Home>Finance>Where Are Preferred Dividends On Financial Statements

Finance

Where Are Preferred Dividends On Financial Statements

Modified: January 5, 2024

Learn where preferred dividends are recorded on financial statements in the field of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to analyzing a company’s financial statements, understanding the various components is vital. One such component that is often seen on financial statements, particularly in the banking and finance sectors, is preferred dividends. Preferred dividends represent a unique type of dividend payment that is distinct from the more common form of dividends paid to common shareholders.

In this article, we will delve into the world of preferred dividends, exploring their definition, types, and how they are represented on financial statements. By gaining a deeper understanding of preferred dividends, investors and analysts can better evaluate a company’s financial health and dividend policy.

Before we dive into the details, it is important to note that preferred dividends are typically paid to preferred shareholders. Preferred shareholders hold a special class of stock that comes with certain rights and privileges, such as priority in receiving dividends and asset distribution in the event of bankruptcy.

Now, let’s explore the world of preferred dividends and uncover their significance on financial statements.

Definition of Preferred Dividends

Preferred dividends are a type of dividend payment that is distributed to preferred shareholders. Unlike common dividends, which are paid to common shareholders, preferred dividends have a specific set of terms and conditions that dictate when and how they are paid.

Preferred dividends are typically fixed in nature, meaning that they are paid at a predetermined rate, often expressed as a percentage of the preferred share’s face value. This fixed rate distinguishes preferred dividends from common dividends, which can vary based on the company’s profitability and management’s discretion.

Furthermore, preferred dividends are usually paid before any dividends are distributed to common shareholders. This preference gives preferred shareholders a higher priority in receiving dividend payments. In some cases, preferred dividends may accumulate in periods when they are not fully paid, resulting in a cumulative dividend obligation that must be repaid in the future.

The preference for preferred dividend payments stems from the fact that preferred shareholders have a higher claim on a company’s assets and earnings compared to common shareholders. In the event of bankruptcy or liquidation, preferred shareholders have priority in receiving their investment back before common shareholders.

It’s important to note that the payment of preferred dividends is not mandatory. As such, a company may choose not to pay preferred dividends if it is facing financial difficulties or has insufficient profits. However, the non-payment of preferred dividends can have implications for a company’s reputation and future ability to attract investors.

Now that we have a clear definition of preferred dividends, let’s explore the different types that exist in the financial world.

Types of Preferred Dividends

Preferred dividends can come in various forms, each with its own unique characteristics. Understanding the different types of preferred dividends is essential for investors and analysts assessing a company’s financial position. Here are the most common types:

- Cumulative Preferred Dividends: Cumulative preferred dividends are dividends that accumulate if they are not paid in a particular period. If a company fails to pay cumulative preferred dividends in one period, it becomes an obligation that must be paid in subsequent periods before any dividends can be paid to common shareholders. This feature provides added protection for preferred shareholders by ensuring that they receive their dividends, even during challenging times.

- Non-Cumulative Preferred Dividends: Non-cumulative preferred dividends, also known as straight preferred dividends, do not accumulate. If the company is unable to pay these dividends in a given period, they do not become an obligation. Instead, the unpaid dividends are forfeited, and the company is not required to make any future payments to compensate for the missed dividends.

- Participating Preferred Dividends: Participating preferred dividends allow preferred shareholders to receive additional dividends beyond the fixed dividend rate. If the company’s profits exceed a predetermined threshold, participating preferred shareholders may be entitled to receive a share of the excess profits, either on top of their fixed dividends or as a separate distribution.

- Convertible Preferred Dividends: Convertible preferred dividends provide preferred shareholders with the option to convert their preferred shares into a specified number of common shares. By exercising this option, preferred shareholders can benefit from any potential increase in the company’s share price or participate in any future common dividend distributions.

It’s important for investors to examine the terms and conditions related to each type of preferred dividend, as they can significantly impact the total return on investment and the risks associated with holding preferred shares.

Now that we understand the different types of preferred dividends, let’s explore how they are represented on a company’s financial statements.

