Home>Finance>What Is The Surrender Value Of A Life Insurance Policy?

Finance

What Is The Surrender Value Of A Life Insurance Policy?

Published: October 15, 2023

Discover the surrender value of a life insurance policy and understand its importance in personal finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Surrender Value?

- Understanding Life Insurance Policies

- Factors Affecting Surrender Value

- Calculation of Surrender Value

- Surrender Value vs Cash Value

- Importance of Surrender Value in Life Insurance

- Pros and Cons of Surrendering a Life Insurance Policy

- Alternatives to Surrendering a Life Insurance Policy

- Conclusion

Introduction

Welcome to the world of life insurance policies! If you’re considering buying a life insurance policy or already have one, you may have come across the term “surrender value”. But what exactly does it mean? In simple terms, the surrender value of a life insurance policy refers to the amount of money that the policyholder receives if they choose to terminate the policy before its maturity date.

Life insurance is designed to provide financial protection to your loved ones in the event of your death. However, circumstances can change, and you may find yourself in a situation where you no longer need or can afford the policy. That’s where the surrender value comes into play. It allows you to terminate the policy and receive a portion of the premiums you have paid over the years.

Understanding the surrender value of a life insurance policy is crucial, as it can have a significant impact on your financial decisions. In this article, we will delve deeper into the concept of surrender value, its calculation, and its importance in the realm of life insurance.

What is Surrender Value?

The surrender value of a life insurance policy represents the cash value that the policyholder is entitled to receive upon surrendering, canceling, or terminating the policy before its maturity. It is the accumulated portion of the policyholder’s premium payments that has not been used for administrative charges, mortality charges, and other associated fees.

Life insurance policies are long-term commitments, often spanning several decades. However, there may be situations where the policyholder decides to surrender the policy due to various reasons. These reasons could include financial difficulties, changing needs, or a better alternative in the market. In such cases, the surrender value acts as a safety net, allowing the policyholder to recoup part of the investment made in the policy.

The surrender value is not fixed and varies based on the type of policy, the premium payment period, the policyholder’s age, and the number of years the policy has been in force. It is important to note that surrendering a policy will result in the forfeiture of the life insurance coverage, and the surrender value will be paid out instead.

It’s crucial to understand that the surrender value is different from the policy’s cash value. While the cash value is the amount that can be accessed during the policy’s lifetime, the surrender value is only applicable when the policy is terminated prematurely.

Calculating the surrender value involves taking into account several factors, including the policy type, the premium payments, and the investment returns generated by the policy. Different insurance providers may have slightly different methods of calculating the surrender value, so it’s essential to review the policy documents or consult your insurance advisor for specific details.

Understanding Life Insurance Policies

Before diving deeper into the concept of surrender value, it is important to have a basic understanding of life insurance policies. Life insurance is a contract between an individual (the policyholder) and an insurance company (the insurer). The primary purpose of life insurance is to provide financial protection to the policyholder’s beneficiaries in the event of their death.

