Finance

Why Did My Auto Insurance Go Up For No Reason

Published: October 6, 2023

Discover the reason behind your sudden auto insurance increase with our expert guide. Learn how finance plays a role in fluctuating insurance premiums.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Auto insurance is a necessary expense for every car owner. It provides financial protection against unforeseen accidents and liabilities on the road. However, you may have noticed that your auto insurance premium has increased without any apparent reason. This can be frustrating and leave you wondering why it happened.

While auto insurance rates can fluctuate for various reasons, it is essential to understand the factors that contribute to these changes. It is not uncommon for insurance premiums to go up even if you haven’t made any claims or had any accidents. In this article, we will explore some of the possible reasons why your auto insurance rates have increased.

Understanding the factors affecting your auto insurance rates can help you make informed decisions when it comes to managing your expenses and finding the best coverage options. By delving into the various factors and possible explanations, we hope to shed light on why your auto insurance may have gone up for no apparent reason.

Factors Affecting Auto Insurance Rates

Auto insurance rates are not set in stone and can vary depending on several factors. Insurance companies consider a variety of elements when determining the premium for a policyholder. It’s crucial to understand these factors to comprehend why your auto insurance rates may have increased:

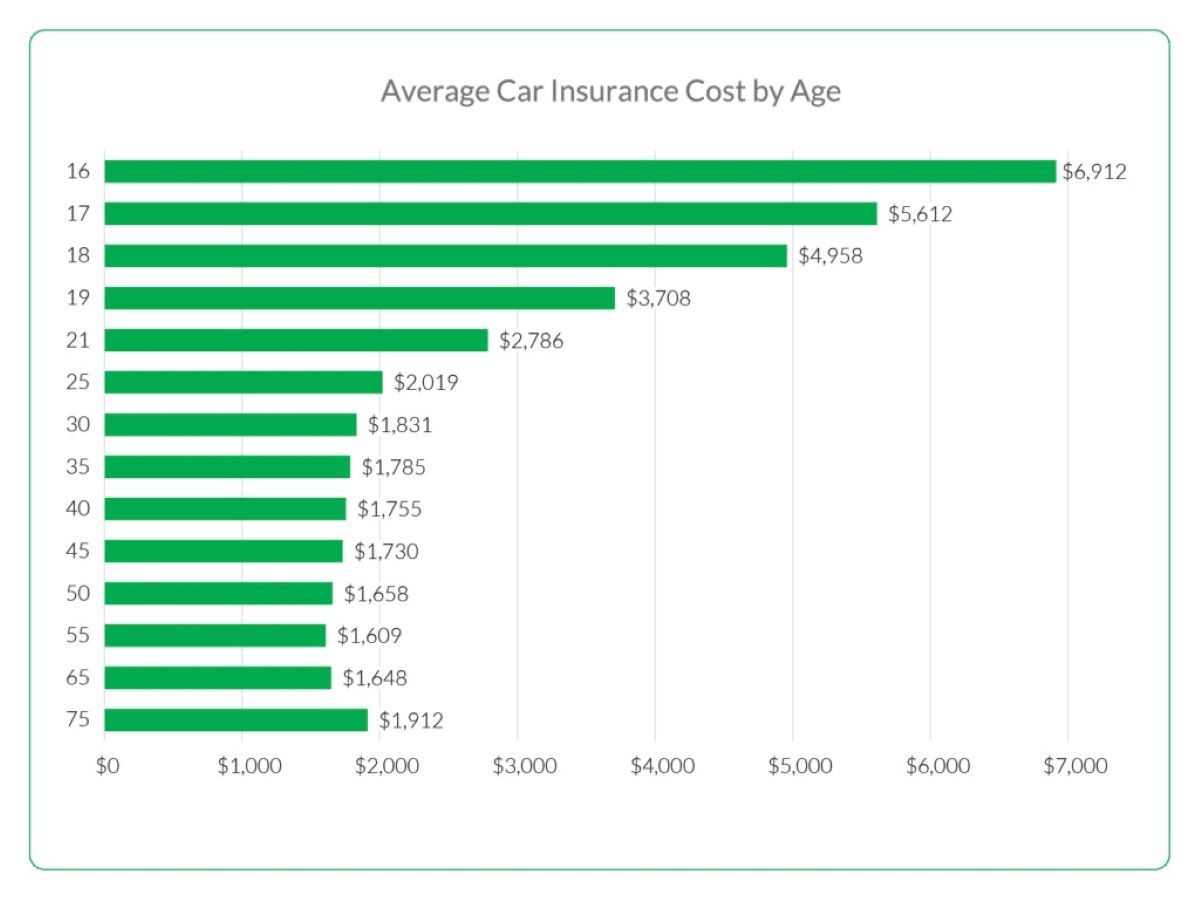

- Age and Gender: Younger drivers, particularly teenagers, are often perceived as high-risk individuals due to their limited driving experience. Similarly, statistics show that men tend to have more accidents and speeding violations than women, leading to higher rates for male drivers.

- Location: The area where you live can impact your auto insurance rates. If you reside in an area with high population density or a higher rate of accidents or thefts, you may experience increased premiums.

- Vehicle Type: The make, model, and age of your vehicle can influence your insurance rates. Cars with advanced safety features and lower theft rates generally qualify for lower rates. On the other hand, expensive luxury vehicles and sports cars often incur higher premiums.

- Driving Record: Your driving history plays a significant role in determining your auto insurance rates. If you have a history of accidents, traffic violations, or speeding tickets, insurance companies may consider you to be a higher risk, resulting in increased premiums.

- Credit Score: In some states and countries, insurance companies factor in your credit score when calculating your premium. Studies indicate that individuals with lower credit scores tend to file more claims, leading to higher insurance rates.

- Annual Mileage: The more you drive, the higher the chances of being involved in an accident. If your annual mileage has increased, it could lead to higher insurance rates.

These are just a few of the many factors that can contribute to changes in auto insurance rates. It is important to note that each insurance company has its own formula for determining rates and can weigh these factors differently.

