Home>Finance>Explain How People Manage Financial Risk Through Risk Transfer

Finance

Explain How People Manage Financial Risk Through Risk Transfer

Modified: December 30, 2023

Discover how individuals effectively manage financial risk through risk transfer strategies in the field of finance. Gain insights into various techniques and tools used to mitigate potential losses and safeguard investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Financial Risk

- Understanding Risk Transfer

- Types of Risk Transfer

- Insurance as a Method of Risk Transfer

- Reinsurance as a Method of Risk Transfer

- Hedging as a Method of Risk Transfer

- Options and Derivatives as Methods of Risk Transfer

- Benefits and Limitations of Risk Transfer

- Examples of Risk Transfer in Practice

- Conclusion

Introduction

Managing financial risk is an essential part of any individual or organization’s financial strategy. In today’s volatile and uncertain economic landscape, the ability to mitigate potential risks is crucial for maintaining financial stability and success. One key strategy used by individuals and businesses to manage financial risk is risk transfer.

Risk transfer involves the transfer of the potential financial loss associated with a specific risk from one party to another. This allows the transferring party to protect themselves against the negative financial consequences of an adverse event. By shifting the risk burden to another entity, individuals and organizations can focus on their core activities without the constant worry of a sudden financial setback.

There are various methods of risk transfer, each with its own benefits and limitations. These methods include insurance, reinsurance, hedging, and utilizing options and derivatives. Understanding how these methods work and their implications is essential for effectively managing financial risks.

This article will explore the concept of risk transfer in more depth, providing a comprehensive overview of the different methods and their significance. Additionally, we will discuss the benefits and limitations of risk transfer and provide real-world examples to illustrate how risk transfer is practiced in various industries.

By the end of this article, readers will have a solid understanding of how risk transfer can be used to manage financial risk and the factors to consider when implementing this strategy.

Definition of Financial Risk

Before delving into the concept of risk transfer, it is important to have a clear understanding of what financial risk entails. Financial risk refers to the possibility of a negative financial outcome or loss resulting from fluctuations in various factors such as interest rates, exchange rates, market conditions, credit default, or operational failures.

Financial risk is an inherent aspect of investment and financial activities. Every decision made in the realm of finance involves some level of risk, which can range from minimal to significant. The objective of managing financial risk is to identify, analyze, and take appropriate measures to mitigate or transfer these risks.

There are several types of financial risk that individuals and organizations face:

- Market Risk: Market risk refers to the possibility of financial loss arising from changes in market conditions such as fluctuations in stock prices, interest rates, commodity prices, or currency exchange rates. This risk is driven by external factors that are beyond an individual’s or organization’s control.

- Credit Risk: Credit risk is the risk of non-payment or default by counterparties or borrowers. This risk arises when individuals or organizations fail to fulfill their financial obligations, leading to potential losses for lenders or investors.

- Operational Risk: Operational risk refers to the risk of financial loss arising from inadequate or failed internal processes, people, or systems. This includes errors, fraud, system failures, or legal and regulatory compliance issues.

- Liquidity Risk: Liquidity risk is the risk of not being able to buy or sell an asset quickly without incurring significant losses. It relates to the ease with which an individual or organization can access cash or convert assets into cash.

- Reputation Risk: Reputation risk is the risk of damage to an individual’s or organization’s reputation, leading to a decline in trust and confidence from stakeholders. Negative public perception can have a significant impact on an organization’s financial standing and future prospects.

Understanding these different types of financial risk is crucial for effectively managing and mitigating potential losses. By identifying and assessing these risks, individuals and organizations can implement appropriate risk management strategies, such as risk transfer, to protect their financial well-being.

Understanding Risk Transfer

Risk transfer is a financial strategy that involves shifting the potential financial loss associated with a specific risk from one party to another. The transferring party transfers the risk burden to another entity, typically in exchange for a fee or premium. This enables the transferring party to protect themselves against the negative financial consequences that may arise from an unforeseen event.

When a risk is transferred, the party assuming the risk becomes responsible for compensating the transferring party in the event of a loss. The transfer can occur through various methods such as insurance, reinsurance, hedging, or utilizing options and derivatives. Each method has its own unique characteristics and applications, but they all serve the common purpose of transferring the potential financial risk to another entity.

