Finance

When Does SBLK Pay Dividends?

Published: January 3, 2024

Discover when SBLK pays dividends and stay updated with the latest financial news and insights. Explore financing options and optimize your investments with expert advice.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Dividends are an essential component of the financial world and play a crucial role in an investor’s portfolio. They provide a steady stream of income and are often seen as a reflection of a company’s stability and profitability. When it comes to investing in stocks, dividend-paying companies are highly sought after.

In this article, we will explore the world of dividends and focus on SBLK, a major player in the finance industry. We will delve into the frequency at which SBLK pays dividends, discuss the factors that influence their dividend payments, and look at historical data to gain a deeper understanding of their dividend policy.

SBLK, also known as Star Bulk Carriers Corp., is a leading global shipping company that specializes in the transportation of dry bulk cargoes. With a large fleet of vessels and a strong reputation in the industry, SBLK has become a popular choice for investors looking to invest in the shipping sector.

Dividend payments are crucial for investors, as they provide them with a tangible return on their investment. By investing in SBLK, investors can potentially receive regular dividend payments alongside the opportunity for capital appreciation.

It is important for investors to understand when and how frequently SBLK pays dividends, as this information can help them make informed decisions regarding their investment strategy. In the next section, we will explore the various aspects of dividend payments and dive deeper into SBLK’s dividend policy.

Understanding Dividends

Before diving into the specifics of SBLK’s dividend payments, let’s first establish a clear understanding of what dividends are and why they matter to investors.

Dividends are a portion of a company’s profits that are distributed to its shareholders. Think of them as a way for companies to share their success with the people who have invested in them. When a company generates profits, it has several options on what to do with that money. It can reinvest it back into the business, pay down debt, repurchase shares, or distribute it to shareholders in the form of dividends.

Dividends are typically paid out on a regular basis, such as quarterly, semi-annually, or annually. The amount each shareholder receives is based on the number of shares they own. Dividends can be paid in the form of cash, additional shares of stock, or other forms of value.

For investors, dividends provide a steady stream of income that can be reinvested or used to cover living expenses. Dividend-paying stocks are especially attractive for income-focused investors who rely on these payments to supplement their regular income.

Dividends can also be an indicator of a company’s financial health and stability. A consistent track record of dividend payments can suggest that a company is profitable and has a sustainable business model. Companies that pay dividends are often viewed as more reliable and investor-friendly.

While dividends are undoubtedly beneficial, it’s important to note that not all companies pay dividends. Some companies choose to reinvest their profits back into the business to fund expansion, research and development, or other growth initiatives. These companies may offer potential capital appreciation but do not provide immediate income through dividends.

Now that we have a solid understanding of dividends, let’s shift our focus to SBLK and explore the specifics of their dividend payments.

Overview of SBLK

SBLK, or Star Bulk Carriers Corp., is a prominent player in the global shipping industry. As one of the largest dry bulk shipping companies, SBLK specializes in the transportation of essential commodities such as iron ore, coal, grain, and other bulk cargoes. With a diverse fleet of vessels and a strong market presence, SBLK has established itself as a leader in the industry.

SBLK’s fleet consists of a range of vessel types, including Capesize, Panamax, and Ultramax vessels, allowing them to serve a wide customer base and meet various shipping needs. By effectively managing their fleet and optimizing operational efficiency, SBLK has built a reputation for reliability and timely delivery.

The company operates globally and has a strong customer base comprising major mining companies, traders, and commodity producers. SBLK’s strategic partnerships and long-term contracts ensure a steady flow of cargoes, providing stability and revenue growth opportunities.

In addition to their operational success, SBLK places a strong emphasis on environmental responsibility. They have made significant investments in eco-friendly vessels and have been recognized for their commitment to sustainable shipping practices. SBLK’s dedication to reducing emissions and promoting eco-friendly initiatives aligns with the growing demand for environmentally conscious transportation solutions.

As a publicly listed company, SBLK trades on major stock exchanges, providing investors with the opportunity to participate in their growth and success. Investors see SBLK as an attractive investment option due to its strong market position, solid financial performance, and potential for dividend income.

Now that we have a general understanding of SBLK’s operations and industry presence, let’s delve into the specifics of their dividend payment frequency.

Dividend Payment Frequency for SBLK

When it comes to dividend payments, SBLK follows a regular schedule to provide investors with a predictable income stream. As a publicly traded company, SBLK is committed to rewarding its shareholders by distributing a portion of its profits in the form of dividends.

Historically, SBLK has adopted a quarterly dividend payment frequency. This means that investors can expect to receive dividend payments every three months. Quarterly dividends are a popular choice among companies, as they strike a balance between providing a regular income to shareholders while retaining enough funds for operational requirements and future growth initiatives.

