Finance

What Is Restructuring Investment Banking?

Modified: December 30, 2023

Learn about restructuring investment banking and its role in finance. Understand the strategies, processes, and implications of financial restructuring in the banking industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Restructuring Investment Banking

- Role and Responsibilities of Restructuring Investment Bankers

- Process of Restructuring Investment Banking

- Key Players in Restructuring Investment Banking

- Challenges and Risks in Restructuring Investment Banking

- Case Studies of Successful Restructuring Investment Banking

- Conclusion

Introduction

Welcome to the world of restructuring investment banking, where financial expertise meets strategic decision-making to revive struggling companies and maximize their value. In today’s volatile and competitive business landscape, companies often encounter financial distress or operational challenges that require a fresh perspective and a comprehensive restructuring plan.

Restructuring investment banking is a specialized branch of investment banking that focuses on guiding companies through the complex process of restructuring their operations, financials, and debt. It involves a deep understanding of financial markets, corporate governance, and legal frameworks to help distressed companies navigate through crisis situations and emerge stronger.

During times of economic downturn or industry disruption, businesses may experience declining revenues, excessive debt burdens, or inefficient operations that jeopardize their sustainability. In such scenarios, restructuring investment bankers step in to analyze the underlying causes of the company’s distress, devise a turnaround strategy, and implement necessary changes to restore financial health.

The primary objective of restructuring investment banking is to help companies reorganize their operations and finances in a way that improves performance, reduces costs, and increases profitability. This entails a comprehensive assessment of the company’s assets, liabilities, cash flow, and overall market position to identify areas of improvement and develop a strategic roadmap.

Throughout the restructuring process, investment bankers play a crucial role in advising top management and stakeholders, collaborating with legal and financial experts, and negotiating with creditors and investors to ensure the successful execution of the restructuring plan. They act as trusted advisors who provide guidance and support in making difficult decisions, including asset divestments, debt restructurings, or even corporate reorganizations.

As the financial world becomes increasingly interconnected and globalized, restructuring investment banking has become an indispensable service for companies across various sectors. Whether it is a distressed manufacturing company, a struggling retail chain, or a debt-ridden energy firm, restructuring investment bankers possess the knowledge and tools necessary to navigate the complex maze of financial challenges and lead companies towards a brighter future.

This article aims to provide a comprehensive overview of restructuring investment banking – its definition, role, process, key players, challenges, and even some case studies of successful restructuring efforts. By the end, you’ll have a deeper understanding of the intricacies involved in transforming distressed companies and the vital role that restructuring investment banking plays in revitalizing businesses.

Definition of Restructuring Investment Banking

Restructuring investment banking, also known as corporate restructuring or financial restructuring, is a specialized field within investment banking that focuses on assisting companies facing financial distress or operational challenges. It involves analyzing the financial situation of the company, identifying the root causes of its issues, and designing and implementing a strategic plan to improve its financial performance and optimize its capital structure.

In simpler terms, restructuring investment banking is all about helping struggling companies get back on track by reorganizing their operations, assets, debts, and liabilities. It aims to address problems such as declining revenues, excessive debt burdens, inefficient cost structures, management inefficiencies, and other factors that can hinder a company’s performance and survival in the market.

Restructuring investment bankers are financial experts who possess in-depth knowledge of corporate finance, accounting, law, and capital markets. They work closely with company management, boards of directors, lenders, and other stakeholders to develop and execute strategies that will enable the company to overcome its financial challenges and achieve long-term stability and growth.

The primary goals of restructuring investment banking are:

- Preserving value: The aim is to ensure that the company’s assets and operations are maximized and its value is preserved. Bankers work to identify ways to optimize the company’s operations, enhance cash flow, and improve profitability.

- Debt restructuring: Many distressed companies find themselves burdened by excessive debt, making it difficult for them to meet their financial obligations. Restructuring investment bankers help negotiate with lenders and creditors to restructure the company’s debt, including extending maturity dates, reducing interest rates, and potentially converting debt into equity.

- Operational restructuring: In some cases, a company’s financial distress may stem from operational inefficiencies. Restructuring investment banking involves conducting a thorough analysis of the company’s operations, identifying areas that need improvement, and implementing changes to enhance efficiency and reduce costs.

- Asset divestment and portfolio rationalization: As part of the restructuring process, investment bankers may recommend divesting non-core assets or subsidiaries that are not generating sufficient returns. This helps streamline the company’s operations, strengthen its core business, and generate cash to repay debt or invest in growth opportunities.

