Home>Finance>What Were The Banking Regulations Before The Great Recession Began?

Finance

What Were The Banking Regulations Before The Great Recession Began?

Modified: December 30, 2023

Discover the banking regulations that were in place before the Great Recession began. Gain insights into the financial landscape of that time with a focus on finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

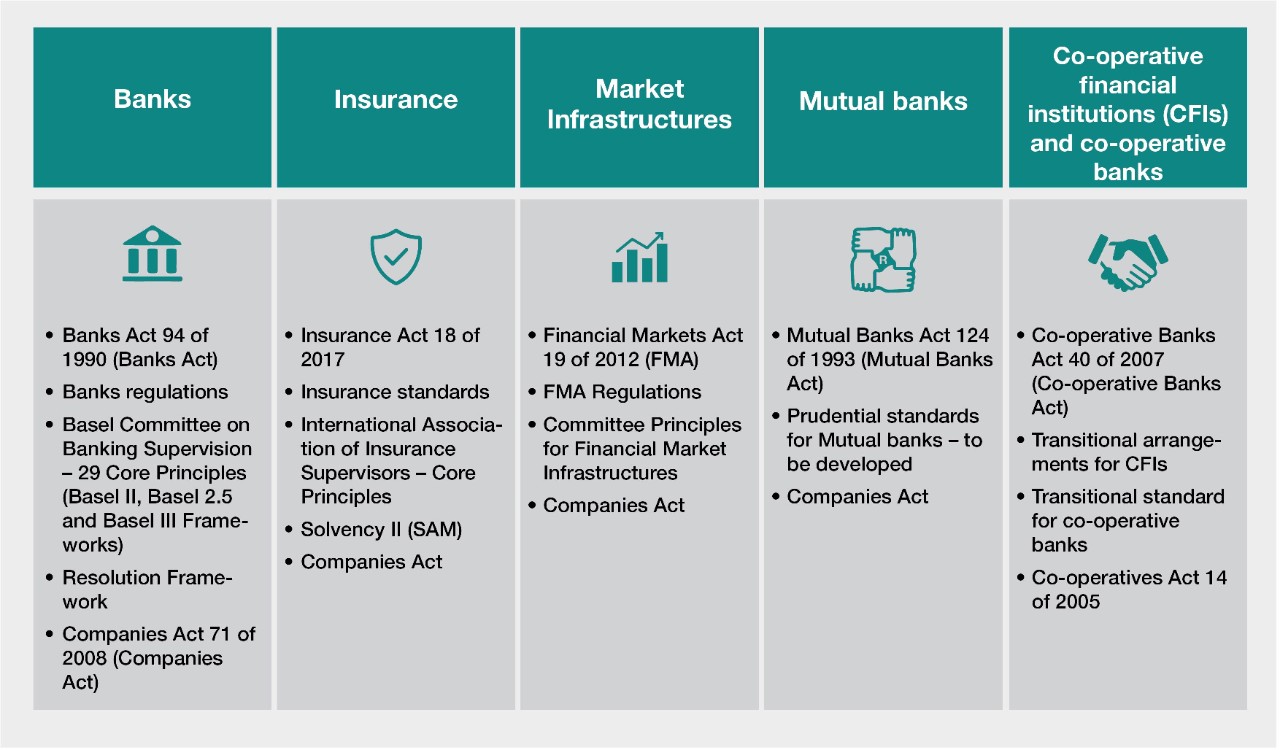

The Great Recession, which began in 2008 and had widespread impacts on the global economy, highlighted the importance of banking regulations in preventing financial crises. Prior to the onset of the recession, the banking industry operated under a set of regulations that aimed to maintain stability and protect consumers. These regulations played a crucial role in shaping the behavior of financial institutions and ensuring the integrity of the banking sector.

This article takes a closer look at the banking regulations in place before the Great Recession and their impact on the financial landscape. Understanding these regulations provides valuable insights into the regulatory framework that existed prior to the crisis and the subsequent changes that were implemented to prevent a similar occurrence in the future.

It is worth noting that banking regulations are complex and can vary across countries. The focus here will be primarily on the regulations in the United States, as they had significant implications for the global financial system. However, many of the concepts and principles discussed apply to banking regulations in other jurisdictions as well.

