Finance

Why Is My FICO Score Higher Than Credit Karma

Published: March 6, 2024

Discover why your FICO score may differ from your Credit Karma score. Learn how to manage your finances effectively and understand your creditworthiness.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the nuances of credit scores is crucial for anyone seeking financial stability and success. Among the various credit scoring models, two prominent ones stand out: the FICO score and the Credit Karma score. These scores play a pivotal role in determining an individual's creditworthiness and can influence their ability to secure loans, mortgages, or favorable interest rates. However, it's not uncommon for individuals to notice disparities between their FICO score and their Credit Karma score, often leading to confusion and concern.

In this comprehensive guide, we will delve into the intricacies of these two scoring systems, shedding light on why your FICO score might differ from your Credit Karma score. By understanding the factors that influence each score and the disparities that may arise, you'll gain valuable insights into managing and monitoring your credit health effectively.

Navigating the world of credit scores can be daunting, but with a clear understanding of the FICO score and Credit Karma score, you can make informed financial decisions and take proactive steps to improve your credit standing. So, let's embark on this enlightening journey to unravel the mysteries behind these scores and empower ourselves with the knowledge to navigate the complex landscape of credit evaluation.

Understanding FICO Score

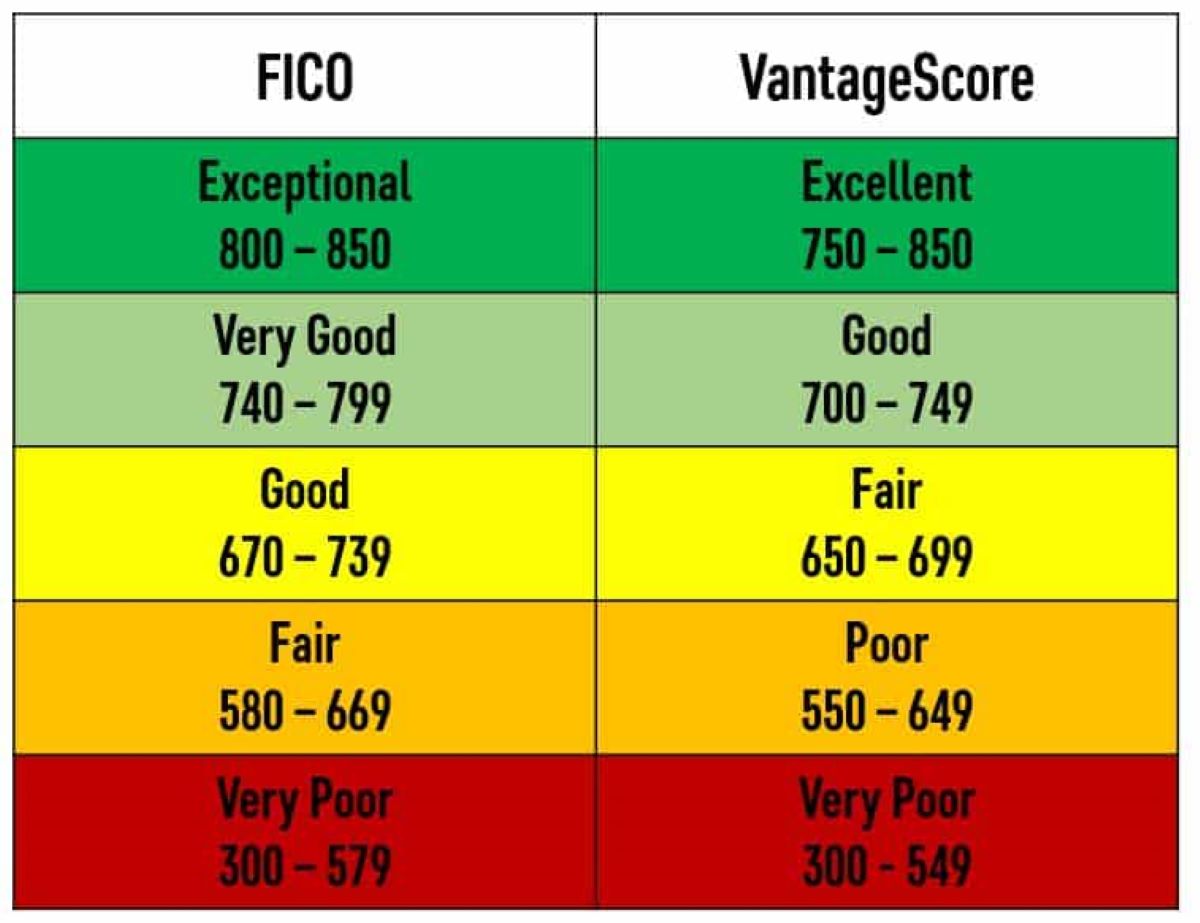

The FICO score, developed by the Fair Isaac Corporation, is one of the most widely used credit scoring models in the United States. This three-digit score, ranging from 300 to 850, serves as a numerical representation of an individual’s credit risk based on their credit history and behavior. FICO scores are utilized by the majority of lenders to assess an individual’s creditworthiness when applying for loans, credit cards, or mortgages.