- Equity fundraising: In certain situations, restructuring investment bankers may help the company raise additional capital through equity financing. This may involve issuing new shares or seeking investments from external parties to strengthen the company’s financial position and support its restructuring efforts.

Overall, restructuring investment banking is a critical component of the financial industry that enables companies in distress to navigate through challenging times and emerge stronger. By providing strategic guidance, financial expertise, and access to capital markets, restructuring investment bankers play a vital role in revitalizing companies and preserving their value for shareholders and stakeholders.

Role and Responsibilities of Restructuring Investment Bankers

Restructuring investment bankers play a crucial role in guiding companies through the complex process of financial restructuring and revitalization. Their expertise and knowledge are invaluable in analyzing a company’s financial health, formulating strategic plans, and implementing necessary changes to improve performance and restore value. Here are some key roles and responsibilities of restructuring investment bankers:

- Financial Analysis: Investment bankers thoroughly analyze a distressed company’s financial statements, cash flow, debt obligations, and overall financial health. They identify the root causes of the company’s distress and assess its feasibility for restructuring.

- Developing Restructuring Strategies: Based on their financial analysis, investment bankers help develop comprehensive restructuring strategies tailored to the specific needs and goals of the distressed company. These strategies may include debt restructuring, operational improvements, asset divestment, or equity fundraising.

- Debt Restructuring: One of the primary responsibilities of restructuring investment bankers is to assist companies in restructuring their debt. They negotiate with lenders and creditors to modify existing debt terms, such as extending maturity dates, reducing interest rates, or converting debt into equity.

- Conducting Due Diligence: Investment bankers perform extensive due diligence to assess the feasibility and potential risks of the proposed restructuring plans. This includes assessing market conditions, competition, legal and regulatory aspects, and potential impacts on stakeholders.

- Collaboration with Legal and Financial Experts: Investment bankers work closely with legal advisors and other financial experts, such as lawyers, accountants, and valuation specialists, to ensure compliance with legal requirements and provide a comprehensive understanding of the financial implications of the restructuring process.

- Stakeholder Management: Investment bankers act as intermediaries between the distressed company and its stakeholders, including shareholders, lenders, employees, customers, and suppliers. They manage communication, provide updates on the progress of the restructuring process, and address concerns or inquiries from various parties.

- Negotiations and Deal Making: Investment bankers are skilled negotiators who represent the company’s interests and work to obtain favorable terms from lenders, creditors, and potential investors. They help structure deals, assess potential funding options, and facilitate transactions throughout the restructuring process.

- Advisory and Decision Support: Restructuring investment bankers serve as trusted advisors to the company’s management, offering strategic guidance, financial insights, and data-driven analysis to support decision-making. They assist in evaluating different restructuring options, assessing the potential impact on the company’s value, and making informed choices.

- Monitoring and Evaluation: Investment bankers monitor the implementation of the restructuring plan, assess its effectiveness, and make adjustments as needed. They track key financial indicators, project milestones, and overall progress to ensure the company is on track towards achieving its financial and operational goals.

Overall, the role of restructuring investment bankers requires a deep understanding of finance, capital markets, legal frameworks, and a strong ability to navigate complex negotiations. They act as catalysts for change, providing essential financial expertise, strategic guidance, and transactional support to companies in distress, with the aim of achieving financial stability, value creation, and long-term success.