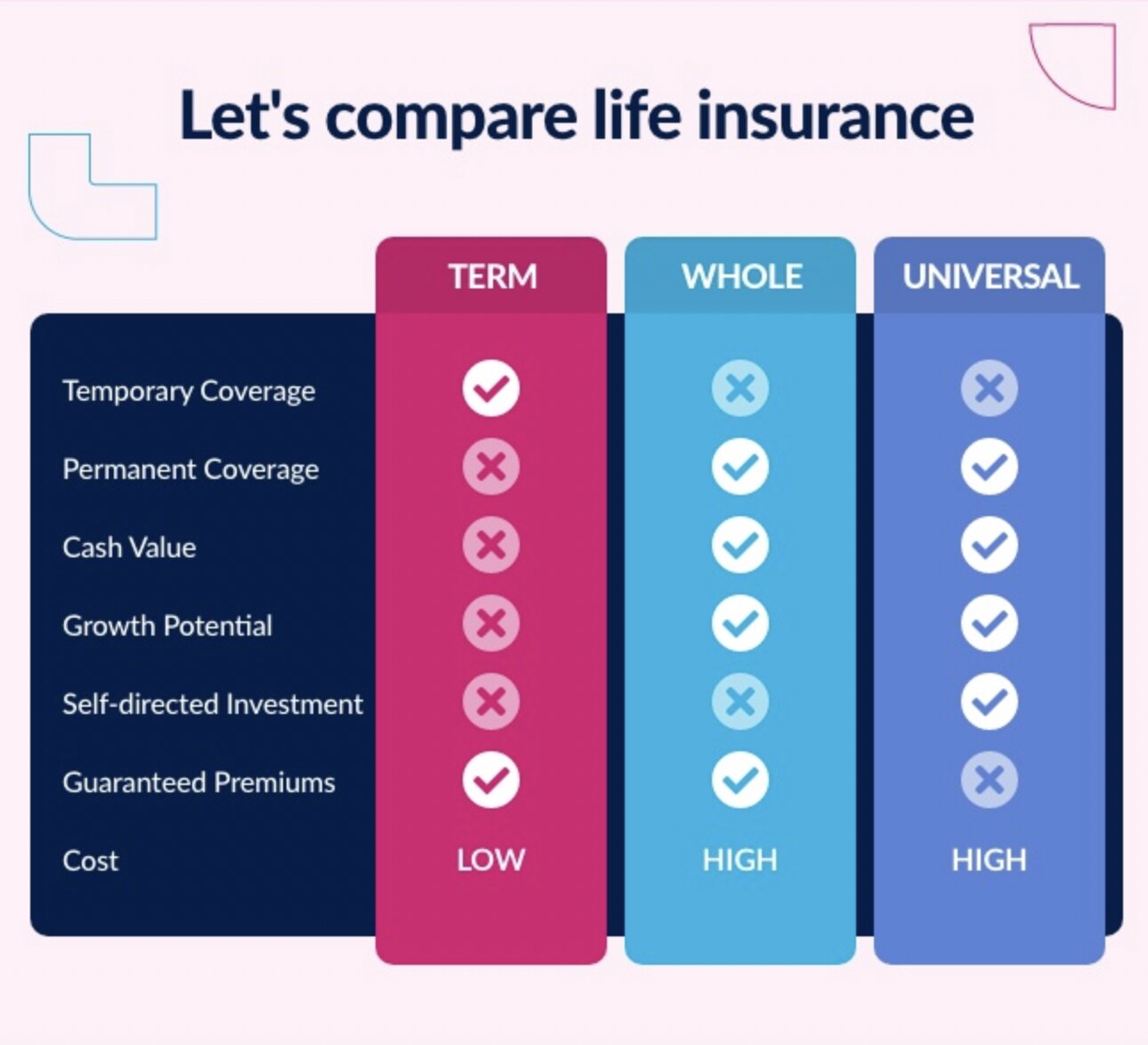

Life insurance policies come in various forms, with the most common types being term life insurance and whole life insurance. Term life insurance provides coverage for a specific period (the term), typically ranging from 10 to 30 years. Whole life insurance, on the other hand, offers lifelong coverage and includes a savings component known as the cash value.

Term life insurance policies do not typically have a surrender value since they are designed to provide coverage for a specific term and do not accumulate cash value. On the other hand, whole life insurance policies combine a death benefit with an investment component, allowing the policy to accumulate cash value over time.

The cash value in a whole life insurance policy grows over time as the policyholder pays premiums, and it can be accessed during the policy’s lifetime through withdrawals or policy loans. The cash value is funded by a portion of the premium payments, which is invested by the insurance company. The policyholder may also earn dividends based on the insurance company’s performance or have the option to participate in the investment returns of the insurer’s general investment portfolio.

Life insurance policies also have various additional features and options, such as riders that provide supplemental coverage for specific situations or events. These riders may include accelerated death benefit riders, which allow the policyholder to receive a portion of the death benefit if diagnosed with a terminal illness, or waiver of premium riders, which waive premium payments if the policyholder becomes disabled.

It is essential to carefully review and understand the terms, conditions, and features of a life insurance policy before purchasing it. This includes understanding the potential growth of the cash value, the premium payment obligations, the death benefit, and any surrender charges or penalties associated with terminating the policy.

Factors Affecting Surrender Value

The surrender value of a life insurance policy is influenced by several factors. Understanding these factors can help policyholders make informed decisions when it comes to surrendering their policies. Here are some key factors that affect the surrender value:

- Policy Type: The type of life insurance policy plays a significant role in determining the surrender value. Whole life insurance policies generally have a higher surrender value compared to term life policies since they accumulate cash value over time.

