Home>Finance>What Is The Accumulated Value Of Life Insurance?

Finance

What Is The Accumulated Value Of Life Insurance?

Published: October 15, 2023

Discover the accumulated value of life insurance and how it impacts your finances. Learn how this financial tool can provide long-term security and peace of mind.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Life insurance is a financial tool that provides a valuable safety net for individuals and their loved ones in the event of an untimely death. It offers financial protection by paying out a pre-agreed sum of money, known as the death benefit, to the beneficiaries listed in the policy. However, life insurance is not just about the death benefit; it can also serve as an investment vehicle.

One important concept to understand when it comes to life insurance is the accumulated value. The accumulated value refers to the total amount of funds that have grown inside a life insurance policy over time. It represents the cash value of the policy and can be accessed by the policyholder during their lifetime. This value not only serves as a savings component but can also be utilized for various purposes, such as supplementing retirement income or funding major expenses.

Understanding the accumulated value of a life insurance policy is crucial for policyholders, as it can significantly impact their financial planning and future goals. In this article, we will delve into the details of the accumulated value of life insurance, including how it is calculated, factors that affect it, and strategies for maximizing its growth.

Understanding Life Insurance

Life insurance is a contract between an individual and an insurance company, where the policyholder pays regular premiums in exchange for financial protection. The purpose of life insurance is to provide a death benefit to the policyholder’s beneficiaries upon their passing. This benefit is typically a lump sum payment and is intended to provide financial support to loved ones, such as covering funeral expenses, clearing debts, replacing lost income, or funding future expenses.