Risk transfer is based on the principle of spreading the risk across multiple parties. By transferring the risk to a specialized entity or market, individuals and organizations can mitigate the impact of a potential loss and maintain their financial stability. Additionally, risk transfer allows parties to allocate their resources more efficiently and focus on their core activities instead of constantly worrying about the possibility of a financial setback.

It is important to note that the transfer of risk does not eliminate the risk itself. Instead, it redistributes the potential financial loss to another party that is better equipped to handle and manage the risk. The transferring party still retains some level of risk, such as the risk of the counterparty failing to fulfill its obligations. However, by transferring the risk, the party can minimize their exposure and protect themselves from significant financial losses.

Furthermore, risk transfer is not a one-size-fits-all solution. The most appropriate method of risk transfer will depend on various factors such as the nature of the risk, the financial resources and capabilities of the parties involved, and the specific industry or sector in question. It is essential to carefully evaluate the available options and consider the potential benefits and limitations of each method before implementing a risk transfer strategy.

In the following sections, we will explore different methods of risk transfer, including insurance, reinsurance, hedging, and options and derivatives. By understanding these methods and their applications, individuals and organizations can make informed decisions when it comes to managing their financial risk.

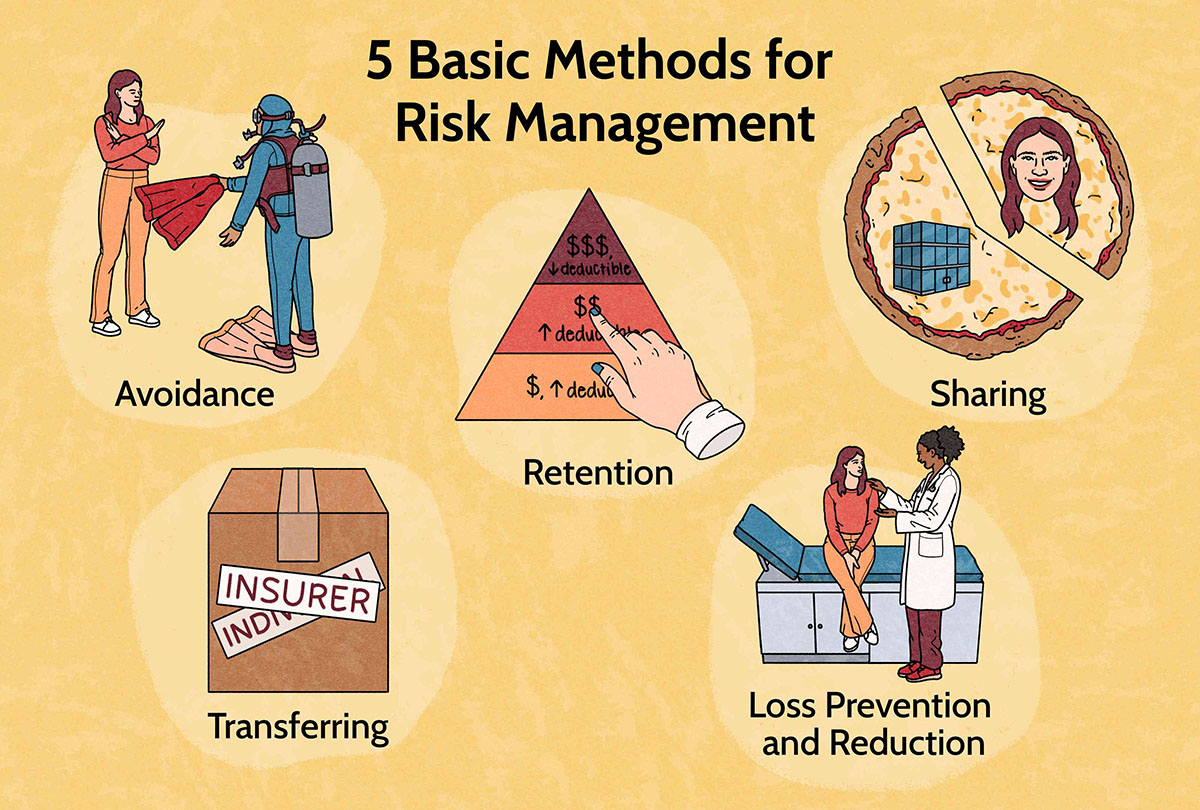

Types of Risk Transfer

Risk transfer can take various forms, depending on the specific needs and circumstances of individuals and organizations. Let’s explore some of the common types of risk transfer methods:

- Insurance: Insurance is one of the most well-known and widely used methods of risk transfer. It involves the transfer of the potential financial loss to an insurance company in exchange for payment of a premium. The insurance company assumes the risk and provides coverage in the event of a specified loss or occurrence. Insurance is commonly used to protect against risks such as property damage, liability claims, loss of income, and healthcare expenses.