Now that we have explored the various factors that can affect auto insurance rates, let’s delve into some possible explanations for why your rates may have increased even if you have not made any changes or claims.

Changes in Personal Circumstances

One of the reasons your auto insurance rates may have gone up for no apparent reason is changes in your personal circumstances. Insurance companies take into account various personal factors when determining your premium. Here are some common changes that can affect your rates:

- Marital Status: Getting married or divorced can impact your auto insurance rates. Studies have shown that married individuals tend to have fewer accidents and file fewer claims, resulting in lower premiums.

- Change of Address: Moving to a new location, especially to an area with higher accident rates or a higher crime rate, can lead to increased insurance premiums. Additionally, if you move from a rural area to an urban area, your rates may go up due to increased traffic and congestion.

- Change in Occupation: Some insurance companies consider your occupation when determining premiums. Certain professions, such as delivery drivers or those with long commutes, may be associated with higher risks, resulting in higher premiums.

- Adding or Removing Drivers: If you add a new driver to your policy, such as a teenager or someone with a poor driving history, your rates may increase. Conversely, if you remove a high-risk driver from your policy, it could lead to a decrease in premiums.

- Change in Credit Score: As mentioned earlier, your credit score can impact your auto insurance rates. If your credit score has decreased since your last policy renewal, it could result in higher premiums.

It’s important to notify your insurance company about any changes in your personal circumstances so that they can accurately adjust your premium. By keeping them informed, you can ensure that your coverage reflects your current situation and potentially avoid any surprises when it comes to renewal time.

In the next section, we will explore another potential reason for the increase in your auto insurance rates — changes in your driving record.

Changes in Driving Record

One of the most significant factors that can impact your auto insurance rates is your driving record. Insurance companies assess your driving habits and history to determine the likelihood of you filing a claim. If there have been any recent changes in your driving record, it could be a reason why your insurance rates have increased. Here are some factors related to your driving record that may lead to higher premiums:

- Accidents: If you have been involved in an at-fault accident or multiple accidents, insurance companies may consider you a higher risk driver. This higher risk translates into increased premiums.

- Traffic Violations: Moving violations such as speeding tickets, running red lights, or reckless driving can result in higher insurance rates. Insurance companies view these violations as indicators of risky behavior on the road.

- DUI/DWI: A conviction for driving under the influence (DUI) or driving while intoxicated (DWI) can have a significant impact on your insurance rates. This offense indicates a severe violation and demonstrates a higher risk of accidents.