By examining the banking regulations that were in effect prior to the Great Recession, we can gain a better understanding of the challenges and vulnerabilities that existed within the financial system. This knowledge can help us appreciate the importance of strong and effective regulatory measures in preventing future economic disruptions.

The Glass-Steagall Act

The Glass-Steagall Act, officially known as the Banking Act of 1933, was one of the most significant banking regulations in the United States prior to the Great Recession. It was enacted in response to the widespread bank failures and financial instability during the Great Depression.

Under the Glass-Steagall Act, commercial banks were separated from investment banks. This separation was aimed at preventing banks from engaging in risky investment activities with depositors’ funds. Commercial banks were restricted from engaging in speculative investments, such as trading securities and underwriting securities issues, while investment banks were prohibited from accepting deposits from the general public.

This regulation was intended to ensure the safety of depositor funds and protect against conflicts of interest. By separating commercial and investment banking activities, the Glass-Steagall Act aimed to prevent the intertwining of risky investment activities with traditional banking functions.

The Glass-Steagall Act also established the Federal Deposit Insurance Corporation (FDIC) to provide deposit insurance for individuals’ bank accounts up to a certain threshold. This insurance coverage helped restore public confidence in the banking system by guaranteeing the safety of deposits, even in the event of a bank failure.

However, over time, the Glass-Steagall Act faced criticism and calls for reform. Advocates for deregulation argued that the separation of commercial and investment banking was outdated and hindered the competitiveness of U.S. financial institutions. In 1999, the Gramm-Leach-Bliley Act was passed, effectively repealing key provisions of the Glass-Steagall Act.

The repeal of the Glass-Steagall Act is often cited as one of the contributing factors to the financial crisis of 2008. The removal of the separation between commercial and investment banking allowed for the increased integration of these two sectors, leading to the emergence of “too big to fail” institutions. Critics argue that this integration contributed to the excessive risk-taking and complex financial products that ultimately led to the collapse of several major financial institutions.

In response to the financial crisis, there have been calls for a reinstatement or revision of the Glass-Steagall Act to prevent future crises. While there is ongoing debate surrounding the effectiveness and feasibility of such measures, the Glass-Steagall Act remains a prominent example of banking regulation prior to the Great Recession.

The Bank Holding Company Act

The Bank Holding Company Act of 1956 was another crucial banking regulation in the United States prior to the Great Recession. This act aimed to regulate the activities of bank holding companies and their subsidiaries to ensure safety and soundness in the banking system.

Under the Bank Holding Company Act, bank holding companies were required to obtain approval from the Federal Reserve before acquiring or merging with other banks or engaging in non-banking activities. This oversight by the Federal Reserve allowed for close monitoring of bank holding companies and their impact on the overall financial system.

The act also established guidelines and restrictions on the capital adequacy, liquidity, and risk management practices of bank holding companies. This was done to ensure that these companies maintained sufficient financial strength to support their subsidiary banks and protect the interests of depositors and other stakeholders.

The Bank Holding Company Act played a significant role in preventing the excessive concentration of banking power and promoting competition within the industry. It aimed to prevent the formation of large, dominant bank holding companies that may pose risks to financial stability.

However, it is important to note that the effectiveness of the Bank Holding Company Act was called into question leading up to the Great Recession. Some argued that the act failed to adequately address the risks posed by non-bank subsidiaries of bank holding companies, such as those engaged in mortgage lending and securitization activities. These risky activities ultimately contributed to the collapse of several financial institutions and the subsequent financial crisis.

In response to the lessons learned from the financial crisis, the Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted in 2010. This act introduced additional regulations and oversight on bank holding companies to enhance the stability of the financial system.

While the Bank Holding Company Act alone may not have been sufficient to prevent the Great Recession, it remains an important piece of banking regulation that aimed to promote the safety and soundness of the banking system by regulating the activities of bank holding companies and their subsidiaries.

The Federal Reserve System

The Federal Reserve System, often referred to as the Fed, is a central banking system and a key regulatory institution in the United States. It was established in 1913 with the primary objective of promoting monetary stability, fostering economic growth, and maintaining the stability of the financial system.