- Reinsurance: Reinsurance is a specific type of risk transfer used by insurance companies to further spread their risk. Insurance companies transfer a portion of the risk they assume from policyholders to other insurers known as reinsurers. This enables the primary insurer to protect itself against catastrophic losses or large claims that may exceed its capacity. Reinsurance helps ensure the solvency and stability of insurance companies.

- Hedging: Hedging involves entering into financial transactions to offset the potential losses from adverse price movements or fluctuations in the market. It is commonly used in the context of commodities, currencies, interest rates, and securities. Hedging allows individuals and businesses to protect against potential losses by taking positions that will gain value if the underlying asset decreases in value.

- Options and Derivatives: Options and derivatives are financial instruments that provide the right, but not the obligation, to buy or sell an asset at a predetermined price and time. They are commonly used to transfer and manage risks associated with fluctuations in prices, interest rates, and currencies. Options and derivatives provide individuals and organizations with the flexibility to protect against potential losses while potentially benefiting from favorable market movements.

These are just a few examples of the types of risk transfer methods available. Each method has its own characteristics and applications, and the choice of method will depend on factors such as the specific risk being transferred, the financial resources available, and the level of desired protection. It is important to carefully analyze and consider the options available before implementing a risk transfer strategy to ensure effective risk management.

Next, we will explore insurance and reinsurance in more detail, as they are the most commonly used methods of risk transfer in various industries and sectors.

Insurance as a Method of Risk Transfer

Insurance is a widely adopted method of risk transfer that provides individuals and organizations with financial protection against potential losses. It involves transferring the risk of specific events or occurrences to an insurance company in exchange for the payment of a premium.

When an individual or organization purchases insurance, they enter into an agreement with the insurer, also known as the insurance policy. The policy outlines the terms and conditions of the coverage, including the scope of protection, the premium amount, and any deductibles or limits that apply.

Insurance covers a wide range of risks, such as property damage, liability claims, loss of income, and healthcare expenses. It plays a crucial role in providing individuals and organizations with peace of mind and financial security in the face of unexpected events.

The process of risk transfer through insurance involves the following key steps:

- Identification of Risks: The first step in purchasing insurance is identifying and assessing the potential risks that need to be mitigated. This involves understanding the specific risks associated with an individual’s or organization’s activities or assets.

- Selection of Insurance Coverage: After identifying the risks, individuals or organizations can select the appropriate insurance coverage to transfer those risks. This involves choosing the type of insurance policy, such as property insurance, liability insurance, or health insurance.

- Premium Payment: In exchange for assuming the risk, the policyholder pays a premium to the insurance company. The premium amount is determined based on various factors, including the level of coverage, the perceived risk, and the claims history of the insured party.

- Claims Process: In the event of a covered loss or occurrence, the policyholder can file a claim with the insurance company. The insurer then evaluates the claim and, if approved, provides financial compensation to the policyholder to cover the insured loss, up to the policy’s limits.

Insurance offers several benefits as a method of risk transfer. It provides financial protection and peace of mind, allowing individuals and organizations to mitigate the potential impact of a loss on their financial stability. Insurance also helps in managing cash flow by spreading the risk and the associated costs over a period of time, rather than facing a significant financial burden all at once.

However, it is important to note that insurance does have its limitations. Policies typically have deductibles and limits, which may leave individuals or organizations partially responsible for covering some of the losses. Furthermore, some risks may be difficult or costly to insure, depending on their nature and severity.

Overall, insurance is a crucial method of risk transfer that enables individuals and organizations to protect themselves against potential financial losses. It is important to carefully select the appropriate insurance coverage and fully understand the terms and conditions of the policy to ensure effective risk management.

Reinsurance as a Method of Risk Transfer

Reinsurance is a specific type of risk transfer used by insurance companies to further spread their risk. It involves the transfer of a portion of the potential financial losses assumed by primary insurers to other insurers known as reinsurers. Reinsurance plays a crucial role in ensuring the stability and solvency of insurance companies by protecting them against large and unexpected losses.

