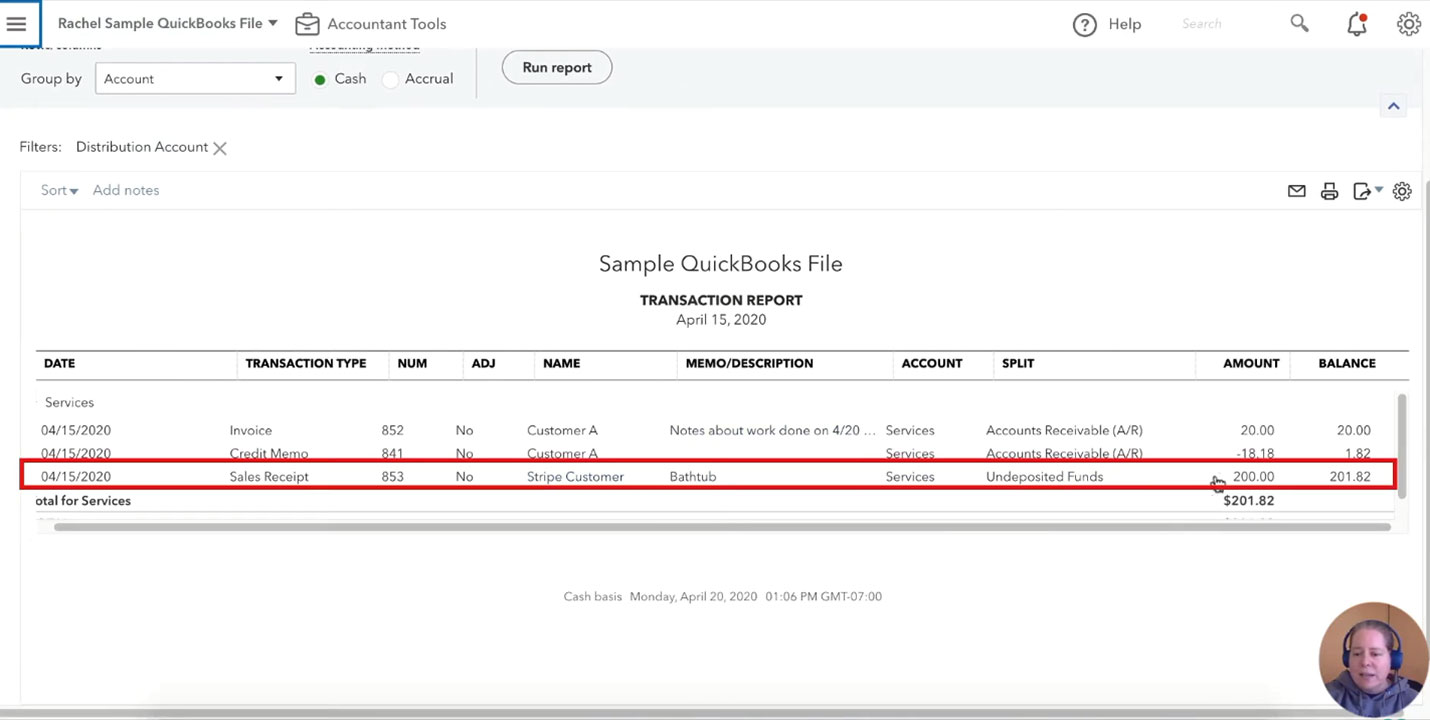

The quick ratio is calculated by subtracting inventory from current assets and dividing the result by current liabilities. The formula can be expressed as follows:

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

By excluding inventory from current assets, the quick ratio provides a more conservative evaluation of a company’s liquidity. This is because inventory is considered less liquid and may take time to convert into cash. By focusing on quick assets, such as cash, marketable securities, and accounts receivable, the quick ratio gives a clearer picture of a company’s ability to meet its short-term obligations.

A quick ratio of 1 indicates that a company’s quick assets are equal to its current liabilities, meaning it can pay off its immediate obligations. A ratio higher than 1 indicates that the company has more quick assets than current liabilities, indicating a higher level of liquidity. Conversely, a ratio below 1 suggests that the company may have difficulty fulfilling its short-term obligations.

It’s important to note that the ideal quick ratio varies across industries. Some industries, such as retail, may have higher levels of inventory and therefore lower quick ratios. On the other hand, service-based industries may have higher quick ratios as they typically have fewer inventory-related assets.

Overall, the quick ratio provides valuable insights into a company’s short-term liquidity position and its ability to handle financial obligations. By analyzing this ratio, stakeholders can assess the financial health of a company and make informed decisions based on its liquidity position.

Formula for Calculating Quick Ratio

The quick ratio, also known as the acid-test ratio, is a financial metric used to assess a company’s ability to pay off its short-term liabilities using its most liquid assets. The formula for calculating the quick ratio is relatively straightforward:

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

To calculate the quick ratio, you need to gather specific information from a company’s financial statements. Begin by identifying the relevant figures for current assets, inventory, and current liabilities.

