Home>Finance>Why Did My Car Insurance Go Down In The Middle Of A Billing Cycle

Finance

Why Did My Car Insurance Go Down In The Middle Of A Billing Cycle

Published: March 7, 2024

Discover why your car insurance decreased mid-billing cycle and the financial implications. Learn how this change impacts your budget and finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the Fluctuations in Car Insurance Premiums

- Understanding the Variables That Impact Insurance Premiums

- How Adjustments in Driving Habits Can Impact Insurance Premiums

- How Adjustments to Insurance Coverage Can Impact Premiums

- How Updates to Personal Details Can Impact Car Insurance Premiums

- How Adjustments to Vehicle Details Can Impact Insurance Premiums

- Navigating the Dynamics of Car Insurance Premiums

Introduction

Understanding the Fluctuations in Car Insurance Premiums

Car insurance premiums are often a source of confusion and frustration for many drivers. It's not uncommon for individuals to notice unexpected changes in their insurance costs, even in the middle of a billing cycle. While these fluctuations can be perplexing, they are not arbitrary. In fact, several factors can contribute to such variations, and understanding them can provide clarity and peace of mind.

In this article, we will delve into the intricacies of car insurance premiums and explore the reasons behind unexpected changes in the midst of a billing cycle. By shedding light on the various factors that influence insurance rates, we aim to empower drivers with the knowledge to make informed decisions and navigate the complexities of car insurance with confidence.

Whether you've experienced a sudden drop in your car insurance premium or are simply curious about the potential reasons for such fluctuations, this article will unravel the mysteries behind these changes and equip you with valuable insights to better comprehend and manage your car insurance costs.

Factors Affecting Car Insurance Rates

Understanding the Variables That Impact Insurance Premiums

Car insurance premiums are influenced by a myriad of factors, each playing a distinct role in determining the cost of coverage. By comprehending these variables, drivers can gain a clearer understanding of the dynamics at play and the reasons behind fluctuations in their insurance rates.

1. Driving Record: A driver’s history of accidents, traffic violations, and claims significantly influences their insurance premiums. A clean driving record often leads to lower rates, whereas a history of accidents or traffic infractions can result in higher premiums.

