Home>Finance>Where To Find Operating Income On Financial Statements

Finance

Where To Find Operating Income On Financial Statements

Modified: December 30, 2023

Learn where to find operating income on financial statements and improve your understanding of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Operating Income

- Components of Operating Income

- Gross Profit

- Operating Expenses

- Depreciation and Amortization

- Operating Income Calculation

- Importance of Operating Income

- Displaying Operating Income on Financial Statements

- Income Statement

- Statement of Comprehensive Income

- Example of Operating Income Calculation

- Conclusion

Introduction

In the world of finance, understanding a company’s financial statements is crucial for assessing its financial health and performance. One key metric that investors, analysts, and stakeholders look at is operating income. Operating income provides valuable insights into the profitability of a business’s core operations.

Operating income, also known as operating profit or operating earnings, is a fundamental financial measure that represents the profit a company generates from its day-to-day operations, excluding non-operating activities such as interest income, interest expense, and taxes. It is a key component in evaluating a company’s operating efficiency and profitability.

In this article, we will delve into the definition and components of operating income, discuss its importance, and explore where it is displayed on financial statements.

By understanding the concept of operating income and how it is calculated, investors and stakeholders can gain valuable insights into a company’s profitability and make informed decisions regarding its financial prospects.

Definition of Operating Income

Operating income, also referred to as operating profit or operating earnings, is a financial metric that measures the profitability and efficiency of a company’s core operations. It represents the amount of profit generated from a company’s day-to-day activities, excluding non-operating expenses and revenues.

Operating income is calculated by subtracting the company’s operating expenses from its gross profit. It provides insight into how well a company’s core operations are performing and generating profits before considering non-operational factors such as interest, taxes, and investments.

Operating income is particularly useful for comparing the performance of companies within the same industry or sector. By focusing on operating income, investors and analysts can assess the relative profitability and efficiency of companies, regardless of their financing, tax structures, or investment choices.

It is important to note that operating income is distinct from net income or the bottom line of a company’s income statement. Net income takes into account other income and expenses, such as interest income, interest expense, taxes, and exceptional items, making it a more comprehensive measure of a company’s overall profitability.

Understanding operating income is crucial for investors, as it provides valuable insights into the profitability and sustainability of a company’s core operations. A consistently positive and growing operating income indicates that a company is effectively managing its costs, generating revenue, and achieving profitability through its primary activities.

Components of Operating Income

Operating income is derived from the combination of several key financial components. Understanding these components is essential for assessing the profitability and efficiency of a company’s operations. Let’s take a closer look at the main elements that make up operating income:

- Gross Profit: Gross profit represents the revenue a company generates from its sales after deducting the cost of goods sold (COGS). It reflects the profitability of a company’s core business activities, excluding operating expenses such as salaries, rent, and marketing expenses.

- Operating Expenses: Operating expenses include all costs incurred in the day-to-day operations of a business. This typically includes expenses related to research and development, marketing, sales, administration, and equipment maintenance. Operating expenses are deducted from gross profit to calculate operating income.

- Depreciation and Amortization: Depreciation and amortization are non-cash expenses that reflect the gradual wear and tear or use of a company’s assets over time. Depreciation applies to tangible assets like buildings and machinery, while amortization applies to intangible assets like patents and copyrights. These expenses are subtracted from operating income to determine net income.

By analyzing these components, investors and stakeholders can assess the efficiency of a company’s operations, evaluate its cost management, and identify potential areas for improvement. A company with a high gross profit margin and effective control over operating expenses is more likely to generate a healthy operating income, indicating a strong and sustainable business model.