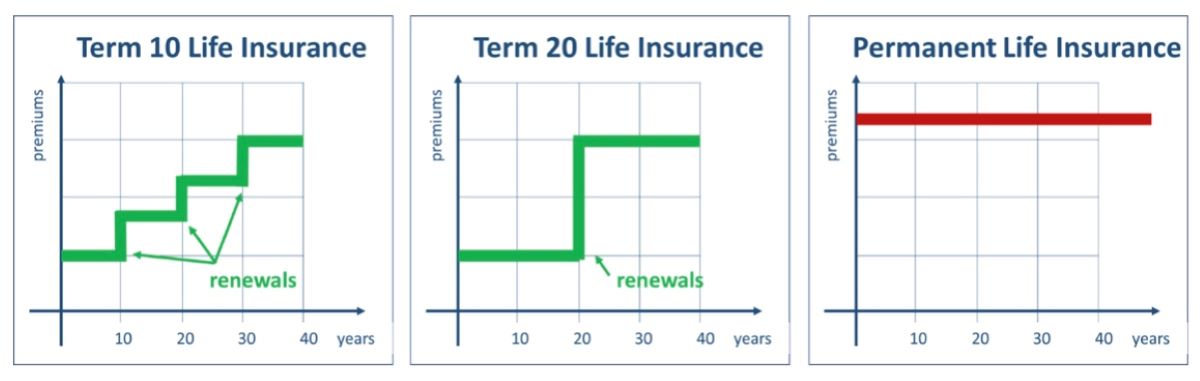

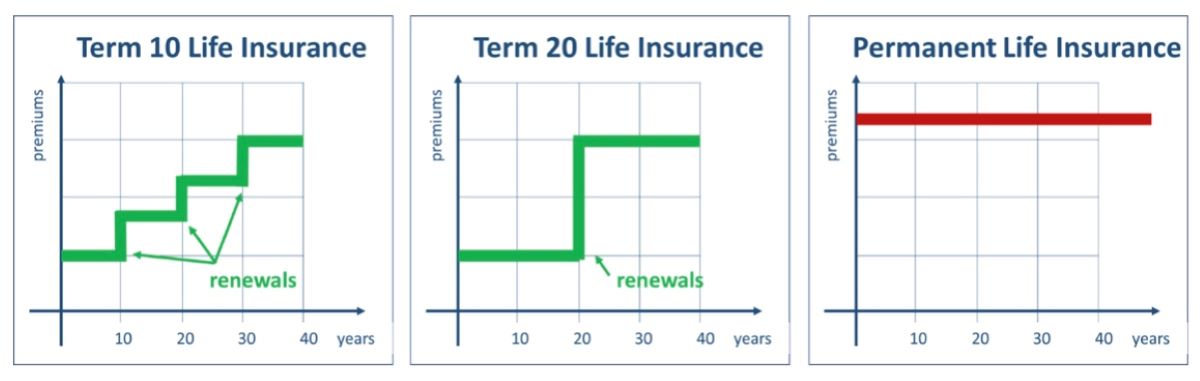

There are different types of life insurance policies available, including term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. If the policyholder passes away during the term, the death benefit is paid out. However, if the policyholder survives the term, no payout is made.

On the other hand, permanent life insurance offers coverage for the policyholder’s entire lifetime. Along with the death benefit, permanent life insurance also accumulates cash value over time. This cash value grows tax-deferred and can be accessed in various ways while the policyholder is alive. Permanent life insurance policies, such as whole life and universal life, have a savings component that allows the policyholder to build up funds over the years.

Life insurance serves as a crucial piece of financial planning, particularly for individuals with dependents or financial obligations. It provides peace of mind, knowing that loved ones will be financially protected in the event of the insured’s death. It can also be an effective tool for wealth preservation and transfer, as the death benefit received by beneficiaries is generally tax-free.

It’s important to assess your individual needs and financial goals when considering life insurance. Factors such as age, health, dependents, income, and debt should be taken into account to determine the appropriate coverage and policy type. Consulting with a qualified insurance professional can help you navigate through the options and select the best policy to suit your circumstances.

What is the Accumulated Value of Life Insurance?

The accumulated value of a life insurance policy refers to the total amount of cash that has accumulated over time within the policy. It represents the savings component of certain types of permanent life insurance policies, such as whole life and universal life insurance. Unlike term life insurance, which does not have a cash value component, permanent life insurance policies allow policyholders to build up savings that can be accessed during their lifetime.

The accumulated value comes from the premiums paid by the policyholder, which are allocated towards the cash value of the policy. As the cash value grows, it also earns interest or returns, depending on the insurance company’s investment performance and the policy’s terms. This means that the accumulated value has the potential to increase over time, providing a source of funds that can be used for various purposes.

Policyholders have flexibility in how they can utilize the accumulated value of their life insurance policies. They can choose to withdraw the cash value, borrow against it through a policy loan, or even surrender the policy in exchange for the accumulated value. However, it’s important to note that accessing the accumulated value may have tax implications, and policyholders should consult with a financial advisor or tax professional before making any decisions.

The accumulated value of life insurance policies can serve as a valuable financial resource for the policyholder. It can be used to supplement retirement income, fund educational expenses, pay off debts, or cover emergency expenses. By accumulating money within the policy, individuals can potentially grow their savings while also ensuring financial protection for their loved ones with the death benefit component.

It’s important to keep in mind that the growth of the accumulated value is not guaranteed and can vary depending on factors such as the policy’s performance, fees, and market conditions. Additionally, policyholders should be aware of any surrender charges or penalties that may apply if they choose to access the accumulated value before a certain period has elapsed.

In the next section, we will explore the factors that can affect the accumulated value of a life insurance policy.

Factors Affecting the Accumulated Value

Several factors can influence the accumulation of value within a life insurance policy. Understanding these factors can help policyholders make informed decisions to maximize the growth and potential benefits of their policies. Here are some key factors that can affect the accumulated value of a life insurance policy:

1. Premiums Paid: The amount of premiums paid into the policy directly impacts the accumulation of cash value. Higher premium payments contribute to a faster accumulation of value within the policy.

2. Rate of Return: The rate of return earned on the policy’s cash value affects the growth of the accumulated value. Insurance companies invest the cash value in various assets, such as bonds, stocks, and mutual funds. The performance of these investments determines the rate of return and subsequent growth of the accumulated value.

