Finance

What Is IRS Form 8832 Used For?

Published: November 1, 2023

Learn how to use IRS Form 8832 for finance purposes. Discover the benefits and requirements of this form to optimize your financial strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to navigating the complex world of finances and taxes, it’s essential to understand the various forms and documents required by the Internal Revenue Service (IRS). One such document that plays a crucial role is IRS Form 8832. Whether you’re an individual or a business entity, understanding the purpose and usage of Form 8832 is vital in ensuring compliance with the IRS regulations.

IRS Form 8832, officially known as the Entity Classification Election, allows businesses to choose how they want to be classified for tax purposes. This form is used to elect the tax status of an entity, specifying whether it will be taxed as a corporation, partnership, or disregarded entity. The classification chosen on Form 8832 determines how the entity will be taxed and treated for federal tax purposes.

Form 8832 is an important tool for businesses as it provides the flexibility to select the most advantageous tax classification based on their specific needs. By properly completing and filing this form, entities can potentially reduce their tax liabilities and maximize their financial benefits.

In this article, we will delve deeper into the purpose of IRS Form 8832, explore who should use it, discuss how to fill it out correctly, highlight important considerations, and provide guidance on submitting the form to the IRS. By understanding the ins and outs of Form 8832, individuals and businesses can make informed decisions about their tax status and ensure compliance with IRS regulations.

What is IRS Form 8832?

IRS Form 8832, also known as the Entity Classification Election, is a form used by businesses to choose how they want to be classified for federal tax purposes. The form allows entities to elect whether they will be taxed as a corporation, partnership, or disregarded entity. The chosen tax classification will determine how the entity is taxed and treated for federal tax purposes.

Form 8832 is essential because different tax classifications have varying tax implications. Understanding these implications and selecting the most advantageous classification can have a significant impact on an entity’s tax liability and financial benefits.

When completing Form 8832, businesses must provide basic identifying information such as the entity’s name, address, and taxpayer identification number. Additionally, the form requires the entity to indicate the desired tax classification and provide a detailed explanation of the entity’s eligibility and reasoning for choosing that classification.

It’s worth noting that individuals who operate as a single-member LLC are automatically classified as a disregarded entity by default. However, they have the option to elect to be classified as a corporation by filing Form 8832.

Overall, IRS Form 8832 serves as a tool for businesses to determine their tax status. It allows entities to choose the classification that best aligns with their financial goals and minimizes their tax burden. Understanding the purpose and usage of Form 8832 is crucial for businesses to ensure proper compliance with IRS regulations and optimize their tax situation.

Purpose of IRS Form 8832

The primary purpose of IRS Form 8832, the Entity Classification Election, is to allow businesses to choose their tax classification for federal tax purposes. The form provides entities with the flexibility to select the most advantageous tax status based on their specific needs and financial goals. This flexibility is especially valuable since different tax classifications have varying tax implications that can significantly impact an entity’s tax liability and financial benefits.

One of the main reasons businesses use Form 8832 is to reduce their tax burden. By strategically selecting a tax classification, entities can take advantage of specific tax benefits and deductions that are available to certain types of businesses. For example, a business that elects to be taxed as an S Corporation may be eligible to enjoy pass-through taxation, which can result in lower overall tax liability.

Another purpose of Form 8832 is to provide clarity in how the entity will be treated for federal tax purposes. By electing a specific tax classification, businesses can avoid any potential confusion or ambiguity about their tax status. This clarity allows the IRS and other relevant parties to properly categorize and assess the entity’s tax obligations.

Form 8832 also serves as a means for businesses to establish their identity and separate themselves legally from their owners or members. Different tax classifications provide varying levels of legal separation and protection. By electing a specific tax classification on Form 8832, businesses can determine the extent to which they are treated as separate legal entities.

Additionally, the purpose of Form 8832 extends to ensuring compliance with IRS regulations. By submitting the form and electing a tax classification, businesses demonstrate their commitment to following the appropriate tax laws and reporting requirements. This helps to foster transparency and accountability within the tax system.

In summary, the purpose of IRS Form 8832 is to allow businesses to choose their tax classification, optimize their tax situation, reduce their tax liability, establish legal separation, and ensure compliance with IRS regulations. By understanding the purpose and importance of Form 8832, businesses can make informed decisions and strategically navigate the complexities of the tax system.

Who Should Use IRS Form 8832?

IRS Form 8832, the Entity Classification Election, is used by a variety of entities that want to determine their tax status for federal tax purposes. The form is applicable to both businesses and individuals who operate as a single-member Limited Liability Company (LLC).

