Home>Finance>Surety: Definition, How It Works With Bonds, And Distinctions

Finance

Surety: Definition, How It Works With Bonds, And Distinctions

Published: February 4, 2024

Learn the definition of surety in finance, how it works with bonds, and the important distinctions to be aware of. Gain a comprehensive understanding of surety within the finance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Surety: Definition, How It Works with Bonds, and Distinctions

When it comes to the world of finance, there are numerous terms that can be quite perplexing. One such term is “surety.” If you’ve come across this term and are curious to learn more about it, you’re in the right place. In this blog post, we’ll explain the definition of surety, how it works with bonds, and the key distinctions to keep in mind.

Key Takeaways:

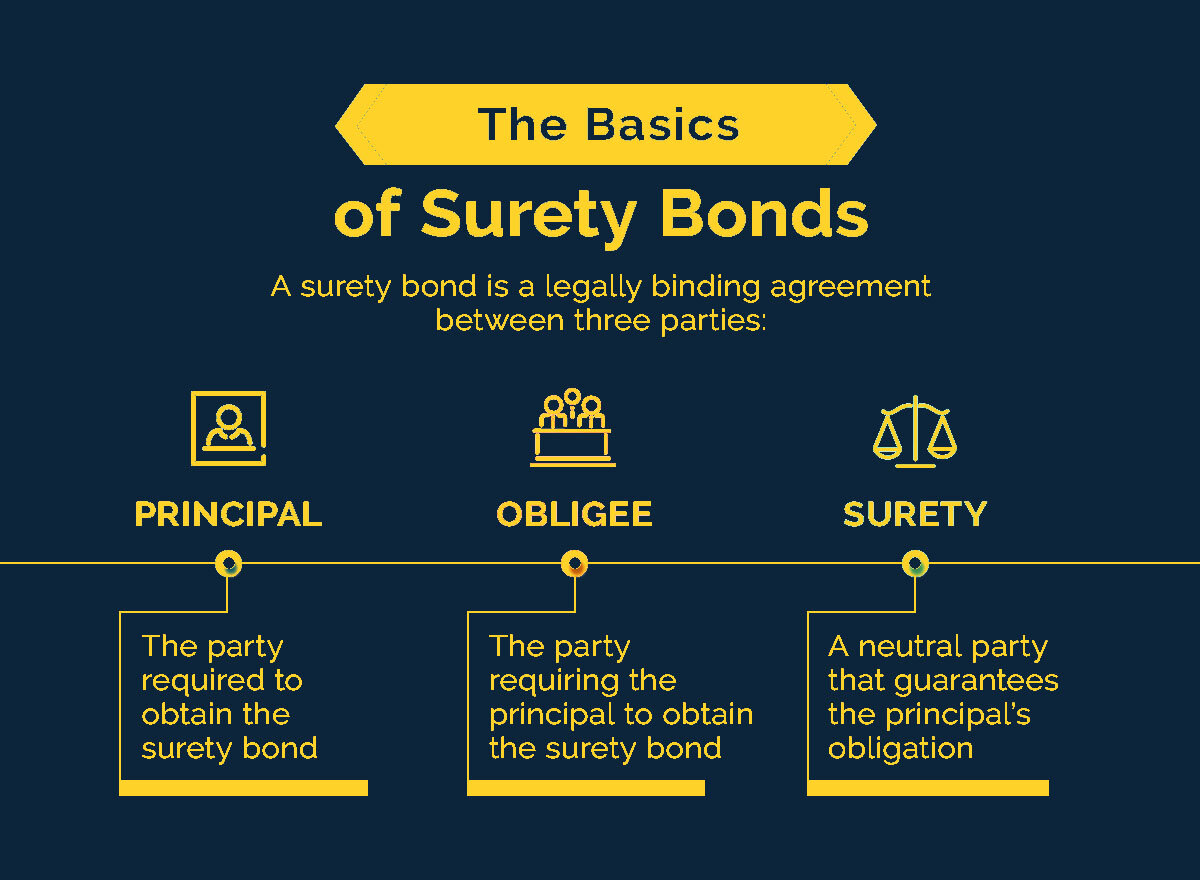

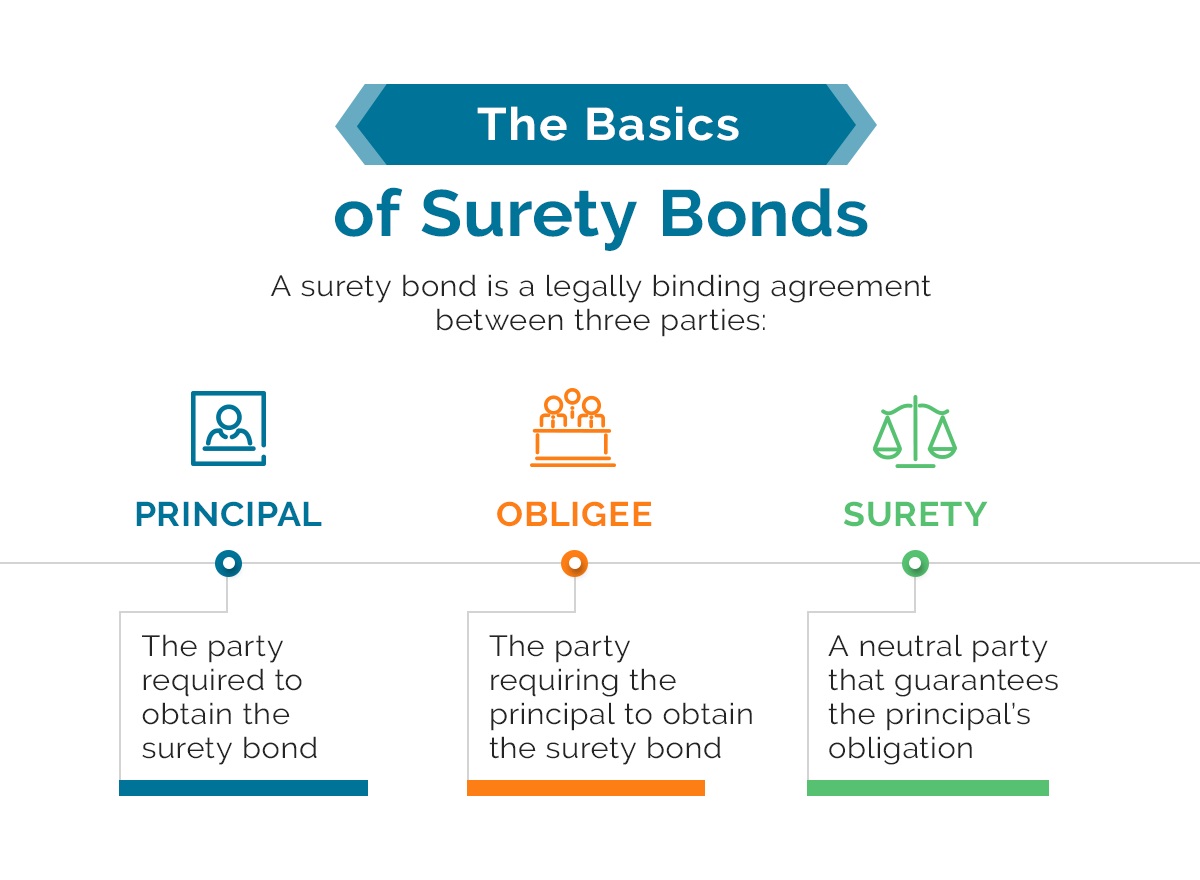

- Surety is a legal contract that involves three parties: the principal, the surety, and the obligee.

- It provides a guarantee that a specific obligation will be fulfilled by the principal party.

Let’s dive into the details and demystify the concept of surety:

What is Surety?

Surety, in the realm of finance, refers to a legally binding contract that involves three parties: the principal, the surety, and the obligee. The principal is the individual or business undertaking an obligation, such as completing a project or fulfilling a financial commitment.

The surety is a separate entity, often a company, that provides a financial guarantee to the obligee that the principal will fulfill their obligation. This guarantee typically comes in the form of a surety bond, which acts as a safety net for the obligee.

How Does Surety Work with Bonds?

A surety bond is a crucial component of the surety contract. It is a legally binding agreement that ensures the principal’s performance and compliance with the terms of a contract or other legal obligations. In simpler terms, a surety bond provides a financial guarantee that the principal will complete their obligations as promised.