3. Policy Expenses: Policy expenses, such as administrative fees, mortality charges, and commissions, can reduce the amount of cash value that accumulates. It’s important to review the policy’s terms and understand the impact of these expenses on the accumulation of value.

4. Policy Loans and Withdrawals: Taking loans or making withdrawals from the policy’s cash value can reduce the accumulated value. Policyholders should be mindful of the impact these actions have on the long-term growth of their policies.

5. Policy Performance: The overall performance of the life insurance policy, including any additional riders or features, can affect the accumulation of value. Policyholders should periodically review their policies’ performance and make adjustments if necessary to optimize the growth of the accumulated value.

6. Policyholder Age and Health: The age and health of the policyholder can impact the accumulation of value. Generally, younger and healthier policyholders have a longer time horizon for their policies to accumulate value, allowing more time for growth.

7. Loan Interest: If a policyholder takes out a loan against their policy’s cash value, they will need to pay interest. This interest can impact the growth of the accumulated value, as it reduces the net amount of cash value that contributes to growth.

It’s important to note that the accumulation of value within a life insurance policy is not guaranteed and can vary based on these factors. Policyholders should regularly review their policies, assess their financial goals, and work with an insurance professional to make appropriate adjustments to maximize the growth and benefits of their policies.

In the next section, we will discuss how the accumulated value of a life insurance policy is calculated.

How is the Accumulated Value Calculated?

The calculation of the accumulated value within a life insurance policy involves several factors and formulas that determine the growth of the policy’s cash value over time. While the specific calculations may vary between insurance companies and policy types, there are some common elements that contribute to the determination of the accumulated value:

Premium Payments: The premiums paid by the policyholder are a crucial factor in the accumulation of the cash value. A portion of each premium payment is allocated towards the policy’s cash value, allowing it to grow over time. The amount allocated to the cash value depends on the policy’s terms and the policyholder’s age, health, and coverage amount.

Interest or Returns: The cash value within a life insurance policy generally earns interest or returns. This growth is based on the performance of the insurance company’s investment portfolio and the policy’s cash value accumulation method. The interest or returns can be credited to the policy on an annual, monthly, or daily basis, depending on the policy’s terms.

Policy Expenses: Policy expenses, such as administrative fees, mortality charges, and commissions, are deducted from the premium payments and can impact the growth of the accumulated value. These expenses cover the costs associated with maintaining the policy and administering the benefits.

Policy Loans and Withdrawals: If the policyholder takes a loan against the policy’s cash value or makes a withdrawal, it can impact the growth of the accumulated value. The loan or withdrawal amount is deducted from the cash value, reducing the net amount available to accumulate interest or returns.

Surrender Charges: Some life insurance policies may have surrender charges if the policyholder chooses to surrender the policy and access the accumulated value before a certain period has elapsed. These charges can reduce the amount received by the policyholder and impact the final accumulated value.

Insurance companies typically provide policyholders with annual statements that show the current cash value and accumulated value of their life insurance policies. These statements also provide projections for the future growth of the policy’s cash value based on certain assumptions and calculations.

It’s important for policyholders to review these statements regularly and understand how their accumulated value is calculated. Insurance professionals can provide guidance and explain the specific calculations and assumptions used by the insurance company.

In the next section, we will explore the importance of monitoring the accumulated value of a life insurance policy.

Importance of Monitoring Accumulated Value

Monitoring the accumulated value of a life insurance policy is essential for policyholders to stay informed about the growth and potential benefits of their policies. Here are some key reasons why monitoring the accumulated value is important:

1. Financial Planning: The accumulated value of a life insurance policy can be a valuable asset in your financial plan. By monitoring its growth, you can better assess how it aligns with your long-term financial goals, such as retirement planning, education funding, or debt management. Regularly reviewing the accumulated value allows you to make informed decisions and adjust your financial strategies accordingly.

