Finance

What Is Tax Deferred Pension

Modified: December 30, 2023

Learn about tax-deferred pensions and how they can help with your finance goals. Find out how to maximize your savings and secure your future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

A tax deferred pension is a financial tool that allows individuals to save for their retirement while enjoying certain tax benefits. It is designed to provide individuals with a steady stream of income during their retirement years, ensuring financial security and stability.

As life expectancies increase and the future of government-funded retirement programs becomes uncertain, it has become increasingly important for individuals to take control of their retirement savings. Tax deferred pensions offer an attractive option for individuals to build a nest egg for their golden years.

At its core, a tax deferred pension is a savings vehicle that allows individuals to contribute a portion of their income to a retirement account, often through their employer. These contributions are made on a pre-tax basis, meaning that the money is deducted from the individual’s income before taxes are applied.

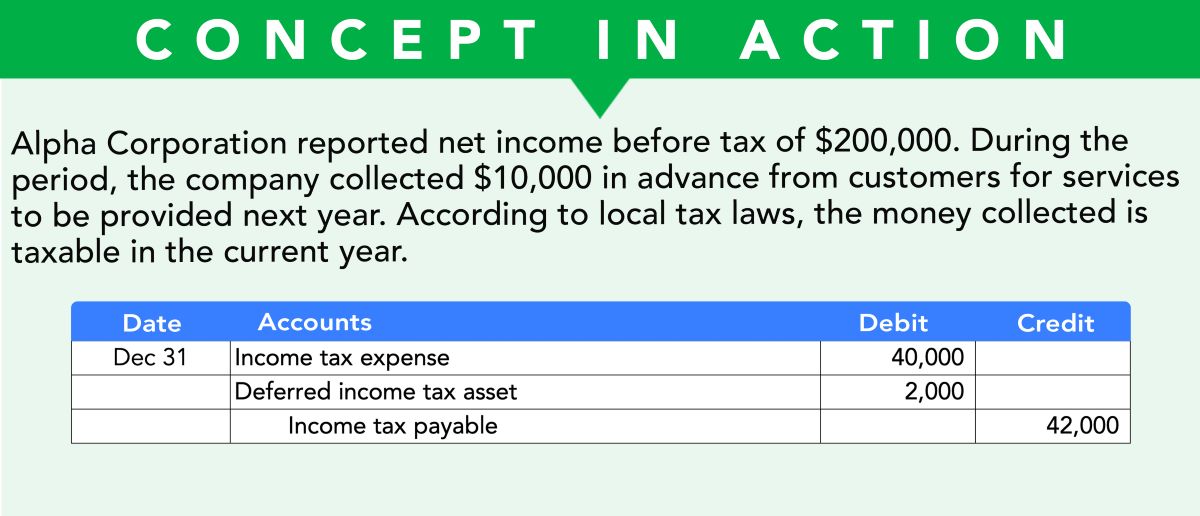

By deferring taxes on these contributions, individuals can potentially lower their taxable income in the current year, resulting in a reduced tax liability. Additionally, the earnings on the investments within the tax deferred pension account grow on a tax-deferred basis, meaning they are not subject to capital gains or income tax until the funds are withdrawn in retirement.

The concept of tax deferred pensions was introduced to encourage individuals to save for retirement and alleviate the burden on government-funded programs. By incentivizing individuals to invest in their own retirement, tax deferred pensions aim to lessen the strain on social security and other public retirement systems.

However, it is important to note that while tax deferred pensions offer significant benefits, they also come with certain limitations and considerations. It is crucial for individuals to understand the various aspects of tax deferred pensions, such as eligibility, contribution limits, and the potential risks involved, before making informed decisions about their retirement savings.

In the following sections, we will delve deeper into the definition of tax deferred pensions, explore their benefits, understand how they work, discuss eligibility and contribution limits, and highlight different types of tax deferred pension plans. We will also cover the risks and considerations associated with tax deferred pensions and provide an overview of the tax treatment of withdrawals from these retirement accounts.

By the end of this article, you will have a comprehensive understanding of tax deferred pensions and be equipped with the knowledge to make informed decisions about your retirement savings strategy.

Definition of Tax Deferred Pension

A tax deferred pension refers to a retirement savings vehicle that allows individuals to contribute a portion of their income to a designated account, typically through an employer-sponsored plan. These contributions are made on a pre-tax basis, meaning that they are deducted from the individual’s income before taxes are applied. This allows individuals to reduce their taxable income in the current year, potentially resulting in a lower tax liability.

