Home>Finance>Where Do You Find Inventory On Financial Statements

Finance

Where Do You Find Inventory On Financial Statements

Modified: March 2, 2024

Discover where to find inventory on financial statements, and gain a deeper understanding of finance with this informative guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Financial statements are essential tools for evaluating the financial health of a company. They provide a detailed snapshot of a company’s financial position, performance, and cash flow. Understanding financial statements is crucial for investors, creditors, and stakeholders who want to make informed decisions about a company’s viability and profitability.

In this article, we will focus on one specific aspect of financial statements – inventory. Inventory refers to the goods that a company holds for sale in the ordinary course of business. It can include raw materials, work-in-progress, and finished goods.

Inventory is a significant asset for many businesses, particularly those in the manufacturing, retail, and distribution sectors. It represents a significant investment and can have a significant impact on a company’s financial statements. Understanding where to find inventory on financial statements and its valuation methods is vital for financial analysis.

By examining the components of the balance sheet, income statement, and cash flow statement, we will explore where inventory is recorded and its impact on financial reporting. Additionally, we will discuss different types of inventory and the methods used to value inventory.

Whether you are an investor, financial analyst, or aspiring entrepreneur, understanding the role of inventory in financial statements is crucial for evaluating a company’s overall performance and profitability. So let’s dive into the world of financial statements and uncover where you can find inventory and how it affects a company’s financial health.

Understanding Financial Statements

Financial statements are formal records that summarize a company’s financial activities, position, and cash flow. They provide valuable information about a company’s profitability, liquidity, and overall financial performance. Understanding financial statements is essential for investors, creditors, and other stakeholders as it helps them assess the financial health and stability of a company.

There are three key financial statements that are commonly prepared by companies: the balance sheet, income statement, and cash flow statement. Each statement provides a different perspective on a company’s financial position and performance.

The balance sheet provides a snapshot of a company’s financial condition at a specific point in time. It includes information about a company’s assets, liabilities, and shareholders’ equity. The balance sheet presents the equation of Assets = Liabilities + Shareholders’ Equity, showing the relationship between what the company owns, what it owes, and the shareholders’ investment.

The income statement, also known as the profit and loss statement, showcases a company’s revenue, expenses, and net profit or loss over a specific period. It helps assess a company’s ability to generate profits from its operations and provides insights into its operating efficiency and profitability.

The cash flow statement tracks the cash inflows and outflows from a company’s operating, investing, and financing activities during a specific period. It provides valuable information about a company’s ability to generate cash, meet financial obligations, and invest in future growth.

By analyzing these financial statements, investors and stakeholders gain a comprehensive understanding of a company’s financial position, performance, and cash flows. This information helps them evaluate the company’s profitability, liquidity, solvency, and overall financial health.

Financial statements are usually prepared in accordance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), ensuring consistency, comparability, and transparency in financial reporting.

In the next sections, we will delve deeper into the components of each financial statement and explore where inventory is recorded on these statements, as well as the various methods used to value inventory. This knowledge will provide a solid foundation for analyzing a company’s financial statements and making informed decisions regarding investment, lending, or other financial considerations.

Components of a Financial Statement

Financial statements consist of various components that provide a comprehensive overview of a company’s financial performance and position. These components are found within the balance sheet, income statement, and cash flow statement. Let’s explore each of these statements and their key components in more detail:

1. Balance Sheet: The balance sheet reflects a company’s financial position at a specific point in time. It consists of three main components:

– Assets: These represent what the company owns, such as cash, accounts receivable, inventory, property, and equipment.

– Liabilities: These represent what the company owes to creditors or other entities, including loans, accounts payable, and accrued expenses.

– Shareholders’ Equity: This represents the residual interest in the company’s assets after deducting liabilities. It includes retained earnings, common stock, and additional paid-in capital.

2. Income Statement: The income statement details a company’s revenues, expenses, gains, and losses during a specific period. Its components include:

– Revenue: This represents the company’s earnings from sales of goods or services to customers.

