Home>Finance>Where Is Preferred Dividends On Financial Statements

Finance

Where Is Preferred Dividends On Financial Statements

Modified: January 5, 2024

Learn where preferred dividends are located on financial statements and how they impact the overall finance of a company.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where the intricacies of financial statements can sometimes be overwhelming. If you’ve ever delved into the realm of preferred dividends, you may have wondered: where do they actually appear on financial statements?

Preferred dividends are a unique component of corporate finance, representing a fixed payment made to preferred shareholders before any dividends are paid to common shareholders. While common dividends are more well-known, preferred dividends play a significant role in the financial landscape.

In this article, we will explore the definition of preferred dividends, the different types of preferred dividends, the accounting treatment involved, and where you can find preferred dividends on financial statements. Furthermore, we will delve into how preferred dividends impact financial analysis, providing you with a comprehensive understanding of their significance.

By the end of this article, you will have a clear understanding of where preferred dividends fit in the financial statement puzzle, as well as the implications they have for shareholders and financial analysts.

Definition of Preferred Dividends

Preferred dividends, also known as preference dividends, are a specific type of dividend payment made to preferred shareholders. Preferred shareholders hold a different class of shares compared to common shareholders, granting them certain benefits and privileges.

Preferred dividends are predetermined, fixed payments that are typically paid quarterly or annually to preferred shareholders. These payments are made before any dividends are distributed to common shareholders. The fixed nature of preferred dividends means that preferred shareholders receive a set amount per share, regardless of the financial performance of the company.

The purpose of preferred dividends is to provide a consistent income stream to preferred shareholders, rewarding them for their investment while ensuring a certain level of financial stability. Preferred dividends are often preferred shareholders’ main source of return on their investment, as they do not have the same voting rights and potential capital gains as common shareholders.

It’s important to note that preferred dividends are not mandatory. If a company faces financial difficulties or is unable to generate sufficient profits, it may choose to suspend or reduce preferred dividends. However, such actions can have detrimental effects on the reputation and perceived financial stability of the company.

Preferred dividends are different from common dividends, which are dividends paid to common shareholders. Common dividends are usually variable, meaning they can fluctuate based on the company’s financial performance and profitability.

Now that we have a clear understanding of what preferred dividends are, let’s explore the different types of preferred dividends that exist.

Types of Preferred Dividends

Preferred dividends are not a one-size-fits-all concept. There are several types of preferred dividends, each with its own unique characteristics. Here are some common types:

- Cumulative Preferred Dividends: Cumulative preferred dividends accumulate if they are not paid in a particular period. These unpaid dividends are added to the next period’s dividend payment and must be paid out before any dividends can be distributed to common shareholders. This ensures that preferred shareholders receive their due dividends, even if the company experiences financial difficulties.

- Non-Cumulative Preferred Dividends: Unlike cumulative preferred dividends, non-cumulative preferred dividends do not accumulate. If these dividends are not paid in a specific period, they are forgone and cannot be claimed in subsequent periods. This type of preferred dividend provides less financial security to preferred shareholders compared to cumulative preferred dividends.

- Participating Preferred Dividends: Participating preferred dividends provide preferred shareholders with the opportunity to receive additional dividends alongside common shareholders. Once the preferred dividend has been paid, participating preferred shareholders are entitled to receive additional dividends based on a predetermined formula. This allows preferred shareholders to share in the company’s financial success beyond their fixed dividend amount.

- Convertible Preferred Dividends: Convertible preferred dividends have the unique feature of being convertible into a predetermined number of common shares. This means that preferred shareholders have the option to convert their preferred shares into common shares at a specified conversion ratio. The conversion feature provides preferred shareholders with the potential for capital appreciation and greater participation in the company’s growth.

It’s important to note that these are just a few examples of the types of preferred dividends that exist. Companies may have their own variations or combinations of these types, depending on the terms and conditions outlined in their preferred share agreements.

Now that we have explored the various types of preferred dividends, let’s dig deeper into the accounting treatment of preferred dividends.

Accounting Treatment of Preferred Dividends

Preferred dividends have a specific accounting treatment that helps companies accurately reflect their financial obligations and the distribution of profits to preferred shareholders. Let’s take a closer look at the accounting treatment of preferred dividends.