When an insurance company purchases reinsurance, it transfers a portion of its risk to the reinsurer in exchange for payment of a reinsurance premium. This premium is typically a percentage of the insurance company’s premium and is based on factors such as the type of risk being transferred, the coverage limits, and the reinsurer’s assessment of the risk.

Reinsurance can take various forms, including:

- Proportional Reinsurance: In this type of reinsurance, the primary insurer and the reinsurer share the risk and premiums on a predetermined percentage basis. For example, if a primary insurer cedes 20% of a policy to a reinsurer, they will share 20% of the premiums and 20% of the potential losses associated with the policy.

- Non-Proportional Reinsurance: Non-proportional reinsurance involves transferring specific risks or a certain layer of risks to the reinsurer. This type of reinsurance kicks in when the losses exceed a predetermined threshold, such as a specified dollar amount or a percentage of the primary insurer’s capital.

- Catastrophe Reinsurance: Catastrophe reinsurance provides coverage for large-scale losses resulting from catastrophic events such as natural disasters or major accidents. This type of reinsurance protects insurance companies against the financial impact of widespread and high-cost claims.

- Excess of Loss Reinsurance: Excess of loss reinsurance covers losses that exceed a specific layer or deductible. It is often used by primary insurers to protect against large individual claims or losses that exceed a predetermined threshold.

Reinsurance offers several benefits to insurance companies. By transferring a portion of their risks, insurance companies can limit their exposure to large and unexpected losses. Reinsurance provides stability to insurance companies and helps them maintain adequate capital reserves to fulfill their obligations to policyholders. It also allows primary insurers to underwrite more significant risks confidently, knowing that they have the support of the reinsurer if large losses occur.

However, reinsurance also has its limitations. Depending on the terms of the reinsurance agreement, insurance companies may still retain some level of risk and potential liability. Reinsurance premiums can also be costly, reducing the profitability of insurance policies. Additionally, the availability and cost of reinsurance can vary depending on market conditions, the perceived risk, and the financial strength of the insurer.

Overall, reinsurance serves as a vital method of risk transfer within the insurance industry. It enables insurance companies to effectively manage and diversify their risk portfolios, ensuring their ability to withstand significant losses and provide financial protection to policyholders.

Hedging as a Method of Risk Transfer

Hedging is a financial strategy used to manage and mitigate the potential losses resulting from adverse price movements or fluctuations in the market. It involves entering into financial transactions that offset the risk associated with changes in prices, interest rates, currencies, or other financial variables. Hedging serves as a method of risk transfer by shifting the potential loss to a counterparty or the market.

Hedging is commonly employed by individuals, businesses, and investors to protect against the uncertainties and volatilities of the financial markets. By hedging their positions, they aim to limit their exposure to potential losses and preserve their financial stability. While hedging does not eliminate the risk entirely, it helps in reducing it to a more manageable level.

There are various hedging strategies and instruments that individuals and organizations can utilize:

- Forward Contracts: A forward contract is an agreement between two parties to buy or sell an asset at a specified price and date in the future. By entering into a forward contract, individuals and organizations can protect themselves against price fluctuations by locking in a predetermined price.

- Futures Contracts: Similar to forward contracts, futures contracts enable parties to buy or sell an asset at a set price and date. However, futures contracts are standardized and traded on regulated exchanges. They provide a more liquid and easily tradable option for hedging purposes.

- Options: Options provide the holder with the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified timeframe. Call options are used to hedge against price increases, while put options are utilized to hedge against price declines.

- Swaps: Swaps are derivative contracts that allow parties to exchange cash flows based on different variables. For instance, interest rate swaps enable parties to exchange fixed and floating interest rate payments, helping to manage interest rate risk.

The specific hedging strategy and instrument chosen will depend on the type of risk being managed and the financial goals of the hedger. Hedging allows individuals and organizations to protect against potential losses while still potentially benefiting from favorable market movements.

However, hedging also has its limitations and considerations. The cost of entering into hedging contracts, such as transaction costs or margin requirements, should be taken into account. Additionally, not all risks can be effectively hedged, and hedging strategies may not always provide perfect protection against losses.

Overall, hedging serves as a valuable method of risk transfer by allowing individuals and organizations to manage their exposure to market risks. By implementing effective hedging strategies, they can safeguard their financial positions and navigate the uncertainties of the financial markets more confidently.