Here are some examples of entities that should consider using Form 8832:

- LLCs: Limited Liability Companies are a common type of business entity that can benefit from using Form 8832. Single-member LLCs are automatically classified as disregarded entities, but they have the option to elect to be taxed as a corporation by filing Form 8832. Multiple-member LLCs can also utilize the form to choose between being taxed as a partnership or a corporation.

- Partnerships: Partnerships can use Form 8832 to elect whether they want to be classified as partnerships for tax purposes or be treated as a corporation.

- Corporations: Corporations may also find Form 8832 useful if they want to change their tax classification. For example, a C Corporation may choose to elect S Corporation status for pass-through taxation benefits.

- Sole Proprietorships: Although sole proprietorships are not required to file Form 8832, they may choose to do so if they want to change their tax classification and be treated as a corporation.

It’s important for entities considering the use of IRS Form 8832 to carefully evaluate their specific circumstances and seek guidance from a tax professional. The decision to use the form should be based on the entity’s financial goals, desired tax advantages, and long-term tax planning strategies.

Additionally, it’s crucial for entities to assess the potential impact of changing tax classifications on their overall tax liability, reporting requirements, and any legal implications associated with different tax classifications.

In summary, businesses and individuals operating as an LLC, partnership, corporation, or sole proprietorship may utilize IRS Form 8832 to determine their tax status for federal tax purposes. By selecting the appropriate tax classification, entities can optimize their tax situation and align their tax treatment with their financial goals.

How to Fill Out IRS Form 8832

Filling out IRS Form 8832, the Entity Classification Election, requires careful attention to detail to ensure accurate and timely submission. Here’s a step-by-step guide on how to properly complete the form:

- Provide entity information: Begin by entering the legal name of the entity, followed by the address and Employer Identification Number (EIN). If the entity does not have an EIN, it must apply for one before completing Form 8832.

- Select the tax classification: Indicate the desired tax classification by checking the appropriate box on line 6 of the form. The available options are corporation, partnership, or disregarded entity. This selection will determine how the entity is taxed and treated for federal tax purposes.

- Explain the election: On line 7, provide a detailed explanation of the entity’s eligibility for the chosen tax classification and the reasons for making the election. It’s important to provide a clear and concise explanation that supports the entity’s decision.

- Identify the effective date: On line 8, specify the desired effective date of the election. This can be the current tax year, a future date, or even a retroactive date. Note that there are specific rules and limitations for retroactive effective dates, so it’s essential to consult IRS guidelines or seek professional advice if choosing a retroactive date.

- Signature: The completed Form 8832 must be signed and dated by an authorized individual, such as the entity’s owner, officer, or member. By signing the form, the individual acknowledges that all the information provided is true and accurate to the best of their knowledge.

It’s crucial to review the completed form thoroughly for accuracy, ensuring that all information provided is correct and consistent. Incomplete or erroneous forms may be rejected or result in delays in processing.

Entities should also keep a copy of the completed Form 8832 for their records and retain it as part of their tax documentation.

Please note that while this guide provides a general overview of how to fill out IRS Form 8832, it’s recommended to consult with a tax professional or refer to the IRS instructions for Form 8832 to ensure compliance with the latest guidelines and regulations.

Important Considerations for Form 8832

When completing IRS Form 8832, the Entity Classification Election, it’s essential to consider several important factors to ensure compliance and make informed decisions. Here are some key considerations to keep in mind:

- Tax Implications: Choosing a specific tax classification on Form 8832 can have significant tax implications. It’s crucial to consult with a tax professional or seek guidance from a qualified accountant to understand the potential tax benefits and consequences associated with each classification option.

- Eligibility: Ensure that the entity meets the eligibility requirements for the desired tax classification. Some classifications have specific criteria such as the number of owners or the nature of the entity’s activities. Failing to meet the eligibility requirements can result in IRS objections or complications.

- Long-Term Planning: Consider the long-term implications of the chosen tax classification. It’s essential to assess how the selected classification aligns with the entity’s future growth and financial goals. Changing tax classifications in the future may have additional legal and tax consequences, so careful planning is crucial.

- Ownership and Control: The chosen tax classification can affect the level of control and ownership rights within the entity. For example, electing S Corporation status often imposes restrictions on the number and type of shareholders. Carefully evaluate the impact of the classification on ownership and decision-making within the entity.