There are various types of surety bonds, including contract bonds, bid bonds, performance bonds, and more. Each type serves a specific purpose, but they all work in a similar manner. If the principal fails to fulfill their obligation, the obligee can make a claim on the surety bond, which will then be investigated by the surety company. If the claim is found to be valid, the surety will compensate the obligee for the financial loss.

Distinctions to Keep in Mind

While surety bonds may sound similar to insurance, it’s important to understand the distinctions:

- Financial Guarantee: Surety provides a financial guarantee that the principal will meet their contractual obligations. In insurance, the focus is on compensating for damages or losses.

- Three-Party Contract: Surety involves a three-party contract between the principal, surety, and obligee, while insurance typically involves two parties—the insured and the insurer.

- Preventive Measure: Surety bonds are often required upfront to mitigate potential risks and ensure the successful completion of projects. Insurance is typically obtained after a loss or damage occurs.

Understanding the distinctions between surety and insurance is essential to fully grasp the role and importance of surety in the world of finance.

In Conclusion

Surety plays a significant role in the finance industry, providing a safety net for parties involved in contractual agreements. By offering a financial guarantee through surety bonds, it ensures that obligations are fulfilled and project completion is successful. Remember, surety is not insurance. It functions as a preventive measure that protects all parties involved.

So the next time you come across the term “surety,” you’ll know that it relates to a three-party contract, a financial guarantee, and the smooth progression of contractual obligations.