2. Asset Growth: The accumulated value represents the growth of your policy’s cash value over time. By monitoring it, you can track the growth rate and evaluate the performance of the policy. This can help you assess whether your policy is meeting your expectations and provide an indication of the potential future value of the policy.

3. Policy Adjustments: Monitoring the accumulated value allows you to identify opportunities for policy adjustments. If the growth is not meeting your expectations or financial needs, you can explore options such as increasing premium payments, adjusting the death benefit amount, or considering additional policy riders or features. By staying proactive, you can maximize the benefits of your life insurance policy.

4. Financial Flexibility: The accumulated value can provide financial flexibility, as it can be accessed during your lifetime. By monitoring its growth, you can identify potential opportunities to utilize the accumulated value for various purposes, such as supplementing retirement income, funding a major expense, or covering unforeseen financial emergencies.

5. Policy Performance: Monitoring the accumulated value allows you to assess the performance of your life insurance policy. If the accumulated value is not growing as expected or if there are significant fluctuations in the growth rate, it may indicate the need to review and evaluate the policy’s terms, underlying investments, or expenses. This helps ensure that your policy remains aligned with your financial objectives.

6. Tax Considerations: Accessing the accumulated value of a life insurance policy may have tax implications. By monitoring the growth of the accumulated value, you can better plan for any potential tax liabilities and seek guidance from tax professionals to optimize the use of the accumulated value.

Overall, monitoring the accumulated value of your life insurance policy empowers you to make informed financial decisions, adjust your strategies, and utilize the benefits offered by the policy to meet your financial goals. It’s important to maintain regular contact with your insurance professional to stay updated on the performance and growth of your policy’s accumulated value.

In the next section, we will discuss strategies for increasing the accumulated value of a life insurance policy.

Ways to Increase the Accumulated Value

Increasing the accumulated value of a life insurance policy can provide policyholders with enhanced financial flexibility and potential benefits. Here are some strategies that can help increase the accumulated value:

1. Regular Premium Payments: Making regular premium payments is crucial to accumulating value within a life insurance policy. Consistently paying the premiums on time and in full ensures that a significant portion of the payment goes towards the cash value, allowing it to grow over time.

2. Increased Premium Payments: If your financial situation allows, consider increasing your premium payments. By paying higher premiums, you can allocate more funds towards the cash value, leading to faster accumulation of value within the policy.

3. Managing Policy Expenses: Review the policy’s expenses, such as administrative fees and mortality charges, and see if there are opportunities to minimize or optimize them. By reducing these expenses, more of your premium payments can go towards the accumulation of value.

4. Maximizing Cash Value Growth: Explore different policy options and features that allow for greater cash value growth. Some policies offer more favorable interest rates or investment options that can enhance the growth of the accumulated value. Discuss these options with your insurance professional to find the best fit for your financial goals.

5. Selecting the Right Policy Type: When choosing a life insurance policy, consider selecting a policy type that is designed for the accumulation of cash value. Permanent life insurance policies, such as whole life or universal life, provide the opportunity for cash value growth over time.

6. Avoiding Policy Loans and Withdrawals: While your policy’s cash value can be accessed through loans or withdrawals, utilizing these options can reduce the accumulated value. Try to avoid taking loans or withdrawals unless absolutely necessary to maintain the growth of the policy’s cash value.

7. Benefiting From Dividends: Some life insurance policies, such as participating whole life insurance, may offer dividends based on the insurance company’s financial performance. These dividends can be reinvested into the policy, increasing the accumulated value.

8. Regular Policy Reviews: Regularly review your policy with your insurance professional to ensure it aligns with your current financial goals and circumstances. This allows for adjustments to be made, such as increasing the death benefit or modifying the premium payments, which can impact the accumulation of value.

Remember, increasing the accumulated value requires a long-term commitment to maintaining the policy, making timely payments, and regularly assessing its performance. Consult with a knowledgeable insurance professional to determine the most effective strategies for increasing the accumulated value of your specific life insurance policy.