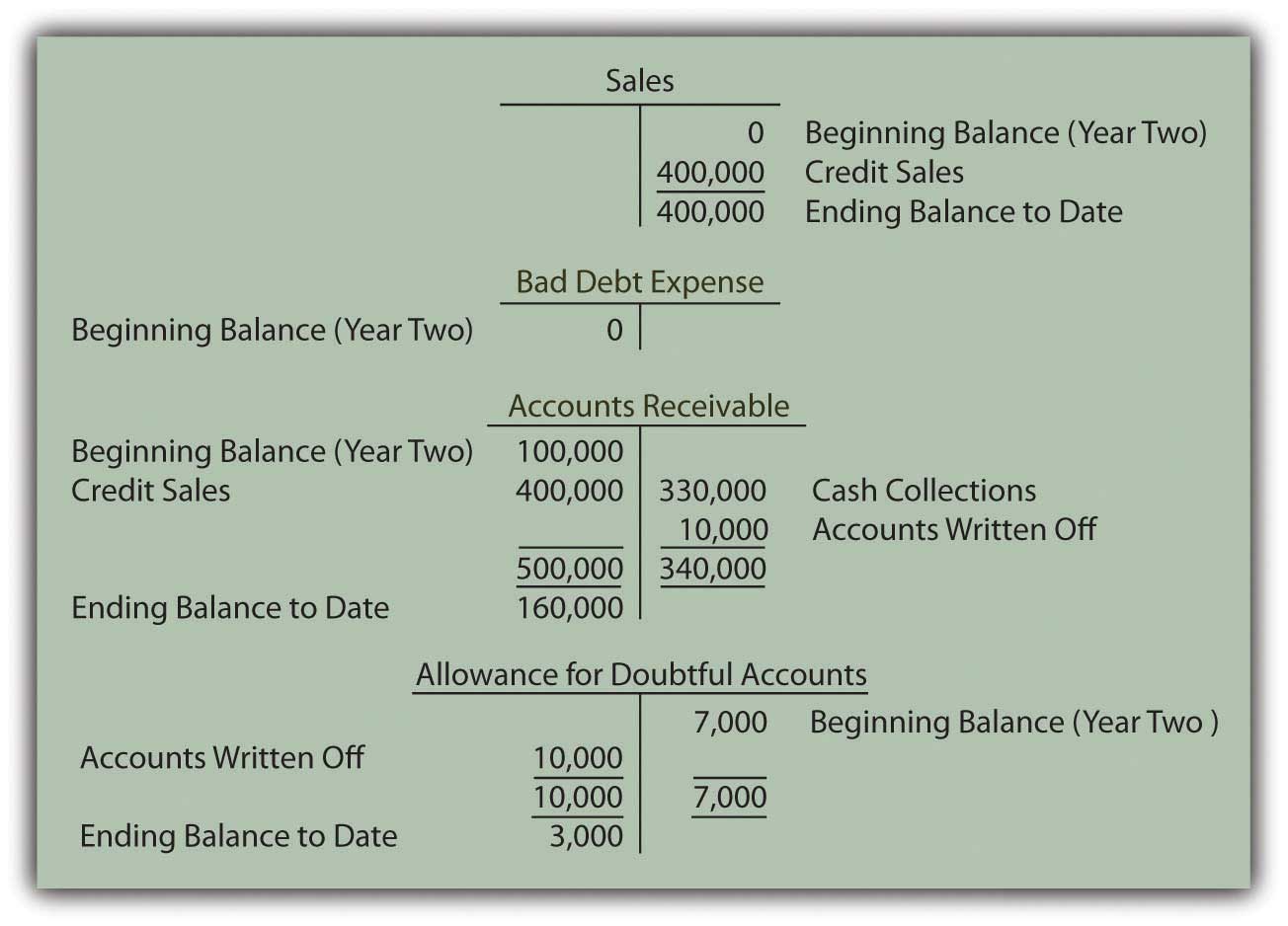

When a company declares preferred dividends, it must record the liability in its financial statements. The amount of preferred dividends declared is debited to the retained earnings account and credited to the preferred dividends payable account on the balance sheet.

Once the preferred dividends are paid to the preferred shareholders, the company debits the preferred dividends payable account and credits the cash account. This transaction reduces the company’s liability to the preferred shareholders.

The accounting treatment of preferred dividends is important because it allows stakeholders to accurately assess a company’s financial health and its ability to meet its dividend obligations.