- State and Local Requirements: While Form 8832 relates to federal tax status, it’s important to consider any state or local tax implications that may arise from the chosen classification. Different jurisdictions may have specific regulations and requirements for various tax classifications.

- Professional Guidance: Seeking the guidance of a certified tax professional or accountant is highly advisable when completing Form 8832. They can provide personalized advice based on the entity’s specific circumstances, ensuring compliance with IRS regulations and optimizing tax strategies.

It’s crucial to approach the decision-making process for IRS Form 8832 with careful consideration and take the time to fully understand the implications and potential consequences. Each entity’s situation is unique, and what may be advantageous for one entity may not be the best option for another.

By thoroughly assessing these important considerations and seeking professional guidance, entities can make informed decisions and maximize the benefits of choosing the appropriate tax classification on Form 8832.

Submitting IRS Form 8832

Once you have completed IRS Form 8832, the Entity Classification Election, it’s important to submit it to the Internal Revenue Service (IRS) to ensure proper processing. Here are the steps to submit the form:

- Review the Form: Before submitting, carefully review the completed Form 8832 to ensure all information is accurate and complete. Any errors or omissions could result in delays or rejections.

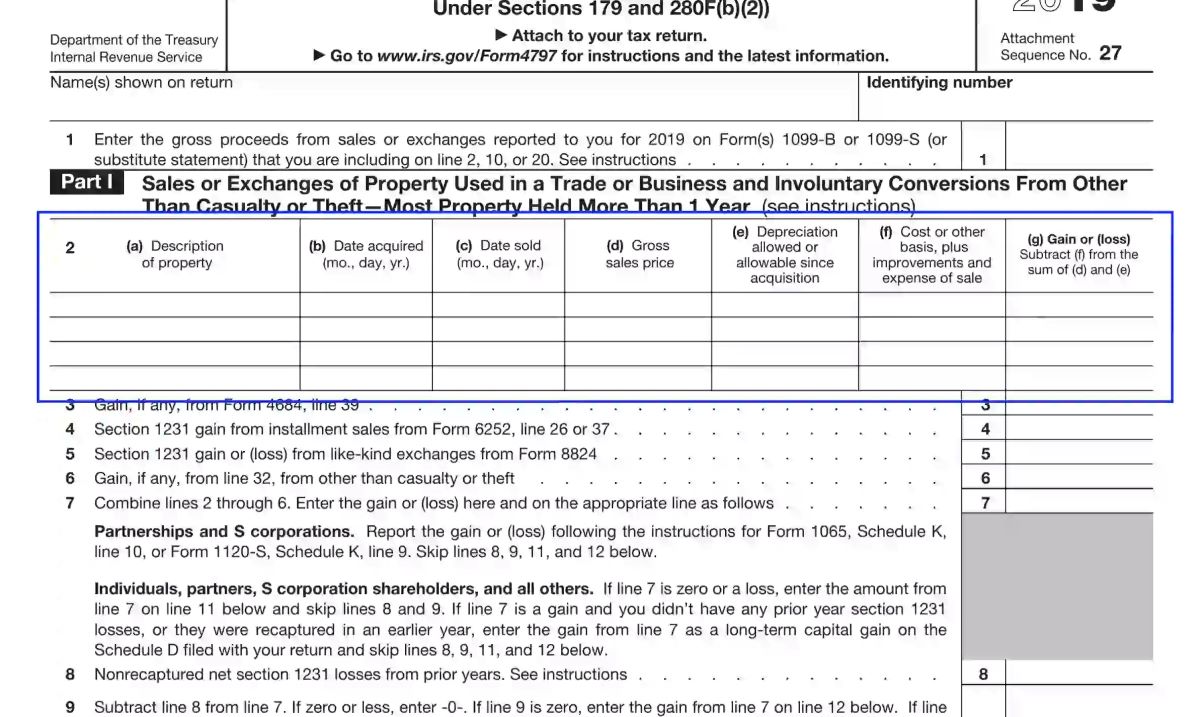

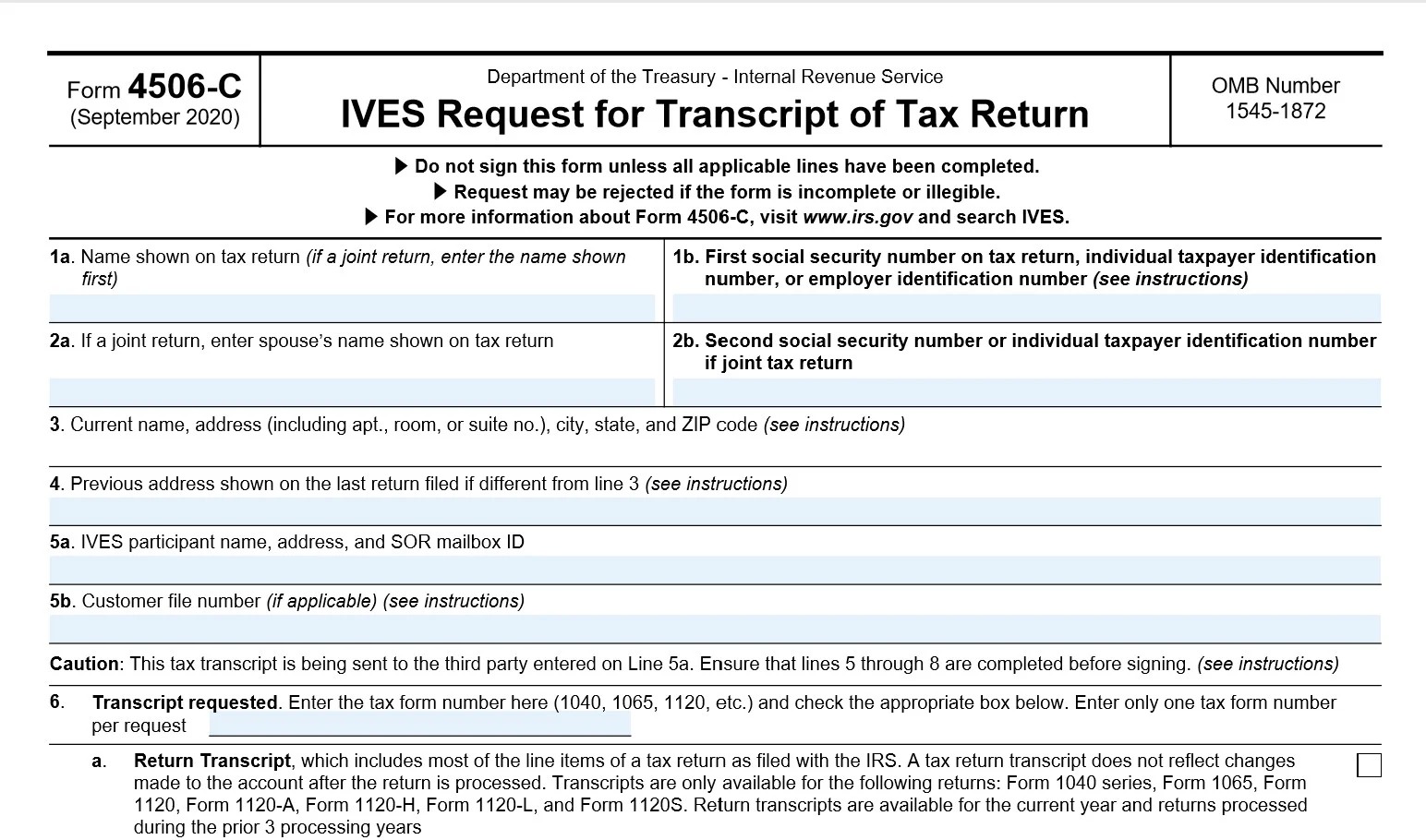

- Attach Supporting Documentation: Depending on the election being made and the entity’s situation, supporting documentation may be required. This includes any necessary attachments, such as an explanation of the entity’s eligibility for the chosen tax classification or any additional documents requested by the IRS.