One of the primary roles of the Federal Reserve System is to conduct monetary policy. Through its Open Market Operations, the Fed buys and sells government securities to influence the supply of money in the economy. Controlling the money supply helps regulate interest rates, inflation, and economic growth.

In addition to its monetary policy responsibilities, the Federal Reserve System serves as a regulator and supervisor of banks and other financial institutions. It ensures the safety and soundness of the banking system by implementing regulations, conducting inspections, and monitoring the financial health of institutions under its jurisdiction.

The Federal Reserve System also provides a range of services to banks and the broader financial system. This includes acting as a lender of last resort during times of financial stress, facilitating the clearing and settlement of payments, and maintaining the stability of the payment systems.

During the years leading up to the Great Recession, the Federal Reserve faced criticism for its regulatory approach and oversight of the financial system. Some argued that the Fed failed to adequately address the risks associated with the housing market and subprime mortgage lending, which eventually led to the collapse of several major financial institutions.

In response to the financial crisis, the Federal Reserve implemented various measures to stabilize the financial system and stimulate economic recovery. These included emergency lending programs, monetary stimulus, and increased regulatory oversight.

The role and effectiveness of the Federal Reserve System in preventing future financial crises continue to be topics of debate. Some argue for more stringent regulation and oversight, while others emphasize the importance of maintaining the independence and flexibility of the central bank.

Overall, the Federal Reserve System plays a critical role in shaping monetary policy, regulating the banking industry, and maintaining financial stability in the United States. Its actions and policies have far-reaching implications for the economy and the overall functioning of the financial system.

The Office of the Comptroller of the Currency

The Office of the Comptroller of the Currency (OCC) is a regulatory agency within the U.S. Department of the Treasury that oversees and supervises national banks and federal savings associations. Established in 1863, the OCC plays a crucial role in ensuring the safety and soundness of the banking system.

The primary responsibility of the OCC is to charter, regulate, and supervise national banks. It ensures that these institutions operate in a safe and sound manner, comply with relevant laws and regulations, and adequately manage risks. The OCC conducts regular examinations of banks to assess their financial condition, internal controls, and compliance with relevant banking laws.

One of the key objectives of the OCC is to protect depositors and ensure the stability of the banking system. It sets and enforces standards and guidelines to ensure that banks have adequate capital, liquidity, and risk management practices. This oversight helps prevent excessive risk-taking and promotes the overall integrity of the banking industry.

In addition to its supervisory role, the OCC also has the authority to take enforcement actions against banks that violate banking laws or engage in unsafe and unsound practices. These actions can range from issuing formal enforcement orders to imposing civil monetary penalties or removing bank officials from their positions.

The OCC works in close collaboration with other regulatory agencies, such as the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC), to coordinate supervision and ensure regulatory consistency across the banking industry. This cooperation helps establish a comprehensive regulatory framework that addresses the unique challenges and risks faced by banks.

During the years leading up to the Great Recession, the OCC faced criticism for its role in overseeing the banking industry. Some argued that the OCC did not adequately address the risks associated with subprime mortgages and failed to enforce regulations effectively. These criticisms led to various regulatory reforms and changes to enhance the oversight and supervision of financial institutions.

In response to the financial crisis, the OCC, along with other regulatory agencies, implemented measures to strengthen supervision, enhance risk management practices, and improve the overall resilience of the banking system.

The Office of the Comptroller of the Currency continues to play a vital role in the regulation and supervision of national banks, working to ensure the stability, safety, and soundness of the banking industry in the United States.

The Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the U.S. government that provides deposit insurance for banks and promotes the stability and public confidence in the nation’s financial system. It was established in 1933 in response to the widespread bank failures during the Great Depression.

The primary function of the FDIC is to insure bank deposits and protect depositors in the event of a bank failure. The FDIC provides deposit insurance coverage up to a certain threshold per depositor, per insured bank. This insurance coverage ensures that depositors’ funds are protected and can be recovered even if a bank experiences financial distress or goes bankrupt.

The FDIC also plays a crucial role in the resolution of failed banks. In the event of a bank failure, the FDIC steps in as the receiver and works to minimize disruptions to the banking system. It takes over the failed bank’s operations, sells its assets, and arranges for the transfer of deposits to other banks. This resolution process helps maintain public confidence in the stability of the banking system and ensures that depositors can access their funds.

