Finance

How To File Corrected 1099-NEC With The IRS

Modified: February 21, 2024

Learn how to file a corrected 1099-NEC form with the IRS and ensure accurate reporting for your finance records.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction:

When it comes to tax reporting, accuracy is of utmost importance. Whether you’re an individual or a business owner, filing your taxes correctly ensures compliance with the Internal Revenue Service (IRS) regulations and helps you avoid unnecessary penalties. However, mistakes can happen, and if you’ve realized that you made errors on your 1099-NEC form, it’s crucial to take immediate action to correct them.

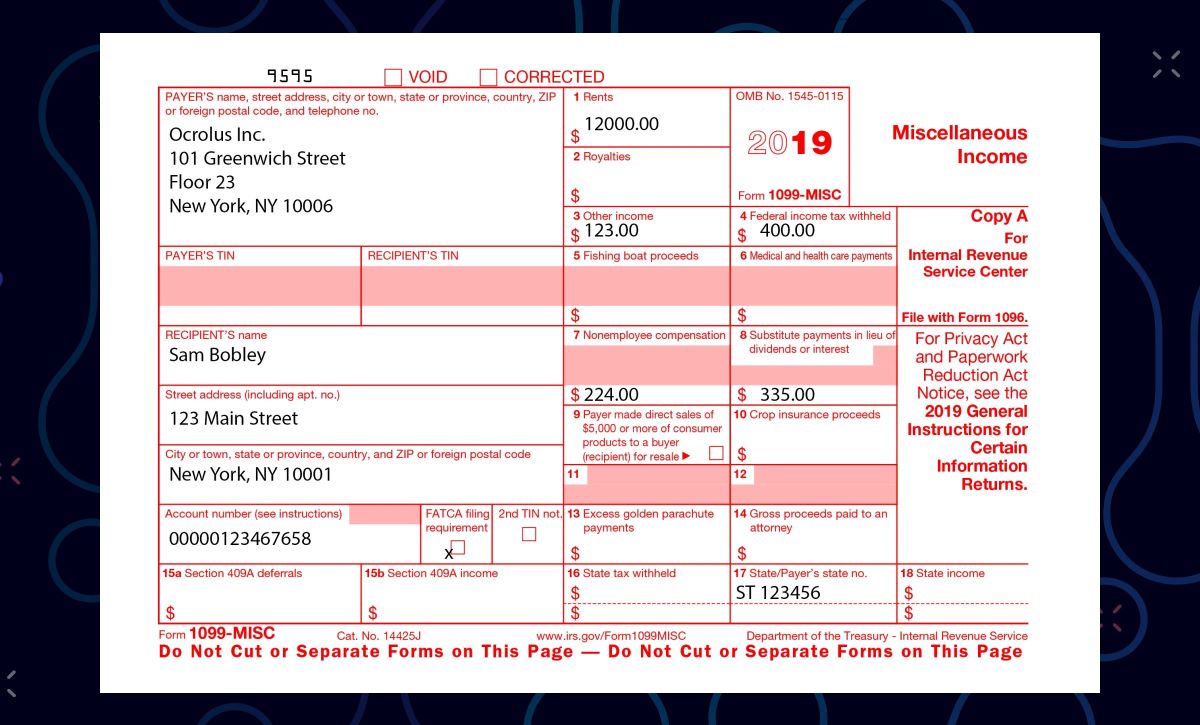

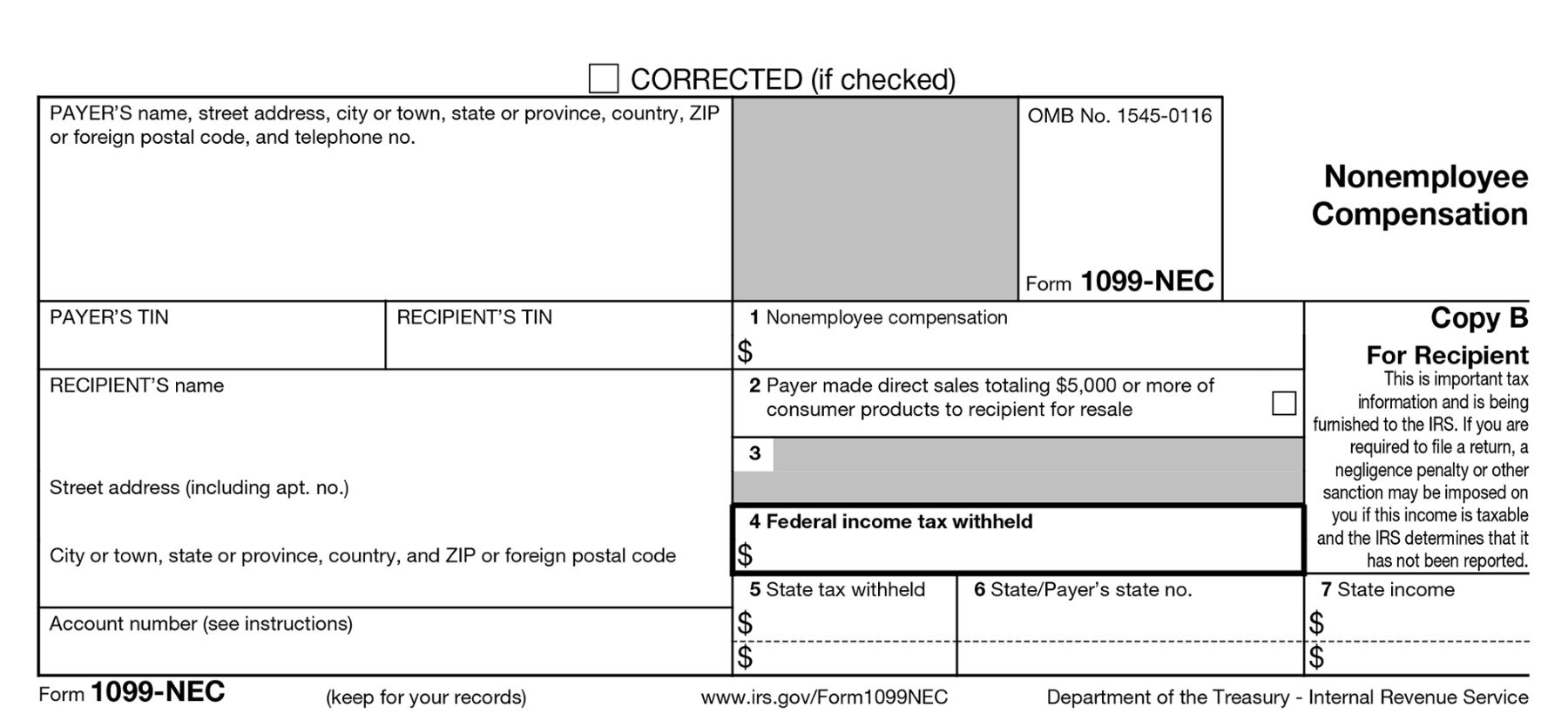

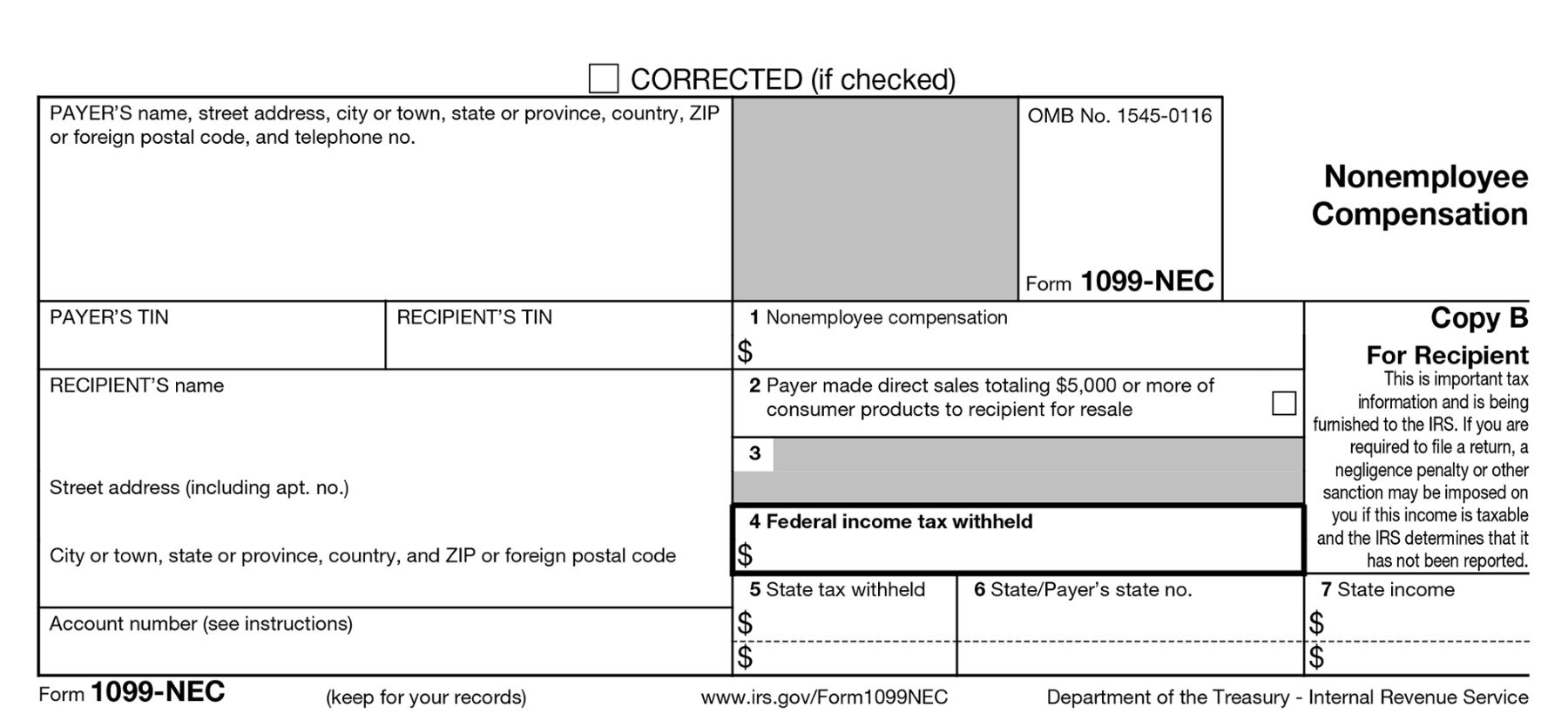

The 1099-NEC form is used to report income earned by non-employees, such as independent contractors, freelancers, and self-employed individuals. It is important to note that starting from tax year 2020, the 1099-NEC form replaced the use of box 7 on the 1099-MISC form to report non-employee compensation. Understanding the correct way to file your corrected 1099-NEC form with the IRS is essential to ensure accuracy in your tax records.

In this comprehensive guide, we will walk you through the process of correcting errors on your 1099-NEC form and filing it with the IRS. Whether you made a typo in a recipient’s name, misreported income amounts, or forgot to include certain payments, we will provide you with all the necessary steps to rectify the errors and ensure your tax compliance.

Before we dive into the details, it’s essential to remember that these instructions pertain to filing corrections for tax year 2020 and onward. If you need to correct errors on a 1099-NEC form from a previous tax year, it’s recommended to consult a tax professional for guidance, as the process may differ.

Now, let’s get started on rectifying any errors you may have made on your 1099-NEC form and ensuring that your tax reporting remains accurate and compliant.

