Finance

When Does Credit Card Company Report Balance

Modified: February 25, 2024

Learn when credit card companies report your balance and how it impacts your finance. Stay on top of your credit utilization to manage your financial health effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Balance Reporting

- Factors That Determine When Credit Card Companies Report Balance

- Monthly Statement Closing Date

- Statement Generation Date

- Reporting Date to Credit Bureaus

- Importance of Knowing When Credit Card Companies Report Balance

- Tips for Managing Credit Card Balances

- Conclusion

Introduction

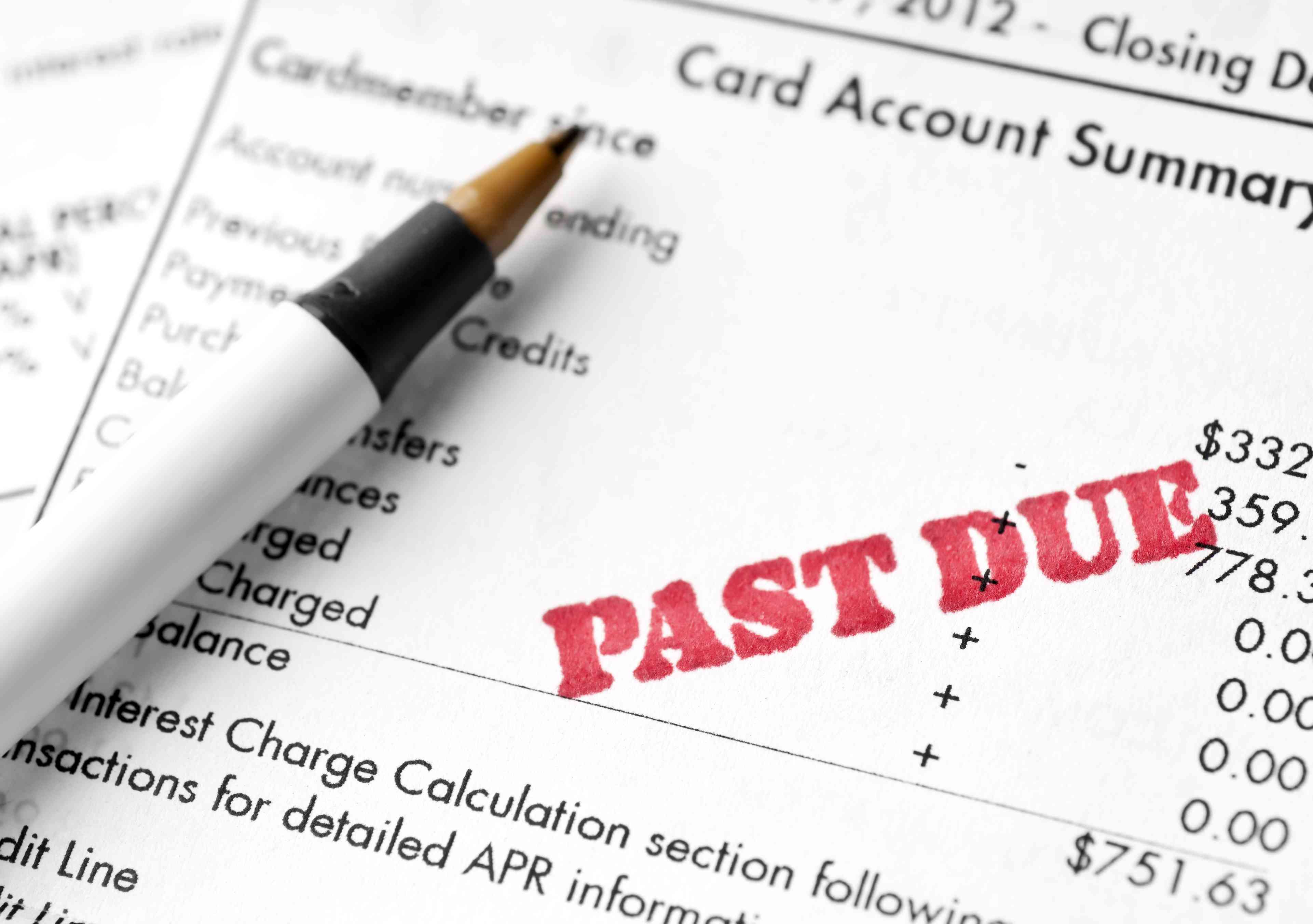

When it comes to managing your credit card balances, it’s crucial to have a clear understanding of when credit card companies report your balance. This information plays a significant role in determining your credit score and overall financial health. By knowing when your credit card company reports your balance, you can strategically plan your payments and maximize your creditworthiness.