Several key factors contribute to the calculation of a FICO score, with payment history carrying significant weight. Timely payments on credit accounts, such as loans and credit cards, demonstrate responsible financial behavior and have a positive impact on the FICO score. The amount owed, length of credit history, new credit accounts, and the mix of credit types also influence the FICO score, albeit to varying degrees.

It’s important to note that FICO scores are dynamic and can fluctuate based on an individual’s financial activities. Regularly monitoring your FICO score is essential for staying informed about your credit standing and identifying any potential discrepancies or unauthorized activities that may impact your score.

Ultimately, understanding the intricacies of the FICO score empowers individuals to take proactive steps in managing their credit health. By maintaining a strong payment history, managing credit utilization, and being mindful of credit inquiries, individuals can work towards achieving and sustaining a favorable FICO score, thus opening doors to better financial opportunities.

Understanding Credit Karma Score

The Credit Karma score, provided by the financial management platform Credit Karma, offers individuals free access to their credit scores and credit reports from two major credit bureaus, TransUnion and Equifax. This VantageScore 3.0, which ranges from 300 to 850, serves as a valuable tool for individuals to monitor their credit health and gain insights into the factors influencing their creditworthiness.

Unlike the FICO score, which is widely used by lenders, the Credit Karma score is not typically utilized for credit decisions. Instead, it serves as an educational resource, empowering individuals to understand the key components shaping their credit profile. The Credit Karma score considers various factors, including payment history, credit utilization, derogatory marks, age of credit history, total accounts, and hard inquiries.

One notable aspect of the Credit Karma score is its emphasis on providing personalized insights and recommendations to help individuals improve their credit standing. Through the Credit Karma platform, users can access tailored suggestions for optimizing their credit scores, such as reducing credit card balances, making timely payments, and diversifying their credit mix.

By offering a user-friendly interface and valuable educational resources, the Credit Karma score equips individuals with the knowledge and tools to actively manage and enhance their credit profiles. Regularly monitoring the Credit Karma score can provide individuals with a comprehensive overview of their credit health and serve as a catalyst for making informed financial decisions.

Factors that Affect FICO Score

The FICO score is influenced by several key factors, each carrying a different level of significance in determining an individual’s creditworthiness. Understanding these factors is essential for individuals aiming to maintain or improve their FICO scores.

- Payment History: Timely payments on credit accounts, including loans and credit cards, contribute significantly to the FICO score. Consistent on-time payments demonstrate responsible financial behavior and have a positive impact on the score.

- Amount Owed: The amount of credit owed, also known as credit utilization, plays a crucial role in the FICO score calculation. High credit card balances relative to credit limits can negatively impact the score.

- Length of Credit History: The length of time credit accounts have been open and the time since the most recent account activity are considered in the FICO score. A longer credit history can have a positive influence on the score.

- New Credit Accounts: Opening multiple new credit accounts within a short period may raise concerns for lenders and can potentially lower the FICO score. It’s important to manage new credit openings prudently.

- Credit Mix: Having a diverse mix of credit accounts, such as credit cards, installment loans, and mortgages, can positively impact the FICO score, showcasing an individual’s ability to manage various types of credit responsibly.

By being mindful of these factors and their implications, individuals can take proactive steps to maintain a healthy FICO score. Regularly reviewing credit reports, managing credit card balances, and avoiding excessive new credit applications are essential strategies for safeguarding and enhancing one’s FICO score.

Factors that Affect Credit Karma Score

The Credit Karma score, generated using the VantageScore 3.0 model, takes into account several key factors that influence an individual’s creditworthiness. Understanding these factors is crucial for individuals seeking to comprehend the dynamics of their Credit Karma score and make informed decisions to improve it.

- Payment History: Similar to the FICO score, the payment history significantly impacts the Credit Karma score. Timely payments on credit accounts demonstrate responsible financial behavior and contribute positively to the overall score.

- Credit Utilization: The ratio of credit card balances to credit limits, known as credit utilization, plays a pivotal role in the Credit Karma score calculation. High credit card balances relative to limits can negatively impact the score.

- Derogatory Marks: Negative marks such as bankruptcies, foreclosures, and collections can significantly lower the Credit Karma score, highlighting the importance of maintaining a clean credit history.

- Age of Credit History: The length of an individual’s credit history and the average age of their credit accounts are considered in the Credit Karma score calculation. A longer credit history can have a positive influence on the score.

- Total Accounts and Inquiries: The total number of credit accounts and recent hard inquiries can impact the Credit Karma score. Prudent management of credit accounts and minimizing new credit inquiries can help maintain a favorable score.

By comprehending the factors that shape the Credit Karma score, individuals can take proactive measures to bolster their credit profiles. Making on-time payments, managing credit card balances, and addressing derogatory marks are essential steps in optimizing the Credit Karma score and enhancing overall credit health.

