Home>Finance>When I Use A Debit Card Online, Is There A Merchant Fee

Finance

When I Use A Debit Card Online, Is There A Merchant Fee

Published: February 23, 2024

Learn about merchant fees for using a debit card online and how it impacts your finances. Understand the costs and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the fast-paced world of digital transactions, the use of debit cards has become increasingly prevalent. These convenient financial tools offer a seamless way to access funds, make purchases, and manage expenses. However, when it comes to using a debit card for online transactions, questions often arise regarding the potential existence of merchant fees. Understanding the intricacies of debit card transactions, including the associated fees, is crucial for consumers seeking to make informed financial decisions.

Debit cards, linked directly to a cardholder's bank account, provide a convenient and secure means of conducting transactions. Unlike credit cards, which essentially provide a short-term loan from the issuing financial institution, debit cards enable users to access funds directly from their checking or savings accounts. This fundamental distinction influences the way transactions are processed and the potential fees that may be incurred.

As the landscape of consumer spending continues to shift towards online platforms, the use of debit cards for digital purchases has become commonplace. However, concerns about additional fees imposed by merchants for online debit card transactions have led to a growing need for clarity on this topic. By delving into the specifics of debit card transactions and the associated merchant fees, individuals can gain a comprehensive understanding of the financial implications of using debit cards for online purchases.

Understanding Debit Card Transactions

Debit card transactions involve a series of complex processes that occur seamlessly behind the scenes, enabling individuals to make purchases and access funds with ease. When a cardholder initiates a transaction using a debit card, the process typically involves several key steps. Firstly, the cardholder presents the debit card as a form of payment, whether in person at a physical store or online through a digital platform. Upon authorizing the transaction, the merchant sends an authorization request to the cardholder’s bank or financial institution to verify the availability of funds in the associated account.

If the necessary funds are available, the transaction is approved, and the funds are reserved for the purchase. This process occurs in real-time, ensuring that the cardholder’s available balance reflects the pending transaction. Subsequently, the approved transaction is settled, and the reserved funds are transferred from the cardholder’s account to the merchant’s account. This entire sequence of events takes place swiftly and seamlessly, allowing for the efficient processing of debit card transactions.

It is important to note that the mechanics of debit card transactions differ from those of credit card transactions. While credit cards essentially facilitate a short-term loan from the issuing financial institution, debit cards enable direct access to the cardholder’s funds. This fundamental distinction influences the way transactions are processed and the potential fees that may be associated with debit card usage.

Understanding the intricacies of debit card transactions empowers individuals to make informed decisions regarding their financial activities. By gaining insight into the processes that underpin debit card transactions, cardholders can navigate the world of digital payments with confidence, knowing how their transactions are executed and how they may be impacted by associated fees.

Merchant Fees for Debit Card Transactions

When a consumer makes a purchase using a debit card, the merchant involved in the transaction may be subject to certain fees. These fees, known as interchange fees, are charged by the merchant’s bank to the cardholder’s bank as compensation for processing the transaction. Interchange fees are predetermined by payment networks such as Visa, Mastercard, and others, and they are typically calculated as a percentage of the transaction amount plus a flat fee.

It’s important to understand that these interchange fees are typically borne by the merchant rather than the cardholder. However, merchants often factor these fees into their overall operational costs, which can indirectly impact pricing and potentially influence consumers’ purchasing experiences. In some cases, merchants may choose to offer discounts for cash transactions as a strategy to mitigate the impact of interchange fees associated with card payments.

Additionally, the specific interchange fees applied to debit card transactions can vary based on factors such as the merchant’s industry, the type of debit card used, and the nature of the transaction (e.g., in-person or online). For example, transactions involving rewards or premium debit cards may incur higher interchange fees due to the added benefits and incentives offered by such cards.

Understanding the dynamics of merchant fees for debit card transactions sheds light on the broader ecosystem of digital payments. While consumers are not directly responsible for these fees, their existence can influence merchants’ pricing strategies and potentially shape the overall landscape of consumer transactions. By recognizing the interplay between interchange fees and merchant operations, individuals can gain a deeper understanding of the financial mechanisms that underpin the use of debit cards for purchases.