Options and Derivatives as Methods of Risk Transfer

Options and derivatives are financial instruments that provide individuals and organizations with opportunities to transfer and manage risks associated with fluctuations in prices, interest rates, currencies, and other underlying variables. They offer flexible and customizable strategies for risk transfer, enabling market participants to protect against potential losses while potentially benefiting from favorable market movements.

Options provide the holder with the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified timeframe. By holding options, individuals and organizations can protect against adverse price movements and secure a predetermined price at which they can buy or sell the underlying asset.

Derivatives, on the other hand, are financial contracts whose value depends on the price movements or performance of an underlying asset. They can be used as risk management tools, allowing market participants to hedge against potential losses or speculate on future market movements.

Both options and derivatives offer various benefits and strategies for risk transfer:

- Hedging: Options and derivatives can be utilized to hedge against price or interest rate movements. For example, a company exposed to foreign currency risk can use currency options or forwards to hedge against exchange rate fluctuations, thereby protecting the value of their assets or liabilities.

- Speculation: Options and derivatives also provide opportunities for speculative trading strategies. Traders can take positions based on their views on the future direction of the underlying asset, aiming to profit from price movements.

- Arbitrage: Market participants can use options and derivatives to capitalize on pricing discrepancies between related assets or markets, engaging in arbitrage strategies to generate profits with minimal risk.

- Portfolio Diversification: Options and derivatives offer market participants the ability to diversify their portfolios and spread their risks across different assets or markets. By incorporating derivatives into their investment strategies, individuals and organizations can potentially reduce their overall risk exposure.

- Customization: Options and derivatives provide flexibility in terms of contract specifications, allowing market participants to tailor the instruments to their specific risk transfer needs. This customization enables precise hedging strategies and risk management techniques.

It is important to note that options and derivatives come with their own risks and complexities. Options have expiration dates and may expire worthless if the desired price movement does not occur within the specified timeframe. Derivatives, such as futures or swap contracts, carry the risk of counterparty default or market volatility. It is crucial for market participants to fully understand the risks and mechanics of options and derivatives before engaging in these instruments.

Overall, options and derivatives offer powerful methods of risk transfer, providing individuals and organizations with tools to manage and protect against potential losses resulting from market fluctuations. By utilizing these instruments effectively, market participants can navigate the complexities of the financial markets and enhance their risk management strategies.

Benefits and Limitations of Risk Transfer

Risk transfer is a valuable strategy for managing financial risks, offering several benefits to individuals and organizations. However, it is also important to be aware of the limitations and considerations associated with this approach. Let’s explore the benefits and limitations of risk transfer:

Benefits of Risk Transfer:

- Financial Protection: Risk transfer provides individuals and organizations with a means of protecting themselves against potential financial losses. By transferring the risk to another party, they can minimize the negative impact of adverse events and maintain their financial stability.

- Specialization: Risk transfer allows individuals and organizations to focus on their core activities and expertise. By transferring risks to specialized entities, such as insurance companies or derivative market participants, they can allocate their resources more efficiently and concentrate on their primary objectives.

- Improved Cash Flow Management: Risk transfer helps in managing cash flows by spreading potential losses over time. Instead of facing a significant financial burden all at once, individuals and organizations can pay premiums or engage in hedging strategies that provide ongoing protection against risks.

- Access to Expertise: By utilizing risk transfer methods such as insurance or reinsurance, individuals and organizations can benefit from the expertise and experience of specialized entities. Insurance companies employ underwriters, actuaries, and risk assessors who can accurately assess and price risks, helping clients make informed decisions.

- Diversification: Risk transfer allows individuals and organizations to diversify their risk exposure. By spreading risks across multiple parties or asset classes, they can reduce their overall risk and potentially enhance their risk-adjusted returns.

Limitations of Risk Transfer:

- Costs: Risk transfer methods such as insurance or reinsurance involve premium payments and transaction costs that can impact profitability. The cost of transferring risks should be carefully evaluated to ensure it is justified by the potential benefits and protection offered.

- Retained Risk: While risk transfer can mitigate potential losses, it does not eliminate all risk. Individuals and organizations often retain some level of risk, such as deductibles or self-insured portions. It is crucial to assess and manage the residual risk effectively.

- Availability and Affordability: The availability and affordability of risk transfer methods can vary depending on market conditions, industry-specific risks, and the financial strength of insurers or counterparties. It is essential to assess the options and seek competitive quotes to ensure adequate coverage at a reasonable cost.