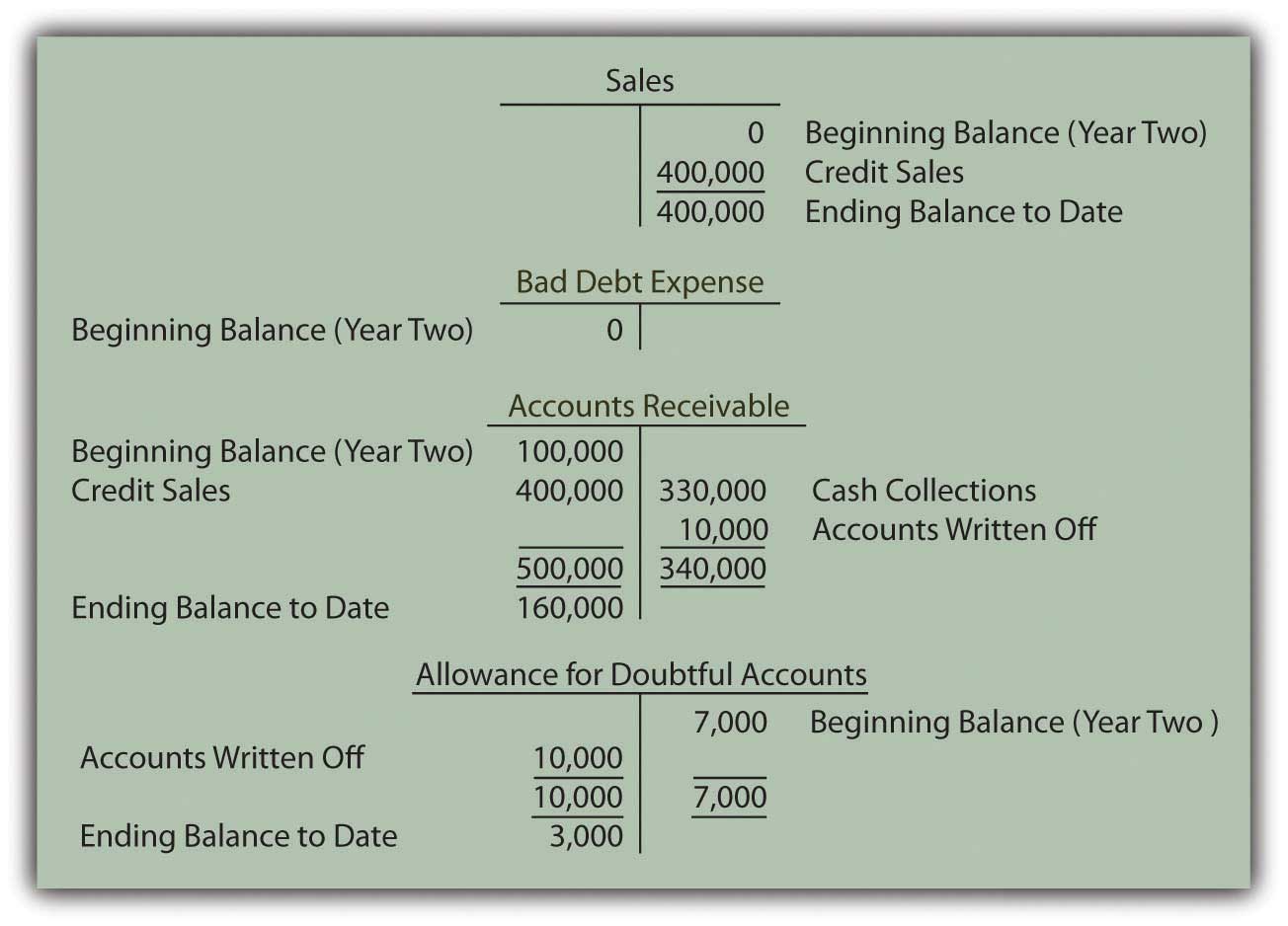

Preferred Dividends on the Balance Sheet

Preferred dividends play a significant role in shaping a company’s financial position, and they are reflected on the balance sheet. The balance sheet provides a snapshot of a company’s financial health at a specific point in time, including its assets, liabilities, and equity.

On the liability side of the balance sheet, preferred dividends are recorded under the “Shareholders’ Equity” section. They are typically classified as “Preferred Stock Dividends Payable” or a similar term that explicitly indicates their nature as dividends payable to preferred shareholders. The amount of preferred dividends payable represents the total accumulated dividends owed to preferred shareholders up to the reporting date.

It’s worth noting that preferred dividends payable are considered a liability because they represent an obligation that the company must fulfill to its preferred shareholders. As such, the amount is subtracted from the total shareholders’ equity to derive the net equity available to common shareholders.

When the company pays preferred dividends, the corresponding amount is deducted from the preferred dividends payable liability and recorded as a decrease in the company’s cash or retained earnings, depending on its payment method and accounting policies.

