Home>Finance>When Does The IRS Withdraw Funds From Bank Account?

Finance

When Does The IRS Withdraw Funds From Bank Account?

Published: November 1, 2023

Discover when the IRS withdraws funds from your bank account for financial transactions. Stay informed with our comprehensive guide on finance and IRS payment schedules.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing your finances and staying on top of your tax obligations, it’s essential to have a clear understanding of how the Internal Revenue Service (IRS) withdraws funds from your bank account. Whether you owe taxes, have entered into an installment agreement, or are facing a federal tax lien or bank levy, knowing the process can help you plan and stay in control of your finances.

Understanding the various methods the IRS uses to withdraw funds from your bank account can also help you avoid any surprises and ensure you can manage your cash flow effectively.

In this article, we will explore different scenarios that may lead to the IRS withdrawing funds from your bank account. From electronic funds withdrawal to bank levies, we will cover the key details you need to know about each process.

It’s important to note that while the IRS has the authority to withdraw funds from your bank account under certain circumstances, they typically follow a well-defined process that involves providing notice and an opportunity to address outstanding tax issues.

Now, let’s dive into the different scenarios where the IRS may withdraw funds from your bank account and the steps you can take to navigate these situations.

Electronic Funds Withdrawal

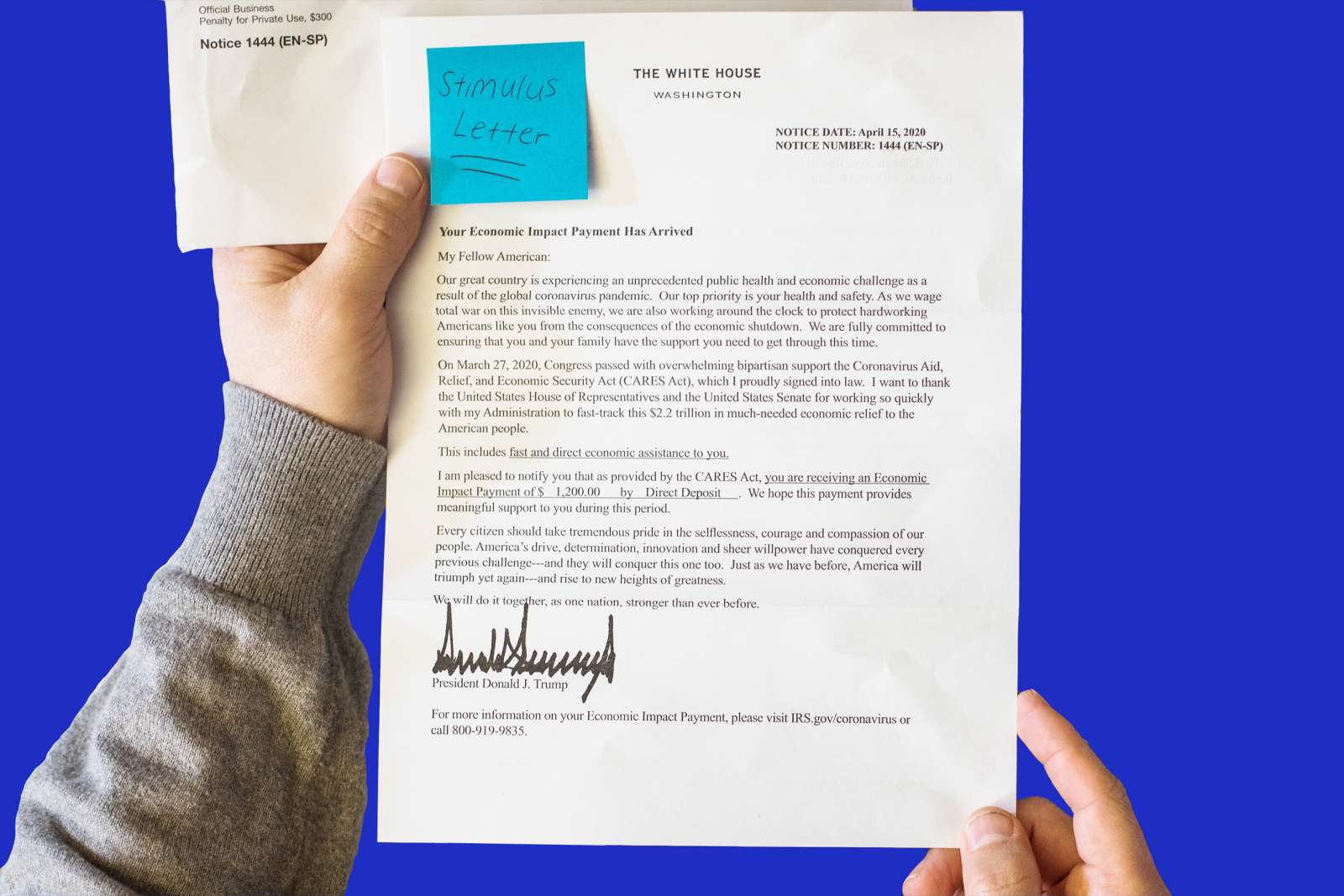

Electronic Funds Withdrawal (EFW) is a convenient and secure method used by the IRS to withdraw funds directly from your bank account when you file your tax return. This option allows you to authorize the IRS to transfer the funds needed to pay your tax liability.

When you e-file your tax return, you have the option to provide your bank account information and authorize the IRS to initiate an electronic withdrawal. The IRS will then directly debit the amount you owe from your bank account on the date you specify or on the due date of your tax return.

Electing for EFW offers several advantages. First, it eliminates the need to write and mail a paper check or send your payment through an online payment platform. It also ensures that your payment is made on time, reducing the risk of penalties and interest for late payments.

