Home>Finance>What Process Could The Pension Funds Use To Gain Control Of Mylan’s Board?

Finance

What Process Could The Pension Funds Use To Gain Control Of Mylan’s Board?

Published: January 23, 2024

Learn how pension funds can leverage their influence to gain control of Mylan's board through strategic financial processes. Explore the intersection of finance and corporate governance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the Potential Impact of Pension Funds in Corporate Governance

- The Role and Significance of Pension Funds in the Financial Landscape

- Shaping Corporate Practices and Strategic Direction

- Navigating the Path to Board Influence

- Navigating Complexities and Upholding Fiduciary Duties

- Empowering Governance Advocacy and Fostering Sustainable Value Creation

Introduction

Understanding the Potential Impact of Pension Funds in Corporate Governance

Pension funds, often regarded as the financial backbone of retirement security for millions of individuals, wield substantial influence in the corporate world. These funds, managed by professional investment firms, are entrusted with the task of safeguarding and growing the assets earmarked for retirees. However, beyond this fiduciary responsibility, pension funds also play a pivotal role in shaping the governance and strategic direction of the companies in which they invest.

In recent times, the spotlight has turned to Mylan, a global pharmaceutical company, where pension funds are seeking to assert their influence. The potential implications of pension funds gaining control of Mylan's board are far-reaching, encompassing strategic decision-making, corporate policies, and ultimately, the company's financial performance. To comprehend the significance of this development, it is crucial to delve into the nature of pension funds and their role in corporate governance.

Pension funds, representing the retirement savings of employees, are entrusted to pension fund managers who are tasked with investing these funds in a diversified portfolio to ensure long-term growth and stability. The collective clout of these funds is formidable, as they often represent a significant ownership stake in numerous publicly traded companies. Consequently, pension funds hold substantial voting power in crucial corporate decisions, including the election of board members, executive compensation, and major strategic initiatives.

Moreover, the fiduciary duty of pension fund managers compels them to act in the best interests of the fund's beneficiaries, prioritizing sustainable growth, ethical business practices, and long-term value creation. This responsibility underscores the potential impact of pension funds on the governance and operational dynamics of the companies in which they invest.

As the narrative surrounding Mylan and pension funds unfolds, it becomes evident that the actions and decisions of these institutional investors carry profound implications for the company's future trajectory. This article aims to elucidate the process through which pension funds seek to gain control of Mylan's board, the challenges they may encounter, and the broader implications for corporate governance and shareholder activism. By delving into these intricacies, readers will gain a comprehensive understanding of the multifaceted interplay between pension funds and corporate governance, shedding light on a pivotal juncture in the corporate landscape.

Understanding Pension Funds

The Role and Significance of Pension Funds in the Financial Landscape

Pension funds serve as a cornerstone of retirement planning, providing a vital source of financial security for employees post-retirement. These funds are typically managed by professional investment firms, entrusted with the responsibility of prudently investing the contributions made by employees and employers to ensure long-term growth and sustainability.

