Finance

Why Did My Car Insurance Go Up Progressive?

Published: November 10, 2023

Looking to understand why your car insurance rates have gone up with Progressive? Get expert insights on the financial factors that could be affecting your premiums.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Car insurance premiums can be a significant expense for drivers, and it can be frustrating to see your rates increase, especially if you haven’t had any recent accidents or claims. Progressive, one of the leading car insurance providers, is known for its competitive premiums, personalized policies, and user-friendly approach. However, there can be various reasons why your car insurance rates with Progressive may have gone up.

Understanding the factors that can cause an increase in car insurance rates is crucial. It allows you to evaluate your options, make necessary changes, and potentially find ways to mitigate the increase. While there can be several reasons for the increase, it is important to remember that insurance companies like Progressive consider multiple variables when determining premiums.

Progressive takes into account factors such as your driving record, vehicle type, location, age, and more. These factors help insurance companies assess the risk associated with insuring you and calculate your premiums accordingly. Therefore, any changes in these factors can potentially impact your car insurance rates.

In this article, we will explore the possible reasons why your car insurance rates may have increased with Progressive. We’ll delve into the company’s pricing model, changes in your driving record, risk factors, and the overall insurance market. By understanding these factors, you’ll be better equipped to evaluate and potentially minimize the impact of a rate increase.

Factors that can Cause Car Insurance Rates to Increase

Car insurance rates are not set in stone, and they can fluctuate based on several factors. Here are some common factors that can cause your car insurance rates to increase:

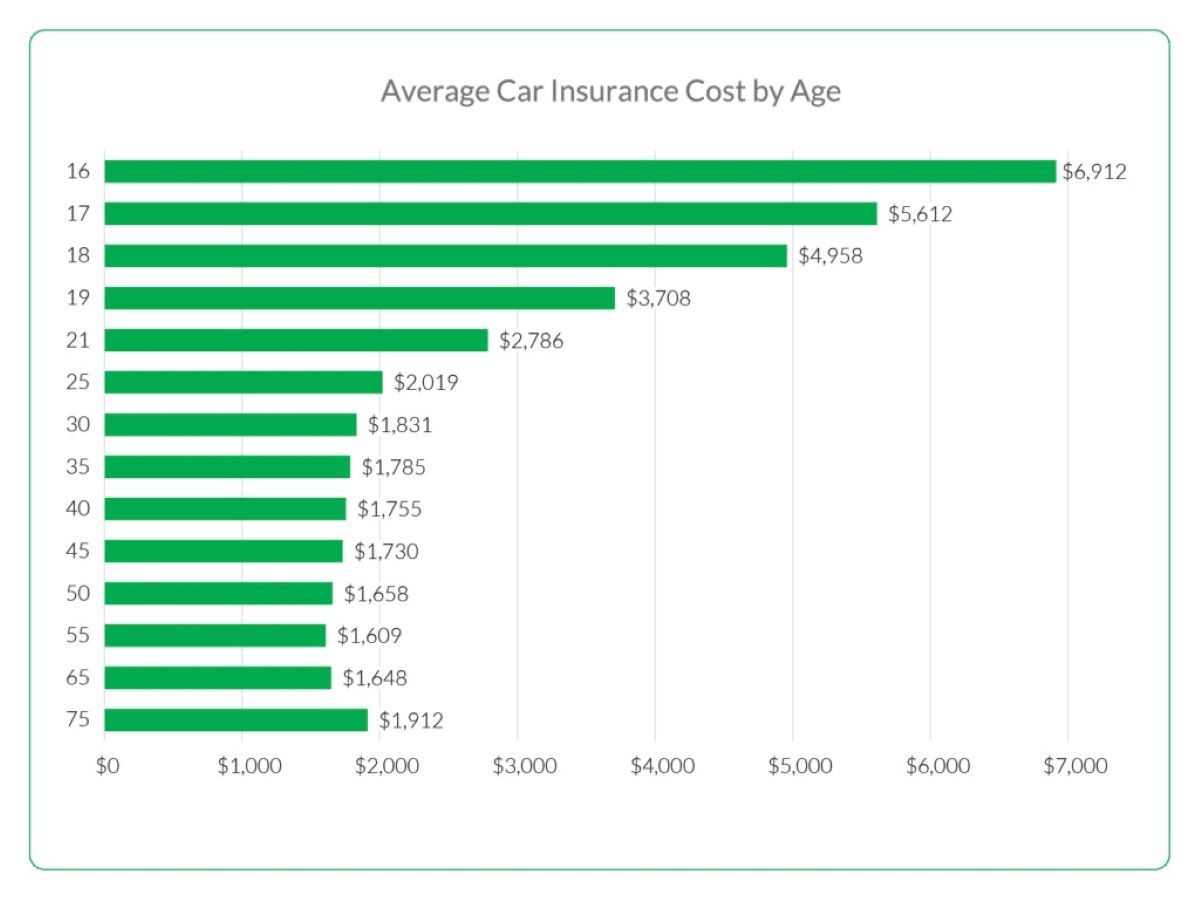

- Age and driving experience: Young, inexperienced drivers are statistically more likely to be involved in accidents, so they often face higher insurance premiums. Similarly, older individuals may also see an increase in rates due to potential health issues that can affect their driving ability.

- Driving record: One of the most significant factors in determining car insurance rates is your driving record. If you’ve recently had accidents, tickets, or traffic violations, insurance companies may view you as a higher risk driver and increase your premiums accordingly.

- Location: The area where you live can impact your car insurance rates. If you reside in an area with high crime rates, congested traffic, or a higher likelihood of accidents, insurance companies may charge higher premiums to offset the potential risk.

- Vehicle type: The type of vehicle you drive can also affect your insurance rates. Generally, expensive and high-performance cars tend to have higher insurance premiums due to the increased cost of repairs and replacement parts.

- Insurance claims: If you have recently filed claims with your insurance company, especially for at-fault accidents, it can lead to an increase in your premium. Insurance companies may view you as a higher risk and adjust your rates accordingly.

- Credit score: In some states, insurance companies use credit scores as one of the factors in determining car insurance rates. A low credit score can be indicative of financial irresponsibility, leading insurance providers to charge higher premiums.

- Changes in the insurance market: Insurance rates can also be influenced by larger market conditions, such as increased claims, natural disasters, or changes in legislation. These external factors can impact insurance companies’ financial stability and result in rate adjustments for policyholders.

It’s essential to keep in mind that each insurance company has its own pricing model and considers these factors differently. Therefore, the impact of these factors on your car insurance rates may vary depending on the specific company you are insured with.

Progressive’s Pricing Model

Understanding how Progressive determines its car insurance rates can provide insight into why your premiums may have increased. Progressive’s pricing model takes into account several factors to assess the risk associated with insuring a driver and to calculate an appropriate premium. Here are some key components of Progressive’s pricing model:

- Snapshot: Progressive offers a program called Snapshot, which rewards safe driving habits by monitoring your driving behavior through a device or a mobile app. This data is used to calculate personalized premiums based on your actual driving habits, such as driving speed, mileage, and time of day you drive. Drivers who demonstrate safe driving behaviors may be eligible for discounted rates.

- Usage-based insurance: Progressive’s pricing model also incorporates the concept of usage-based insurance. This approach considers factors such as how often you use your vehicle, the distance you typically drive, and your driving patterns. Drivers who use their vehicles less frequently may be eligible for lower premiums.

- Claims experience: Progressive takes into account your previous claims history when determining your rates. If you have filed multiple claims or had recent at-fault accidents, your premiums may increase. On the other hand, if you have a history of being a safe and responsible driver, it may have a positive impact on your rates.

- Discounts: Progressive offers various discounts that can help reduce your car insurance premiums. These discounts include safe driver discounts, multi-policy discounts, good student discounts, and discounts for installing anti-theft devices or safety features in your vehicle.

- Market conditions: Like any insurance provider, Progressive’s rates can also be influenced by market conditions, including changes in the overall insurance industry, regulatory changes, and trends in claims frequency and severity. These factors can impact pricing decisions and lead to rate adjustments.

- Underwriting guidelines: Progressive has specific underwriting guidelines that determine the eligibility and pricing for coverage. These guidelines consider factors such as your age, driving record, credit score, and the type of vehicle you drive. Meeting or exceeding the criteria set by these guidelines can result in lower premiums.

It is important to note that Progressive’s pricing model is complex and may vary depending on your personal circumstances. By understanding the different elements of their pricing model, you can gain insight into why your premiums may have increased and potentially find ways to lower them.

Reasons Why Your Car Insurance Premiums Might Have Increased with Progressive

While there can be various reasons for an increase in your car insurance premiums with Progressive, several common factors may have contributed to the change. Here are some possible reasons why your rates might have gone up:

- Changes in your driving record: If you recently have been involved in accidents, received tickets, or had any traffic violations, your driving record may negatively impact your premiums. Progressive closely considers your driving history when determining rates, and any negative changes can result in higher premiums.