– Expenses: These are the costs incurred by the company to generate revenue, such as salaries, rent, utilities, and marketing expenses.

– Gains: These are the positive financial outcomes resulting from activities not directly related to the company’s primary operations, such as the sale of assets.

– Losses: These are the negative financial outcomes resulting from activities not directly related to the company’s primary operations.

3. Cash Flow Statement: The cash flow statement provides insight into a company’s cash inflows and outflows during a specific period. Its components include:

– Operating Activities: These are the cash flows resulting from the company’s core operating activities, such as cash generated from sales and payments to suppliers.

– Investing Activities: These represent cash flows related to the purchase or sale of long-term assets, such as property, plant, and equipment.

– Financing Activities: These are the cash flows related to the company’s financing activities, including the issuance or repayment of debt, dividend payments, and stock repurchases.

By examining these components of the financial statements, investors, creditors, and other stakeholders can gain a comprehensive understanding of a company’s financial health and performance. In the next sections, we will specifically focus on where inventory is recorded on the balance sheet and the impact of inventory on financial reporting.

Balance Sheet

The balance sheet is a key financial statement that provides a snapshot of a company’s financial position at a specific point in time. It depicts what the company owns (assets), what it owes (liabilities), and the shareholders’ equity.

Let’s dive into the components of a balance sheet:

1. Assets: Assets represent what the company owns and include both tangible and intangible items. Some common types of assets found on a balance sheet include:

– Cash: This includes any cash and cash equivalents held by the company.

– Accounts Receivable: This represents the amount due from customers who have purchased goods or services on credit.

– Inventory: This includes goods that the company holds for sale in the ordinary course of business. Inventory can vary by type, such as raw materials, work-in-progress, or finished goods.

– Property, Plant, and Equipment: These are tangible assets used in the company’s operations, such as land, buildings, machinery, and vehicles.

– Intangible Assets: These are non-physical assets, such as patents, trademarks, copyrights, and goodwill.

2. Liabilities: Liabilities represent what the company owes to creditors and other entities. They can be classified as current liabilities (due within one year) or long-term liabilities (due after one year). Common types of liabilities include:

– Accounts Payable: This represents the amount owed to suppliers for goods or services purchased on credit.

– Loans and Borrowings: This includes any outstanding loans or debt obligations.

– Accrued Expenses: These are expenses that the company has incurred but has not yet paid, such as salaries, utilities, or taxes.

– Deferred Revenue: This represents payments received in advance for goods or services that have not yet been delivered.

3. Shareholders’ Equity: Shareholders’ equity represents the residual interest in the company’s assets after deducting liabilities. It includes the following components:

– Retained Earnings: This is the accumulated net profit or loss that the company has retained over time.

– Common Stock: This represents the shares issued to shareholders in exchange for their investment.

– Additional Paid-In Capital: This reflects any additional amount received from shareholders when they purchase shares at a price higher than the par value.

The balance sheet equation is Assets = Liabilities + Shareholders’ Equity. It emphasizes the concept of “balance,” where the total value of assets must equal the combined value of liabilities and shareholders’ equity.

Inventory is an important component of the balance sheet, typically classified as a current asset. Its value is reported in the assets section, under the category of “Inventory.” The specific details of the inventory, such as its type (raw materials, work-in-progress, or finished goods), are often disclosed in the notes to the financial statements.

Understanding the balance sheet and the placement of inventory within it is crucial for assessing a company’s liquidity, solvency, and overall financial health. In the next sections, we will explore the different types of inventory, methods used to value inventory, and the impact of inventory on financial reporting.

Income Statement

The income statement, also known as the profit and loss statement, is a crucial financial statement that reveals a company’s financial performance over a specific period. It summarizes the revenues, expenses, gains, and losses of a company, ultimately resulting in its net profit or loss.

Let’s take a closer look at the key components of an income statement:

1. Revenue: Revenue represents the inflow of economic benefits resulting from the sale of goods or services. It is also known as sales, sales revenue, or net sales. Revenue can come from various sources, such as the sale of products, provision of services, or licensing of intellectual property.