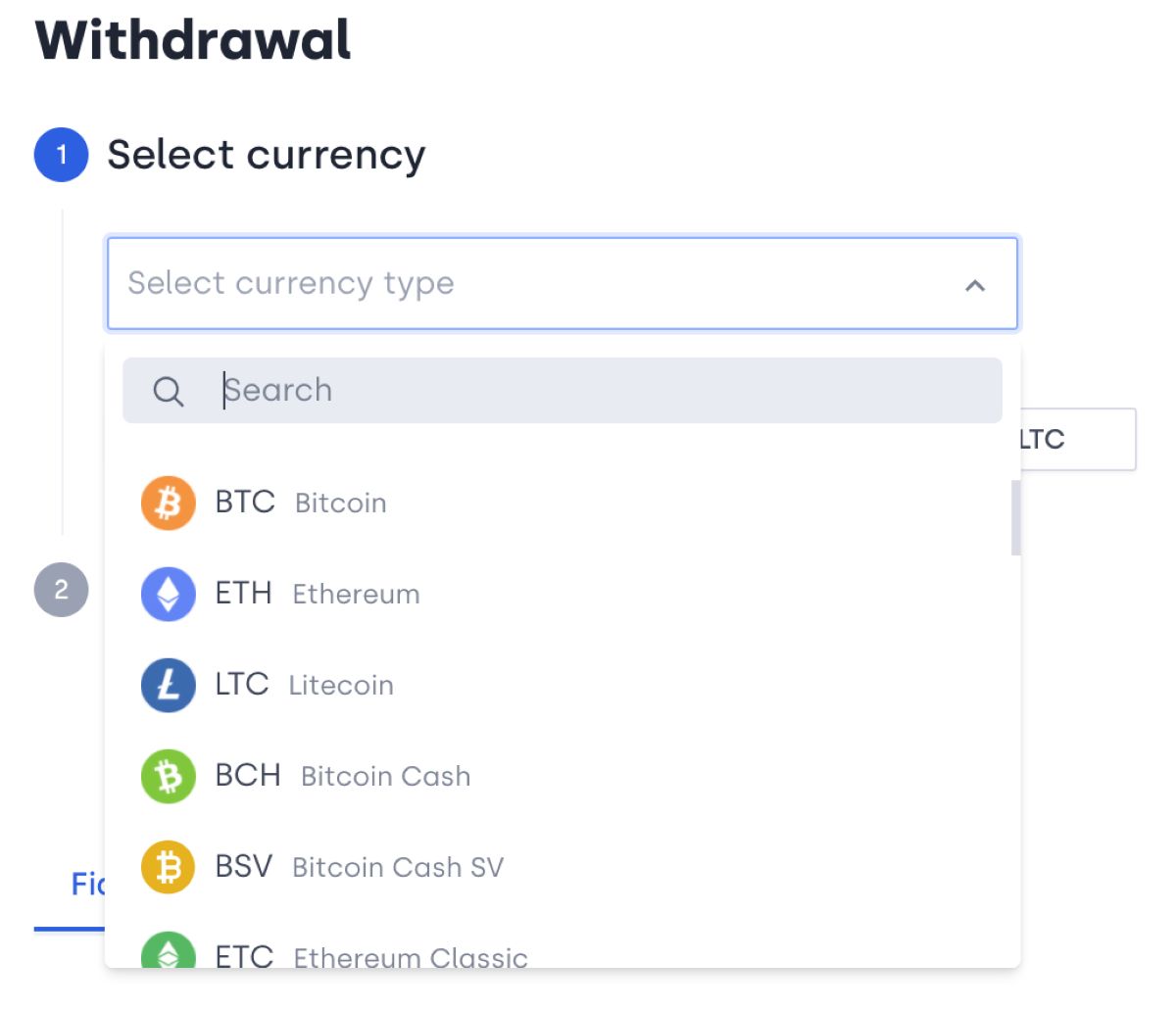

To authorize an electronic funds withdrawal, you will need to provide your bank’s routing number, your account number, and indicate whether it is a checking or savings account. It’s crucial to double-check the accuracy of this information for a smooth and successful transaction. Any errors could result in payment processing delays or potential issues with your tax return.

It’s important to note that EFW can only be used for timely payments and cannot be used to pay past-due taxes or other outstanding IRS liabilities. If you have outstanding tax debts, you may need to explore other payment options, such as an installment agreement or an offer in compromise.

Overall, Electronic Funds Withdrawal is an efficient and straightforward method for paying your tax liability when filing your tax return. By authorizing the IRS to withdraw funds directly from your bank account, you can ensure timely payment and avoid any potential penalties or interest associated with late payments.

Direct Debit Authorization

Direct Debit Authorization is another method that allows the IRS to withdraw funds directly from your bank account. Unlike Electronic Funds Withdrawal, which is used during the tax return filing process, Direct Debit Authorization is typically used for ongoing payments, such as installment agreement payments or estimated tax payments.

If you have entered into an installment agreement with the IRS to pay off your tax debt over an extended period, you may opt for Direct Debit Authorization to streamline the payment process. By providing your bank account information and authorizing the IRS to withdraw the agreed-upon amount each month, you can ensure consistent and timely payments towards your outstanding tax liability.

Similarly, if you are making estimated tax payments throughout the year, you can choose Direct Debit Authorization to have the funds automatically withdrawn from your bank account on the designated due dates. This can help you stay on top of your tax obligations and avoid potential penalties for underpayment.

When setting up Direct Debit Authorization, you will need to provide your bank’s routing number, your account number, and specify whether it is a checking or savings account. It’s critical to ensure the accuracy of this information to avoid any payment processing issues.

It’s important to note that when utilizing Direct Debit Authorization, you have the flexibility to adjust the payment amount or suspend the automatic withdrawals if needed. However, it’s crucial to communicate any changes or requests to the IRS in a timely manner to ensure they are properly processed.

