Finance

What Is Restructuring Investment Banking

Modified: December 30, 2023

Learn about restructuring investment banking in the finance industry and its significance in financial transactions and corporate restructuring.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Restructuring Investment Banking

- Role of Restructuring Investment Bankers

- Key Skills and Qualifications for Restructuring Investment Bankers

- Types of Restructuring Deals

- Process and Steps in a Restructuring Transaction

- Challenges and Risks in Restructuring Investment Banking

- Case Studies and Examples of Successful Restructuring Deals

- Conclusion

Introduction

Restructuring investment banking is a specialized field within the finance industry that deals with helping distressed companies regain financial stability. It involves assessing a company’s financial situation, devising strategies to address their challenges, and implementing changes to improve their overall performance. In other words, restructuring investment bankers act as financial advisors to struggling companies, guiding them through the process of revamping their operations, reducing debt, and enhancing profitability.

During periods of economic downturns, companies may face various financial difficulties such as declining revenues, mounting debt, or inefficient operations. In such situations, restructuring investment bankers play a crucial role in helping these companies navigate through turbulent times and emerge stronger.

Restructuring investment banking is a challenging and dynamic field that requires a deep understanding of finance, excellent analytical skills, and the ability to think strategically. Professionals in this field need to have a comprehensive knowledge of financial markets, mergers and acquisitions, bankruptcy laws, and industry trends.

In this article, we will explore the definition of restructuring investment banking, the role of restructuring investment bankers, the key skills and qualifications required for this field, the types of restructuring deals, the process and steps involved in a restructuring transaction, the challenges and risks associated with restructuring investment banking, and some case studies of successful restructuring deals.

Whether you are a finance professional looking to specialize in restructuring investment banking or an entrepreneur seeking insights on how to turn around a distressed business, this article will provide you with a comprehensive understanding of the field and its intricacies.

Definition of Restructuring Investment Banking

Restructuring investment banking is a specialized area within the broader field of investment banking that focuses on providing financial advisory services to companies that are facing financial distress or undergoing significant organizational changes. The primary objective of restructuring investment banking is to help these companies improve their financial health, enhance operational efficiency, and ultimately restore profitability.

Restructuring can take various forms depending on the specific needs and circumstances of the company. It may involve a comprehensive review and reorganization of the company’s capital structure, including debt reduction, renegotiation of loan terms, and raising additional capital. In some cases, restructuring may also entail divestitures, mergers, acquisitions, or strategic alliances to streamline operations and realign the business model.

Restructuring investment bankers are responsible for guiding companies through the complex process of restructuring. They analyze the company’s financial situation, identify areas of concern, and develop a tailored restructuring plan that aligns with the company’s goals and objectives. This plan typically includes a detailed analysis of the company’s financial statements, evaluation of debt obligations, assessment of operational inefficiencies, and identification of potential cost-saving measures.

Restructuring investment bankers also play a crucial role in negotiating with stakeholders such as lenders, bondholders, shareholders, and suppliers to reach consensus on the proposed restructuring plan. They facilitate discussions, mediate disagreements, and work towards a mutually beneficial outcome that will address the financial challenges faced by the company.

Furthermore, restructuring investment bankers closely monitor the implementation of the restructuring plan and provide ongoing support and guidance to ensure its successful execution. They work closely with other professionals, including lawyers, accountants, and consultants, to navigate legal and regulatory obligations, optimize tax implications, and maximize the value of the restructured company.

Overall, restructuring investment banking requires a deep understanding of financial markets, corporate finance, bankruptcy laws, and industry dynamics. It demands strategic thinking, strong analytical skills, and the ability to formulate viable solutions in challenging and rapidly changing environments.

In the following sections, we will delve deeper into the role of restructuring investment bankers, the key skills and qualifications required for this field, and the types of restructuring deals commonly encountered in practice.

Role of Restructuring Investment Bankers

Restructuring investment bankers play a vital role in advising and supporting companies going through financial distress or significant operational changes. They act as strategic partners, providing guidance and expertise to help companies navigate through challenging situations and emerge stronger. The role of restructuring investment bankers encompasses various responsibilities, including:

- Financial Analysis: Restructuring investment bankers conduct in-depth financial analysis of companies in distress. They assess the overall financial health, including cash flow, debt obligations, and profitability. By examining financial statements and market trends, they identify key issues and develop strategies to address them effectively.

- Strategic Planning: Based on their analysis, restructuring investment bankers develop comprehensive restructuring plans. These plans may include reducing debt, divesting non-core assets, renegotiating contracts, or implementing cost-cutting measures. They collaborate with company management to align the restructuring plan with the company’s long-term strategic goals.