Understanding the 1099-NEC Form:

Before we delve into the process of correcting errors on your 1099-NEC form, it’s essential to have a clear understanding of what the form entails. The 1099-NEC form, also known as the Nonemployee Compensation form, is used to report income earned by non-employees, such as independent contractors, freelancers, and self-employed individuals. It is important to note that starting from tax year 2020, the 1099-NEC form is used exclusively for reporting non-employee compensation.

As a payer, if you paid $600 or more to a non-employee, you are required to issue a 1099-NEC form to report the income. The form captures important information, including the recipient’s name, address, Taxpayer Identification Number (TIN), and the amount of compensation provided. It is crucial to accurately report this information to the IRS to ensure compliance with tax regulations.

In addition to the recipient’s details, the form also requires you to provide your own information as the payer. This includes your name, address, and TIN or Employer Identification Number (EIN). The 1099-NEC form is typically sent to both the recipient and the IRS, with different deadlines depending on the filing method.

It’s important to note that the 1099-NEC form should not be used to report employee wages or salaries. If you have paid wages to employees, you will need to use a different form, such as the W-2, to report that information to the IRS.

Properly understanding the purpose and usage of the 1099-NEC form will help you identify any errors more effectively and take the necessary steps to correct them. Whether it’s a misspelled recipient’s name, incorrect payment amount, or missing information, keep these key elements of the 1099-NEC form in mind as we move forward in the process of filing corrected forms.

Identifying Errors on Form 1099-NEC:

Once you’ve realized that there are errors on your Form 1099-NEC, the first step is to identify and assess the nature of the mistakes. This ensures that you can take the appropriate actions to correct them. Here are some common errors that you might encounter:

- Recipient’s Information: Check if the recipient’s name, address, or Taxpayer Identification Number (TIN) is misspelled, incomplete, or inaccurate. Any discrepancies can lead to problems with tax reporting.

- Income Amount: Examine the reported compensation amount to confirm that it is accurate. Ensure that you haven’t omitted any payments or included incorrect amounts.

- Payer’s Information: Verify that your name, address, and Employer Identification Number (EIN) are correctly stated on the form. Any errors in your information can hinder proper tax reporting.

- Other Errors: Scrutinize the form for any missing or incorrect information, such as payment dates or other relevant details. These errors can impact the accuracy of your tax reporting.

It’s crucial to rectify these errors promptly to ensure compliance with IRS regulations and avoid potential penalties or scrutiny. The next step is to gather the corrected information necessary to file an accurate 1099-NEC form. By addressing the errors and providing accurate information, you can maintain the integrity of your tax reporting records.

Gathering Corrected Information:

Once you have identified the errors on your Form 1099-NEC, the next step is to gather the corrected information. This includes accurate details about the recipient, income amounts, payer’s information, and any other relevant data. Here are the steps to ensure you have the necessary corrected information:

- Recipient’s Information: Contact the recipient and obtain the correct spelling of their name, updated address, and accurate Taxpayer Identification Number (TIN). Make sure to verify the information with the recipient to ensure its accuracy.

- Income Amount: Review your records, invoices, or payment history to gather the correct income amounts paid to the recipient. Double-check for any missed payments or incorrect amounts that need to be reported.

- Payer’s Information: Ensure that your information as the payer is accurate. Confirm your name, address, and Employer Identification Number (EIN) to avoid any discrepancies in the corrected form.

- Other Relevant Information: Check for any missing or incorrect details on the form, such as payment dates or other relevant information. Collect the accurate information and make note of any necessary corrections.

By diligently gathering the corrected information, you will be equipped to file an accurate and error-free Form 1099-NEC. Maintaining accurate records is crucial for tax compliance and helps prevent any potential issues with the IRS.

Once you have all the necessary information, you can proceed with the process of filing the corrected Form 1099-NEC with the IRS. The following sections will outline the steps for both paper filing and electronic filing methods, ensuring that you can choose the most convenient approach for your specific situation.