Through a tax deferred pension plan, individuals can accumulate savings and investments in a sheltered account, which grows on a tax-deferred basis. This means that the earnings generated by the investments are not subject to capital gains or income tax until the funds are withdrawn in retirement.

The tax-deferred growth of assets within a tax deferred pension allows for potential compounding, where the earnings generated from investments are reinvested and generate additional earnings over time. This can lead to significant growth of retirement savings, especially when contributions are made regularly and the investments perform well.

There are different types of tax deferred pension plans available, such as 401(k)s, 403(b)s, and Individual Retirement Accounts (IRAs), each with its own eligibility criteria and contribution limits. They may also have different rules regarding withdrawals and required minimum distributions (RMDs) during retirement.

It is important to note that while tax deferred pensions provide attractive tax advantages, there are restrictions on when and how withdrawals can be made. Generally, early withdrawals before the age of 59 and a half may be subject to penalties and taxes. However, once individuals reach the age of 59 and a half, withdrawals from tax deferred pension plans are typically allowed and taxed as ordinary income.

Overall, tax deferred pensions play a vital role in retirement planning by allowing individuals to save for their future while enjoying tax advantages. They provide a disciplined approach to building a retirement nest egg and can offer a steady stream of income during the golden years. However, it is important for individuals to understand the specific rules and regulations associated with their chosen tax deferred pension plan to maximize the benefits and avoid any potential pitfalls.

Benefits of Tax Deferred Pension

Tax deferred pensions offer numerous benefits for individuals looking to save for retirement. By taking advantage of these retirement savings vehicles, individuals can enjoy financial security and reap the following advantages:

- Tax Advantages: One of the primary benefits of tax deferred pensions is the ability to save on taxes. Contributions made to the pension plan are deducted from an individual’s taxable income, effectively reducing their current-year tax liability. Additionally, the earnings on the investments within the pension account grow on a tax-deferred basis, meaning they are not subject to capital gains or income taxes until withdrawal. This potential compounding of tax-free growth can significantly enhance the growth of retirement savings over time.

- Employer Contributions: Many tax deferred pension plans, such as 401(k)s, offer the option for employers to make matching contributions. This means that for every dollar an employee contributes to the plan, their employer also contributes a certain percentage, often up to a specified limit. Employer contributions are essentially free money, effectively boosting the individual’s retirement savings without any additional cost.

- Retirement Income: Tax deferred pensions are specifically designed to provide individuals with a reliable source of income during their retirement years. By contributing consistently and allowing the investments to grow over time, individuals can build a substantial nest egg. The accumulated savings can then be withdrawn in retirement, serving as a steady stream of income to cover living expenses, healthcare costs, and other financial needs.

- Portability: Unlike traditional pensions that are tied to specific employers, tax deferred pension plans are often portable. This means that individuals can take their retirement savings with them when they change jobs. They have the flexibility to roll over their accumulated funds into a new employer’s retirement plan or an Individual Retirement Account (IRA), avoiding any significant disruptions to their retirement savings strategy.

- Flexibility: Tax deferred pension plans offer individuals flexibility in terms of investment options. These plans typically offer a range of investment vehicles, such as stocks, bonds, mutual funds, and other financial instruments. Individuals can choose their preferred investment mix based on their risk tolerance, financial goals, and market conditions, allowing them to optimize their returns and tailor their retirement portfolio to their specific needs.

- Asset Protection: In some cases, tax deferred pension assets may be protected from creditors. This means that in the event of bankruptcy or legal proceedings, retirement savings held within a tax deferred pension plan may be shielded from claims, providing an added layer of financial security for individuals.

Overall, tax deferred pensions offer a wide range of benefits that can significantly enhance an individual’s retirement savings journey. By taking advantage of the tax advantages, employer contributions, and flexibility offered by these plans, individuals can proactively save for their future and enjoy a secure and comfortable retirement.

How Tax Deferred Pension Works

Understanding how tax deferred pensions work is crucial for individuals planning for their retirement. Here’s a step-by-step breakdown of how these retirement savings vehicles operate:

- Eligibility: Individuals typically become eligible for a tax deferred pension through their employer. It may be offered as part of an employee benefits package or through a specific retirement plan, such as a 401(k) or 403(b). Employers may have different eligibility requirements, such as a minimum age or a certain period of employment before employees can participate in the pension plan.