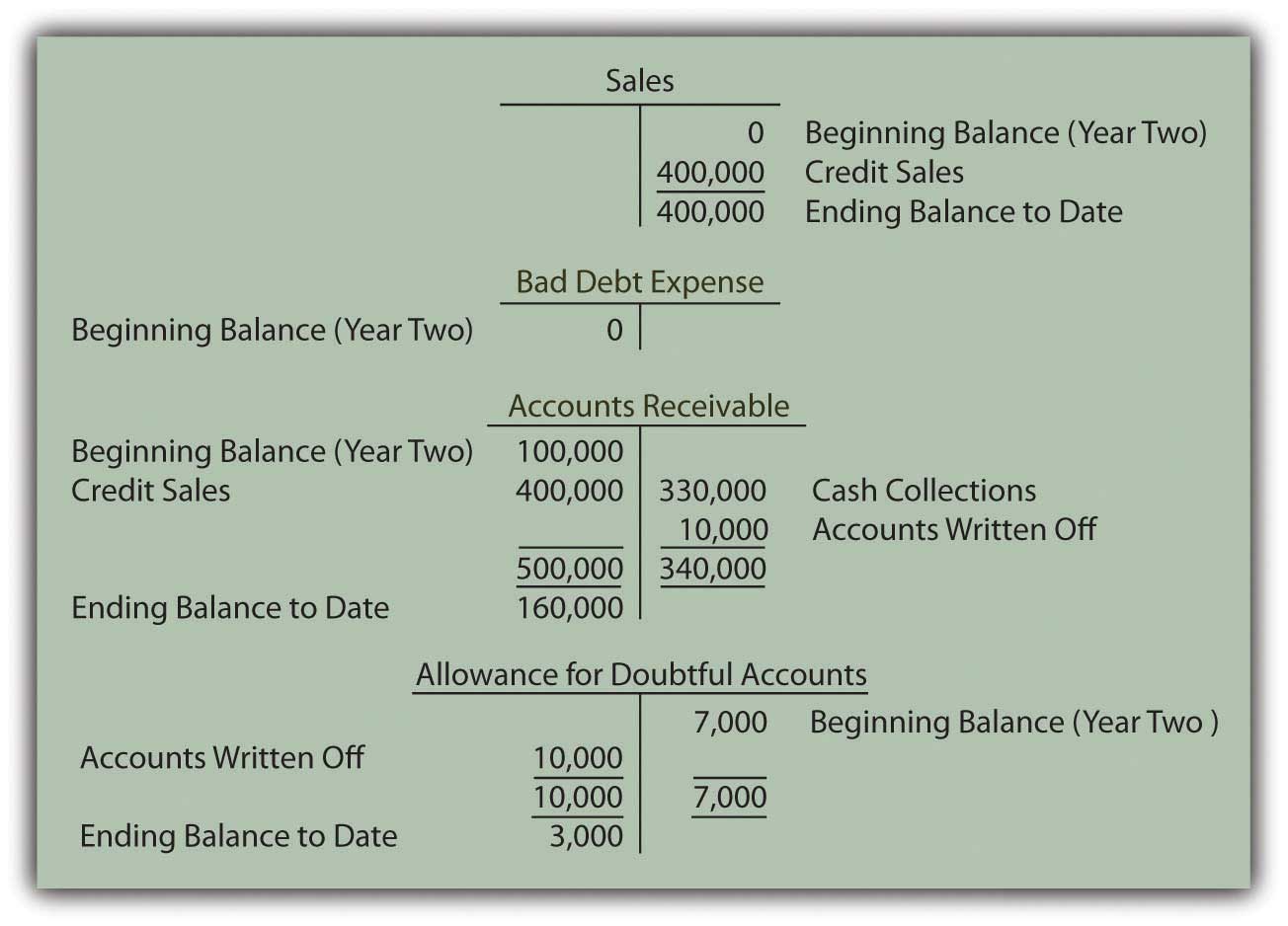

2. Cost of Goods Sold (COGS): Cost of goods sold refers to the direct costs associated with the production or purchase of goods sold by the company. It includes expenses related to raw materials, labor, and overhead costs incurred to transform the inventory into finished goods. COGS is subtracted from revenue to calculate gross profit.