- Suspended License: If your driver’s license has been suspended or revoked due to violations or failure to maintain insurance coverage, it can result in increased insurance premiums. This is because having a suspended license indicates a higher likelihood of engaging in risky behavior on the road.

It’s essential to note that insurance companies generally review your driving record at each policy renewal. Therefore, any changes in your driving history, such as the addition of new violations or accidents, can result in higher premiums.

Keep in mind that these changes in your driving record can have a significant impact on your auto insurance rates. It’s crucial to practice safe driving habits and maintain a clean driving record to potentially qualify for lower insurance premiums in the future.

In the next section, we will explore another potential reason for the increase in your auto insurance rates — changes in your insurance company’s policies.

Changes in Insurance Company Policies

Another potential reason for the increase in your auto insurance rates is changes in your insurance company’s policies. Insurance companies regularly review and adjust their pricing strategies and risk assessment methods. These policy changes can result in higher premiums for policyholders. Here are a few scenarios where changes in insurance company policies can impact your rates:

- Rate Increases: Insurance companies may decide to increase their rates across the board due to various factors, such as increased claim payouts or rising costs of medical treatments and vehicle repairs. These rate increases can result in higher premiums for existing policyholders.

- Adjustment of Underwriting Factors: Insurance companies use various underwriting factors to assess risk and set premiums. If an insurance company revises its underwriting guidelines, it can impact how certain factors are weighted. For example, they may place more emphasis on driving record or credit score, leading to higher rates for individuals with certain risk factors.

- Changes in Discounts: Insurance companies often offer discounts to policyholders based on factors such as safe driving, multi-vehicle policies, or bundling home and auto insurance. If your insurance company removes or reduces these discounts, your rates may go up.

- Reevaluation of Risk Factors: Insurance companies regularly reassess the risks associated with various factors. For example, they may determine that certain vehicle makes and models are more prone to accidents or thefts than previously thought. As a result, the premiums for those vehicles may increase.

It’s important to review your policy and any correspondence from your insurance company to understand if changes in their policies have impacted your rates. If you notice a significant increase, it may be worth considering shopping around for quotes from different insurance providers to ensure you’re getting the best possible rate.

In the next section, we will explore another potential reason for the increase in your auto insurance rates — changes in state regulations.

Changes in State Regulations

Changes in state regulations can also play a role in the increase of your auto insurance rates. State governments have the authority to set regulations and laws that govern the insurance industry. These regulations can impact the cost of insurance and the factors that insurance companies consider when determining premiums. Here are a few ways changes in state regulations can affect your rates:

- Mandatory Coverage Levels: State laws can dictate the minimum coverage levels required for auto insurance. If the state increases these minimum requirements, insurance companies may adjust their rates accordingly.

- Tort Reform: Changes in state laws related to tort reform can impact insurance rates. Tort reform typically aims to limit the amount of compensation individuals can receive in personal injury lawsuits. Insurance companies may adjust rates based on the anticipated impact of these changes on claim costs.

- No-Fault Insurance: Some states have no-fault insurance systems, where each driver’s insurance company pays for their own medical expenses, regardless of fault. If a state transitions to a no-fault system or modifies existing rules, it can result in changes to insurance premiums.

- Regulatory Changes: Changes in regulations governing the insurance industry as a whole, such as licensing requirements or consumer protection laws, can impact insurance costs. These changes may require insurance companies to adjust their operations, which can affect rates.

It’s important to stay informed about any changes in state regulations that could impact your auto insurance rates. Familiarize yourself with the laws specific to your state and consider consulting with your insurance agent or company to understand how these changes may affect your premium.

Now that we have explored the potential reasons for the increase in your auto insurance rates, let’s continue with the next section, which examines increased risk factors.

Increased Risk Factors

Another possible reason for the increase in your auto insurance rates is an increase in risk factors associated with insuring you as a driver. Insurance companies assess risk to determine the likelihood of a claim being filed and adjust premiums accordingly. Here are some common risk factors that can contribute to higher insurance rates:

- Claim History: If you have recently filed multiple claims or had a significant claim payout, insurance companies may view you as a higher risk driver. This can result in increased premiums as the insurer perceives a greater likelihood of future claims.