- Contribution: Once eligible, individuals can start contributing a portion of their income to the tax deferred pension. These contributions are made on a pre-tax basis, meaning that the money is deducted from the individual’s gross income before taxes are levied. Contribution limits may apply, and they are set by the government and can vary depending on the type of pension plan and the individual’s personal circumstances.

- Investment Options: Tax deferred pension plans typically offer a range of investment options for individuals to choose from. These options may include stocks, bonds, mutual funds, and other financial instruments. Individuals can select their preferred investment mix based on their risk tolerance, financial goals, and time horizon. It is important to review the available investment options and consider seeking professional financial advice if needed.

- Tax-Deferred Growth: Contributions to the tax deferred pension plan and any earnings generated by the investments within the account grow on a tax-deferred basis. This means that individuals are not required to pay taxes on the contributions or the earnings until they withdraw the funds in retirement. The potential for tax-deferred growth allows retirement savings to compound over time, potentially leading to substantial growth.

- Retirement Withdrawals: Once individuals reach the age of 59 and a half, they can start withdrawing funds from their tax deferred pension without incurring early withdrawal penalties. However, regular income tax will be applied to the withdrawals as they are considered taxable income. Depending on the pension plan type, individuals may also have to adhere to required minimum distribution (RMD) rules, which mandate a minimum amount that must be withdrawn each year after reaching a certain age.

- Rollovers and Transfers: If individuals change employers or retire, they have the option to roll over their tax deferred pension funds into a new employer’s retirement plan or an Individual Retirement Account (IRA). Rolling over the funds helps maintain the tax-deferred status of the retirement savings and provides flexibility in managing the funds.

It is important for individuals to stay informed and engaged with their tax deferred pension plan. Regularly reviewing investment options, assessing contribution amounts, and adjusting retirement goals as needed can help individuals make the most of their retirement savings. Seeking guidance from financial professionals can provide valuable insights and ensure that individuals are on track to meet their retirement objectives.

By adhering to the rules and regulations governing tax deferred pensions and proactively managing their retirement savings, individuals can build a robust nest egg to support a comfortable and financially secure retirement.

Eligibility and Contribution Limits

Eligibility and contribution limits are important factors to consider when participating in a tax deferred pension plan. These criteria determine who can contribute to the plan and how much they can contribute. Here’s a breakdown of the key aspects:

Eligibility: The eligibility criteria for tax deferred pension plans vary depending on the specific plan and employer. Generally, individuals become eligible to participate in a tax deferred pension through their employer-sponsored retirement plan, such as a 401(k) or 403(b). Employers may require employees to meet certain criteria, such as reaching a minimum age or completing a specific period of employment, before they can join the pension plan.

Contribution Limits: Contribution limits are set by the government and are subject to change each year. These limits determine the maximum amount individuals can contribute to their tax deferred pension plan annually. The limits help regulate the total amount of tax-advantaged savings individuals can accumulate. The two primary types of contribution limits are:

- Employee Contributions: The government sets a maximum dollar amount that individuals can contribute to their tax deferred pension plan every year. For example, in 2022, the annual contribution limit for 401(k) plans is $20,500 for individuals under the age of 50. However, individuals aged 50 and older may be eligible to make additional “catch-up” contributions, allowing them to contribute an extra amount above the regular limit.

- Employer Contributions: Employers may offer matching contributions as part of the tax deferred pension plan. These are additional contributions made by the employer based on the employee’s contributions, up to a certain limit. The limits for employer contributions can vary and may be based on a percentage of the employee’s salary or a fixed dollar amount.

It’s important for individuals to stay informed about the specific contribution limits of their tax deferred pension plan as exceeding these limits can have financial consequences. Contributions made in excess of the limit may be subject to penalties and additional taxes.

It’s worth noting that the contribution limits for tax deferred pensions are separate from other retirement savings accounts, such as Individual Retirement Accounts (IRAs). Individuals can potentially contribute to both a tax deferred pension plan and an IRA, subject to the specific contribution limits for each account.

It’s important for individuals to review and understand their retirement plan’s eligibility requirements and contribution limits. This knowledge will help them maximize their retirement savings while adhering to the regulations set forth by the government and their employers. Regularly assessing contribution amounts and adjusting as necessary can help individuals make the most of their tax deferred pension plan and stay on track to achieve their retirement goals.