3. Gross Profit: Gross profit represents the difference between revenue and the cost of goods sold. It reveals the profitability of a company’s core operations before considering operating expenses.

4. Operating Expenses: Operating expenses encompass the costs incurred to support and maintain the company’s operations. They include expenses such as salaries and wages, rent, utilities, advertising, and administrative expenses. These expenses are deducted from gross profit to calculate operating income (or operating loss).

5. Other Income and Expenses: Other income and expenses refer to gains and losses that arise from activities not directly related to the company’s primary operations. They can include income from investments, interest income, interest expense, gains or losses from the sale of assets, or foreign exchange gains or losses.

6. Net Income (or Net Loss): Net income is the final figure on the income statement and represents the bottom line profitability of the company. It is calculated by deducting all expenses, including operating expenses and other income and expenses, from revenue. If expenses exceed revenue, it results in a net loss.

The income statement is essential for evaluating a company’s profitability, efficiency, and ability to generate consistent earnings. It provides valuable insights into the company’s revenue streams, cost management strategies, and overall financial performance.

Moreover, the income statement helps analysts and investors assess the company’s gross profit margin (gross profit divided by revenue), operating profit margin (operating income divided by revenue), and net profit margin (net income divided by revenue). These margins provide a deeper understanding of the efficiency and profitability of the company’s operations.

Analyzing trends in the income statement over time can reveal the company’s growth patterns, cost-saving initiatives, and areas of improvement. It can also aid in comparing the performance of a company to its industry peers and benchmarking against industry standards.

In the next section, we will discuss the cash flow statement, another crucial financial statement that provides insights into a company’s cash inflows and outflows.

Cash Flow Statement

The cash flow statement is a vital financial statement that provides valuable information about a company’s cash inflows and outflows during a specific period. It helps stakeholders understand how a company generates and utilizes cash, providing insights into the company’s liquidity, solvency, and ability to meet its financial obligations.

Let’s explore the key components of a cash flow statement:

1. Operating Activities: Operating activities represent the core business activities that directly affect cash flow. They include cash inflows and outflows related to the company’s primary operations, such as revenue from sales, payments to suppliers, wages, taxes paid, and other expenses incurred in day-to-day operations.

2. Investing Activities: Investing activities involve the acquisition or disposal of long-term assets and investments. They include cash inflows from the sale of assets (e.g., property, plant, equipment), as well as cash outflows from the purchase of new assets or investments.

3. Financing Activities: Financing activities revolve around the company’s capital structure and financing activities. They encompass cash inflows and outflows associated with raising capital, repaying debt, and distributing dividends. Examples include proceeds from issuing new shares, repayment of loans or bonds, and dividend payments to shareholders.

The cash flow statement is structured into three sections: operating activities, investing activities, and financing activities. Each section reports the net cash flow generated or used during the period.

By analyzing the cash flow statement, investors and stakeholders can gain valuable insights into a company’s financial health. Here are a few key aspects to consider when examining a cash flow statement:

1. Cash Flow from Operating Activities: Positive cash flow from operating activities indicates that the company generated more cash from its core operations than it spent. It reflects the company’s ability to generate consistent cash flow from its day-to-day activities.

2. Cash Flow from Investing Activities: Negative cash flow from investing activities, such as significant capital expenditures or acquisitions, may indicate that the company is investing in long-term growth and expansion. However, it is essential to evaluate the effectiveness of these investments and their potential to generate future cash flow.

3. Cash Flow from Financing Activities: Positive cash flow from financing activities can indicate that the company has successfully raised funds from investors or creditors. On the other hand, negative cash flow from financing activities, such as debt repayments or dividend payments, may indicate that the company is utilizing cash to meet its financial obligations.

