Finance

Where To Invest In Yahoo Stocks

Published: January 19, 2024

Find out the best places to invest in Yahoo stocks and diversify your finance portfolio with our expert insights and recommendations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Investing in stocks is a popular and potentially lucrative way to grow one’s wealth. Among the numerous companies available for investment, Yahoo is a well-known name in the finance world. With its extensive range of products and services, Yahoo has become a prominent player in the technology and media industries.

This article aims to provide an overview of investing in Yahoo stocks, highlighting the factors that prospective investors should consider before making a decision. Whether you are an experienced investor or someone just starting to explore the world of stock investment, understanding the potential risks and opportunities associated with Yahoo stocks is essential.

At its core, Yahoo is a multinational technology company that operates a variety of internet-based services. From its pioneering search engine to its widely popular email platform, Yahoo has built a diversified portfolio of products that cater to different segments of the market.

As an investor, it is crucial to analyze the financial health of the company and assess its future growth prospects. By delving deeper into Yahoo’s financial statements, market position, and strategic initiatives, you can make informed decisions regarding your investment strategy.

However, keep in mind that investing in stocks carries inherent risks. The value of a stock can fluctuate due to market conditions, economic factors, competition, and company-specific issues. It is vital to carefully evaluate these risks and weigh them against the potential rewards before deciding to invest in Yahoo stocks.

In the following sections, we will discuss the factors to consider before investing in Yahoo stocks, the potential risks involved, and where you can invest in Yahoo stocks to maximize your returns.

Overview of Yahoo Stocks

Yahoo stocks offer investors an opportunity to own a stake in a diverse technology company with a solid presence in the online media and advertising space. Created in 1994 by Jerry Yang and David Filo, Yahoo has evolved and expanded its range of products and services over the years, becoming one of the most recognized brands worldwide.

Yahoo’s core business includes its search engine, Yahoo Search, which ranks as one of the top search engines globally. The company also offers a wide selection of online products, such as Yahoo Mail, Yahoo Finance, Yahoo News, and Yahoo Sports, catering to various interests and user preferences.

With the increasing importance of online advertising, Yahoo has positioned itself as a key player in the digital marketing space. The company’s advertising platform, Yahoo Gemini, provides advertisers with targeted advertising options on both desktop and mobile devices.

One significant event in Yahoo’s history was its acquisition by Verizon Communications in 2017. This acquisition led to the merger of Yahoo and AOL, another major internet company owned by Verizon, creating a new entity known as Verizon Media.

Despite undergoing various transformations, Yahoo has maintained its relevance and continues to attract a substantial user base. This user base, coupled with the wide range of online products and services offered by Yahoo, creates a solid foundation for potential growth and revenue generation.

It is important to note that while Yahoo stocks may offer exciting opportunities, they also come with risks. As an investor, it is crucial to understand the factors that can influence the value and performance of Yahoo stocks before making an investment decision. In the following sections, we will delve deeper into these considerations and potential risks associated with investing in Yahoo stocks.

Factors to Consider Before Investing in Yahoo Stocks

Before investing in Yahoo stocks, it is important to assess various factors that can affect the performance and value of the stock. Understanding these factors and conducting thorough research can help you make informed investment decisions. Here are some key factors to consider:

- Financial Performance: Analyze Yahoo’s financial statements to evaluate its revenue growth, profitability, and cash flow. Look for consistent revenue growth and healthy financial ratios, such as a strong return on equity and a manageable debt-to-equity ratio. A company with sound financial performance is more likely to withstand market volatility and provide long-term value for investors.

- Competition: Assess the competitive landscape in which Yahoo operates. Consider the presence of major competitors, such as Google, Microsoft, and Facebook, and evaluate Yahoo’s ability to differentiate itself in the market. A company with a strong competitive advantage is better positioned to capture market share and drive growth.

- Market Trends: Stay informed about the latest market trends and industry developments that may impact Yahoo’s business. For example, changes in user behavior, advancements in technology, or shifts in advertising trends can significantly influence Yahoo’s revenue streams. Understanding these trends will help you assess the company’s future prospects.

- Strategic Initiatives: Keep track of Yahoo’s strategic initiatives and investments. Look for evidence of innovation, partnerships, and acquisitions that can potentially drive growth and improve the company’s competitive position. Evaluate the success of previous strategic moves and the company’s ability to execute its plans effectively.

- Regulatory Environment: Consider the regulatory environment in which Yahoo operates. Changes in privacy laws, data protection regulations, or government policies can impact the company’s operations and financial performance. Stay updated on any regulatory developments that may affect Yahoo’s business model.

It is essential to conduct thorough research and seek advice from financial experts or investment professionals before making any investment decisions. Remember that investing in stocks involves risks, and there are no guarantees of returns. By carefully evaluating these factors, you can make well-informed investment choices regarding Yahoo stocks.