- Stakeholder Management: Restructuring investment bankers work closely with stakeholders such as creditors, shareholders, and suppliers. They negotiate with these parties to obtain their buy-in and support for restructuring initiatives. This may involve debt restructurings, equity infusions, or modifications to existing contracts to ensure the successful implementation of the restructuring plan.

- Transaction Execution: Restructuring investment bankers are responsible for executing the financial transactions required to implement the restructuring plan. This may involve raising capital through debt or equity offerings, arranging refinancing or recapitalization, or facilitating asset sales or acquisitions. They guide companies through regulatory processes and assist in closing the necessary agreements.

- Legal and Regulatory Expertise: As restructuring involves complex legal and regulatory considerations, restructuring investment bankers work closely with legal advisors. They ensure compliance with bankruptcy laws, negotiate with regulatory authorities, and manage the various legal requirements associated with the restructuring process. Their expertise in navigating these complexities helps mitigate risks and ensures a smooth restructuring process.

- Ongoing Monitoring: Even after the restructuring plan is implemented, restructuring investment bankers continue to monitor the company’s progress. They track financial performance, assess the effectiveness of implemented strategies, and make adjustments as necessary. Their ongoing support helps companies maintain financial stability and adapt to changing market conditions.

The role of restructuring investment bankers requires a combination of financial expertise, strategic thinking, negotiation skills, and the ability to work under high-pressure situations. They must possess a deep understanding of financial markets, accounting principles, and industry dynamics. By providing guidance and executing strategic initiatives, restructuring investment bankers play a critical role in helping companies navigate financial distress and position themselves for long-term success.

Key Skills and Qualifications for Restructuring Investment Bankers

Restructuring investment banking is a demanding field that requires a unique set of skills and qualifications. To excel in this role, professionals need to possess a combination of technical expertise, analytical skills, and the ability to navigate complex financial situations. The key skills and qualifications necessary for restructuring investment bankers include:

- Financial Acumen: A strong foundation in finance is essential for restructuring investment bankers. They need to have a deep understanding of financial statements, financial modeling, and valuation techniques. Proficiency in analyzing financial data and identifying key financial metrics is critical for assessing a company’s financial health and formulating effective restructuring strategies.

- Strategic Thinking: Restructuring investment bankers must be strategic thinkers who can evaluate a company’s current situation and develop a vision for its future. They need to identify the underlying causes of financial distress and devise innovative solutions to address them. The ability to anticipate industry trends and assess potential risks and opportunities is vital for creating successful restructuring plans.

- Analytical Skills: Effective restructuring requires a comprehensive analysis of a company’s operations, financials, and market dynamics. Restructuring investment bankers must possess strong analytical skills to dissect complex issues, identify trends, and evaluate different scenarios. They should be proficient in financial modeling, forecasting, and risk assessment, enabling them to make informed decisions and develop sound restructuring strategies.

- Communication and Negotiation: Communication and negotiation skills are essential for restructuring investment bankers. They need to effectively communicate complex financial concepts and restructuring plans to various stakeholders, including company management, lenders, and investors. Strong negotiation skills are crucial for resolving conflicts, reaching consensus on restructuring terms, and securing favorable agreements with creditors and other parties involved in the restructuring process.

- Knowledge of Bankruptcy and Legal Frameworks: Restructuring often involves navigating bankruptcy laws and legal frameworks. Restructuring investment bankers must have a solid understanding of these regulations to ensure compliance and maximize the benefits of restructuring. They work closely with legal advisors to develop strategies that align with the legal requirements and protect the interests of the company and its stakeholders.

- Industry Expertise: A deep understanding of the industry in which the distressed company operates is invaluable for restructuring investment bankers. They need to be aware of industry-specific challenges, trends, and best practices. This knowledge enables them to develop tailored restructuring strategies that address the unique needs and dynamics of the industry.

- Teamwork and Leadership: Restructuring investment bankers often work in teams that include professionals from various disciplines, such as legal, finance, and strategy. The ability to collaborate effectively, provide leadership, and manage multiple stakeholders is essential for successful restructuring. Strong interpersonal skills, adaptability, and a collaborative mindset are key to fostering a cohesive and productive team environment.

Overall, successful restructuring investment bankers possess a unique blend of technical and interpersonal skills. They combine financial acumen, strategic thinking, analytical prowess, and effective communication to guide companies through financial distress and help them emerge stronger and more sustainable.