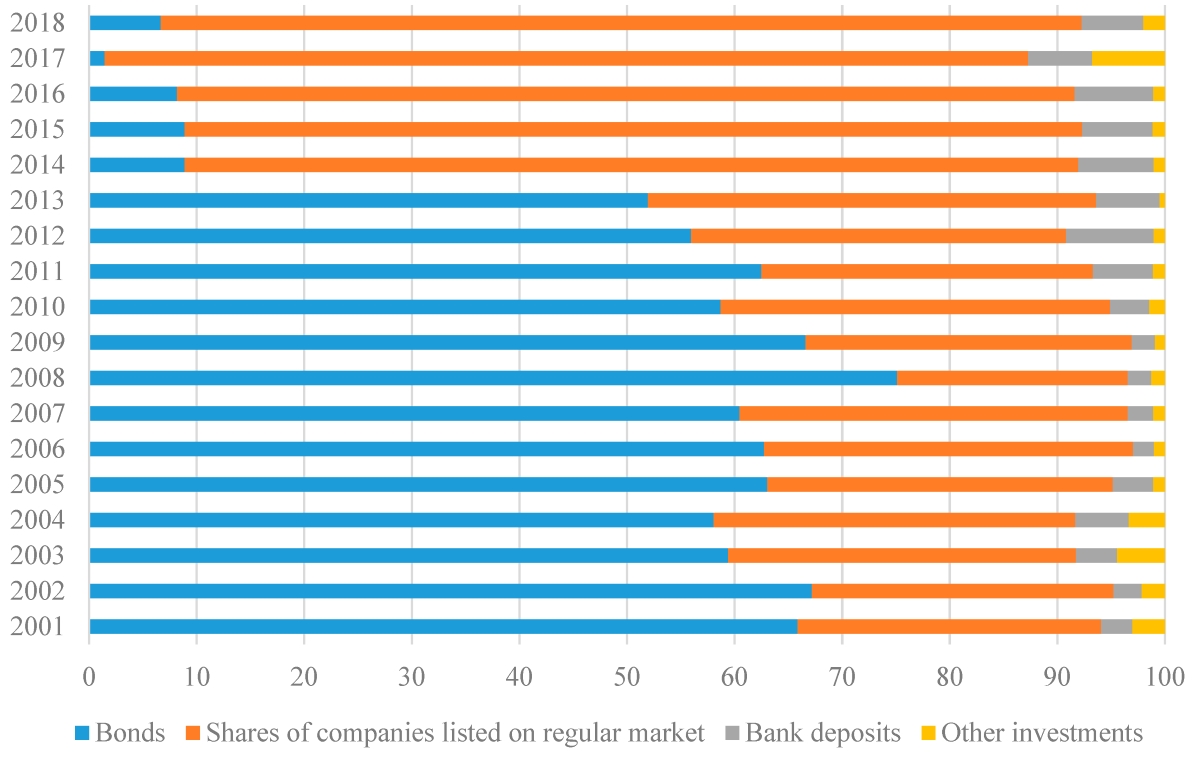

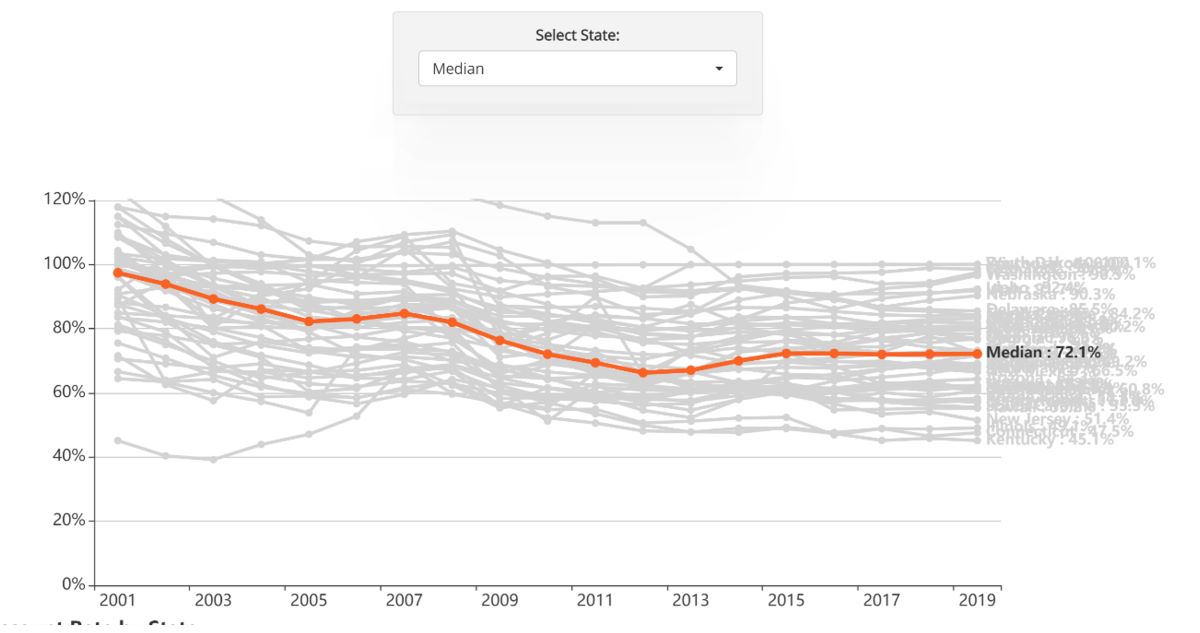

One of the defining characteristics of pension funds is their long-term investment horizon. Unlike individual investors or hedge funds, pension funds operate with an extended time horizon, often spanning several decades. This prolonged investment outlook enables pension funds to allocate capital to a diverse array of assets, including stocks, bonds, real estate, and alternative investments, with the aim of generating consistent returns while mitigating risk.

Moreover, pension funds are subject to stringent regulatory oversight and fiduciary obligations, compelling fund managers to act in the best interests of the fund’s beneficiaries. This fiduciary duty underscores the paramount importance of prudence, due diligence, and ethical conduct in the investment decisions made by pension fund managers.

Furthermore, pension funds wield substantial influence in the financial markets due to their sheer size and collective ownership stakes in numerous publicly traded companies. This influence extends to the realm of corporate governance, where pension funds actively engage with companies on matters such as board composition, executive compensation, and strategic initiatives, aiming to align corporate practices with long-term shareholder value creation.

