Home>Finance>How To Calculate The Cash Value Of Life Insurance

Finance

How To Calculate The Cash Value Of Life Insurance

Published: November 18, 2023

Learn how to calculate the cash value of your life insurance policy and make smart financial decisions. Enhance your finance knowledge today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of life insurance, where financial protection meets investment potential. Life insurance is a crucial component of a well-rounded financial plan, providing peace of mind and security for your loved ones in the event of your passing. However, life insurance policies often come with an added benefit – the cash value.

The cash value of a life insurance policy is the accumulated value that grows over time. It can be likened to a savings account within your insurance policy, allowing you to access funds for various purposes, such as supplementing retirement income, paying for education expenses, or handling unexpected financial emergencies.

Understanding how to calculate the cash value of your life insurance policy is essential for making informed financial decisions. Whether you have a whole life insurance, universal life insurance, or variable life insurance policy, each type has its own method of determining its cash value.

In this article, we will explore the different types of life insurance policies and delve into how to calculate the cash value for each. We will also discuss the factors that affect the cash value and why it is important to monitor it regularly.

So, whether you are considering purchasing a new life insurance policy or are already a policyholder looking to gain a deeper understanding of its cash value, let’s dive in and explore the ins and outs of calculating the cash value of life insurance.

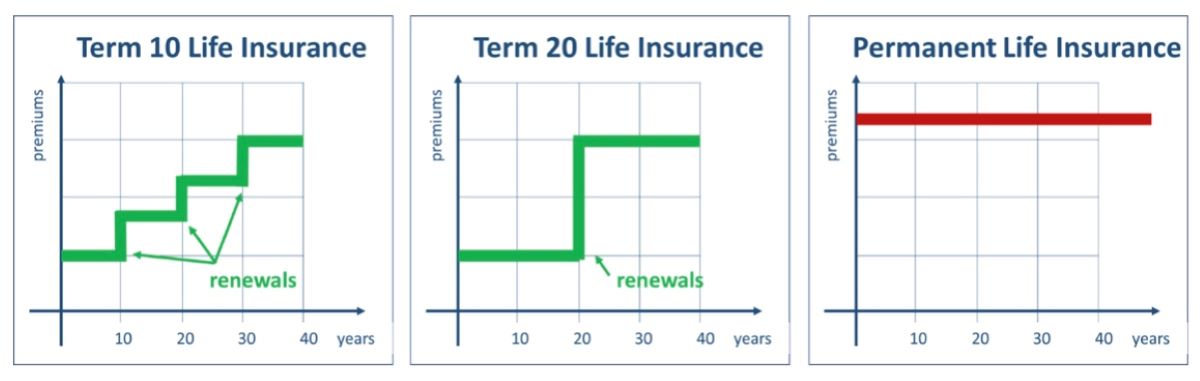

Understanding the Cash Value of Life Insurance

The cash value of a life insurance policy is essentially the savings component of the policy. It represents the amount of money that accumulates over time, in addition to the death benefit, which is the amount paid out to beneficiaries upon your passing. Unlike term life insurance, which provides coverage for a specific term, policies with cash value, such as whole life insurance, universal life insurance, and variable life insurance, offer both protection and an opportunity for growth.

The cash value grows through a combination of premiums paid, investment returns, and any additional contributions made to the policy. It is important to note that the cash value is tax-deferred, which means you do not have to pay taxes on the growth until you withdraw or surrender the policy.

One of the significant advantages of having a life insurance policy with cash value is the ability to access these funds while you are still alive. This can be done through policy loans or partial withdrawals, allowing you to use the cash value for various financial needs, such as paying for college tuition, funding a down payment on a home, or supplementing retirement income.

It’s important to understand that any loans or withdrawals from the cash value will reduce the death benefit and may also have tax implications. Additionally, if the policy is terminated, any outstanding loans will be subtracted from the cash value before it is paid out.

Overall, the cash value of a life insurance policy provides individuals with a unique combination of protection and flexibility. It acts as a financial resource for policyholders, enabling them to tap into the value of their policy to meet financial goals and obligations during their lifetime.