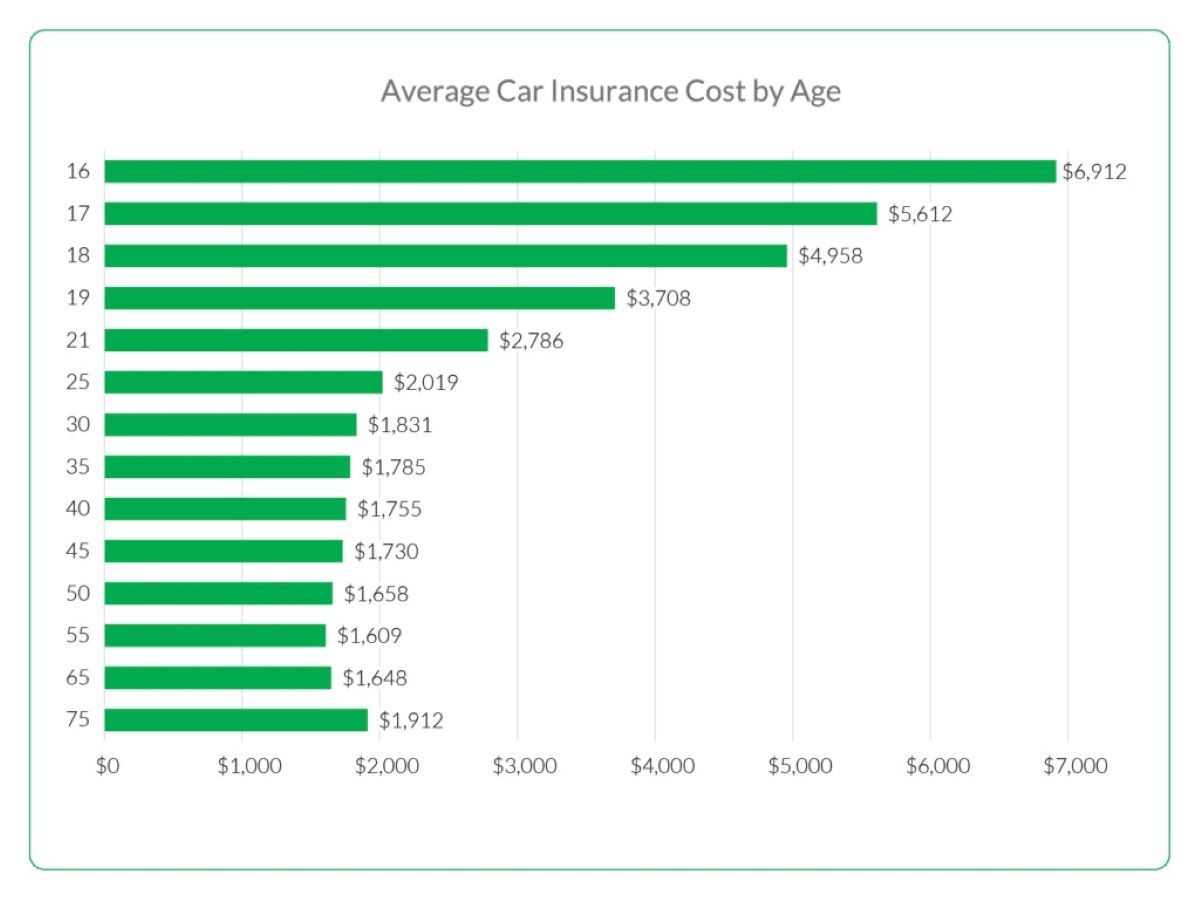

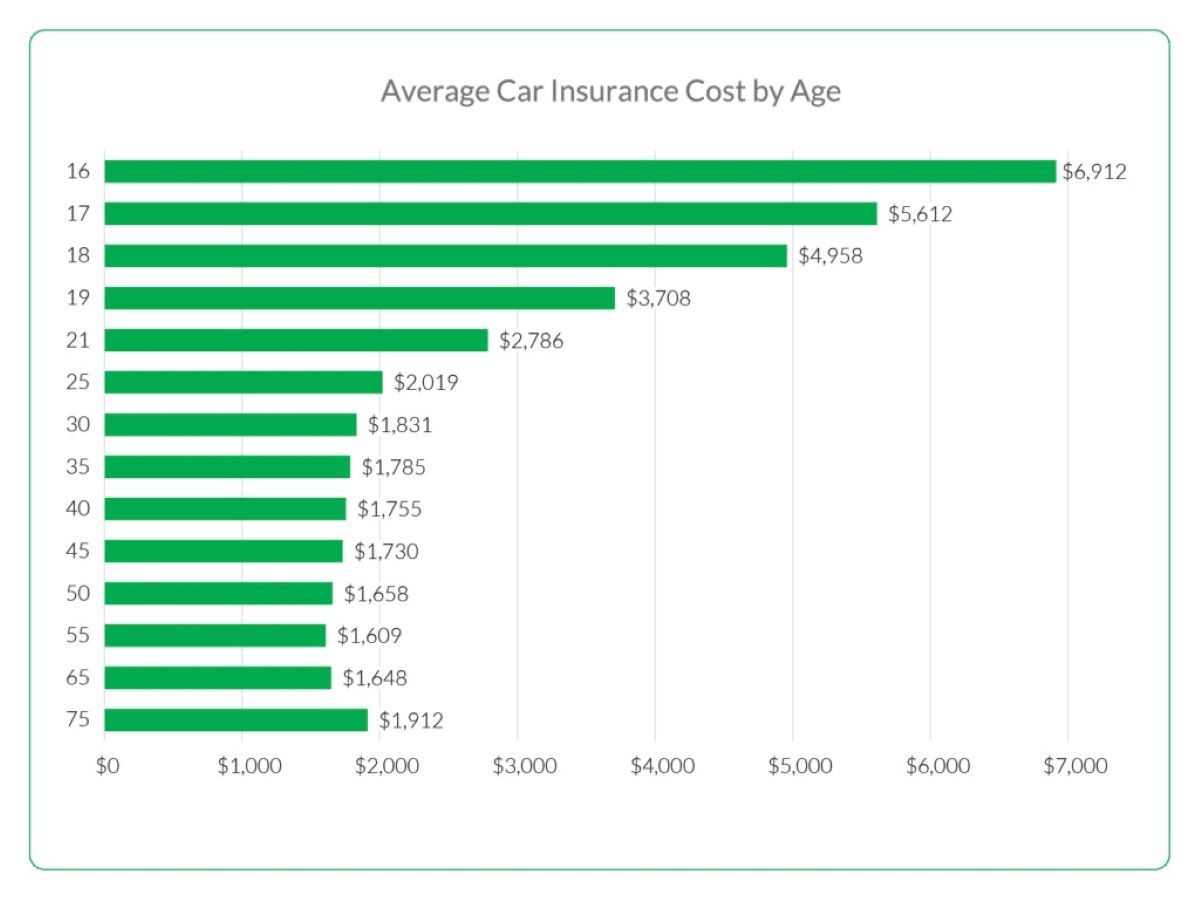

2. Age and Experience: Young and inexperienced drivers typically face higher insurance costs due to their perceived higher risk. Conversely, older, more experienced drivers may benefit from lower premiums.