Types of Restructuring Deals

Restructuring deals can take various forms depending on the specific needs and circumstances of the company. Each type of deal aims to address different aspects of the company’s financial distress and operational challenges. Here are some common types of restructuring deals:

- Debt Restructuring: This type of restructuring deal involves renegotiating the terms of existing debt obligations to provide relief to the company. It may include extensions of maturity dates, reductions in interest rates or principal amounts, or changes to payment schedules. Debt restructuring helps alleviate the financial burden on the company and provides a more manageable repayment structure.

- Equity Infusion: In some cases, a restructuring deal may involve an equity infusion, where new investors inject fresh capital into the company in exchange for an ownership stake. This helps strengthen the company’s balance sheet and provides the necessary funds to execute restructuring initiatives. Equity infusions can be in the form of private equity investments, strategic partnerships, or public offerings.

- Divestitures: Divestitures involve selling off non-core assets or business lines to simplify the company’s operations and focus on its core strengths. Divestitures can generate cash inflows that can be used to repay debt, reduce expenses, or invest in more profitable areas of the business. This type of restructuring deal helps streamline the company’s operations and improve its financial position.

- Mergers and Acquisitions: Sometimes, a restructuring deal may involve merging with or acquiring another company. This can lead to synergies, cost savings, and improved operational efficiencies. Mergers and acquisitions in a restructuring context can help companies expand their market share, diversify their product offerings, or access new markets.

- Operational Restructuring: Operational restructuring deals focus on improving the efficiency and effectiveness of a company’s operations. This may involve cost-cutting measures, organizational restructuring, process optimization, or reengineering of business processes. Operational restructuring aims to enhance profitability and competitiveness by eliminating inefficiencies and streamlining operations.

- Asset Sales: Another type of restructuring deal is selling off assets that are no longer generating sufficient returns or are not aligned with the company’s strategic objectives. Asset sales generate immediate cash inflows and allow companies to focus on their core business lines. This type of restructuring deal can be especially beneficial for reducing debt and improving liquidity.

It’s important to note that these types of restructuring deals are not mutually exclusive and can often overlap in practice. The specific combination of restructuring strategies depends on the unique circumstances of each company and the goals of the restructuring process.

In the next section, we will discuss the process and steps involved in a typical restructuring transaction.

Process and Steps in a Restructuring Transaction

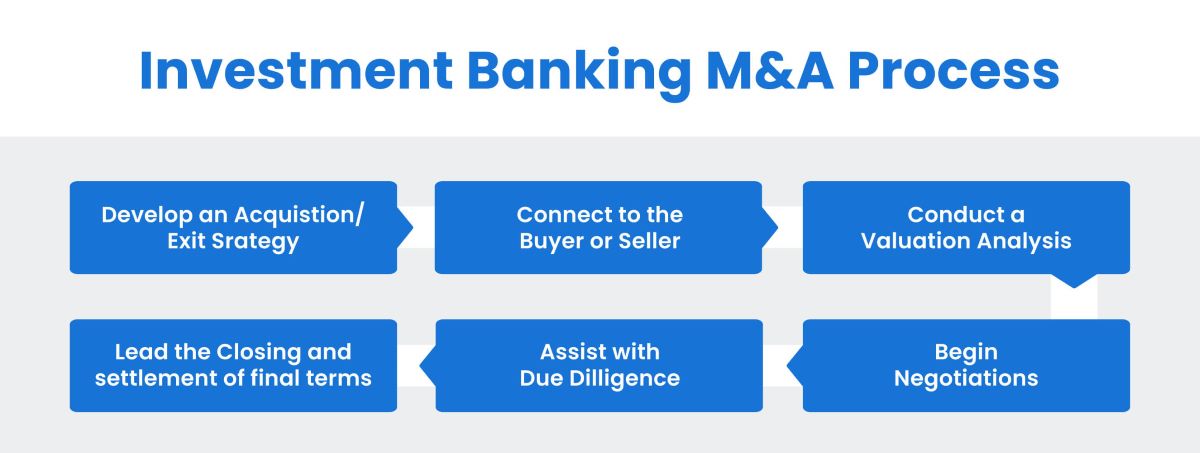

A restructuring transaction involves a series of carefully planned steps aimed at improving the financial health and operational efficiency of a distressed company. While the specific process may vary based on the circumstances of the company and the type of restructuring being pursued, there are common steps involved in a typical restructuring transaction:

- Assessment and Analysis: The first step in a restructuring transaction is to assess the company’s financial situation and identify the root causes of its distress. This involves a comprehensive analysis of the company’s financial statements, debt structure, operational inefficiencies, and market dynamics. The goal is to gain a deep understanding of the company’s challenges and develop a clear picture of the areas that need to be addressed in the restructuring process.