Understanding the process of balance reporting involves familiarizing yourself with the various factors that influence when credit card companies report your balance. These factors include the monthly statement closing date, statement generation date, and reporting date to credit bureaus.

This article will delve into these factors in detail and equip you with the knowledge to navigate your credit card balances effectively. We will also highlight the importance of knowing when your credit card company reports your balance and provide tips for managing your credit card balances to maintain a healthy financial profile.

So, let’s dive in and uncover the ins and outs of balance reporting by credit card companies!

Definition of Balance Reporting

Balance reporting refers to the process by which credit card companies provide information about your credit card balance to credit bureaus. This information is crucial for credit bureaus to accurately assess your creditworthiness and calculate your credit score.

When you make purchases or incur charges on your credit card, your outstanding balance increases. Credit card companies regularly keep track of these balances and update them on your monthly billing statements. However, the balance on your monthly statement may not necessarily be the balance that gets reported to the credit bureaus.

Balance reporting typically involves transmitting your credit card balance information to credit bureaus, such as Equifax, Experian, and TransUnion, on a regular basis. This information allows credit bureaus to include your current credit card balances in their calculations when determining your creditworthiness.

It’s important to note that balance reporting is not a real-time process. Credit card companies often report your balance once a month, but the exact timing can vary. Understanding the factors that influence when credit card companies report your balance is essential to effectively manage your credit card balances and maintain a healthy credit profile.

Now that we have established the definition of balance reporting, let’s explore the key factors that determine when credit card companies report your balance.

Factors That Determine When Credit Card Companies Report Balance

When credit card companies report your balance to credit bureaus, several factors come into play. Understanding these factors can help you anticipate when your credit card balances will be reported and make informed decisions regarding your credit management. Let’s take a closer look at the key factors:

- Monthly Statement Closing Date: The monthly statement closing date is an important factor that determines when credit card companies report your balance. This date marks the end of your monthly billing cycle and signifies when your statement is generated. It is typically the same day each month and can be found on your credit card statement or online account. Any purchases or payments made after this date will not be reflected in the current month’s statement or balance reporting.

- Statement Generation Date: After the monthly statement closing date, credit card companies usually take a few days to generate your statement. This statement contains information about your transactions, payments, and balances for the billing cycle. The statement generation date is when the credit card company compiles this information and prepares your statement. This date is essential because it determines the snapshot of your account that will be reported to the credit bureaus.

- Reporting Date to Credit Bureaus: Once your statement is generated, the credit card company will transmit your balance information to the credit bureaus. This reporting date may differ from one credit card company to another and can vary within the month. Some credit card companies report balances shortly after the statement generation date, while others may wait a few days before reporting. It’s crucial to know the reporting date for your specific credit card to have a better understanding of when your balances will be updated on your credit report.

By considering these factors, you can estimate when your credit card balances will be reported to the credit bureaus. This information is valuable for managing your credit utilization ratio and overall creditworthiness.

Next, let’s explore why it is important to know when credit card companies report your balance.

Monthly Statement Closing Date

The monthly statement closing date is a significant date to keep track of when managing your credit card balances. It marks the end of your monthly billing cycle and indicates when your credit card company finalizes the transactions and balances for that period. Understanding the monthly statement closing date is crucial for several reasons:

- Credit Utilization Ratio: The monthly statement closing date plays a key role in calculating your credit utilization ratio. This ratio is the percentage of your available credit that you are currently using. Credit bureaus consider this ratio when determining your creditworthiness. By knowing your monthly statement closing date, you can strategically make payments to reduce your outstanding balance before the closing date. This can help lower your credit utilization ratio, which is generally recommended to be below 30% to maintain a healthy credit score.

- Due Date for Payment: The monthly statement closing date also affects the due date for your payment. Typically, credit card companies give you a grace period of a few weeks after the statement closing date to make your payment. By knowing the statement closing date, you can plan your finances and ensure that you make your payment on time. This helps avoid late payment fees and potential negative impacts on your credit score.