- Premium Payments: The amount and duration of premium payments made by the policyholder impact the surrender value. Higher premium payments over a longer period can result in a higher surrender value.

- Policy Age: The number of years the policy has been in force is an important factor in calculating the surrender value. Policies that have been in force for a longer duration typically have a higher surrender value.

- Policyholder’s Age: The age of the policyholder at the time of surrender is considered when determining the surrender value. Generally, surrendering a policy at a younger age may result in a lower surrender value.

- Investment Returns: The investment returns generated by the insurance company’s investment portfolio can influence the surrender value. Higher investment returns may lead to a higher surrender value.

- Surrender Charges: Some life insurance policies may have surrender charges or penalties associated with early termination. These charges are deducted from the surrender value, reducing the amount the policyholder receives.

- Policy Loans and Withdrawals: If the policyholder has taken out policy loans or made withdrawals from the policy’s cash value, these amounts are subtracted from the surrender value.

It’s important to note that the surrender value is not the same as the accumulated cash value. The surrender value is typically lower than the total cash value due to deductions such as surrender charges and outstanding policy loans.

Insurance companies have their own specific formulas and factors they use to calculate the surrender value. It is recommended to review the policy documents or consult with your insurance provider or financial advisor to understand the specific factors that apply to your policy.

Calculation of Surrender Value

The calculation of surrender value for a life insurance policy can be complex and varies depending on the policy type, insurance company, and specific policy provisions. Insurance companies use different methods to determine the surrender value, but here are some common approaches:

- Net Cash Value Method: This method calculates the surrender value by subtracting any outstanding policy loans and unpaid premiums from the policy’s cash value. Surrender charges may also be deducted, depending on the policy’s terms and conditions.

- Guaranteed Cash Value Method: Some policies have a predetermined schedule that guarantees specific cash values at certain policy durations. The surrender value would be based on these guaranteed values.

- Proportional Method: With this method, the insurance company calculates the surrender value by proportionally allocating a percentage of the total premiums paid to the number of years the policy has been in force.

- Adjusted Cash Value Method: This method factors in various adjustments, such as mortality costs, administrative fees, and a surrender charge schedule specified in the policy. The surrender value is calculated by subtracting these adjustments from the policy’s cash value.

- Formula-based Method: Certain policies may have a specific formula mentioned in the policy contract that dictates how the surrender value is calculated. This formula takes into account factors such as policy duration, premium payments, and investment returns.

It’s important to note that surrender charges or penalties may apply when calculating the surrender value. These charges are typically higher in the early years of the policy and decrease over time. The surrender charge is deducted from the policy’s cash value before arriving at the final surrender value.

To obtain an accurate calculation of the surrender value, policyholders should refer to their policy documents or contact their insurance provider or financial advisor. They can provide specific details on the surrender value calculation and any charges or adjustments applicable to the policy.

It’s advisable to carefully evaluate the surrender value before making a decision. Depending on the policy, surrendering the policy early may result in a lower-than-expected surrender value due to charges and deductions. Considering the surrender value alongside future financial needs and alternative options can help policyholders make an informed decision.

Surrender Value vs Cash Value

When it comes to life insurance policies, understanding the difference between surrender value and cash value is crucial. While both terms relate to the financial aspects of a policy, they represent different concepts and serve different purposes. Let’s explore the distinction between surrender value and cash value:

Cash Value: Cash value refers to the savings component of a permanent life insurance policy, such as whole life or universal life insurance. As policyholders make premium payments, a portion is allocated to the cash value account. Over time, the cash value grows based on the policy’s earnings, which may be tied to investments or a guaranteed interest rate set by the insurer. Policyholders can access the cash value through policy loans or withdrawals, often with certain limitations or fees.

Surrender Value: Surrender value, on the other hand, represents the portion of the policy’s cash value that a policyholder is entitled to receive if they choose to terminate or surrender the policy before its maturity date. It serves as a way for policyholders to recoup a portion of the premiums they have paid into the policy. The surrender value is calculated after deducting any applicable surrender charges, outstanding loans, and other policy-related fees.

The key difference between cash value and surrender value lies in how they are used and when they are accessed. Cash value is meant to provide policyholders with a potential source of funds during the policy’s lifetime, which can be accessed through loans or withdrawals. On the other hand, surrender value comes into play when a policyholder decides to terminate the policy prematurely and receive a lump sum payout. Surrendering a policy forfeits the life insurance coverage, but the surrender value provides a financial safety net.