In addition to recording the liability and payment of preferred dividends, companies must also disclose information related to preferred dividends in the notes to financial statements. This includes details about the terms and conditions of the preferred shares, such as the fixed dividend rate, cumulative or non-cumulative nature, conversion features, and any other relevant information.

Now that we understand the accounting treatment of preferred dividends, let’s move on to the presentation of preferred dividends on financial statements.

Presentation of Preferred Dividends on Financial Statements

Preferred dividends are an important component of a company’s financial obligations and must be reflected accurately on financial statements. Let’s explore how preferred dividends are presented on financial statements.

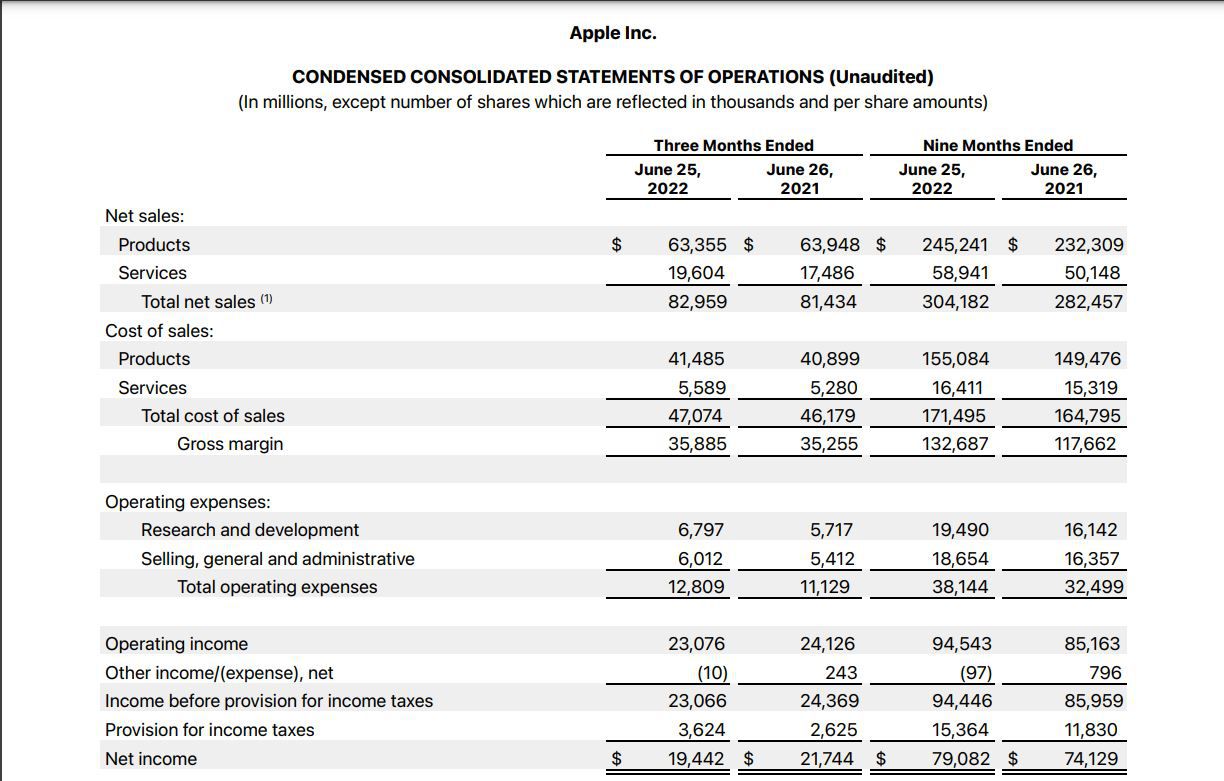

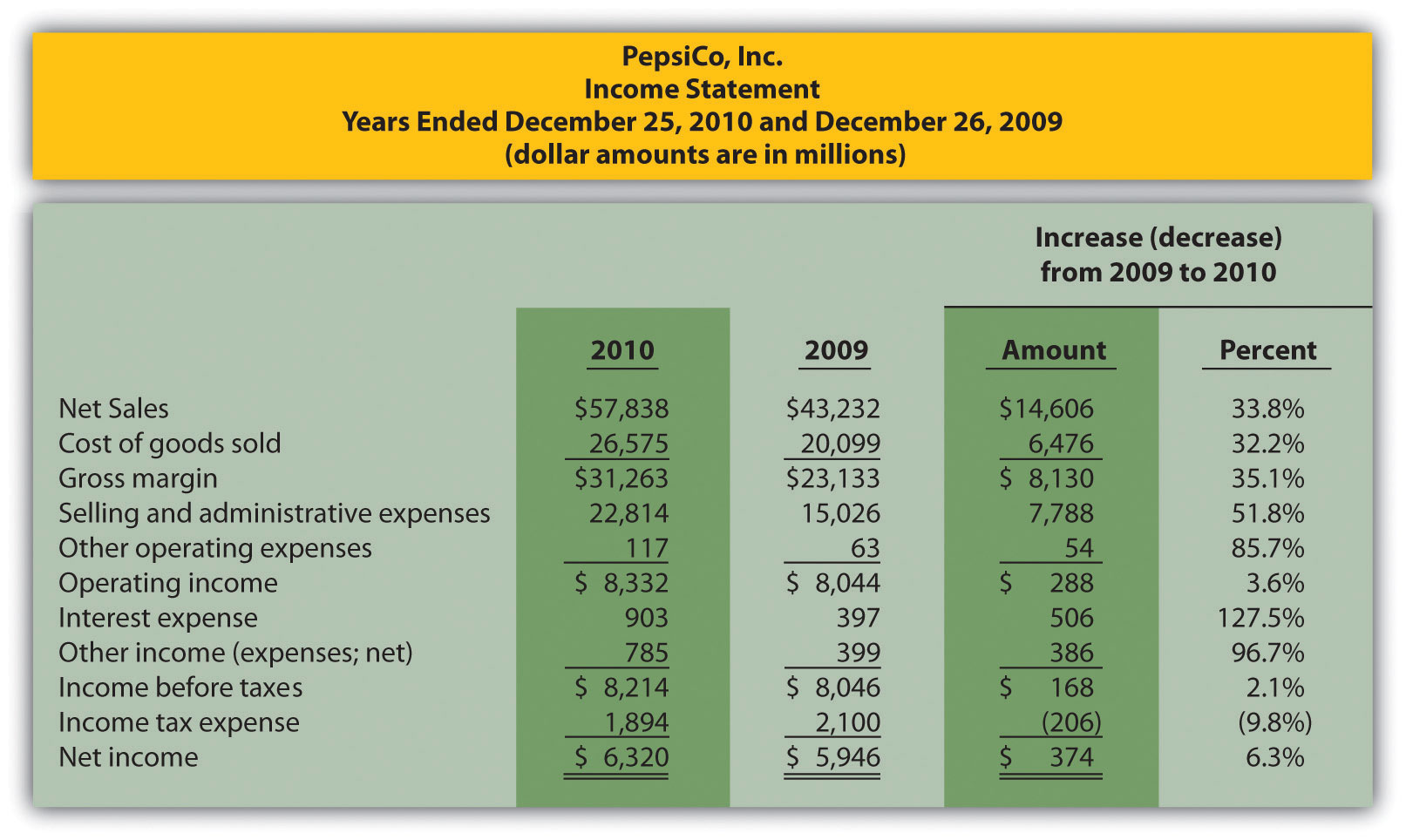

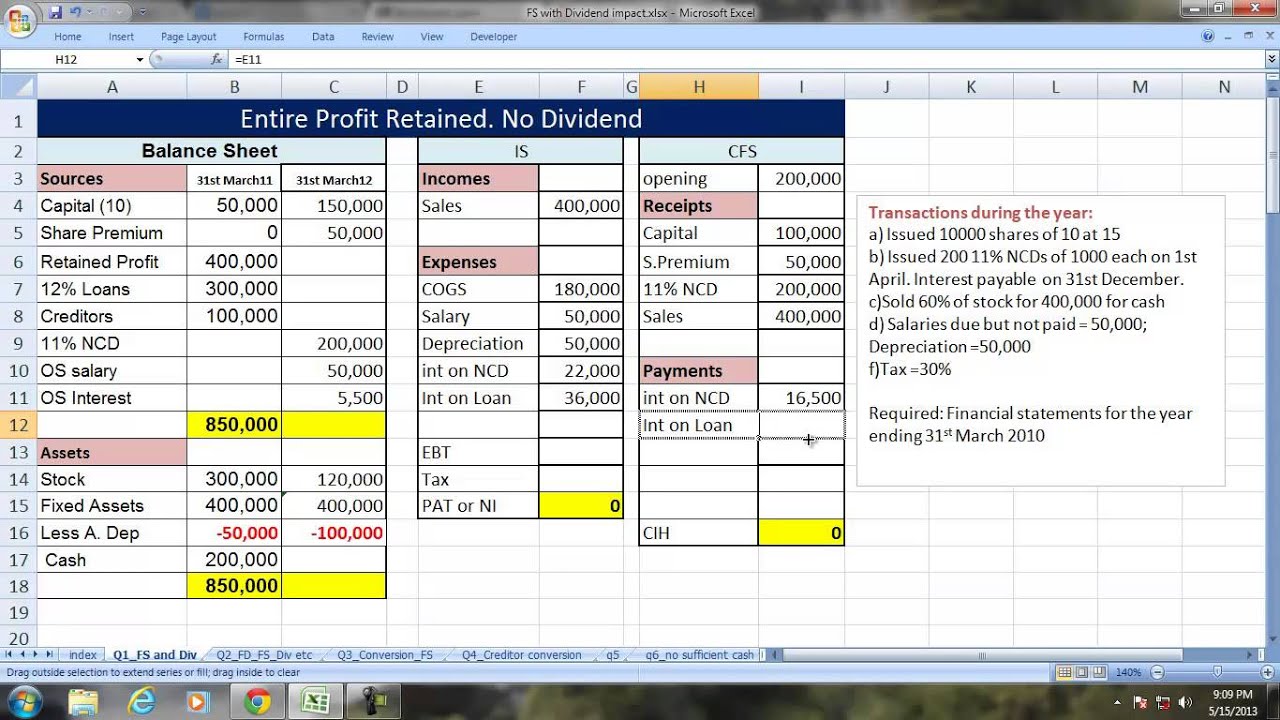

One of the key financial statements where preferred dividends are showcased is the income statement. Preferred dividends are deducted from the net income to arrive at the company’s earnings available to common shareholders. This ensures that preferred dividends are accounted for before calculating the earnings applicable to the common stockholders.