It is important for investors and analysts to carefully assess the amount of preferred dividends payable on the balance sheet, as it can significantly impact a company’s financial stability and cash flow obligations.

Now that we understand how preferred dividends are reflected on the balance sheet, let’s move on to explore their representation on the income statement.

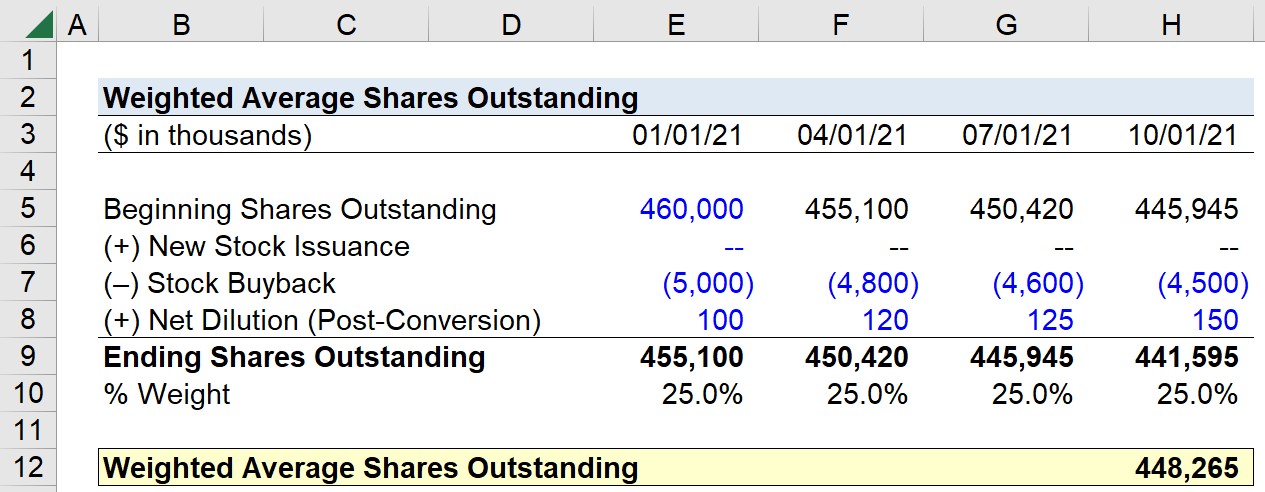

Preferred Dividends on the Income Statement

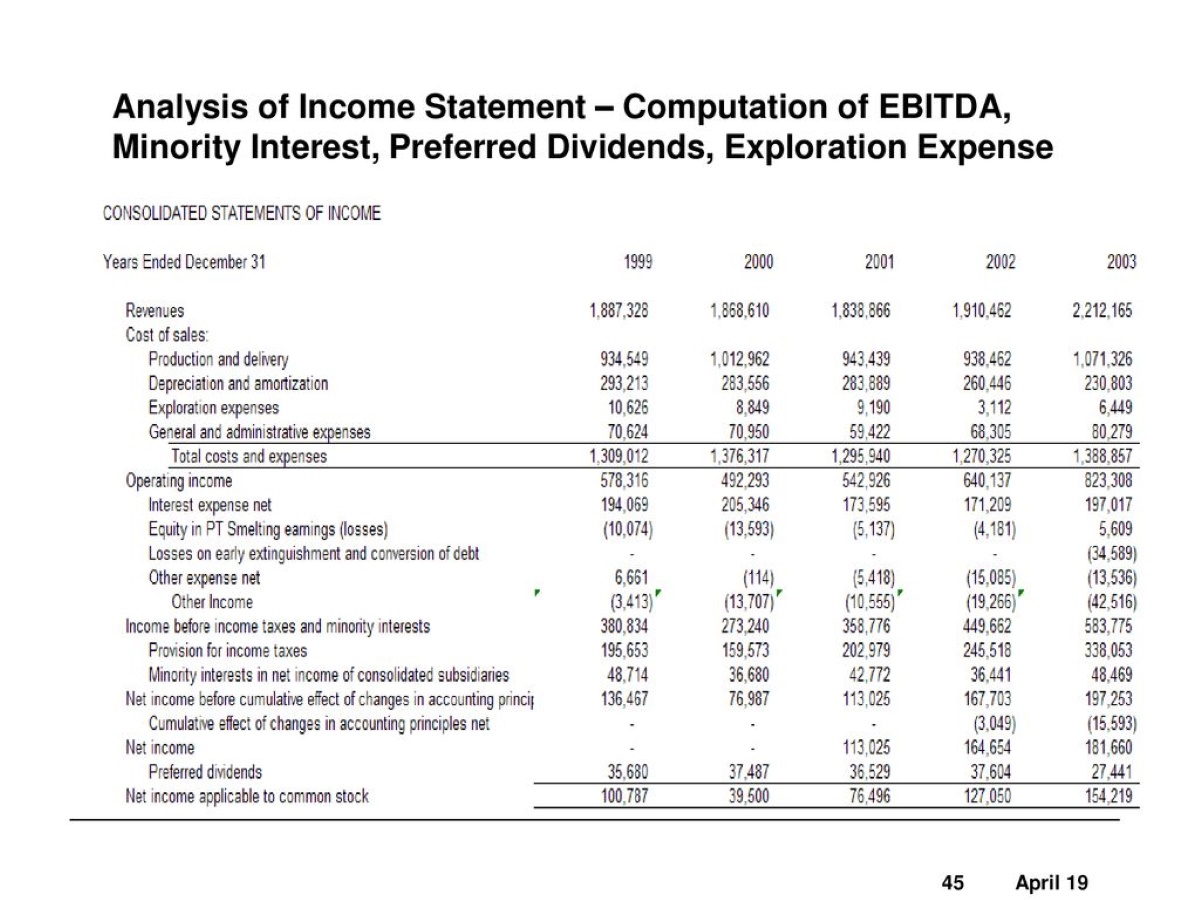

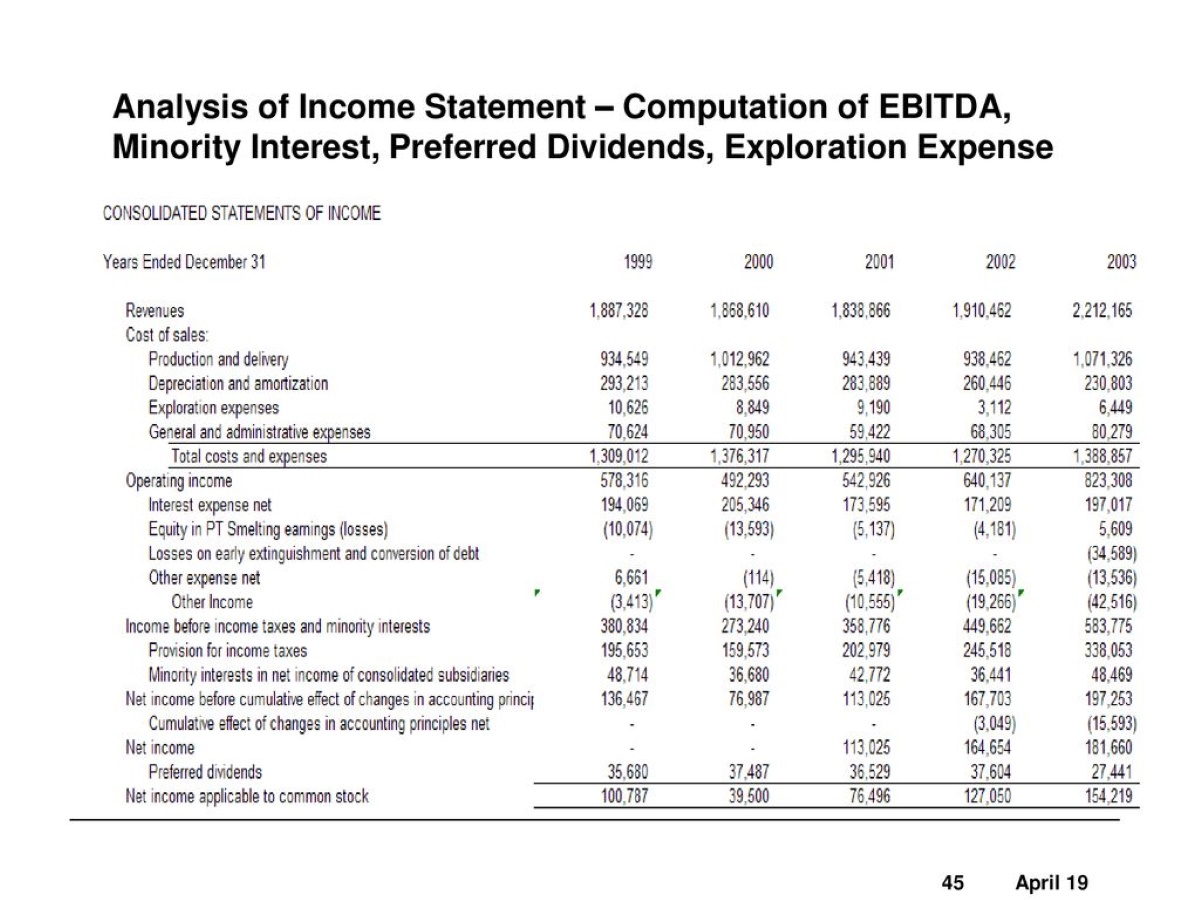

Preferred dividends also have an impact on a company’s income statement, which provides a comprehensive view of its financial performance over a specific period. The income statement outlines the company’s revenues, expenses, gains, and losses, ultimately determining its net income or net loss.