Potential Risks of Investing in Yahoo Stocks

While investing in Yahoo stocks may present attractive opportunities, it is crucial to be aware of the potential risks involved. Understanding these risks can help you make informed investment decisions. Here are some key risks associated with investing in Yahoo stocks:

- Market Volatility: The stock market is inherently volatile, and Yahoo stocks are not immune to market fluctuations. Economic uncertainties, geopolitical events, and changes in investor sentiment can impact the value of Yahoo stocks. It’s important to be prepared for short-term market turbulence and have a long-term investment outlook.

- Competition: Yahoo operates in a highly competitive industry. Major tech giants, such as Google and Facebook, compete for users’ attention and advertising revenues. Increased competition can potentially affect Yahoo’s market share, growth prospects, and profitability. Monitoring the competitive landscape is important when evaluating the potential risks of investing in Yahoo stocks.

- Technological Disruption: The technology landscape is constantly evolving, and disruptive technologies can have a significant impact on companies like Yahoo. Shifts in user behavior, emerging technologies, or changes in the digital advertising landscape can challenge Yahoo’s business model and affect its revenue streams. It’s crucial to assess the company’s ability to adapt and innovate in a rapidly changing technological environment.

- Regulatory Changes: Regulations and legal frameworks can impact Yahoo’s operations and financial performance. Changes in privacy laws, data protection regulations, or government policies may require Yahoo to make adjustments or incur additional costs. Monitoring the regulatory environment and its potential impact on Yahoo’s business is essential when considering the risks of investing in Yahoo stocks.

- Company-Specific Challenges: Yahoo’s performance and stock value can be influenced by company-specific factors. Management changes, unsuccessful strategic initiatives, cybersecurity threats, or legal disputes can impact Yahoo’s reputation, financial position, and shareholder value. Assessing the company’s ability to overcome such challenges is important in understanding the risks associated with Yahoo stocks.

It’s important to remember that all investments carry risks, and Yahoo stocks are no exception. Conducting thorough research, staying informed about market trends, and diversifying your investment portfolio can help mitigate some of these risks. Consulting with a financial advisor or investment professional can also provide valuable insights and guidance when considering the potential risks associated with investing in Yahoo stocks.

Where to Invest in Yahoo Stocks

When it comes to investing in Yahoo stocks, there are a few options available. Here are some avenues to consider:

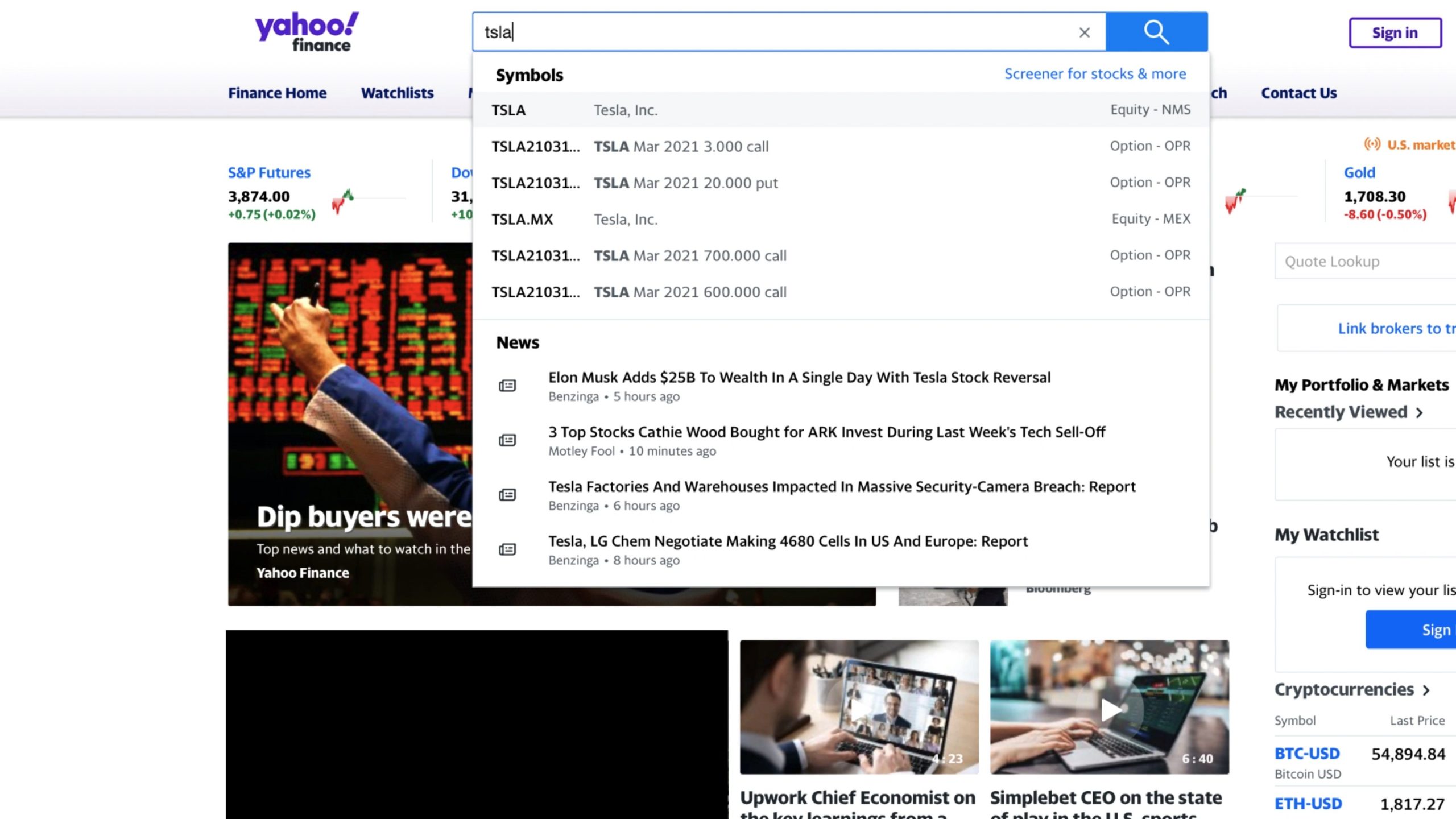

- Stock Exchanges: Yahoo stocks are listed and traded on major stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. Investors can purchase Yahoo stocks directly through a brokerage account on these exchanges. It’s important to choose a reputable and reliable brokerage platform that suits your individual investment needs.

- Index Funds and ETFs: Another option to gain exposure to Yahoo stocks is through index funds or exchange-traded funds (ETFs) that include Yahoo in their portfolio. These funds offer a diversified approach by investing in a basket of stocks, including Yahoo. This can be a suitable option for investors who prefer a more diversified investment approach.

- Mutual Funds: Mutual funds are professionally managed investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks. Some mutual funds may include Yahoo stocks in their holdings. Investors can research and select mutual funds that align with their investment goals and risk tolerance.

- Individual Retirement Accounts (IRAs): For investors who want to include Yahoo stocks in their retirement portfolio, individual retirement accounts (IRAs) can be a suitable option. IRAs provide tax advantages, allowing individuals to save for retirement while potentially benefiting from the capital appreciation of Yahoo stocks over the long term.

- Online Investment Platforms: Online investment platforms have gained popularity in recent years, providing individuals with an easy and convenient way to invest in stocks. These platforms often offer a user-friendly interface, competitive pricing, and educational resources to help beginners get started. Some popular online investment platforms include Robinhood, E*TRADE, and TD Ameritrade.

When deciding where to invest in Yahoo stocks, it is important to assess factors such as fees, customer service, trading tools, and research resources offered by the chosen investment platform or brokerage. Conducting due diligence and understanding the terms and conditions associated with the investment platform is crucial to ensure a smooth and satisfactory investment experience.

Additionally, keep in mind that stock investments involve risks, and it is important to diversify your investment portfolio to mitigate risk. Consider consulting with a financial advisor or investment professional to help determine the most suitable approach and investment strategy based on your individual financial goals and risk tolerance.

Conclusion

Investing in Yahoo stocks can be an exciting opportunity for individuals looking to diversify their investment portfolios and participate in the growth of a prominent technology and media company. However, before making any investment decisions, it is crucial to thoroughly evaluate the factors that can impact the performance of Yahoo stocks and understand the associated risks.

By considering factors such as Yahoo’s financial performance, competition, market trends, strategic initiatives, and regulatory environment, investors can make informed choices. It is important to conduct thorough research, stay updated on market developments, and seek professional advice to navigate the complexities of investing in stocks.

While potential risks exist, including market volatility, competition, technological disruption, regulatory changes, and company-specific challenges, investors can adopt risk management strategies and diversify their portfolios to mitigate these risks. Diversification can be achieved through investing in a variety of stocks, asset classes, and investment vehicles.

When determining where to invest in Yahoo stocks, investors have options such as stock exchanges, index funds/ETFs, mutual funds, individual retirement accounts (IRAs), and online investment platforms. Each option has its own advantages and considerations, and investors should choose the approach that aligns with their investment goals, risk tolerance, and preferences.

In conclusion, investing in Yahoo stocks can provide potential opportunities for growth and financial returns. However, investors should carefully assess the factors and risks involved, diversify their portfolios, and make informed investment decisions. By staying proactive, adaptable, and informed, investors can navigate the dynamic landscape of stock investing and potentially benefit from a stake in Yahoo’s continued success.