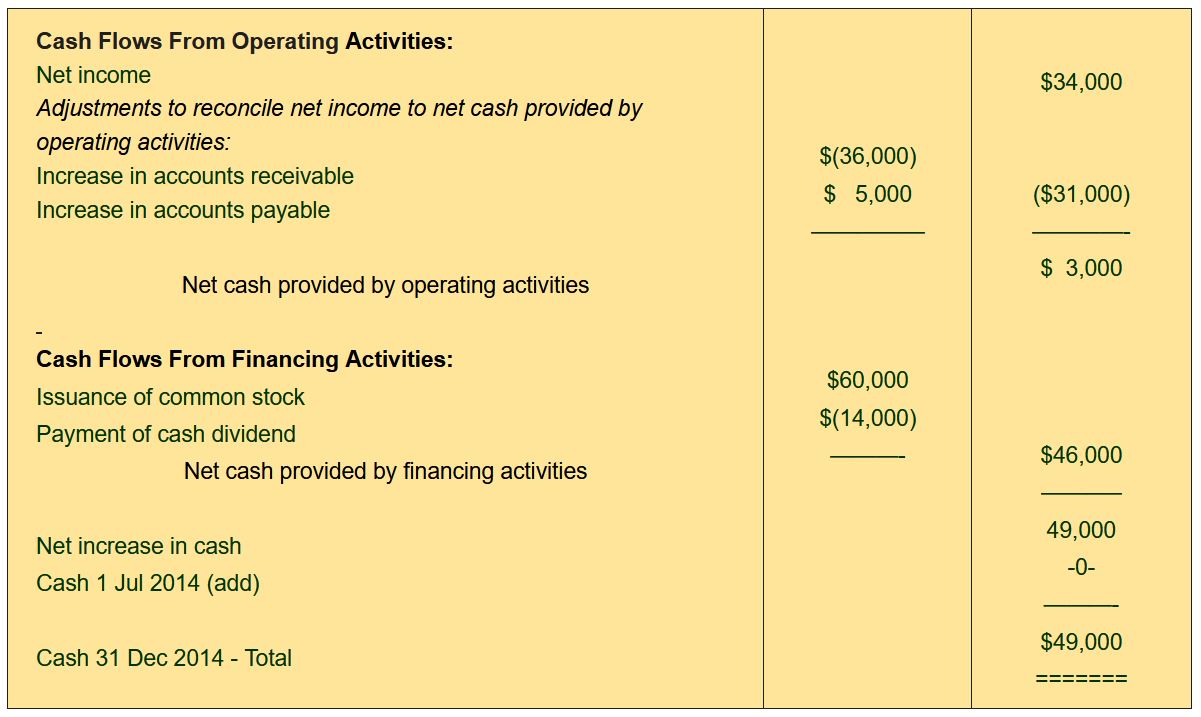

On the balance sheet, preferred dividends are disclosed as a separate line item under the liabilities section. They are listed as preferred dividends payable, representing the amount owed to preferred shareholders for the dividends accrued but not yet paid.

In the equity section of the balance sheet, preferred dividends are also reflected in the retained earnings account. This account will show a decrease in the amount of retained earnings due to the payment of preferred dividends.

It’s worth noting that the presentation of preferred dividends on financial statements may vary depending on the specific accounting standards followed by the company and the jurisdiction in which it operates.

In addition to the income statement and balance sheet, companies are also required to disclose information related to preferred dividends in the notes to financial statements. This includes details about the total amount of preferred dividends declared and paid during the reporting period, as well as any changes or updates in the terms and conditions of the preferred shares.

Proper presentation and disclosure of preferred dividends on financial statements is crucial for stakeholders to have a comprehensive understanding of a company’s financial position, obligations, and the distribution of profits to preferred shareholders.

Now that we have explored how preferred dividends are presented on financial statements, let’s move on to examining the impact of preferred dividends on financial analysis.

Impact of Preferred Dividends on Financial Analysis

Preferred dividends have a significant impact on financial analysis, affecting various metrics and indicators that investors and analysts use to evaluate a company’s performance and financial health. Let’s delve into the key impacts of preferred dividends on financial analysis.