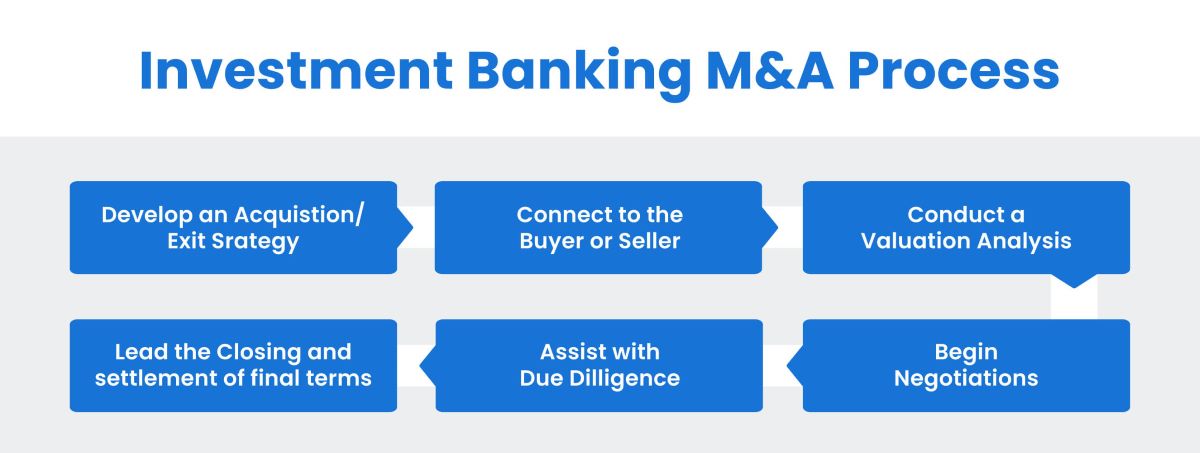

Process of Restructuring Investment Banking

The process of restructuring investment banking involves a series of steps designed to assess a company’s financial health, develop a restructuring plan, and implement necessary changes to improve its performance and restore value. While the specifics may vary depending on the unique circumstances of each distressed company, the following steps provide a general framework for the restructuring process:

- Financial Assessment: The first step is to conduct a comprehensive analysis of the company’s financial statements, cash flow, debt obligations, and overall financial health. Investment bankers assess the root causes of the company’s distress and identify key areas that require attention.

- Strategy Development: Based on the financial assessment, investment bankers work with the management team to develop a restructuring strategy tailored to the company’s specific needs and goals. This strategy may involve debt restructuring, operational improvement initiatives, asset divestment, or equity fundraising.

- Due Diligence: Investment bankers perform due diligence to gather additional information about the company, its industry, competitors, market conditions, legal and regulatory aspects, and potential risks and opportunities. This step helps in evaluating the feasibility and potential impacts of the proposed restructuring plan.

- Stakeholder Engagement: Investment bankers engage with key stakeholders, including lenders, creditors, shareholders, employees, customers, and suppliers. They communicate the company’s restructuring plans, address concerns, and seek support from relevant parties to facilitate the successful execution of the restructuring process.

- Debt Restructuring: If debt restructuring is part of the plan, investment bankers negotiate with lenders and creditors to modify existing debt terms. This may involve extending maturity dates, reducing interest rates, converting debt into equity, or refinancing options, all aimed at reducing financial burdens and improving the company’s cash flow.

- Operational Improvement: Investment bankers work with the company’s management team to identify operational inefficiencies and implement changes to enhance efficiency, reduce costs, and improve overall performance. This may involve streamlining processes, optimizing the supply chain, or identifying areas for cost reduction.

- Asset Divestment: In some cases, divesting non-core assets or subsidiaries that are not generating sufficient returns can help strengthen the company’s financial position. Investment bankers assess the company’s assets, determine the value and potential buyers, and facilitate the divestment process to generate cash and refocus the company on its core business.

- Equity Fundraising: If additional capital is required to support the restructuring efforts, investment bankers may help the company raise equity funding. This may involve issuing new shares or seeking investments from external parties to strengthen the company’s capital structure and provide the necessary financial support.

- Implementation and Monitoring: Once the restructuring plan is finalized, investment bankers support the company in implementing the necessary changes. They monitor the progress, track key financial indicators, and evaluate the effectiveness of the restructuring efforts. Adjustments may be made as needed to ensure the company stays on track towards achieving its financial and operational goals.

It’s important to note that the restructuring process can be complex and time-consuming, requiring close collaboration between the company’s management team, the investment bankers, legal advisors, and other stakeholders involved. A well-executed restructuring plan combined with effective implementation and monitoring can help distressed companies overcome financial challenges, regain stability, and set the stage for future growth and success.

Key Players in Restructuring Investment Banking

Restructuring investment banking involves the collaboration of various key players who work together to navigate distressed companies through the restructuring process. Each player brings a unique set of skills and expertise to the table, contributing to the successful execution of the restructuring plan. Here are the key players involved:

- Restructuring Investment Bankers: These professionals are at the forefront of the restructuring process. They are typically from investment banks or specialized restructuring firms and possess in-depth knowledge of finance, accounting, capital markets, and restructuring strategies. Investment bankers play a pivotal role in conducting financial analysis, developing and executing restructuring plans, negotiating with creditors, and providing strategic advice to distressed companies.