Gross Profit

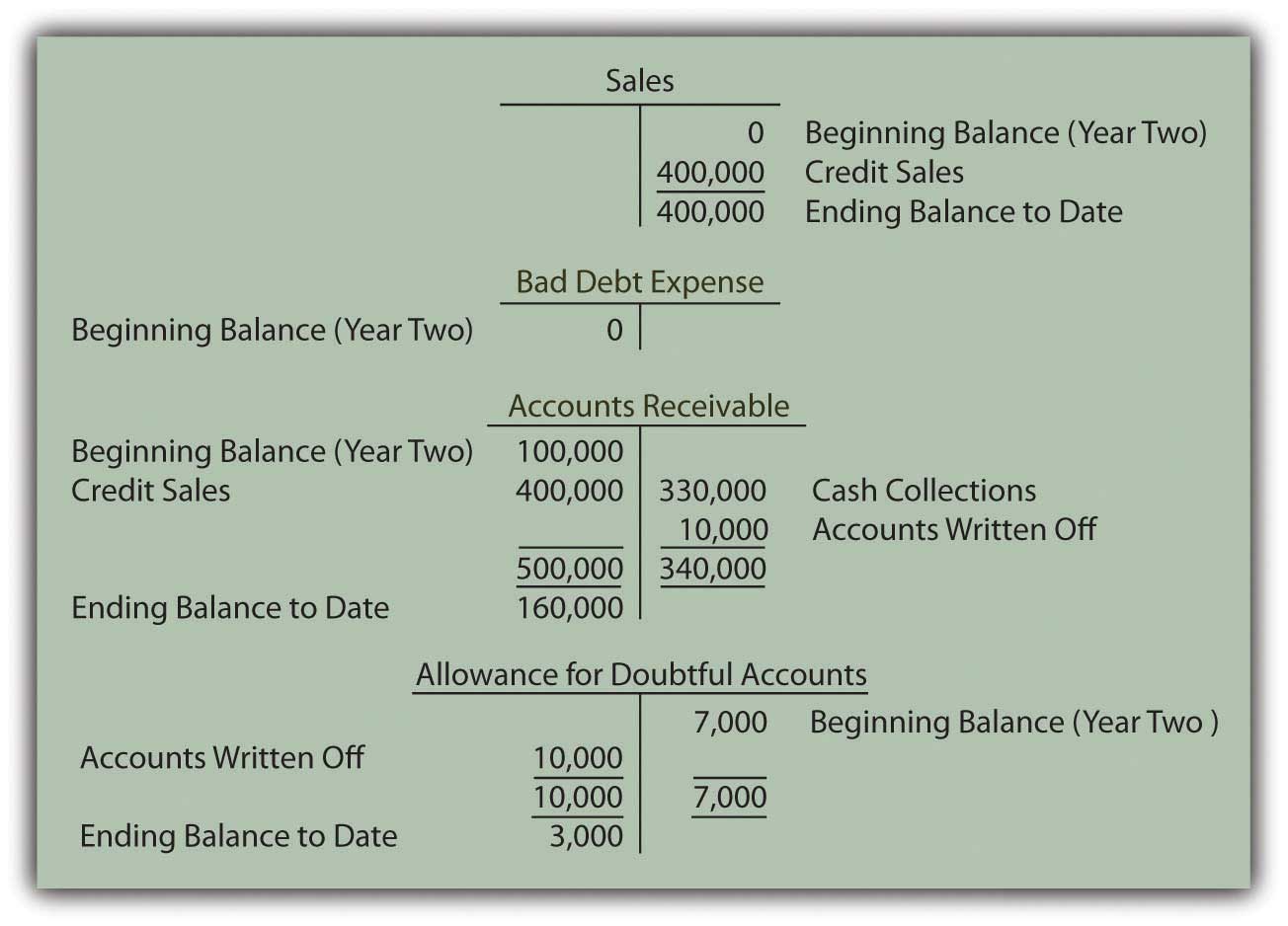

Gross profit is a key component of operating income and represents the revenue generated by a company’s sales after deducting the cost of goods sold (COGS). It reflects the profitability of a company’s core business activities, specifically the ability to generate revenue above the direct costs associated with producing and delivering its products or services.