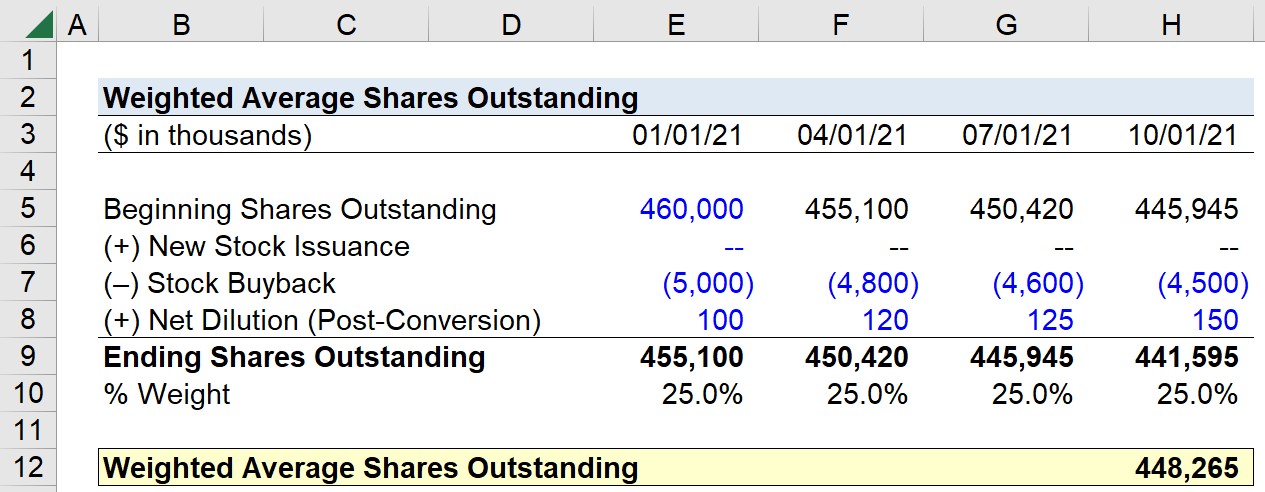

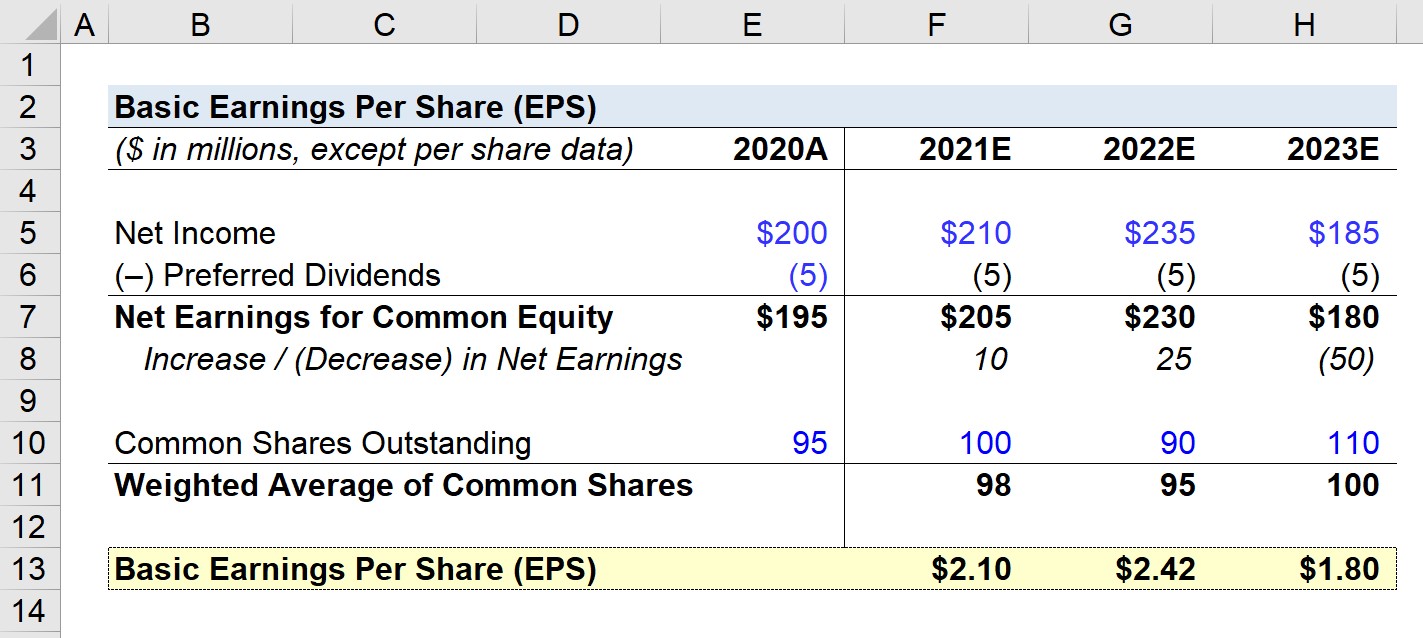

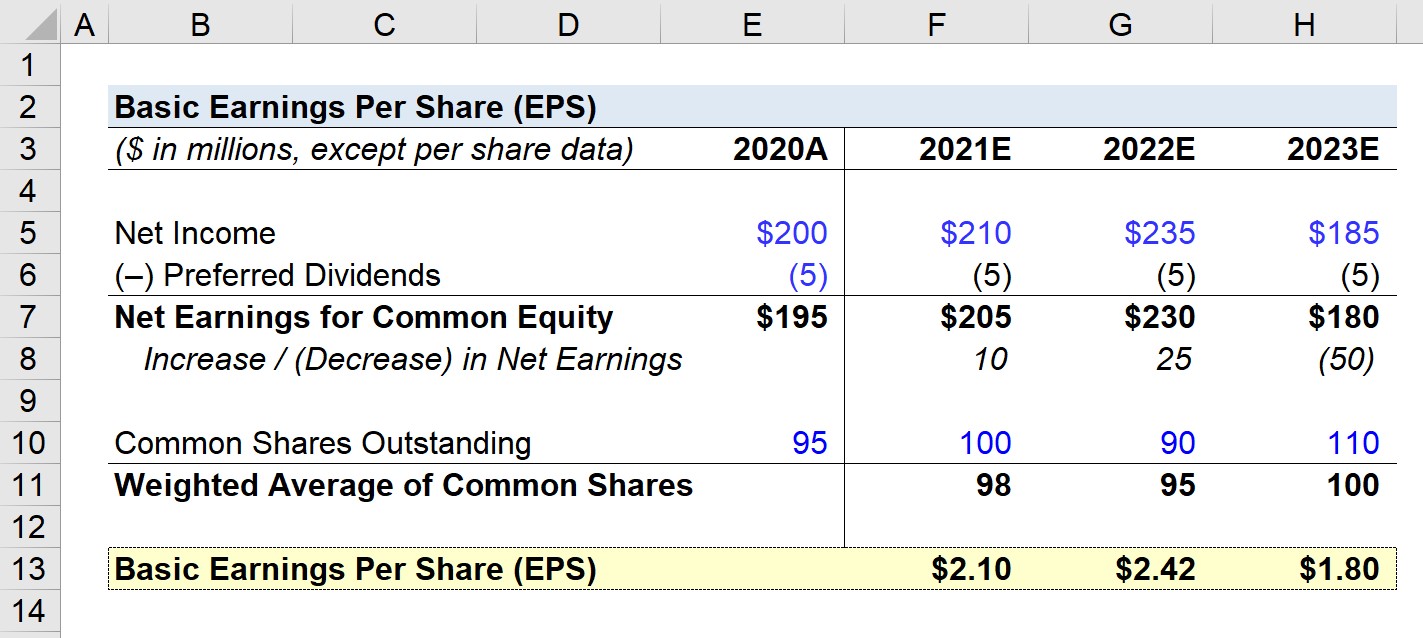

1. Earnings Per Share (EPS): Preferred dividends reduce the earnings available to common shareholders, resulting in a lower EPS. This can potentially impact the perceived profitability and attractiveness of the company’s stock. Analysts often adjust the EPS calculation to exclude preferred dividends to get a clearer picture of the company’s earnings potential for common shareholders.

2. Degree of Financial Leverage: Preferred dividends are fixed obligations that must be paid regardless of the company’s financial performance. The presence of preferred dividends increases the financial leverage of a company, as it has a greater portion of fixed obligations compared to common equity. This can impact the risk profile of the company and its ability to handle financial obligations.

3. Distribution Policy: The existence of preferred dividends reveals the company’s distribution policy and its commitment to preferred shareholders. It can provide insights into the company’s financial stability and its willingness to prioritize the interests of preferred shareholders over common shareholders.

4. Valuation: Preferred dividends can impact the valuation of a company. The fixed nature of preferred dividends provides more certainty to investors about the expected cash flows. Preferred dividends are often valued using different methodologies, such as the dividend discount model, to assess their present value and determine an appropriate price to pay for preferred shares.