- Legal Advisors: As the restructuring process involves legal implications and considerations, legal advisors play a critical role in ensuring compliance with regulatory requirements. They assist in drafting and reviewing legal documents, providing guidance on corporate governance matters, and navigating complex legal issues related to debt restructuring, asset divestment, and potential litigation.

- Financial Advisors: In addition to investment bankers, financial advisors such as accountants and valuation specialists contribute their expertise to the restructuring process. They assist in analyzing the company’s financial statements, assessing the value of assets, evaluating potential investment opportunities, and providing recommendations to enhance financial stability and performance.

- Management Team: The company’s management team, including executives and board members, plays a crucial role in the restructuring process. They work closely with the investment bankers and other advisors to develop and execute the restructuring plan, make critical decisions, and ensure the company’s long-term viability and growth.

- Lenders and Creditors: Lenders and creditors, such as banks, bondholders, and other financial institutions, have a significant stake in the restructuring process. They closely collaborate with the investment bankers and legal advisors to negotiate the terms of debt restructuring, evaluate new investment opportunities, and protect their financial interests.

- Shareholders and Equity Investors: Shareholders and equity investors also play a role in the restructuring process, particularly if a company seeks to raise additional capital through equity financing. They may provide capital infusion to support the company’s restructuring efforts and help stabilize its financial position.

- Government and Regulatory Bodies: Depending on the jurisdiction and industry, government agencies and regulatory bodies may have a role in the restructuring process. They may provide oversight, review legal compliance, and offer support or incentives to distressed companies undergoing restructuring, particularly in industries of strategic importance.

- Employees and Unions: Employees and labor unions are important stakeholders in the restructuring process. Their cooperation and support are necessary to implement operational changes, cost-saving measures, and potential workforce reductions. Communication and engagement with employees and unions are critical to ensure smooth execution of the restructuring plan.

- Other External Advisors: Depending on the specific circumstances, there may be other external advisors involved in the restructuring process, such as industry experts, turnaround consultants, or public relations specialists. They bring specialized knowledge or skills that are relevant to the unique challenges faced by the distressed company.

The success of the restructuring process depends on the collaborative efforts of these key players. Their collective expertise, experience, and synergy are essential in guiding distressed companies through the complexities of financial restructuring, providing strategic guidance, and positioning them for long-term viability and growth.

Challenges and Risks in Restructuring Investment Banking

Restructuring investment banking is a complex and challenging field that involves navigating through a myriad of obstacles and risks. While each restructuring process is unique, there are common challenges that restructuring investment bankers face. Understanding these challenges and risks is crucial for successful execution of a restructuring plan. Here are some of the key challenges and risks in restructuring investment banking:

- Financial Complexity: Financial distress often results from a combination of complex issues, such as declining revenues, excessive debt burdens, and inefficient cost structures. Understanding and unraveling these complexities requires sophisticated financial analysis and modeling to develop effective restructuring strategies.

- Legal and Regulatory Hurdles: The intricacies of legal and regulatory systems can pose significant challenges during the restructuring process. Companies must navigate complex laws, regulations, and contractual obligations, including bankruptcy laws, tax implications, and employment regulations, which vary across jurisdictions.

- Stakeholder Conflicts: Restructuring involves multiple stakeholders with conflicting interests, such as lenders, creditors, shareholders, and employees. Balancing these competing interests and achieving consensus can be a daunting task, requiring negotiation skills, effective communication, and careful management of relationships.

- Market Volatility: Economic and market volatility can significantly impact the success of a restructuring plan. Fluctuating interest rates, currency exchange rates, commodity prices, and market conditions can create challenges in securing financing, selling assets, or attracting investors, impacting the outcome of the restructuring process.

- Operational Disruptions: Implementing changes to improve operational efficiency and reduce costs can disrupt the normal business operations of a distressed company. Ensuring a smooth transition, minimizing disruptions to customer relationships, and maintaining employee morale are critical factors that must be carefully managed.

- Debt and Capital Constraints: High levels of debt and limited access to capital can constrain the options available for a distressed company. Restructuring investment bankers must navigate the complexities of debt restructuring, negotiate favorable terms with lenders, and explore alternative financing options to provide the company with liquidity and financial stability.

- Execution Risks: The successful execution of a restructuring plan requires effective project management, attention to detail, and timely decision-making. Risks associated with project execution, including delays, cost overruns, and unforeseen challenges, must be managed to ensure the successful implementation of the restructuring initiatives.