Gross profit is calculated by subtracting the cost of goods sold from the total revenue. The cost of goods sold refers to the direct costs incurred in producing or purchasing the products or services that are sold to customers. This includes expenses such as raw materials, labor, and manufacturing overheads.

A high gross profit indicates that a company is effectively managing its production and procurement costs, allowing it to generate significant revenue from its sales. It demonstrates the efficiency of the company’s operations and its ability to generate profits from its primary activities.

However, it is essential to consider industry benchmarks and the specific dynamics of the business when evaluating gross profit. Industries with high competition or low barriers to entry may have lower gross profit margins, while industries with unique products or high demand may have higher margins.

Investors and analysts often compare the gross profit margin of a company to that of its competitors within the same industry. A higher gross profit margin relative to peers suggests a favorable competitive position and a more efficient cost structure.

While gross profit is a critical measure of a company’s profitability, it does not provide a complete picture of its overall financial health. It is important to consider other factors such as operating expenses, depreciation, and taxes to assess a company’s net income and overall profitability.

Overall, gross profit serves as a starting point for calculating operating income and provides valuable insights into a company’s ability to generate revenue above direct production costs. By analyzing the gross profit margin and comparing it to industry benchmarks, investors can gain a deeper understanding of a company’s competitive position and operating efficiency.

Operating Expenses

Operating expenses are a crucial component of operating income. They encompass all the costs incurred by a company to maintain and support its day-to-day operations. Operating expenses are subtracted from the gross profit to calculate the operating income, thus playing a significant role in determining a company’s profitability.

Operational expenses can vary widely depending on the nature of the business and industry. They typically include costs associated with research and development, marketing and advertising, sales, administration, salaries and wages, rent, utilities, and other general overhead expenses.

Operating expenses are essential to keep the business running smoothly, supporting core activities and maintaining the infrastructure necessary for ongoing operations. However, it is crucial for companies to manage these expenses efficiently to ensure profitability and long-term sustainability.

When analyzing a company’s financial statements, investors and analysts pay close attention to the trends in operating expenses relative to revenue. Increasing operating expenses as a percentage of revenue over time may indicate a lack of cost control or inefficiency in managing the company’s operations.

It is also important to assess the composition of operating expenses. Some expenses, such as marketing and research and development, are investments aimed at driving future growth and innovation. However, excessive or unnecessary expenses, such as extravagant office spaces or excessive executive compensation, can weigh down a company’s profitability.

In some cases, companies may have non-recurring or exceptional operating expenses that are not part of their ongoing business activities. It is important to adjust for these exceptional expenses when assessing a company’s true operating performance.

Evaluating and managing operating expenses is crucial for businesses of all sizes. By implementing cost-control measures, optimizing operational efficiency, and regularly reviewing expenses, companies can improve profitability and overall financial performance.

Ultimately, maintaining a healthy balance between operating expenses and revenue is essential for a company’s success. By effectively managing these expenses, companies can maximize their operating income and create a solid foundation for sustained growth and profitability.

Depreciation and Amortization

Depreciation and amortization are non-cash expenses that play a significant role in calculating operating income. They reflect the gradual wear and tear, obsolescence, or expiration of a company’s tangible and intangible assets over time. While not directly impacting a company’s cash flow, depreciation and amortization are important factors in accurately determining the profitability and financial performance of a business.

Depreciation: Depreciation applies to tangible assets such as buildings, machinery, vehicles, and equipment. These assets have a limited useful life and experience a decline in value over time due to factors such as wear and tear, technological advancements, and market obsolescence. Depreciation expense is allocated over the asset’s estimated useful life, allowing the company to recognize the cost of the asset gradually.

Amortization: Amortization, on the other hand, applies to intangible assets like patents, trademarks, copyrights, and goodwill. Intangible assets derive their value from intellectual or legal rights and also have limited useful lives. Amortization expense is recognized over the asset’s estimated useful life, reflecting the gradual consumption of its value.