- Transaction Cutoff: The monthly statement closing date also serves as a cutoff point for transactions. Any transactions made after the closing date will be included in the next billing cycle’s statement and balance reporting. It’s important to be aware of this cutoff to avoid surprises and accurately track your expenses.

You can find your monthly statement closing date on your credit card statement or by logging into your online credit card account. Make it a habit to note this date and plan your payments and expenses accordingly. By doing so, you can effectively manage your credit card balances and optimize your credit utilization ratio.

Now, let’s explore the significance of the statement generation date in relation to balance reporting.

Statement Generation Date

The statement generation date is a critical element in understanding when your credit card balances are reported. It is the date when your credit card company compiles the transactions, payments, and balances for the billing cycle and generates your monthly statement. The statement generation date has several implications that you should be aware of:

- Snapshots your Account: The statement generation date serves as a snapshot of your credit card account. It captures the balances and activities on your account up until that date. Any transactions or payments made after the statement generation date will not be reflected in the current month’s statement or reported balance.

- Reflects your Current Balance: The statement generated on the statement generation date reflects your current balance at that point in time. It includes outstanding charges, credits, and any fees or interest incurred during the billing cycle. This balance is typically the one that credit card companies report to the credit bureaus.

- Determines Minimum Payment: The statement generation date also determines the minimum payment amount due for that billing cycle. Credit card companies calculate the minimum payment based on the statement balance. It’s essential to make at least the minimum payment by the due date to avoid penalties and negative impacts on your credit score.

Knowing the statement generation date allows you to plan your payments and manage your credit card balances effectively. By understanding when your statement is generated, you can make payments and manage your expenses to ensure the reported balance accurately represents your financial situation.

Remember, you can find the statement generation date on your credit card statement or by accessing your online account. It’s crucial to keep track of this date and stay informed about your current balance and payment due date.

Next, let’s discuss the reporting date to credit bureaus and its significance in balance reporting.

Reporting Date to Credit Bureaus

The reporting date to credit bureaus is the date when your credit card company sends your credit card balance information to the credit bureaus. This information is used by credit bureaus to update your credit report and calculate your credit score. Understanding the reporting date is crucial for several reasons:

- Timely Reporting: The reporting date determines when your credit card balances are updated on your credit report. It influences the accuracy of your credit utilization ratio and overall creditworthiness. By knowing the reporting date, you can ensure that your recent payments and transactions are reflected in your credit report.

- Credit Score Impact: The reported balance plays a significant role in calculating your credit score. A high balance can negatively impact your credit score, while a low balance can positively affect it. By staying informed about the reporting date, you can plan your credit card payments to maintain a low balance or pay off outstanding balances before the reporting date.

- Timing of Applications: The reporting date is also important if you are planning to apply for new credit. Lenders and creditors often evaluate your creditworthiness based on your credit report. By understanding the reporting date, you can time your credit card payments and manage your balances strategically to present a favorable credit utilization ratio to potential lenders.

It’s important to note that the reporting date can vary among credit card companies. While some companies may report your balance shortly after the statement generation date, others may have a specific reporting schedule. You can typically find the reporting date by contacting your credit card company or checking your online account.

By staying aware of the reporting date, you can take proactive steps to manage your credit card balances effectively, maintain a healthy credit profile, and have a better understanding of your financial situation as seen by lenders and creditors.

Now that we have discussed the factors that determine when credit card companies report your balance, let’s explore the importance of knowing this information.

Importance of Knowing When Credit Card Companies Report Balance

Knowing when credit card companies report your balance is crucial for several reasons. It allows you to have a better understanding of your financial standing, make informed decisions, and effectively manage your credit card balances. Here are some key reasons why knowing this information is important:

- Manage Credit Utilization Ratio: Your credit utilization ratio is the amount of credit you are currently using compared to your total available credit. It is a significant factor that influences your credit score. By knowing when your credit card company reports your balance, you can strategically plan your payments to keep your credit utilization ratio low. Maintaining a low ratio, ideally below 30%, demonstrates responsible credit management and can positively impact your credit score.

- Improve Credit Score: Your credit card balances play a vital role in determining your creditworthiness. By staying informed about the reporting date, you can make timely payments and pay off outstanding balances before the reporting date. This proactive approach can help improve your credit score over time and open up opportunities for better interest rates, loan approvals, and credit card offers.