- Contractual Obligations: Engaging in risk transfer often involves contractual obligations. Parties must fulfill their contractual commitments and meet specified conditions to ensure the transfer of risk and coverage. Failure to comply with contractual obligations can lead to coverage denial or disputes.

- Inadequate Coverage: Risk transfer methods may not provide comprehensive coverage for all risks. Certain risks may be difficult or costly to insure, and there may be exclusions or limitations in insurance policies. Conducting a thorough analysis of the risks and coverage is necessary to ensure adequate protection.

Understanding the benefits and limitations of risk transfer is crucial for effective risk management. By leveraging the advantages of risk transfer while being mindful of the limitations, individuals and organizations can make informed decisions to protect their financial well-being and navigate the complexities of the risk landscape.

Examples of Risk Transfer in Practice

Risk transfer is a widely utilized strategy in various industries and sectors. Let’s explore some real-world examples of risk transfer in practice:

- Property Insurance: Homeowners purchase property insurance to transfer the risk of damage or loss to their property to an insurance company. If an insured event such as a fire, theft, or natural disaster occurs, the insurance company compensates the homeowner for the damages or loss, allowing them to recover financially.

- Commercial Liability Insurance: Businesses often obtain liability insurance to transfer the risk of legal claims and damages resulting from accidents, injuries, or property damage caused by their operations. This type of insurance protects businesses from costly lawsuits and potential financial ruin.

- Reinsurance in the Insurance Industry: Insurance companies transfer a portion of their risk to reinsurers. For example, a primary insurer offering property insurance policies may purchase reinsurance to protect against catastrophic events like hurricanes or earthquakes, transferring a portion of the potential losses to the reinsurer.

- Currency Hedging: Exporters and importers often utilize currency hedging strategies such as forward contracts or options to transfer the risk of fluctuating exchange rates. These strategies protect them from potential losses or unexpected changes in currency values, allowing for more predictable financial outcomes in international trade.

- Commodity Futures Contracts: Farmers and producers of commodities use futures contracts to hedge against price fluctuations. For example, a wheat farmer can enter into a futures contract to sell their crop at a predetermined price to protect themselves from potential losses if the market price of wheat decreases.

- Interest Rate Swaps: Companies that have borrowed money at variable interest rates can enter into interest rate swap agreements to transfer the risk of rising rates. By swapping their variable interest payments for fixed payments with another party, they can guard against the negative impact of increases in interest rates.

- Derivatives in Financial Markets: Investors and traders utilize various derivatives, such as options or futures contracts, to transfer and manage risks associated with stock prices, interest rates, or market volatility. These instruments allow market participants to protect their portfolios from adverse movements in the financial markets.

These examples illustrate how risk transfer is implemented in practice across different industries and scenarios. By transferring risks to specialized entities or utilizing financial instruments, individuals and organizations can effectively manage and mitigate potential financial losses, thus maintaining their financial stability and protecting their assets.

Conclusion

Risk transfer is a crucial aspect of financial risk management, allowing individuals and organizations to protect themselves against potential losses by shifting the burden to other parties or markets. Through methods such as insurance, reinsurance, hedging, and the use of options and derivatives, they can effectively mitigate the financial impact of adverse events and fluctuations in the market.

By transferring risks, individuals and organizations gain several benefits. They can obtain financial protection, focus on their core activities and expertise, manage cash flows more efficiently, access specialized expertise, and diversify their risk exposure. Risk transfer methods offer flexibility, customization, and opportunities for speculation or arbitrage.

However, it is important to recognize the limitations and considerations associated with risk transfer. Costs, retained risk, availability and affordability, contractual obligations, and potential gaps in coverage require careful evaluation. Risk transfer does not eliminate all risk, and comprehensive analysis is necessary to ensure adequate protection.

Real-world examples demonstrate the practical application of risk transfer in various industries and sectors, such as property insurance, liability insurance, reinsurance, hedging, currency hedging, commodity futures contracts, interest rate swaps, and the use of derivatives in financial markets.

In conclusion, risk transfer is a valuable strategy for managing financial risk. It offers individuals and organizations the means to protect against potential losses, capitalize on opportunities, and navigate the uncertainties of the market. By understanding the benefits, limitations, and practical applications of risk transfer, individuals and organizations can make informed decisions to safeguard their financial well-being and achieve long-term success.