By adopting a consistent quarterly dividend policy, SBLK aims to provide stability and predictability to its investors. This allows shareholders to plan their finances and make informed decisions based on the expected dividend income.

It is important to note that dividend payments are subject to the company’s financial performance and the discretion of the board of directors. While SBLK strives to maintain consistent dividend payments, economic conditions, industry trends, and other factors may influence the board’s decision on the amount and timing of dividend distributions.

Investors interested in receiving dividend payments from SBLK should keep an eye on the company’s financial announcements and quarterly reports. These sources of information can provide insights into the company’s financial health and indicate whether dividend payments are expected to continue or potentially change.

Now that we understand the dividend payment frequency for SBLK, let’s explore the factors that can affect their dividend payments.

Factors Affecting SBLK Dividend Payments

While SBLK strives to maintain a regular dividend payment schedule, several factors can influence their ability to distribute dividends. Understanding these factors is crucial for investors to assess the sustainability and potential fluctuations in dividend payments.

1. Financial Performance: The most significant factor that impacts dividend payments is the company’s financial performance. SBLK’s profitability and cash flow generation play a vital role in determining the amount of funds available for dividend distributions. If the company experiences a decrease in revenues or incurs significant expenses, it may affect the dividend amount or even result in the suspension of dividend payments temporarily.

2. Industry Conditions: The shipping industry is subject to various market forces and fluctuations. Factors such as global trade trends, commodity demand, freight rates, and competition can impact SBLK’s revenue and profitability. In challenging times or a downturn in the industry, SBLK may choose to conserve cash and allocate funds towards maintaining their operations rather than paying out dividends.

3. Debt Obligations: Just like any other company, SBLK has financial obligations, including debt repayments and interest payments. These obligations require a significant portion of the company’s cash flow. In times when debt obligations are high or liquidity is constrained, SBLK may need to prioritize debt servicing over dividend payments.

4. Capital Expenditure: SBLK operates in a capital-intensive industry, requiring investments in ships, maintenance, and expansion. To ensure the continued growth and competitiveness of the business, SBLK may need to allocate a portion of its earnings towards capital expenditures. This allocation could impact the funds available for dividend payments.

5. Regulatory Environment: The shipping industry is subject to various regulations and compliance requirements related to safety, environment, and labor standards. Changes in regulations or increased compliance costs can impact SBLK’s financials and cash flow. This, in turn, may influence the ability to pay dividends.

It is important to note that dividend payments are ultimately determined by the company’s board of directors. They take into consideration all relevant factors, including the ones mentioned above, in their decision-making process. Shareholders can assess these factors by reviewing SBLK’s financial statements, industry news, and management outlook to gauge the potential stability and sustainability of dividend payments.

Now that we understand the factors that can affect SBLK’s dividend payments, let’s examine historical data to gain insights into their dividend policy.

Historical Data on SBLK Dividend Payments

Examining the historical dividend data of SBLK can provide valuable insights into the company’s dividend policy and its commitment to rewarding shareholders through regular distributions.

SBLK has a history of paying dividends to its shareholders, reflecting its profitability and dedication to providing returns. While dividend payments can fluctuate based on various factors, analyzing the patterns can help investors gauge the reliability and consistency of these payments.

In recent years, SBLK has maintained a quarterly dividend payment schedule. For example, in 2020, the company paid dividends in each quarter at a steady rate. This demonstrates their commitment to regular distributions and is a positive sign for income-seeking investors.

However, it is important to note that the exact dividend amounts may vary based on the company’s financial performance and the decisions of the board of directors. In some cases, SBLK has increased the dividend amount, reflecting confidence in the company’s prospects and financial strength.