- Apply for New Credit: If you are planning to apply for new credit, such as a loan or a mortgage, knowing when your credit card balances are reported is crucial. Lenders use your credit report to evaluate your creditworthiness. By strategically managing your balances and timing your payments before the reporting date, you can present a favorable credit utilization ratio to potential lenders, increasing your chances of approval and potentially receiving more favorable terms.

- Avoid Late Payments: Understanding when your credit card company reports your balance helps you stay on top of your payment due dates. By making payments before the reporting date, you can ensure that your payments are updated in your credit report and avoid late payment penalties. Late payments can negatively impact your credit score and may result in increased interest rates or decreased credit limits.

Knowing when credit card companies report your balance empowers you to take control of your financial situation, make strategic decisions, and improve your creditworthiness. By actively managing your credit card balances and staying informed about reporting dates, you can maintain a healthy credit profile and establish a solid foundation for your financial future.

Next, let’s explore some tips for effectively managing your credit card balances.

Tips for Managing Credit Card Balances

Managing your credit card balances effectively is essential for maintaining a healthy financial profile. Here are some tips to help you stay on top of your credit card balances and improve your overall financial well-being:

- Create a Budget: Start by creating a budget that includes your monthly income and expenses. Allocate a specific amount for your credit card payments and ensure that it aligns with your financial goals. A budget will help you prioritize your spending and avoid accumulating unnecessary credit card debt.

- Pay on Time: Always make your credit card payments on time to avoid late fees and potential negative impacts on your credit score. Set up payment reminders or schedule automatic payments to ensure that you never miss a due date.

- Pay More Than the Minimum: Paying only the minimum payment required can keep you in debt longer due to interest charges. Whenever possible, pay more than the minimum to reduce your credit card balances faster and save on interest charges.

- Track Your Spending: Monitor your credit card spending regularly to identify any unnecessary expenses or areas where you can cut back. Use online banking tools or mobile apps to track your transactions and stay aware of your overall credit card balances.

- Reduce Credit Card Usage: Minimize your reliance on credit cards by using cash or debit cards for everyday expenses. This helps prevent unnecessary credit card debt and allows you to better manage your spending.

- Pay Before the Statement Closing Date: To maintain a low credit utilization ratio, make a payment before the statement closing date to reduce the reported balance. This can positively impact your credit score and improve your chances of obtaining favorable credit terms in the future.

- Keep Unused Credit Cards Open: Instead of closing unused credit card accounts, consider keeping them open. Closing credit cards can affect your overall credit utilization ratio and potentially lower your credit score. However, be mindful of any annual fees associated with the unused cards.

- Regularly Review Your Credit Reports: Obtain your credit reports from the major credit bureaus at least once a year and review them for any inaccuracies or discrepancies. Reporting errors could negatively impact your credit score, so it’s important to address them promptly.

By implementing these tips, you can take control of your credit card balances and improve your financial management skills. Remember, responsible credit card usage and timely payments are key to maintaining a healthy credit profile and achieving your long-term financial goals.

Finally, let’s wrap up our discussion.

Conclusion

Understanding when credit card companies report your balance is essential for effective credit card balance management. Knowing the monthly statement closing date, statement generation date, and reporting date to credit bureaus enables you to strategically plan your payments, monitor your credit utilization ratio, and improve your creditworthiness.

By being aware of these factors, you can take proactive steps to maintain a low credit utilization ratio, make timely payments, and avoid late fees and negative impacts on your credit score. Additionally, knowing when your balances are reported allows you to time your credit card payments strategically, especially if you are planning to apply for new credit.

Managing your credit card balances wisely involves creating a budget, making payments on time, paying more than the minimum, tracking your spending, and reducing credit card usage. By implementing these tips, you can stay in control of your finances, reduce debt, and optimize your overall financial well-being.

Regularly reviewing your credit reports for accuracy and addressing any errors promptly is also essential. Remember, your credit card balances and payment history have a significant impact on your credit score, which in turn affects your ability to secure loans, obtain competitive interest rates, and achieve your financial goals.

In conclusion, by understanding the factors that determine when credit card companies report your balance and implementing effective credit card balance management strategies, you can maintain a healthy credit profile and build a strong foundation for your financial future.