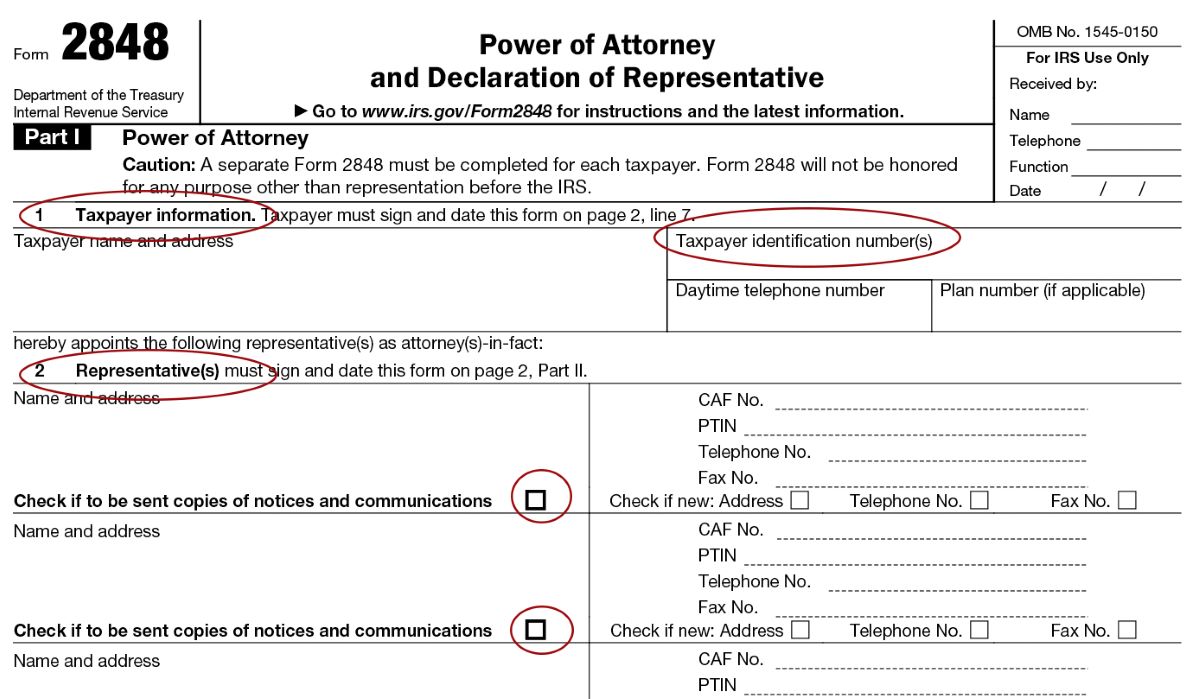

- Provide Authorization: If someone other than the entity’s authorized individual is submitting the form, a valid authorization document must be included. This authorization can take the form of a power of attorney or other authorized representative documents.

- Mail the Form: The completed and signed Form 8832, along with any supporting documentation, should be mailed to the appropriate IRS address. The IRS provides different addresses depending on the entity’s location and the type of delivery service used, so it’s important to consult the instructions for Form 8832 or the IRS website to find the correct mailing address.

- Retain a Copy: It’s crucial to keep a copy of the submitted Form 8832, along with any documents sent to the IRS, for your records. This will serve as proof of submission and help in case any inquiries or disputes arise in the future.

After mailing the form, it’s important to allow sufficient time for the IRS to process and respond to the submitted Form 8832. The processing time can vary, so it’s advisable to check the current guidelines provided by the IRS for estimated processing times.

If the IRS approves the election made on Form 8832, they will send a letter confirming the entity’s new tax classification. If the IRS has any questions or requires additional information, they may contact the entity for clarification or request further documentation.

Remember that timely submission and proper compliance with IRS regulations are crucial when submitting Form 8832. If you have any uncertainties or concerns, it is highly recommended to seek professional assistance from a certified tax professional or accountant to ensure accuracy and compliance with IRS guidelines.

Conclusion

Understanding IRS Form 8832, the Entity Classification Election, is essential for businesses and individuals seeking to determine their tax status for federal tax purposes. By carefully completing and submitting this form, entities can select the most advantageous tax classification that aligns with their financial goals, reduces their tax liability, and ensures compliance with IRS regulations.

Form 8832 provides the flexibility to choose between being taxed as a corporation, partnership, or disregarded entity. This choice has significant implications on how the entity is taxed, treated legally, and impacts its long-term financial strategy.

It’s important to consider various factors when deciding on a tax classification, including the potential tax benefits, eligibility requirements, long-term planning, ownership and control implications, and any state or local tax obligations that may arise. Seeking guidance from a tax professional or accountant can help navigate these considerations and ensure informed decision-making.

Once the form is completed, it should be carefully reviewed for accuracy and completeness before being mailed to the IRS along with any necessary supporting documentation. Retaining a copy of the submitted form is crucial for record-keeping and future reference.

In conclusion, IRS Form 8832 is a valuable tool that allows entities to determine their tax status and optimize their tax situation. By understanding the purpose of the form, considering important factors, and following the appropriate guidelines for completion and submission, entities can make well-informed decisions that align with their financial goals and ensure compliance with IRS regulations.

Navigating tax classifications can be complex, and the guidance of a tax professional is highly recommended to ensure proper compliance and maximize the benefits of choosing the appropriate tax classification on Form 8832.