Online Debit Card Transactions

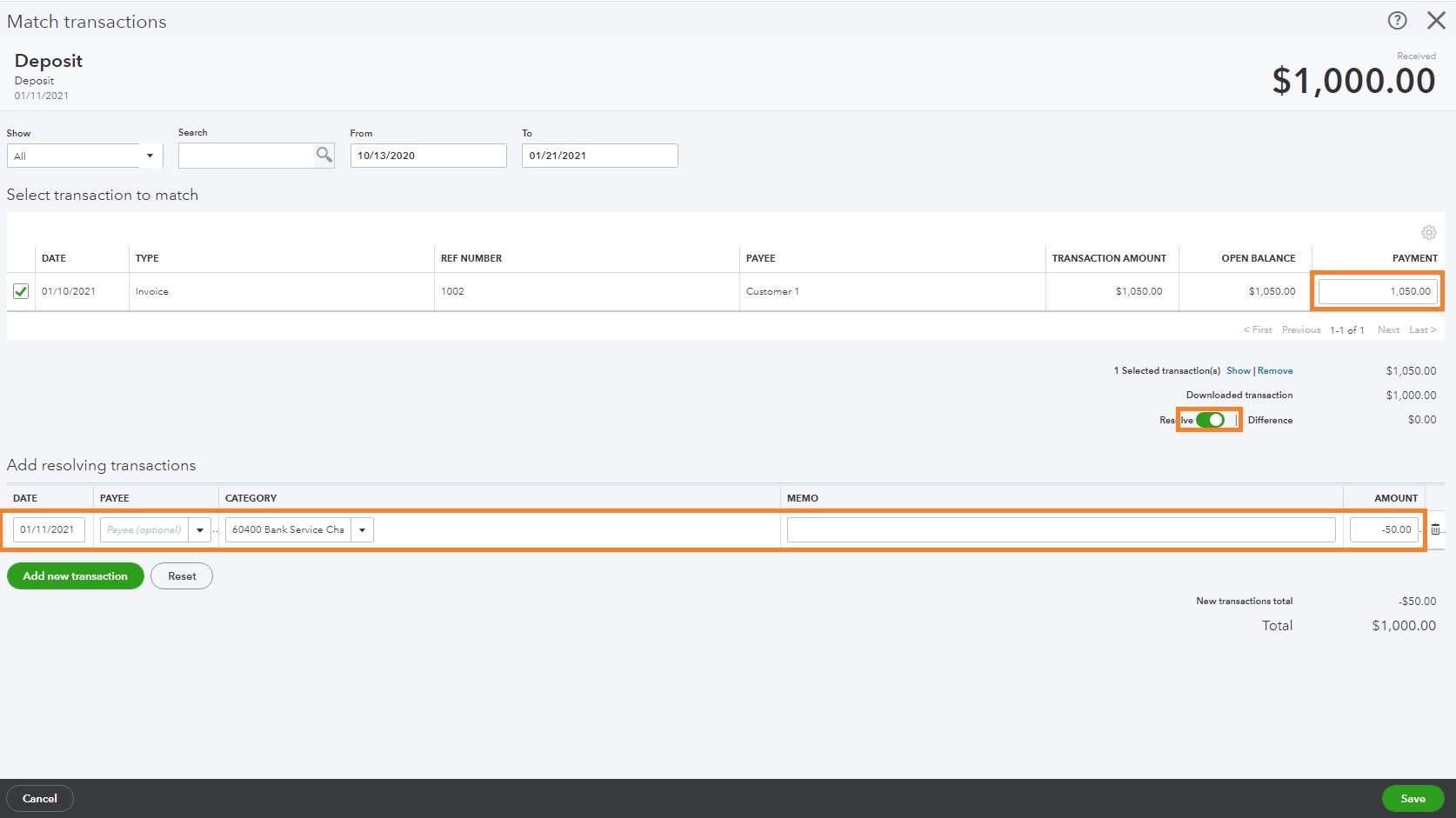

With the proliferation of e-commerce and digital payment platforms, online debit card transactions have become increasingly prevalent in the modern era. When utilizing a debit card for online purchases, consumers may wonder about the potential implications for merchant fees and the overall transaction process. Online debit card transactions essentially mirror the fundamental steps involved in traditional in-person purchases, albeit within the virtual realm.

When a consumer initiates an online purchase using a debit card, the transaction unfolds through a series of secure digital channels. The cardholder typically enters the card details, including the card number, expiration date, and security code, into the payment interface provided by the online merchant. Subsequently, the merchant submits an authorization request to the cardholder’s bank to verify the availability of funds and initiate the transaction process.

Upon approval, the necessary funds are reserved in the cardholder’s account, reflecting the pending transaction. The subsequent settlement of the approved transaction involves the transfer of the reserved funds from the cardholder’s account to the merchant’s account, finalizing the purchase. Throughout this process, robust security measures are employed to safeguard the integrity of online debit card transactions, ensuring the protection of sensitive financial information.

From a consumer perspective, the experience of using a debit card for online transactions offers convenience and flexibility, enabling seamless digital purchases across a diverse array of online platforms. However, it’s important to note that the potential existence of merchant fees for online debit card transactions may indirectly impact consumers through the pricing strategies employed by merchants. While consumers are not directly responsible for these fees, they form part of the broader financial landscape that shapes the dynamics of online commerce.

By familiarizing themselves with the intricacies of online debit card transactions, consumers can navigate the digital realm of e-commerce with confidence, leveraging the convenience of debit cards while remaining cognizant of the underlying transaction processes and potential implications for merchant fees.

Conclusion

As consumers increasingly turn to debit cards for their financial transactions, particularly in the realm of online purchases, understanding the nuances of debit card transactions and associated merchant fees is paramount. Debit cards offer a convenient and direct means of accessing funds, enabling seamless transactions both in physical stores and across diverse digital platforms. However, the potential existence of merchant fees for debit card transactions, including those conducted online, underscores the need for individuals to grasp the broader financial landscape shaping their purchasing experiences.

By delving into the mechanics of debit card transactions, consumers can gain insight into the processes that underpin their financial activities. From the authorization and reservation of funds to the settlement of transactions, comprehending these fundamental steps empowers individuals to make informed decisions regarding their financial interactions. Furthermore, recognizing the impact of interchange fees on merchants and their operational strategies provides a holistic view of the interconnected dynamics at play in the realm of digital payments.

When it comes to online debit card transactions, the seamless integration of digital platforms with the fundamental principles of debit card usage offers consumers unparalleled convenience. However, it is essential for individuals to remain mindful of the potential indirect impact of merchant fees on their purchasing experiences. By staying informed about the intricacies of online debit card transactions, consumers can navigate the digital landscape with confidence, leveraging the advantages of debit card usage while remaining attuned to the broader financial ecosystem.

In essence, the evolving landscape of digital payments, coupled with the widespread adoption of debit cards, underscores the importance of understanding the intricacies of debit card transactions and the potential implications for consumers. Armed with this knowledge, individuals can engage in digital transactions with clarity and confidence, making informed decisions that align with their financial goals and preferences.