Both depreciation and amortization are recorded as expenses on the income statement, reducing the company’s operating income. These expenses are non-cash in nature, meaning they do not involve a direct outflow of cash but are essential for accurately reflecting the true cost of using assets in the production of goods or services.

Depreciation and amortization expenses have a twofold impact on a company’s financial statements. Firstly, they reduce the reported net income, reflecting the gradual consumption of asset values. Secondly, they provide a means of allocating the cost of assets over their useful lives, ensuring that the financial statements accurately reflect the economic reality of the company’s operations.

It is worth noting that the actual cash spent on acquiring or maintaining assets is not reflected in the depreciation and amortization expenses. Instead, these expenses represent systematic allocations of the original cost or fair value of the assets over time.

By understanding the impact of depreciation and amortization, investors and analysts can gain insights into a company’s capital investment decisions, the age and condition of its assets, and the ongoing operating costs required to maintain its operations.

Ultimately, depreciation and amortization expenses allow companies to match the costs of their assets with the revenue generated by using those assets. This ensures that the financial statements accurately reflect the economic reality of the business and improve the comparability of companies within the same industry.

Operating Income Calculation

The calculation of operating income involves subtracting the total operating expenses from the gross profit. This straightforward calculation provides insight into the profitability of a company’s core operations and serves as a vital measure for assessing its financial health. Here’s how operating income is calculated:

Gross Profit: Begin by calculating the gross profit. Gross profit is determined by subtracting the cost of goods sold (COGS) from the total revenue. The formula is:

Gross Profit = Total Revenue – Cost of Goods Sold

Operating Expenses: Identify and sum up all operating expenses incurred by the company during a specific period. This includes costs related to research and development, marketing, sales, administration, salaries, rent, utilities, and other general overhead expenses.

Operating Income: Subtract the total sum of operating expenses from the gross profit to obtain the operating income. The formula is:

Operating Income = Gross Profit – Operating Expenses

The resulting figure represents the profit generated by a company’s core operations before taking into account non-operating activities, interest expenses, taxes, and other factors.

By calculating operating income, companies can assess their ability to generate profits solely through their primary activities, allowing for a closer evaluation of their operational efficiency and profitability.

It is important to note that operating income is just one component of a company’s overall financial performance. To derive the net income or the bottom line, non-operating income and expenses, interest, taxes, and exceptional items are incorporated into the calculation.

Calculating and monitoring operating income over time allows investors and stakeholders to evaluate the company’s operational performance, identify trends, and make informed decisions regarding their investments and business partnerships.

Importance of Operating Income

Operating income is a crucial financial metric that holds significant importance for companies, investors, and stakeholders. It provides valuable insights into a company’s profitability, operational efficiency, and overall financial health. Here are some key reasons why operating income is important:

- Profitability Assessment: Operating income allows for a clear assessment of a company’s profitability from its core operations. By excluding non-operating activities, such as interest income, interest expense, and taxes, operating income provides a more accurate gauge of a company’s ability to generate profit solely from its primary activities.

- Operational Efficiency: Operating income reflects the efficiency of a company’s operations and its ability to manage production costs, control expenses, and generate revenue. Positive trends in operating income indicate effective cost management, streamlined operations, and a strong competitive position in the market.

- Comparative Analysis: Operating income is useful for comparing companies within the same industry or sector. It offers a standardized measure that allows for a fair evaluation of their performance, regardless of differences in financing, tax structures, or investment choices.

- Investment Decision-Making: Operating income is a critical factor considered by investors when assessing the financial health and potential returns of a company. It provides valuable insights into the company’s ability to generate sustainable profits. A consistently positive and growing operating income suggests stability and the potential for future dividends or appreciation in the value of the company’s stock.

- Business Analysis and Planning: Operating income is an essential tool for analyzing a company’s financial statements and developing strategic plans. It helps management identify areas where cost reduction or efficiency improvement measures may be implemented. By monitoring operating income over time, companies can track their progress toward financial goals and make data-driven decisions to optimize their performance.