3. Location: The area in which a driver resides can impact insurance rates. Urban areas with higher rates of accidents or theft may lead to increased premiums compared to rural or suburban locations.

4. Vehicle Type: The make, model, and year of the insured vehicle play a crucial role in determining insurance costs. Factors such as the car’s safety features, value, and likelihood of theft or damage are taken into account.

5. Credit Score: In many regions, credit history is used as a factor in calculating insurance premiums. Individuals with higher credit scores may be eligible for lower insurance rates.

6. Coverage Limits and Deductibles: The extent of coverage and the chosen deductible amount directly impact insurance premiums. Higher coverage limits and lower deductibles often result in higher premiums, while opting for lower coverage limits and higher deductibles can lead to reduced costs.

7. Marital Status: Married individuals may be eligible for lower insurance rates, as they are perceived to be more responsible and less prone to risky driving behavior.

8. Annual Mileage: The number of miles driven annually can influence insurance premiums, with higher mileage often correlating to increased risk and higher costs.

By considering these factors, drivers can gain insight into the complexities of insurance premium calculations and the various elements that contribute to the fluctuations in their car insurance rates.

Changes in Driving Behavior

How Adjustments in Driving Habits Can Impact Insurance Premiums

One of the key factors that can lead to fluctuations in car insurance premiums is changes in driving behavior. Insurers often take into account an individual’s driving habits and patterns when determining insurance rates, and alterations in these behaviors can directly impact the cost of coverage.

1. Mileage Adjustments: A significant change in the number of miles driven annually can influence insurance premiums. If a driver’s commuting distance or overall mileage decreases, they may be eligible for lower premiums, as reduced time on the road typically equates to a lower risk of accidents.

2. Driving Infractions or Accidents: The occurrence of traffic violations or accidents during a billing cycle can lead to immediate adjustments in insurance premiums. Instances of reckless driving, speeding tickets, or at-fault accidents can result in premium increases, reflecting the heightened risk associated with such behaviors.

3. Defensive Driving Courses: Conversely, participation in defensive driving courses or programs aimed at enhancing road safety can have a positive impact on insurance premiums. Many insurers offer discounts to drivers who proactively engage in such educational initiatives, recognizing the potential reduction in risk associated with improved driving skills.

4. Vehicle Usage: Changes in the primary use of a vehicle, such as transitioning from personal use to commercial use or vice versa, can prompt adjustments in insurance premiums. It’s essential to inform the insurer of any significant shifts in vehicle usage to ensure accurate coverage and premiums.

By being mindful of these potential influences on insurance premiums, drivers can proactively manage their coverage costs and make informed decisions regarding their driving behaviors and habits. Whether it involves reducing mileage, prioritizing safe driving practices, or participating in educational programs, understanding the impact of driving behavior on insurance rates empowers individuals to take control of their coverage expenses.

Changes in Coverage

How Adjustments to Insurance Coverage Can Impact Premiums

Modifying the coverage of a car insurance policy can have a direct impact on the associated premiums. Whether it involves increasing or decreasing coverage limits, adjusting deductibles, or adding supplementary protections, changes in coverage can lead to fluctuations in insurance costs.

1. Coverage Limits: Altering the limits of coverage, such as liability, comprehensive, and collision coverage, can result in adjustments to insurance premiums. Increasing coverage limits typically leads to higher premiums, as it expands the level of financial protection provided by the policy. Conversely, reducing coverage limits may result in lower premiums, albeit with a potential increase in out-of-pocket expenses in the event of a claim.

2. Deductible Adjustments: The chosen deductible amount, which represents the portion of a claim that the policyholder is responsible for covering, can impact insurance premiums. Opting for a higher deductible often leads to lower premiums, as it signifies a greater financial contribution from the policyholder in the event of a claim, thereby reducing the insurer’s risk.

3. Additional Protections: Adding supplemental coverage options, such as roadside assistance, rental car reimbursement, or gap insurance, can influence insurance premiums. While these additional protections offer enhanced peace of mind and support, they also contribute to an increase in policy costs.

4. Policy Endorsements: Endorsements or riders that modify specific aspects of the policy, such as coverage for custom parts and equipment or special endorsements for high-value items, can lead to adjustments in insurance premiums. These endorsements cater to unique needs and preferences but may impact the overall cost of coverage.

By being mindful of the potential ramifications of adjusting insurance coverage, drivers can make informed decisions that align with their individual needs and financial circumstances. Whether it involves tailoring coverage to specific requirements, seeking cost-saving opportunities through deductible adjustments, or evaluating the necessity of supplemental protections, understanding the relationship between coverage modifications and insurance premiums empowers individuals to navigate their insurance policies effectively.