Analyzing the cash flow statement alongside the balance sheet and income statement provides a more comprehensive understanding of a company’s financial performance. It helps investors assess the company’s cash-generating capabilities, ability to fund growth initiatives, and ability to manage its financial obligations.

In high-growth or capital-intensive industries, monitoring cash flow is particularly crucial as it ensures the company has the necessary liquidity to support its operations and sustain growth.

In the next section, we will delve into where inventory is recorded on the balance sheet and explore the different types of inventory.

Where to Find Inventory on the Balance Sheet

Inventory is a significant asset for many businesses, and it plays a crucial role in financial reporting. On the balance sheet, inventory is typically categorized as a current asset and is included in the section labeled “Assets” under the heading “Current Assets.”

Inventory is recorded on the balance sheet at its original cost, which includes the cost of acquiring or producing the goods, along with any additional costs incurred to bring the inventory to its present location and condition. It is important to note that the valuation of inventory can vary depending on the inventory valuation method used by the company.

Under the current assets section, you will find a line item specifically dedicated to inventory. It may be labeled as “Inventory” or “Inventory and merchandise.” The specific details of the inventory, such as its type (raw materials, work-in-progress, or finished goods), are often disclosed in the notes to the financial statements.

The inventory amount reported on the balance sheet represents the total value of inventory held by the company at a particular point in time. This value is determined based on the lower of cost or market value principle. This means that if the current market value of the inventory is lower than its cost, the inventory is written down to its market value to accurately reflect its value on the balance sheet.

Inventory is an essential component of a company’s working capital, which includes current assets and current liabilities. It is part of the operating cycle of a business, as it represents the goods that are in various stages of being transformed into revenue through the sales process.

Successful inventory management is crucial for businesses to ensure efficient operations, minimize carrying costs, and meet customer demand. Companies need to strike a balance between having enough inventory to fulfill orders and avoiding excess inventory that can tie up valuable resources.

Analyzing the inventory levels on the balance sheet in comparison to sales and industry benchmarks can provide insights into a company’s inventory management practices. It helps identify any potential inefficiencies, such as slow-moving or obsolete inventory, and allows for adjustments to optimize inventory levels and improve profitability.

Understanding where to find inventory on the balance sheet gives investors, creditors, and stakeholders a clear view of a company’s tangible assets and its ability to generate revenue from its inventory. It is an important aspect of financial analysis and decision-making, as inventory can significantly impact a company’s liquidity, profitability, and overall financial health.

Types of Inventory

Inventory is a crucial component of a company’s assets, representing the goods that a company holds for sale in the ordinary course of business. Inventory can consist of various types of goods, each serving a different purpose within the company’s operations. Let’s explore some common types of inventory:

1. Raw Materials: Raw materials are the basic materials that are used in the production process. They are typically purchased from suppliers and are transformed into finished goods through manufacturing or assembly. Examples of raw materials include metals, plastics, fabrics, chemicals, and components used in the production of goods.

2. Work-in-Progress (WIP): Work-in-progress inventory consists of goods that are currently being processed or undergoing manufacturing operations. These goods are at various stages of completion and are not yet considered finished goods. WIP includes partially assembled products, goods awaiting further processing, and products in the testing or quality control phase.

3. Finished Goods: Finished goods inventory refers to the final products that are ready for sale to customers. These goods have completed the manufacturing or assembly process and are in their final form. Examples of finished goods include electronics, clothing, furniture, packaged food items, and automobiles.

4. Merchandise Inventory: Merchandise inventory is the inventory held by retailers or wholesalers that consist of goods purchased from suppliers for resale to customers. This inventory includes a wide range of products, such as apparel, electronics, household goods, and consumer durables. Merchandise inventory is typically categorized based on product type, brand, or category.

5. Maintenance, Repair, and Operations (MRO) Inventory: MRO inventory consists of goods and supplies necessary to support the company’s day-to-day operations. These items are not directly involved in the production process but are essential for the maintenance and operation of the business. Examples of MRO inventory include cleaning supplies, office supplies, tools, spare parts, and safety equipment.