- Development of a Restructuring Plan: Based on the assessment, restructuring investment bankers work closely with company management to develop a customized restructuring plan. This plan outlines the specific strategies and actions that will be taken to address the identified challenges. It may include debt restructuring, cost reduction initiatives, asset sales, organizational changes, or other measures to enhance operational efficiency and restore profitability.

- Negotiation with Stakeholders: Restructuring investment bankers play a critical role in negotiating with stakeholders such as lenders, bondholders, shareholders, and suppliers. They present the restructuring plan and work towards gaining acceptance and support from these parties. Negotiations may involve discussions on debt repayment terms, interest rate adjustments, equity infusions, or modifications to existing contracts. The goal is to reach a consensus that aligns the interests of all parties and facilitates the successful implementation of the restructuring plan.

- Execution of Financial Transactions: Once the restructuring plan is approved by the stakeholders, restructuring investment bankers assist in executing the necessary financial transactions. This may involve raising additional capital through debt or equity offerings, refinancing existing debt, arranging new financing facilities, or facilitating asset sales or acquisitions. The objective is to provide the company with the necessary financial resources to implement the restructuring plan effectively.

- Implementation and Monitoring: After the restructuring plan is set in motion, it is crucial to closely monitor its implementation and progress. Restructuring investment bankers work with company management to ensure that the agreed-upon actions are executed according to the plan. They track the company’s financial performance, assess the effectiveness of the implemented strategies, and make adjustments if necessary. Ongoing monitoring helps to identify any obstacles, risks, or deviations from the plan and enables timely corrective actions.

- Evaluation and Adjustment: As the restructuring plan progresses, periodic evaluations are conducted to assess its impact and effectiveness. Adjustments may need to be made based on changing market conditions, unforeseen circumstances, or emerging opportunities. Restructuring investment bankers provide guidance and recommendations for fine-tuning the plan to maximize the chances of a successful turnaround. The goal is to ensure the long-term viability and sustainability of the restructured company.

It’s important to note that the restructuring process can be complex and time-consuming, often involving multiple parties, legal considerations, and regulatory requirements. Therefore, it is crucial to have experienced restructuring investment bankers who can navigate these challenges and guide the company through each step of the transaction.

In the next section, we will discuss the challenges and risks associated with restructuring investment banking.

Challenges and Risks in Restructuring Investment Banking

Restructuring investment banking is a high-stakes field that comes with its fair share of challenges and risks. Successfully navigating these challenges is crucial to achieving a positive outcome in the restructuring process. Some key challenges and risks in restructuring investment banking include:

- Complexity of Situations: Each restructuring case is unique, and the complexity of the financial distress or operational issues can vary widely. Restructuring investment bankers must carefully analyze the company’s situation, identify the underlying causes, and develop tailored solutions. The need to balance multiple stakeholders’ interests, legal obligations, and financial intricacies adds to the complexity of the process.

- Stakeholder Alignment: Restructuring often involves negotiating with various stakeholders, such as lenders, bondholders, shareholders, and suppliers. These parties may have different preferences, priorities, or incentives. Achieving consensus and aligning their interests can be challenging, as conflicting objectives and demands can arise. Restructuring investment bankers must skillfully navigate these negotiations to gain support for the restructuring plan.

- Legal and Regulatory Considerations: Restructuring transactions involve complex legal and regulatory frameworks, including bankruptcy laws, tax regulations, and industry-specific rules. Ensuring compliance with these regulations while maximizing the benefits of the restructuring requires a thorough understanding of the legal landscape. Failure to navigate these complexities correctly can lead to delays, higher costs, and legal disputes.

- Financial and Market Volatility: The financial viability of a distressed company is often influenced by external market factors and economic conditions. Fluctuations in interest rates, currency exchange rates, commodity prices, or market sentiment can significantly impact the restructuring process. Restructuring investment bankers need to be adaptable and proactive in assessing changing market dynamics and adjusting the restructuring plan accordingly.

- Execution and Implementation Risks: Successfully executing a restructuring plan requires careful planning and diligent implementation. However, there are inherent risks in executing complex financial transactions and operational changes. Poor implementation may result in unintended consequences, operational disruptions, or resistance from stakeholders. Restructuring investment bankers must monitor the progress, manage potential risks, and provide ongoing guidance to ensure a smooth and effective implementation.