- Investor Confidence: Operating income serves as a key indicator of a company’s financial performance and stability. A strong and consistently positive operating income enhances investor confidence and may attract potential investors, lenders, and business partners who seek companies with a track record of profitability and efficient operations.

Ultimately, operating income provides a comprehensive view of a company’s profitability from core operations, allowing for a more accurate assessment of its financial performance. By understanding and analyzing operating income, companies, investors, and stakeholders can make informed decisions, drive strategic initiatives, and evaluate the financial health and potential for growth of a business.

Displaying Operating Income on Financial Statements

Operating income is an essential financial metric that is typically displayed on a company’s financial statements. It provides stakeholders with valuable information about the profitability and financial health of a business. Let’s explore how operating income is displayed on financial statements:

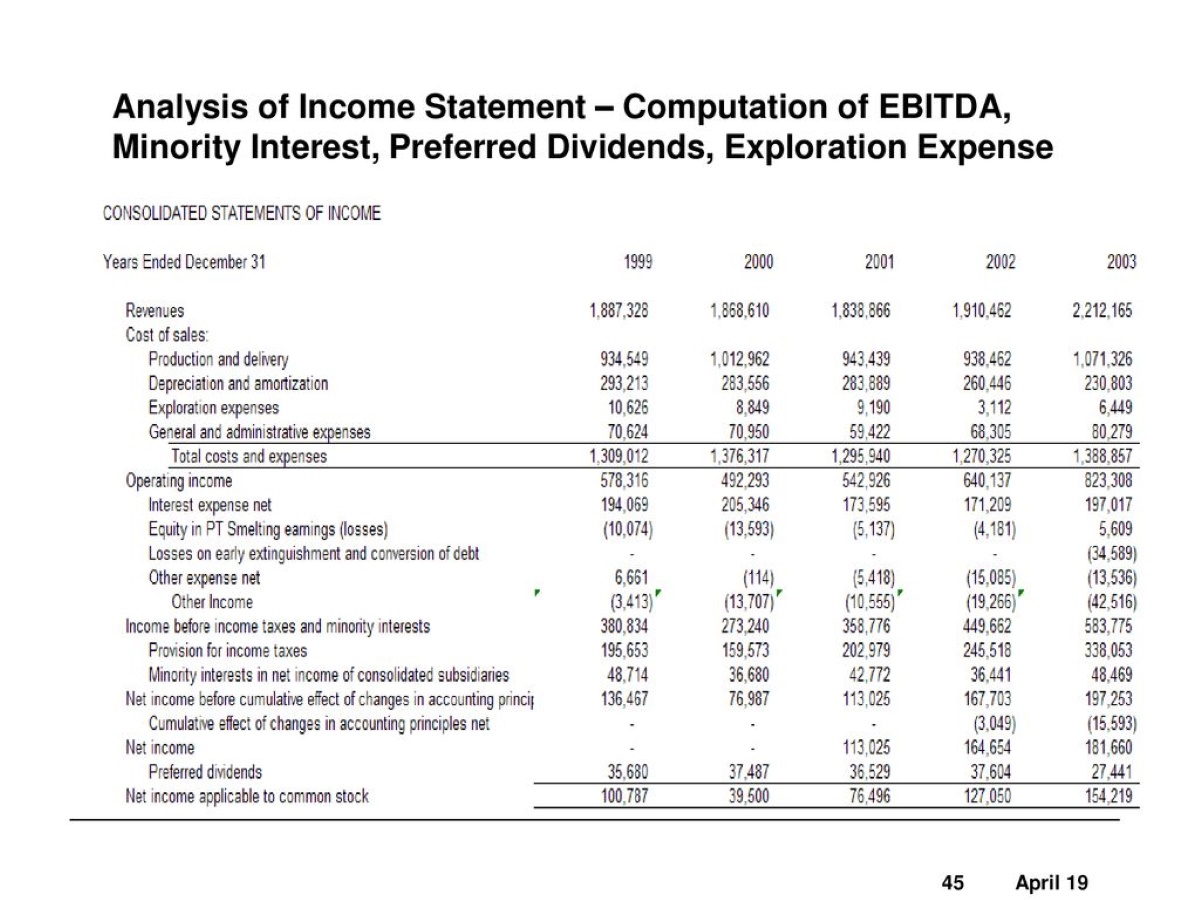

Income Statement: The income statement, also known as a profit and loss statement or statement of earnings, is a primary financial statement that summarizes a company’s revenues, expenses, and net income over a specific period. Operating income is displayed on the income statement as a separate line item, typically located below the gross profit and above non-operating income or expenses.

The income statement typically follows this format:

- Revenue

- Cost of Goods Sold (COGS)

- Gross Profit

- Operating Expenses

- Operating Income

- Non-Operating Income/Expenses

- Net Income

The operating income is calculated by subtracting the operating expenses from the gross profit. It reflects the profit generated from the company’s core operations before considering non-operating activities.

Statement of Comprehensive Income: In some financial reporting frameworks, such as International Financial Reporting Standards (IFRS), operating income may be displayed on the statement of comprehensive income. This statement provides a comprehensive view of a company’s financial performance, including operating, non-operating, and other comprehensive income.

On the statement of comprehensive income, operating income appears as a separate line item, representing the profit generated from a company’s core business activities.

Both the income statement and the statement of comprehensive income are crucial financial statements that provide insights into a company’s profitability and financial performance. They serve as valuable sources of information for investors, analysts, and other stakeholders.

It is important to note that the specific presentation of financial statements may vary based on applicable accounting standards and reporting requirements. However, operating income is typically displayed prominently to provide a clear picture of a company’s operating profitability.