Direct Debit Authorization offers a convenient and automated way to make regular payments towards your tax liabilities. By authorizing the IRS to withdraw funds directly from your bank account, you can maintain compliance with your installment agreement or estimated tax payment requirements and avoid the hassle of manual payments.

Installment Agreement Payments

When you owe a significant amount of tax liability to the IRS but are unable to pay it in full, you may be eligible for an installment agreement. An installment agreement allows you to make monthly payments over an extended period to satisfy your tax debt.

To initiate an installment agreement, you will need to submit Form 9465, Installment Agreement Request, along with your tax return or separately. This form outlines your proposed monthly payment amount and the duration of the agreement. If your proposed payment amount is accepted by the IRS, they will send you a notice confirming the terms of the installment agreement.

Once you have established an installment agreement, you have several options for making your monthly payments. One of the most convenient methods is through Direct Debit Authorization, as discussed in the previous section. By authorizing the IRS to withdraw funds directly from your bank account, you can ensure consistent and timely payments towards your tax debt.

If you choose not to utilize Direct Debit Authorization, you have other payment options available. You can make payments online through the IRS website using their Electronic Federal Tax Payment System (EFTPS). Additionally, you can make payments by phone, mail, or by visiting an authorized payment provider.

It’s important to note that while an installment agreement allows you to pay off your tax debt over time, penalties and interest will continue to accrue until the balance is fully paid. Therefore, it’s advisable to make payments as per the agreed terms to minimize any additional costs.

If you are facing financial hardship and cannot meet the agreed-upon payment terms, you may be eligible for a modified installment agreement or even a temporary delay in payments. It’s crucial to communicate with the IRS and provide them with the necessary documentation and information to support your request.

Overall, entering into an installment agreement can provide you with a structured approach to pay off your tax debt. By setting up a regular payment plan, whether through Direct Debit Authorization or other methods, you can regain control of your finances and fulfill your tax obligations in a manageable way.

Federal Tax Lien Withdrawal

When you owe a significant amount of unpaid taxes to the IRS, they have the authority to place a federal tax lien on your assets, including your property, financial accounts, and other personal belongings. A federal tax lien serves as a legal claim that the IRS has on your property as security for the unpaid tax debt.

However, under certain circumstances, you may be able to request a federal tax lien withdrawal. A tax lien withdrawal removes the public Notice of Federal Tax Lien and releases the lien from your specific assets. This can help improve your credit rating and make it easier for you to sell or refinance your property.

To request a federal tax lien withdrawal, you must meet certain criteria set by the IRS. These criteria involve demonstrating that the withdrawal will facilitate the collection of the unpaid tax debt and be in the best interest of both the taxpayer and the government.

One common scenario where a federal tax lien withdrawal may be granted is through the IRS’s Fresh Start program. This program aims to help taxpayers who are struggling to pay their tax debt by providing them with options for resolution.

If you meet the eligibility requirements of the Fresh Start program, you may be able to request a federal tax lien withdrawal after entering into a Direct Debit Installment Agreement. This allows you to make monthly payments towards your tax debt, and if you have successfully made three consecutive payments, you can submit Form 12277, Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien, to request a lien withdrawal.

It’s important to note that even if a federal tax lien withdrawal is granted, it does not release you from the obligation to pay the outstanding tax debt. You are still responsible for making timely payments as per the terms of the installment agreement or other resolution options.

If you believe you meet the criteria for a federal tax lien withdrawal, it’s essential to consult with a tax professional or contact the IRS directly to understand the specific requirements and steps involved in the application process.

Obtaining a federal tax lien withdrawal can provide significant relief and improve your financial situation. By taking the necessary steps and demonstrating your commitment to resolving your tax debt, you can work towards eliminating the lien and regaining control over your assets.