Factors Affecting the Cash Value

The cash value of a life insurance policy is influenced by various factors. Understanding these factors is crucial for estimating the growth potential of your policy and making informed financial decisions. Here are some key factors that can affect the cash value of your life insurance policy:

- Policy Type: Different types of life insurance policies have varying cash value accumulation methods. Whole life insurance offers guaranteed cash value growth, while universal life insurance provides more flexibility with adjustable premiums and death benefits. Variable life insurance allows policyholders to invest in various sub-accounts, which can impact the cash value depending on market performance.

- Premium Payments: The amount and frequency of your premium payments can directly impact the cash value. Consistently paying premiums in full and on time will maximize the growth of the cash value. Additionally, some insurance policies allow for additional contributions to boost the cash value accumulation.

- Interest and Dividends: Many life insurance policies, particularly whole life insurance, earn interest or dividends on the cash value. The interest rate or dividend rate declared by the insurance company will affect the growth of the cash value. It’s important to review and understand the interest or dividend options offered by your insurer.

- Policy Expenses: Insurance policies have various fees and expenses, such as administrative fees, mortality charges, and surrender charges. These fees are deducted from the cash value and can impact its growth. Understanding the policy’s expense structure is important when evaluating the potential cash value growth.

- Policy Performance: In the case of variable life insurance, the performance of the underlying investment sub-accounts will directly impact the cash value. If the investments perform well, the cash value may increase significantly. However, if the investments perform poorly, the cash value can be negatively affected.

- Withdrawals and Loans: Any withdrawals or loans taken against the cash value will directly impact the growth and size of the cash value. Loans typically accrue interest, while withdrawals reduce the cash value by the amount withdrawn. It’s important to carefully consider the impact of accessing funds from the cash value and the potential long-term consequences.

By considering these factors and consulting with a financial advisor, you can gain a better understanding of how they affect the growth and value of your life insurance policy’s cash value. Monitoring these factors and making adjustments as needed can help ensure the cash value aligns with your long-term financial goals.

Determining the Cash Value of Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for your entire lifetime. It also offers a guaranteed cash value component that grows over time. Determining the cash value of a whole life insurance policy involves a combination of guaranteed and non-guaranteed components.

The guaranteed cash value of a whole life insurance policy is determined by the insurance company based on the policy’s premium payments, interest rate, and the policyholder’s age. This cash value will continue to grow at a guaranteed rate over the life of the policy as long as premiums are paid.

In addition to the guaranteed cash value, whole life insurance policies may also include a non-guaranteed cash value component known as the dividend. Dividends are typically paid out by mutual insurance companies, and their size and consistency can vary. The dividends can be used to increase the cash value, purchase additional coverage, or receive cash payments.

Insurance companies determine the non-guaranteed cash value based on various factors, including investment performance, mortality experience, and expenses. These factors can influence the dividends paid to policyholders, which in turn affect the cash value. It’s important to note that dividends are not guaranteed, and their payment is at the discretion of the insurance company.

To determine the current cash value of a whole life insurance policy, policyholders can refer to their policy statement or contact their insurance company directly. The statement will provide a breakdown of the guaranteed cash value, any accumulated dividends, and the total cash value. It’s important to review the policy statement regularly to monitor the growth of the cash value and any changes in dividends.

If the policyholder wishes to access the cash value of their whole life insurance policy, they can do so through policy loans or partial withdrawals. Policy loans allow the policyholder to borrow against the cash value while keeping the policy in force. The loan amount accrues interest, which is deducted from the cash value. Partial withdrawals involve taking out a portion of the cash value, reducing both the cash value and the death benefit.

Before making any decisions regarding policy loans or withdrawals, policyholders should consider the impact on the cash value, death benefit, and potential tax consequences. Consulting with a financial advisor can provide guidance on the optimal way to utilize the cash value to meet financial needs.

In summary, the cash value of a whole life insurance policy is determined by a combination of guaranteed and non-guaranteed components. Monitoring the cash value and understanding the factors that influence its growth is essential for maximizing the benefits of this permanent life insurance coverage.

Calculating the Cash Value of Universal Life Insurance

Universal life insurance is a type of permanent life insurance that combines a death benefit with a flexible savings component. Unlike whole life insurance, universal life insurance allows policyholders to adjust their premium payments and death benefits over time. Calculating the cash value of a universal life insurance policy involves understanding the three main components: premiums, interest, and policy expenses.