- Uncertain Economic and Industry Outlook: Restructuring deals often occur during challenging economic environments or in industries facing structural shifts. The uncertainty of the economic and industry outlook introduces additional risks to the restructuring process. Restructuring investment bankers need to carefully assess the long-term viability of the company in light of market trends, technological advancements, and competitive dynamics.

Despite these challenges and risks, successful restructuring investment bankers leverage their expertise, analytical skills, and strategic thinking to overcome obstacles and drive positive outcomes. They work closely with their clients to mitigate risks, find creative solutions, and navigate the complexities of the restructuring process.

In the following section, we will explore case studies and examples of successful restructuring deals to illustrate the impact and effectiveness of restructuring investment banking.

Case Studies and Examples of Successful Restructuring Deals

Restructuring investment banking has played a critical role in helping numerous companies overcome financial distress and achieve successful turnarounds. Here are a few notable case studies and examples of successful restructuring deals:

1. General Motors (GM)

During the global financial crisis in 2008, General Motors faced severe financial challenges, leading to its bankruptcy filing in 2009. The company embarked on a large-scale restructuring process with the assistance of restructuring investment bankers. The restructuring plan involved significant debt reduction, closing multiple manufacturing plants, and renegotiating labor agreements. The support of restructuring investment bankers helped GM emerge from bankruptcy and regain profitability, enabling the company’s subsequent successful public stock offering.

2. Delta Air Lines

In the early 2000s, Delta Air Lines faced financial difficulties due to a downturn in the airline industry. The company sought the assistance of restructuring investment bankers to develop a comprehensive restructuring plan. The plan involved cost-cutting measures, route optimization, and a debt restructuring strategy. With the guidance of restructuring investment bankers, Delta successfully navigated through bankruptcy, emerged as a stronger and more efficient airline, and eventually merged with Northwest Airlines to become the world’s largest air carrier.

3. Energy Future Holdings (EFH)

Energy Future Holdings, formerly known as TXU Corp, faced significant financial challenges due to high levels of debt and declining energy prices. The company enlisted the help of restructuring investment bankers to develop a restructuring plan that involved a debt-for-equity swap and a reduction in overall debt levels. The successful execution of the restructuring plan allowed EFH to emerge from bankruptcy, paving the way for improved financial stability and long-term viability.

4. Toys “R” Us

Toys “R” Us, a leading toy retailer, faced financial distress amidst increased competition from online retailers and changing consumer preferences. Restructuring investment bankers played a crucial role in developing and executing a restructuring plan that involved store closures, debt refinancing, and negotiations with stakeholders. The successful restructuring efforts allowed Toys “R” Us to continue operating and reposition itself as a more streamlined and competitive player in the toy retail industry.

These case studies demonstrate the effectiveness of restructuring investment banking in helping distressed companies overcome financial challenges and achieve successful turnarounds. By providing strategic guidance, executing financial transactions, and negotiating with stakeholders, restructuring investment bankers play a pivotal role in revitalizing struggling companies and positioning them for long-term success.

In the concluding section, we will summarize the key insights from this article on restructuring investment banking.

Conclusion

Restructuring investment banking is a specialized field that plays a crucial role in helping distressed companies regain financial stability and operational efficiency. Restructuring investment bankers provide strategic guidance, develop comprehensive restructuring plans, and execute financial transactions to address a company’s financial distress and drive a successful turnaround.

Throughout this article, we have explored the definition of restructuring investment banking, the role of restructuring investment bankers, the key skills and qualifications required for this field, the types of restructuring deals, the process and steps involved in a restructuring transaction, the challenges and risks associated with restructuring investment banking, and case studies of successful restructuring deals.

From General Motors to Delta Air Lines, these real-world examples have showcased the impact of restructuring investment banking in helping companies overcome financial challenges and emerge stronger. Through careful analysis, strategic planning, stakeholder management, and execution of financial transactions, restructuring investment bankers play a critical role in guiding distressed companies towards financial stability and long-term success.

To succeed in restructuring investment banking, professionals need to possess a combination of financial acumen, strategic thinking, analytical skills, communication and negotiation abilities, and industry expertise. They must be well-versed in legal and regulatory frameworks and be adaptable to changing economic conditions and market dynamics.

While restructuring deals present their share of challenges and risks, such as complexity, stakeholder alignment, legal considerations, and market volatility, skilled restructuring investment bankers leverage their expertise to navigate these obstacles and drive positive outcomes.

In conclusion, restructuring investment banking is a dynamic field that requires a deep understanding of finance, strategic planning, and effective execution. By helping distressed companies regain financial stability and operational efficiency, restructuring investment bankers play a vital role in shaping the future of businesses and contributing to the overall health of the economy.