Changes in Personal Information

How Updates to Personal Details Can Impact Car Insurance Premiums

Changes in personal information, such as marital status, address, and credit score, can significantly influence car insurance premiums. Insurers often consider these factors when calculating insurance rates, and alterations to personal details can lead to adjustments in the cost of coverage.

1. Marital Status: Getting married or divorced can impact insurance premiums. Married individuals may be eligible for lower rates, as they are perceived to be more stable and responsible. Conversely, a change in marital status may prompt adjustments in insurance costs, reflecting the evolving risk profile associated with such life changes.

2. Address Updates: Relocating to a new address, particularly to a different ZIP code or area with distinct risk factors, can lead to changes in insurance premiums. Urban, suburban, and rural areas may have varying rates of accidents and theft, influencing the cost of coverage based on the new location.

3. Credit Score Changes: Fluctuations in credit scores can impact insurance premiums in regions where credit history is utilized as a rating factor. Improvements in credit scores may lead to lower premiums, while declines in creditworthiness can result in increased insurance costs.

4. Employment Changes: Certain insurers consider occupation and employment status when determining insurance rates. Shifts in employment, particularly if they involve changes in commuting distance or usage patterns, can influence insurance premiums.

By remaining mindful of the potential impact of personal information updates on insurance premiums, individuals can proactively manage their coverage costs and ensure that their policies accurately reflect their current circumstances. Whether it involves notifying the insurer of a change in marital status, updating address details, or monitoring credit score fluctuations, understanding the relationship between personal information and insurance rates empowers individuals to navigate their policies effectively.

Changes in Vehicle Information

How Adjustments to Vehicle Details Can Impact Insurance Premiums

Modifying the details of the insured vehicle can have a direct impact on car insurance premiums. Whether it involves changes to the vehicle’s make and model, usage patterns, or safety features, adjustments in vehicle information can lead to fluctuations in insurance costs.

1. Vehicle Upgrades: Installing safety features or anti-theft devices in the insured vehicle can potentially lead to lower insurance premiums. Safety enhancements such as anti-lock brakes, electronic stability control, or advanced airbag systems demonstrate a commitment to risk reduction, which insurers may reward with cost savings.

2. Vehicle Modifications: Customizations or modifications to the vehicle, such as engine enhancements, body kit installations, or performance upgrades, can impact insurance premiums. These alterations may increase the vehicle’s value and risk profile, leading to adjustments in insurance costs.

3. Change in Primary Use: Adjusting the primary use of the vehicle, such as transitioning from personal use to commercial use or vice versa, can prompt changes in insurance premiums. Commercial usage typically involves higher mileage and increased exposure to potential risks, which can influence the cost of coverage.

4. Vehicle Replacement: Replacing the insured vehicle with a new model or a different make and model can lead to adjustments in insurance premiums. The value, safety features, and theft susceptibility of the new vehicle are factors that insurers consider when calculating premiums.

By understanding the potential impact of adjustments to vehicle information on insurance premiums, individuals can make informed decisions regarding their coverage costs. Whether it involves implementing safety enhancements, monitoring modifications, or evaluating the implications of vehicle replacements, recognizing the relationship between vehicle details and insurance rates empowers individuals to manage their policies effectively.

Conclusion

Navigating the Dynamics of Car Insurance Premiums

Fluctuations in car insurance premiums, even in the middle of a billing cycle, can often leave drivers puzzled and seeking clarity. However, by delving into the multifaceted factors that influence insurance rates, individuals can gain valuable insights into the intricacies of premium calculations and the potential reasons behind unexpected changes in their coverage costs.

From the impact of driving behavior and personal information updates to the significance of coverage modifications and adjustments to vehicle details, it becomes evident that numerous variables contribute to the dynamic nature of car insurance premiums. Understanding these influences empowers drivers to make informed decisions, proactively manage their coverage costs, and navigate the complexities of car insurance with confidence.

By recognizing the relationship between driving habits and insurance rates, individuals can strive to prioritize safe and responsible behaviors, potentially leading to cost savings and enhanced road safety. Moreover, staying mindful of the implications of personal information changes and vehicle adjustments enables drivers to ensure that their insurance policies accurately reflect their current circumstances, thereby avoiding potential discrepancies in coverage and premiums.

Ultimately, the fluctuations in car insurance premiums serve as a reminder of the nuanced interplay between individual factors and insurance costs. By embracing a proactive and informed approach to managing their policies, drivers can not only comprehend the reasons behind premium variations but also optimize their coverage to align with their evolving needs and circumstances.

Armed with a deeper understanding of the variables that shape insurance rates, individuals are better equipped to navigate the ever-changing landscape of car insurance, make strategic choices to mitigate premium fluctuations, and embark on their journeys with the confidence that their coverage aligns with their unique situations and preferences.