- Reputation Risks: Restructuring processes can attract significant attention from the media, the public, and other stakeholders. Any negative perception of the restructuring plan or the company’s financial health can have a detrimental impact on its reputation and future business prospects.

- Uncertain Outcomes: Despite careful planning and execution, there is no guarantee of a successful outcome in a restructuring process. External factors, unforeseen events, or changes in market conditions can impact the viability of the restructuring plan, requiring flexibility and adaptability to manage potential setbacks.

While the challenges and risks in restructuring investment banking can be daunting, they can also present opportunities for value creation and long-term sustainability. Experienced restructuring investment bankers understand the complexities involved and employ comprehensive risk management and mitigation strategies to navigate through these challenges and increase the chances of a successful restructuring outcome.

Case Studies of Successful Restructuring Investment Banking

Examining case studies of successful restructuring investment banking provides valuable insights into the potential outcomes and benefits of a well-executed restructuring plan. Here are two notable examples:

1. General Motors (GM) Restructuring:

In the aftermath of the 2008 financial crisis, General Motors (GM) faced significant financial distress and was on the verge of bankruptcy. The company turned to restructuring investment banking to orchestrate a successful turnaround. Investment bankers worked collaboratively with the management team and stakeholders to develop a comprehensive restructuring plan. Key elements of the plan included asset divestment, reduction of production capacity, renegotiation of labor contracts, debt restructuring, and a focus on innovation and product quality.

Through effective negotiation with creditors, government support, and operational improvements, GM successfully emerged from bankruptcy in just over a year. The restructuring plan enabled the company to shed unprofitable brands, reduce debt burden, streamline operations, and refocus on core product lines. GM’s successful restructuring not only saved thousands of jobs but also revitalized the company’s financial health, leading to sustained profitability and renewed investor confidence.

2. American Airlines Restructuring:

American Airlines faced financial challenges as a result of high labor costs, mounting debt, and intense competition. In 2011, the company filed for Chapter 11 bankruptcy protection and engaged in a restructuring process. Investment bankers played a crucial role in negotiating with creditors, devising operational improvements, and implementing financial restructuring strategies.

During the restructuring process, American Airlines effectively renegotiated labor contracts, reduced non-profitable routes, and achieved significant cost savings. Through debt restructuring and access to new capital, the company improved its balance sheet and liquidity position. American Airlines emerged from bankruptcy in 2013, successfully completing its restructuring and positioning itself for sustained growth and profitability. Subsequently, the company merged with US Airways to become one of the largest airlines globally.

These case studies demonstrate how restructuring investment banking can be instrumental in guiding distressed companies through challenging times. Strategic planning, effective communication, strong negotiation skills, and a focus on operational improvements are key elements that contributed to their success.

It’s important to note that each restructuring situation is unique, and outcomes can vary depending on various factors, including market conditions and industry dynamics. However, by analyzing case studies of successful restructuring investment banking, companies can gain valuable insights and potential strategies to help guide their own restructuring efforts.

Conclusion

Restructuring investment banking plays a crucial role in helping distressed companies navigate financial challenges and emerge stronger. The process involves in-depth financial analysis, strategic planning, and implementation of necessary changes to restore value and improve performance. Through debt restructuring, operational improvements, asset divestment, and equity fundraising, restructuring investment bankers assist companies in overcoming financial distress, preserving value, and positioning themselves for long-term success.

Throughout the restructuring process, various key players, including investment bankers, legal advisors, financial experts, stakeholders, and management teams, collaborate to develop and execute a comprehensive restructuring plan. This involves addressing challenges such as financial complexity, stakeholder conflicts, market volatility, and legal and regulatory hurdles. Risks such as execution challenges and uncertain outcomes are carefully managed to increase the probability of a successful restructuring outcome.

Case studies of successful restructuring investment banking, such as General Motors and American Airlines, exemplify the positive impact a well-executed restructuring plan can have on a distressed company. These examples demonstrate that effective strategic planning, negotiation skills, and a focus on operational improvements can revitalize financial health, restore investor confidence, and ensure long-term viability.

In conclusion, restructuring investment banking is a specialized field that brings together financial expertise, legal knowledge, and negotiation skills to guide distressed companies through challenging times. By employing a comprehensive approach and leveraging the expertise of key players, restructuring investment banking can help companies not only survive but thrive, positioning them for sustainable growth and success.