By including operating income on financial statements, companies can provide transparent and meaningful information to stakeholders, enabling them to make informed decisions and gain a comprehensive understanding of the company’s financial position and performance.

Income Statement

The income statement, also known as the profit and loss statement or statement of earnings, is a crucial financial statement that summarizes a company’s revenues, expenses, and net income over a specific period. It provides insights into a company’s financial performance and profitability by showing the income generated and the expenses incurred during that period.

The income statement typically follows a standardized format, consisting of several key components:

- Revenues: Revenues, also referred to as sales or turnover, represent the total amount of money generated by a company through its primary business activities, such as selling products or providing services.

- Cost of Goods Sold (COGS): COGS refers to the direct costs associated with producing or purchasing the goods or services that a company sells. It includes expenses such as raw materials, labor, and manufacturing overheads.

- Gross Profit: Gross profit is calculated by subtracting the COGS from the revenues. It represents the profit generated by a company’s core operations before considering operating expenses.

- Operating Expenses: Operating expenses include costs incurred in the day-to-day operations of a business, such as research and development, marketing, sales, administration, salaries, rent, and utilities.

- Operating Income: Operating income, also known as operating profit or operating earnings, is derived by subtracting the total operating expenses from the gross profit. It represents the profit generated from a company’s core operations before considering non-operating activities.

- Non-Operating Income/Expenses: Non-operating income or expenses include items that are not directly related to a company’s core operations. Examples include interest income, interest expense, gains or losses from the sale of assets, and foreign exchange fluctuations.

- Net Income: Net income, also referred to as net profit or bottom line, is the final amount that remains after subtracting non-operating income or expenses from the operating income. It represents the total profit or loss generated by a company for the given period.

The income statement provides stakeholders with valuable information about a company’s revenue generation, cost management, and profitability. It allows investors, analysts, and other interested parties to assess the company’s financial performance, make comparisons to industry peers, and evaluate its ability to generate sustainable profits.