Bank Levy

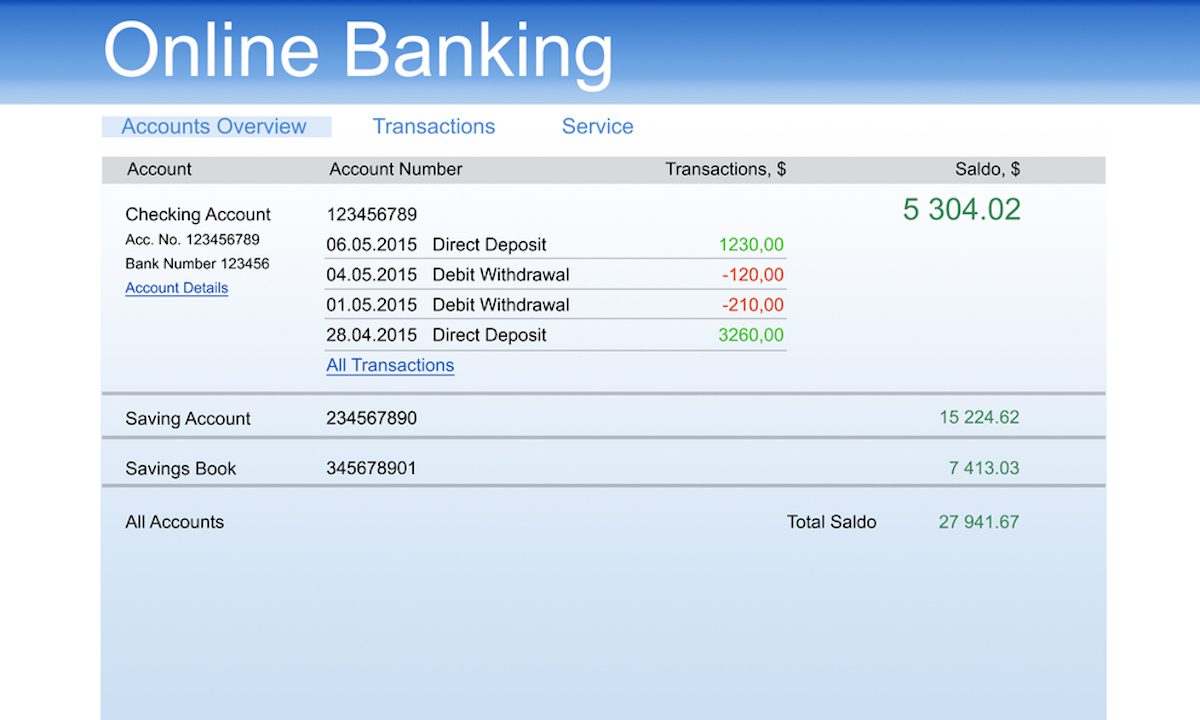

A bank levy is a powerful tool that the IRS can use to collect unpaid taxes. With a bank levy, the IRS can legally seize funds from your bank account to satisfy your outstanding tax debt.

When the IRS intends to issue a bank levy, they will typically send you a Notice and Demand for Payment, also known as a final notice. This notice provides you with an opportunity to address your tax debt before the levy is initiated.

If you fail to respond or make arrangements to resolve your tax debt, the IRS can move forward with the bank levy. Once the levy is in effect, the IRS will contact your bank and instruct them to freeze the funds in your account. The bank is then required to hold the funds for a specified period, typically 21 days, before sending them to the IRS.

It’s important to note that a bank levy can be a sudden and unexpected event, as the IRS is not required to provide prior notice to your bank. Once the levy is initiated, you may face challenges accessing your funds, paying bills, or meeting other financial obligations.

If you find yourself facing a bank levy, it’s essential to take immediate action. Contacting the IRS and seeking professional assistance can help you understand your options and potentially negotiate a release of the levy or set up an alternative payment arrangement.

It’s crucial to be proactive in resolving your tax debt to avoid the risk of a bank levy. The IRS offers various options for resolving tax liabilities, such as installment agreements, offers in compromise, and hardship programs. Exploring these options and taking steps to address your tax debt can help prevent the stress and financial consequences of a bank levy.