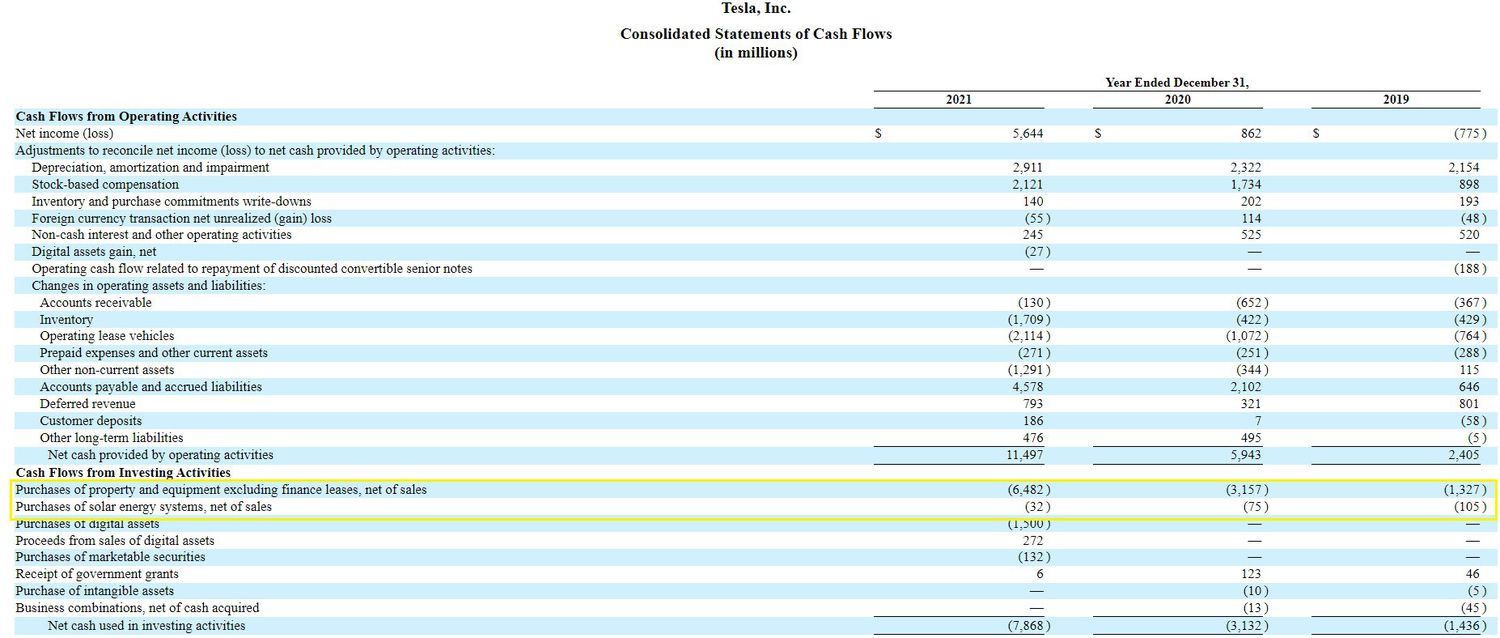

An investor can refer to SBLK’s financial statements, particularly the income statement and cash flow statement, to track dividend payments over time. These documents provide a comprehensive overview of the company’s financial performance and cash flow, offering insights into the dividend payment history.

By analyzing SBLK’s dividend payment history, investors can better understand the stability and consistency of dividend distributions over the years. This historical data can also help investors assess the company’s commitment to returning value to shareholders and its ability to generate sustainable profits for future dividend payments.

It is important to remember that past performance is not indicative of future results, and dividend payments can be subject to change based on various internal and external factors. Therefore, investors should always consider the latest financial information and stay updated with company announcements to make informed decisions regarding their investment strategy.

Now that we have explored the historical data on SBLK’s dividend payments, let’s conclude our discussion.

Conclusion

Dividend payments are a key consideration for investors looking to generate income and build a stable portfolio. When it comes to SBLK, a leading global shipping company, understanding their dividend policy and payment frequency is crucial for investors seeking to invest in the shipping sector.

SBLK has established a reputation for regular dividend payments. Historically, the company has followed a quarterly dividend payment schedule, providing investors with a predictable income stream. This consistent dividend policy reflects SBLK’s commitment to returning value to its shareholders.

However, it’s important to acknowledge that various factors can affect SBLK’s ability to distribute dividends. These factors include financial performance, industry conditions, debt obligations, capital expenditure requirements, and regulatory environment. Therefore, investors should carefully monitor SBLK’s financial statements, industry trends, and management commentary to evaluate the sustainability and potential fluctuations in dividend payments.

Analyzing the historical data on SBLK’s dividend payments can provide insights into the company’s dividend policy and its dedication to rewarding shareholders. By tracking dividend amounts and consistency over time, investors can gain a better understanding of the reliability and stability of dividend distributions.

As with any investment decision, it’s crucial to conduct thorough research, consider one’s investment goals, and consult with a financial advisor before making investment decisions. This ensures that the investment strategy aligns with individual risk tolerance and financial objectives.

In conclusion, SBLK’s dividend payment frequency and commitment to maintaining regular distributions make it an attractive option for income-seeking investors. By staying informed about the company’s financial performance, industry trends, and management outlook, investors can make well-informed decisions regarding their investment in SBLK.

Remember, investing in stocks and dividends carries risks, and it’s important to diversify investments and carefully assess one’s own financial situation before committing to any investment opportunity.