In addition to its role in deposit insurance and bank resolution, the FDIC conducts regular examinations of banks to assess their financial condition, risk management practices, and compliance with banking regulations. Through its supervisory function, the FDIC works to promote the safety and soundness of financial institutions and mitigate risks that could threaten the stability of the banking system.

During the years leading up to the Great Recession, the FDIC faced significant challenges as a result of the large number of bank failures. The financial crisis tested the capacity of the FDIC to respond effectively to the increased number of banks in distress, resulting in significant costs for the agency and the need for additional funding from the government.

In response to the financial crisis, the FDIC implemented various measures to strengthen its regulatory framework and preparedness for bank failures. These included enhanced capital and liquidity requirements for banks, increased deposit insurance coverage, and improved risk monitoring and early warning systems.

The FDIC continues to play a critical role in maintaining public confidence and stability in the banking system. Its deposit insurance guarantees and bank resolution efforts serve as key safeguards for depositors, contributing to the overall integrity and resilience of the financial system.

The Community Reinvestment Act

The Community Reinvestment Act (CRA), enacted in 1977, is a U.S. banking regulation that seeks to encourage financial institutions to meet the credit needs of the communities in which they operate, particularly low- and moderate-income neighborhoods. The act was implemented in response to concerns about redlining and the lack of access to credit in underserved communities.

Under the CRA, banks are required to demonstrate that they are meeting the credit needs of their entire community, including low- and moderate-income individuals and neighborhoods. The act applies to all insured banks and thrift institutions that receive deposits from the public.

Banks are evaluated by regulatory agencies, including the Federal Reserve, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation, to assess their compliance with the CRA. These evaluations consider factors such as the bank’s lending, investment, and service activities in low- and moderate-income areas.

The CRA encourages banks to provide loans, mortgages, and other financial services to individuals and businesses in underserved communities. It aims to combat discriminatory practices and ensure that all communities have access to affordable and equitable financial services.

The implementation of the CRA has had a significant impact on the availability of credit in underserved communities. It has led to increased lending and investment in affordable housing projects, small businesses, and community development initiatives.

The CRA has also sparked debates and discussions about its effectiveness and potential unintended consequences. Critics argue that the act can create incentives for banks to make risky loans in order to meet their CRA requirements, which some believe played a role in the housing market crisis leading up to the Great Recession.

Nevertheless, the CRA remains an important regulatory framework that promotes financial inclusion and supports economic development in underserved communities. It encourages banks to play an active role in meeting the credit needs of all residents, regardless of their income level or neighborhood.

In recent years, there have been proposals for modernizing and updating the CRA to better align with the changing banking landscape and address the evolving credit needs of communities. The goal is to ensure that the CRA continues to serve its intended purpose in promoting equitable access to financial services and fostering community development.

The Securities and Exchange Commission

The Securities and Exchange Commission (SEC) is a regulatory agency in the United States that oversees and regulates the securities industry. It was established in 1934 in response to the stock market crash of 1929 and the ensuing Great Depression.

The primary mission of the SEC is to protect investors, maintain fair and efficient markets, and facilitate capital formation. It achieves this through the enforcement of securities laws, the regulation of securities markets, and the oversight of securities professionals, including brokers, investment advisors, and public companies.

One of the key responsibilities of the SEC is to ensure that securities markets operate in a fair and transparent manner. The SEC regulates the registration and disclosure requirements for companies offering securities to the public, requiring them to provide accurate and timely information to investors. This promotes transparency, helps investors make informed decisions, and prevents fraudulent activities.

The SEC also enforces securities laws to combat insider trading, market manipulation, and other fraudulent activities that can undermine investor confidence and disrupt the integrity of financial markets. It conducts investigations and takes legal action against individuals and entities that violate securities laws, imposing penalties and seeking remedies for harmed investors.

In addition to its enforcement role, the SEC plays a vital role in setting and enforcing rules and regulations for the securities industry. This includes establishing standards for financial reporting and auditing, enforcing corporate governance practices, and overseeing the activities of securities professionals to maintain market integrity.