Amid the evolving landscape of corporate governance and shareholder activism, pension funds have emerged as influential advocates for sustainable and responsible business practices. Their active participation in proxy voting, shareholder resolutions, and engagement with company management underscores their commitment to fostering transparent, accountable, and value-driven corporate governance practices.

Overall, the role of pension funds transcends mere financial stewardship, encompassing a broader mandate of shaping corporate governance, promoting sustainable investment practices, and safeguarding the long-term interests of retirees. As pivotal players in the financial ecosystem, pension funds wield significant influence and carry profound implications for the companies in which they invest, underscoring their multifaceted role in the contemporary financial landscape.

The Role of Pension Funds in Corporate Governance

Shaping Corporate Practices and Strategic Direction

Pension funds, as institutional investors entrusted with safeguarding the retirement savings of millions, play a pivotal role in shaping the governance and strategic direction of the companies in which they invest. Their influence extends across various facets of corporate governance, encompassing board oversight, executive compensation, shareholder rights, and sustainable business practices.

One of the primary avenues through which pension funds exert their influence is through proxy voting. As significant shareholders in numerous publicly traded companies, pension funds actively participate in voting on key corporate matters, including the election of board members, approval of executive compensation packages, and pivotal strategic decisions. This voting power empowers pension funds to advocate for governance reforms, board diversity, and alignment of corporate strategies with long-term shareholder value creation.

Beyond proxy voting, pension funds engage in constructive dialogues with company management and boards of directors, advocating for transparent disclosure practices, risk management protocols, and ethical business conduct. These engagements serve to foster a culture of accountability, responsible stewardship, and alignment of corporate practices with the long-term interests of shareholders and stakeholders.

Moreover, pension funds are at the forefront of promoting sustainable and ethical business practices within the companies they invest in. By advocating for environmental, social, and governance (ESG) considerations, pension funds seek to ensure that companies integrate sustainability principles into their operational frameworks, thereby mitigating risks and enhancing long-term value creation.

Furthermore, pension funds actively participate in shareholder resolutions, leveraging their collective influence to advocate for governance reforms, executive accountability, and strategic realignment. This proactive stance underscores their commitment to fostering transparent, accountable, and value-driven corporate governance practices.

Overall, the role of pension funds in corporate governance is characterized by active engagement, advocacy for responsible business practices, and alignment of corporate strategies with long-term shareholder value creation. As influential stewards of capital, pension funds wield considerable influence in shaping the governance dynamics and strategic orientation of the companies in which they invest, underscoring their pivotal role in the contemporary corporate landscape.

The Process for Pension Funds to Gain Control of Mylan’s Board

Navigating the Path to Board Influence

The endeavor for pension funds to gain control of Mylan’s board entails a meticulously orchestrated process that involves strategic planning, shareholder engagement, and advocacy for governance reforms. This pursuit unfolds through a series of pivotal steps, each aimed at garnering support, influencing corporate decisions, and ultimately shaping the composition and strategic orientation of the company’s board.

Accumulating Ownership Stake: A fundamental aspect of gaining control of a company’s board is amassing a substantial ownership stake. Pension funds, leveraging their collective assets, strategically acquire shares of the company, thereby bolstering their voting power and influence in crucial corporate decisions, including board elections and strategic initiatives.

Engagement and Advocacy: Pension funds actively engage with Mylan’s management and board, advocating for governance reforms, board diversity, and alignment of corporate strategies with long-term shareholder value creation. This engagement entails constructive dialogues, proxy voting, and the presentation of shareholder resolutions aimed at fostering transparent, accountable, and value-driven corporate governance practices.

Collaboration with Institutional Investors: Collaboration with other institutional investors forms a pivotal aspect of the process. Pension funds seek to garner support from like-minded investors who share their vision for governance reforms and strategic realignment. This collective advocacy amplifies their influence and enhances the prospects of effecting meaningful changes in the board composition and strategic direction of the company.

Advocacy for Board Representation: A key milestone in the process involves advocating for board representation. Pension funds may nominate independent director candidates with diverse expertise and a strategic vision aligned with long-term value creation. This nomination aims to reshape the board’s composition, infusing it with expertise, independence, and a commitment to governance best practices.

Proxy Contests and Shareholder Resolutions: In cases where constructive engagement does not yield the desired outcomes, pension funds may resort to proxy contests and shareholder resolutions. These mechanisms serve as potent tools for advocating governance reforms, board accountability, and strategic realignment, thereby exerting substantial pressure on the incumbent board to accede to the demands of the institutional investors.

By navigating these strategic steps with precision, pension funds endeavor to gain control of Mylan’s board, effecting governance reforms and strategic realignment that align the company’s trajectory with the long-term interests of shareholders and stakeholders. This process underscores the proactive stance of pension funds in shaping corporate governance dynamics and fostering sustainable value creation within the companies in which they invest.