If you are facing a bank levy or have concerns about your ability to pay your tax debt, it’s advisable to seek guidance from a tax professional who can assist you in navigating the process and finding the most suitable solution for your financial situation.

Remember, addressing your tax debt proactively and working with the IRS can help you avoid the potential impact of a bank levy and regain control of your finances.

Collection Due Process Hearing

If you have received a notice from the IRS regarding a tax lien, levy, or other collection actions, you have the right to request a Collection Due Process (CDP) hearing. A CDP hearing provides you with an opportunity to contest the proposed collection actions and present your case to an independent appeals officer.

To request a CDP hearing, you must submit Form 12153, Request for a Collection Due Process or Equivalent Hearing, within the specified timeframe mentioned in the IRS notice. This form outlines your reasons for the disagreement and provides supporting documentation or evidence.

Once your request is received and processed, the IRS will schedule a CDP hearing. This hearing can be conducted either in-person, by telephone, or through written correspondence, depending on your preference and the complexity of your case.

During the CDP hearing, you will have the opportunity to explain your position, present evidence or documentation, and discuss possible resolutions with the appeals officer. The officer will review your case and consider your arguments before making a decision.

If you are not satisfied with the outcome of the CDP hearing, you have the right to further appeal the decision in the United States Tax Court.

It’s important to note that requesting a CDP hearing does not automatically suspend collection activities by the IRS. However, it does provide you with additional time to resolve your tax issues and explore potential options for resolution.

Under certain circumstances, the IRS may be willing to suspend collection actions, such as liens or levies, while the CDP hearing is pending. This is known as a Collection Appeal Program (CAP) hearing, and it offers a faster resolution process than a full CDP hearing.

Engaging in a CDP hearing can be a valuable opportunity to present your case and potentially negotiate a resolution with the IRS. It’s important to gather supporting documentation, understand your rights, and seek professional advice if needed to help navigate the hearing process effectively.

If you believe that you have legitimate reasons to challenge the proposed collection actions by the IRS, a CDP hearing can be a crucial step in protecting your rights and finding a fair resolution to your tax issues.

Innocent Spouse Relief

In certain situations, when you file a joint tax return with your spouse, you may qualify for Innocent Spouse Relief. This relief is designed to protect spouses who have been subjected to tax liabilities resulting from errors, omissions, or fraudulent activities committed by their spouse or former spouse.

To be eligible for Innocent Spouse Relief, you must meet certain criteria set by the IRS. These criteria include:

- Having filed a joint tax return that contains an understatement of tax.

- Not being aware or having reason to know about the understatement when you signed the return.

- It would be unfair to hold you responsible for the tax liability.

If you meet these requirements, you can request Innocent Spouse Relief by submitting Form 8857, Request for Innocent Spouse Relief, to the IRS. In this form, you will need to provide detailed information about your situation and explain why you believe you should not be held responsible for the tax debt.

The IRS will review your request and consider various factors, such as your knowledge or involvement in the questionable items on the tax return, your current marital status, and the extent to which you have benefited from the understated tax.

If your request for Innocent Spouse Relief is approved, you will be relieved of the tax liability and any associated penalties and interest. However, it’s important to note that this relief is not granted automatically, and you must provide sufficient evidence to support your claim.

If your request is denied, you have the option to appeal the decision within a specific timeframe. Seeking professional advice and assistance can be helpful in understanding the requirements, gathering necessary documentation, and navigating the Innocent Spouse Relief process.

Innocent Spouse Relief can provide significant financial relief for spouses who find themselves in challenging tax situations due to the actions of their partner. It allows innocent spouses to separate their tax liability from their spouse’s and avoid personal financial repercussions.

If you believe you may qualify for Innocent Spouse Relief, it’s important to consult with a tax professional or contact the IRS directly to understand the specific criteria and steps involved in applying for this relief.