It is important to note that the income statement represents a specific period and does not provide a comprehensive view of a company’s financial position. To gain a holistic understanding of the company’s financial health, it is essential to analyze the income statement in conjunction with other financial statements, such as the balance sheet and cash flow statement.

Overall, the income statement is a vital tool for evaluating a company’s financial performance and profitability. By studying the various components and trends within the income statement, stakeholders can make informed decisions, assess the company’s operational efficiency, and gauge its potential for future growth.

Statement of Comprehensive Income

The statement of comprehensive income, also known as the income statement, is a financial statement that provides a comprehensive view of a company’s financial performance over a specific period. It goes beyond the traditional income statement by including additional components, such as non-operating income, expenses, and other comprehensive income items.

The statement of comprehensive income follows a format similar to the income statement, including key elements such as:

- Revenue: Revenue represents the total amount of money generated by a company through its primary business activities, such as sales or services provided.

- Cost of Goods Sold (COGS): COGS refers to the direct costs associated with producing or purchasing the goods or services that a company sells.

- Gross Profit: Gross profit is calculated by subtracting the COGS from the revenue. It reflects the profitability of a company’s core operations before considering operating expenses.

- Operating Expenses: Operating expenses include costs incurred in the day-to-day operations of a business, such as research and development, marketing, sales, administration, salaries, rent, and utilities.

- Operating Income: Operating income, also known as operating profit or operating earnings, is derived by subtracting the total operating expenses from the gross profit. It represents the profit generated from a company’s core operations before considering non-operating activities.

- Non-Operating Income/Expenses: Non-operating income or expenses include items that are not directly related to a company’s core operations but still impact its overall financial performance. These may include interest income, interest expense, gains or losses from the sale of assets, and foreign exchange fluctuations.

- Other Comprehensive Income (OCI): Other comprehensive income represents gains and losses that are not included in the net income but have the potential to impact a company’s financial position. These items can include unrealized gains or losses on investments, foreign currency translation adjustments, or adjustments from pension plans.

- Net Income: Net income, also referred to as net profit or bottom line, is the final amount obtained by subtracting non-operating income or expenses from the operating income. It represents the total profit or loss generated by a company for the given period.

- Total Comprehensive Income: Total comprehensive income is the summation of net income and other comprehensive income, providing a comprehensive view of a company’s financial performance.

The statement of comprehensive income provides stakeholders with a more complete understanding of a company’s financial position as it includes both the operating and non-operating aspects of its performance. By including other comprehensive income, this statement captures additional gains or losses that are not typically reflected in the net income, offering a broader view of a company’s financial health.

When analyzing the statement of comprehensive income, stakeholders can assess the company’s overall profitability, identify trends, evaluate the impact of non-operating items, and gain insights into the potential risks and opportunities that may affect its financial stability.

It’s important to consider the specific reporting requirements and accounting standards applicable in each jurisdiction, as the presentation of the statement of comprehensive income may vary based on these factors. Regardless of the specific format, the statement of comprehensive income serves as a crucial financial statement that complements the information provided by the income statement, giving stakeholders a more comprehensive picture of a company’s financial performance and position.