Types of Tax Deferred Pension Plans

There are various types of tax deferred pension plans available, each with its own features and eligibility requirements. Understanding the different types can help individuals choose the plan that best aligns with their retirement goals. Here are some common types of tax deferred pension plans:

- 401(k) Plans: 401(k) plans are employer-sponsored retirement plans that allow employees to contribute a portion of their pre-tax income to their retirement account. Employers may offer matching contributions up to a certain limit. Contributions and earnings within a 401(k) plan grow on a tax-deferred basis until withdrawal in retirement.

- 403(b) Plans: 403(b) plans are similar to 401(k) plans but are typically offered by public schools, nonprofit organizations, and certain tax-exempt organizations. These plans allow employees to contribute a portion of their income on a pre-tax basis, and contributions and earnings grow tax-deferred until withdrawal.

- Traditional IRAs: Individual Retirement Accounts (IRAs) are personal retirement accounts that individuals can open independently of their employer. Traditional IRAs allow eligible individuals to contribute a certain amount each year on a pre-tax basis. Contributions and earnings within a traditional IRA grow tax-deferred until withdrawal in retirement.

- SIMPLE IRAs: Savings Incentive Match Plan for Employees (SIMPLE) IRAs are employer-sponsored retirement plans designed for small businesses with fewer than 100 employees. Employees can contribute a portion of their pre-tax income, and employers must either match contributions or make a non-elective contribution. Contributions and earnings grow tax-deferred and are taxed upon withdrawal in retirement.

- SEP IRAs: Simplified Employee Pension (SEP) IRAs are retirement plans available to self-employed individuals and small business owners. Business owners can contribute a certain percentage of their income or a set dollar amount to their SEP IRA on a tax-deferred basis. Contributions and earnings grow tax-deferred until withdrawal.

Each type of tax deferred pension plan has its own contribution limits, withdrawal rules, and eligibility criteria. It’s crucial for individuals to review the specifics of each plan and understand their options before making decisions about their retirement savings.

Some individuals may have access to multiple types of tax deferred pension plans, either through their employer or on an individual basis. It’s important to consider the advantages and limitations of each plan when determining how to allocate retirement savings. Consulting with a financial advisor can provide valuable insights and help individuals make informed decisions based on their unique circumstances.

Additionally, individuals may have the option to rollover funds from one tax deferred pension plan to another, allowing them to consolidate their retirement savings or take advantage of different plan features. However, rollovers must be done properly to maintain the tax-deferred status of the funds.

By understanding the different types of tax deferred pension plans and their respective benefits, individuals can make informed choices that align with their retirement goals and financial needs.

Risks and Considerations of Tax Deferred Pension

While tax deferred pensions offer significant benefits, it is important to be aware of the potential risks and considerations associated with these retirement savings vehicles. Understanding these factors can help individuals make informed decisions about their financial future. Here are some key risks and considerations to keep in mind:

- Market Volatility: The performance of investments within a tax deferred pension plan is subject to market fluctuations. Economic downturns or market volatility can impact the value of the investments and potentially lead to temporary losses. It’s essential to understand that there are inherent risks associated with investing, and past performance is not indicative of future results.

- Withdrawal Restrictions: Tax deferred pensions are designed to provide income during retirement. Withdrawals made before the age of 59 and a half may be subject to early withdrawal penalties and additional taxes. It is important to carefully consider and plan for income needs before retirement to avoid unnecessary penalties and maintain the tax advantages of the pension account.

- Tax Considerations: While contributions to tax deferred pensions are made on a pre-tax basis, withdrawals in retirement are taxed as ordinary income. It’s important to understand the tax implications of pension withdrawals and properly plan for retirement expenses to ensure a tax-efficient strategy. Consulting with a tax professional can help individuals optimize their tax situation in retirement.

- Changes in Legislation: Government regulations and tax laws surrounding retirement accounts can change over time. It’s crucial to stay updated on any changes that could impact tax deferred pensions. Being aware of legislative updates allows individuals to adapt their savings strategies and ensure compliance with any new requirements.

- Limited Investment Options: While tax deferred pensions typically offer a range of investment options, individuals may have limited control over the specific investments within the plan. The available investment options may not align with individual preferences or risk tolerance. It’s important to carefully review the investment choices and consider diversification strategies to mitigate risk within the given options.

- Inflation: Over time, the cost of living tends to rise due to inflation. If investment returns within a tax deferred pension plan do not keep pace with inflation, the purchasing power of the retirement savings may diminish. It’s important to factor inflation into retirement planning and regularly assess the performance of investment options to ensure they can help protect against inflationary pressures.