Current assets include assets that are expected to be converted into cash within a year or the operating cycle of the business, whichever is longer. These assets commonly include cash, marketable securities, accounts receivable, and prepaid expenses. For the quick ratio calculation, you need to exclude inventory from the current assets figure.

Inventory refers to goods held by a company for sale or production. While inventory is considered an essential asset for many businesses, it is excluded from the quick ratio calculation because it may not be easily converted into cash in a short period of time.

Current liabilities, on the other hand, represent short-term obligations that are due within a year or the operating cycle of the business, whichever is longer. Examples of current liabilities include accounts payable, accrued expenses, and short-term debt.

Once you have gathered the necessary figures, subtract the inventory amount from the current assets and divide the result by the current liabilities. The resulting figure is the quick ratio.

For example, let’s say Company ABC has current assets of $500,000, inventory of $100,000, and current liabilities of $200,000. Using the quick ratio formula, we can calculate the ratio as follows:

Quick Ratio = ($500,000 – $100,000) / $200,000 = 2.5

In this example, Company ABC has a quick ratio of 2.5, indicating that it has $2.50 of quick assets available to cover each dollar of current liabilities. This suggests that the company has a relatively high level of liquidity and is well-positioned to meet its short-term obligations.

By calculating and analyzing the quick ratio, stakeholders can gain valuable insights into a company’s liquidity position and make informed decisions based on its ability to handle financial obligations.

Importance of Quick Ratio in Accounting

The quick ratio is a vital metric in accounting that provides crucial insights into a company’s short-term liquidity position and its ability to meet its immediate financial obligations. There are several reasons why the quick ratio is of significant importance in financial analysis:

Assessing Liquidity: The quick ratio is specifically designed to evaluate a company’s liquidity by focusing on its most liquid assets. By excluding inventory, which may take time to convert into cash, the quick ratio provides a conservative assessment of a company’s ability to meet its short-term liabilities. It helps determine whether a business has enough readily available assets to cover its immediate financial obligations.

Identifying Financial Risk: The quick ratio serves as a useful tool for identifying potential financial risks. A ratio below 1 implies that a company may struggle to pay off its short-term liabilities if they become due immediately. This may indicate that the company is heavily reliant on inventory or has limited cash reserves. Financial stakeholders can use this information to assess the company’s financial stability and potential risks associated with its liquidity position.

Comparing Companies: The quick ratio allows for easy comparison of companies within the same industry. Different industries have varying levels of inventory requirements. By comparing the quick ratios of companies operating in the same industry, investors and financial analysts can gain useful insights into how well each company manages its liquidity compared to its peers. This information can be valuable when making investment decisions or assessing potential partners or competitors.

Assisting in Decision-Making: Stakeholders, such as investors, creditors, and management, can use the quick ratio to make informed decisions. Investors can evaluate a company’s financial health by analyzing its liquidity position. Creditors can assess the risk of extending credit to a company by examining its ability to pay off short-term obligations. Management can use the quick ratio as a benchmark to monitor the company’s liquidity over time and identify areas for improvement.

Monitoring Working Capital: The quick ratio is closely related to working capital management. A company with a low quick ratio may face difficulties in managing its working capital effectively. By regularly monitoring the quick ratio, companies can identify potential issues in cash flow, inventory management, or accounts receivable collection, and take appropriate actions to optimize working capital and maintain a healthy liquidity position.

Overall, the quick ratio is an essential metric in accounting that helps stakeholders evaluate a company’s liquidity position and make informed decisions. By providing a conservative assessment of a company’s ability to cover short-term obligations, the quick ratio plays a crucial role in assessing financial stability, identifying risks, and facilitating effective financial management.

Interpreting Quick Ratio

The quick ratio, also known as the acid-test ratio, provides valuable insights into a company’s liquidity and its ability to meet short-term obligations. Interpreting the quick ratio involves analyzing the ratio in combination with other factors and considering industry benchmarks. Here are some key points to consider when interpreting the quick ratio:

Conservative Liquidity Assessment: The quick ratio is a more conservative measure of liquidity compared to the current ratio, as it excludes inventory from current assets. A quick ratio of 1 or higher indicates that a company can cover its short-term liabilities without relying on the sale of inventory. This suggests a strong liquidity position. However, a ratio below 1 may indicate that the company relies more heavily on slow-moving inventory to meet its obligations, which can pose liquidity risks.

Industry Comparisons: Comparing the quick ratio to industry benchmarks is essential due to variations in liquidity requirements across sectors. Different industries have different working capital needs and inventory cycles. What may be considered a healthy quick ratio in one industry may be inadequate in another. It is crucial to compare a company’s quick ratio to industry peers to assess its liquidity position relative to industry norms.