- Change in Vehicle Usage: If you have started using your vehicle for business purposes or have significantly increased your mileage, it can be considered a higher risk factor. Increased usage implies more exposure to potential accidents and may lead to higher insurance rates.

- Insurance Lapse or Cancellation: If you have previously allowed your auto insurance coverage to lapse or your policy was canceled due to non-payment, it can signal to insurers that you may be a higher-risk driver. Reinstating coverage or finding a new policy after a lapse can result in higher premiums.

- Uninsured Motorist Claims: If you have been involved in an accident with an uninsured or underinsured motorist and made a claim against your own policy, it can impact your rates. Insurance companies consider such incidents as a higher risk and may adjust premiums accordingly.

It’s essential to be aware of how these risk factors can impact your insurance rates. While some factors may be beyond your control, evaluating and addressing any controllable factors can help mitigate the risk and potentially lead to lower insurance premiums.

In the final section, we will briefly explore the potential impact of inflation and economic factors on your auto insurance rates.

Inflation and Economic Factors

Inflation and economic factors can also contribute to an increase in auto insurance rates. As prices rise due to inflation, insurance companies may adjust their premiums to keep up with the increased cost of vehicle repairs, medical expenses, and other related expenses. Here are some ways in which inflation and economic factors can impact your auto insurance rates:

- Increased Cost of Vehicle Repairs: As the cost of auto parts and labor increases due to inflation, insurance companies may need to raise premiums to cover the higher expenses associated with repairing vehicles involved in accidents.

- Higher Medical Expenses: Inflation can drive up the cost of medical treatments and healthcare services. Since auto insurance includes coverage for medical expenses resulting from accidents, insurers may adjust premiums to account for these rising costs.

- Rising Insurance Industry Costs: Insurance companies have their own operational expenses, such as salaries, overhead costs, and technology investments, which can be subject to inflation. To offset these increased costs, insurers may pass some of the expenses onto policyholders through higher premiums.

- Impact of Economic Conditions: Economic conditions, such as a recession or an increase in unemployment rates, can affect auto insurance rates. A struggling economy may result in a higher number of uninsured motorists or an increase in fraudulent claims, which can contribute to higher insurance costs for everyone.

It’s important to understand that inflation and economic factors are external forces that can impact insurance rates across the industry. While these factors may not be within your control, staying informed about changes in the economy and monitoring your insurance premiums can help you make informed decisions and consider shopping around for better rates if necessary.

Now that we have explored the potential impact of inflation and economic factors on auto insurance rates, let’s summarize the information we have covered.

Conclusion

In conclusion, there are several potential reasons why your auto insurance rates may have increased for what seems like no reason. Understanding these factors can help you navigate the world of insurance and make informed decisions. Here are the main points to remember:

- Factors such as age, gender, location, driving record, credit score, and annual mileage can all affect your auto insurance rates.

- Changes in personal circumstances, such as marital status, address, occupation, and adding or removing drivers, can impact your rates.

- Changes in your driving record, including accidents, traffic violations, DUI/DWI, and suspended licenses, can lead to higher premiums.

- Changes in your insurance company’s policies, such as rate increases, adjustments in underwriting factors, changes in discounts, and reevaluation of risk factors, can result in higher premiums.

- Changes in state regulations, mandatory coverage levels, tort reform, no-fault insurance, and other regulatory changes, can impact insurance rates.

- Increased risk factors like a history of claims, changes in vehicle usage, insurance lapse or cancellation, and uninsured motorist claims can lead to higher premiums.

- Inflation and economic factors, such as increased vehicle repair costs, higher medical expenses, rising insurance industry costs, and the impact of economic conditions, can contribute to increased rates.

If you experience a sudden increase in your auto insurance rates, it’s important to review your policy, discuss the changes with your insurance company, and consider shopping around for quotes from different providers. By being proactive and informed, you can find the best coverage options that suit your needs and potentially lower your insurance costs.

Remember, auto insurance rates are not set in stone and can fluctuate due to various factors. Stay vigilant, practice safe driving habits, and stay informed about any changes that may affect your premiums. Dedicating time to understanding your auto insurance policy will ultimately help you make well-informed decisions and protect yourself financially on the road.