Unlike common dividends, which are typically not recorded as an expense on the income statement, preferred dividends are treated as an expense. The amount of preferred dividends paid during the period is deducted from the company’s net income to calculate its earnings available to common shareholders.

The inclusion of preferred dividends as an expense reflects the fact that they represent a direct cost to the company as a result of fulfilling its obligations to preferred shareholders. It is important to analyze the trend of preferred dividend expenses over multiple periods to assess any potential impact on the company’s profitability, sustainability, and ability to generate earnings available to common shareholders.

It’s worth noting that the calculation of earnings available to common shareholders may vary depending on the company’s specific accounting policies and the presence of any participating preferred shares. In some cases, the calculation may involve deducting the fixed preferred dividends from net income before determining the remaining earnings available to common shareholders.

By examining the treatment of preferred dividends on the income statement, investors and analysts can gain insights into the company’s ability to generate profits that are available to be distributed to common shareholders.

Now that we have explored the representation of preferred dividends on the income statement, let’s move on to the statement of cash flows and understand their impact on cash flow activities.

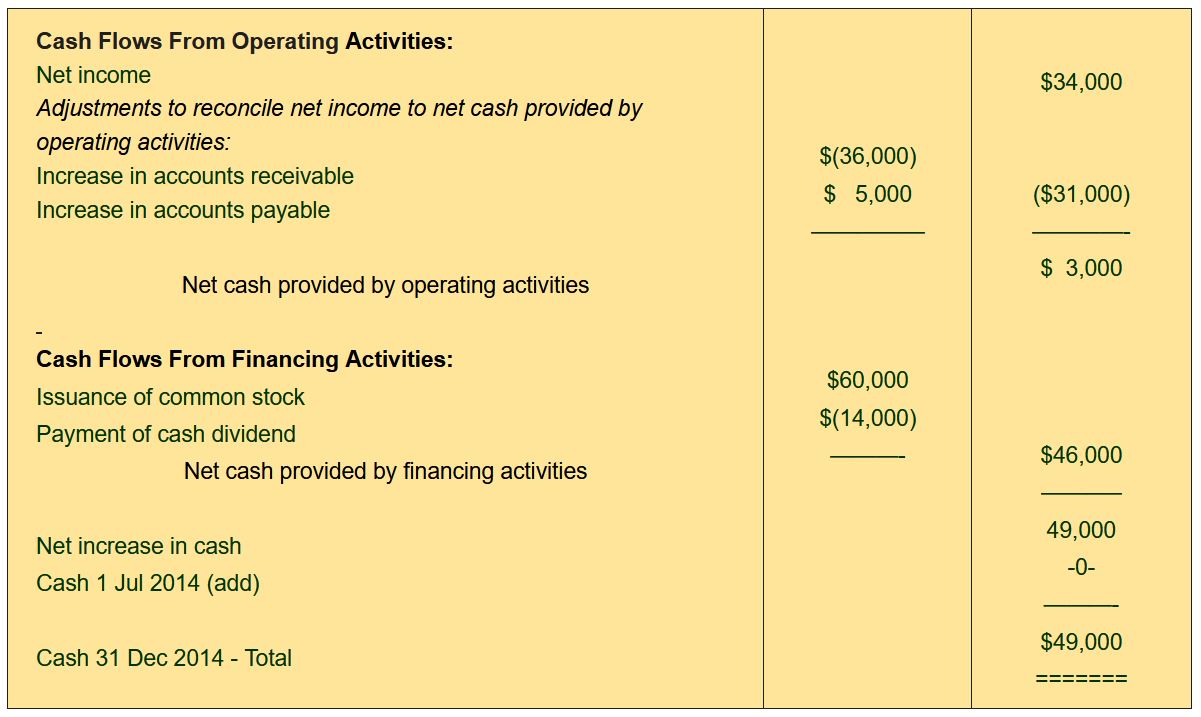

Preferred Dividends on the Statement of Cash Flows

Preferred dividends also influence the statement of cash flows, which provides information about a company’s cash inflows and outflows during a specific period. The statement of cash flows consists of three sections: operating activities, investing activities, and financing activities.