Discrepancies in Reporting

It’s not uncommon for individuals to notice disparities between their FICO score and their Credit Karma score, leading to confusion and concern. These variations can stem from several factors, highlighting the nuanced nature of credit reporting and scoring models.

One primary reason for differences between the two scores is the utilization of distinct scoring models. While the FICO score is widely used by lenders and is based on a proprietary algorithm developed by the Fair Isaac Corporation, the Credit Karma score employs the VantageScore model, which utilizes a different methodology for score calculation. As a result, the scoring criteria and weight given to various factors may differ between the two models, leading to discrepancies in the final scores.

Furthermore, variations in the credit data utilized by each scoring model can contribute to differences in reported scores. Credit bureaus may not always have identical information, and the timing of data updates can differ, leading to discrepancies in the credit profiles used to generate the FICO score and the Credit Karma score.

Additionally, the frequency of score updates and the specific scoring model versions used by lenders can lead to discrepancies. Lenders may utilize updated FICO score versions that differ from the version accessible through Credit Karma, resulting in score variations when applying for credit.

Understanding these potential sources of disparities is essential for individuals seeking to make sense of differing credit scores. While variations in reported scores can be perplexing, they underscore the importance of regularly monitoring both FICO scores and Credit Karma scores to gain a comprehensive understanding of one’s credit health.

By acknowledging the potential for discrepancies and staying informed about the factors influencing each score, individuals can navigate the complexities of credit reporting and scoring with greater clarity and confidence.

Importance of Monitoring Both Scores

Monitoring both FICO scores and Credit Karma scores is instrumental in gaining a holistic understanding of one’s credit health and financial standing. Each scoring model offers unique insights and serves distinct purposes, collectively providing individuals with a comprehensive overview of their credit profiles.

The FICO score, widely utilized by lenders, directly impacts an individual’s ability to secure favorable loan terms, obtain credit cards, and access various financial products. As such, regularly monitoring the FICO score is crucial for individuals seeking to gauge their creditworthiness as perceived by potential lenders. By staying abreast of their FICO scores, individuals can identify areas for improvement and take proactive steps to bolster their credit profiles, thereby enhancing their eligibility for competitive financial opportunities.

On the other hand, the Credit Karma score, while not typically used for credit decisions, offers valuable educational insights and personalized recommendations for improving one’s credit health. By actively monitoring the Credit Karma score, individuals can gain a deeper understanding of the factors influencing their credit profiles and access tailored suggestions for optimizing their scores. This empowers individuals to make informed decisions and implement strategies to enhance their overall credit standing.

Discrepancies between the two scores further underscore the importance of monitoring both FICO scores and Credit Karma scores. By comparing and contrasting the information provided by each score, individuals can identify potential discrepancies, address inaccuracies, and gain a more comprehensive view of their credit health. This proactive approach enables individuals to rectify any discrepancies and maintain accurate credit profiles, thereby mitigating the risk of encountering surprises or challenges when seeking credit.

Moreover, the act of monitoring both scores instills a sense of financial awareness and responsibility, encouraging individuals to actively engage in managing their credit health. By regularly reviewing their FICO scores and Credit Karma scores, individuals become better equipped to make informed financial decisions, navigate credit-related challenges, and work towards achieving their long-term financial goals.

In essence, the dual monitoring of FICO scores and Credit Karma scores empowers individuals to proactively manage their credit health, optimize their credit profiles, and position themselves for greater financial stability and success.

Conclusion

Understanding the intricacies of credit scoring models, particularly the FICO score and the Credit Karma score, is essential for individuals navigating the complex landscape of personal finance. While both scores offer valuable insights into an individual’s credit health, disparities between them can lead to confusion and uncertainty. By delving into the factors influencing each score and the importance of monitoring both, individuals can gain a comprehensive understanding of their credit profiles and take proactive steps to optimize their credit standing.

The FICO score, widely utilized by lenders, serves as a critical determinant of an individual’s creditworthiness in the eyes of potential creditors. Regularly monitoring the FICO score enables individuals to identify areas for improvement, maintain accurate credit profiles, and enhance their eligibility for favorable financial opportunities.

Conversely, the Credit Karma score, while not typically used for credit decisions, offers valuable educational insights and personalized recommendations for improving credit health. Actively monitoring the Credit Karma score empowers individuals to comprehend the factors shaping their credit profiles and implement strategies to bolster their overall credit standing.

Discrepancies between the two scores underscore the need for dual monitoring, enabling individuals to identify potential discrepancies, rectify inaccuracies, and gain a comprehensive view of their credit health. This proactive approach fosters financial awareness and responsibility, equipping individuals to make informed financial decisions and navigate credit-related challenges effectively.

In essence, by gaining insights into the nuances of the FICO score and the Credit Karma score, individuals can navigate the complexities of credit evaluation with confidence and clarity. The combined monitoring of both scores empowers individuals to proactively manage their credit health, optimize their credit profiles, and position themselves for greater financial stability and success.

Armed with this knowledge, individuals can embark on their financial journeys with a deeper understanding of their credit standing and the tools to make informed decisions that pave the way for long-term financial well-being.