Individuals should consider their risk tolerance, financial goals, and personal circumstances when evaluating the risks and considerations associated with tax deferred pensions. Consulting with a financial advisor can provide valuable guidance in addressing these factors and creating a retirement savings strategy that aligns with individual needs and objectives.

By understanding the risks and considerations of tax deferred pensions, individuals can make informed decisions, set realistic expectations, and take measures to protect and optimize their retirement savings for the long term.

Tax Treatment of Withdrawals from Tax Deferred Pension

The tax treatment of withdrawals from tax deferred pension plans is a crucial aspect to consider as individuals plan for their retirement. When it comes time to withdraw funds from these accounts, it’s important to understand how taxes will be applied. Here’s an overview of the tax treatment of withdrawals:

Taxable Income: Withdrawals from tax deferred pension plans are generally considered taxable income. The funds withdrawn are subject to federal and state income taxes at the individual’s applicable tax rate. This means that when individuals withdraw money from their tax deferred pension accounts, they will likely need to include that amount as part of their taxable income for the year.

Ordinary Income Tax Rates: The withdrawals from tax deferred pensions are typically taxed at the individual’s ordinary income tax rates. These rates vary depending on the individual’s income level and tax bracket, with higher income earners potentially facing higher tax rates on their pension withdrawals.

No Penalty After Age 59 and a Half: Individuals who reach the age of 59 and a half are generally eligible to take withdrawals from their tax deferred pension plans without incurring any early withdrawal penalties. This allows individuals to access their retirement savings without facing additional financial consequences.

Required Minimum Distributions (RMDs): After reaching a certain age, typically 72 years old for most retirement accounts, individuals are required to take minimum distributions from their tax deferred pension plans. RMDs are calculated based on the account balance and the individual’s life expectancy. Failure to take the required distributions can result in significant penalties.

Rollovers and Transfers: Individuals who change jobs or retire may choose to roll over their tax deferred pension funds into a new employer’s retirement plan or an Individual Retirement Account (IRA). Rollovers and transfers allow individuals to maintain the tax-deferred status of their retirement savings and delay taxes on the funds until withdrawals are made in the future.

Roth Conversions: In some cases, individuals have the option to convert their tax deferred pension funds into a Roth IRA. This conversion involves paying taxes on the converted amount upfront but allows for tax-free withdrawals in retirement. It’s important to carefully consider the potential tax implications and consult with a financial advisor before pursuing a Roth conversion.

It’s important for individuals to plan accordingly for the tax implications of pension withdrawals in retirement. Working with a tax professional and financial advisor can help individuals optimize their withdrawal strategies, minimize tax liabilities, and ensure compliance with tax laws.

By understanding the tax treatment of withdrawals from tax deferred pension plans, individuals can make informed decisions about their retirement income strategy and effectively manage their tax obligations throughout their retirement years.

Conclusion

Tax deferred pensions offer individuals a valuable opportunity to save for retirement while enjoying significant tax advantages. These retirement savings vehicles allow individuals to contribute a portion of their income on a pre-tax basis, potentially reducing their current-year tax liability. The investments within the tax deferred pension account grow on a tax-deferred basis, meaning they are not subject to capital gains or income tax until withdrawn in retirement.

Throughout this article, we have explored the definition of tax deferred pension plans, discussed their benefits, explained how they work, and highlighted various considerations. We have also examined the eligibility and contribution limits associated with these plans, along with the different types of tax deferred pension plans available.

While tax deferred pensions provide numerous advantages, it’s important to consider the potential risks and considerations, such as market volatility, withdrawal restrictions, and tax implications. Individuals should also be mindful of changes in legislation and the limited investment options within certain plans. These factors underscore the need for proactive management and ongoing evaluation of retirement savings strategies.

As individuals plan for their retirement, understanding the tax treatment of withdrawals from tax deferred pension plans is essential. Withdrawing funds from these accounts will typically result in taxable income, subject to ordinary income tax rates. Factors such as age, required minimum distributions, and rollovers/transfers should be taken into account when considering withdrawal strategies.

In conclusion, tax deferred pensions offer individuals a powerful tool to accumulate savings for retirement, with the added benefit of potential tax advantages. By carefully considering eligibility, contribution limits, investment options, risk factors, and tax implications, individuals can make informed decisions and build a strong financial foundation for their retirement years.

It is recommended that individuals consult with financial professionals and tax advisors to tailor a retirement savings strategy that aligns with their unique circumstances, financial goals, and risk tolerance. With proper planning and ongoing monitoring, individuals can enhance their prospects of enjoying a financially secure and fulfilling retirement.