During the years leading up to the Great Recession, the SEC faced criticism for perceived regulatory gaps and failures in its oversight of the financial industry. Some argued that the SEC did not effectively address the risks associated with subprime mortgage-backed securities and complex financial products, contributing to the financial crisis.

In response to the crisis, the SEC implemented reforms to strengthen regulatory oversight, enhance transparency, and improve risk management practices. These reforms aimed to address the weaknesses identified during the crisis and strengthen the SEC’s ability to protect investors and maintain the stability of the securities markets.

The Securities and Exchange Commission continues to play a crucial role in regulating the securities industry and safeguarding the interests of investors. Its efforts to promote fairness, transparency, and investor protection contribute to the integrity and stability of the U.S. financial markets.

The Sarbanes-Oxley Act

The Sarbanes-Oxley Act, also known as the Public Company Accounting Reform and Investor Protection Act, is a U.S. federal law enacted in 2002 in response to a series of corporate accounting scandals, including Enron and WorldCom. The act aims to enhance corporate governance, strengthen financial reporting, and restore investor confidence in the wake of these scandals.

One of the key provisions of the Sarbanes-Oxley Act is the establishment of the Public Company Accounting Oversight Board (PCAOB). This independent board oversees the auditing profession and sets auditing standards for public companies. The PCAOB conducts inspections of accounting firms to ensure compliance with these standards and promotes the integrity and reliability of financial statements.

The act also enhances corporate accountability by imposing stricter financial reporting and internal controls requirements on public companies. It mandates that CEOs and CFOs certify the accuracy of financial statements, establishes criminal penalties for corporate fraud, and requires companies to establish and maintain effective internal controls over financial reporting.

Furthermore, the Sarbanes-Oxley Act requires more transparency and accountability in corporate governance. It mandates that public companies have independent audit committees made up of outside directors who oversee financial reporting and engage with external auditors. It also restricts certain non-audit services that auditors can provide to their clients to minimize potential conflicts of interest.

The Sarbanes-Oxley Act has had a significant impact on the corporate landscape since its enactment. It has led to increased scrutiny of financial reporting practices, stricter internal controls, and improved corporate governance. These changes aim to protect investors and restore their trust in the integrity of financial markets.

While the Sarbanes-Oxley Act has been successful in improving financial reporting and enhancing corporate governance, it has also faced criticism for its perceived regulatory burden on businesses, especially smaller companies. Critics argue that the compliance costs associated with the act can be substantial, particularly for smaller entities.

Nevertheless, the Sarbanes-Oxley Act remains an important piece of legislation that promotes transparency, accountability, and investor protection in the corporate world. Its key provisions have significantly influenced corporate practices and continue to shape the regulatory landscape for public companies in the United States.

Conclusion

The banking regulations in place before the Great Recession played a crucial role in shaping the behavior of financial institutions and safeguarding the stability of the financial system. Regulations such as the Glass-Steagall Act aimed to prevent the intertwining of risky investment activities with traditional banking functions, while the Bank Holding Company Act focused on regulating the activities of bank holding companies. The Federal Reserve System and the Office of the Comptroller of the Currency played key roles in overseeing and supervising banks, ensuring their safety and soundness.

The Securities and Exchange Commission regulated the securities industry, promoting fair and transparent markets, while the Sarbanes-Oxley Act enhanced corporate governance and financial reporting standards. The Federal Deposit Insurance Corporation provided deposit insurance and worked to maintain public confidence in the banking system.

Although these regulations were in place prior to the Great Recession, the financial crisis exposed certain weaknesses and gaps in the regulatory framework. In response, various reforms and changes were implemented to enhance oversight and improve risk management practices. The lessons learned from the crisis continue to shape ongoing discussions about the need for stronger regulatory measures to prevent future economic disruptions.

Overall, the importance of effective banking regulations cannot be understated. They provide a framework for stability, protect consumers, and promote the overall integrity of the financial system. The complex and ever-evolving nature of the financial industry calls for continuous evaluation and adaptation of regulatory measures to ensure they remain effective in addressing emerging risks and challenges.

By gaining a deeper understanding of the banking regulations before the Great Recession, we can appreciate the importance of a robust regulatory framework in maintaining a healthy and resilient financial sector. This knowledge can contribute to ongoing discussions about improving regulations to prevent future crises and promote sustainable economic growth and stability.