Challenges and Considerations for Pension Funds

Navigating Complexities and Upholding Fiduciary Duties

As pension funds embark on the journey to gain control of Mylan’s board, they encounter a myriad of challenges and considerations that necessitate astute navigation and steadfast adherence to fiduciary responsibilities. These complexities underscore the multifaceted nature of shareholder activism and governance advocacy, shaping the strategic approach of pension funds as they seek to effect meaningful changes in corporate governance.

Regulatory Hurdles: Pension funds operate within a stringent regulatory framework, subject to oversight by regulatory bodies that mandate adherence to fiduciary duties and responsible investment practices. Navigating these regulatory complexities while advocating for governance reforms requires a nuanced understanding of legal and compliance considerations, ensuring that the actions of pension funds align with regulatory mandates.

Stakeholder Alignment: Garnering support from diverse stakeholders, including other institutional investors, proxy advisory firms, and retail shareholders, presents a significant challenge. Pension funds must articulate a compelling case for governance reforms and board realignment, garnering support for their initiatives and fostering alignment among stakeholders with varying perspectives and priorities.

Strategic Engagement: Engaging with Mylan’s management and board necessitates a strategic and diplomatic approach. Pension funds must navigate delicate negotiations, constructive dialogues, and proxy voting, aiming to foster a collaborative environment conducive to governance reforms while safeguarding the long-term interests of the fund’s beneficiaries.

Long-Term Value Creation: Upholding the mandate of long-term value creation amidst the pursuit of board control poses a significant consideration for pension funds. Balancing short-term pressures with the imperative of sustainable growth and ethical business practices requires a prudent and discerning approach, ensuring that governance advocacy aligns with the overarching goal of maximizing shareholder value over the long term.

Board Representation: Advocating for board representation necessitates the identification and nomination of independent director candidates who embody diverse expertise, independence, and a strategic vision aligned with long-term value creation. Selecting directors who possess the acumen to drive governance reforms and strategic realignment is pivotal, demanding a meticulous vetting process and strategic alignment with the fund’s objectives.

Shareholder Activism Risks: Embracing a stance of shareholder activism entails inherent risks, including potential backlash from incumbent boards, proxy contests, and shareholder litigation. Pension funds must prudently assess and mitigate these risks, ensuring that their advocacy efforts are underpinned by a comprehensive risk management framework that safeguards the interests of the fund and its beneficiaries.

As pension funds navigate these challenges and considerations, they exemplify their commitment to upholding fiduciary duties, fostering transparent and accountable corporate governance practices, and advocating for sustainable value creation within the companies in which they invest. The complexities inherent in this endeavor underscore the proactive and multifaceted nature of pension funds’ role in shaping the corporate governance landscape.

Conclusion

Empowering Governance Advocacy and Fostering Sustainable Value Creation

The pursuit of gaining control of Mylan’s board by pension funds encapsulates a compelling narrative of shareholder activism, governance advocacy, and the multifaceted role of institutional investors in shaping the corporate governance landscape. As pension funds navigate the complexities and strategic considerations inherent in this endeavor, they exemplify their commitment to upholding fiduciary duties, fostering transparent and accountable corporate governance practices, and advocating for sustainable value creation within the companies in which they invest.

At the heart of this pursuit lies a resolute dedication to safeguarding the long-term interests of retirees, ensuring that the assets entrusted to pension funds are prudently invested to secure financial security post-retirement. This fiduciary responsibility transcends mere financial stewardship, encompassing a broader mandate of shaping governance dynamics, promoting sustainable investment practices, and advocating for governance reforms that align corporate strategies with long-term shareholder value creation.

Furthermore, the process through which pension funds seek to gain control of Mylan’s board underscores the proactive stance of institutional investors in shaping the strategic orientation and governance practices of the companies in which they hold ownership stakes. By engaging in constructive dialogues, proxy voting, and advocacy for governance reforms, pension funds wield their collective influence to foster a culture of accountability, responsible stewardship, and alignment of corporate practices with the long-term interests of shareholders and stakeholders.

As the narrative unfolds, the challenges and considerations encountered by pension funds underscore the nuanced nature of governance advocacy and the imperative of navigating regulatory complexities, stakeholder alignment, and long-term value creation. By prudently addressing these challenges, pension funds exemplify their commitment to fostering sustainable and ethical business practices, aligning board composition with governance best practices, and advocating for strategic realignment that augurs well for the long-term prosperity of the companies in which they invest.

In essence, the endeavor for pension funds to gain control of Mylan’s board epitomizes the proactive and influential role of institutional investors in shaping the corporate governance landscape. Through strategic engagement, governance advocacy, and a steadfast commitment to fiduciary responsibilities, pension funds exemplify their pivotal role as advocates for sustainable value creation, transparent governance practices, and the long-term prosperity of the companies and the beneficiaries they serve.