Filing Corrections: Paper Form:

If you prefer to file your corrected Form 1099-NEC via mail, you can do so by following these steps:

- Obtain the Corrected Form: Obtain a blank copy of Form 1099-NEC from the IRS website or other reliable sources. Ensure that it is the version applicable to the tax year you are amending.

- Enter Corrected Information: Fill out the form with the corrected information. Include the accurate recipient’s name, updated address, correct TIN, and the accurate income amount. Make sure to enter your own information as the payer correctly as well.

- Attach an Explanation: Prepare a written explanation on a separate piece of paper detailing the reason for the correction. Include any additional pertinent information that may help the IRS understand the errors and the steps taken to rectify them. Sign and date the explanation.

- Accurate Form Submission: Ensure that the corrected Form 1099-NEC and the written explanation are accurate and legible. Keep a copy of the corrected form, the written explanation, and any supporting documentation for your records.

- Submit to the IRS: Mail the corrected Form 1099-NEC and the written explanation to the appropriate IRS mailing address. Refer to the IRS instructions or their website for the correct mailing address specific to your region.

It is recommended to send the corrected form via certified mail with a return receipt requested, or use a reputable courier service. This will provide proof of delivery and allow you to track the package.

After you have mailed the corrected Form 1099-NEC, it is important to keep track of your submission and follow up with the IRS if necessary. Be sure to retain copies of all correspondence and documentation related to the correction for your records.

Remember, filing the paper form may take longer for processing and verification by the IRS compared to electronic filing. However, it is a valid option if you prefer a physical filing method or if electronic filing is not available to you.

Filing Corrections: Electronic Filing:

If you prefer a quicker and more streamlined method for filing corrected Form 1099-NEC, electronic filing is a convenient option available to you. Here are the steps to electronically file your corrected form:

- Access an Authorized IRS e-file Provider: Ensure that you have access to an IRS-approved e-file provider. These providers offer online platforms or software that allow you to electronically file and correct your Form 1099-NEC.

- Enter Corrected Information: Log in to the e-file platform or software and enter the corrected information for the recipient, income amount, payer’s details, and any other relevant information. Double-check the accuracy of the entered data.

- Submit Corrections: Submit the corrected Form 1099-NEC through the e-file platform or software. Follow the prompts and instructions provided to ensure that all required fields are completed accurately.

- Review Confirmation: After the submission, review the confirmation of filing or any error messages received. Ensure that the correction was successfully submitted without any issues.

- Retain Documentation: Keep a copy of the confirmation of filing and any other relevant documentation as proof of correction submission. Retaining these records will be essential for your tax records and potential future reference.

It’s important to note that electronic filing offers several advantages over paper filing. It is faster, more efficient, and provides instant confirmation of your submission. Additionally, the e-file system can automatically validate and check for errors, minimizing the chances of additional mistakes in your corrected form.

Before using an IRS-approved e-file provider, ensure that you have securely stored all the necessary corrected information mentioned earlier in the “Gathering Corrected Information” section. This will make the electronic filing process smoother and help you avoid any delays or errors.

By choosing electronic filing, you can expedite the correction process and have peace of mind knowing that your corrected Form 1099-NEC is submitted accurately and efficiently.

Sending Corrections to the IRS:

After you have filed the corrected Form 1099-NEC, it’s important to notify the IRS of the corrections you have made. Here is what you need to do:

- Wait for Acknowledgment: Whether you filed the corrected form through paper filing or electronic filing, wait for the IRS to acknowledge receipt and processing of your correction. This acknowledgement may come in the form of a notification or confirmation letter.

- Keep Documentation: Retain copies of all documentation related to the correction, including the corrected Form 1099-NEC, the written explanation, and any proof of delivery or confirmation of electronic filing. These records will be crucial in case of any inquiries or discrepancies.

- Respond to Requests: If the IRS requests any additional information or documentation regarding the correction, promptly respond to their inquiries. Provide the requested information in a timely manner to ensure smooth communication and resolution.