In the next section, we will explore different strategies for utilizing the accumulated value of a life insurance policy.

Strategies for Utilizing Accumulated Value

The accumulated value within a life insurance policy can provide policyholders with financial options and opportunities. Here are some strategies for utilizing the accumulated value:

1. Withdrawals: One option is to withdraw funds from the accumulated value of the policy. This can be useful for covering unexpected expenses or funding short-term financial goals. However, it’s important to be mindful of any tax implications or surrender charges that may apply.

2. Policy Loans: Policyholders can also consider taking out a policy loan against the accumulated value. With a policy loan, you borrow funds from the cash value while using the policy as collateral. The advantage of a policy loan is that it does not need to be repaid; instead, the loan amount is deducted from the policy’s death benefit if not repaid during the policyholder’s lifetime.

3. Paid-Up Additions: Policyholders may choose to use the accumulated value to purchase paid-up additions. These additions are additional coverage amounts that are paid-up, meaning they do not require further premium payments. This strategy can enhance the death benefit and increase the policy’s cash value over time.

4. Supplement Retirement Income: Another strategy is to utilize the accumulated value as an additional source of retirement income. By withdrawing funds or taking policy loans during retirement, individuals can supplement their other sources of retirement income, such as pensions or Social Security benefits.

5. Fund Education Expenses: The accumulated value can also be used to fund educational expenses, such as college tuition. By withdrawing or borrowing against the cash value, policyholders can provide financial support for their children’s or grandchildren’s education.

6. Legacy Planning: The accumulated value can be used for legacy planning purposes. Policyholders may choose to keep the policy in force, allowing the accumulated value to grow over time and provide a larger death benefit to their beneficiaries. This can be a way to leave a financial legacy for future generations.

7. Long-Term Care Expenses: In some cases, the accumulated value can be utilized to cover long-term care expenses. Policyholders may be able to access the cash value to pay for nursing home care or other medical needs, providing financial assistance during times of health challenges.

It’s important to carefully consider the implications and potential risks associated with utilizing the accumulated value. Consultation with a financial advisor or insurance professional is highly recommended to assess the best strategies for your specific situation and to understand any tax or policy implications.

By strategically utilizing the accumulated value of a life insurance policy, policyholders can optimize the benefits of the policy and use the funds to meet their financial goals and needs. Regular review and assessment of the policy’s accumulated value, along with guidance from professionals, can help ensure that the funds are utilized effectively.

In the following section, we will summarize the key points discussed in this article.

Conclusion

Understanding the accumulated value of a life insurance policy is essential for policyholders seeking to maximize the benefits and potential growth of their policies. The accumulated value represents the cash value within certain types of permanent life insurance policies and can serve as a valuable asset for policyholders during their lifetime.

Throughout this article, we have explored various aspects related to the accumulated value of life insurance, including its definition, factors affecting its growth, calculation methods, and strategies for increasing its value. We have also discussed the importance of monitoring the accumulated value, as well as strategies for utilizing it to achieve financial goals.

By monitoring the accumulated value, policyholders can make informed decisions about their financial planning, assess the performance of their policies, and adjust strategies if necessary. Maximizing the growth of the accumulated value can be achieved through strategies such as regular premium payments, managing policy expenses, and selecting the right policy type.

Utilizing the accumulated value requires careful consideration of withdrawal options, policy loans, and other strategies to meet specific financial needs, such as retirement income, education expenses, or long-term care. However, it’s important to evaluate the potential tax implications and any associated costs or risks before utilizing the accumulated value.

In conclusion, the accumulated value of a life insurance policy can be a valuable asset for policyholders, providing financial flexibility and potential benefits. By understanding how to increase, monitor, and utilize the accumulated value effectively, policyholders can optimize the financial advantages of their life insurance policies and work towards achieving their long-term financial goals.