5. Debt Capacity: The payment of preferred dividends represents a fixed cash outflow, reducing the company’s free cash flow available for other purposes such as debt repayment or investments. Lenders and creditors may assess a company’s ability to meet its preferred dividend obligations when considering its debt capacity and risk profile.

It’s important for financial analysts and investors to consider the impact of preferred dividends when conducting financial analysis, as it can provide a more holistic view of the company’s financial position, profitability, and ability to generate returns for shareholders.

Now, let’s summarize the key points we have covered in this article.

Conclusion

In conclusion, preferred dividends play a crucial role in the world of finance. These fixed payments provide a consistent income stream to preferred shareholders, rewarding them for their investments and ensuring a certain level of financial stability. Understanding the different types of preferred dividends, such as cumulative, non-cumulative, participating, and convertible, allows investors and analysts to grasp the unique characteristics and benefits associated with each type.

The accounting treatment of preferred dividends involves recording the liability and payment of these dividends, as well as disclosing relevant information in the financial statements. Preferred dividends are deducted from the net income on the income statement and listed as a liability in the balance sheet, impacting metrics like earnings per share and the degree of financial leverage.

The presentation of preferred dividends on financial statements allows stakeholders to assess a company’s financial obligations and the distribution of profits to preferred shareholders. Analysts and investors must consider the impact of preferred dividends on various financial analysis aspects, including earnings per share, distribution policy, valuation, and debt capacity, to gain a comprehensive understanding of a company’s performance and financial health.

To navigate the complex world of finance successfully, it is essential to have a clear understanding of preferred dividends and their implications. By considering preferred dividends alongside other financial metrics, stakeholders can make informed decisions, evaluate investment opportunities, and perform thorough financial analysis.

We hope this article has provided valuable insights into the nature of preferred dividends, their accounting treatment, and their impact on financial analysis. As always, it is important to consult with financial professionals and conduct further research to gain a deeper understanding of specific companies and their preferred dividend structures.

Thank you for joining us on this journey through the world of preferred dividends in financial statements. Happy analyzing!