- Keep Updated Records: Update your personal records and maintain an organized filing system for all your tax-related documents. This will help you easily access and refer to the corrected Form 1099-NEC and any other necessary documentation in the future.

It is important to note that the processing time for corrections may vary depending on the IRS workload and other factors. Therefore, it is recommended to exercise patience and follow up with the IRS if necessary.

Additionally, it’s crucial to ensure that the corrected Form 1099-NEC and any associated documentation are securely stored for a minimum of three years. This is to comply with IRS record-keeping requirements and be prepared in case of any future audits or inquiries.

By promptly notifying the IRS of the corrections made and maintaining accurate records, you can ensure a smoother resolution of the correction process and help maintain your tax compliance.

Avoiding Future Errors on Form 1099-NEC:

To prevent future errors on your Form 1099-NEC and ensure accurate tax reporting, it’s important to implement a few best practices. Here are some tips to help you avoid common mistakes:

- Keep Accurate Records: Maintain detailed and organized records of all payments made to non-employees throughout the year. This includes invoices, receipts, and any other supporting documentation.

- Double-Check Recipient Information: Verify the recipient’s name, address, and Taxpayer Identification Number (TIN) before filing. Validate this information with the recipient to avoid any errors.

- Stay Updated on IRS Guidelines: Familiarize yourself with the latest IRS guidelines and instructions regarding Form 1099-NEC reporting. Stay updated on any changes or updates that may affect your tax obligations.

- Use Reliable Software or Service: If you opt for electronic filing, choose a reputable and IRS-approved software or service to ensure accuracy and compliance. Ensure that the software or service provides error-checking features to help identify any potential errors.

- Review Before Submission: Before filing, take the time to review and double-check all information on the Form 1099-NEC. Confirm that the recipient’s information, income amounts, and payer’s details are accurate and up to date.

- Address Mistakes Promptly: If you do identify errors after filing, address them promptly. Follow the steps outlined earlier in this guide to correct and file the amended Form 1099-NEC as soon as possible.

- Seek Professional Assistance: If you are uncertain about any aspect of Form 1099-NEC reporting or correction, consider consulting with a tax professional. They can provide guidance and ensure that you comply with IRS regulations.

By implementing these practices, you can minimize the likelihood of errors on Form 1099-NEC and promote accurate tax reporting. It’s essential to make conscientious efforts to maintain accurate records and stay informed about the latest IRS requirements to ensure compliance.

Remember, accurate reporting not only helps you avoid penalties and potential audits but also contributes to the smooth operation of your business and the overall integrity of the tax system.

Conclusion:

Correcting errors on your Form 1099-NEC and ensuring accurate tax reporting is a crucial responsibility for both individuals and businesses. By following the steps outlined in this guide, you can rectify any mistakes made on the form and maintain compliance with IRS regulations. Whether you choose paper filing or electronic filing, the key is to gather the corrected information, file the necessary amendments, and communicate with the IRS effectively.

Remember to identify the errors on the form carefully, gather the correct information, and take the appropriate steps to file the corrected 1099-NEC form. Utilize the paper filing or electronic filing method that suits your needs and preferences. Additionally, keep accurate records, stay updated on IRS guidelines, and double-check all information before submission to avoid errors in the future.

If you encounter any challenges during the correction process, it’s advisable to seek assistance from a trusted tax professional. They can provide guidance and ensure that you navigate the correction process smoothly.

By prioritizing accuracy and proactive correction, you can maintain the integrity of your tax reporting and ensure compliance with IRS regulations. Properly reporting non-employee compensation is not only a legal obligation but also a fundamental aspect of maintaining a healthy financial standing.

Remember, mistakes can happen to anyone, but it’s how you address and correct them that truly matters. By taking the necessary steps to rectify the errors on your Form 1099-NEC, you can safeguard your financial interests and preserve your reputation as a responsible taxpayer.

Stay vigilant, stay informed, and stay proactive in your tax reporting. By doing so, you will ensure accurate reporting, avoid unnecessary penalties, and enjoy a smooth tax filing experience.