- Changes in risk factors: Certain risk factors, such as your age, location, or vehicle type, can influence your premium rates. If any of these factors have changed since you last renewed your policy, it could lead to an increase in your rates. For example, moving to an area with higher traffic or increased crime rates may result in higher premiums.

- Insurance claims: If you’ve recently filed multiple claims or had at-fault accidents, Progressive may consider you a higher risk driver. Insurance companies typically adjust premiums for individuals who have a history of claims, as they are more likely to file future claims. This can result in an increase in your car insurance rates.

- Losses experienced by Progressive: If Progressive has experienced a higher number of claims or increased losses in a particular region or among a specific group of policyholders, they may adjust premiums to offset these costs. While this factor is not directly under your control, it can impact the rates offered by Progressive.

- Changes in the insurance market: External factors, such as changes in the overall insurance market, can influence car insurance rates. If there has been an increase in claim frequency or severity across the industry, including factors like weather-related incidents or rise in repair costs, insurance companies like Progressive may raise rates to remain financially viable.

It’s important to review your policy periodically and stay informed about any changes that may impact your car insurance premiums. By understanding the reasons behind the increase, you can make informed decisions regarding your coverage and potentially explore options to mitigate the impact on your finances.

Changes in your Driving Record

One of the key factors that can contribute to an increase in your car insurance premiums with Progressive is any changes in your driving record. Progressive closely considers your driving history when determining your rates, and any negative changes can lead to higher premiums.

If you have recently been involved in accidents, received tickets, or had any traffic violations, these incidents can have a significant impact on your car insurance rates. Insurance companies like Progressive view these events as indicators of increased risk, as they suggest a higher likelihood of future accidents or claims.

Accidents, particularly those you are at fault for, can significantly impact your rates. Insurance companies consider the severity of the accidents, the cost of the claims paid out, and the frequency of accidents to assess the risk associated with insuring you. If you have a recent history of accidents, even if they were minor, it can result in an increase in your premiums.

Similarly, traffic violations such as speeding tickets, reckless driving, or running red lights can negatively impact your rates. These violations indicate a disregard for traffic laws and safe driving practices, which insurers consider as an increased risk. The more violations you accumulate, the higher the likelihood of an increase in your insurance premiums.

It is essential to understand that changes in your driving record are not permanent. Most insurance companies, including Progressive, consider a certain span of time when evaluating your driving record. As time passes without any additional accidents or violations, the negative impact on your premiums may decrease.

To mitigate the impact of changes in your driving record, it is crucial to practice safe driving habits. Obey traffic laws, maintain proper speed, and avoid distractions while driving. Additionally, consider taking defensive driving courses, as some insurance providers offer discounts for completing these courses, which can help offset any premium increases.

If you believe that there are inaccurate records or errors in your driving history, it is advisable to contact your local Department of Motor Vehicles (DMV) to rectify the issue. Ensuring that your driving record is accurate can prevent any unnecessary increase in your car insurance premiums.

Regularly reviewing your driving record and maintaining a clean record can help you avoid unnecessary premium increases. By practicing safe driving habits and staying vigilant on the road, you can improve your driving record and potentially lower your car insurance rates with Progressive.

Changes in the Risk Factors

Another factor that can contribute to an increase in your car insurance premiums with Progressive is any changes in the risk factors associated with insuring you. Risk factors such as age, location, and vehicle type are critical components in determining insurance rates. If any of these factors change, it can result in an adjustment to your premiums.

Age: As you get older, your car insurance rates typically decrease. Younger drivers, especially teenagers, are considered higher risk due to their lack of driving experience. Therefore, they often face higher insurance premiums. However, if you’ve recently entered a new age bracket, such as turning 25 or 30, and your rates have increased, it might be worth contacting Progressive to understand the rationale behind the increase.

Location: Your location plays a significant role in determining your car insurance rates. If you have recently moved to an area with higher crime rates, increased traffic congestion, or a higher likelihood of accidents, it can lead to an increase in your premiums. Insurance companies take into account the risk associated with the location where your vehicle is primarily driven and adjust rates accordingly.

Vehicle type: The type of vehicle you drive also affects your car insurance rates. Expensive and high-performance cars tend to have higher insurance premiums due to the potential cost of repairs or replacement parts. Additionally, if you’ve recently purchased a new car or made modifications to your existing vehicle, it could impact your insurance rates.