The premiums paid into a universal life insurance policy are divided into two parts: the cost of insurance and the excess premium. The cost of insurance covers the mortality risk and administrative expenses, while the excess premium is allocated towards the cash value. The cash value is credited with interest, typically based on an adjustable interest rate declared by the insurance company.

The interest credited to the cash value of a universal life insurance policy is affected by the current interest rate environment. Insurance companies typically provide a minimum guaranteed interest rate, ensuring that the cash value will not decrease. However, the actual interest credited may be higher if the insurer’s investments perform well. It’s important to review the policy details and understand how the interest rate changes over time.

Policy expenses, including administrative fees and mortality charges, are deducted from the cash value. These expenses cover the cost of maintaining the policy and providing the death benefit coverage. It’s important to understand the structure of policy expenses and how they can impact the growth of the cash value.

To calculate the cash value of a universal life insurance policy, policyholders can refer to their policy statement or contact their insurance company. The statement will provide a breakdown of the cash value, including the accumulation of premiums, interest credited, and any deductions for expenses. It’s essential to review the policy statement regularly and monitor the growth of the cash value to ensure it aligns with your financial goals.

Policyholders may have the option to make additional contributions to the cash value of their universal life insurance policy. These contributions can help boost the cash value and potentially provide greater flexibility in the future. However, it’s crucial to understand the rules and limitations set by the insurance company regarding additional contributions.

If policyholders wish to access the cash value of their universal life insurance policy, they can do so through policy loans or partial withdrawals. Policy loans allow borrowing against the cash value while keeping the policy in force. Partial withdrawals involve taking out a portion of the cash value, reducing both the cash value and the death benefit.

Before making any decisions regarding policy loans or withdrawals, it’s important to consider the impact on the cash value, death benefit, and any potential tax implications. Consulting with a financial advisor can help evaluate the best strategy for utilizing the cash value to meet financial needs.

In summary, calculating the cash value of a universal life insurance policy involves understanding the premium payments, interest credited, and deductions for policy expenses. Monitoring the cash value and reviewing the policy regularly can help maximize the benefits of this flexible type of permanent life insurance coverage.

Evaluating the Cash Value of Variable Life Insurance

Variable life insurance is a type of permanent life insurance that combines a death benefit with investment opportunities. Unlike other forms of life insurance, variable life insurance allows policyholders to invest a portion of their premium payments into various investment sub-accounts. The cash value of a variable life insurance policy fluctuates based on the performance of these sub-accounts.

When evaluating the cash value of a variable life insurance policy, it’s essential to consider the following factors:

- Investment Performance: The cash value of a variable life insurance policy is directly impacted by the performance of the chosen investment sub-accounts. These sub-accounts are typically invested in stocks, bonds, or other securities. Positive performance can result in growth in the cash value, while negative performance may lead to a decrease in the cash value. It’s important to review and understand the investment options available within the policy and monitor their performance.

- Fees and Expenses: Variable life insurance policies often have associated fees and expenses, such as management fees, administrative charges, and mortality and expense risk charges. These fees are deducted from the cash value and can reduce the overall growth. It’s crucial to carefully review the policy documentation to understand the impact of these fees on the cash value.

- Premium Payments: The amount and frequency of premium payments made into a variable life insurance policy can directly affect the cash value. Consistent and timely premium payments can contribute to the growth of the cash value. Additionally, policyholders may have the option to make additional contributions to boost the cash value. It’s important to understand the options and limitations regarding premium payments and additional contributions.

- Withdrawals and Surrenders: Accessing the cash value of a variable life insurance policy can be done through partial withdrawals or surrendering the policy entirely. Partial withdrawals involve taking out a portion of the cash value, which may reduce both the cash value and the death benefit. Surrendering the policy means terminating the coverage and receiving the cash surrender value, which can be lower than the total cash value due to surrender charges. It’s crucial to evaluate the potential impact on the policy’s cash value and death benefit before considering withdrawals or surrenders.

Evaluating the cash value of a variable life insurance policy requires active monitoring and assessment of the investment performance, fees, and any potential opportunities to optimize the policy. Working with a financial advisor who specializes in insurance and investments can provide valuable guidance in managing the cash value and making informed decisions.