In general, the surrender value is lower than the cash value due to deductions for surrender charges, outstanding loans, and other fees. Therefore, it’s important for policyholders to carefully consider the surrender value before making any decisions. Surrender charges are typically higher in the early years of the policy and decrease over time.

It’s worth noting that surrendering a policy may have tax implications, particularly if the surrender value exceeds the total premiums paid. Policyholders should consult with a tax advisor or financial professional to understand the tax implications.

Both cash value and surrender value play significant roles in permanent life insurance policies. Understanding their distinctions can help policyholders make informed financial decisions and assess the potential benefits and drawbacks of surrendering a policy versus utilizing the cash value.

Importance of Surrender Value in Life Insurance

The surrender value holds great importance in the realm of life insurance. It provides policyholders with financial flexibility and serves as a safeguard for their investment. Let’s explore the significance of surrender value in life insurance:

Financial Flexibility: Life is unpredictable, and circumstances can change. Policyholders may find themselves in situations where they no longer need or can afford their life insurance policies. In such cases, the surrender value allows them to terminate the policy and receive a portion of the premiums they have paid over the years. This gives policyholders the financial flexibility to redirect their funds towards other pressing needs or priorities.

Emergency Funds: Life insurance policies, especially those with a cash value component, can serve as a source of emergency funds. In times of financial hardship or unexpected expenses, policyholders can access the cash value through policy loans or withdrawals. This can provide a much-needed safety net during challenging times, without the need to surrender the policy and forfeit the life insurance coverage.

Exiting an Unfavorable Policy: Over time, a life insurance policy may no longer align with the policyholder’s goals or financial situation. Surrendering the policy and receiving the surrender value allows them to exit an unfavorable policy and explore alternative options that better meet their changing needs. Whether it’s finding a more suitable policy with another insurer or reallocating funds to different investment avenues, surrendering the policy can facilitate a new financial strategy.

Opportunity Cost: Holding onto a life insurance policy that no longer serves its intended purpose can result in missed investment opportunities. By surrendering the policy and utilizing the surrender value, policyholders can potentially redirect funds towards more profitable or strategic investments. This allows for greater control over their financial future and maximizes the potential for growth and returns.

Improved Cash Flow: Surrendering a life insurance policy can provide immediate cash flow relief. This can be especially beneficial for individuals facing financial challenges or experiencing a temporary income shortage. The surrender value can be used to cover essential expenses, repay debts, or bridge financial gaps, offering temporary relief until financial stability is regained.

It’s important to weigh the importance of the surrender value against the potential drawbacks of surrendering the policy, such as the loss of life insurance coverage and any tax implications. Careful consideration, financial analysis, and consulting with a financial advisor can help policyholders make an informed decision that aligns with their overall financial goals and needs.

Pros and Cons of Surrendering a Life Insurance Policy

Surrendering a life insurance policy is a decision that should be carefully considered, weighing the pros and cons to make an informed choice. Here are some potential advantages and disadvantages of surrendering a life insurance policy:

Pros:

- Access to Cash: Surrendering a policy provides policyholders with immediate access to a lump sum of money in the form of the surrender value. This can be beneficial for addressing pressing financial needs or pursuing other investment opportunities.

- Financial Flexibility: Surrendering a policy can offer policyholders flexibility in reallocating funds to areas of greater importance, such as paying off debts, covering medical expenses, or funding educational costs.

- Exiting an Unfavorable Policy: Surrendering a life insurance policy allows policyholders to terminate coverage that no longer aligns with their current needs or financial goals. It provides the opportunity to explore alternative insurance options or investment strategies better suited to their circumstances.

- Eliminating Premium Payments: Surrendering a policy relieves policyholders of future premium payment obligations. This can be advantageous if financial conditions make it difficult to continue paying premiums.

- Emergency Funds: Accessing the surrender value can provide a source of emergency funds to address unexpected financial hardships or to cover urgent expenses.

Cons:

- Loss of Life Insurance Coverage: Surrendering a life insurance policy results in the loss of the death benefit protection. If the policyholder still requires coverage, surrendering the policy may leave them without financial protection for their beneficiaries.