The payment of preferred dividends is classified as a cash outflow under the financing activities section of the statement of cash flows. It is essential to note that this cash outflow represents the actual cash paid to preferred shareholders as dividends. The payment of preferred dividends reduces the company’s available cash and impacts its cash flow position.

Moreover, the payment of preferred dividends is subtracted from the net cash provided by operating activities to derive the net cash flow available to common shareholders. This adjustment is made because preferred dividends are considered an obligation to preferred shareholders and are unrelated to the company’s operations.

By presenting the payment of preferred dividends separately in the statement of cash flows, investors and analysts can assess the company’s ability to generate sufficient cash flow to meet its dividend obligations and evaluate its cash flow stability.

It’s important to analyze the trend of preferred dividend payments on the statement of cash flows to ensure that the company’s cash flow from operating activities is sufficient to cover its dividend payments and support future growth and investment opportunities.

Now that we understand how preferred dividends are represented on the statement of cash flows, let’s move on to discussing the disclosure of preferred dividends in the notes to the financial statements.

Disclosure of Preferred Dividends in the Notes to Financial Statements

In addition to being represented on the balance sheet, income statement, and statement of cash flows, preferred dividends are also disclosed in the notes to the financial statements. The notes provide detailed explanations and additional information to help readers fully understand the financial statements.

The disclosure of preferred dividends in the notes typically includes information about the terms and conditions of the preferred shares, such as the dividend rate, cumulative or non-cumulative nature, and any participating or convertible features. This information is essential for investors and analysts to assess the rights and obligations associated with the preferred shares and the potential impact on the company’s financial position.

The notes may also disclose any restrictions or limitations on the payment of preferred dividends. For example, if the company is subject to certain debt covenants, it may be restricted from paying dividends if it fails to meet specific financial ratios or maintain a certain level of cash reserves.

Furthermore, the notes may provide details on the preferences and rights of preferred shareholders, including their priority in receiving dividends, liquidation preferences, and any potential call or redemption provisions that could impact the future payment of dividends.

Additionally, if the company has issued different series or classes of preferred shares with varying dividend rates or features, the notes may disclose the specifics of each series or class.

Investors and analysts should carefully review the notes to gain a comprehensive understanding of the preferred dividends and their implications on the company’s financial position, cash flows, and shareholder rights.

Lastly, it is important to note that the specific disclosure requirements for preferred dividends may vary depending on the accounting standards and regulations applicable in the company’s jurisdiction.

Now that we have explored the disclosure of preferred dividends in the notes to the financial statements, let’s summarize the key points before concluding our article.

Conclusion

Preferred dividends are a crucial component of a company’s financial statements, particularly for investors and analysts in the banking and finance sectors. Understanding the definition, types, and representation of preferred dividends can provide valuable insights into a company’s financial health, dividend policy, and cash flow obligations.

Preferred dividends are distinctive from common dividends and are typically fixed in nature, paid to preferred shareholders before any dividends are distributed to common shareholders. They can be cumulative or non-cumulative, participating or convertible, and have varying rights and preferences.

On the balance sheet, preferred dividends are recorded as a liability in the shareholders’ equity section under “Preferred Stock Dividends Payable.” On the income statement, they are treated as an expense, deducting from the net income to determine the earnings available to common shareholders.

When analyzing the statement of cash flows, preferred dividends are classified as a cash outflow under financing activities, reflecting the actual cash paid to preferred shareholders. Their presentation in the statement of cash flows allows for an assessment of the company’s ability to meet dividend obligations and maintain cash flow stability.

Furthermore, preferred dividends are disclosed in the notes to the financial statements, providing detailed information on their terms, restrictions, and any specific characteristics of the preferred shares.

By considering the representation and impact of preferred dividends across the financial statements, investors and analysts can gain a comprehensive understanding of a company’s financial position, profitability, dividend policy, and cash flow obligations. This knowledge is crucial for making informed investment decisions and assessing the long-term value and stability of an investment.

In conclusion, preferred dividends are a key element to consider when examining a company’s financial statements. They provide insights into the company’s financial health, dividend distribution, and cash flow obligations, providing a comprehensive picture of its overall financial picture.