It’s also important to remember that the cash value of a variable life insurance policy is subject to market volatility and investment risks. Understanding the potential rewards and risks associated with variable life insurance is essential for ensuring it aligns with your financial goals and risk tolerance.

In summary, evaluating the cash value of variable life insurance involves considering investment performance, fees and expenses, premium payments, and potential withdrawals or surrenders. Regular monitoring and consulting with a financial advisor can help optimize the cash value and overall performance of your variable life insurance policy.

Importance of Monitoring the Cash Value

Monitoring the cash value of your life insurance policy is crucial for several reasons. It allows you to track the growth and performance of your policy’s cash value, ensure it aligns with your financial goals, and make informed decisions based on the changing circumstances. Here are some key reasons why monitoring the cash value of your life insurance policy is important:

- Financial Planning: The cash value of a life insurance policy can play a significant role in your overall financial plan. By monitoring its growth, you can assess how it aligns with your long-term financial goals, such as retirement planning, education funding, or estate planning. Regular monitoring helps ensure that the cash value is on track to provide the desired financial benefits when needed.

- Understanding Policy Performance: The cash value reflects the performance of your life insurance policy. Monitoring it allows you to evaluate whether the policy is delivering the expected growth and returns. If the cash value is not growing as anticipated, it may be necessary to reevaluate the policy or make adjustments to maximize its potential.

- Opportunity for Adjustments: By monitoring the cash value, you can identify opportunities for adjustments. For example, if the cash value is growing faster than expected, you may have the option to reduce premium payments, adjust the policy coverage, or withdraw some funds for other financial needs. Conversely, if the cash value is not meeting expectations, you can explore options to potentially increase premium payments or reassess the investment strategy.

- Managing Policy Expenses: Monitoring the cash value helps you stay aware of any policy expenses deducted from it. This includes administrative fees, mortality charges, or other charges specific to your policy. By understanding these expenses, you can assess their impact on the cash value and make informed decisions about managing them effectively.

- Maximizing Benefits: Regularly monitoring the cash value allows you to proactively manage your life insurance policy to maximize its benefits. It provides an opportunity to assess whether the current policy meets your evolving needs and make adjustments if necessary. For example, if you have accumulated a substantial cash value, you may consider using it to purchase additional coverage or explore other financial opportunities.

Overall, monitoring the cash value of your life insurance policy ensures that it remains a valuable asset in your financial portfolio. By staying informed and actively managing the cash value, you can make timely decisions to optimize its growth and align it with your changing financial goals. Consulting with a financial advisor who specializes in life insurance can provide valuable insights and guidance in monitoring and managing the cash value of your policy.

Conclusion

The cash value of a life insurance policy adds a valuable dimension to the financial benefits provided by life insurance. Whether you have a whole life insurance, universal life insurance, or variable life insurance policy, understanding and monitoring the cash value is essential for making informed financial decisions.

Throughout this article, we explored the significance of the cash value and how it differs across different types of life insurance policies. We discussed the factors that influence the growth of the cash value, such as premium payments, interest rates, investment performance, and policy expenses. We also highlighted the importance of regularly monitoring the cash value to ensure it aligns with your financial goals.

Monitoring the cash value allows you to assess the performance of your policy, make adjustments as needed, and potentially take advantage of its flexibility. It enables you to evaluate how the cash value can be utilized to meet financial needs, such as supplementing retirement income, funding education expenses, or handling unforeseen emergencies.

Remember, evaluating the cash value requires careful consideration of investment performance, fees and expenses, premium payments, and potential withdrawals or surrenders. Regularly reviewing your policy statement and consulting with a financial advisor can help you navigate the complexities of managing the cash value effectively.

Life insurance is not just about the death benefit; it is a valuable financial tool that provides protection and growth potential. By understanding and monitoring the cash value of your life insurance policy, you can make the most of its benefits and ensure that it remains a valuable asset in your overall financial plan.

As life changes and financial goals evolve, it is essential to review and reassess your life insurance policy regularly. By staying informed and proactive, you can make the necessary adjustments to maximize the benefits of the cash value and align it with your long-term financial objectives.

So, take the time to understand your life insurance policy’s cash value, monitor its growth, and consult with professionals to guide you in making decisions that will positively impact your financial future.