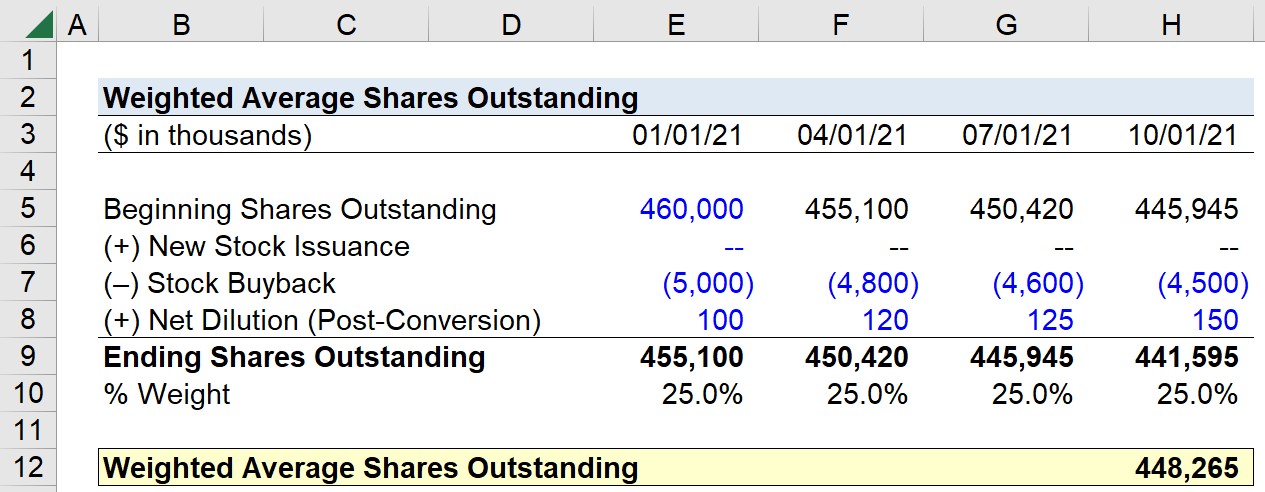

Example of Operating Income Calculation

To understand how operating income is calculated, let’s consider an example using fictional company XYZ Ltd:

XYZ Ltd’s financial information for the year is as follows:

- Revenue: $500,000

- Cost of Goods Sold (COGS): $200,000

- Operating Expenses: $150,000

Using the given figures, we can calculate the operating income for XYZ Ltd:

Gross Profit:

$500,000 (Revenue) – $200,000 (COGS) = $300,000

Operating Income:

$300,000 (Gross Profit) – $150,000 (Operating Expenses) = $150,000

Thus, the operating income for XYZ Ltd is $150,000.

This calculation shows that XYZ Ltd generated a gross profit of $300,000 from its core operations after deducting the cost of goods sold. After subtracting the operating expenses of $150,000, the company achieved an operating income of $150,000.

By calculating operating income, XYZ Ltd can assess the profitability and efficiency of its day-to-day operations. It provides insights into the profitability generated before considering non-operating activities, interest expenses, and taxes.

It’s important to note that this is a simplified example, and in reality, companies may have more complex income statements with various revenue streams, cost components, and operating expenses. However, the principles of calculating operating income remain the same.

By analyzing the operating income over time, companies can track their performance, identify trends, and make informed decisions to optimize their profitability and overall financial health.

Conclusion

Operating income is a key financial metric that provides valuable insights into a company’s profitability and efficiency. By excluding non-operating activities and focusing solely on core operations, operating income allows stakeholders to assess the financial health and performance of a business.

In this article, we explored the definition of operating income, its components, and its significance in assessing a company’s financial position. We discussed how gross profit, operating expenses, and depreciation/amortization contribute to the calculation of operating income.

We also highlighted the importance of operating income in various aspects such as profitability assessment, comparative analysis, investment decision-making, and business analysis. It serves as a critical tool for evaluating a company’s operational efficiency and attracting investor confidence.

Furthermore, we examined how operating income is displayed on financial statements, such as the income statement and the statement of comprehensive income. These statements provide stakeholders with a comprehensive view of a company’s financial performance, allowing for a deeper analysis of its revenue generation, expenses, and overall profitability.

To bring clarity, we provided an example of operating income calculation using fictional company XYZ Ltd. This example emphasized the steps involved and demonstrated how operating income is derived by subtracting operating expenses from the gross profit.

In conclusion, operating income is a fundamental measure in assessing a company’s financial health and performance. By understanding and analyzing operating income, stakeholders can make informed decisions, evaluate operational efficiency, and gauge a company’s potential for growth and profitability. It serves as a valuable tool for investors, analysts, and other stakeholders in their assessment of a company’s financial position and overall prospects.