In addition to these primary types of inventory, some companies may have specialized inventory categories based on their unique operations or industry. For instance, in the food industry, perishable inventory includes goods with a limited shelf life, such as fresh produce, dairy products, and baked goods.

Managing different types of inventory requires effective inventory control systems to ensure optimal levels, minimize carrying costs, and prevent stockouts or overstock situations. Companies need to have accurate records, implement proper inventory valuation methods, and establish efficient inventory replenishment processes.

Understanding the different types of inventory is essential for businesses as it helps in inventory planning, demand forecasting, production scheduling, and ensuring timely delivery to customers. Investors and stakeholders also gain insights into a company’s operations, supply chain, and overall inventory management practices.

In the next section, we will discuss the various methods used to value inventory, which is important for accurate financial reporting and analysis.

Inventory Valuation Methods

Inventory valuation refers to the process of assigning a monetary value to the inventory held by a company. There are several methods used to value inventory, each with its own implications for financial reporting and profitability analysis. Let’s explore some common inventory valuation methods:

1. First-In, First-Out (FIFO): The FIFO method assumes that the inventory items purchased or produced first are the first ones sold or used. Under FIFO, the cost of the most recent purchases or production is considered inventory, while the cost of earlier purchases is considered cost of goods sold. This method reflects the flow of inventory and is commonly used when the sale of goods closely follows their purchase or production order.

2. Last-In, First-Out (LIFO): LIFO assumes that the inventory items purchased or produced most recently are sold or used first. It means that the cost of the most recent purchases or production is considered cost of goods sold, while the cost of earlier purchases is considered inventory. LIFO is often used when costs are rising because it results in a higher cost of goods sold, lowering taxable income in periods of inflation.

3. Weighted Average Cost: The weighted average cost method calculates the average cost of the inventory by dividing the total cost of goods available for sale by the total number of units. This average cost is then applied to the units sold to determine the cost of goods sold and the remaining units in inventory.

4. Specific Identification: This method individually assigns the actual cost of each item in the inventory to that specific item. It is typically used when the items in inventory are unique, have high value, or can be easily distinguished and tracked separately. Specific identification provides the most accurate valuation but may not be practical for companies with large volumes of inventory or when items are interchangeable.

The choice of inventory valuation method can have significant implications for a company’s financial statements and profitability analysis. It affects the cost of goods sold, gross profit, net income, and inventory valuation on the balance sheet.

Moreover, the valuation method impacts a company’s tax liability. Different inventory valuation methods can result in variations in taxable income, which affects income tax expenses. It is important for companies to follow the accounting standards and regulations in their jurisdiction when selecting an appropriate inventory valuation method.

The inventory valuation method should be consistently applied to ensure comparability between financial periods. Changes in inventory valuation methods are generally discouraged unless there is a valid reason and the change is disclosed and explained in the financial statements.

The choice of inventory valuation method depends on various factors, including the nature of the business, industry practices, tax considerations, and management preferences. It is important for companies to understand the implications of each method and select the one that best aligns with their specific circumstances and financial objectives.

Accurate inventory valuation is essential for financial reporting, decision-making, and analyzing a company’s profitability. It provides insights into the true cost of goods sold, the value of inventory on the balance sheet, and the overall financial health of a business.

Impacts of Inventory on Financial Statements

Inventory is a critical component of a company’s financial statements, and it can have significant impacts on various financial metrics and ratios. Understanding these impacts is essential for financial analysis and decision-making. Let’s explore how inventory affects the key components of financial statements.

1. Balance Sheet: Inventory is recorded as a current asset on the balance sheet, categorized under the “Assets” section. The value of inventory on the balance sheet impacts the company’s total assets, shareholders’ equity, and working capital. It is crucial to accurately value and report inventory to provide an accurate representation of a company’s financial position.

2. Income Statement: Inventory affects the income statement through the cost of goods sold (COGS) and gross profit. When inventory is sold, its cost is recognized as COGS, which is deducted from revenue to calculate gross profit. The value of COGS has a direct impact on gross profit margin, reflecting the efficiency of a company’s cost management and pricing strategies.