Changes in vehicle usage: If you’ve experienced changes in your driving habits, it can influence your car insurance rates. For example, if you now use your vehicle for business purposes or have significantly increased your annual mileage, Progressive may adjust your premiums to account for the increased risk associated with higher usage.

Credit score: In some states, insurance companies, including Progressive, consider credit scores as a factor in determining car insurance rates. A lower credit score can be seen as an indicator of financial irresponsibility, leading to higher premiums. If your credit score has recently decreased, it may contribute to an increase in your car insurance rates.

Changes in any of these risk factors can result in an adjustment to your car insurance premiums. While some changes may be beyond your control, it’s valuable to review your policy regularly and communicate with Progressive to understand the specific factors contributing to the increase in your rates. By staying informed and proactive, you can better manage any changes in the risk factors and possibly find options to mitigate the impact on your premiums.

Changes in the Insurance Market

The insurance market is subject to various external factors that can influence car insurance rates. Changes in the overall insurance market can impact premiums offered by companies like Progressive. Here are some key factors related to changes in the insurance market that may contribute to an increase in your car insurance premiums:

Increased claims frequency: If there has been a rise in the number of insurance claims filed across the industry, it can lead to higher premiums. This could be due to factors such as an increase in accidents, weather-related incidents, or other events that result in more claims being filed. Insurance companies, including Progressive, adjust premiums to account for the increased potential for payouts.

Increased claims severity: Not only the frequency but also the severity of claims can impact insurance rates. If there has been a significant increase in the cost of repairs, medical expenses, or legal settlements, insurance companies may adjust premiums to mitigate these increased costs. This ensures that the company remains financially stable and can continue to provide coverage to policyholders.

Economic conditions: Economic factors, such as inflation or changes in interest rates, can influence the insurance market. These conditions can impact insurance companies’ profitability, which may result in rate adjustments. Economic downturns can also lead to fraud or increased insurance risks, which can impact premiums.

Regulatory changes: Changes in legislation or regulations can impact the insurance industry and consequently affect car insurance rates. New laws or regulations related to insurance coverage, claims handling, or liability determination can result in increased costs for insurance providers. These costs may be passed on to policyholders, leading to higher premiums.

Market competition: Competition among insurance companies can also influence car insurance rates. If competitors increase their rates, it can prompt other companies, including Progressive, to adjust their premiums to remain competitive in the market. Increases in rates by multiple insurers can lead to an industry-wide trend of higher premiums.

External events: Catastrophic events, such as natural disasters or widespread accidents, can impact insurance rates. These events can result in increased claims, higher costs, and changes in the risk landscape for insurers. Thus, insurance companies adjust premiums to account for the potential impact of such events on their financial stability.

While changes in the insurance market may be beyond your control, it’s essential to stay informed and monitor any notices or communications from Progressive regarding rate adjustments. Reviewing your policy regularly and exploring options such as shopping around for competitive rates can help you manage the impact of market changes on your car insurance premiums.

Conclusion

Understanding why your car insurance premiums may have increased with Progressive is essential for managing your finances and making informed decisions about your coverage. While it can be frustrating to see rates go up, it’s important to remember that insurance companies, like Progressive, consider various factors when determining premiums.

We discussed some common factors that can cause car insurance rates to increase, such as changes in your driving record, risk factors, and the overall insurance market. Changes in your driving record, such as accidents or tickets, can lead to higher premiums. Similarly, changes in risk factors like age, location, and vehicle type can also impact your rates. Additionally, external market factors, like increased claims frequency, severity, economic conditions, regulatory changes, and market competition, can contribute to rate adjustments.

It’s crucial to review your policy regularly, stay informed about any changes in your driving record or risk factors, and communicate with Progressive to understand the specific reasons behind the rate increase. By practicing safe driving habits, maintaining a clean driving record, and exploring potential discounts or options to mitigate the impact, you may be able to lower your car insurance premiums.

Remember that car insurance rates are not set in stone, and you always have the option to shop around and compare quotes from different insurance providers. Taking the time to research and understand your coverage options can potentially lead to finding more favorable rates and the policy that best suits your needs.

In conclusion, while it can be disheartening to see an increase in your car insurance premiums with Progressive, by understanding the factors that influence these rates and proactively managing your driving record and risk factors, you can take steps to mitigate the impact and potentially find more affordable coverage options.