Trends and Historical Analysis: Monitoring changes in the company’s quick ratio over time is crucial. A declining trend may indicate deterioration in the company’s liquidity position, while an increasing trend suggests improved liquidity management. Comparing the current quick ratio to historical data allows for better understanding of liquidity fluctuations and potential underlying issues in the company’s operations or financial management.

External Factors: External factors, such as economic conditions, industry trends, and seasonality, can impact a company’s quick ratio. For instance, a company operating in a cyclical industry may experience fluctuations in its quick ratio due to variations in demand and sales cycles. Understanding these external influences is essential for accurate interpretation of the quick ratio and avoiding misjudgments solely based on the ratio itself.

Limitations: While the quick ratio provides valuable insights, it has certain limitations. First, it does not consider the quality of receivables or the time it takes to collect them. It assumes that all receivables will be collected within the specified period. Second, it does not consider the timing of cash inflows and outflows, which may impact a company’s ability to meet its obligations. Third, the quick ratio focuses on short-term liquidity and may not reflect a company’s overall financial health.

In summary, the quick ratio should be interpreted in conjunction with other financial metrics and industry benchmarks. It provides a conservative assessment of a company’s liquidity, but other factors, such as trends, external influences, and limitations, must be considered for a comprehensive understanding of the company’s liquidity position.

Advantages and Limitations of Quick Ratio

The quick ratio, also known as the acid-test ratio, is a valuable financial metric for assessing a company’s short-term liquidity. Like any financial ratio, the quick ratio has its advantages and limitations that should be considered when analyzing a company’s financial health:

Advantages:

- Focus on Immediate Liquidity: The quick ratio provides a snapshot of a company’s ability to meet its short-term obligations using its most liquid assets. By excluding inventory, which may take time to convert into cash, the quick ratio offers a more conservative assessment of a company’s liquidity.

- Conservative Measure of Financial Health: The quick ratio helps stakeholders, such as investors and creditors, assess a company’s financial stability. A ratio above 1 indicates that a company has more quick assets than current liabilities, suggesting a strong liquidity position. It provides assurance to investors and creditors that a company can meet its short-term obligations.

- Useful Comparison Tool: The quick ratio allows for easy comparison among companies within the same industry. By benchmarking a company’s quick ratio against its competitors, investors and financial analysts can gain insights into how well it manages liquidity and how it performs relative to industry peers. This helps in making investment decisions or assessing potential partnerships or acquisitions.

Limitations:

- Excludes Long-Term Liquidity: The quick ratio solely focuses on short-term liquidity and does not account for a company’s long-term financial health. It does not consider long-term assets or the timing of cash inflows and outflows, which may impact a company’s ability to meet its obligations beyond the short term.

- Does Not Assess Profitability: The quick ratio does not provide information about a company’s profitability or its ability to generate future cash flows. A company with a high quick ratio may still face profitability issues or have difficulty sustaining its operations in the long run.

- Industry-Specific Considerations: The ideal quick ratio varies across industries due to different working capital requirements and inventory cycles. Industries with higher inventory turnover may have lower quick ratios, which could be misleading when comparing companies from different sectors.

- Does Not Account for Quality of Receivables: The quick ratio assumes that all accounts receivable can be easily converted into cash. However, it does not consider the quality of receivables or the time it takes to collect them. A high level of overdue or uncollectible receivables may impact a company’s ability to convert them into cash quickly.

Despite its limitations, the quick ratio is a widely used and valuable metric in financial analysis. It provides a conservative assessment of a company’s short-term liquidity and helps stakeholders make informed decisions about its financial health and ability to meet its immediate obligations.

Conclusion

The quick ratio is a crucial metric in accounting that provides valuable insights into a company’s short-term liquidity position and its ability to meet immediate financial obligations. By focusing on a company’s most liquid assets and excluding inventory, the quick ratio offers a conservative assessment of liquidity that is useful for investors, creditors, and financial analysts.

Understanding the definition and calculation of the quick ratio is essential for accurately assessing a company’s financial health. By comparing the quick ratio to industry benchmarks and analyzing trends over time, stakeholders can gain valuable insights into a company’s liquidity position and identify potential risks.

Despite its advantages, the quick ratio has its limitations. It does not consider long-term liquidity, profitability, or the quality of receivables. Therefore, it is important to interpret the quick ratio in conjunction with other financial metrics and industry norms.

By incorporating the quick ratio into financial analysis, stakeholders can make informed decisions regarding investment opportunities, creditworthiness, and overall financial stability. The quick ratio plays a crucial role in evaluating a company’s ability to meet short-term obligations and helps in effective financial management.

In conclusion, the quick ratio is an essential tool in assessing a company’s liquidity and provides valuable insights into its financial health. It helps stakeholders make informed decisions based on a company’s ability to handle financial obligations and manage its liquidity effectively.