- Lower Than Expected Surrender Value: The surrender value may be lower than anticipated, especially in the early years of the policy due to surrender charges, outstanding loans, or other deductions. The surrender value may not fully recoup the premiums paid.

- Tax Implications: Surrendering a policy may have tax consequences, particularly if the surrender value exceeds the total premiums paid. Policyholders should consult with a tax advisor to understand and evaluate potential tax liabilities.

- Loss of Potential Future Growth: If a policy has an investment component, surrendering it means forfeiting any potential future growth in the cash value. Keeping the policy active may provide long-term accumulation and potentially higher returns.

- Reapplication Challenges: If policyholders surrender their current policy and decide to reapply for life insurance coverage in the future, they may encounter challenges due to changes in health or age, potentially resulting in higher premiums or limited coverage options.

Ultimately, the decision to surrender a life insurance policy should be based on an individual’s specific circumstances, financial goals, and needs. It is advisable to carefully review the policy provisions, calculate the surrender value, consider alternatives, and seek guidance from a financial advisor to make the best possible choice for your financial future.

Alternatives to Surrendering a Life Insurance Policy

Surrendering a life insurance policy is not the only option available when policyholders find themselves in need of a change or facing financial challenges. Here are some alternatives to consider before deciding to surrender a life insurance policy:

- Policy Loans: If the policy has a cash value, policyholders can consider taking out a policy loan against the cash value. This allows them to access funds without surrendering the policy. Keep in mind that policy loans typically accrue interest and might affect the death benefit.

- Partial Withdrawals: Instead of surrendering the entire policy, policyholders may have the option to make partial withdrawals from the cash value. This allows them to access some funds while keeping the policy intact.

- Reduced Paid-Up Policy: Some life insurance policies provide the option to convert the existing policy into a reduced paid-up policy. This means that policyholders stop paying future premiums, but the policy remains in force with a reduced death benefit.

- Policy Conversion: Depending on the type of policy, there may be an option to convert it into a different type of policy. For example, a convertible term life insurance policy can be converted into a permanent life insurance policy without the need for a new medical examination.

- Sell the Policy: In certain situations, policyholders may consider selling their life insurance policy through a process called a life settlement. This involves selling the policy to a third party for a lump sum payment. It can be a viable option for policyholders who no longer need the coverage and can benefit from immediate cash.

- Policy Lapse: If the policyholder can no longer afford the premiums and has determined that the coverage is no longer needed, allowing the policy to lapse may be an option. This means ceasing premium payments, which will result in the policy terminating and no longer providing coverage.

Before making a decision, it is essential to thoroughly evaluate each alternative, considering its impact on financial goals, coverage needs, tax implications, and long-term consequences. Consulting with a financial advisor or an insurance professional can provide valuable insights and guidance in exploring these alternatives and selecting the most appropriate course of action.

It’s important to note that the availability of alternatives may depend on the specific terms, conditions, and provisions of the life insurance policy. Reviewing the policy documents and discussing options with the insurance company or an advisor can help policyholders make an informed decision that aligns with their unique circumstances.

Conclusion

Understanding the surrender value of a life insurance policy is crucial for policyholders to make informed financial decisions. While surrendering a policy can provide immediate access to funds and financial flexibility, it comes with trade-offs, such as the loss of life insurance coverage and potential tax implications. Evaluating the pros and cons, as well as exploring alternatives to surrendering, is essential to ensure the best possible outcome.

Factors such as policy type, premium payments, policy age, and investment returns impact the surrender value calculation. Policyholders should carefully review policy documents, consult insurance advisors, and analyze the specific terms and conditions pertaining to their policies to understand the surrender value and any potential charges or deductions associated with surrendering.

Before making a decision, policyholders can explore alternatives such as policy loans, partial withdrawals, reduced paid-up policies, policy conversions, selling the policy, or allowing the policy to lapse. Each option has its own advantages and considerations that should be weighed against the intended goals and financial situation.

Ultimately, the decision to surrender a life insurance policy should align with the policyholder’s specific needs, financial goals, and circumstances. Seeking guidance from a financial advisor or insurance professional can provide valuable insights and help navigate the complexities of surrendering or exploring alternative options.

By carefully considering the surrender value, understanding the alternatives, and consulting with professionals, policyholders can make informed choices that best suit their financial needs and provide a solid foundation for their future financial well-being.