3. Cash Flow Statement: Changes in inventory levels also impact the cash flow statement. An increase in inventory requires additional cash outflows for purchases, while a decrease in inventory generates cash inflows from the sale of inventory. Managing inventory effectively is crucial for aligning cash flow from operating activities and optimizing working capital.

4. Profitability Ratios: Inventory turnover ratio, calculated by dividing COGS by the average inventory value, measures how efficiently a company manages and sells its inventory. A higher inventory turnover ratio signifies a faster sales cycle and more effective inventory management. This ratio provides insights into a company’s ability to convert inventory into revenue and generate profits.

5. Liquidity Ratios: Inventory also affects liquidity ratios such as the current ratio and quick ratio. These ratios assess a company’s ability to meet short-term obligations. If inventory levels are too high, it may indicate a potential risk of stock obsolescence or illiquidity, affecting the company’s ability to pay its current liabilities.

6. Risk of Obsolescence or Losses: Inventory that becomes obsolete, damaged, or outdated can result in write-downs or losses, impacting the company’s profitability and overall financial performance. Proper inventory management practices, including monitoring inventory levels, implementing effective forecasting systems, and regularly assessing inventory quality, can mitigate these risks.

It is important to note that inventory valuation methods, such as FIFO, LIFO, or weighted average cost, can also impact the financial statements. The choice of inventory valuation method affects the reported cost of goods sold and the value of inventory on the balance sheet, ultimately impacting profitability ratios, taxation, and financial analysis.

Analyzing the impacts of inventory on financial statements requires a holistic understanding of a company’s inventory management practices, supply chain dynamics, market demand, and industry-specific factors. It allows investors, creditors, and stakeholders to assess a company’s operational efficiency, profitability, risk exposure, and overall financial health.

Overall, effective inventory management is essential for optimizing financial performance, maintaining liquidity, and ensuring the accuracy and integrity of financial statements. It is a key aspect of financial analysis and decision-making for businesses across industries.

Conclusion

In conclusion, understanding the role of inventory in financial statements is crucial for evaluating a company’s financial health and performance. Inventory is a significant asset that impacts various aspects of financial reporting and analysis.

The balance sheet captures the value of inventory as a current asset, providing insights into a company’s overall assets and working capital. The income statement reflects the cost of goods sold, gross profit, and net income, which are influenced by inventory values. The cash flow statement tracks the inflows and outflows related to inventory, ensuring proper cash management.

Different types of inventory, such as raw materials, work-in-progress, finished goods, and merchandise, serve specific purposes within a company’s operations. Proper management of inventory levels, valuation methods, and quality control plays a vital role in efficient operations and profitability.

Inventory valuation methods, including FIFO, LIFO, weighted average cost, or specific identification, impact financial statements and profitability analysis. Each method presents unique implications for reporting and tax considerations, requiring careful selection and consistency.

The impacts of inventory on financial statements extend beyond the numbers alone. Inventory turnover ratios, liquidity ratios, and the risk of obsolescence or losses all provide insights into a company’s operational efficiency, cash flow management, and financial risk.

By understanding the significance of inventory in financial reporting, investors, creditors, and stakeholders can make informed decisions. Analyzing financial statements, assessing inventory management practices, and monitoring key performance indicators enable a comprehensive evaluation of a company’s financial health, solvency, and profitability.

Successful inventory management involves optimizing inventory levels, implementing effective forecasting systems, and aligning supply chain operations with market demand. It requires a delicate balance between having enough inventory to meet customer demands and minimizing carrying costs and potential losses.

Ultimately, effective inventory management leads to improved financial performance, enhanced liquidity, and greater confidence from investors and creditors. Businesses must strive to implement robust inventory management systems and practices to ensure accurate financial reporting and capitalize on opportunities for growth.

In conclusion, inventory is a valuable asset that must be carefully managed and properly accounted for in financial statements. By employing sound inventory management strategies and understanding the impacts on financial reporting, businesses can enhance their financial health, profitability, and overall success.